“CFPB Launches New Initiative” proclaimed part of a headline on JD Supra on 3.18.2022. As has been previously noted by MHProNews, JD Supra is a “News and Insights” website used by attorneys to highlight legal issues and developments. By doing so, attorneys get media exposure and perhaps pick up clients too. In this case, the JD Supra post was by the Goodwin Law Firm. Keep in mind that aspects of their report and the most recent items from the Consumer Financial Protection Bureau (CFPB) should cause eyebrows to furrow in the Knoxville, TN metro offices of 21st Mortgage Corporation and of Vanderbilt Mortgage and Finance (VMF) – that aspect of today’s report will follow the opening segment, which is more communities focused.

Referencing the 3.10.2022 CFPB post on their announcement, Ahmed Abdelhamid for Goodwin Law quoted as follows.

“We are concerned about these threats to rural household financial resiliency and committed to using our tools and authorities to ensure that rural communities, and the people who live in them, have opportunities to build wealth and thrive.”

— CFPB Official Shawn Sebastian

There were three areas noted by Abdelhamid, citing the CFPB, which included manufactured housing.

- Rural banking deserts, in which consumers face a declining number of banks, higher fees and interest rates from non-bank alternatives, loss of local, on-the-ground knowledge of how rural communities operate due to bank consolidation, and racial disparities in access to credit and banking services;

- Discriminatory and predatory agricultural credit, including a long history of credit providers discriminating against Black farmers, resulting in Black-owned land loss and a decline of Black farmers, and farmers being steered by dominant agriculture firms to take out large loans; and

- Manufactured housing, where consumers face dramatically increased rents and tacked-on fees from private equity firms that buy the lot and force eviction while taking possession of the manufactured home as abandoned property without paying the owner.

As a brief segue, never mind that CFPB may have played a role in the background of issues such as “rural banking deserts” which was a phenomenon that some analysts have said apparently accelerated once the CFPB’s regulations seemingly caused a wave of closures, mergers and acquisitions.

That noted, JD Supra noted that complaints are being sought by the federal regulator.

“The CFPB encourages relevant parties to share their experiences about the challenges facing rural areas and to submit a complaint, as appropriate.” MHProNews and/or MHLivingNews plans to revisit that in the near term.

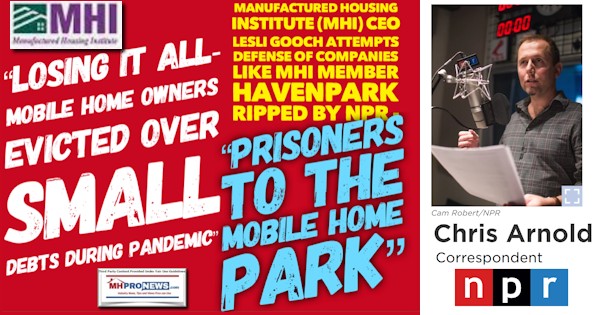

But stating the obvious to bring clarity to the issue, there are reasons to believe that as word of this request for “complaints” and “experiences” requested by the CFPB gets out, will it be a surprise if MHAction, NMHOA, or other state-based manufactured home community connected advocacy groups use those portals to ask for probes into problematic and predatory firms operating in the manufactured housing community sector? If death and taxes are a sure thing, then next to those, complaints by residents who are feeling the sting of the tactics of Manufactured Housing Institute members such as:

- Havenpark Capital i.e. Havenpark Communities,

- partners Frank Rolfe and Dave Reynolds via their various enterprises,

- RHP Properties,

- Equity LifeStyle Communities (ELS) which is reportedly facing a class action lawsuit,

- Sun Communities, and other MHI/National Community Council members

likely means that federal and other impacts are all but a given. See some of the reports on those firms linked further below for examples.

This CFPB development may shed added light on what was spotlighted yesterday on MHProNews Sunday featured report in our weekly recap.

Was/is this window-dressing of a community organization an attempt to build cover for predatory brands that have created a growing level of pushback by state, local, and federal officials? See the report, ICYMI.

That same JD Supra article noted the following development.

“On March 16, the CFPB announced that it is expanding its anti-discrimination efforts to combat discriminatory practices in all consumer finance markets, including credit, servicing, collections, consumer reporting, payments, remittances and deposits, clarifying that discrimination, whether intentional or not, can be “unfair” and trigger liability under the Consumer Financial Protection Act, even in cases where the conduct may also be covered by the Equal Credit Opportunity Act.”

