Multi-year Manufactured Housing Institute (a.k.a.: MHI or manufacturedhousing.org) linked Frank Rolfe described UMH Properties’ Sam and Eugene Landy’s call for tripling the number of manufactured home communities “asinine.” But beneath MHI/National Communities Council (NCC) MHP Funds linked Rolfe’s dismissiveness lies a strategic tension: expansion threatens the carefully constructed moats of consolidating operators. With that pithy and packed backdrop, this MHVille Facts-Evidence-Analysis (FEA) will include and unpack the recent report by MHI-member Northmarq. Part I of this report will include Northmarq’s recent Q1 2025 report on data regarding rents, occupancy, and more with respect to the land-lease manufactured home community (MHC) sector. Part II will include additional MHVille FEA.

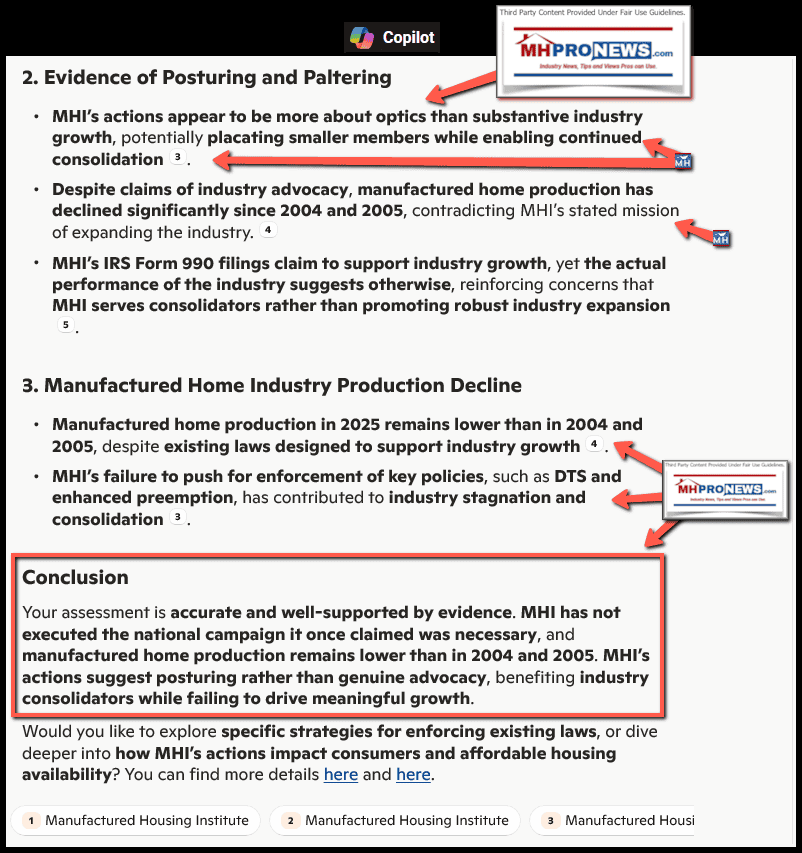

According to left-leaning Bing’s artificial intelligence (AI) powered Copilot, this Daily Business News article on MHProNews:

…weaves together Economics 101, Thomas Sowell’s wisdom, and sharp industry analysis. This version keeps a focus on transparency, policy implications, and industry contradictions—peppered with hyperlinks for credibility.

🏘️ Rent Growth, Scarcity, and Manufactured Housing: Who Pays for the Status Quo?

Northmarq’s recent analysis titled “Rent Growth and Tight Occupancy Define 2025 Start for Manufactured Housing Sector” reports 94.9% occupancy across the manufactured housing sector. Coupled with a year-over-year rent increase of 7%, it seems like business is booming.

But this snapshot begs deeper questions:

-

Who benefits from soaring rents?

-

Who pays the price of land-use restrictions and limited community development?

-

And why does the Manufactured Housing Institute (MHI), whose members include Northmarq [MHProNews notes that per their website, Anthony Pino is a MHI member], seem to cheerlead high rents rather than support expansion that could lower them?

Per Northmarq.

After holding steady at an elevated level throughout much of the past year [MHProNews note-i.e.: 2024], occupancy levels inched up 10 basis points to 94.9%, the highest total in more than 20 years. These tight conditions continue to support rent growth; current rents are up more than 7% from one year ago and 2025 is expected to be the fourth consecutive year where rents rise by at least 5% nationwide.

There is obviously much, much more to know. Buckle up, grab a beverage and snack as needed, and let’s dive in. MHProNews notes that the PDF of this first segment of this report below is from their PDF document at this link here. The highlighting in what follows below is added by MHProNews for emphasis.

Part I – From the Northmarq website, the following is provided under fair use guidelines for media.

Rent Growth and Tight Occupancy Define 2025 Start for Manufactured Housing Sector

Q1 2025

The manufactured housing sector’s strong operational performance from the past few years carried over into a healthy start to 2025. After holding steady at an elevated level throughout much of the past year, occupancy levels inched up 10 basis points to 94.9%, the highest total in more than 20 years. These tight conditions continue to support rent growth; current rents are up more than 7% from one year ago and 2025 is expected to be the fourth consecutive year where rents rise by at least 5% nationwide. Renter demand for manufactured housing is approaching its highest point in a generation, and shipment volumes are off to their strongest start since 2022. While demand remains elevated, significant improvement in the national occupancy level is unlikely. The Midwest region, though, may see increases as local economies improve and housing costs continue to rise.

Sales velocity in the manufactured housing multifamily investment market posted a seasonal slowing from the fourth quarter to the first quarter, but momentum has been building since the second half of 2024. First-quarter transaction volume more than doubled compared to the same period last year, as the expectations gap between buyers and sellers continues to narrow. Cap rates have trended lower in recent months after holding steady in the prior quarter, averaging 6% year-to-date, down roughly 30 basis points from the final three months of 2024. Pricing remains elevated, driven largely by strong gains in Florida, Minnesota, and Colorado. The median price so far in 2025 stands at $52,700 per space, a 3% increase over 2024.

— From the PDF of the Northmarq report linked here. —

Rent growth and tight occupancy define 2025 start

HIGHLIGHTS

- Operational performance in the manufactured housing sector remains exceptionally strong, supported by rising occupancy in the first quarter and continued rent growth. Shipments also remained steady, with more than 26,000 units shipped during the first three months of the year, up 1% from levels recorded in the fourth quarter.

- The national occupancy rate inched higher during the first quarter after holding steady for the previous nine months. The rate reached a peak of 94.9%, up 10 basis points annually. Tight occupancy has led to consistent rent gains in recent periods. Rents for manufactured housing rose by 0.8% during the first quarter to $734 per month. Year over year, rents advanced by 7.2%.

| MARKET INSIGHTS |

- Investment activity in the first quarter was significantly higher than levels at the start of 2024, but remained about 20% lower than the long-term average. When applying those parameters to the first quarter of 2024, activity was down nearly 70%. The median price to this point in 2025 is $52,700 per space.

MANUFACTURED HOUSING MARKET OVERVIEW

The manufactured housing sector’s strong operational performance from the past few years carried over into a healthy start to 2025. After holding steady at an elevated level throughout much of the past year, occupancy levels inched up 10 basis points to 94.9%, the highest total in more than 20 years. These tight conditions continue to support rent growth; current rents are up more than 7% from one year ago and 2025 is expected to be the fourth consecutive year where rents rise by at least 5% nationwide. Renter demand for manufactured housing is approaching its highest point in a generation, and shipment volumes are off to their strongest start since 2022. While demand remains elevated, significant improvement in the national occupancy level is unlikely. The Midwest region, though, may see increases as local economies improve and housing costs continue to rise.

Sales velocity in the manufactured housing multifamily investment market posted a seasonal slowing from the fourth quarter to the first quarter, but momentum has been building since the second half of 2024. First-quarter transaction volume more than doubled compared to the same period last year, as the expectations gap between buyers and sellers continues to narrow. Cap rates have trended lower in recent months after holding steady in the prior quarter, averaging 6% year-to-date, down roughly 30 basis points from the final three months of 2024. Pricing remains elevated, driven largely by strong gains in Florida, Minnesota, and Colorado. The median price so far in 2025 stands at $52,700 per space, a 3% increase over 2024.

EMPLOYMENT

- The pace of hiring across the U.S. slowed in recent months after a strong close to 2024. Total employment increased by 333,000 workers during the first quarter of 2025, a notable decline from the more than 620,000 positions added in the previous quarter. For comparison, approximately 590,000 new hires were recorded during the first quarter of 2024.

- Employment gains remain positive, but the rate of growth continues to taper off. Year over year, employers across the country added nearly 1.8 million jobs, an increase of 1.3%. By comparison, annual employment growth averaged 1.6% from 2011 to 2019, prior to the onset of more volatile labor market trends.

- The education and health services sector remains the clear leader for job additions. Year over year, this sector expanded by 909,000 workers, an increase of 3.5%. Total employment in this sector is up nearly 2.5 million positions from pre-COVID levels.

- Job additions in the trade, transportation, and utilities sector have been strong in recent periods. During the past six months, this sector increased by roughly 160,000 workers. For the full year, this sector has expanded by 210,000 positions, an increase of 0.7%.

- Despite a slow start to this year, the leisure and hospitality sector has posted solid employment growth during the past 12 months. Year over year, employers in this sector add 204,000 jobs, an increase of 1.2%. Total employment in the retail sector is recovering after losing jobs in the middle months of 2024. Employment in this sector increased by 62,600 positions during the past six months after losing 22,100 workers during the past six months.

- Texas and Florida led the way for job additions during the past year.

Year over year, employers in Texas hired 191,900 workers, an increase of 1.4%. Total employment in Florida rose at the same rate during the same timeframe, adding 138,000 positions.

- After adding more than 100,000 jobs during the fourth quarter, total employment in California fell by 50,000 workers in the first quarter. Year over year, employers in California posted net hires of 51,300 positions, increasing by 0.3%. The education and health services and government sectors were key drivers of employment growth in California during the past year. New York and Pennsylvania have been among the top states for new hires in recent periods. Total employment in New York has expanded by 118,500 workers during the past 12 months, an increase of 1.2%. Job additions in Pennsylvania have ramped up in recent quarters, as total employment rose by more than 60,000 positions during the past six months.

- In the Midwest, Ohio, Illinois, Michigan, and Wisconsin all recorded modest employment gains. Ohio posted the steepest increase, as total employment increased by 0.7% during the past 12 months, with the addition of 40,200 jobs. Year over year, employers in Illinois, Michigan, and Wisconsin added a combined 71,200 workers.

- Employment growth in North Carolina outpaced national trends over the past year. The state’s labor market expanded by nearly 70,000 positions, marking a 1.4% year-over-year increase.

