Tonight’s featured focus will be just such a spotlight report.

If you are an ethically minded investor or professional, wonderful. If you have been harmed or have benefited from this COVID19 crisis, either way, this report will have something for you.

Every evening our headlines that follow provide snapshots from two major media outlets on each side of the left-right news spectrum that reflect topics that influence or move investor sentiment. In moments on this business evening report, you can get ‘insights-at-a-glance.’

This report also sets the broader context for manufactured housing markets, in keeping with our mantra, “News through the lens of manufactured homes and factory-built housing” ©.

We begin with headlines left-of-center CNN followed by right-of-center Fox Business. We share closing tickers and other related data courtesy of Yahoo Finance, and more. 5 to 10 minutes reading this MHProNews market report every business night could save you 30 minutes to an hour of similar reading or fact-gathering elsewhere.

Perhaps more important, you will get insights about the industry from experts that care, but also dare to challenge the routine narrative that arguably keeps manufactured housing underperforming during an affordable housing crisis.

Newsy, Peeling Back Media Bias, Manufactured Housing Sales, Investing, Politics, and You

Headlines from left-of-center CNN Business

- Stocks soar

- The Fearless Girl statue stands in front of the New York Stock Exchange near Wall Street on March 23, 2020 in New York City. – Wall Street fell early March 23, 2020 as Congress wrangled over a massive stimulus package while the Federal Reserve unveiled new emergency programs to boost the economy including with unlimited bond buying. About 45 minutes into trading, the Dow Jones Industrial Average was down 0.6 percent at 19,053.17, and the broad-based S&P 500 also fell 0.6 percent to 2,290.31 after regaining some ground lost just after the open.

- The Dow has rallied nearly 20% … since Monday

- Gasoline demand is falling off a cliff

- UK lenders offer mortgage extensions as banks and customers grapple with coronavirus disruptions

- Unemployment claims soared to 3.3 million last week, the most in history

- The bill for saving the world economy is $7 trillion and rising

- The $2 trillion stimulus will slam the mortgage industry — unless the Fed comes to the rescue

- Opinion: These taxpayers won’t get stimulus checks. That’s unjust

- How small business owners may benefit from the $2 trillion in federal aid

- Why CEOs are giving up their salaries during the coronavirus crisis

- A flight attendant dies, and colleagues are ‘very much on edge’

- 5 truck drivers talk about hauling critical supplies during a pandemic

- Help is coming for gig economy workers and small businesses

- McDonald’s and other brands make ‘social distancing’ logos

- CoVent is a new ventilator specifically designed by Dyson and TTP. It meets the clinician-led specifications, to address the explicit clinical needs of Covid-19 patients.

- Dyson is making 15,000 ventilators to fight the pandemic

- Billionaire investor William Ackman appears for a speech by President Donald Trump at the Economic Club of New York at the New York Hilton Midtown in New York, Tuesday, Nov. 12, 2019.

- LISTEN Billionaire hedge fund chief: Shut down the economy for a month

- Want to buy gold coins or bars? Good luck finding any

- MARKETS

- PROBLEMS PAYING THE BILLS

- LOS ANGELES, CALIFORNIA – NOVEMBER 06: Arriving passengers wait to board Uber vehicles at the new LAX ride-hail passenger pickup lot at Los Angeles International Airport (LAX) on November 6, 2019 in Los Angeles, California. The airport has instituted a ban on Lyft, Uber and taxi curbside pickups as airport construction increases during a modernization program. Passengers have complained of long wait times and confusion at the pickup area, especially during peak hours. Passengers must depart their terminal and then ride a shuttle bus or walk to the separate pickup lot.

- Uber and Lyft still aren’t helping their most vulnerable drivers

- Millions of gig economy workers need help now

- Workers say gig companies doing ‘bare minimum’

- Food lines, tears and despair as layoffs mount

- Local restaurants fear for survival

- STRESS EATING

- Shoppers browse items inside a Grocery Outlet Holding Corp. store in San Francisco, California, U.S., on Thursday, June 20, 2019. Grocery Outlet Holding rose in its trading debut after raising $378 million in an above-range initial public offering. The discount supermarket chain's shares, which rose as much as 43% Thursday, closed up 30% to $28.51, valuing the company at $2.44 billion.

- Why the ‘TJMaxx of groceries’ is succeeding right now

- Egg prices skyrocket because of panic shopping

- How grocery stores restock shelves in a pandemic

- Coronavirus will change the grocery industry forever

- Grocery stores add extra security

Headlines from right-of-center Fox Business

- Union finds 39 million coronavirus masks in 5 days

- It’s now telling health providers where they can find the masks and other equipment.