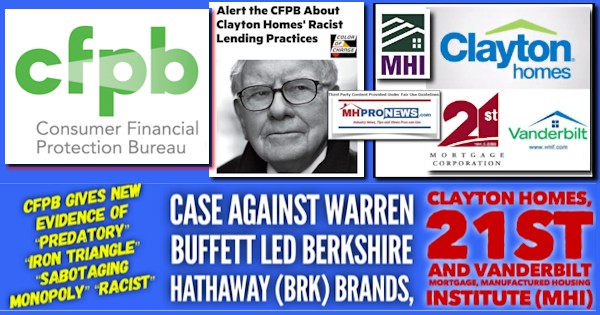

Given the level of discrimination previously reported by MHProNews/MHLivingNews in complaints that included congressional lawmakers like those cited below, the same points made above could apply in this instance. To unpack that, see the reports linked below. Note the lawmakers shown referred their joint letter to the CFPB and to the DoJ.

The same JD Supra article pointed to announcements from the SEC on disclosures and trading practices, insights about the Biden White House on digital currencies and blockchains, and more.

More on the CFPB Announcements

While this focused on rural issues that involve manufactured housing, one should not think that if someone in a metropolitan area has suffered from the same concerns that the CFPB has asked for comments on that complaints from manufactured home residents will be ignored. It should be obvious that a given resident’s geographic local does not change their legal or constitutional rights. That noted, here is more from the CFPB’s 3.10.2022 announcement.

Note that the CFPB stated that “more than half” of all manufactured home are in “rural” areas.

New effort focused on financial issues facing rural communities

By Shawn Sebastian – MAR 10, 2022

The Consumer Financial Protection Bureau has launched a new initiative to focus on financial issues facing rural America. Our effort will initially focus on rural banking deserts, discriminatory and predatory agricultural credit, and manufactured housing.

There is no single rural America–from Appalachia and the Deep South to rural Alaska, rural places have a wide range of diverse people, economies, and ways of life. Rural people are deeply committed to the places they live, but face real challenges in accessing reliable services and good jobs, keeping up with household expenses, maintaining farming, and finding affordable housing.

It is well known that larger economic trends have uniquely affected rural communities over the past several decades. The number of jobs in rural areas have still not fully recovered from the shock of the 2008 financial crash and job growth in rural areas has been less than a third of the rate of job growth in urban areas. Rural wages are lower , and rural poverty rates are higher than in non-rural areas and the gap is growing . Increasing corporate consolidation across the economy has hit rural areas particularly hard, suppressing wages and leaving rural people with fewer employment options . In addition, the effects of the COVID-19 pandemic on rural populations have been severe, with significant negative impacts on unemployment and the economic outlook .

We have a responsibility to pay attention to the particular challenges rural communities face as they work to build and maintain their financial resiliency. Last month, Director Chopra invited over 50 people from organizations representing rural people across the country to tell their stories and share their concerns. What we heard is that larger economic trends are affecting the financial resilience of rural families and their experiences with consumer finance.

The issues surfaced include:

- Rural Banking Deserts: Stakeholders described how stark declines in the number of banks in rural areas have had a particularly negative impact on rural communities. The decline in banks, in turn, has led to non-bank alternatives that charge higher fees and interest rates, which results in more money leaving rural communities. Trends of bank consolidation have also resulted in the loss of local, on-the-ground knowledge of how rural communities operate. As a result, banking relationships and credit disappear, followed by small businesses and jobs.We also heard that race is a major factor in banking access in rural areas; the rural counties most deeply affected by bank closures are those with a greater proportion of African American residents relative to other rural counties. Community institutions serving rural communities of color in the Deep South and Rio Grande Valley emphasized the essential role of Community Development Financial Institutions (CDFIs) in serving people that other banks won’t. They also highlighted the need for Community Reinvestment Act requirements to support serving rural banking deserts, particularly in persistent poverty counties, which are overwhelmingly rural.

- Discriminatory and Predatory Agricultural Credit: We heard from farmers who described the important role that agricultural credit (or the lack of such credit) plays in their overall financial stability. Stakeholders working closely with Black farmers described a long history of credit providers discriminating against Black farmers contributing to the decline of Black farmers and Black land loss. In 1920 there were nearly one million Black farmers , representing 14% of all farmers, and today there are fewer than 50,000 , representing about 1.5% of all farmers. Black farmers have lost more than 12 million acres of farmland over the past century, mostly since the 1950s. We heard from people working on the ground with Black farmers that discrimination in lending to Black farmers continues to persist and that many Black farmers still struggle to access the credit they need.We also heard from farmers that their obligations to banks can trap them in exploitative arrangements with dominant agriculture firms. We heard from a former chicken farmer who described how consolidated poultry integrators steer farmers to take out large loans of nearly a million dollars while chicken farmers only get paid on short-term 60-day contracts that provide inconsistent, unpredictable pay. Farmers described the downstream consumer finance impacts of trying to subsist and hold onto their families’ homes and farms under these arrangements by cobbling together off-farm income, taking out credit card debt, personal loans, and other forms of credit just to make ends meet.