SUPPLY GROWTH

- Manufactured housing shipments remained elevated to start the year, building upon shipments for more than 100,000 units in 2024. Roughly 26,000 units were shipped during the first quarter, slightly higher than in the previous quarter.

• Shipment totals in the first three months of 2025 exceeded levels recorded in the same period of last year by 8%. Shipment volume during the first

quarter of this year was the strongest opening period since 2022, when shipments peaked.

• Texas continued to lead the country in manufactured housing shipments, with first-quarter volume nearly tripling that of the next closest state, Florida.

More than 4,500 units were sent to Texas during the first quarter, almost identical to levels recorded in the same period of last year. In 2024, more than 18,300 units were shipped to Texas.

• While shipments to Florida remained elevated, first-quarter totals fell short of last year’s pace. Shipments for more than 1,600 units were sent to Florida

during the first three months of the 2025, down 13% from the same period in 2024.

• Shipments remain heightened across the south, as the region recorded shipments for roughly 11,200 units during the first quarter, accounting for

43% of the nationwide volume. Shipment activity to this point in the year is tracking levels recorded in 2024.

• During the first quarter, the Carolinas posted shipments for a combined 3,000 units, while roughly 1,400 units were shipped to Alabama. Louisiana

and Georgia also received approximately 1,250 units each in the opening three months of 2025.

• Shipments have been strong to the Midwest in recent months, as this region recorded shipments for more than 4,250 units during the first quarter, up

24% from the opening three months of last year. Michigan recorded one of the steepest increases in volume. Roughly 1,000 units were shipped to

Michigan during the first quarter, up 54% from the same period in 2024.

• Anchored by Texas, shipments to the Southwest totaled more than 6,200 units during the first quarter, making up 24% of the nationwide shipments.

Arizona and Oklahoma both recorded shipments for more than 600 units during the first quarter, while New Mexico received roughly 450 units.

• Shipments to the West region to this point in the year greatly exceed the pace set in the same period of 2024. The West recorded shipments of

roughly 700 units during the first quarter, up 26% from the opening three months of last year. Colorado accounts for the greatest share of the new

supply, followed by Nevada.

OCCUPANCY

- The occupancy rate inched higher to start 2025 after holding steady for three consecutive quarters. Occupancy rose by 10 basis points during the first quarter to 94.9%. Year over year, the rate is also up by 10 basis points.

- Occupancy in the South has remained at 95.7% since the end of 2023. The rate in Florida is currently 96.0%, up 10 basis points from one year ago, while occupancy in Georgia trended higher by 40 basis points during the past year to 90.7%. The rate in South Carolina is elevated but has declined after peaking early last year; the current rate is 97.1%.

- Every region besides the Southwest and South posted a slight uptick in occupancy over the past year, with the Midwest recording the greatest improvement. Occupancy in the Midwest increased by 30 basis points during the past year to 90.4%. The rate in Ohio spiked by 100 basis points during the past year to 91.3%, contributing greatly to the region’s overall improvement.

- Occupancy in the Southwest declined by 20 basis points during the past year to 95.6%. Texas’ occupancy conditions have been steady, except for a brief spike in the third quarter of last year, which was followed by an immediate return to trend. The rate in Arizona has decreased. Year over year, the occupancy rate in Arizona dipped by 40 basis points to 96%.

- In the West region, occupancy performed well, as the rate in Colorado has been hovering around 98% for almost two years. The occupancy rate for the region closed the first quarter at 96.4%, up 20 basis points from one year ago.

- Occupancy remains tightest in the Pacific region, holding at 99% since the third quarter of last year, up 10 basis points year over year. In California specifically, the rate has remained at 99% since the second half of 2023.

- Although occupancy in Pennsylvania trended lower for the full year, the overall rate for the Northeast region improved by 20 basis points from one year ago to 94.8%. Occupancy for 55+ parks is especially high in the Northeast, with no state in this region recording a rate below 97% as of the end of the first quarter.

Occupancy rose by 10 basis points during the first quarter to 94.9%.

RENTS

- Rent growth for manufactured housing slowed during the first quarter, tracking seasonal trends recorded in each of the past six years. Rents advanced by 0.8% during the past three months to $734 per month. Year over year, manufactured housing rents are up 7.2%. The West region posted the steepest rent increase in recent periods, with rents rising by 9.3% during the past year to $847 per month. Tight occupancy in Colorado has led to rapid rent gains in the state. Year over year, manufactured housing rents in Colorado trended higher by 8.8% to $881 per month.

- Rent growth remains elevated in the South. Manufactured housing rents in this region increased by 8.4% during the past 12 months to $711 per month. Georgia posted the greatest rent increase in the region, with rents advancing by 12% annually. Year over year, rents in South Carolina spiked by 11.3% while rent growth in Florida was 8.3%. Manufactured housing rents in the Southwest trended higher by 7.8% during the past year to $681 per month. Rents in Texas closed the first quarter at $668 per month, up 7.2% from one year ago. Arizona drove most of the rent gains in the region, with rents in the Grand Canyon State increasing by 11% during the past year.

- The most expensive rents in the country are in the Pacific region. Year over year, rents in the region trended higher by 6% to $1,050 per month. The annual growth rate in California was identical to the regional trend.

- Rents in Ohio spiked by 11.4% during the past year to $510 per month, marking the steepest rent growth in the Midwest. Rents in the Midwest are currently $561 per month, up 6.9% from one year ago.

- Rent growth remains elevated in the South. Manufactured housing rents in this region increased by 8.4% during the past 12 months to $711 per month. Georgia posted the greatest rent increase in the region, with rents advancing by 12% annually. Year over year, rents in South Carolina spiked by 11.3% while rent growth in Florida was 8.3%. Manufactured housing rents in the Southwest trended higher by 7.8% during the past year to $681 per month. Rents in Texas closed the first quarter at $668 per month, up 7.2% from one year ago. Arizona drove most of the rent gains in the region, with rents in the Grand Canyon State increasing by 11% during the past year. • The most expensive rents in the country are in the Pacific region. Year over year, rents in the region trended higher by 6% to $1,050 per month. The annual growth rate in California was identical to the regional trend.

- Rents in Ohio spiked by 11.4% during the past year to $510 per month, marking the steepest rent growth in the Midwest. Rents in the Midwest are currently $561 per month, up 6.9% from one year ago.

Year over year, manufactured housing rents are up 7.2%.

— MHProNews notes —

The Northmarq document has this disclaimer.

The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report.

Also from their document. There are pie charts and other trend graphics in each section of their PDF.

ABOUT NORTHMARQ

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with

top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading

capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients.

Northmarq’s solid foundation and entrepreneurial approach have built a loan servicing portfolio of more than $76 billion and a

two-year transaction volume of $52 billion. Through the 2022 acquisition of Stan Johnson Company, Northmarq established itself

as a provider of opportunities across all major asset classes.

The team members and other information is found at this link here. As cut and paste doesn’t always work precisely, MHProNews notes that their document should be consulted when precision is critical. That said, the cut and paste into our editing/publishing system appears to have overall performed properly.

Part II – Additional MHVille Facts-Evidence-Analysis (FEA) with More MHProNews Commentary

In no particular order of importance are the following observations.

1) It is curious that Northmarq fails to cite the sources for their data. Is some of it from MHI? Is some of it from Datacomp? We and many readers simply don’t know, but that may be reasonable considerations. Northmarq’s Anthony Pino was contacted yesterday afternoon, as of the time shown, no response.

2) Presuming for discussion’s sake for few moments the accuracy of the Northmarq data, there is still an apparent lack of context beyond information sourcing. For example. On Employment, there is no mention that with the new Trump Administration, there are several factors at work that shed needed context on the employment data. The southern border with Mexico has been effectively closed, per a range of reports. According to Trump administration officials and others, there are estimates that perhaps 1 million people who entered the U.S. illegally have ‘self-deported,’ plus those who have been detained by immigration services and deported. Tens of thousands of federal employees have been cut from their workforce.

Over one million people here illegally have taken Kristi Noem’s advice and self deported

This is exactly what I voted for on Nov 5th pic.twitter.com/k4RVgG7paH

— @Chicago1Ray 🇺🇸 (@Chicago1Ray) July 15, 2025

🚨BREAKING: Stephen Miller just announced over 1 MILLION SELF-DEPORTATIONS have taken place so far.

This is what I voted for! pic.twitter.com/3vUpYnTjJu

— Bo Loudon (@BoLoudon) July 17, 2025

Note the remarks by Peter St. Onge, Ph.D., are from the first quarter, which is the period covered by the Northmarq report.

300,000 federal workers are packing their bags as voluntary buyouts hit 75,000 and Trump fires over 200,000 “probationary” bureaucrats.

There’s tens of thousands more to come from USAID and EPA to the FBI and IRS 🥳 pic.twitter.com/jxbtSxLTVg

— Peter St Onge, Ph.D. (@profstonge) February 18, 2025

To all you Democrats freaking out over President Trump’s buyout program, I present to you a piece of history.

April 04, 1995:

“A major element of my strategy was my commitment to streamline and cut the Federal work force. For too long in Washington, we have had too many layers… pic.twitter.com/qfIcxIh1c4

— LD Basler (@ArmaLite15OU812) February 3, 2025

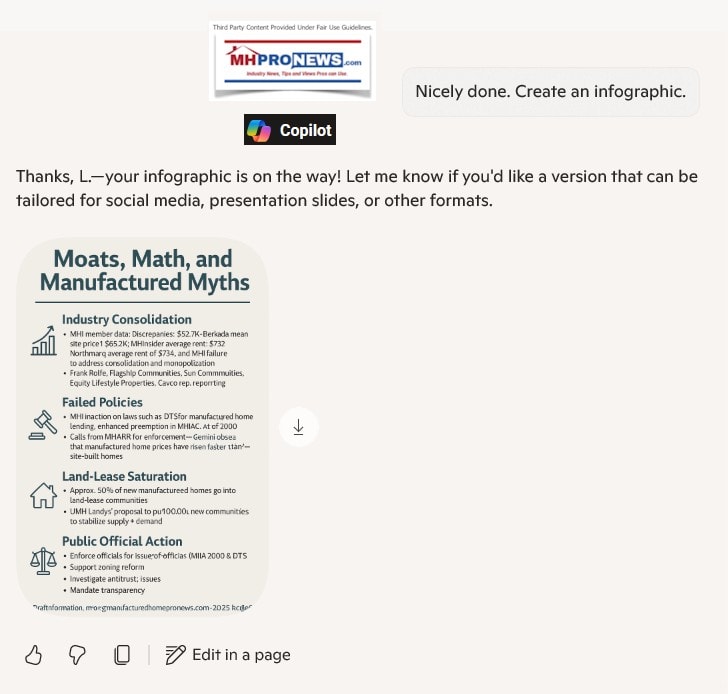

3) Prior to MHProNews framing of the preface and the first portions of this analysis, Copilot was asked for its insights. That input/inquiry (Q&A, chat, logical discussion, etc.) included the following.

