Eddie Carlisle, Chief Financial Officer (CFO) of Flagship Communities Real Estate Investment Trust (REIT) made the following information available via a Canadian press release. Flagship Communities (MHU:C) is traded on the Toronto Exchange (TSX). Their release and required disclosures will be followed by additional information, MHProNews analysis and commentary.

Flagship Communities REIT Acquires a Portfolio of Seven Manufactured Housing Communities for $12.9 Million

Dec 17, 2020, 15:27 ET

TORONTO, Dec. 17, 2020 /CNW/ – Flagship Communities Real Estate Investment Trust (“Flagship” or the “REIT”) (TSX: MHC.U) announced today that it has completed the acquisition of five manufactured housing communities and waived due diligence conditions on the acquisition of two additional MHCs (collectively, the “Acquisitions”) for a purchase price of approximately US$12.9 million. The Acquisitions are expected to be immediately accretive to the REIT’s adjusted funds from operations (“AFFO”) on a per unit basis.

The purchase price of $12.9 million will be funded with cash on the REIT’s balance sheet. The REIT’s pro forma debt to gross book value (“GBV” – see “Non-IFRS Financial Measures” below) following the Acquisitions is expected to be 48.9%.

“The Acquisitions are an outstanding addition to our portfolio and speak to the REIT’s positive momentum following its initial public offering in October 2020,” said Kurt Keeney, President and Chief Executive Officer.” By purchasing MHCs within our existing footprint, we are better able to achieve economies of scale and benefit from operational synergies by clustering the acquisitions within our existing portfolio.”

The Acquisition Portfolio is 87.6% leased as of December 1st, 2020. The Acquisitions expand the REIT’s presence within its existing operational footprint, providing the opportunity for continued growth and management operating synergies as the REIT consolidates communities in its core markets.

“These acquisitions reflect the strong market fundamentals with the MHC space and our long-standing industry relationships,” said Nathan Smith, Chief Investment Officer. “The acquisitions are in line with our stated acquisition strategy and are immediately accretive to our AFFO per unit with additional above market growth over time.”

Overview of the Acquisitions

Evansville, Indiana: The Evansville portfolio comprises three communities with 197 lots and expands the REIT’s local market inventory by nearly 10%. The Evansville portfolio is located approximately five miles from Flagship’s existing community of Carolina Pointe, is adjacent to two retail plazas and within close proximity to the Evansville Regional Airport, Deaconess Hospital, and three universities. Major employers nearby include Toyota Motor Corporation, Berry Global Group, Inc. and Alcoa Warrick Operations.

Paducah, Kentucky: The Paducah portfolio comprises two communities with 81 lots and expands the REIT’s local market inventory by nearly 40%. The Paducah portfolio is approximately two miles from Flagship’s existing community of Southwood Pointe. Centrally located, the Paducah portfolio is within 15 minutes of the Barkley Regional Airport, Riverside Hospital, and the University of Kentucky (Paducah Campus). The region’s economic and employment stability benefits from the well-developed transportation and shipping infrastructure for agricultural products.

Northern Kentucky (Greater Cincinnati Metro Area) *closing date December 18, 2020: The Northern Kentucky portfolio is comprised of two communities with 101 lots and expands the REIT’s local market inventory by approximately 5%. The Northern Kentucky portfolio is conveniently located near Interstates 75 and 275 and is a short drive to the Cincinnati/Northern Kentucky International Airport, Amazon’s CVG Air Hub and fulfillment center as well as numerous other large private and public employers in the Greater Cincinnati metro area.

Pro Forma Portfolio

The Acquisitions are a targeted and strategic expansion of the REIT’s portfolio, increasing the number of MHCs from 45 to 52 and the number of manufactured housing lots from 8,255 to 8,634. In-place net operating income (“NOI” – see “Non-IFRS Financial Measures” below) is expected to increase to approximately US$24 million by September 30th, 2021. The table below provides a summary of the Acquisition Portfolio and the REIT’s pro forma portfolio:

At IPO | Acquisition Portfolio

| At IPO | Acquisition Portfolio | Pro Forma | ||

| # of Lots | (#) | 8,255 | 379 | 8,634 |

| Lot Occupancy | (%) | 79.8% | 87.6% | 80.2% |

| Lot AMR | (US$) | $365 | $265 | $361 |

| Forecast NOI | (US$ mm) | $23.2 | $0.9 | $24.0 |

About Flagship Communities Real Estate Investment Trust:

Flagship Communities Real Estate Investment Trust is a newly created, internally managed, unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario. The REIT currently owns and operates a portfolio of 50 income-producing manufactured housing communities within four contiguous states – Kentucky, Indiana, Ohio and Tennessee, and a fleet of approximately 700 manufactured homes for lease to residents of such housing communities. Upon the successful closing of the final two aforementioned communities, the portfolio will increase to 52 income-producing manufactured housing communities.

