“Evidence-Based Argument on Industry and Analyst Failures” is a quote from the source as cited in Part III of this report that included this: “…certain manufactured housing firms and analysts may be failing in their duties is supported by evidence of systemic issues within the industry.” To tee up this report, Part I covers the basics of what an earnings call is and what the role of the different parties on an earnings call is supposed to accomplish. By going to the basics, and by considering what the Securities and Exchange Commission (SEC) has to say on relevant aspects of the headline subjects, using the Champion Homes (SKY) earning call as part of the factual backdrop. Part II is the most recent Champion Homes earning call for calendar 2025. Part III is additional information with more MHProNews facts-evidence-analysis (FEA) and commentary from sources as cited.

Per Bing this morning is the following. The bold is in the original. It defines the SEC as follows.

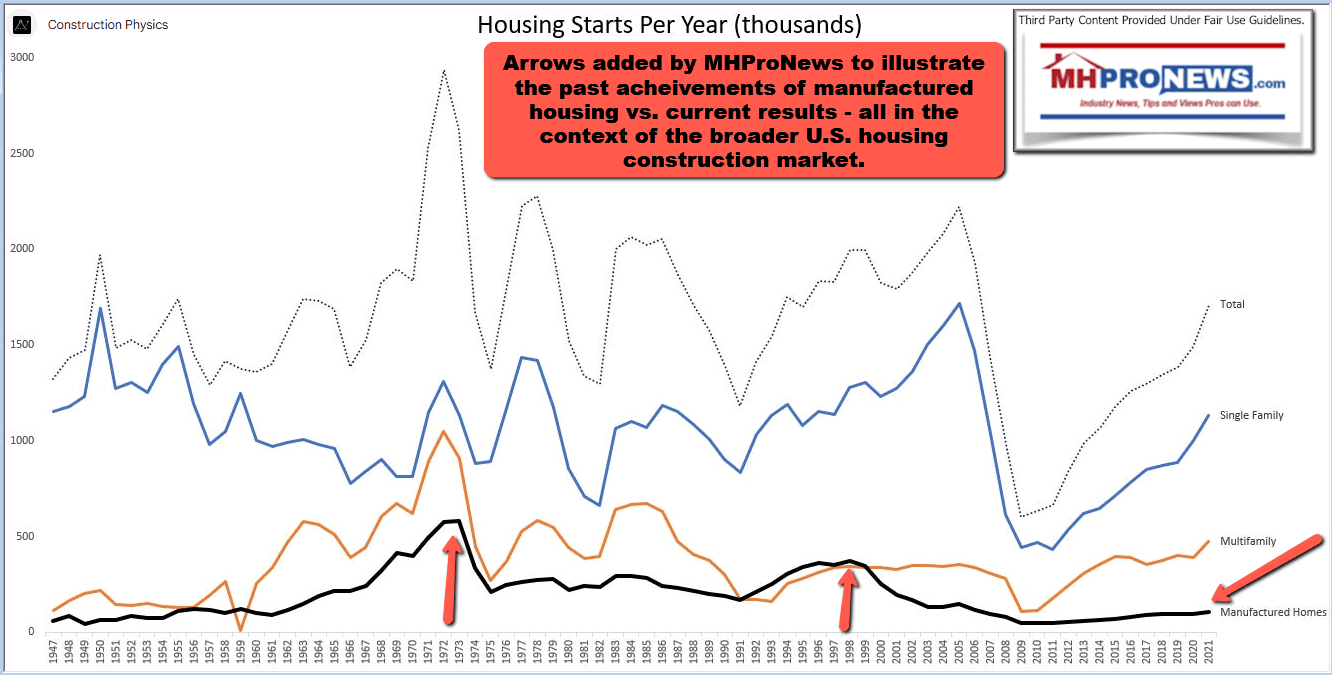

Independent federal government regulatory agency

With that brief background, let’s dive into Part I, which will begin to unpack concerns about how earnings calls are being conducted in certain specific publicly traded manufactured housing industry related firms, which are routinely members of the Manufactured Housing Institute (MHI). Sources in every instance are as shown. This is a deeper dive, so grab your favorite beverage for this time of day and whatever snack might be suitable, as yet another voyage of discovery that helps explain manufactured housing industry underperformance in the 21st century is underway. To see the image below in a larger size, in most devices, click here or on the image and follow the prompts. You can also download the image onto your device and open it to a larger size that way.

Part I – Q&A and related insights generated from chat with Bing‘s AI Powered Copilot

1) Questions are by MHProNews. The response is by Copilot. Logos as shown in the text and/or on the screen capture of the Q&A are added by MHProNews to further clarify the party asking the question and the party providing the response.

Hey, Copilot. What is the role of an analyst on an earnings call, particularly in publicly traded manufactured housing? Does the analyst represent the interests of the firm that they are working for? For example, on the Champion Homes (SKY) earnings call on Seeking Alpha dated 2.5.2025 there are shown the following Conference Call Participants.

Greg Palm – Craig-Hallum Daniel Moore – CJS Securities Phil Ng – Jefferies Mike Dahl – RBC Capital Markets Matthew Bouley – Barclays Jesse Lederman – Zelman & Associates

- Evaluating Financial Performance: Analysts listen to the company’s management discuss quarterly or annual financial results, future plans, and market dynamics. They use this information to assess the company’s financial health and performance.

- Asking Questions: During the Q&A session, analysts often ask pointed questions to clarify details, probe deeper into financial metrics, or understand strategic decisions. These questions are usually aligned with the interests of their firm or clients.

- Providing Insights: After the call, analysts may issue reports or recommendations based on the information gathered. These insights help investors make informed decisions.

Regarding the Champion Homes (SKY) earnings call on February 5, 2025, the listed participants represent various firms specializing in equity research and investment analysis. Each analyst’s questions and focus areas likely reflect their firm’s investment strategies or client interests. For example, firms like Jefferies or Barclays might emphasize broader market trends, while Zelman & Associates might focus on housing-specific insights.

Would you like to explore the specific questions asked by these analysts or dive deeper into manufactured housing trends?

2) The first response by Copilot linked above was to a post on TickerOn that included the following.

What is an Earnings Call?

Earnings calls serve as vital platforms for public companies to communicate their financial results, future plans, and market dynamics to analysts, investors, and the media. These conference calls provide an opportunity for stakeholders to gain deeper insights into a company’s performance, ask questions, and make informed investment decisions. In this article, we will explore the definition of earnings calls and their significance in financial analysis. By examining the provided articles and relevant keywords, we will shed light on how earnings calls work, their connection to SEC forms 10-Q and 10-K, their role in fundamental analysis, and the advantages and disadvantages they present. Finally, we will analyze an example earnings call to illustrate the practical implications of these discussions.

Understanding Earnings Calls

An earnings call is a conference call conducted by a public company’s management team, involving analysts, investors, and the media. It serves as a platform to discuss the company’s financial performance during a specific reporting period, such as a quarter or fiscal year. Earnings calls typically follow the release of an earnings report, which provides a summary of the company’s financial results for the period.

During an earnings call, company executives discuss important aspects of their quarterly 10-Q report or annual 10-K report, with a particular focus on the management discussion and analysis (MD&A) section. This section provides a comprehensive discussion of financial results, including the factors driving growth or decline in various financial statements. Additionally, executives may use the MD&A to outline future goals, projects, and initiatives, as well as any changes in the executive team.

Earnings Calls and Fundamental Analysis

Analysts utilize information obtained from earnings calls as a crucial component of fundamental analysis. By analyzing a company’s financial statements and listening to verbal cues during the earnings call, analysts gain valuable insights into a company’s financial health and performance. The MD&A section of the company’s SEC filings often provides the most detailed and qualitative information. Analysts may focus on specific concepts, details in footnotes, and key performance indicators mentioned during the call to gain a comprehensive understanding of the company’s prospects.

Advantages and Disadvantages of Earnings Calls

Earnings calls offer numerous advantages for investors, analysts, and the financial community. They provide a wealth of information that aids in fundamental analysis and guides investment decisions. Earnings calls also allow participants to ask questions, further clarifying important aspects of a company’s performance and future plans.

Preparing for earnings calls can be time-consuming and resource-intensive, diverting attention from normal business operations. Additionally, the Q&A session can sometimes result in unfavorable outcomes if questions touch upon sensitive topics or reveal information that management may not want to disclose publicly. To mitigate these risks, companies must establish a regular cadence of earnings calls to maintain transparency and prevent negative speculation.

That same post also had this.

Summary

An earnings call is when a company opens up a teleconference line or webcast that the public can join to hear the company management talk about how the company performed recently, their plans for the future, and the market forces that exist in the current environment.

Most publicly traded companies today have adopted this practice. …

Every call will generally feature a lengthy disclaimer statement at the beginning, end, or both, to distance the company from liability if an investor takes a hint from something said and fails miserably.

…

Earnings will often be stated as earnings per share (EPS). Investors should also be aware that, like any good salesman, the company leaders all the call will do their best to make things sound as good as possible…Investors must be willing to take it in with a degree of skepticism.

The second response by Copilot was to the Seeking Alpha transcript shown below and like the above are provided under fair use guidelines for news media and research. There will be more on analysts in the added facts-evidence-analysis Part III.