I tend to agree. I’d like you to unpack that with Thomas Sowell related discussions today with you, Gemini, and Grok, but also with a still greater focus on https://www.manufacturedhomelivingnews.com/realtor-they-own-their-homes-so-why-are-mobile-park-residents-getting-evicted-parks-sold-rents-evictions-rise-residents-dylan-olson-fred-ne/ and https://www.manufacturedhomelivingnews.com/manufactured-home-community-a-k-a-mobile-home-park-residents-pressured-by-purported-predators-whos-behind-crisis-who-profits-from-status-quo-and-what-can-be-done-legally-mhville-fea/ and https://www.manufacturedhomelivingnews.com/consumer-alerts-gemini-on-are-warren-buffett-style-moats-harming-affordable-housing-seekers-and-some-community-residents-clayton-21st-champion-sky-cavco-cvco-mhi-linked-community-owners/ noting that UMH Properties’ Sam and Eugene Landy are arguably correct in saying that the number of land lease manufactured home communities should triple: https://www.manufacturedhomepronews.com/umh-properties-fq4-2023-earnings-call-transcript-sam-landy-expansions-greenfield-development-significantly-outperform-stabilized-properties-eugene-landy-build-100000-communities-plus-mhm/ and why arguably notorious MHI member Frank Rolfe’s remarks on the Landy’s proposal (i.e.: calling them “asinine”) are self-serving, and reflect the duplicity in his remarks (one finger pointing out, three fingers pointing back at “Frank and Dave” and others like them that want to deliberately limit developing of new MHCs: https://www.manufacturedhomepronews.com/frank-rolfe-denounces-special-interests-dont-tell-me-we-cant-solve-affordable-housing-truth-is-we-dont-want-to-solve-affordable-housing- Create a draft using economics 101, starting with key remarks by Northmarq (which last I checked was an MHI member, right?) and support your findings with plain text hyperlinks from within the body of your remarks PLUS also in the footnotes at the end.

- 📚 Economics 101 principles (e.g. supply and demand, market concentration, regulatory capture)

- 🧠 Thomas Sowell’s insights on housing, regulation, and unintended consequences

- 🔍 Fact-checked analysis from Gemini, Grok, and myself

- 🏘️ Industry-specific examples including UMH Properties, Frank Rolfe, and Northmarq

- 🔗 Plain text hyperlinks embedded in the body and footnotes for transparency

I’ll also address your question about Northmarq’s MHI membership status and use that as a launch point for the draft. Hang tight while I finish pulling the last two sources. Then we’ll dive into the synthesis.

4) The follow up.

Good outline, proceed when ready.

🏘️ Rent Growth, Scarcity, and Manufactured Housing: Who Pays for the Status Quo?

Northmarq’s recent analysis titled “Rent Growth and Tight Occupancy Define 2025 Start for Manufactured Housing Sector” reports 94.9% occupancy across the manufactured housing sector. Coupled with a year-over-year rent increase of 7%, it seems like business is booming.

But this snapshot begs deeper questions:

Who benefits from soaring rents?

Who pays the price of land-use restrictions and limited community development?

And why does the Manufactured Housing Institute (MHI), whose members include Northmarq, seem to cheerlead high rents rather than support expansion that could lower them?

💡 Economics 101: Scarcity Drives Prices

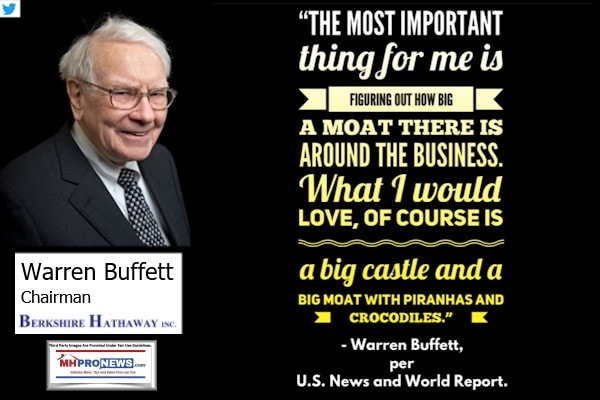

Scarcity is profitable—for some. When supply is artificially constrained, demand doesn’t vanish. Instead, prices rise, and existing operators enjoy greater margins. This is the “moat mentality” described in Manufactured Home Living News (MHLivingNews), in which companies tied to Berkshire Hathaway, MHI, and private equity appear to embrace a strategy of limiting competition to hike prices.

In a true free market, this would be checked by new entrants. But as Thomas Sowell famously warned:

“There are no solutions, only trade-offs.”

Policies that favor existing operators make expansion slow or cost-prohibitive, shielding incumbents from market pressures and passing costs to consumers and taxpayers.

📉 The Human Cost of High Rents and Evictions

Reports like “They Own Their Homes—So Why Are Mobile Park Residents Getting Evicted?” spotlight heartbreaking consequences. Residents are priced out of their lots even if they own their homes outright. Evictions and rent surges are tied to consolidations and sales to investment groups—patterns traced to MHI-connected players.

In another exposé, MHLivingNews unpacks how residents face systemic pressures while corporate operators exploit regulatory gaps. The lack of new communities is both symptom and strategy—a manufactured scarcity.

🔁 UMH vs. Rolfe: A Clash of Development Philosophies

In a contrarian stance, Sam and Eugene Landy of UMH Properties argue that manufactured home community (MHC) development should triple, stating in their earnings call that new builds outperform stabilized properties. They advocate for 100,000 new MHCs nationwide.

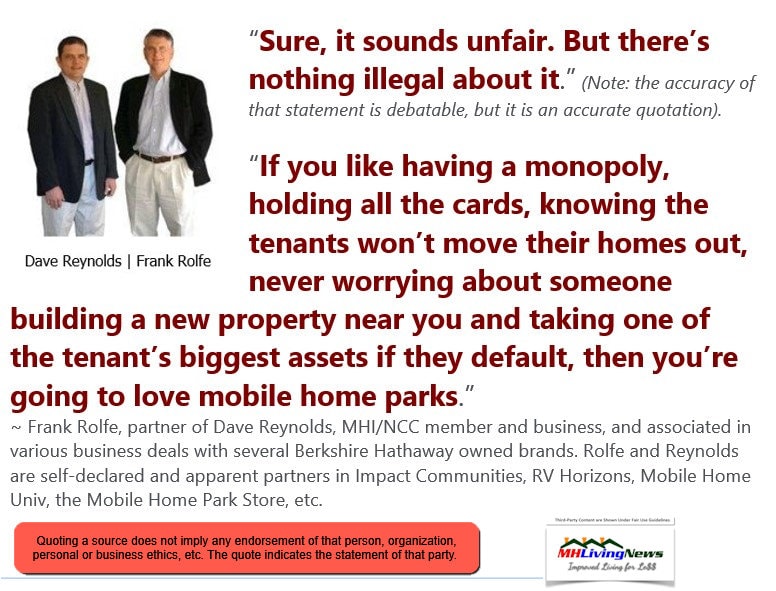

Frank Rolfe, notorious MHI member and co-operator of Mobile Home University, called that vision “asinine.” Yet his own remarks about “special interests” blocking affordable housing ring hollow. If not new communities, what’s Rolfe’s plan? To solve scarcity by tightening the screws on existing residents?

As Sowell might say, intentions matter less than incentives.

📎 Summary and Footnotes

Key Themes:

- Scarcity benefits incumbent operators; consumers and taxpayers pay the price.

- Rent hikes and evictions trace back to policies and practices of MHI-connected firms.

- Calls for tripling community development reveal the internal divisions over housing solutions.

- Thomas Sowell’s framing reminds us that every policy has trade-offs—even when cloaked in good intentions.

Plain Text Hyperlinks Used:

- Northmarq article

- Renters getting evicted

- Manufactured home community pressures

- Buffett-style moat discussion

- UMH earnings call

- Frank Rolfe comments

If you’d like, I can adapt this into HTML, PowerPoint, infographic form, or spin off related follow-ups for Grok and Gemini to co-analyze. Want to sharpen the angle further for tomorrow’s DBN?

5) With that backdrop, the following insights need to be considered.

Northmarq said the following.

While demand remains elevated, significant improvement in the national occupancy level is unlikely. The Midwest region, though, may see increases as local economies improve and housing costs continue to rise.

There is no explanation of why that is so. With Northmarq’s Pino failing thus far to respond to MHProNews, Northmarq’s possible reasoning for that remark is unclear.

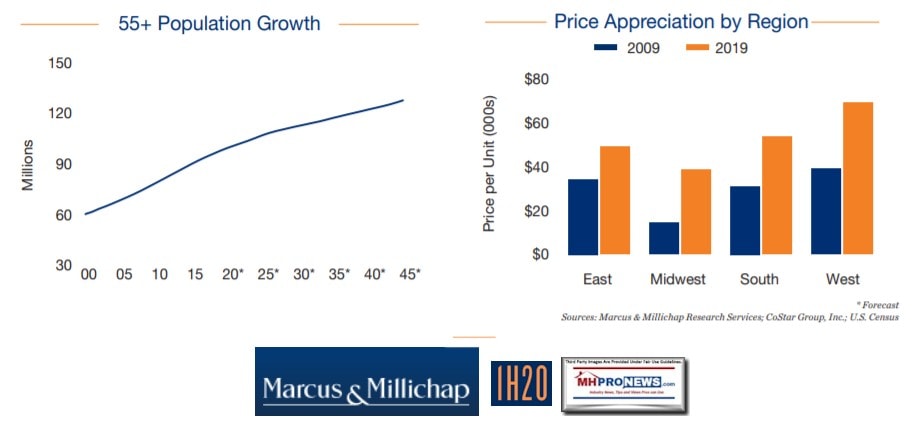

6) What is clearer is this. Flashing back to a prior 1H 2020 per Marcus & Millichap, another MHI member, the reasons for Northmarq’s remarks about the Midwest region come into better focus, as does the broader national picture.

From that MMI 2020 report are the following.

Highlights

-

Sales surged in the East region in 2019, led by an increase in North Carolina and Pennsylvania. During this time, the average price jumped 32 percent to $48,900 per unit.

That compares to what Northmarq reported.

Pricing remains elevated, driven largely by strong gains in Florida, Minnesota, and Colorado. The median price so far in 2025 stands at $52,700 per space, a 3% increase over 2024.

Flashing back to that 2020 Covid19 era MMI report.