Non-IFRS Financial Measures:

Certain financial measures disclosed in this press release do not have any standardized meaning prescribed by International Financial Reporting Standards (“IFRS”) and are therefore a non-IFRS financial measures. The REIT’s method of calculating such non-IFRS financial measures may differ from other issuers’ methods and, accordingly, may not be comparable to such non-IFRS financial measures reported by other issuers.

AFFO is defined by the REIT as Funds From Operations (being IFRS consolidated net income adjusted for items such as distributions on redeemable or exchangeable units recorded as finance cost under IFRS (including distributions on the class B units of the REIT’s subsidiary, Flagship Operating, LLC), unrealized fair value adjustments to investment properties, loss on extinguishment of mortgages payable, gain on disposition of investment properties and depreciation) adjusted for items such as maintenance capital expenditures, and certain non-cash items such as amortization of intangible assets, deferred financing costs that were incurred prior to the formation of the REIT, premiums and discounts on debt and investments. The REIT’s method of calculating AFFO is substantially in accordance with the recommendations of the Real Property Association of Canada. The REIT regards AFFO as a key measure of operating performance.

Debt to Gross Book Value Ratio does not have any standardized meaning prescribed by IFRS and is therefore a non-IFRS financial measure. Debt to Gross Book Value Ratio is calculated as Indebtedness (as defined in the declaration of trust governing the REIT, which is available under the REIT’s profile on SEDAR at www.sedar.com) divided by Gross Book Value (being, at any time, the greater of: (a) the value of the assets of the REIT and its consolidated subsidiaries, as shown on its then most recent consolidated balance sheet prepared in accordance with IFRS, less the amount of any receivable reflecting interest rate subsidies on any debt assumed by the REIT; and (b) the historical cost of the investment properties, plus (i) the carrying value of cash and cash equivalents, (ii) the carrying value of mortgages receivable; and (iii) the historical cost of other assets and investments used in operations).

NOI is defined as total revenue from properties (i.e., rental revenue and other property income) less direct property operating expenses in accordance with IFRS. NOI should not be construed as an alternative to net income determined in accordance with IFRS. The REIT regards NOI as an important measure of the income generated from the income producing properties and uses NOI in evaluating the performance of the REIT’s properties. It is also a key input in determining the value of the REIT’s properties.

Forward-Looking Statements:

This press release contains statements that include forward-looking information within the meaning of Canadian securities laws, including with respect to the terms of, timing for completion of and source of funding for the pending Acquisitions, the expected synergies AFFO from the Acquisitions and timing thereof, the expected impact of the Acquisitions on the REIT’s NOI and debt-to-GBV ratio. In some cases, forward-looking statements can be identified by terms such as “may”, “will”, “could”, “occur”, “expect”, “anticipate”, “believe”, “intend”, “estimate”, “target”, “project”, “predict”, “forecast”, “continue”, or the negative thereof or other similar expressions concerning matters that are not historical facts.

These forward-looking statements reflect the current expectations of the REIT regarding future events. The REIT has based these forward-looking statements on certain assumptions about future events and trends, including that: occupancy levels at the REIT’s properties stay consistent with recent past experience with very modest growth in the first year for much of the Acquisition Portfolio; rent collections for the Acquisition Portfolio are consistent with the trend generally experienced for the REIT’s portfolio. The REIT cautions that this list of assumptions is not exhaustive; inflation remains relatively low; interest rates remain relatively stable; and tax laws remain unchanged. While management considers these assumptions to be reasonable based on currently available information, they may prove to be incorrect.

Although management believes the expectations reflected in such forward-looking statements are reasonable and represent the REIT’s internal expectations and beliefs at this time, such statements involve known and unknown risks and uncertainties and may not prove to be accurate and certain objectives and strategic goals may not be achieved. A variety of factors, many of which are beyond the REIT’s control, could cause actual results in future periods to differ materially from current expectations of events or results expressed or implied by such forward-looking statements, such as the risks identified in the REIT’s final prospectus available at www.sedar.com, including under the heading “Risk Factors” therein. Readers are cautioned against placing undue reliance on forward-looking statements. Except as required by applicable Canadian securities laws, the REIT undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made.