Part II

MHProNews notes that highlighting in what follows is added by MHProNews and is not in the original. More could be highlighted in this, but for reasons shown in Part III, only the items shown will be highlighted for now.

Champion Homes, Inc. (SKY) Q3 2025 Earnings Call Transcript

Feb. 05, 2025 12:32 PM ET Champion Homes, Inc. (SKY) Stock SKY

Champion Homes, Inc. (NYSE:SKY) Q3 2025 Earnings Conference Call February 5, 2025 8:00 AM ET

Company Participants

Jason Blair – Investor Relations

Tim Larson – President & Chief Executive Officer

Laurie Hough – Executive Vice President, Chief Financial Officer & Treasurer

Conference Call Participants

Greg Palm – Craig-Hallum

Daniel Moore – CJS Securities

Phil Ng – Jefferies

Mike Dahl – RBC Capital Markets

Matthew Bouley – Barclays

Jesse Lederman – Zelman & Associates

Operator

Good morning, and welcome to the Champion Homes Third Quarter Fiscal 2025 Earnings Call. My name is Rob, and I’ll be your — coordinating your call today. At this time, all participants are in a listen-only mode. The question-and-answer session will follow today’s formal presentation. [Operator Instructions] As a reminder, this conference is being recorded.

I’ll now turn the call over to your host, Jason Blair, to begin. Jason, please go ahead.

Jason Blair

Good morning. Thank you for taking the time to join us for today’s conference call and review of our business results for the third quarter ended December 28, 2024. Here to review Champion’s results are Tim Larson, Champion Homes’ President and Chief Executive Officer; and Laurie Hough, Executive Vice President, Chief Financial Officer and Treasurer.

Yesterday, after the market closed, we issued our earnings release. As a reminder, the earnings release and statements made during today’s call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Please note that today’s remarks contain non-GAAP financial measures, which we believe can be useful in evaluating performance. Definitions and reconciliations of these measures can be found in the earnings release.

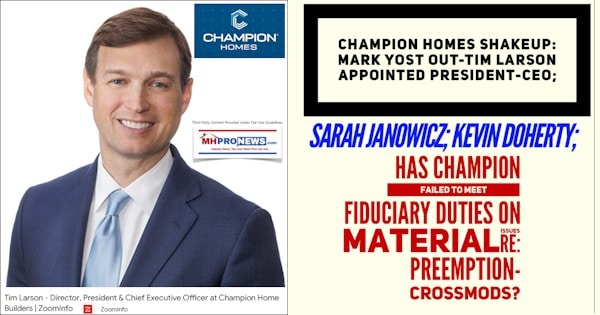

I would now like to introduce Champion Homes’ CEO, Tim Larson, who was appointed CEO and a member of the company’s Board of Directors in December. Tim is a highly accomplished executive and CEO with decades of leadership in the consumer products and manufacturing industries, including significant experience transforming a diverse portfolio of businesses via customer-driven innovation and omnichannel retail. Tim originally joined Champion Homes in May of 2021 as Chief Growth Officer and led the development and delivery of the company’s customer experience growth strategy and omnichannel platform. During this time, Tim has worked very closely with Champion’s talented employees, customers and channel partners as well as working closely with the leadership team.

I will now turn the call over to Champion Homes’ CEO, Tim Larson.

Tim Larson

Thank you, Jason. Good morning, everyone. We appreciate you attending today’s earnings call.

Since joining Champion three-and-a-half years ago, being part of this team and what we do has become core to my purpose. I’m honored to serve and lead our collective team as we embark on our next phase of growth.

Champion Homes is a company with a talented team, a strong reputation and a great portfolio of brands and products. Each of those attributes were recently recognized nationally. For the fifth straight year, our Skyline brand was named the most trusted manufacturing housing brand by Lifestory Research. This reflects our unwavering commitment to provide customers with high-quality homes and experiences.

Since stepping into the role, I’ve been actively engaged in feedback sessions across our stakeholders. We’ve already identified opportunities to further capitalize on our strengths and drive additional value. I’m committed to building on the effectiveness of our strategy, including the expansion of our retail and direct-to-consumer capabilities and strategic investments that support the growth of our community, independent retail and builder developer customers.

In my conversations with employees, I’m thrilled by their enthusiasm and willingness to think differently and advance even further as a customer-centric organization. It’s already unlocking new ideas and actions to improve and elevate the business. I’ve already been able to connect with numerous customers in my first 50 days, and I remain impressed by their passion for the industry and the opportunities ahead.

In December, I was able to meet with several investors and analysts to share my excitement for the Champion Homes business, and I look forward to building on our conversations, including our commitment to drive sustainable profitable growth and long-term value. As I look ahead, we will continue to execute our differentiated strategy while remaining nimble in a dynamic market.

With that backdrop in mind, I’ll now provide an overview of the recent quarter and our expectations for the remainder of the fiscal year.

Our third quarter performance demonstrates strong execution across the company, including by our sales, retail and manufacturing teams that have definitely delivered on the market’s growing demand. In the third quarter, year-over-year net sales increased 15.3% to $645 million. Homes sold during the period increased 13% for a total of 6,646 homes. The third quarter saw a sequential increase in the revenue from the fiscal second quarter of $28 million.

Our backlog at end of the third quarter was $313 million, which is up 8% from the same period last year. We saw a normal seasonal slowdown in order rates throughout the quarter, contributing to the 27% sequential decline in backlog and average backlog ended Q3 at 10 weeks, which is on the higher side of our four- to 12-week norms.

Now, I’ll provide some additional commentary from the quarter on each of our sales channels. Sales to our independent retailer channel grew during the quarter and we anticipate that to continue, enabled by our direct-to-consumer and digital capabilities, combined with new products and flooring support. Sales through our captive retail channel continues to grow. We are very pleased with the organic growth of the Regional Homes business and the accretive nature of the overall transaction. The success of the Regional acquisition is a testament to the combined organizations, including the tenacity and customer-centric approach of the Regional team.

Spending time with our community customers is among my many highlights of the last 50 days. We are growing with our community customers and are committed to supporting their mission and goals. We’re developing new products with communities in mind and are encouraged by the response to the new homes we featured at the recent Louisville show.

In our builder developer channel, homes sold increased year-over-year and the project pipeline interest continue to grow. We recently delivered homes to projects across several markets, and we’ve had very positive feedback from customers and the local community on the design and value of the homes. With each project, we capture the proof points and the insights that benefit future developments. That includes working with federal, state and local officials to expand zoning and accelerate the often long lead times associated with these projects.

Across our channels, we are pleased with the progress of Champion Financing, our joint venture with Triad Financial Services. We are seeing early benefits consistent with our vision to serve consumers across their home purchase experience. Our floor plan programs ensure our retailers have the right mix and value of products for today’s consumers. And our retail loan programs further drives increased affordability and value. We look forward to continued collaboration with the ECM Capital and Triad teams and partners.

Before touching on Q4, I want to express our heartfelt concerns for all those affected by the devastating California fires. We have three plants in Southern California, and fortunately, there was no direct damage to our facilities or retailers in the area. We are committed to supporting the region and working closely with the community on rebuilding efforts.

Looking to our fiscal fourth quarter, demand from our customers remains within our expectations. We anticipate fourth quarter revenue to be up low double-digits from the same quarter last year and in-line with pre-earnings fourth quarter consensus. A sequential moderation from the third quarter is anticipated and in-line with our typical slower winter selling season. We are closely monitoring the dynamic tariff environment and have an agile playbook that builds on previous experiences.

We are still early in the spring selling season and are prepared to further scale production with order demand. As I mentioned, we received a very strong response at the Louisville Show and anticipate that will positively contribute to our fiscal fourth quarter and into fiscal 2026.

In summary, affordable housing remains a pivotal need across our U.S. and Canadian markets, reflected in the recent trends and our anticipation for strong medium-term and long-term demand.

I will now turn the call over to Laurie, who will discuss our quarterly financial performance in more detail.

Laurie Hough

Thanks, Tim, and good morning, everyone.

I’ll begin by reviewing our financial results for the third quarter followed by a discussion of our balance sheet and cash flows. I’ll also briefly discuss our near-term expectations.

During the third quarter, net sales increased 15% to $645 million compared to the same quarter last year with U.S. factory-built housing revenue increasing 17%. The number of homes sold increased 14% to 6,437 homes in the U.S. compared to 5,643 homes in the prior-year period. U.S. home volume during the quarter was supported by healthy demand across our sales channels as well as an additional two weeks of sales from our Regional Homes acquisition, which closed mid-October of last year. The average selling price per U.S. homes sold increased by 2.8% to $94,900 due to a higher mix of units sold through our company-owned retail sales centers.

On a sequential basis, U.S. factory-built housing revenue increased 4% in the third quarter compared to the second quarter of fiscal 2025. We saw a sequential increase mainly due to increased shipments after hurricane delays at the end of our fiscal second quarter, both in our plant’s ability to ship homes as well as our company-owned retail location’s ability to close home sales. In addition, manufacturing capacity utilization was 63% compared to 60% in the sequential second quarter. On a sequential basis, the average selling price per home increased 2.7% due to a higher mix of units sold through our company-owned retail sales centers.