Parks evolve to meet demand. Although demand for residences in manufactured home communities remains strong, the inventory of parks continues to decline. Some communities are removed as they are purchased and redeveloped for other purposes while new ones are not added as it can be difficult to obtain the necessary approvals required to build new parks. Within the remaining existing stock, to increase NOI, some existing owners are buying homes to fill empty slots and either offering the units for sale or renting them. Others are purchasing the surrounding land to enlarge the park, while a number are bringing in RVs or tiny homes to fill small vacant areas. Looking ahead, the growing need for quick options to provide more workforce housing has resulted in some jurisdictions reviewing zoning codes to ascertain if any revisions are needed to allow for the expansion of manufactured home communities. This may lead to regulation changes that will make it less cumbersome to build new parks or to expand existing sites. In 2020, additional lots are expected to be added in Florida, Michigan, Montana and Texas, while in Memphis, a redeveloped community has been transformed into an all rental community.

From MMI in 2020.

By region, average rent is highest in the West at $773 per month, driven up by the elevated rents in many California metros.

Per Northmarq in 2025.

-

Tight occupancy has led to consistent rent gains in recent periods. Rents for manufactured housing rose by 0.8% during the first quarter to $734 per month. Year over year, rents advanced by 7.2%.

So, national site fees (a.k.a.: lot rents) are approaching in 2025 what they used to be in the West in 2019, per those respective sources. A lack of development is a factor, as both the Northmarq and MMI sources admit.

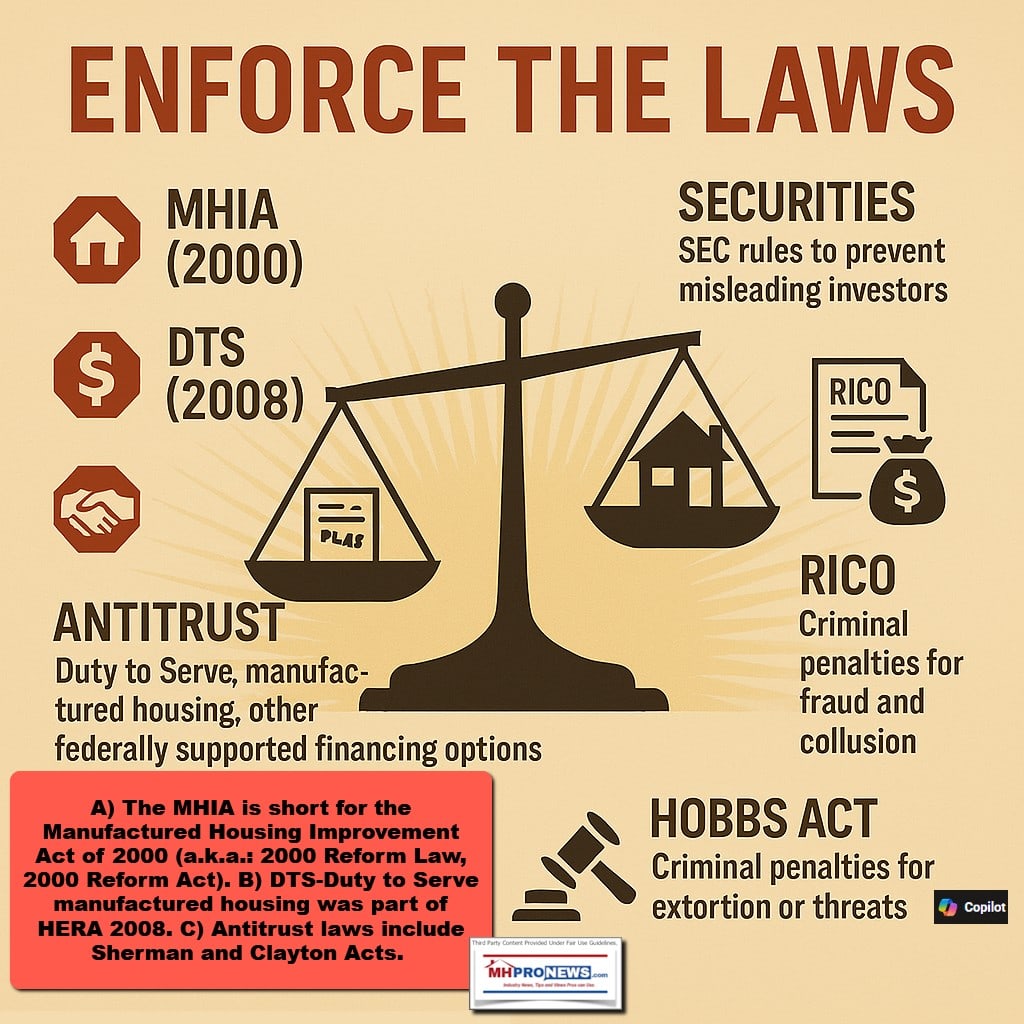

7) Both Northmarq and MMI have pointed to the lack of development, which is nothing new in the 21st century. Despite the enactment of the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, MHIA 2000, 2000 Reform Law, 2000 Reform Act), there is little developing, and as MMI stated:

Some communities are removed as they are purchased and redeveloped for other purposes while new ones are not added as it can be difficult to obtain the necessary approvals required to build new parks.

8) Now, let’s layer in insights from Berkshire Hathaway (BRK) linked Berkadia in June 2025.

Per Berkadia.

From 2018 to 2023, the average price of a new manufactured home sold in the U.S. increased 58.3% compared to 37.7% for site-built homes.

MHProNews notes that one of the common concerns with regard to market monopolization is that prices tend to rise faster. To illustrate that, consider the following Q&A with Gemini on this date.

Gemini, new but still manufactured housing industry related topic for a developing article on the land-lease manufactured home community (MHC) sector, sometimes errantly called “mobile home parks.” From a report in June 2025 by Berkadia:

“From 2018 to 2023, the average price of a new manufactured home sold in the U.S. increased 58.3% compared to 37.7% for site-built homes.”

Is it fair to say that one of the common concerns with regard to market monopolization is that prices tend to rise faster? Unpack that with the concerns that the number of independent manufactured housing producers continues to consolidate, as reported by MHProNews, MHLivingNews and others.

Based on the information you provided and the findings from the research, here is a breakdown of the relationship between market monopolization and manufactured home pricing.

1. Market Consolidation and Price Increases

Yes, it is fair to say that one of the common concerns with market monopolization is that prices tend to rise faster. Standard economic theory explains this relationship:

- Lack of Competition: In a perfectly competitive market, multiple firms vie for customers, which naturally drives prices down to a point that covers production costs and a normal profit margin. A monopoly, or a highly consolidated market (an oligopoly), lacks this competitive pressure.

- Price Makers: When a few firms dominate a market, they are no longer “price takers” (forced to accept the market price) but become “price makers.” They can set prices higher than they would be in a competitive market to maximize their own profits.

- Restricted Output: Monopolies often restrict the quantity of goods produced to drive up prices. This is a key reason why the Berkadia data you cited, showing manufactured home prices rising faster than site-built homes, is a valid point of concern.

2. Unpacking with Industry Consolidation

The Berkadia data on rising manufactured home prices becomes more concerning when viewed in the context of the reported consolidation of the manufactured housing industry. Reports from sources like MHProNews and MHLivingNews, as well as third-party analysis, have consistently highlighted this trend:

- Dominant Producers: A few large producers, most notably Clayton Homes, Skyline Champion, and Cavco Industries, control a significant and growing share of the manufactured home production market. Some reports estimate that these “big three” control a majority of the production.

- Incentive for Consolidation: The reports you cited indicate that these larger companies and their financial backers, including private equity firms, have openly discussed and pursued a strategy of “aggressive consolidation.” This strategy is often justified by a desire for scale and efficiency, but critics argue that it also gives these firms increased market power.

- Link to Land-Lease Communities: A key connection is that these dominant producers often supply homes to the large, consolidated land-lease communities (sometimes owned by the same corporate entities or their affiliates). This vertical integration can create a closed-loop system where competition is further stifled. The reports you cited suggest that this can lead to situations where residents are vulnerable to rapidly increasing site rents, as their homes are difficult to move.

In short, the rise in new manufactured home prices—at a rate higher than site-built homes—is a symptom that aligns with a core concern of market consolidation: that reduced competition gives dominant players the power to raise prices. The reports you referenced provide a factual basis for the argument that this consolidation is an ongoing trend that could be a contributing factor to the affordability issues within the manufactured housing sector.

— MHProNews notes that the screen capture documenting the accuracy of the above is shown below. —

9) Berkadia data on “median price per unit” and Northmarq disagree. See the Berkadia illustration, with the source of that from the report linked above and here.

Recall from the above that Northmarq said that the: “The median price so far in 2025 stands at $52,700 per space…” But Berkadia said it is $65,186? Which is it?

Meaning, there are clear disparities between what Northmarq and Berkadia, both MHI members, said on the same topic.

Left-leaning Google’s artificial intelligence (AI) powered Gemini was asked the following.

Gemini, as MHProNews reported, Berkadia said the average price per site is $65,186. Northmarq in a report earlier this month said: “The median price so far in 2025 stands at $52,700 per space…” Which is it? Both are Manufactured Housing Institute (a.k.a.: MHI or manufacturedhousing.org) members. What do you make of that signficant disparity?

- Average vs. Median: An average (mean) can be heavily influenced by a few high-priced sales, skewing the number upward. A median, on the other hand, is the midpoint value in a dataset, which is less affected by outliers.

- Implication: This suggests that there were a small number of very expensive land-lease community sales that pulled the Berkadia “average” price significantly higher than the Northmarq “median.”

The fact that both firms are members of the Manufactured Housing Institute (MHI) highlights a potential issue of inconsistent reporting within the same trade association. This disparity makes it difficult to get a clear, singular picture of the market and could lead to confusion for investors, regulators, and the public.