- Dow soars 21% in largest three-day winning streak since 1931

- How courts are handling coronavirus outbreak

- US jobless claims surge to record high

- Full list: Companies hiring right now

- How to find work during the pandemic

- These businesses are still open

- List of CEOs foregoing pay

- Kudlow’s timeline for US economic recovery

- Coronavirus induced shutdown at GM will continue indefinitely

- Who will get relief checks — and when

- Oil prices sink amid crippled demand

- Boston restaurateur shares coronavirus nightmare business collapse

- Virus is not ’08 crisis: What DC must do

- Coronavirus relief may help gold miners strike mother lode

- Hedge fund titans seeing wealth slashed by coronavirus crisis

- Coronavirus ‘social distancing’ getting new guidelines from Trump admin

- Researchers report breakthrough tech that could ease mask shortage crisis

- Coronavirus strikes growing number of Amazon facilities amid delivery rush

- Taylor Swift gives coronavirus relief money to fans

- Patriots made ‘mistake’ letting Tom Brady go, Joe Montana says

- New Yorkers escape coronavirus: Why Florida’s always been a favorite

- Coronavirus losses drive car dealers to online sales push

- How to optimize Wi-Fi during pandemic-forced work from home: FCC

- Lori Loughlin demands bribery charges be tossed, slams prosecutors

- Small-dollar loans pushed in coronavirus crisis for consumer relief

- Big cruise-ship lines wouldn’t qualify for aid under stimulus package

- Fox, iHeart Radio ‘Living Room Concert for America’ gives to two charities

- Pandemic relief: Major changes coming to unemployment insurance benefits

- Restaurant workers laid off during coronavirus get meals from Dallas chef

- Disney+ to release Meghan Markle-narrated documentary about elephants

- WATCH: Atlanta cheers for coronavirus-fighting medics

- Coronavirus prompts NBA to cut pay for executives by 20 percent: Report

- Fed’s Powell says US economy may already be in a recession

- Coronavirus relief checks could go to Americans within 3 weeks, Labor secretary says

- WHO getting coronavirus tech ideas from teens, startups

- Fiat Chrysler could reopen after coronavirus closed factories

- Postmates couriers have right to unemployment insurance benefits: Court

- Virtual IndyCar races during coronavirus pandemic

- Coronavirus leads WNBA to hold virtual draft event this season

- Smaller cities prepare for coronavirus onslaught

- US indicts Venezuela’s Maduro on narcoterrorism charges

- NBCUniversal CEO Jeff Shell tests positive for coronavirus

- Jails officials, experts warn of coronavirus effects: ‘A storm is coming’

- US economy grew at 2.1% rate in fourth quarter

- Coronavirus pushes United Airlines to offer buyouts to US employees

- Relief bill to ban corporate stock buybacks for companies receiving federal aid

- Coronavirus propels gun sales, background checks in South Florida

- UnitedHealth rolls out self-swab virus testing to help protect health workers

- Coronavirus boosts Target’s sales of essential goods as panicked shoppers stock up

- Ford aims to reopen some North American plants in April after coronavirus shutdown

- GrubHub CEO: Deferring revenue during coronavirus to save restaurants

- AFL-CIO’s Trumka: Coronavirus relief package ‘not perfect’ but ‘going to do a lot of good’

- Coronavirus delivers ‘body blow’ to Colorado’s ski industry

- Hospitals scramble for space, pack rooms as virus patients flood facilities

- US coronavirus death toll tops 1,000 as $2.2T in aid approved

- Tesla’s Elon Musk pledges coronavirus ventilator production in New York

- Bill Gates: Trump’s 15-day coronavirus economy plan ‘very irresponsible’

- Coronavirus prompts Starbucks, Krispy Kreme, JetBlue to donate to health care workers

- Fox, iHeartMedia team with Elton John in star-studded show for Americans

- MLB ballparks empty as coronavirus weighs on

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus – Where Business, Politics and Investing Can Meet

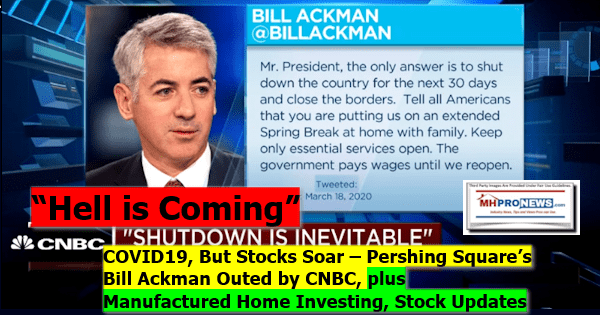

Bill Ackman turned a net profit of more than $2 billion on Monday after he sold his bets against the market less than one week after warning CNBC that “hell is coming”

- The Ackman about-face came less than one week after he told CNBC that the United States was in jeopardy unless the White House closed the country.

- That he added to his Hilton position using the money he earned from his bets against the market is notable after saying the stock could be headed to zero.

- Pershing Square manager Bill Ackman turned a net profit of more than $2 billion on Monday after he sold his bets against the market less than one week after warning CNBC that “hell is coming” and imploring the White House to shut down the country for a month

- He then used those proceeds to wager that existing Pershing bets, including hotel operator Hilton Worldwide, would rebound.

- Ackman said the fund completed the exit from his bets against the market on March 23 and generated $2.6 billion compared with premiums paid and commissions totaling $27 million. The amount of capital Ackman put behind protecting credit — the actual principal wagered against the market — is unknown.