Canadian revenue during the quarter was $26 million, representing a 16% decline in the number of homes sold versus the prior-year period. The average home selling price in Canada decreased 0.6% to $122,900, primarily due to a shift in product mix. The reduction in Canadian sales volume can be attributed to a combination of factors, including higher interest rates and economic uncertainty in key markets that have tempered buyer enthusiasm for new homes. These conditions are anticipated to continue to impact the housing market dynamics in Canada in the near-term.

Consolidated gross profit increased 28% to $181 million in the third quarter, and our gross margin expanded 280 basis points from 25.3% in the prior-year period. The higher gross margin was primarily due to higher average selling prices on new homes sold through our company-owned retail sales centers, which also generated a greater percentage of total revenue. In addition, lower input costs and acquisition synergy capture also contributed to higher gross margins versus the prior-year period. On a sequential basis, gross margin came in better than anticipated due to lower input costs and higher captive retail sales.

SG&A in the third quarter increased $23 million over the prior-year period to $108 million. The increase was primarily attributable to increased sales volumes through our company-owned retail sales centers and higher variable costs related to higher revenue and profitability. In addition, we continued to make investments in people and technology to support for future growth.

The company’s effective tax rate for the quarter was 21.1% versus an effective tax rate of 21.4% for the year-ago period.

Net income attributable to Champion Homes for the third quarter increased 31% to $62 million or earnings of $1.06 per diluted share compared to net income of $47 million or earnings of $0.81 per diluted share during the same period last year. The increase in EPS was driven mainly by higher operating income in the third quarter.

Adjusted EBITDA for the quarter was $83 million compared to $66 million in the prior-year period. Adjusted EBITDA margin was 12.9% compared to 11.8% in the prior-year period, which was driven by higher gross margins.

Looking forward, we expect gross margins to return to the 26% to 27% range as the benefit of lower forest product costs dissipate relative to ASPs and as we experienced fluctuations in the percentage of sales running through our company-owned retail sales centers and overall product mix.

As of December 28, 2024, we had $582 million of cash and cash equivalents and long-term borrowings of $25 million with no maturities until 2026. We generated $50 million of operating cash flows for the quarter compared to $90 million in the prior-year period. In the quarter, we leveraged our strong cash position and returned capital to our shareholders through $20 million in share repurchase.

Additionally, our Board recently approved the replenishment of our $100 million share repurchase authority, reflecting confidence in our continued strong cash generation.

I’ll now turn the call back to Tim for some closing remarks.

Tim Larson

Thank you, Laurie. It’s an exciting time at Champion, and I’m honored to be [collabing] (ph) with such a talented team. While the word Champion certainly conveys the excellence we are driven to deliver, we are also embracing the meaning Champion as a verb to champion our customers and to champion off-site built homes.

In summary, after a bit over 50 days in the new role, we have the team highly focused on a core set of priorities, executing the fundamentals, including leveraging our capacity, innovating with product to grow and bring in new buyers to the category, evolving the experience for today’s and tomorrow’s customers with solutions before, during and after the sale, elevating the awareness of the benefits of off-site built homes, driving a customer centric culture and strategically deploying our capital. I look forward to updating you on these initiatives on our next earnings call.

And now, I’d like to open the floor for questions. Operator, please proceed.

Question-and-Answer Session

Operator

Thank you. We’ll now be conducting a question-and-answer session. [Operator Instructions] And our first question is from the line of Greg Palm with Craig-Hallum. Please proceed with your questions.

Greg Palm

Yeah, thanks. Good morning, everybody, and congrats on the good results here.

Tim Larson

Thank you.

Greg Palm

Maybe start with just a little bit more of a recap on the quarter and kind of the outlook, I was hoping maybe you could give us a little bit more color on kind of how orders trended throughout the quarter. And then, just in terms of what you’re kind of seeing in January, and more importantly, what you’re hearing from your customers in terms of outlook for 2025 in general?

Tim Larson

Yeah, Greg, as far as Q3 goes in that recap, our plant shipments in retail recovered a little quicker on the hurricane outcomes than expected. So, that was some tailwinds. And then, we were able to increase capacity, as you heard in Laurie’s remarks, up to that 63%. So that allowed us to produce more during the Q3. And then, as Q3 went on towards the back half, when seasonality started to come into play, orders slowed a bit. But as we noted, we still have a strong Q4 ahead of us and we expect a low-double-digit growth versus last fourth quarter.

And what’s driving that is we’re seeing healthy traffic at our stores and we’re hearing that from independents as well. Quoting activity has picked up here recently and we certainly had a strong response at Louisville. Now, there have been a few geographies that were impacted a bit by the temps and snow. So, that’s a consideration. So that’s a bit of the basis for why we shared what we did in terms of the fourth quarter view. But all in all, we’re optimistic as we start the spring selling season.

Greg Palm

Yeah. Okay. Makes sense. And Tim, I think all of us would probably appreciate a little bit more color on kind of what you think the company has done well or maybe could do better or just kind of any change in kind of direction or strategic focus going forward, just given that you’re now at the CEO seat now.

Tim Larson

Yeah. I mean, strategically, because I’ve been here 3.5 years, I’ve been a part of building the strategy and executing the key priorities. So, it’s major strategic themes I don’t see changing. What we’re really doing is, as I mentioned in my remarks, really focusing on the fundamentals, the things that we see work well in the market across our retail operation, how do we expand those.

From a product perspective, you’re going to continue to see innovating and evolving. We got to be nimble for today’s consumer and make sure we can also invite new buyers into the category with product. And from a customer experience, if you think about digital as the front door, then at retail and then what happens post sale, really executing on that experience. And then, really being smart with our capital and deploying it across those strategic priority. So, I think it’s really those themes and it’s really driving the execution across those themes.

Greg Palm

Yeah. Okay. Well, look forward to get progress updates over time. Best of luck. Thanks.

Tim Larson

Sounds good. Thanks, Greg.

Operator

Our next question comes from the line of Daniel Moore with CJS Securities. Please proceed with your questions.

Daniel Moore

Yes, thank you. Good morning, Tim. Good morning, Laurie. Champion, as you described, increase the number of homes sold sequentially. It sounds like recovered from the hurricane a little bit faster than expected. It dipped into backlog a little during the quarter, but still healthy at 10 weeks. Just talk about the confidence and trajectory of order rates as we look to Q4 and early fiscal ’26? And should we expect production to roughly align with the trajectory of order rates going forward? How do you think about managing backlogs? Thanks.

Tim Larson

Yeah, from a backlog perspective, you mentioned the 10 weeks and that was at the end of the Q3. What I would say as we go forward, we’re feeling good about our orders. It’s really early in the selling season from the full F ’26 view and we certainly are seeing some signs with our retail, as I mentioned that are promising.

We obviously got to look at the broader housing market. If you think about F ’25 from an economy perspective, there’s mixed signals. Some are saying some flat, little up. Now we’re very optimistic about our products and our price points as an advantage. And so, as we develop our fiscal year ’26 plans, we’re planning for continued profitable growth, leveraging our capacity, and we’re going to update you further on our next call. But the early signs would indicate we’re feeling good about those rates and we’re going to execute accordingly.

Daniel Moore

Great. And one of the themes over the last several years has been a penetration of those kind of top 100 community developers. How is that trending from your perspective? How do you think about the opportunity set there and more generally for Champion and MH to take share from site built where the biggest opportunities over the next, say, two to three years?

Tim Larson

Yeah, in the near-term, we were able to have the growth in that channel up year-over-year. It’s obviously a smaller channel for us today, but we see over time that really building. And as I mentioned, we executed projects in a number of markets that give us the proof points that we’re learning on how do you evolve those, make them go faster and that includes working with the local municipalities. Those particular projects require zoning support, they require the local involvement, and we’re learning how to accelerate that.

And so, I would say from an opportunity, we’re really strong in terms of the long-term view of it. In the near term, it’s just working through those realities by market. But we’re pleased with the response that we have in those markets to the quality of the homes, the price value, the acceptance in those communities. We just have to have more communities see that and learn from those and embrace those as we go forward. And so, our strategy is going to continue to grow the builder developer channel.

Daniel Moore

Helpful. Last one for me. I’ll jump back in queue. But SG&A, it ticked higher as a percentage of revenue despite the strong top-line growth. How much of that spend or increase would you say reflects incremental investments, including technology and personnel to support growth? And more generally, you gave good color in terms of outlook for revenue and gross margin. How do we think about SG&A in Q4 relative to Q3 and what’s a good run rate going forward? Thank you again.

Laurie Hough

Hi, Dan. So, SG&A is usually about 35% variable. So, as revenue increases or decreases, that 35% variability is going to change relative to revenue. So that’s what we saw this quarter as revenue went up, our variable comp structure went up. We are making investments in people to drive our strategy forward, including our captive retail organization and then also investing in technology to support our direct-to-consumer platform and other IT capabilities to support our captive retail as well as back-office enhancements. So, those are going to continue at the pace we saw in the third quarter for the next several quarters.

Daniel Moore

Understood. I’ll jump back with follow-ups. Thank you again.

Operator

Our next question is from the line of Phil Ng with Jefferies. Please proceed with your questions.