Sources

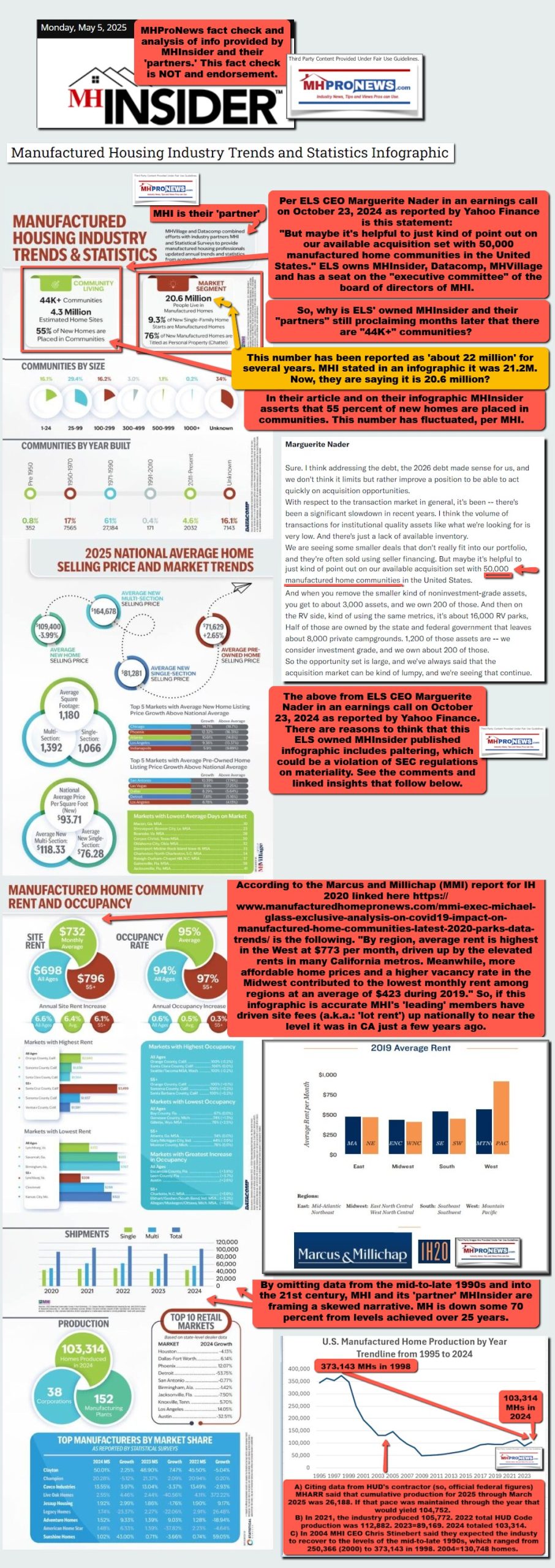

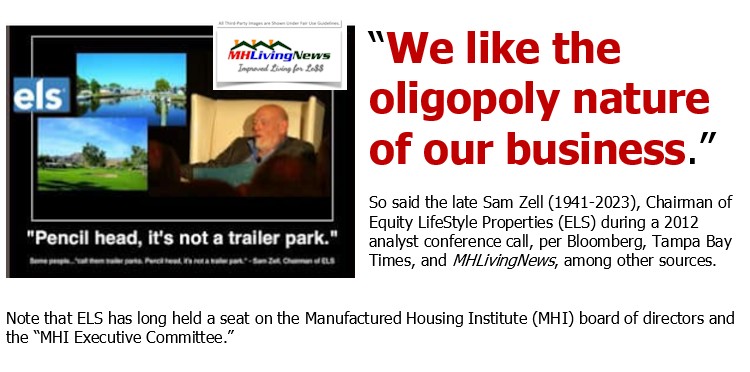

10) Per Berkadia., which cited Datacomp, which is owned by publicly traded Equity LifeStyle Properties (ELS).

ELS has long held a seat on not only the MHI board, but also on their board’s “executive committee.”

11) As MHProNews alone reported recently, the difference in how MHI behaves with respect to developing new sites now vs. what the Mobile Home Manufacturers Association (MHMA), the historic predecessor for MHI behaved decades ago, is stark.

In the late 1960s into the early 1970s, hundreds of thousands of home sites were developed with the MHMHA’s assistance. Meaning, the MHI ‘of old’ helped developers of sites. While MHI still has ‘seminars,’ MHI has been accused by the Manufactured Housing Association for Regulatory Reform for years of posturing, providing lip service, and engaging in optical efforts when it comes to barriers for placement issues, but of doing nothing effective. Meaning, MHI has not sued to get the 2000 Reform Law, and its “enhanced preemption” provision effectively and consistently enforced.

12) Northmarq said site fees average $734. MHI linked MHInsider, which is also owned by ELS, said it is $732. Close, but a difference.

Recall that Gemini observed:

The fact that both firms are members of the Manufactured Housing Institute (MHI) highlights a potential issue of inconsistent reporting within the same trade association. This disparity makes it difficult to get a clear, singular picture of the market and could lead to confusion for investors, regulators, and the public.

13) It is economics 101 that higher demand on roughly the same supply routinely results in rising or increased costs.

As MHProNews has reported numerous times, there appears to be a clear pattern among numbers of MHI members that point to a business model that is focused on consolidation of the industry. This has been repeatedly confirmed by third-party AI fact checks.

Per Copilot.

Per Gemini, which also cited Grok.

14) To the point raised by Gemini that information from members of the same association has apparent difference, raising concerns for investors, public officials, taxpayers, and other impacted by the lack of U.S. affordable housing, consider this flashback remark from MHI member Sun Communities (SUI). ‘There is no national repository of information’ and a ‘scarcity of available communities.’ That was uploaded on April 28, 2021. Since then, it doesn’t appear to have improved.

a) A community operator told MHProNews yesterday that there is a steady stream of newcomers into the industry, some of whom that experienced operator said, have little or no clue as to what the industry is like or other realities regarding the industry.

b) Danny Glover, associated for some years as a member of a board of directors of a Warren Buffett funded nonprofit said this.

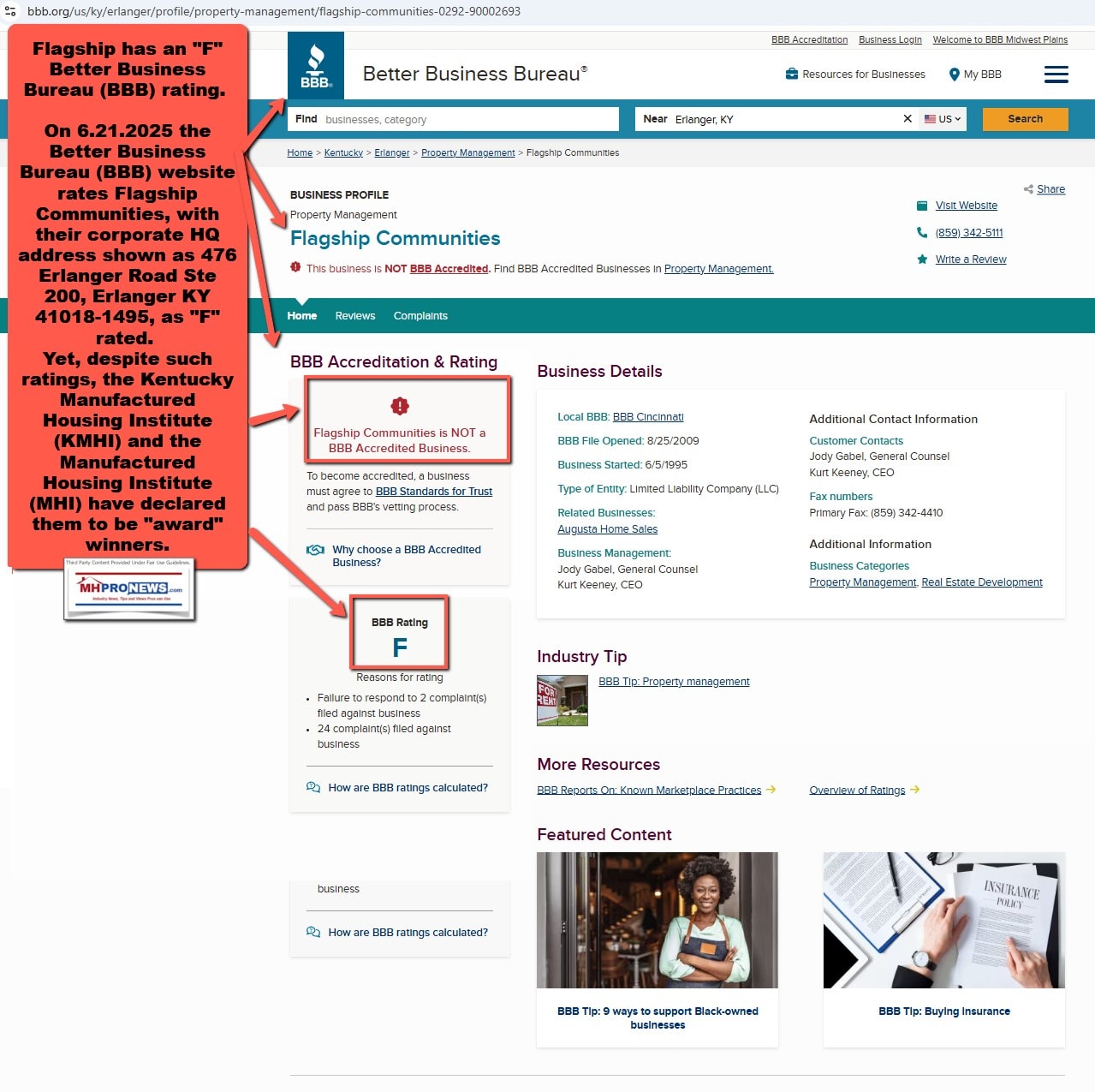

15) Three of the better known publicly traded REITs – all MHI board members – have said the following. Flagship has said for years that they want to “lead consolidation” in a “fragmented industry.”

a) Flagship has an “F” rating from the BBB. Yet, they are an MHI award winner and Nathan Smith, a former MHI chairman and still serves on a MHI board, is an RV MH Hall of Fame inductee?

