Arguably at the heart of the affordable housing crisis is an access to lending for the most affordable homes built in America, manufactured homes. “The Enterprises” of Fannie Mae and Freddie Mac are mandated by the Housing and Economic Recovery Act (HERA 2008) to support manufactured home lending under the ‘Duty to Serve,’ or DTS for short.

The “Federal Home Loan Mortgage Corp. (FMCC) (Freddie Mac), a government-sponsored home mortgage lender, was delivering 23% returns on equity and trading for less than eight times estimated earnings when Buffett touted the investment to Fortune Magazine in 1988,” writes Holly LaFon, an editor for GuruFocus.

“‘You’ve got a low price/earnings ratio on a company with a terrific record,” Buffett told the magazine. “You’ve got growing earnings. And you have a stock that is bound to become much better known to equity investors.”

The Fortune article cited factors why Berkshire Hathaway Chairman Buffett and Charlie Munger, the Vice Chairman of Berkshire, were particularly attracted to Freddie Mac. ”I can’t think of a more tangible compliment to the stock than to buy every damn share we are allowed to,” Munger said.

By 2000, Berkshire was the largest shareholder of Freddie Mac, said LaFon, explaining that the “stock had soared to between $41 and $64 per share, for a sizable gain. His view on it changed, though, and he unloaded nearly all of his Freddie Mac and Fannie Mae shares that year, according to his testimony to the U.S. Financial Crisis Inquiry Commission in May 2010.”

Brad Bondi, deputy general counselor of the commission, asked if Buffett if he sold because the stocks were no longer good investments. Per GuruFocus, Buffett responded that he “didn’t know they weren’t going to be good investments” but became “concerned” about their management.

The Motley Fool, another investment-focused operation, said that Buffett colorfully said: “I figure if you see just one cockroach, there’s probably a lot.”

“They were trying to -– and proclaiming that they could increase earnings per share in some low double-digit range or something of the sort,” Buffett reportedly said. “And any time a large financial institution starts promising regular earnings increases, you’re going to have trouble, you know?”

“Now, they are dealing essentially with government-guaranteed credit, so we know about that and we had it ratified subsequently about what has happened,” Buffett said. “So, here was an institution that was trying to serve two masters: Wall Street and their investors, and Congress.”

“And the truth was that they were arbitraging the government’s credit, and for something that the government really didn’t intend for them to do,” the Berkshire chairman told the commission. “And, you know, there is seldom just one cockroach in the kitchen. You know, you turn on the light and, all of sudden, they all start scurrying around. And I couldn’t find the light switch, but I had seen one.”

The Daily Business News reported recently on a related commentary by Forbes contributor, David Marotta, who said that in 2012, that the entire presidential race should come down to a single question. “Who caused the financial crisis of 2008?” By the sounds of Buffett’s testimony, he didn’t cause it, but he did apparently believe that there was a crisis coming.

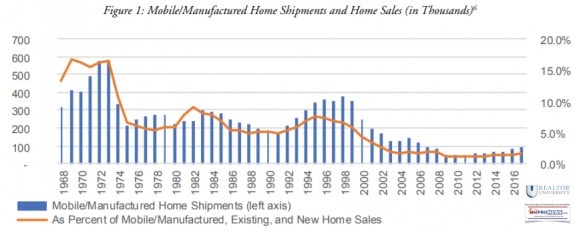

That crash, combined with other maneuvers linked below, led to a historic drop in manufactured housing shipments.

Freddie Mac and Fannie Mae’s stock prices did not begin to crash until seven years later in 2007 when mounting home foreclosures led to unsustainable losses. In 2008, Buffett passed when Freddie Mac approached him about participating in a capital infusion. See that related report later, at the link below.

“They’re [the GSEs, Fannie and Freddie] looking for help, obviously. And the scale of help is such that I don’t think it can come from the private sector,” Buffett told CNBC. Fannie and Freddie are still under the supervision of the Federal Housing Finance Agency (FHFA).

As regular Daily Business News readers know, there’s been a swirl of controversies around Mel Watt, FHFA, the GSEs, and the tepid way that the GSEs are meeting the decade old required Duty to Serve (DTS) manufactured housing. See related reports, further below.

Recall too that earlier this year, GuruFocus and Seattle Times, both did reports on Clayton Home and allegations of how Buffett’s manufactured housing brands engaged in monopolistic practices.

There is no questioning the overall Buffett and Munger success at operating Berkshire’s investments. But does this once more spotlight some of the ways that success has occurred. Upcoming related reports will be forthcoming in the days ahead. Stay tuned, and sign up for our emailed updates, further below at the right. That’s this evening’s “News through the lens of manufactured homes, and factory-built housing” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

The Masthead

There are some who can’t win based upon sound reason and the truth. So, to obtain their goals, they lie, play act, and deceive others to get what they want. That pattern impacts independent businesses, our industry’s home owners and millions of potential customers.