Phil Ng

Hey, guys. Tim, congrats to the new role. Looking forward to working with you more going forward.

I guess the first question I have is obviously from your prepared remarks, you said it’s a pretty fluid situation, but tariffs are top of mind for a lot of investors. It’s on a pause, but let’s say if it does move forward, whether it’s Mexico, Canada and China, how does that impact you? Certainly, you guys do use a lot of wood products. Some of that comes from Canada. But just kind of help us think through the impact in terms of operationally and what that means from an inflation standpoint and your ability to kind of manage that and kind of sustain that gross margin framework, Laurie, you kind of highlighted earlier.

Tim Larson

Yeah, Phil, obviously, it is very dynamic and we’re monitored very closely. And what I would say is we do have a playbook that has elements from what we learned from COVID that can apply. And from a macro perspective, what we’re really going to be looking at is how do we make sure we balance that cost versus price versus volume if we do start to see those inflationary impacts out of the tariffs.

Now, we’ve seen some scenarios where maybe there’ll be less of that impact as we think about some of the different supply elements, and that’s why we have to take a really piece-by-piece approach for all the different drivers. But our team is already on it and really anticipating that we prepared in the event we’ve seen some of those things come back after this immediate stay. So, we’ll keep you posted as we go along, and we’re obviously going to be very thoughtful about how we approach across those three drivers.

Phil Ng

Just operationally — I mean, you guys have a business in Canada, but operationally from a manufacturing and whatnot in Canada versus U.S., is there any trade flow and any color to kind of size up in terms of your supply base in terms of materials and stuff that could be impacted from tariffs? Have you taken a stab at quantifying that?

Tim Larson

We feel pretty balanced in terms of our flow of different sources. So, we’re not concerned operationally. It’s obviously we’re going to watch the cost. And as I mentioned, manage that relative price and volume. But really, I think the team is prepared to execute given different scenarios. So, we’re just watching it very closely and making sure that we continue to run operations at the levels we need. So at this point, we’re just managing it from that perspective.

Phil Ng

Okay. And then, this Regional Home acquisition has been a home run for you guys. Having your own captive retailer has been quite additive. Is there a game plan to do more of that, whether it’s organically and M&A? And have you gotten any pushbacks just given some of the channel conflict dynamics?

Tim Larson

In terms of our ability to operate our retail, when we talk about direct-to-consumer, it really is both supporting our captive, but it’s really been supporting our independent because as we make investments in digital, we’re sending lead to our independents. We’re supporting that. And so, we look at it on a market-by-market basis. And one of the benefits of having a family of brands is we can have multiple brands in the market, which allows us to support multiple retail approaches, and we’re going to continue to do that. So, we really see it as a strength because some of the things we learn in captive, we apply to our independents and vice versa. And so, it’s really an additive approach to the business and we’re going to continue to do that.

Phil Ng

Okay. And just last — one last one for me really quickly. On the FEMA order side, I know the hurricanes obviously was very devastating in the South, particularly in the Carolinas area and then the wildfires in California right now. Is that an opportunity? Have you seen any orders come from FEMA, particularly in the Carolinas thus far?

Tim Larson

There’s been a lot of conversations in our outreach, both at the federal and local level, but there’s not yet any specific orders. We’re certainly managing our capacity in anticipation of that, and we’re really eager to serve those in the Carolinas as well as in California. So, we’ll keep you posted as that evolves.

Phil Ng

Okay. Thank you. Appreciate the color.

Operator

Thank you. Our next questions are from the line of Mike Dahl with RBC Capital Markets. Please proceed with your questions.

Mike Dahl

Hi. Thanks for taking my questions, and echo the congrats, Tim. Tim, I guess just picking up on one of Phil’s questions in terms of the captive retail, can you give us a sense, just update us on what percentage of your U.S. sales are going through captive retail at this point today? And do you have a target or a vision for what that mix ultimately gets to?

Tim Larson

So, it’s currently 35% of our sales on the U.S. side. In terms of our goal, I would really say it’s going to be strategically how we achieve our growth goals and objectives across a portfolio of channels, which captive is really important. But obviously, we have our independent channel, our community or builder developer. And so, I would look at it as by market where we see opportunities, we’re going to prioritize the right channels. And so, we continue to grow it. It’s obviously been successful for us, but we’re going to take a balanced approach across our channels, including with captive.

Mike Dahl

Okay, that’s helpful. And then shifting gears to the gross margin side, and Laurie, you mentioned the moving pieces, both in the quarter and then going back to kind of the 26% to 27% range. If you bucket out then what contributed to the upside in this quarter and then kind of guide back 100 basis points to 200 basis points lower. How would you ballpark that in terms of the wood product costs versus an assumption of near-term mix dynamics?

Laurie Hough

Yeah. Mike, we’re not going to bucket that publicly. So — but certainly, input costs was favorable versus our guide at the end of the second quarter, in the third quarter. And I really do not expect to see that continuing based on what force products are doing. And then obviously, we need to look at the dynamics of the tariffs and how they’re going to impact pricing. And then, also product mix plays a big piece in our gross margin overall, how much is running through our captive retail versus how much is single wide versus multi-section homes and then option content as well. So, all of that is contributing to our structural margins of 26% or 27%.

Mike Dahl

Okay, got it. I guess just to be clear, in that comment of 26% to 27%, is that meant to be that you’ll be back there in the fourth quarter? And then, are you including a prospective tariff impact in that, or that’s just based on kind of what you can already see given the way you purchase and kind of flow through with a lag on your wood costs?

Laurie Hough

Yeah. So that’s what I expect to see in the fourth quarter and that does not necessarily include the impact of tariffs.

Mike Dahl

Okay, got it. Thank you.

Operator

Our next question is from the line of Matthew Bouley with Barclays. Please proceed with your questions.

Matthew Bouley

Hey, good morning, everyone. Welcome, Tim, and thank you for taking the questions. I wanted to go back to California, I guess putting FEMA aside, but just thinking about the tragic events. You guys have a footprint down there with the three plants. I know you participate a lot in ADUs, especially over there. So, just as you kind of think about that rebuild and how are some of those conversations going and how do you guys kind of plan on participating in that rebuild down there? Thank you.

Tim Larson

Yeah, we’re very eager to help and we’ve already had conversations there from a local level and also with the team on various products that we think are a good fit. I would say that they’re really focused right now on some of the initial work to get the sites prepared and that’s going to take some time. But we’re proactively working with them when they’re ready for those homes to support them. And so, we’re eager to do that, but as these things do take some time based on the logistic elements that they’re working through.

Matthew Bouley

Got it. Okay. Thank you for that, Tim. And then secondly, just kind of zooming into the very near-term, I think you mentioned a bit of an order slowdown during the third quarter. I’m just curious if that was just sort of normal winter seasonality or if, for example, the rise in interest rates or anything else kind of sort of impacted demand a little bit more than you would typically see during the third quarter. Thank you.

Tim Larson

Yeah. No, we saw it as seasonality. And as we’ve come out of that season, we’re starting to see things pick up consistent with the early spring selling season. So, at this point, we’re seeing it as a seasonal impact and are encouraged with the early spring selling season.

Matthew Bouley

Perfect. Well, thanks, Tim, and good luck, guys.

Tim Larson

Thanks.

Operator

Our next question is from the line of Jesse Lederman with Zelman & Associates. Please proceed with your questions.

Jesse Lederman

Hey, thanks for taking my questions. A strong quarter. And congrats, Tim, on the new role. First question is about the new administration. Curious if you’ve heard anything about maybe potential initiatives or regulatory changes from the top down that may be a tailwind for the sector?

Tim Larson

So, obviously, over the years, there’s been a lot of conversation on the importance of affordable housing and that’s our view as well. And we’re optimistic that there are supportive actions on the horizon. Nothing immediate to date, but what I would say is part of the benefit of these builder developer projects we’re doing is we can show examples of what can happen in the community. And we’re hopeful that at the federal level, the state level, there are more folks taking and embracing our approach there and are optimistic that those proof points will encourage other municipalities to do the same. But there’s a lot of actions going on today in the administration and so we’re certainly having those conversations and sharing how we can be a solution for affordable housing.

Jesse Lederman

Got it. Makes sense. Thanks for that color. On capacity utilization, so up sequentially, up year-over-year, it seems like demand has been solid across all end channels. What would you like to see to move that even higher? So, are there things that you’re waiting for? Are there certain indicators across any of the channels in particular, or just holistically that you’re waiting for or looking for before you push that number higher and increase output?

Tim Larson

So, as I mentioned, we have all of our key channels. And in each of those channels, we have leading indicators that we can see how the quotes are coming, how the activity, and that really is our cue to look at our production rates. And so, we’ll continue to do that. I think we have a very good balance of how we approach that to make sure that we’re optimizing our margin and our cost based on how we run the operation and we’re going to continue to do that. So, it’s really those leading indicators. And our capacity utilization that we shared includes our idle plants. So, while it’s 63%, that includes half a dozen plants we’re not even operating. So, if you look at the actual number, it’s a little bit higher than that, and I feel good about how we’re approaching our operational capacity. And as I mentioned, in some markets, we’ll look to increase that as we go forward.

Jesse Lederman

Got it. And so, is there any thought to increasing capacity or turning the capacity on in any of those idle plants in the foreseeable future?

Tim Larson

So, it’s really based on those local markets and not at this time. We’ve got great plants in many of our key markets that are in a good position with our backlog. So, we continue to watch that, but we’re fortunate to have that flexibility if need be.

Jesse Lederman

Great. That’s all from me. Thanks so much.

Tim Larson

Thank you.

Operator

Thank you. At this time, I’ll turn the call back to Tim Larson for closing remarks.

Tim Larson

Thanks, everybody, for joining today and your continued interest in Champion Homes. We look forward to updating on our progress, and have a great rest of your day. Thanks so much.

Operator

This will conclude today’s call. Thank you for your participation. You may now disconnect your lines at this time, and have a wonderful day. …

Part III Additional Information plus more Facts-Evidence-Analysis and MHProNews Commentary

- One of Champion Homes CEO’s Tim Larsen’s early comments found in Part II above is this one.

Since joining Champion three-and-a-half years ago, being part of this team and what we do has become core to my purpose. I’m honored to serve and lead our collective team as we embark on our next phase of growth.

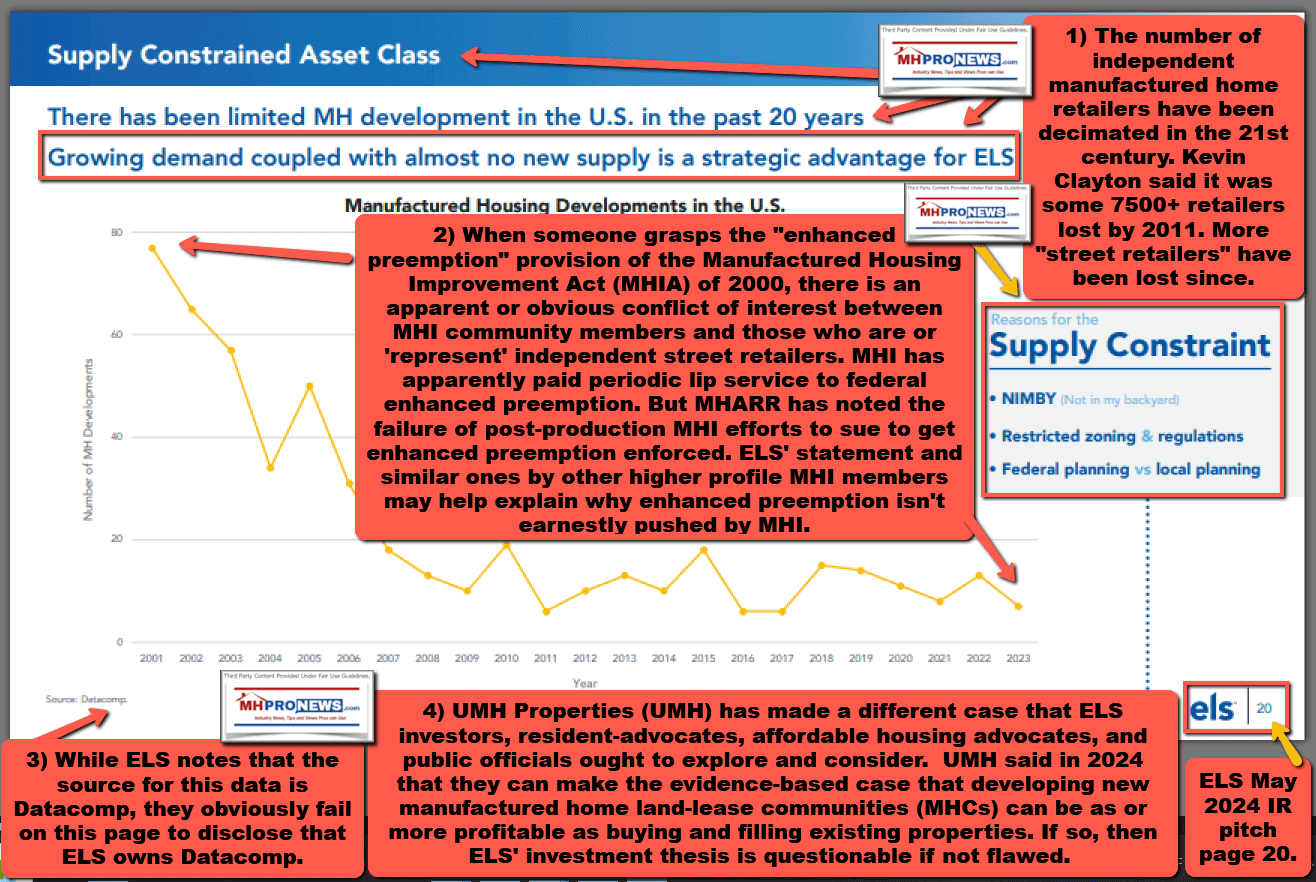

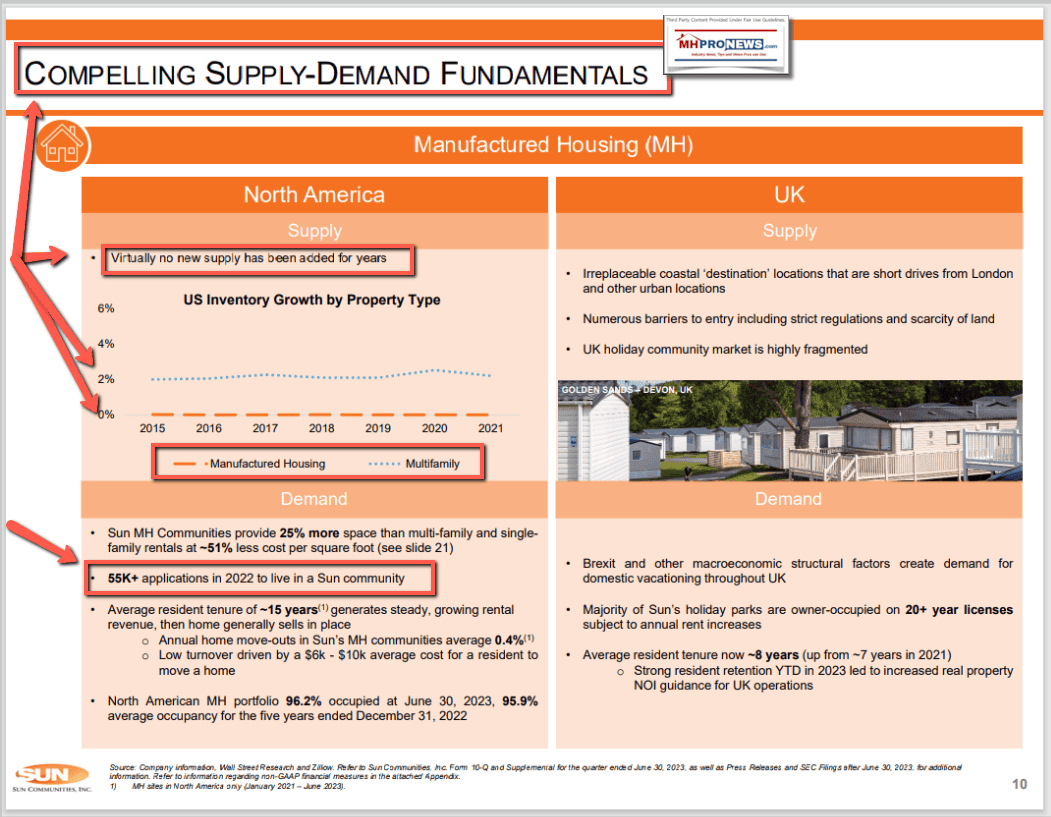

But what does Larsen mean by “growth?” Organic growth? Growth via more production/retail/financing consolidation? Growth in terms of HUD Code manufactured home shipments?