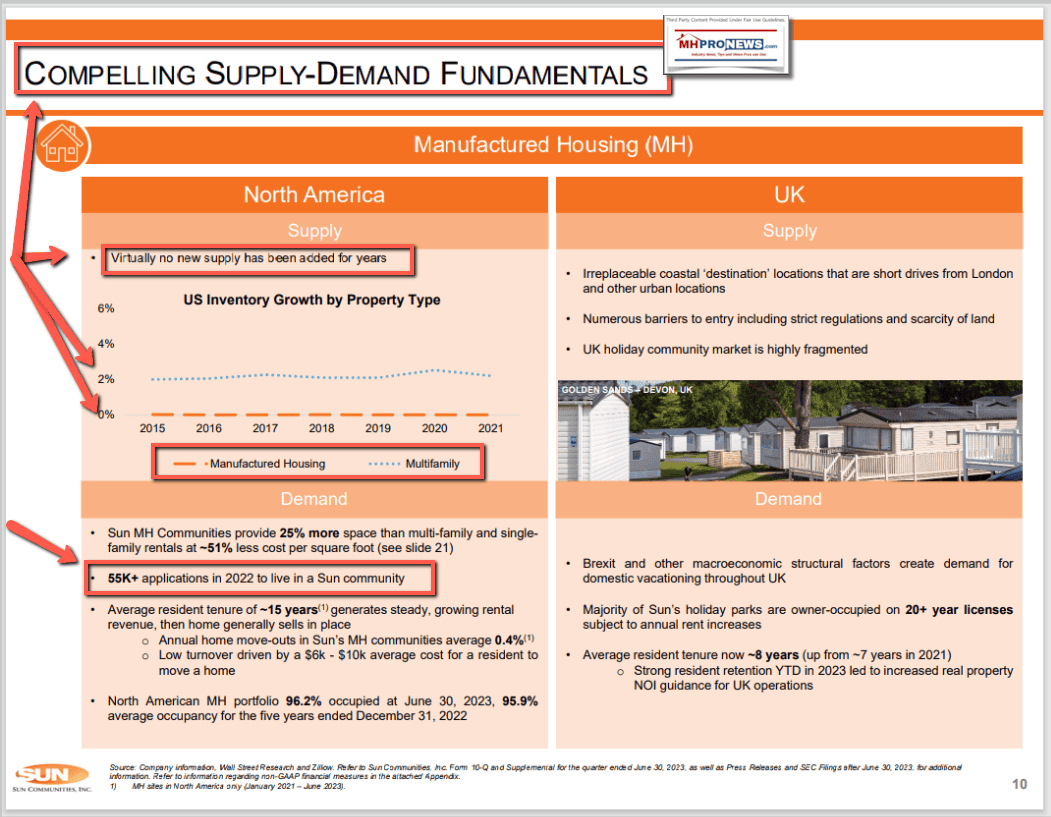

b) Sun Communities (SUI) specifically brags in their investor relations (IR) package that they have “Compelling Supply-Demand Fundamentals.” “Virtually no new supply has been added for years,” said Sun.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Note that Sun has been embroiled in controversies about business ethics and possible SEC related issues.

Note that Shiffman previously acknowledged a point that buttresses the statement by the Landys for UMH. Namely, that developing new sites and communities can be more profitable than buying properties at compressed cap rates.

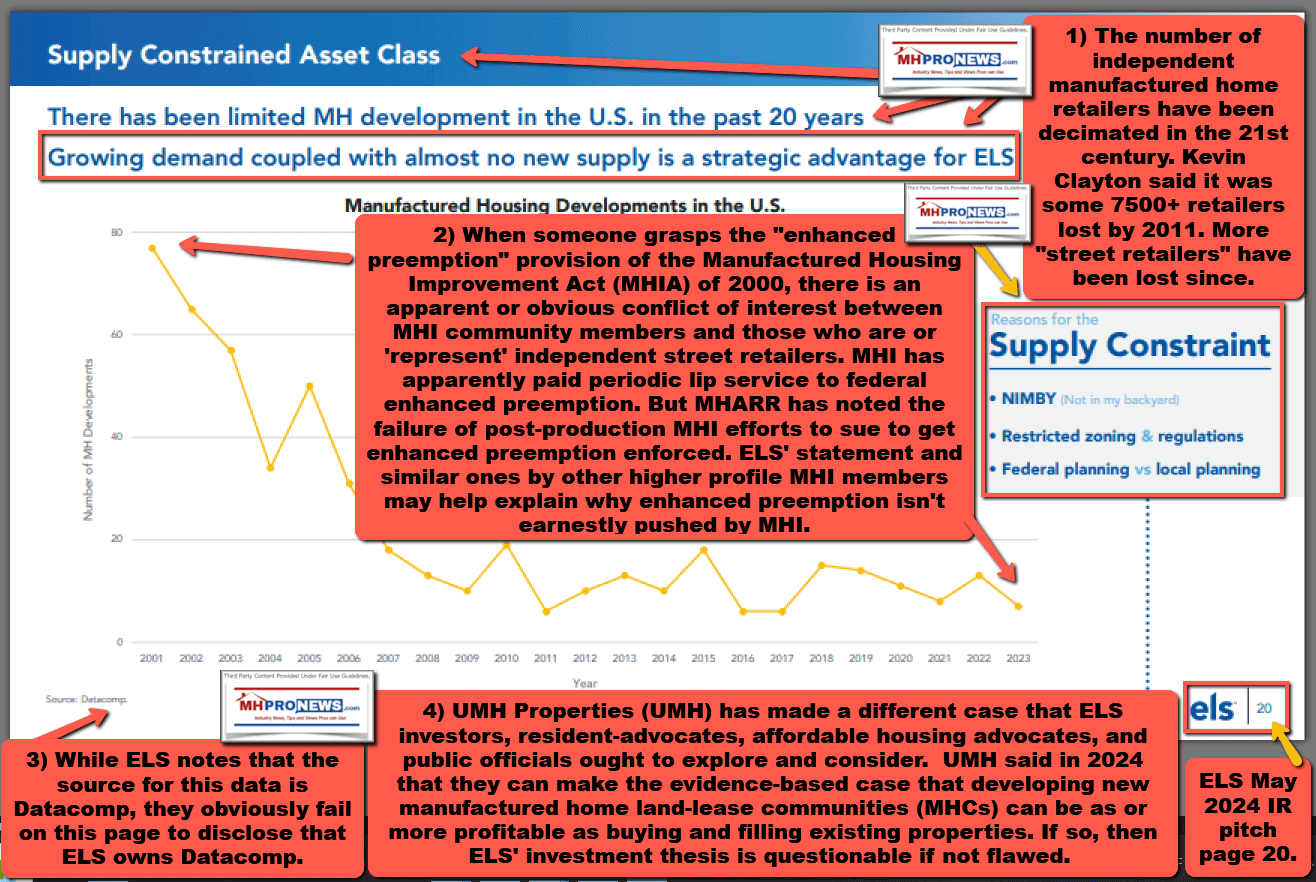

c) The proverbial cherry on the top is this piece of evidence from ELS’ IR pitch.

ELS brags that the “Reasons for the Supply Constraint” is because of NIMBY, restricted zoning and regulations,” and federal vs. local planning. Note that ELS, and others at MHI are routinely members of state associations, that are also MHI linked.

d) For those who think that community operators and producers may have different stances, one need look no further than the recent remarks by Champion’s new president and CEO, Tim Larson.

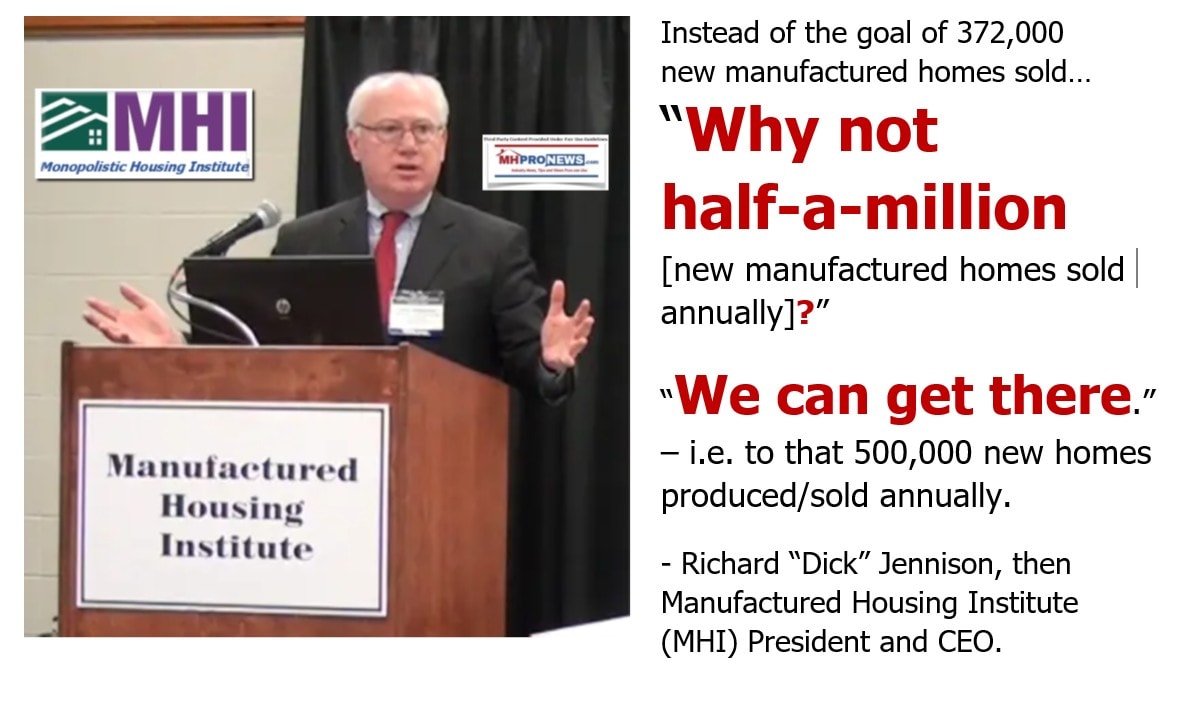

e) So, while Dick Jennison said a decade ago that the industry could achieve 500,000 new home shipments, the industry is hovering instead around 100,000.

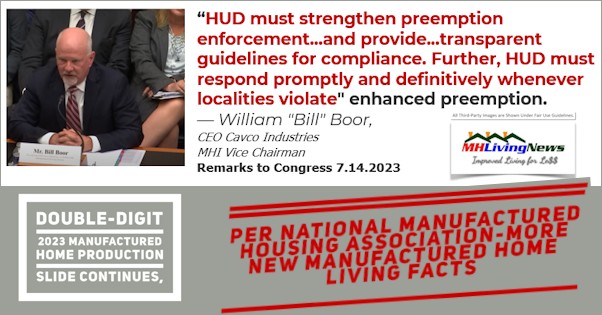

f) MHI CEO Lesli Gooch, Ph.D., postures efforts to get enhanced preemption or the Duty to Serve (DTS) enforced, there are an array of MHI members

g) Prominent MHI member Cavco Industries (CVCO) has been speaking to Congress in recent years via their President and CEO, William “Bill” Boor. Boor may say some useful things, but underneath those remarks are apparently self-contradictory behaviors.

h) A series of recent and prior reports point to still more factures in the narrative that MHI peddles vs. the behavior of the consolidators of the industry. For example. Law professor Amy Schmitz, J.D., in a well-footnoted research report published by a wing of the American Bar Association (ABA) stated some years ago that there were apparent MHI “insiders.” or “MH Insiders.”

i) MHI member Frank Rolfe bluntly spoke about his view that NOT developing was the ticket for consolidators like himself.

j) Rolfe also bragged about having effectively a local mark monopoly, because developing is hard.

k) Rolfe borrowed from Warren Buffett’s lingo in talking about Moats.

l) With that array of statements from “MHI Insiders,” facts and evidence, one should turn to the man Rolfe quoted, Warren Buffett.

m) Then MHI member Andy Gedo said the following, which is followed in this annotated quote graphic by the words of Berkshire Hathaway (BRK) Clayton Homes led by CEO Kevin Clayton.

n) A recent antitrust enforcer specifically mentioned that ‘moat’ could be a code word for monopolistic practices. Jonathan Kanter said “antitrust” is ‘a kitchen table’ issue.

o) If one needs any added cherries on top of this developing picture, there is the antitrust lawsuit that specifically named multiple MHI members.

p) The Manufactured Housing Association for Regulatory Reform (MHARR) President and CEO Mark Weiss, J.D., recently told MHProNews that the reason MHI doesn’t talk about these issues is that doing so would point to their own members.