- Manufactured Housing: We heard from people living in rural areas that quality, affordable housing is hard to come by in rural areas and there are too few rental properties available. People depend on manufactured housing – more than half of all manufactured homes are in rural areas – which is particularly important to older people on fixed incomes. Manufactured housing residents told us that manufactured home parks are increasingly being bought up by private equity firms that have, in some cases, dramatically increased rents and tacked on fees in short periods of time. According to the residents we heard from, some feel trapped in the arrangement because they’re still paying off their home-only loan and don’t want to lose the equity they’ve invested. Manufactured home owners told us about examples when their neighbors could no longer afford the increased lot rents and were forced to move and leave their house behind because it is usually cost-prohibitive to move a manufactured home. Stakeholders reported that sometimes the private equity firm that owns the lot both forces the eviction and takes possession of the manufactured home as abandoned property without paying the owner.

We are concerned about these threats to rural household financial resiliency and committed to using our tools and authorities to ensure that rural communities, and the people who live in them, have opportunities to build wealth and thrive.

If these issues resonate with your experiences, or you have other challenges you are facing in your rural area, please share your story, and – as always – if you have a problem with an auto loan, credit card, collections, mortgages, debt collector, or another consumer financial product, you can submit a complaint. ##

Some relevant examples of recent reports on related predatory and other legal issues being probed by the CFPB are shown below.

Additional Information, More MHProNews Analysis and Commentary in Brief

What emerges from such probes and related congressional, state, or local level action may in time call into question the brazen approach used by Frank Rolfe and his partner Dave Reynolds who have said that manufactured home community owners should “push rents relentlessly.” The Rolfe quote is another one that may in time come back to haunt him.

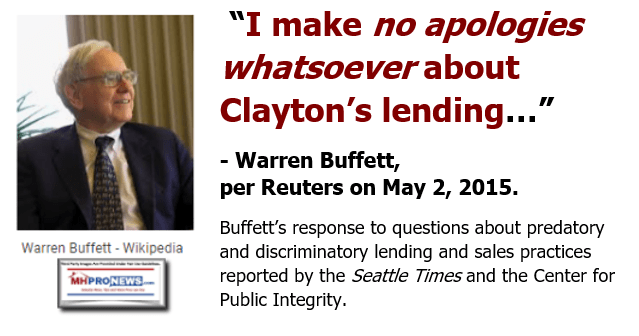

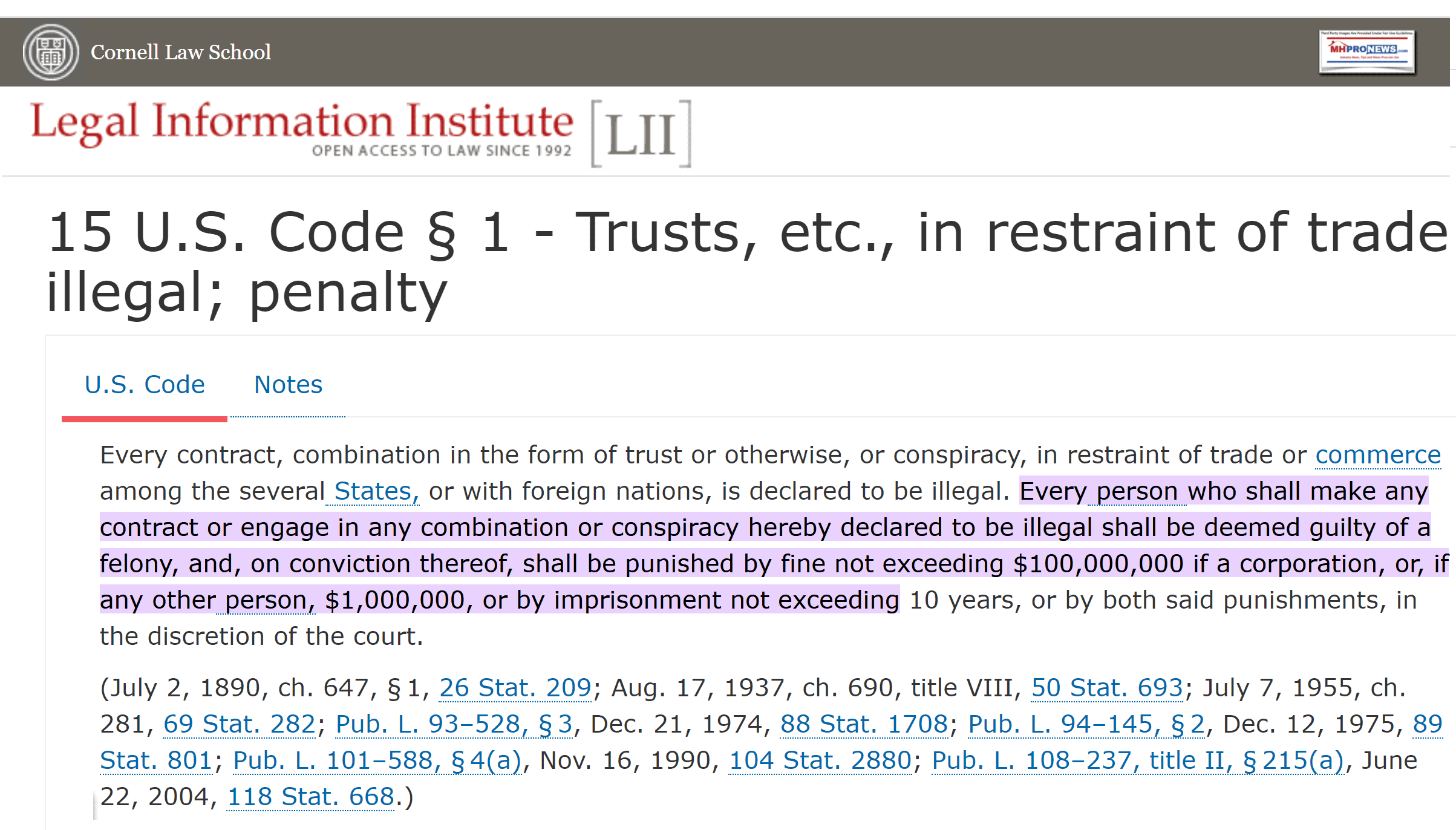

Why might that bite? Because the Sherman Antitrust Act provides for criminal as well as civil penalties for such behavior. Note that “restraint of trade” is part of what’s prohibited. There are arguably several types of ‘restraints’ in manufactured housing today that are caused by specific “contract,” “combination” “in the form of trust or otherwise,” or “conspiracy,” is prohibited. Look up the meaning of each of those words, and the reason that this report is an apparently big deal to a range of Manufactured Housing Institute (MHI) member firms will become more obvious.

Note too from the CFPB announcement referenced above was linked to an updated “CFPB Consumer Laws and Regulations UDAAP” or “Unfair, Deceptive, or Abusive Acts or Practices.”

“Unfair, deceptive, or abusive acts and practices (UDAAPs) can cause significant financial injury to consumers, erode consumer confidence, and undermine the financial marketplace. Under the Dodd-Frank Act, it is unlawful for any provider of consumer financial products or services or a service provider to engage in any unfair, deceptive or abusive act or practice.1 The Act also provides CFPB with rule-making authority and, with respect to entities within its jurisdiction, enforcement authority to prevent unfair, deceptive, or abusive acts or practices in connection with any transaction with a consumer for a consumer financial product or service, or the offering of a consumer financial product or service.2 In addition, CFPB has supervisory authority for detecting and assessing risks to consumers and to markets for consumer financial products and services.3”

That language is broad enough where not only lenders but others providing “any transaction with a consumer” for a “consumer financial product or service” might run afoul of regulators. Given that financing of manufactured homes in or outside of land-lease communities occurs, lending in general, and perhaps lending in manufactured home communities in particular could be at increased risk of federal involvement.

Not to be overlooked, the CFPB would have the ability to refer cases to the Department of Justice (DoJ), Federal Trade Commission (FTC) or other federal agencies for antitrust or other agencies if they thought a case warranted doing so.

The CFPB UDAAP document updated and linked here states in part the following.

Unfair Acts or Practices The standard for unfairness in the Dodd-Frank Act is that an act or practice is unfair when:

(1) It causes or is likely to cause substantial injury to consumers;

(2) The injury is not reasonably avoidable by consumers; and

(3) The injury is not outweighed by countervailing benefits to consumers or to competition.4

Doesn’t that UDAAP list describe a range of problems reported by consumers to local, regional, and national media as well as to public officials?

The bottom line?

With the winds of change blowing in Washington, D.C. and across America, and a thirst for accountability for “predatory practices” arguably growing too, don’t be surprised if later in 2022 and beyond legal risks to predatory and black hat firms grow. Plus, by accident and/or design, some state manufactured housing association – which happen to be MHI state affiliates – have recently made statements that don’t shed a happy light on recent MHI actions and/or some of their ‘predatory’ members.

See the related reports cited below.

CBS Spotlights Manufactured Home Community Leader Video Interview

###

Again, our thanks to you, our sources, and sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.