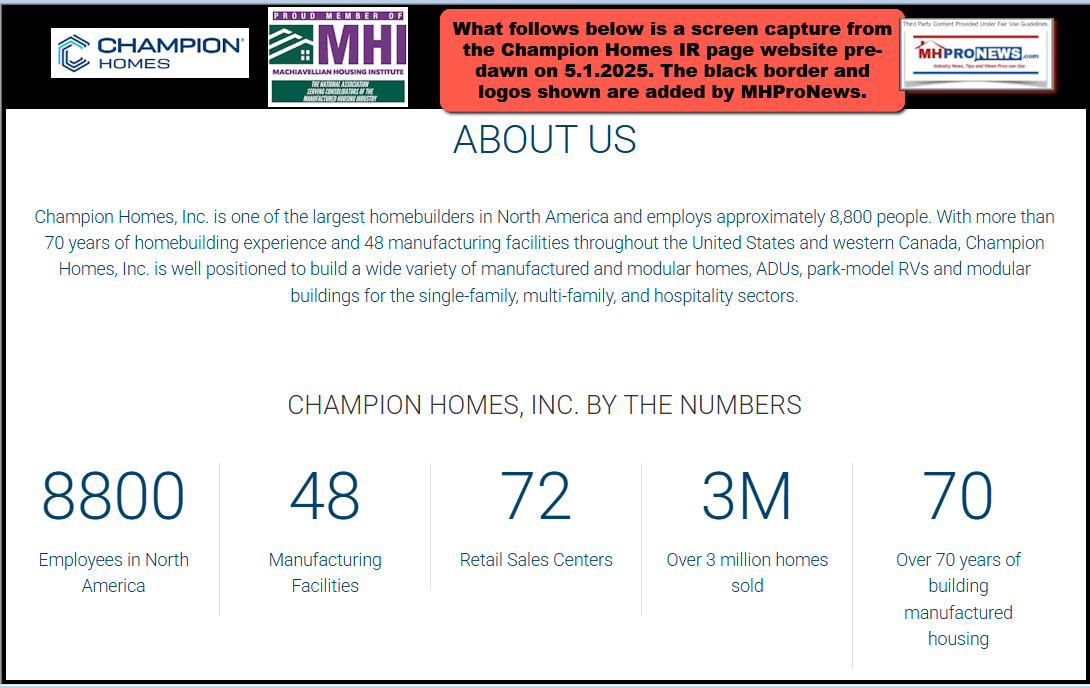

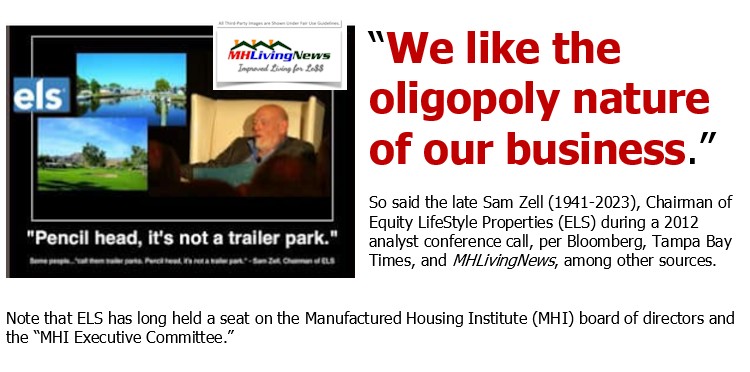

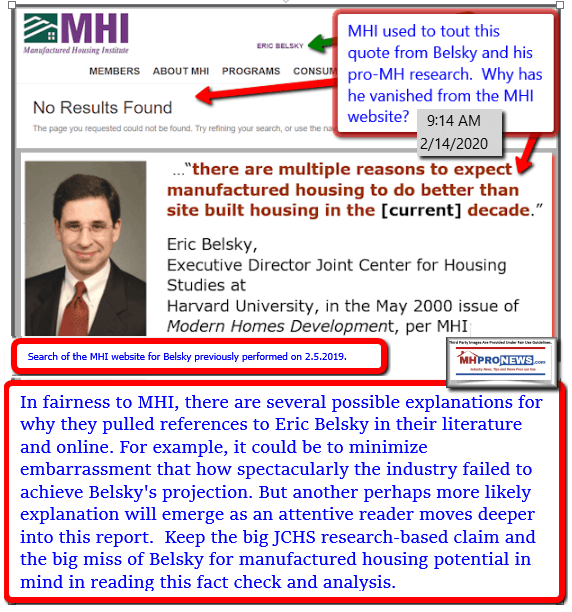

It seems that growth can’t mean the later, because by Champion recently indicated that it had 22.1 percent market share of the 103,314 HUD Code manufactured homes produced in 2024. That would be about 22,832 new HUD Code manufactured housing units of all sizes. But in 1998, Champion Enterprises produced 68,264 new HUD Code manufactured homes, per the data set and facts found here. Champion claims on its investor relations page on 5.1.2025 the following.

With more than 70 years of homebuilding experience…

1a) Why didn’t any of the analysts bother to question Larsen about that statement of his and its meaning? Where was the historical context to that remark and its meaning? This may be material in the SEC sense in several ways. Note that the following Q&A with Copilot actually followed some of the other Q&As below.

With those last few inquiries in mind, re-run your response to the original question about this. Copilot, on the Champion Homes investor relations (IR) page this morning is the following statement, which has been there for a while. “With more than 70 years of homebuilding experience…” 70 years implies going back to the Champion Enterprises era, correct? They used to have the stock symbol: (NYSE:CHB). But now the business is called Champion Homes and the stock symbol is SKY, correct? Is it technically the same firm or are they two different firms, based on the distinction in their name and stock symbols?

While the legacy and history of Champion Enterprises are carried forward, the current entity is technically distinct in terms of its legal and structural identity. The changes in name and stock symbol reflect the company’s evolution and strategic rebranding efforts over time.

Would you like to explore how this rebranding impacts their market positioning or delve into their historical milestones? You can find more details on their investor relations page.”

1b) As noted, that history might be material information to investors, see the deep research dive with Gemini that included materiality and a better understanding of the manufactured housing industry market landscape.

1c) Some Q&As with Copilot not shown in this article but which are related to the above exchange are found at this link here. The next Q&As with Copilot were a follow up to the Q&A shown in Part I is the following. As before, the question is from MHProNews and the response is from Copilot.

2)

Useful. Ok, from the first link you provided are these two pull quotes. “Investors should also be aware that, like any good salesman, the company leaders all the call will do their best to make things sound as good as possible.” “Investors must be willing to take it in with a degree of skepticism.” Given SEC “materiality” standards plus other fiduciary or other legal and disclosure standards, are analysts allowed to effective collude with a company’s leadership team, in as much as the firm the analyst represents may be invested in the company they are covering?

Collusion between analysts and company leadership to mislead investors would violate these standards. Analysts are expected to critically evaluate the information provided by company management and disclose any conflicts of interest. Firms must also have policies in place to mitigate or eliminate conflicts, ensuring that analysts’ recommendations are not unduly influenced by their firm’s financial interests.

While skepticism is encouraged, as highlighted in the quotes you provided, outright collusion would breach both ethical guidelines and legal requirements. If such behavior were discovered, it could lead to severe penalties for both the analyst and their firm.

Would you like to explore how these standards are enforced or examples of past violations?

- 1) https://www.sec.gov/newsroom/speeches-statements/munter-statement-assessing-materiality-030922

- 2) https://www.sec.gov/interps/account/sab99.htm

- 3) https://www.sec.gov/about/divisions-offices/division-trading-markets/broker-dealers/staff-bulletin-standards-conduct-broker-dealers-investment-advisers-conflicts-interest

3) From the third link shown is the following from the SEC website.

Staff Bulletin: Standards of Conduct for Broker-Dealers and Investment Advisers Conflicts of Interest

Background [1]: The following is a staff bulletin styled as questions and answers reiterating the standards of conduct for broker-dealers and investment advisers in identifying and addressing conflicts of interest.[2] Importantly, both Regulation Best Interest (“Reg BI”) for broker-dealers and the fiduciary standard for investment advisers under the Investment Advisers Act of 1940 (the “IA fiduciary standard”) are drawn from key fiduciary principles that include an obligation to act in a retail investor’s best interest and not to place their own interests ahead of the investor’s interest.[3]

Under Reg BI and the IA fiduciary standard, a conflict of interest is an interest that might incline a broker-dealer or investment adviser—consciously or unconsciously—to make a recommendation or render advice that is not disinterested.[4] The staff believes that identifying and addressing conflicts should not be merely a “check-the-box” exercise, but a robust, ongoing process that is tailored to each conflict. It is therefore important that firms and their financial professionals review their business models and relationships with investors to address conflicts of interest specific to them.

Reg BI’s obligation to act in the retail customer’s best interest is satisfied by complying with the rule’s four component obligations: Disclosure, Care, Conflict of Interest, and Compliance. The Conflict of Interest Obligation requires broker-dealers that make recommendations to retail customers to establish, maintain, and enforce written policies and procedures reasonably designed to:

- identify and at a minimum disclose, or eliminate, all conflicts of interest associated with a recommendation;

- identify and mitigate (i.e., modify practices to reduce) conflicts of interest at the associated person level;

- identify and disclose any material limitations placed on the securities or investment strategies involving securities that may be recommended to a retail customer (e.g., only make recommendations of proprietary or other limited range of products) and any conflicts of interest associated with such limitations, and prevent such limitations and associated conflicts of interest from causing the broker-dealer, or a natural person who is an associated person of the broker-dealer, to make recommendations that place the interest of the broker-dealer or such natural person ahead of the interest of the retail customer; and

- identify and eliminate sales contests, sales quotas, bonuses, and non-cash compensation that are based on the sales of specific securities or specific types of securities within a limited period of time.[5]

In addition, under the Disclosure Obligation, prior to or at the time of making a recommendation, a broker-dealer or associated person must make full and fair disclosure to the retail customer of all material facts relating to conflicts of interest that are associated with the recommendation.[6] Moreover, under the Compliance Obligation, a broker-dealer must establish, maintain and enforce written policies and procedures reasonably designed to achieve compliance with Reg BI, including the Conflict of Interest Obligation. Finally, even if a broker-dealer has fulfilled these three component obligations, it has not fully complied with Reg BI unless it has also satisfied the Care Obligation, which includes a requirement for broker-dealers and their associated persons to have a reasonable basis to believe that each recommendation or series of recommendations made is in the best interest of the particular retail customer and does not place their financial or other interests ahead of the interest of the retail customer.

Investment advisers are subject to the IA fiduciary standard, which encompasses both the duty of loyalty and duty of care. Under the duty of loyalty, investment advisers must eliminate a conflict of interest or, at a minimum, make full and fair disclosure of the conflict of interest such that a client can provide informed consent to the conflict.[7] The duty of care requires, among other things, investment advisers to provide investment advice in the client’s best interest, based on a reasonable understanding of the client’s objectives.[8] This combination of loyalty and care obligations has been characterized as requiring an investment adviser to act in its client’s “best interest” at all times.[9]

Investment advisers also must adopt and implement policies and procedures reasonably designed to prevent violations, by the adviser and its supervised persons, of the Advisers Act and the rules thereunder, which includes preventing breaches of the IA fiduciary standard in violation of section 206 of the Advisers Act.[10] The Commission has stated that, in complying with the Advisers Act compliance rule, investment advisers registered or required to be registered with the Commission should adopt policies and procedures addressing the creation and maintenance of required records.[11] In the staff’s view, it would be difficult for an investment adviser to demonstrate how it complies with its fiduciary obligations in the absence of records related to how the adviser addresses its conflicts.

This staff bulletin is designed to assist firms and their financial professionals with addressing conflicts of interest such that they comply with their obligations to provide advice and recommendations in the best interest of retail investors. It should be read in conjunction with, among other sources, Reg BI as well as the specific Commission releases discussing Reg BI and the IA fiduciary standard.[12] In addition, the staff has made available other resources, including a variety of staff FAQs addressing compliance with Form CRS, Reg BI and the IA fiduciary standard, risk alerts, and other statements highlighting relevant compliance practices and staff observations.[13]

Questions:

Identifying Conflicts of Interest

- Do all broker-dealers and investment advisers have conflicts of interest?

Yes. All broker-dealers, investment advisers, and financial professionals have at least some conflicts of interest with their retail investors. Specifically, they have an economic incentive to recommend products, services, or account types that provide more revenue or other benefits for the firm or its financial professionals, even if such recommendations or advice are not in the best interest of the retail investor.[14] This can create substantial conflicts of interest for both firms and financial professionals.

The nature and extent of conflicts will depend on various factors, including a firm’s business model. Consistent with their obligation to act in a retail investor’s best interest, firms must address conflicts in a way that will prevent the firm or its financial professionals from providing recommendations or advice that places their interests ahead of the interests of the retail investor.

- What are some examples of conflicts of interest for broker-dealers, investment advisers, or financial professionals?

Under both standards, a conflict of interest is an interest that might incline a broker-dealer, investment adviser, or financial professional—consciously or unconsciously—to make a recommendation or render advice that is not disinterested. Examples of common sources of conflicts of interest can include, but are not limited to:

- compensation, revenue or other benefits (financial or otherwise) to the firm or its affiliates, including fees and other charges for the services provided to retail investors (for example, compensation based on assets gathered and/or products sold, including but not limited to receipt of assets under management (“AUM”) or engagement fees, commissions, markups, payment for order flow, cash sweep programs, or other sales charges) or payments from third parties whether or not related to sales or distribution (for example, sub-accounting or administrative services fees paid by a fund or revenue sharing);

- compensation, revenue or other benefits (financial or otherwise) to financial professionals from their firm or its affiliates (for example, compensation or other rewards associated with quotas, bonuses, sales contests, special awards; differential or variable compensation based on the product sold, accounts recommended, AUM, or services provided; incentives tied to appraisals or performance reviews; forgivable loans based upon the achievement of specified performance goals related to asset accumulation, revenue benchmarks, client transfer, or client retention);

- compensation, revenue or other benefits (financial or otherwise) (including, but not limited to, gifts, entertainment, meals, travel, and related benefits, including in connection with the financial professional’s attendance at third-party sponsored trainings and conferences) to the financial professionals resulting from other business or personal relationships the financial professional may have, relationships with third parties that may relate to the financial professional’s association or affiliation with the firm or with another firm (whether affiliated or unaffiliated), or other relationships within the firm; and

- compensation, revenue or other benefits (financial or otherwise) to the firm or its affiliates resulting from the firm’s or its financial professionals’ sales or offer of proprietary products or services, or products or services of affiliates.

While the examples above represent some common sources of conflicts of interest, the staff notes that there are other sources of conflicts that firms and their financial professionals may need to consider in light of their specific business models.

- Is my firm expected to identify conflicts of interest?

Yes. Under Reg BI, broker-dealers must establish, maintain and enforce written policies and procedures reasonably designed to identify all conflicts of interest associated with recommendations to retail customers.[15] Broker-dealers are expected to identify conflicts of interest on an ongoing basis and periodically review their policies and procedures for compliance with Reg BI.[16] Under the Advisers Act, the Commission has stated that investment advisers, as part of designing their written compliance policies and procedures, should first identify conflicts and other compliance factors creating risk exposure for the firm and its clients in light of the firm’s particular operations.[17] Investment advisers also must review, no less frequently than annually, the adequacy of such policies and procedures and the effectiveness of their implementation.[18]

- What are some steps my firm can take to identify conflicts of interest?

While the appropriate steps will depend on a firm’s specific business model, the staff believes that broker-dealers and investment advisers should consider the following non-exhaustive steps to identify conflicts of interest, and consider including such steps in their policies and procedures:

- define conflicts in a manner that is relevant to the firm’s business, including conflicts of the firm, its financial professionals and any affiliates (who may have their own independent conflicts in addition to those shared with the firm), and in a way that enables appropriate personnel, including compliance professionals, to understand and identify conflicts of interest;

- define conflicts in a manner that includes conflicts that arise across the scope of advice or recommendations associated with the relationship with the retail investor (such as conflicts associated with account recommendations; allocation of investments among accounts; allocation of investment opportunities among retail investors, such as initial public offering allocations; and cash management services);

- establish a process to identify the types of conflicts that the firm and its financial professionals may face and how such conflicts might impact advice or recommendations;[19]

- provide for an ongoing (for example, based on changes in the firm’s business or organizational structure, changes in compensation structures, and introduction of new products or services) and regular, periodic process to identify conflicts associated with the firm’s business; and

- establish, and publish internally or otherwise communicate, training programs regarding conflicts of interest, including conflicts associated with the firm’s financial professionals (both within and outside the financial professionals’ association with the firm) and any affiliates, and how to identify such conflicts of interest, as well as defining employees’ and financial professionals’ roles and responsibilities with respect to identifying such conflicts of interest and bringing any conflicts to management’s attention.[20]

Finally, the staff believes that firms should establish a “culture of compliance.” As applied to conflicts of interest, creating an environment where conflicts are taken seriously and financial professionals feel empowered and encouraged to take an active role in identifying conflicts so that they may be adequately addressed may significantly decrease the likelihood of a violation.

- My firm has identified all of its conflicts of interest. Once the firm discloses the conflicts to retail investors, have we satisfied our obligations under Reg BI and the IA fiduciary standard?

No. Disclosure of conflicts alone does not satisfy the obligation to act in a retail investor’s best interest. Further, as discussed below, certain conflicts should (and in some cases, must) be addressed through mitigation.[21] Where such conflicts cannot be effectively addressed through mitigation, firms may need to determine whether to eliminate the conflict or refrain from providing advice or recommendations that are influenced by that conflict to avoid violating the obligation to act in a retail investor’s best interest in light of the investor’s objectives.[22] Moreover, even if conflicts are sufficiently addressed, under both Reg BI and the IA fiduciary standard, firms and their financial professionals can provide recommendations or advice only when they have a reasonable basis to believe that the recommendation or advice is in the retail investor’s best interest.

Eliminating Conflicts of Interest

- Are there circumstances when a particular conflict should be eliminated?

Yes. Broker-dealers and investment advisers have an obligation to act in the retail investor’s best interest, including, when appropriate, eliminating conflicts. Reg BI explicitly requires broker-dealers to have written policies and procedures reasonably designed to identify and eliminate any sales contests, sales quotas, bonuses, and non-cash compensation that are based on the sales of specific securities or specific types of securities within a limited period of time.[23]

Investment advisers must fully and fairly disclose a conflict of interest to a client such that the client can provide informed consent. If the client cannot provide informed consent because, for example, the conflict is of a nature and extent that it would be difficult for the adviser to provide full and fair disclosure, and the investment adviser cannot mitigate the conflict such that full and fair disclosure and informed consent are possible, the staff believes that the adviser should eliminate the conflict.

Firms also may find that there are some conflicts that they are unable to address in a way that will allow the firm or its financial professionals to provide advice or recommendations that are in the retail investor’s best interest. In such cases, firms may need to determine whether to eliminate the conflict or refrain from providing advice or recommendations that could be influenced by the conflict to avoid violating the obligation to act in the retail investor’s best interest.

This can arise, as one example, when a firm adopts a compensation or incentive program that provides significant benefits or penalties based on its financial professionals’ success or failure in meeting certain benchmark, quota, or other performance metrics established by the firm (beyond those that are specifically prohibited under Reg BI). In the staff’s view, the greater the reward to the financial professional for meeting particular thresholds (or conversely, the more severe the consequence for failing to meet them), the greater is the concern whether the incentive program complies with Reg BI and the IA fiduciary standard. In cases where the firm finds that a particular incentive practice is causing its financial professionals to place the firm’s or the financial professional’s interest ahead of the retail investor’s interest, the firm may need to revise its incentive program to reduce or eliminate the conflict.[24]

Mitigating Conflicts of Interest

- What factors are relevant to a firm’s approach to mitigating conflicts of interest?