- Still, the Ackman about-face came less than one week after he told CNBC’s Scott Wapner in an emotional interview that the United States was in jeopardy unless President Donald Trump closed the country for one month in a sort-of “Spring Break.”

- “America will end as we know it. I’m sorry to say so, unless we take this option,” he told CNBC on March 18, five days before ending his bet against the market. “We need to shut it down now. … This is the only answer.”

The scenario above has several tell-tale signs that should be considered in the light of this other recent news report.

Ackerman predicted a ‘Depression-era’ period with a “million” Americans dying, based on then current conditions. This week, he sold the beg against the market, and has ridden a wave up. It is far bigger and more brazen, one could argue, than what occured in the fictional Michael Douglas movie Wall Street.

“Bill Ackman makes a $2.5 bn ‘recovery bet’, raises stake in Buffett’s Berkshire Hathaway among others,” per MoneyControl on March 24, 2020

- The self-proclaimed activist investor has raised stake in several of his portfolio companies, including Lowe’s Cos, Hilton Worldwide Holdings and Warren Buffett’s Berkshire Hathaway.

- The billionaire investor, who has been on a buying spree for the last few days, said that his Pershing Square Capital Management had taken off all the hedges placed to offset the effects of the coronavirus via shorts in the credit market.

“Bill Ackman makes a $2.5 bn ‘recovery bet’, raises stake in Buffett’s Berkshire Hathaway among others,” per MoneyControl on March 24, 2020

- The self-proclaimed activist investor has raised stake in several of his portfolio companies, including Lowe’s Cos, Hilton Worldwide Holdings and Warren Buffett’s Berkshire Hathaway.

- The billionaire investor, who has been on a buying spree for the last few days, said that his Pershing Square Capital Management had taken off all the hedges placed to offset the effects of the coronavirus via shorts in the credit market.

Forbes on August 16, 2019 published an article entitled “Billionaire Bill Ackman Explains Why He Invested 11% Of His Fund In Berkshire Hathaway.”

- The enduring competitive advantages of Berkshire’s insurance businesses have allowed it to consistently grow its float (the net premiums received held on Berkshire’s balance sheet that will be used to pay for expected losses in the often distant future) at a higher rate and a lower cost than its peers. While Mr. Buffett is best known as a great investor, he should perhaps also be considered the world’s greatest insurance company architect and CEO because the returns Berkshire has achieved on investment would not be nearly as good without the material benefits it has realized by financing these investments with low- cost insurance float.

- Burlington Northern is North America’s largest railroad which benefits from strong barriers to entry, industry-leading scale, and long-term secular growth due to rail’s cost advantages over trucking in moving freight over long distances.

- Net of its excess cash, Berkshire currently trades at less than 12 times our estimate of earnings per share over the next year. Given the company’s strong competitive position, solid future growth prospects, large degree of excess cash and superlative track record of value creation, we believe that Berkshire should be valued at a large premium to its current valuation. Moreover, we believe an investor’s downside is limited due to the company’s fortress balance sheet, highly diversified business portfolio, and significant earnings contribution from recession-resistant businesses such as insurance and regulated utilities.

- We expect that Berkshire’s enviable competitive advantages and the positive underlying growth trends in most of its businesses will allow the company to sustainably grow its earnings at a high-single digit rate without any operational improvement at its larger businesses, and without including the benefit of the productive deployment of excess capital.

- If Berkshire can improve its operations and intelligently deploy a substantial portion of its excess capital over time, we estimate that the company’s earnings per share should grow at a mid-teens’ compounded annual rate over the intermediate term. In light of the company’s currently depressed valuation, understated near-term earnings, and the potential for significant future earnings per share growth, we believe that Berkshire’s share price is likely to increase substantially over the coming years.”

Note that each of these revolves around topics that have been covered now for several years on MHProNews, and to a lesser extent, on our MHLivingNews sister-site. Namely, Ackman is describing Buffett’s “Castle and Moat” maxims:

- durable competitive advantages, competitive advantages, “the company’s fortress balance sheet” and the like.

But the primary point this evening is in relation to a stratagem that MHProNews has argued has been employed by Bill Gates, Warren Buffett’s long-time buddy and a Berkshire board member for over a decade.

CNBC has clearly suggested that Ackman gave a massive head-fake. It is a tactic that Buffett has also been accused of, as this morning’s report reflected.

The question is, are these random, disconnected moves by Gates, Ackman and perhaps others? Is there any coordination, or is it a wink and a nod, or mere coincidence?

These are questions for the SEC and other public officials to investigate. There have been 3 sizable scams in the 21st century that for years escaped the notice of public officials. There are reasons to believe that several billionaires are involved in a ploy that has harmed millions of Americans that would arguably put the other three combined to shame.

See the related reports for more.

Related Reports:

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

Spring 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has now celebrated our tenth anniversary.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach, co-managing member of LifeStyle Factory Homes, LLC and co-founder for MHProNews.com, and MHLivingNews.com.

Connect with us on LinkedIn here and here.