SOURCE Flagship Communities Real Estate Investment Trust

###

Additional Information, MHProNews Analysis and Commentary

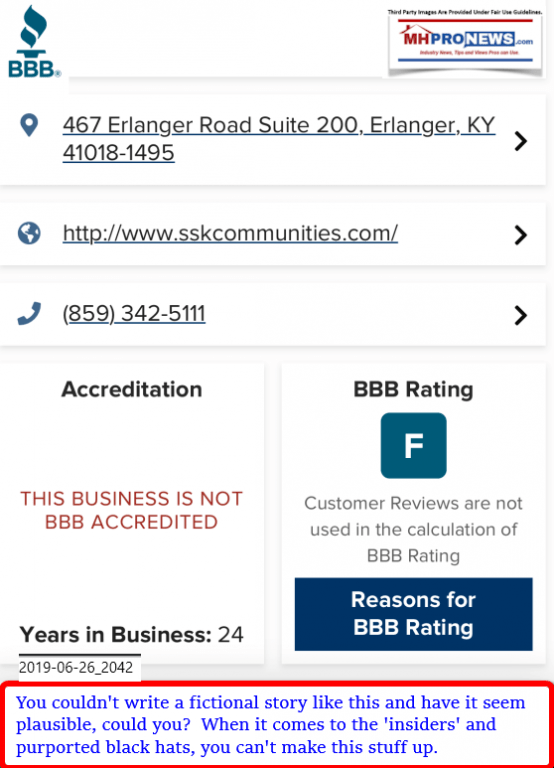

When an objective reader digs into the history of Flagship Communities, i.e. its previous brand name of SSK Communities, the recently formed REIT certainly could be aptly described as “scandal plagued,” based upon years of law suits, regulatory issues, purported posturing of being a do-gooder when the reality was quite different.

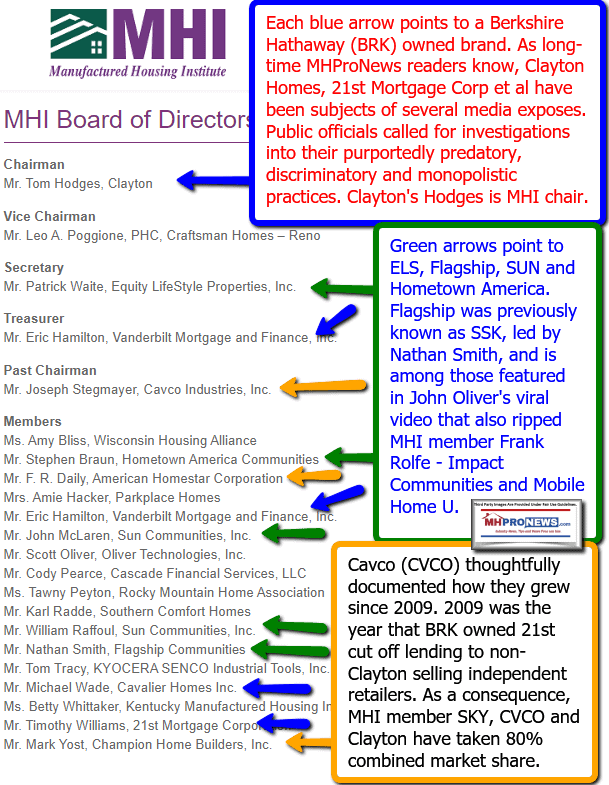

While not specifically named, a mainstream news clip of a ‘scandal’ at SSK Communities made the cut for inclusion in HBO’s Last Week Tonight with John Oliver’s viral video. As the report with video below reflects, the bulk of the firms named had direct ties to the Manufactured Housing Institute (MHI).