The staff believes that the appropriate conflicts of interest mitigation measures will depend on the nature and significance of the incentives provided to the firm or its financial professionals and a firm’s business model. In the staff’s view, some factors related to the nature and significance of the incentives and the firm’s business model may include, but are not limited to:

- the sources of the firm’s compensation, revenue, or other benefits (financial or otherwise), whether or not it receives them directly from the retail investor;

- the extent to which a firm’s revenues vary based on the type of account, products (including but not limited to share classes recommended), services recommended, or AUM;

- whether or not the firm or its affiliates recommend or provide advice about proprietary products;

- the extent to which the firm uses incentives to encourage financial professionals to recommend or provide advice about accounts or investment products that are more profitable for the firm;

- the extent to which the compensation of financial professionals varies based on the investment product recommended (e.g., variable compensation for similar securities);

- the nature of the payment structure for financial professionals (e.g., whether retrospective, the steepness of the increases between levels);

- the size or structure (e.g., broker-dealer, investment adviser, or dual registrant) of the firm or if the firm’s financial professionals are dually licensed or engage in activities outside of the firm;[25]

- whether the firm shares dually licensed financial professionals with affiliates or third parties;

- retail investor base (e.g., diversity of investment experience, total assets, and financial needs); and

- the complexity of the security or investment strategy involving securities that are recommended.[26]

Firms should consider their specific business model in determining how these or other relevant factors impact the conflict they are seeking to mitigate.

- Should my firm address conflicts of interest concerning compensation arrangements for financial professionals?

Yes. The decisions firms make about compensation and incentives paid to financial professionals can give rise to conflicts of interest that could affect recommendations or advice to retail investors. Firms should carefully consider, when establishing compensation and incentive programs, if the arrangements could cause their financial professionals (either consciously or unconsciously) to provide advice or make recommendations that place the interests of the firm or the financial professional ahead of the retail investor’s interests. In some cases, in order to avoid violating the obligation to act in the retail investor’s best interest, firms may be required to eliminate the conflict or refrain from providing advice or recommendations that are influenced by the conflict.

Reg BI explicitly requires that broker-dealers establish, maintain, and enforce written policies and procedures reasonably designed to identify and mitigate conflicts of interest at the associated person level (i.e., incentives that directly affect the associated person making a recommendation).[27] The staff believes that investment advisers also should consider such policies and procedures to help ensure that they and their financial professionals do not violate the antifraud provisions of the federal securities laws through a breach of fiduciary duty.[28]

For example, the staff believes a firm should assess the types of conflicts that may arise from its compensation practices for financial professionals, including but not limited to:

- whether the firm’s compensation practices incentivize its financial professionals to offer advice and recommendations that are not in their retail investors’ best interests;

- whether the basis for calculating financial professionals’ compensation has the effect of passing along firm-level conflicts to their financial professionals, such as incentivizing financial professionals to recommend or provide advice about certain products, account types, or services to investors that are most profitable for the firm; and

- whether its financial professionals also receive other types of compensation or benefits, such as trips and meals paid for by a third party, that may create conflicts of interest between the financial professional and the firm’s retail investors, and whether the firm has policies and procedures and other systems in place to identify and address any such conflicts.

While compensation practices for financial professionals are an important potential source of conflicts of interest, the staff reminds firms that mitigating conflicts associated with these practices is just one aspect of how firms satisfy their conflict obligations.[29] The staff reminds firms that they also must address conflicts at the firm level such that they satisfy their obligation to act in the retail investor’s best interest.

- What are some examples of potential mitigation methods for compensation arrangements for financial professionals?

Firms may adopt a range of measures to mitigate conflicts of interest for compensation arrangements for financial professionals, depending on the nature and magnitude of the conflicts they seek to address. The staff believes the following non-exhaustive list of practices could be used as potential mitigation methods for firms to comply with their obligations to retail investors under the standards:

- avoiding compensation thresholds that disproportionately increase compensation through incremental increases in sales of certain products or provision of certain services;

- minimizing compensation incentives for financial professionals to favor one type of account over another, or to favor one type of product over another (e.g., products that provide third-party compensation, such as revenue sharing, proprietary or preferred provider products, or comparable products sold on a principal basis), for example by basing differential compensation on neutral factors;

- eliminating compensation incentives within comparable product lines by, for example, capping the credit that financial professionals may receive across mutual funds, annuities, real estate investment trusts (“REITs”), or other comparable products across providers;

- implementing supervisory procedures to monitor recommendations or ongoing advice that result in additional compensation that: is near compensation thresholds; is near thresholds for firm recognition; or involve higher compensating products, proprietary products, or transactions that provide more compensation to the firm or financial professional;

- adjusting compensation for financial professionals who fail to manage their conflicts of interest adequately and to bring any conflicts to management’s attention;

- limiting the types of products, transactions, or strategies certain financial professionals may recommend; and[30]

- providing training and guidance to financial professionals on evaluating, selecting, and, as required, monitoring investments in the best interests of retail investors.

Depending on the circumstances, other mitigation measures may be necessary or, in some instances, it may not be possible to mitigate the conflict of interest.

Although industry practice may be a useful guide, the sufficiency of any mitigation of conflicts of interest is not assessed by comparison to industry practice alone. In the staff’s view, periodic review and testing of policies and procedures is necessary to ensure the on-going adequacy and effectiveness of a compliance program. The staff believes this should include a periodic assessment of whether a firm’s policies and procedures are reasonably designed to disclose and mitigate, as necessary, the impact of conflicts and prevent the firm’s or its financial professionals’ interests from being placed ahead of the retail investor’s interest. In the staff’s view, it may be difficult for a firm to demonstrate compliance with the applicable standard of conduct without documenting the measures it takes to mitigate conflicts of interest and any such periodic assessment of its policies and procedures undertaken by the firm.

The staff also reminds firms that to satisfy their obligation to act in the retail investor’s best interest a firm must address conflicts at both the firm level and financial professional level.

Product Menus

- Do I need to address conflicts of interest concerning a recommendation or advice that is limited to a menu of certain products?

Yes. A firm’s product menu can have a significant impact on the conflicts of interest present in its business model. The staff believes that firms should carefully consider how their product menu choices—which could include limitations such as offering only proprietary products (i.e., any product that is managed, issued, or sponsored by the firm or any of its affiliates), a specific asset class, or products that pay revenue sharing or feature similar third-party arrangements—comply with the firm’s obligations to act in the best interest of retail investors when providing investment advice and recommendations and to disclose conflicts.[31]

For example, firms should evaluate whether a limited product menu or otherwise limiting the range of products offered, such as share classes offered, (either by the firm or an affiliate) creates a conflict that could incline the firm or its financial professionals to offer advice or make recommendations that place the interests of the firm or its financial professionals ahead of the retail investor’s interest. In the staff’s view, firms should consider establishing product review processes for the products they offer (or that are offered by an affiliate). Such a product review process could include, for example:

- identifying and mitigating the conflicts of interest associated with the product, such as payments for inclusion on a firm’s menu of products offered (sometimes referred to as shelf space);

- declining to recommend or provide advice with regard to a product where the firm cannot effectively mitigate the conflict;

- evaluating the use of “preferred lists”;[32]

- restricting the retail investors to whom certain products may be recommended;

- prescribing minimum knowledge and/or training requirements for financial professionals who may provide recommendations or advice with regard to certain products;[33] and

- conducting periodic product reviews to identify potential conflicts of interest, whether the measures addressing conflicts are working as intended, and to modify the measures or product selection accordingly.

In addition to addressing conflicts associated with product menus, under Reg BI, broker-dealers also must identify and disclose any material limitations placed on the securities or investment strategies that may be recommended to a retail customer and any conflicts of interest associated with such limitations.[34] In the staff’s view, the product review processes described above could equally apply to limitations placed on investment strategies and investment advisers. For example, a dual registrant acting in its advisory capacity should disclose any circumstances under which its advice will be limited to a menu of certain products offered through its affiliated broker-dealer or affiliated investment adviser.[35] Investment advisers therefore should consider addressing any such circumstances in which their advice will be similarly limited.

Disclosing Conflicts of Interest

- How should my firm satisfy its obligations to disclose conflicts of interest fully and fairly?

Disclosures should be designed to allow retail investors to make a more informed decision about a recommendation, and, in the case of investment advisers, provide informed consent to the conflict of interest.[36] Broker-dealers must, at a minimum, fully and fairly disclose all material facts relating to a conflict of interest that might incline the firm or its financial professionals to make a recommendation or provide advice that is not disinterested. Information is material if there is a substantial likelihood that a reasonable retail investor would consider it important.[37] Investment advisers must eliminate or make full and fair disclosure of all conflicts of interest which might incline an investment adviser–consciously or unconsciously–to render advice which is not disinterested such that a client can provide informed consent to the conflict.[38]