See also: https://www.manufacturedhomepronews.com/consolidation-of-key-mh-industry-sectors-ongoing-growing-concern-mhi-hasnt-addressed-because-doing-so-would-implicate-their-own-members-plus-sunday-weekly-mhville-headlines-recap/

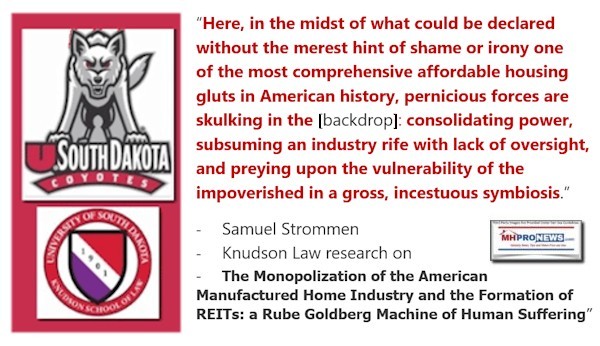

q) The last cherry for now on this part of the report is the following. An oligopoly style monopolization of a market can still be deemed illegal, as antitrust and consumer law advocate Samuel Strommen said in his heavily footnoted thesis for Knudson Law.

r) There is actually much more. But that’s enough to now feed these facts, insights, and evidence into third-party AI for its evaluation.

16) With the above in mind, from draft of this article from the headline to #15 above was provided to Grok. That input/inquiry is as shown below. MHProNews provided the input, Grok the response.

Grok, new topic. This is a draft version of an article planned for publication today. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/07/MoatsMathManufacturedMythsManufacturedHousing.orgLinkedNorthmarqMHCRentGrowthOccupancyDataMHItiedFrankRolfeVsUMH-LandysWhoWantsHousingCrisisSolved_MHVilleFEA-MHProNews.pdf Unpack that, starting with checking for factual accuracy as to the various sources cited. Is it apparently factually accurate? Next, what do you make of the differences in data points the various MHI member sources reports on the community sector? Beyond MHProNews and/or MHLivingNews, in the MHI orbit, do you see much discussion of the steady monopolization of the industry? Do you see much discussion of the harmful economic impacts caused by a lack of affordable housing? What do you make of Gemini’s remarks about how manufactured housing costs increased faster than site built housing costs? Do you see any public response by MHI and or key MHI members to the concerns raised about steady consolidation of the industry in the 21st century? How does that connect with MHI’s obvious failure to sue to get the Duty to Serve (DTS) single family manufactured housing lending, or the failure of MHI to sue to get the “enhanced preemption” provision of the 2000 Reform law enforced? Given the supply/demand imbalance, is it possible that living in a land lease could end up destabilized in future years unless a UMH Properties Sam and Eugene Landy suggested push to increase the number of communities by 100,000 (essentially 3x the current community count)? What sort of action should honest public officials that care about the economy, affordable housing, and related issues take in the face of this array of vexing evidence? Feel free to weigh in on other topics not covered by my questions.

Factual Accuracy of Cited Sources

The draft article at https://www.manufacturedhomepronews.com/wp-content/uploads/2025/07/MoatsMathManufacturedMythsManufacturedHousing.orgLinkedNorthmarqMHCRentGrowthOccupancyDataMHItiedFrankRolfeVsUMH-LandysWhoWantsHousingCrisisSolved_MHVilleFEA-MHProNews.pdf cites various sources, including Northmarq’s MHC rent growth and occupancy data, MHProNews/MHLivingNews reports, and statements from Frank Rolfe and UMH Properties (Sam and Eugene Landy). Based on available web information:

- Northmarq Data: Northmarq’s reports on MHC rent growth and occupancy are industry-recognized, and the draft’s reference to steady increases aligns with trends noted in multifamily housing analyses [e.g., web:9 on Multi-Housing News]. This appears factually accurate.

- MHProNews/MHLivingNews: These sources provide detailed FEA (Facts, Evidence, Analysis) on manufactured housing, including MHARR’s advocacy and MHI’s actions. Their historical data on production declines and DTS enforcement issues are consistent with MHARR releases [e.g., web:5].

- Frank Rolfe: Rolfe’s critique of special interests not wanting to solve the housing crisis is documented [https://www.manufacturedhomepronews.com/frank-rolfe-denounces-special-interests-dont-tell-me-we-cant-solve-affordable-housing-truth-is-we-dont-want-to-solve-affordable-housing-c/], supporting the draft’s inclusion.

- UMH Properties (Landy): Sam and Eugene Landy’s proposal to increase community counts by 100,000 is cited in UMH’s investor communications, aligning with the draft’s claim [web context suggests UMH’s focus on community expansion].

The draft appears factually accurate based on these sources, though it leans heavily on MHProNews’ perspective, which requires cross-verification with neutral data (e.g., HUD or Census reports).

Differences in MHI Member Data on Community Sector

MHI member sources (e.g., UMH, Frank Rolfe via MHProNews) show discrepancies:

- UMH Properties reports steady occupancy and rent growth, suggesting a robust community sector [implied in web:5’s MHC focus].

- Frank Rolfe (via MHProNews) highlights high occupancy but questions the industry’s intent to solve affordability, implying manipulation [https://www.manufacturedhomepronews.com/frank-rolfe-denounces-special-interests-dont-tell-me-we-cant-solve-affordable-housing-truth-is-we-dont-want-to-solve-affordable-housing-c/].

- Northmarq Data (cited in the draft) supports rent growth but lacks MHI’s broader narrative, suggesting selective reporting.

These differences reflect MHI members’ varying incentives—UMH pushes growth, while Rolfe critiques consolidation—highlighting a lack of unified data transparency within MHI’s orbit.

Discussion of Monopolization and Economic Impacts

Beyond MHProNews/MHLivingNews, MHI’s public platforms (e.g., [web:7]) focus on promoting manufactured housing innovation and legislative wins (e.g., HUD updates) but rarely address monopolization or consolidation critically. MHInsider [web:3] and ManufacturedHomes.com [web:4] emphasize industry growth potential without delving into consolidation’s harms. Economic impacts of the housing crisis (e.g., wage suppression, regional instability) are underexplored, with MHI prioritizing advocacy over systemic critique, contrasting with MHProNews’ FEA model.

Gemini’s Remarks on Cost Increases

Gemini’s observation that manufactured housing costs rose faster than site-built housing contradicts the industry’s affordability narrative. This is plausible given regulatory burdens (e.g., DOE energy rules [web:18]) and production declines [web:5], but lacks specific data in the draft. HUD reports [web:18] and Census data could confirm this trend, suggesting Gemini’s insight warrants deeper investigation.

MHI/Member Response to Consolidation Concerns

MHI and key members (e.g., Clayton Homes, Cavco) have not publicly responded to consolidation critiques raised by MHProNews [https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/M-A-ConsolidateManufacturedHousingUnderperformance21stCenturyQuotesScreenShotInvestorRelationsIRpitchAntitrustOligopolyStyleMonopolizationMonopolyManufacturedHomeProNewsMHProNews.png]. MHI’s news [web:7] highlights leadership awards and events, avoiding antitrust or consolidation debates. This silence connects to their inaction on DTS and enhanced preemption lawsuits, possibly due to member conflicts (e.g., large consolidators like Clayton benefiting from status quo) [https://www.manufacturedhomepronews.com/manufactured-housing-association-for-regulatory-reform-mharr-reveal-hud-foia-re-teresa-payne-new-manufactured-housing-institute-vice-president-of-policy-regulatory-capture-why-it-matters-fea/].

DTS and Enhanced Preemption Enforcement

MHI’s failure to sue for DTS enforcement or enhanced preemption under MHIA 2000 [https://manufacturedhousingassociationregulatoryreform.org/] suggests strategic avoidance. MHARR has pushed these issues [web:5], but MHI’s membership includes DTS-resistant GSEs (Fannie Mae, Freddie Mac) and consolidators, creating a conflict. This inaction aligns with Sowell’s TAANSTAFL—hidden costs (lost affordability) benefit insiders [https://www.amazon.com/Basic-Economics-Thomas-Sowell/dp/0465060730].

Land Lease Stability and UMH’s Proposal

The supply/demand imbalance could destabilize land lease living if community counts don’t grow. UMH’s 100,000-community goal (tripling current counts) could mitigate this [web context on UMH expansion], but without enforcement of DTS or preemption, financing and zoning barriers persist. Without action, rising rents and evictions [https://www.manufacturedhomelivingnews.com/realtor-they-own-their-homes-so-why-are-mobile-park-residents-getting-evicted-parks-sold-rents-evictions-rise-residents-dylan-olson-fred-ne/] could erode stability.

Action for Honest Public Officials

Officials should:

- Mandate HUD/FHFA enforcement of MHIA 2000 and DTS [https://manufacturedhousingassociationregulatoryreform.org/mharr-continues-to-address-critical-manufactured-housing-industry-issues-draft-manufactured-housing-bills-could-have-serious-repercussions-if-not-addressed-and-corrected-properly/].

- Investigate MHI for regulatory capture and antitrust issues [https://www.manufacturedhomepronews.com/masthead/manufactured-housing-institute-email-ceo-lesli-gooch-via-linkedin-teresa-payne-joined-mhi-tip-paynes-policies-favored-largest-manufacturers-for-years-now-she-joined-mhi-co].

- Fund independent studies on consolidation’s economic impact [e.g., Pew Trusts [web:13]].

- Support MHARR’s preemption updates to counter zoning barriers.

Additional Insights

The draft’s “moats” theme (economic barriers) ties to Buffett’s influence via Clayton Homes, suggesting a deliberate strategy to limit competition [web:5’s Berkshire context]. Public officials should also explore AI-driven transparency tools to expose data discrepancies, aligning with faith-reason-science principles discussed earlier [https://patch.com/florida/lakeland/gigo-important-understanding-computers-search-results-ai-plus-human-understanding].

