There are multiple layers to this, as a complete reading of this report will reveal several new items, but let’s begin with the news of the day. Two days before Thanksgiving, Fannie Mae, per their website, announced the following about manufactured home lending programs on 11.26.2019.

“Today’s modern manufactured homes (MH) can help ease the affordable housing shortage in your community and provide a growing business opportunity. To originate a mortgage for MH, it must be titled as real property in a process that varies from state to state. This document provides a broad overview of the two most common processes for titling MH as real property.”

More specifically, the following on this date.

“To originate a mortgage for MH, it must be titled as real property in a process that varies from state to state. This document provides a broad overview of the two most common processes for titling MH as real property.”

That document is linked here as a download.

Another more recent item per Fannie is dated in August and said the following.

- Aug 06, 2019 MH is now Eligible for C-to-P financing

“Manufactured homes are now eligible for Construction-to-Permanent financing. Find more details on the C-to-P Financing page or New Manufactured Home Financing Matrix.”

That second news item begs questions. For example, why – if Fannie is committed to making robust lending on manufactured housing – have they taken so long to create parity between conventional housing and manufactured homes for C-to-P financing?

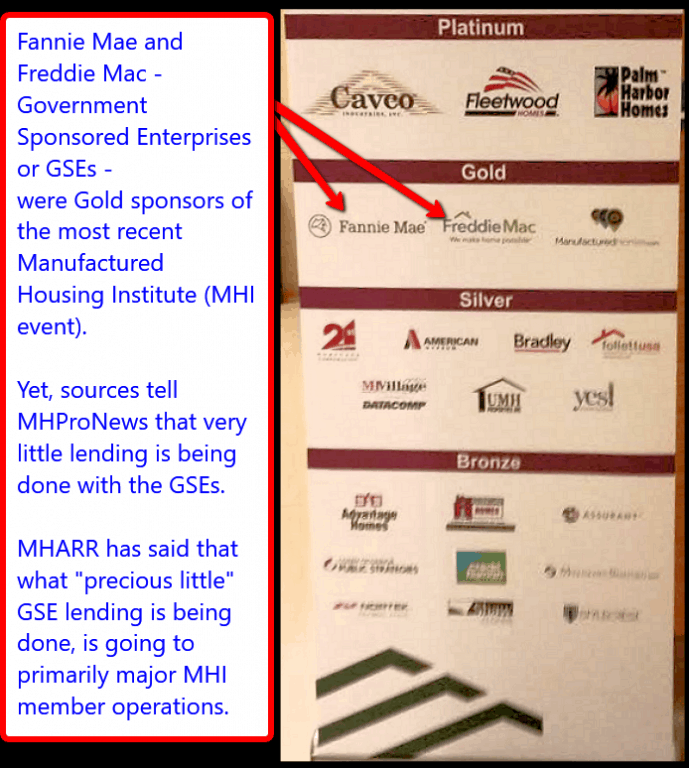

Hold that thought as we push on to other new pieces of information from the Government Sponsored Enterprises or GSEs.

Some of the information from Fannie Mae’s MH Advantage program for the Manufactured Housing Institute (MHI) backed ‘new class of homes’ is linked here as a download.

MHProNews will be doing a report, fact-check and analysis of a specific deployment of a new HUD Code home built to the standards the Enterprises have established for their special lending, ala Fannie’s MH Advantage program. We have several on the record comments from individuals involved. It will likely be published in the next 24 to 48 hours.

As a reminder, almost 1½ years ago, we did that fact check and analysis linked above.

An objective person might admit that the report linked here and above proved to be on point.

More recently, we’ve carefully unpacked comments by the Manufactured Housing Institute (MHI) EVP and CEO-elect Lesli Gooch, compared with a non-industry nonprofit – David Dworkin National Housing Conference – letter to FHFA.

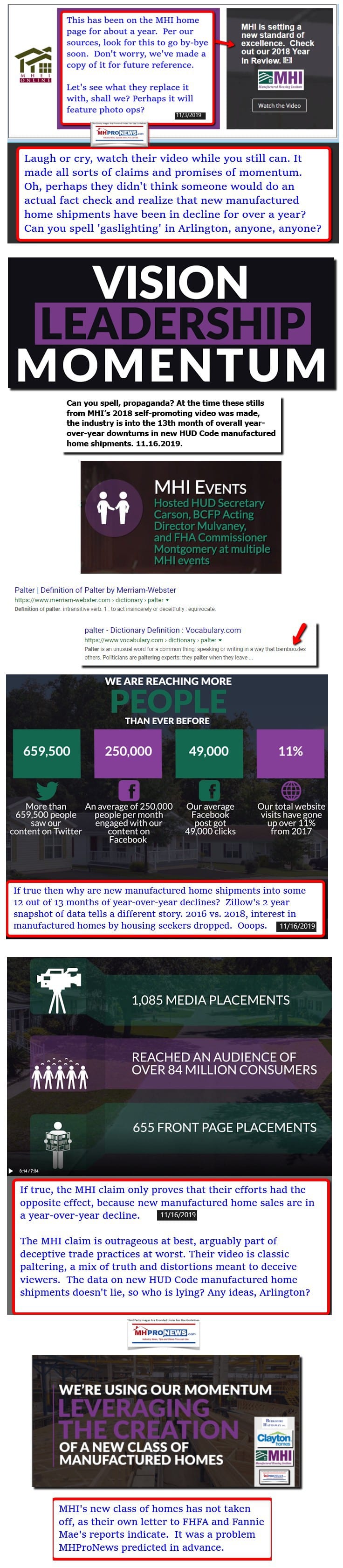

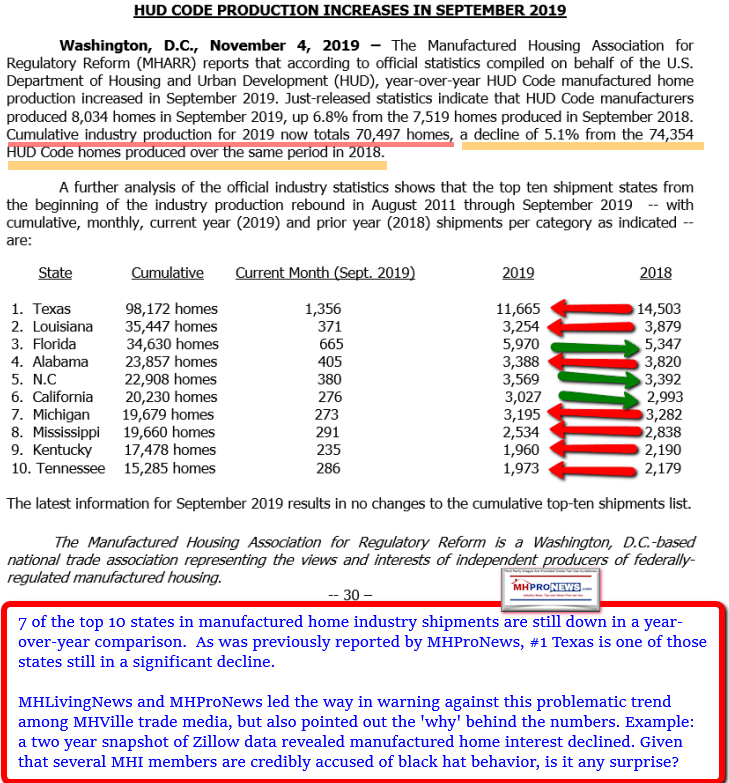

The powers that be in manufactured housing have been pushing a program that was supposed to be a step forward. However, as the evidence – as measured by the acid test of new manufactured homes built and shipped has revealed – it has been a step backward.

See our related report earlier today on the Freddie Mac parallel program via the linked text/image box below.

The Big Revelation from the GSEs?

As noted, a related report is planned in the next 24 to 48 hours. But for now let’s note that informed sources tell MHProNews that in 2018 and through about of October 2019, between Fannie and Freddie, a combined total of less than 20 ‘new class of homes’ have been financed.

Rephrased, that would be less than .00010526 market share of all new HUD Code manufactured homes.

That seems to be supported by Fannie’s request for plan modification.

Which begs the question. Given the statistically abject failure of the program to date to create market significant support to manufactured housing, why is there so much effort, cost and energy being pour into it by MHI, the GSEs, and the big boys of manufactured housing? Isn’t it better to pivot to what the law actually calls for, namely, the support of all HUD Code manufactured homes?

FHFA’s website says: “The Duty to Serve (DTS) requires Fannie Mae and Freddie Mac (Enterprises) to facilitate a secondary market for mortgages on housing for very low-, low-, and moderate-income families in: Manufactured housing…”

As a matter of law, HERA 2008 was passed about a decade before this ‘new class’ of “CrossModTM homes” was created and envisaged DTS loans applying to all manufactured homes, without exception.

Earlier today, we observed that Cicero would have recognized these folks for what they are. Smiling yet treacherous ‘friends’ to manufactured housing.

That’s your installment of manufactured home “Industry News, Tips, and Views Pros Can Use,” © your runaway #1, biggest and most-read professional information resource, where “We Provide, You Decide.” © (News, fact-checks, analysis, and commentary.)

Soheyla is a co-founder and managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

White House Council Requesting Input From Manufactured Home Industry on Affordable Housing Barriers

Publicly Traded Manufactured Housing Firms – Which Source Do You Trust More? Why? MHI, MHARR, Others

Unique Opportunities for More Competitive Lending for All HUD Code Manufactured Homes