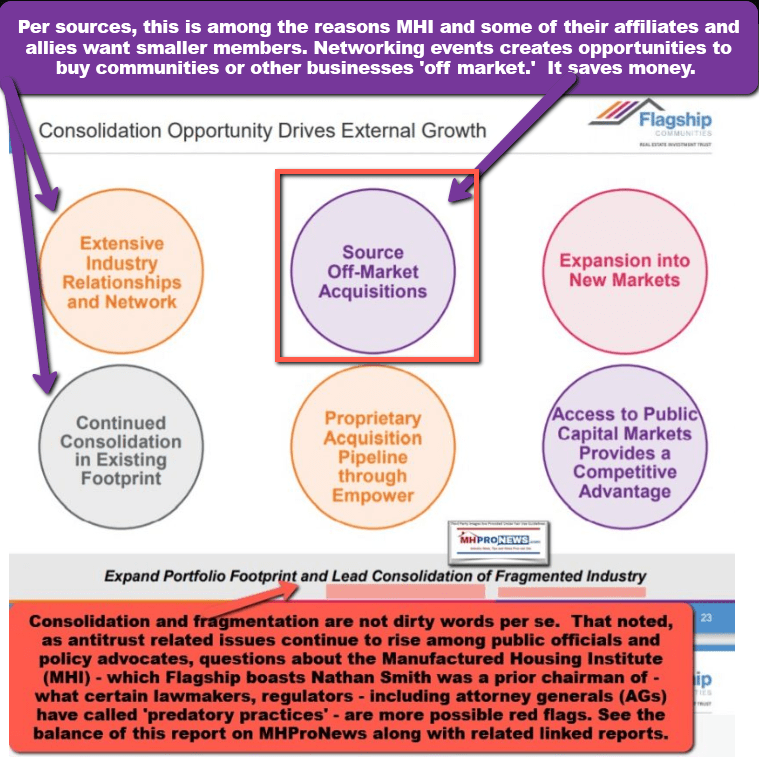

Despite pledges by Nathan Smith when he was chairman to pivot MHI, given what he described as a history of being reactive instead of pro-active as a trade group, have things improved since that promise by Smith was made? Or was that simply part of the MHI window dressing – like the so-called MHI/NCC Code of Ethical Conduct?

Smith made it plain in the exclusive video interview that MHProNews did with him some years ago that he had ambitions to do much of what he is currently doing.

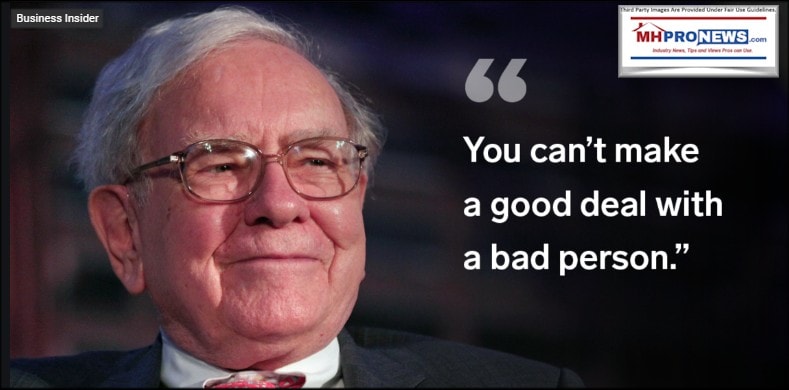

Warren Buffett famously quipped that you can not make a good deal with a bad person. When will the next shoe from Flagship’s leadership and methods of doing business drop? To learn more, see the related reports.

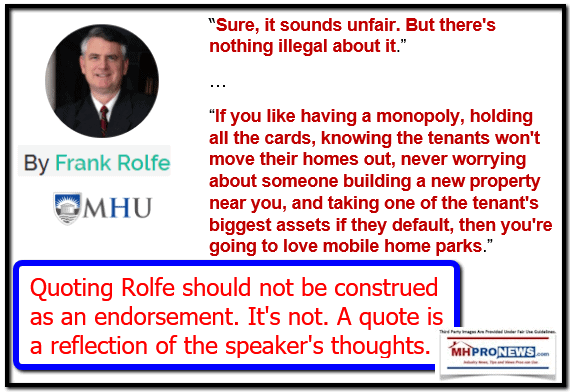

Manufactured housing is a good product that arguably has, for whatever reasons, attracted several black hat players. As reports linked below reflect, the system in this industry is arguably rigged against white hat operators, and too often operates in a predatory fashion with respect to consumers.

There is always more to know. Stay tuned with the runaway largest and documented number one most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

Warren Buffett Declared “Class Warfare,” Buffett Says Fellow Billionaires – “We’re Winning”

“More Punitive Regulatory” Regime Looms Warns New Manufactured Housing Industry Insider

Frank Rolfe, MHU/RV Horizons Protest by MHAction; Nathan Smith/SSK/MHI Flashbacks?

Barriers to Entry, Persistence, and Exiting in Business, Affordable Housing, and Manufactured Homes

Manufactured Housing Institute Warns Members – Pondering Legal Action, Insider Insights