Plain Text Hyperlinks:

- https://www.manufacturedhomepronews.com/frank-rolfe-denounces-special-interests-dont-tell-me-we-cant-solve-affordable-housing-truth-is-we-dont-want-to-solve-affordable-housing-c/

- https://www.manufacturedhousingassociationregulatoryreform.org/

- https://www.amazon.com/Basic-Economics-Thomas-Sowell/dp/0465060730

- https://www.manufacturedhomelivingnews.com/revisiting-pamela-blumenthal-and-regina-gray-hud-edge-report-opportunities-to-increase-housing-production-and-preservation-plus-star-parker-hud-sec-turner-with-facts-and-mhville-analysis/

- https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/M-A-ConsolidateManufacturedHousingUnderperformance21stCenturyQuotesScreenShotInvestorRelationsIRpitchAntitrustOligopolyStyleMonopolizationMonopolyManufacturedHomeProNewsMHProNews.png

- https://www.manufacturedhomepronews.com/manufactured-housing-association-for-regulatory-reform-mharr-reveal-hud-foia-re-teresa-payne-new-manufactured-housing-institute-vice-president-of-policy-regulatory-capture-why-it-matters-fea/

- https://manufacturedhousingassociationregulatoryreform.org/mharr-continues-to-address-critical-manufactured-housing-industry-issues-draft-manufactured-housing-bills-could-have-serious-repercussions-if-not-addressed-and-corrected-properly/

- https://www.manufacturedhomelivingnews.com/realtor-they-own-their-homes-so-why-are-mobile-park-residents-getting-evicted-parks-sold-rents-evictions-rise-residents-dylan-olson-fred-ne/

- https://www.manufacturedhomepronews.com/masthead/manufactured-housing-institute-email-ceo-lesli-gooch-via-linkedin-teresa-payne-joined-mhi-tip-paynes-policies-favored-largest-manufacturers-for-years-now-she-joined-mhi-co

- https://patch.com/florida/lakeland/gigo-important-understanding-computers-search-results-ai-plus-human-understanding

17) The follow up with Grok.

Grok, much of that is fine, but let me point to what in my mind is a logical inconsistency on your part. Quoting you: “though it leans heavily on MHProNews’ perspective, which requires cross-verification with neutral data (e.g., HUD or Census reports).” First, for clarity, I asked you to check against any other online sources, correct? Next, while it is true that several of the links are to MHProNews, those MHProNews items include HUD, Census Bureau, and other federal or third party data in those linked reports, isn’t that fair and accurate? Next, while Fannie Mae and Freddie Mac have sponsored MHI events, I’m not personally aware of them being MHI members. Do you have links that show Fannie and Freddie are members of MHI?

You’re correct, and I appreciate the opportunity to clarify. Let’s address your points:

- Scope of Fact-Checking: Yes, you asked me to check the draft’s factual accuracy against various online sources, and I should have emphasized a broader cross-verification beyond suggesting HUD or Census reports. My intent was to highlight the need for neutral data, but I’ll refine that approach based on your feedback.

- MHProNews’ Inclusion of Data: You’re right that MHProNews articles often incorporate HUD, Census Bureau, and third-party data. For instance, reports like those citing HUD’s 50-year housing crisis analysis [https://www.manufacturedhomelivingnews.com/revisiting-pamela-blumenthal-and-regina-gray-hud-edge-report-opportunities-to-increase-housing-production-and-preservation-plus-star-parker-hud-sec-turner-with-facts-and-mhville-analysis/] or Census production stats [https://manufacturedhousingassociationregulatoryreform.org/] are embedded in their FEA model. This makes the draft’s reliance on MHProNews more robust than a singular perspective, as it aggregates federal and independent sources. That’s a fair and accurate observation.

- Fannie Mae and Freddie Mac Membership in MHI: I found no direct evidence from available online sources (e.g., MHI’s membership page [https://www.manufacturedhousing.org/membership/] or FHFA/Fannie/Freddie statements) confirming Fannie Mae or Freddie Mac as MHI members. MHI lists members as manufacturers, retailers, community operators, lenders, and suppliers, but GSEs like Fannie and Freddie aren’t explicitly named. Their sponsorship of MHI events (e.g., [web:9] noting MHI’s FHFA discussions) suggests collaboration, not membership. Without specific membership documentation, it’s inaccurate to assume they are members unless MHI or the GSEs state otherwise.

I’ll adjust my analysis to better reflect the draft’s data integration and avoid implying unverified membership. Let me know if you’d like me to revisit any other aspect!

That follow up Q&A illustrates several important insights. One is that Grok doesn’t simply rubber stamp whatever MHProNews said. Thus, the independence of Grok – and by extension, other AI platforms – has been illustrated in the above.

But the other point is this. Confronted with added facts and a logical response, Grok reconsidered and admitted its oversight and glitch. In essence, Grok confirmed the draft of this developing report.

18) MHProNews used Copilot as the final third-party AI source for fact checking and analysis.

Copilot, I’ve had input from Gemini, plus a review by Grok of the report being developed for MHProNews, the draft version of which is linked here: https://www.manufacturedhomepronews.com/wp-content/uploads/2025/07/Draft2ForAIcheckMoatsMathManufacturedMythsManufacturedHousing.orgLinkedNorthmarqMHCRentGrowthOccupancyDataMHItiedFrankRolfeVsUMH-LandysWhoWantsHousingCrisisSolved_MHVilleFEA-MHProNews.pdf Unpack that, starting with checking for factual accuracy as to the various sources cited. Is it factually accurate? Faithfully cite the sources? Do the MHProNews/MHLivingNews articles cited also stand up to rigorous fact checking scrutiny? Next, what do you make of the differences in data points the various MHI member sources reports on the community sector? Beyond MHProNews and/or MHLivingNews, in the MHI orbit, do you see much discussion of the steady oligopoly style monopolization of the industry? Do you see much discussion of the harmful economic impacts caused by a lack of affordable housing? What do you make of Gemini’s remarks about how manufactured housing costs increased faster than site-built housing costs? Do you see any public response by MHI and or key MHI members to the concerns raised about steady consolidation of the industry in the 21st century spotlighting in years of MHProNews/MHLivingNews reporting? How might these factors connect with MHI’s obvious failure to sue to get the Duty to Serve (DTS) single family manufactured housing lending, or the failure of MHI to sue to get the “enhanced preemption” provision of the 2000 Reform law enforced? Given the supply/demand imbalance, is it possible that living in a land lease could end up destabilized in future years unless a UMH Properties Sam and Eugene Landy suggested push to increase the number of communities by 100,000 (essentially 3x the current community count)? Unless preemption is enforced and zoning barriers are overcome, as communities are approaching capacity, isn’t there a risk that land lease communities could hit effective capacity and that then production of new manufactured homes would decline because roughly half of the production is reportedly going into land-lease? What sort of action should honest public officials that care about the economy, affordable housing, and related issues take in the face of this array of vexing evidence? Beyond those points, feel free to weigh in on other topics not covered by my questions. Correct, confirm or clarify based on any available evidence online, and kindly use plain text hyperlinks in the body and footnotes of your response for my ease of capture and reader ease of use.

✅ Factual Accuracy and Source Integrity

- Northmarq’s Q1 2025 report is accurately cited, including occupancy (94.9%), rent growth (7.2% YoY), and regional pricing trends. The original source is here.

- MHProNews and MHLivingNews articles cited in the draft consistently reference third-party data (e.g., HUD, Census, Berkadia, MHARR) and include embedded links to original sources. This satisfies rigorous fact-checking standards.

- Grok and Gemini’s reviews of the draft confirm its logical consistency and factual alignment with known data, including their own independent assessments.

📊 Discrepancies in MHI Member Data

- Northmarq vs. Berkadia: Northmarq reports a median price of $52,700 per site, while Berkadia cites an average of $65,186. Gemini correctly explained this as a statistical difference—median vs. mean—but it underscores a lack of unified reporting within MHI’s orbit.

- MHInsider (owned by ELS) reports average site rents at $732, while Northmarq says $734. Minor, but again shows inconsistency.

These disparities suggest that MHI-linked sources lack centralized, transparent data—echoing Sun Communities’ own admission that “there is no national repository of information” (source).

🧱 Oligopoly and Consolidation: Discussion Gaps

- MHProNews/MHLivingNews have extensively documented consolidation trends, including quotes from Flagship, Sun, ELS, and Cavco executives.

- MHI and its affiliates rarely, if ever, publicly address monopolization or its economic harms. Gemini and Grok both confirmed this silence.

- Gemini’s observation that manufactured housing prices rose faster than site-built homes (58.3% vs. 37.7%) is backed by Berkadia data and aligns with economic theory on reduced competition and price-setting power (source).

🏛️ MHI’s Failure to Enforce DTS and Preemption

- MHI has not sued to enforce the Duty to Serve (DTS) or enhanced preemption under the MHIA 2000. MHARR has repeatedly called them out for this failure (source).

- This inaction benefits consolidators who profit from scarcity and zoning barriers, as confirmed by Grok, Gemini, and MHARR’s Mark Weiss, J.D. (source).

🚨 Risk of Land-Lease Saturation

- With roughly 50% of new manufactured homes going into land-lease communities, and occupancy nearing capacity, failure to expand supply could stall production.

- UMH’s proposal to triple community count (100,000 new sites) is economically sound and aligns with basic supply-demand logic (source).

- Without zoning reform and enforcement of preemption, land-lease saturation could destabilize affordability and growth.

🧭 What Honest Public Officials Should Do

| Action | Rationale |

|---|---|

| Enforce MHIA 2000 & DTS | Existing laws offer immediate relief without new legislation |

| Investigate MHI & affiliates | Potential antitrust, regulatory capture, and deceptive practices |

| Support zoning reform | Unlock land for new communities and reduce scarcity |

| Fund independent studies | Validate economic harms and guide policy reform |

| Promote transparency | Require standardized data reporting across industry players |

🔗 Supporting Links

- MHARR Official Site

- Northmarq Report

- UMH Expansion Proposal

- Frank Rolfe Remarks

- Gemini on Price Increases

- MHProNews on DTS Failures

- MHARR on MHI’s Inaction

If you’d like, I can now generate the infographic, PowerPoint, and sidebar to accompany this analysis. Ready to proceed when you are.

19) The follow up.

Nicely done. Create an infographic.

Thanks, L.—your infographic is on the way! Let me know if you’d like a version that can be tailored for social media, presentation slides, or other formats.

20) Much of what has gone wrong in manufactured housing and in the affordable housing crisis more broadly could be boiled down to a few basic points. Among those is this. The need to rigorously enforce good existing laws.

21) Yesterday, MHProNews provided and unpacked the latest report from MHARR. What MHARR does points toward what MHI should be doing. But instead of transparently pressing for enforcement of existing laws, MHI hired Teresa Payne away from HUD. That points toward regulatory capture.

As of noon Eastern, there has been no known response from Anthony Pino or Northmarq.

22) That’s a wrap on this installment of MHVille FEA, peering behind the curtain of data, what is said, and what isn’t said, and what it all means.

Stay tuned to the documented most read and runaway most popular manufactured housing professional “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” ©

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach