“The Manufactured Housing Association for Regulatory Reform (MHARR) has published a research White Paper (copy attached) which exposes a decades-long pattern of public relations exploitation — by the supposed representative of “all segments” of the manufactured housing industry — of laws and government benefit programs which purportedly include federally-regulated manufactured housing but, in fact, fail to achieve or deliver results on the ground for either the industry or consumers.” So says the opening paragraph of the anticipated MHARR White Paper. Is the critique fair? Will MHI respond to its allegations and evidence-based claims? Additional information with MHProNews analysis and commentary in brief will follow. But prior to their MHARR press release and the White Paper itself MHProNews will provide one graphic and one link, each of which represents items previously reported by this publication. Properly understood, they can reasonably be understood as examples supporting the arguments made by MHARR and its president/CEO, Mark Weiss, J.D.

Against that backdrop here is the MHARR media release followed by the contents of the MHARR White Paper on manufactured housing. A download of their White Paper is available at this link here.

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

MHARR WHITE PAPER EXPOSES PUBLIC RELATIONS

EXPLOITATION NOTWITHSTANDING CONTINUING INDUSTRY FAILURES

Washington, D.C., July 25, 2022 – The Manufactured Housing Association for Regulatory Reform (MHARR) has published a research White Paper (copy attached) which exposes a decades-long pattern of public relations exploitation — by the supposed representative of “all segments” of the manufactured housing industry — of laws and government benefit programs which purportedly include federally-regulated manufactured housing but, in fact, fail to achieve or deliver results on the ground for either the industry or consumers.

For many years and at an increasing pace, the erstwhile “national” representative of “all segments of the manufactured housing industry” has touted the supposed inclusion of manufactured housing within various housing, housing finance and community assistance programs of the federal government as an alleged benefit for the industry and consumers, and supposed testament to its reach and prowess.

As the MHARR White Paper indicates, however, that alleged inclusion – as well as the “benefits” supposedly flowing from such inclusion – are largely illusory, for both the industry and the lower and moderate-income American consumers who rely on high-quality, affordable and energy-efficient manufactured housing. Simultaneously, this disconnect is one of the main reasons that industry production is mired near the 100,000 homes per year level, despite unprecedented nationwide demand for affordable housing.

The reason for this disconnect, as the White Paper illustrates, is that even though Congress has generously provided – through multiple laws — for the equitable inclusion of manufactured housing in such benefit programs, that inclusion rarely, if ever, translates into the realization of corresponding benefits on the ground due, principally, to the same factors that inhibit and restrict the utilization of HUD Code manufactured housing more broadly – i.e., exclusionary and discriminatory zoning and the absence of meaningful, market-significant support for manufactured housing consumer loans by Fannie Mae, Freddie Mac, the Federal Housing Administration (FHA) and the Government National Mortgage Association (GNMA). Consequently, while benefits through such programs are nominally “available” to manufactured housing consumers, their scope and impact is undermined by the same policy failures that constrain and limit the industry more broadly.

The White Paper thus concludes that rather than seeking to take advantage of (and exploit for public relations purposes) the nominal inclusion of HUD Code homes in federal housing and housing assistance programs – with little or no matching benefit(s) on the ground — the industry should instead be focused on taking specific, aggressive and positive action in order to promote, advance and ensure the full and effective implementation of such programs – on the ground – so that the honorable and legitimate intentions of their supporters in Congress are fulfilled, rather than subverted by discriminatory policies and outright defiance.

In Washington, D.C., MHARR President and CEO, Mark Weiss, stated: “If an organization is going to take credit for representing all segments of the industry, it should be held accountable for the job that it does in relation to all segments of the industry, and whether its words are consistent with and properly representative of its actions. Legitimate accomplishments merit praise, but there is – and should be – no place for empty posturing, seeking credit for alleged accomplishments that achieve nothing concrete or even worse, convey a false pretense of accomplishment while doing nothing of substance to advance either the industry or its consumers. Therefore, rather than continuing to accept empty posturing, the industry should demand proper and legitimate accountability and measurable progress for the industry in living up to its full potential.” Weiss concluded, “The MHARR must-read White Paper sets the direction as to how the industry’s post-production sector can — and indeed, must — fully and properly implement these outstanding laws and programs that congress has generously provided for consumers of affordable housing and the manufactured housing industry”

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

— 30 –

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARR@MHARRPUBLICATIONS.COM

Website: manufacturedhousingassociation.org

##

Downloads of the July 22 and prior 2017 white papers are as shown. The text of the 7.22.2022 White Paper is as shown below, which will include additional MHProNews analysis and commentary afterwards.

Note that Oxford Languages defines a White Paper as “a government or other authoritative report giving information or proposals on an issue.”

THE EXPLOITATION OF FEDERAL HOUSING

FINANCE AND MORTGAGE FUNDING

ASSISTANCE PROGRAMS

AND

POTENTIAL SOLUTIONS

RESEARCHED AND PREPARED BY

THE

MANUFACTURED HOUSING ASSOCIATION

FOR REGULATORY REFORM

JULY 2022

AN MHARR WHITE PAPER

TABLE OF CONTENTS

I. INTRODUCTION 3

II. ANALYSIS 3

A. History of the Industry

B. Federal Program Implementation Failures

C. Misuse of Public Relations to make Baseless Claims of Success

and to Cover-Up Failures

D. Specific Production and Post-Production Failures

Preventing Field Implementation of Government Programs

- Discriminatory and Exclusionary State and Local Zoning Laws

- Discriminatory and Exclusionary Consumer Finance Regulation

E. How Discriminatory and Exclusionary Zoning Laws Work Against Consumers and the Industry

F. How Discriminatory and Exclusionary Consumer Finance Regulation Works Against Consumers and the Industry

G. Real Beneficiaries of such Failures to Fully and Properly Implement Post-Production Provisions of Applicable Law

III. POTENTIAL SOLUTIONS 13

A. Creation of an Independent National Post-Production Manufactured Housing Association

B. Legal Challenges and Congressional Hearings to Establish Accountability for Implementation of Enabling Laws

- The Industry Should Press HUD to Pursue Targeted Zoning Preemption Litigation

- The Industry Should Seek Congressional action to Strengthen Zoning Preemption and DTS

IV. CONCLUSION 15

- INTRODUCTION

The Biden Administration’s recent focus on federal housing, finance and mortgage assistance programs, with an alleged emphasis on promoting affordable housing, is unintentionally helping to expose worsening discrimination against federally-regulated manufactured homes and manufactured housing consumers, as well as the exclusion of such homes and the mostly moderate and lower-income Americans who rely on them, from these very same “affordable” housing programs. This discrimination and baseless exclusion work in direct opposition to the legitimate goals and objectives of these affordable housing programs, by restricting the flow and availability of federal (and other) benefits to lower and moderate-income manufactured housing consumers, who otherwise would be among the natural and expected beneficiaries of affordable homeownership and homeownership assistance programs.

These negative impacts have raised serious concerns among the expected constituencies of such programs (e.g., affordable housing consumers, the manufactured housing industry, housing authorities and others), by illustrating that while such programs typically include pro forma references to federally-regulated manufactured housing in the text of their enabling legislation, such references rarely, if ever, lead to full-fledged government support for – or assistance to – an individual or community-based manufactured housing project actually developed in the field. Worse yet, while the Manufactured Housing Institute (MHI), which claims to represent the post-production sector of the federally-regulated manufactured housing industry (i.e., retailers, communities/developers, finance and insurance entities, among others), has and continues to routinely claim credit for the mere textual inclusion of manufactured homes in such enabling laws — and uses that inclusion aggressively for public relations purposes — the actual implementation of those programs in the field, specifically with respect to affordable manufactured housing, has not occurred, or is not readily traceable.

The purpose of this White Paper report, accordingly, is, to expose and explain this disconnect and disparity between claims (and the exploitation of such claims) on the one hand, and actual results on the other, which continues to deprive manufactured housing and its largely moderate and lower-income consumers of all the benefits that could – and rightly should – be derived from such federal housing, finance and mortgage assistance programs.

II. ANALYSIS

A. HISTORY OF THE INDUSTRY

Manufactured housing, which emerged as a distinct housing type in the mid-20th century, is affordable housing, historically utilized by lower and moderate-income families. In order to maintain that affordability without the need for costly government subsidies, manufactured housing construction and safety must be regulated at the federal level. Federal regulation allows the full cost efficiencies and savings of factory-based construction to be passed to homebuyers by ensuring: (1) federal preemption of state and local standards, regulations and requirements, which facilitates interstate commerce and allows manufactured homes to be sited anywhere in the United States; (2) uniform performance-based standards which facilitate technological innovation to achieve cost savings; and (3) uniform federal enforcement based on a balance between affordability and full protection of homeowners.

These unique concepts to ensure affordable homeownership, especially for lower and moderate-income families, were enshrined by Congress in the National Manufactured Housing Construction and Safety Standards Act of 1974. This law established the basic framework for the current U.S. Department of Housing and Urban Development (HUD) manufactured housing program and most aspects of the federal standards and enforcement system. Indeed, MHARR was established in 1985 specifically in order to advance, protect and defend the regulatory due process safeguards that Congress incorporated into the federal manufactured housing program through the 1974 law. At the time the 1974 law was adopted, however, manufactured homes were still transitioning from the vehicle-like “trailers” of the Post-War Era to legitimate full-fledged housing. As a result, Congress modeled the 1974 law on the existing federal safety law for automobiles – the National Traffic and Motor Vehicle Safety Act of 1966 — complete with vehicle-like recall provisions.

As manufactured housing progressed and evolved, after the implementation of the 1974 law, into full-fledged housing, however, both Congress and the various stakeholders in the federal program recognized the need to reform and modernize the original law to acknowledge and protect manufactured homes as legitimate, affordable “housing,” at parity, for all purposes, with other types of housing (and thus eligible for inclusion, on an equal basis, in all relevant and appropriate federal housing and housing finance programs). At the same time a string of HUD regulatory abuses involving the adoption and enforcement of de facto standards, regulations and regulatory practices through so-called “interpretations” enacted without notice and comment rulemaking – which denied the due process rights of manufacturers and simultaneously imposed needless and unjustified costs on both producers and consumers – highlighted the need for an open, transparent and accountable process for the development of standards, regulations and related practices, as well as other fundamental program reforms. Against this backdrop, with MHARR fully-established by the late 1980’s and after several regulatory skirmishes with governments at all levels, and after winning (and losing) some of these skirmishes, the Association concluded that the 1974 law was too outdated for modern manufactured housing and decided to take the lead on a major reform and overhaul of that original law.

Thus, in December 2000, after 12 years of congressional hearings, studies and analysis, Congress, on a bipartisan basis, enacted the Manufactured Housing Improvement Act of 2000. (2000 reform law). This landmark legislation adopted key reforms to the original 1974 law, designed ultimately to establish manufactured homes as legitimate “housing” for all purposes and the full parity of manufactured homes with all other types of housing. These reforms include, but are not limited to:

(1) Specific congressional recognition of federally-regulated manufactured housing as “housing” for all purposes including, by necessary implication, consumer financing;

(2) Specific congressional recognition of manufactured homes as “affordable” housing and the mandatory consideration of that affordability in all decisions affecting the federal standards and their enforcement;

(3) establishment of an independent, statutory consensus committee to consider, evaluate and recommend all new or revised standards, enforcement regulations, interpretations and other program actions; and

(4) significantly enhanced federal preemption, to be “broadly and liberally” construed, applicable to all state or local standards or “requirements” that conflict with or impair the federal objectives of the law and federal “superintendence” of the manufactured housing industry.

These structural reforms pertaining to federal regulation of the industry and designed by Congress to advance the availability and utilization of affordable manufactured homes, were supplemented further by Congress with the enactment of the Duty to Serve Underserved Markets (DTS) provision of the Housing and Economic Recovery Act of 2008 (HERA). Under DTS, the federal mortgage giants Fannie Mae and Freddie Mac are directed to provide securitization and secondary market support for certain statutorily-identified historically underserved consumer home financing markets, including the mainstream HUD Code manufactured housing market. The DTS provision, moreover, makes it abundantly clear that its scope and mandate within the manufactured housing market, embraces all types of manufactured housing consumer loans, including both real estate-based loans and the more prevalent personal property or “chattel” loans. DTS, accordingly, is a private sector analog for the federal Title I manufactured home financing program, designed to provide support for manufactured housing personal property consumer loans through the Federal Housing Administration (FHA) and the Government National Mortgage Association (Ginnie Mae).

For its part, MHARR – recognizing the industry’s weak representation in the nation’s capital — and as a manufactured housing producers’ organization, has spent the past two decades aggressively advancing and promoting the full and proper implementation of all these reforms, and most particularly items 2, 3 and 4, which most directly affect the production and post-production environments and the vitality of the manufactured housing market (and industry). Such activity by MHARR continues today, as it seeks to advance, protect and defend today’s modern, affordable, energy efficient manufactured homes.

Unfortunately, notwithstanding the generous support for affordable manufactured housing – and manufactured homebuyers — that Congress has legislated through these various enactments, the growth and evolution of the industry, and with it, the availability and utilization of affordable manufactured homes by Americans (and particularly lower and moderate-income Americans), has been needlessly restrained and limited. This is due, in substantial part to HUD’s failure to fully and properly implement reforms 1 and 4, above, in conjunction with local biases and related restrictions that:

(1) have not been effectively addressed by the industry; and

(2) function to effectively exclude federal aid or support for the utilization of highly-affordable, modern and energy efficient manufactured homes in those communities.

These biases and restrictions, moreover, have simultaneously acted to ensure that the nominal or technical inclusion of affordable manufactured homes in multiple federal programs and initiatives has not resulted in “on the ground” improvements to – and increases in — the utilization of today’s modern, affordable, energy efficient manufactured homes either on an individual or on a community basis. As a result, federally-regulated manufactured homes, which are the nation’s leading source of affordable housing and homeownership are incongruously (and through no inherent fault of their own) either totally excluded from such programs, or are a negligible component of programs in which they should play a much larger and more significant role. Thus, while MHI and others within the industry brag and posture regarding the inclusion of HUD Code homes in such programs, the reality is that little or nothing is actually achieved “on the ground” with respect to manufactured home inclusion; thus the “exploitation” noted in the title of this White Paper.

- FEDERAL PROGRAM IMPLEMENTATION FAILURES

Initially, it should be noted that the 2000 law did far more than simply update and modernize the original 1974 law. Instead, the 2000 reform law was a policy watershed for all aspects of the treatment of HUD Code manufactured housing by governments at every level. At the federal level, the 2000 reform law, among other things, was a directive for federal agencies to include manufactured housing – on an equal basis – in all federal housing, housing support and housing finance programs. Beyond that, on an intergovernmental level, the 2000 reform law’s findings, purposes and enhanced preemption provide a blueprint for a congressionally-mandated compact between the industry, consumers and federal and state governments, to create a balance between consumer protection and affordability once the home leaves the factory, is sold and placed on a parcel of land (i.e., all post-production related matters including but not limited to placement and consumer finance). And while manufacturers continue to produce the best modern, energy-efficient and affordable manufactured homes ever, it is in relation to the specific integration of federal manufactured housing into all such programs that the industry has failed to achieve concrete and meaningful results – or even significant progress. This, in turn, has prevented the manufactured housing industry from reaching its full potential, while depriving millions of Americans access to inherently affordable manufactured homes.

The federal government, for example, provides support for affordable housing and homeownership through a multitude of direct and indirect funding programs. And while typically, affordable, federally-regulated manufactured housing is nominally eligible for inclusion and support within these programs, actual support provided for manufactured housing utilization and development, on both an individual and community level has been – and continues to be – quite negligible. Thus, despite being directed by federal statute to recognize the equal status of manufactured housing with other types of homes – for all purposes – including participation in such programs, the involvement of manufactured housing in those programs, in terms of on the ground implementation, has been consistently undermined by the same factors that have constrained the industry’s growth in more general terms – i.e., zoning exclusion/restriction and the broad unavailability of competitive consumer financing.

The same phenomenon – and its negative impacts – are illustrated in recent comments concerning the U.S. Department of Energy’s (DOE) proposed (and now final) manufactured housing energy standards. While the fatal substantive and procedural deficiencies of those standards and the rulemaking process leading to their adoption have already been analyzed and presented in detail by MHARR in multiple filings with DOE, HUD and the MHCC, it is directly relevant to the subject of this analysis that ultimately, the supporters of those standards – and DOE itself – sought to justify, rationalize and defend: (1) their excessive cost; (2) their exclusionary market impacts; and (3) their failure to provide returns and benefits to consumers exceeding their cost, by urging – and in the case of DOE itself — offering the prospect of government subsidies of varying types in order to allegedly offset the extreme up-front costs of the final standards. Unfortunately, though, as has been the case with the nominal inclusion of manufactured housing in other government assistance programs as outlined above, this alleged assistance will inevitably prove to be nothing more than an illusion, a bait-and-switch scheme designed to subvert the existing inherent affordability of HUD Code manufactured homes by offering the prospect of possible benefits, but never actually delivering. Like the other programs noted above, the industry should reject this illusory fraud.

But while the illusory inclusion of manufactured housing within such government programs – without any matching implementation on the ground – has been a failure in substance, it has nevertheless been used as a marketing tool by some in the industry.

C. MISUSE OF PUBLIC RELATIONS TO MAKE BASELESS

CLAIMS OF SUCCESS AND TO COVER-UP FAILURES

Based on the above, it is – or should be — self-evident that, as a federally-regulated industry, and in order to provide full parity in actual practice with other types of housing, manufactured homes can, should and must be an actual, functional part of any and all federal housing, finance and mortgage funding and assistance programs that are enacted by Congress, particularly if such legislation pertains to affordable homeownership for moderate and lower-income American consumers. Put differently, manufactured homes, by virtue of their unparalleled, intrinsic affordability, should axiomatically and necessarily be part of – and included in by actual participation – all such laws from the outset. By contrast, any claim of “credit” or special effort to seek recognition for any subsequent inclusion by an individual or organization — such as MHI (representing the industry’s post-production sector) – is, in reality, more an admission of failure than grounds for praise, i.e., the belated correction of failure ab initio, rather than grounds for boasting, self-serving and self-congratulatory claims of “victory.”

Rather than self-congratulation over empty claims of recognition and inclusion when, in fact, actual on the ground inclusion of federally-regulated manufactured homes in such programs is hardly ever – if ever – accomplished, the industry would be better served by analyzing and understanding why such on the ground inclusion is lacking, or severely lagging, and what can be done within the industry itself, in order rapidly change that paradigm. That, at least, could produce some tangible, positive results, as contrasted with the current exploitative posturing displayed by both government agencies and some within the industry.

D. SPECIFIC POST-PRODUCTION FAILURES PREVENTING

FIELD IMPLEMENTATION OF GOVERNMENT PROGRAMS

- DISCRIMINATORY AND EXCLUSIONARY

STATE AND LOCAL ZONING LAWS

The manufactured housing industry and manufactured homes have undergone a profound transformation since their initial emergence during the mid-20th century. From vehicle-like “travel trailers,” manufactured homes parted ways with recreational vehicles during this initial period and, with the enactment of the National Manufactured Housing Construction and Safety Standards Act in 1974, acquired the legal status of “housing.” It was not until the adoption of the Manufactured Housing Improvement Act of 2000, however, that HUD Code manufactured homes assumed the full status of modern, legitimate housing for all purposes. In part, the 2000 reform law underscored and emphasized the last step in that nearly 80-year evolution from specialty vehicle to legitimate “housing,” by substantially strengthening the federal preemption clause of the 2000 reform law, to override any and all state or local “requirements” – and not just construction or safety standards – that impair the federal superintendence of the industry. The 2000 reform law, therefore, not only secures the ultimate status of HUD Code homes as legitimate “housing” for all purposes, but also strengthens federal preemption in order to ensure that the availability of that legitimate, inherently affordable housing is not – and will not — be impaired by discriminatory measures designed to exclude (or have the effect of excluding) mainstream HUD Code homes from both private land (i.e., single lots) and/or communities and thereby undermine the key objectives of federal manufactured housing law.

Unfortunately, though, the significantly enhanced preemption provided by Congress as part of the 2000 reform law – which key supporters of the law stressed at the time was designed to invalidate the unequal zoning treatment and exclusion of manufactured housing — has not been used or enforced by HUD in order to break down entrenched state and/or local resistance to the placement and utilization of HUD Code homes.

As a result, the patterns of exclusion that have long existed in many areas of the United States, particularly within urban and suburban areas, still remain, with homeownership opportunities correspondingly limited for lower and moderate-income populations in those locations. In substantial part, it is these discriminatory exclusion mandates that have impaired the growth and expansion of the industry, and its ability to provide affordable, non-subsidized homeownership for substantial numbers of Americans as envisioned by Congress. Consequently, during a period that has seen the average cost of a single-family site-built home skyrocket to historically high levels, while the availability of lower-cost affordable housing has declined and is millions of units below existing need according to a 2021 report by the mortgage giant Fannie Mae, the overall utilization and sales of inherently affordable HUD Code manufactured homes has incongruously declined.

Thus, while the need for affordable, non-subsidized homeownership has never been greater, and the affordability of manufactured homes, vis-à-vis site-built homes (including both purchase price and home operation costs) has never been greater, the availability and utilization of HUD Code homes remains mired near the 100,000 homes-per-year plateau, with only relatively small annual production increases. Moreover, and even more importantly, industry production levels do not – and have not – even approached the levels, in the hundreds of thousands of homes, that the industry should be producing based on the documented need for millions of additional units of affordable homes.

The reasons for this production shortfall in relation to inherent affordability is, consequently, a product of two principal factors, affecting the manufactured housing industry’s post-production sector, which continue unabated: (1) discriminatory state and local zoning and placement exclusions; and (2) discriminatory consumer financing limitations, as detailed below – both of which continue unabated despite the existence of specific statutory remedies designed and enacted for the express purpose of ending those baseless restrictions.

As MHARR has documented elsewhere, discriminatory zoning and placement restrictions and/or exclusions prohibit modern, energy-efficient and inherently affordable manufactured homes from many areas of the United States, including areas of concentrated poverty or housing poverty, where affordable homeownership is particularly needed. This includes, but is not limited to, many urban and suburban areas, where HUD-regulated manufactured housing could be a private-sector source of affordable homeownership, or a component of public-sector affordable housing initiatives, but has been – and continues to be — excluded either as a result of de jure zoning/placement exclusions or de facto reluctance and hesitancy related to zoning and placement restrictions. Thus, while manufactured housing is nominally included in any number of federal affordable housing programs, its actual deployment and utilization in many areas is effectively prohibited. These exclusions, in turn, could be overridden by HUD pursuant to the enhanced federal preemption authority provided by the 2000 reform law, but HUD has consistently refused to exert that power in support of American consumers of affordable housing.

- DISCRIMINATORY AND EXCLUSIONARY CONSUMER FINANCE REGULATION

In addition to zoning and placement discrimination, the utilization of mainstream HUD Code manufactured housing as part of federal government affordable housing programs has also been undermined by the unavailability of market-competitive consumer financing for such homes as a result of the failure and refusal of the federal mortgage giants, Fannie Mae and Freddie Mac, to provide support for manufactured housing personal property loans (comprising nearly 80% of the entire HUD Code market and representing the industry’s most affordable models) pursuant to the statutory Duty to Serve Underserved Markets (DTS). The failure to fully and substantially implement DTS within the manufactured housing market more than a decade after the enactment of the DTS mandate, effectively forces manufactured homebuyers to pay unnecessarily high interest rates on arguably predatory manufactured home purchase loans, to a small group of portfolio lenders which effectively dominate the HUD Code consumer financing market. This, in turn, excludes qualified but marginal borrowers who would qualify for financing in a market with legitimately competitive – and, therefore, lower, borrowing rates.

In combination, these fundamental deficiencies within the manufactured housing market, which impair the industry’s ability to compete with other types of homes on a level playing field – despite the inherent affordability of manufactured homes – has suppressed and repressed both the growth of the industry and its ability to serve a larger segment of Americans in need of affordable homeownership.

E. HOW DISCRIMINATORY AND EXCLUSIONARY ZONING

LAWS WORK AGAINST CONSUMERS AND THE INDUSTRY

Discriminatory zoning mandates which exclude federally-regulated manufactured housing, inevitably harm both the industry and lower/moderate-income consumers who rely on the inherent affordability of manufactured homes.

For the industry, the impacts are obvious. Rather than being able to market, sell and site homes on an equal basis with other types of homes (and most particularly site-built homes) in all jurisdictions and in all locations, the industry is instead foreclosed from competing in many areas. This especially includes highly populated areas in cities and suburbs, where potential buyers are more highly concentrated and where the need for affordable housing and homeownership is more pronounced. While only anecdotal information is currently available to demonstrate this phenomenon – which is obvious in any event because of the prevalence of zoning restrictions targeting HUD Code homes, which do not simultaneously restrict site-built and other types of single-family homes – current research being conducted by HUD’s Office of Policy Development and Research regarding manufactured housing zoning exclusion (following a request by MHARR) is certain to fully document this phenomenon.

Similarly, for consumers, the exclusion of affordable manufactured homes from multiple communities via zoning mandates, limits the supply and availability of affordable housing and, therefore, leads to higher overall housing costs. Such higher costs, in turn, promote and maintain racially discriminatory housing patterns, as noted in a recent White House analysis. In relevant part, that analysis states:

“Exclusionary zoning laws enact barriers to entry that constrain housing supply, which, all else equal, translate into an equilibrium with more expensive housing and fewer homes being built. Consistent with theory, the empirical literature finds a relationship between restrictive land use regulations and higher housing prices. *** Research has connected exclusionary zoning to racial segregation, creating greater disparities in measurable outcomes.”

(See, The White House, “Exclusionary Zoning: Its Effect on Racial Discrimination in the Housing Market,” June 17, 2021).

Discriminatory exclusions and restrictions on the availability of inherently affordable manufactured housing, therefore, limit industry production in a manner that is inconsistent with a fully-competitive and functional market, and sharply limits the supply of affordable housing and homeownership for lower and moderate-income Americans, contrary to both sound policy and applicable federal law. Furthermore, within the specific realm of federal housing programs which nominally include manufactured homes, such homes, ultimately, do not reach – and are not ultimately available “on the ground” — because builders, developers, consumers and others trying to utilize such programs typically either dismiss such programs as impractical, or become exhausted and “give up,” effectively leaving manufactured homes out of those programs, in the face of zoning laws which either exclude or significantly discriminate against HUD Code manufactured homes.

F. HOW DISCRIMINATORY AND EXCLUSIONARY CONSUMER FINANCE REGULATION WORKS AGAINST CONSUMERS AND THE INDUSTRY

Discriminatory and exclusionary housing finance regulation and policies have likewise had extremely negative impacts on both the manufactured housing industry and manufactured housing consumers. As MHARR has detailed repeatedly in written comments filed with the Federal Housing Finance Agency (FHFA), that agency’s failure to ensure the full, robust and market-significant implementation of the Duty to Serve Underserved Markets (DTS) mandate of the Housing and Economic Recovery Act of 2008 (HERA), has artificially restrained the number of lenders in the manufactured housing consumer financing market. This, in turn, has restrained competition, allowing the market to be dominated by only a very small number of lenders with the ability to charge interest rates – particularly on home-only “chattel” loans – that exceed the rates that would prevail in a fully-competitive market. Such higher rates, meanwhile, exclude otherwise qualified but lower income buyers from the market who would have been able to obtain a loan within a properly functioning, fully-competitive market.

All of this, moreover, is confirmed by data contained in a May 2021 report by the Consumer Financial Protection Bureau (CFPB). That report shows, among other things, that the “top five” lenders in the manufactured housing market made “nearly 75 percent” of all chattel loans, and that an estimated 50 percent of manufactured home chattel loan applications were denied, while “only 7 percent of site-built applications [are] denied.” (See, Consumer Financial Protection Bureau, “Manufactured Housing Finance: New Insights from the Home Mortgage Disclosure Act Data,”

May 2021). Effectively, then, the failure to implement DTS – at all – with respect to the nearly 80% of the manufactured housing consumer financing market represented by personal property loans (and the vast majority of the industry’s most affordable models), has allowed a less-than-fully-competitive market dominated by a handful of lenders to remain in place and to charge higher interest rates than would be the case in a fully-competitive market that contribute to an extraordinarily high level of exclusion from the manufactured housing consumer financing market.

Again, therefore, within the specific realm of federal housing programs which nominally include manufactured homes, such homes, ultimately, do not reach – and are not ultimately available “on the ground” — because builders, developers, consumers and others trying to utilize such programs either dismiss such programs as impractical, or become exhausted and “give up,” effectively leaving manufactured homes out of those programs, in the face of the broad unavailability of competitive, federally-supported consumer financing for manufactured homes and especially the industry’s most affordable homes financed as personal property.

G. REAL BENEFICIARIES OF SUCH FAILURES TO FULLY AND PROPERLY IMPLEMENT POST-PRODUCTION PROVISIONS OF APPLICABLE LAW

While discriminatory zoning and consumer financing policies harm both the HUD Code industry at large and lower/moderate-income homebuyers, they do have certain select beneficiaries both outside and inside of the mainstream manufactured housing industry.

The extra-industry beneficiaries of such policies are widely varied (including, but not limited to on-site homebuilders, the real estate industry, the rental housing industry and other types of homebuilders, site-built lenders and others). These entities benefit indirectly from the failure of the manufactured housing industry to achieve its full potential and evolve into a source of hundreds-of-thousands of homes annually for lower and moderate-income consumers. In the absence of this competition, external beneficiaries have access to segments of the housing market that would otherwise be dominated by inherently more affordable manufactured housing. This is particularly the case with respect to the less-expensive segment of the non-HUD Code market, which cannot come close to the inherent affordability of competing HUD Code homes, even if all other factors are equalized between those classes of homes. Similarly, the absence of more robust price-competition at the more affordable end of the broader housing market, allows participants in that market to charge higher prices – and achieve higher profit margins for such lower-end “starter” homes.

The principal intra-industry beneficiaries of the de facto exclusion of HUD Code manufactured homes from many communities and federal housing programs, constitute a far narrower group. These beneficiaries principally include a small number of vertically-integrated, industry-dominant producers, a parallel number of mostly captive finance companies, owned by those manufacturers, and large, corporate manufactured housing communities.

As MHARR and other analyses have clearly shown, the small cadre of HUD Code industry conglomerates, and particularly Berkshire Hathaway-owned Clayton Homes, Inc. (and its subsidiaries), have – and are – circumventing exclusionary zoning targeting mainstream HUD Code manufactured homes by the simple expedient of diversifying into site-built, modular and other non-HUD Code production. Simultaneously, these conglomerates have the financial wherewithal to provide portfolio-based consumer financing for their own customers, thereby bypassing any need for the support or involvement of Fannie Mae or Freddie Mac under DTS. Indeed, as has also been demonstrated by MHARR, both the industry conglomerates and their finance companies (and, effectively, their national representation, as well), in reality, are actually incentivized to oppose both the full and market-significant implementation of DTS consumer lending support and the elimination of the GNMA 10-10 rule for FHA Title I loans, because full DTS implementation and elimination of the 10-10 rule would both draw new competitors into the manufactured home consumer lending market and simultaneously place downward pressure on interest rates for such loans by: (1) promoting a higher level of free-market competition within the manufactured housing market generally; (2) promoting a higher level of free market competition within the manufactured housing financing market specifically; and (3) reducing the carried risk on such loans through securitization and secondary market diversification.

By contrast, within the HUD Code industry, exclusionary and discriminatory policies that artificially limit, restrict and constrain industry production, as well as the full participation of HUD Code homes in all applicable federal affordable housing programs, result in disproportionate harm to smaller producers and other smaller, independent industry businesses, which do not share either the resources or market advantages enjoyed by the larger corporate conglomerates. These smaller businesses, which do not have captive finance organizations and are, therefore, dependent on the availability of competitively-based financing and the equitable inclusion of manufactured homes with such federal programs, are directly harmed by such exclusion, both individually and in relation to larger competitors within the manufactured housing market including, among other things, becoming targets for takeover and consolidation, further diminishing production competition.

Consequently, the failure of both HUD and FHFA, as well as Fannie Mae and Freddie Mac, to fully implement Congress’ statutory directives to expand and protect the manufactured housing market and manufactured housing consumers, substantially benefits the industry’s existing corporate conglomerates, while it simultaneously harms and undermines the competitive interests of the industry smaller, independent businesses, as well as lower and moderate-income American homebuyers seeking greater access to inherently affordable homeownership.

III. POTENTIAL SOLUTIONS

A. CREATION OF AN INDEPENDENT NATIONAL POST-

PRODUCTION MANUFACTURED HOUSING ASSOCIATION

As is evident from the foregoing analysis, the principal impairments to the growth and expansion of the domestic manufactured housing industry, are found – and reside — within the industry’s post-production sector. Therefore, the remedies to these impairments should properly originate within, and emanate from, that same sector.

In substantial part, the endemic nature of the zoning and consumer financing restrictions that the industry and its consumers face is evidence of a structural failure in the representation of the industry in general and the industry’s post-production sector in particular. While aggressive and over-reaching regulation within the industry’s production sector has largely been controlled by MHARR’s sector-specific representation of manufactured housing producers, there is currently no parallel independent and equally-aggressive national representation for the industry’s post-production sector. This has made the post-production sector an enticing target for financing and state/local zoning officials, and industry competitors, who are more interested in excluding HUD Code homes wherever possible, than fully including manufactured homes as an affordable housing option. And, even aside from that suppression, the absence of an independent, national post-production association leaves no effective advocate for manufactured homes – within either the private or government market – after those homes leave the factory.

In fact, MHARR became unavoidably aware of this glaring deficiency within the national representation of the industry during and shortly after the enactment of the landmark 2000 reform law. As a leader of the hard-fought ten-year effort to unite the industry behind the 2000 reform law, MHARR quickly realized that manufactured homes produced after the initial implementation of the 2000 reform law would truly be: modern, high-quality, energy-efficient, affordable, consumer-friendly homes, that would warrant a new, vigorous and independent national post-production representation that would be willing and capable of fighting aggressively to advance such homes after they leave the factory, and face emerging challenges in consumer financing, zoning and placement.

Consequently, and as MHARR has advocated for many years, the industry should establish and fund a genuinely independent national, post-production association. Indeed, both the need for – and logistics of — establishing a new, independent post-production industry association, are addressed in detail in a thoroughly-researched November 10, 2017 White Paper published by MHARR (see, copy attached).

The same conclusion results from a cost-benefit analysis. Put simply who, or which entities, primarily benefit from the industry status quo? The primary beneficiaries of suppressed industry growth combined with higher-interest rate, portfolio-based financing, are Berkshire-Hathaway-owned Clayton Homes, Inc. and both of its finance subsidiaries, 21st Mortgage and Vanderbilt Mortgage Corp. Beneficiaries also include other large publicly-held manufactured housing companies and their respective financing affiliates. Certain such entities have conceded in publicly available documents what is already well-known and should be obvious — that they derive more income from their financial operations relating to manufactured housing than from the production and sale of homes themselves. Given this reality, and the domination of the broader industry’s current umbrella representation by these large industry-dominant entities, it is hardly surprising that such entities would resist the creation of an independent, national post-production representative entity that would more fairly and effectively represent the post-production sector and its preponderance of smaller businesses.

The challenge, by contrast, will be for that preponderance of smaller post-production sector businesses to demand effective representation in the form of an independent, national post-production group that would equitably represent the broad interests of the industry’s array of independent businesses and not just those of the large-firm oligarchs.

B. LEGAL CHALLENGES AND CONGRESSIONAL HEARINGS TO ESTABLISH ACCOUNTABILITY FOR IMPLEMENTAION OF ENABLING LAWS

Irrespective of the establishment of a dedicated, independent national representation for the industry’s post-production sector, the industry should aggressively seek specific and concrete action on the constraints that have limited industry growth and expansion, in order to break existing logjams and institutional resistance at HUD and FHFA that have undermined the full, legitimate and market-significant implementation of both those laws.

- THE INDUSTRY SHOULD PRESS HUD TO PURSUE

TARGETED ZONING PREEMTION LITIGATION

With regard to discriminatory zoning and placement exclusions at the local level, the industry should aggressively focus on HUD’s failure to fully and properly implement the enhanced federal preemption of the 2000 reform law, which applies to all state and/or local “requirements” which impair federal superintendence of the manufactured housing industry and thus directly pertains to zoning law and ordinances in addition to state and/or local construction and safety standards. First, HUD must issue updated “guidance” on the preemption of such zoning and placement exclusions to replace outdated “guidance” on that issue published prior to the comprehensive reform of the federal manufactured housing law in 2000. Then, HUD must target one or more egregious instance(s) of manufactured housing zoning exclusion for administrative action to compel that jurisdiction (or jurisdictions) to cease and desist, followed by litigation (if necessary) in order to firmly and specifically establish the plain meaning of the 2000 reform law – i.e., that the 2000 reform law specifically preempts such exclusionary zoning mandates.

- THE INDUSTRY SHOULD SEEK CONGRESSIONAL

ACTION TO STRENGTHEN ZONING PREEMPTION AND DTS

Beyond such administrative action and enforcement litigation, the industry should also seek congressional hearings in both houses of Congress on this entire issue of zoning preemption under the 2000 reform law. Such hearings must make it clear that HUD has an affirmative statutory duty, as the federal agency responsible for the enforcement of federal manufactured housing law, to ensure that discriminatory state and/or local zoning or placement mandates are not, will not and cannot used to target federally-regulated manufactured housing.

Similarly, full congressional hearings in both houses of Congress, must be held on the implementation of DTS and FHFA’s failure, some 14 years after DTS’s enactment, to ensure that the HUD Code manufactured housing market — including the nearly 80% of total industry production financed through personal property loans – is properly served in a market-significant manner. Such a hearing should examine and consider more than a decade of foot-dragging by FHFA and the mortgage giants, Fannie Mae and Freddie Mac, including the baseless excuses that have been asserted by both of them and their federal regulator for failing to serve, under DTS, any more than a minor sliver of the HUD Code manufactured housing market. Based on such a hearing, Congress should act to clarify that manufactured home loans are an essential and mandatory component of DTS, and establish a specific and enforceable deadline for the market-significant implementation of DTS within the chattel market, not to exceed one year.

IV. CONCLUSION

The illusory inclusion of manufactured homes within high-budget federal government affordable housing programs, serves to highlight the inherent fallacies of the industry’s representation in Washington, D.C., which continues to suffer from the absence of an independent, national post-production representation to mirror the dedication and effectiveness of MHARR within the production sector. Insofar as the post-production sector of the manufactured housing industry is – and long has been — the focal point of the two principal limitations constraining the industry’s growth and evolution, i.e., zoning and consumer financing limitations, the post-production sector must also be the focal point of the remedy for those ongoing failures. This can, should and indeed, must start with proper, legitimate and effective national representation for that sector, in the form of an independent national association. Short of this, the industry’s current post-production representation – i.e., MHI – should be held accountable to lead on resolving both of these deficiencies (i.e., baseless zoning and consumer financing restrictions) both before the courts and in Congress in order to unleash the industry’s full potential as a source of affordable, high-quality home ownership. Indeed, MHI should, in the future, clearly explain to industry members (and consumers) as to how it intends to fully implement a federal manufactured housing finance and mortgage funding assistance program, ensuring that it is a workable and practicable program on the ground, and not merely a device for self-promotion while amounting to a dead-end for its supposed beneficiaries.

This study and analysis is available to industry members for their private use or for re-publication in full (i.e., without alteration or substantive modification) with the permission of – and proper attribution to – MHARR).

MHARR is a Washington, D.C.-based national trade association representing the views and interests of independent producers of federally-regulated manufactured housing.

Additional Information with more MHProNews Analysis and Commentary in Brief

MHProNews has documented several times that the Manufactured Housing Institute (MHI) has an apparent pattern of ducking accountability or responding to the allegations of their critics. Examples of that from MHI and/or their major members are linked below.

So, a hypothetical defense by MHI ought to be imagined, as the odds that MHI will directly respond to this MHARR White Paper are slim.

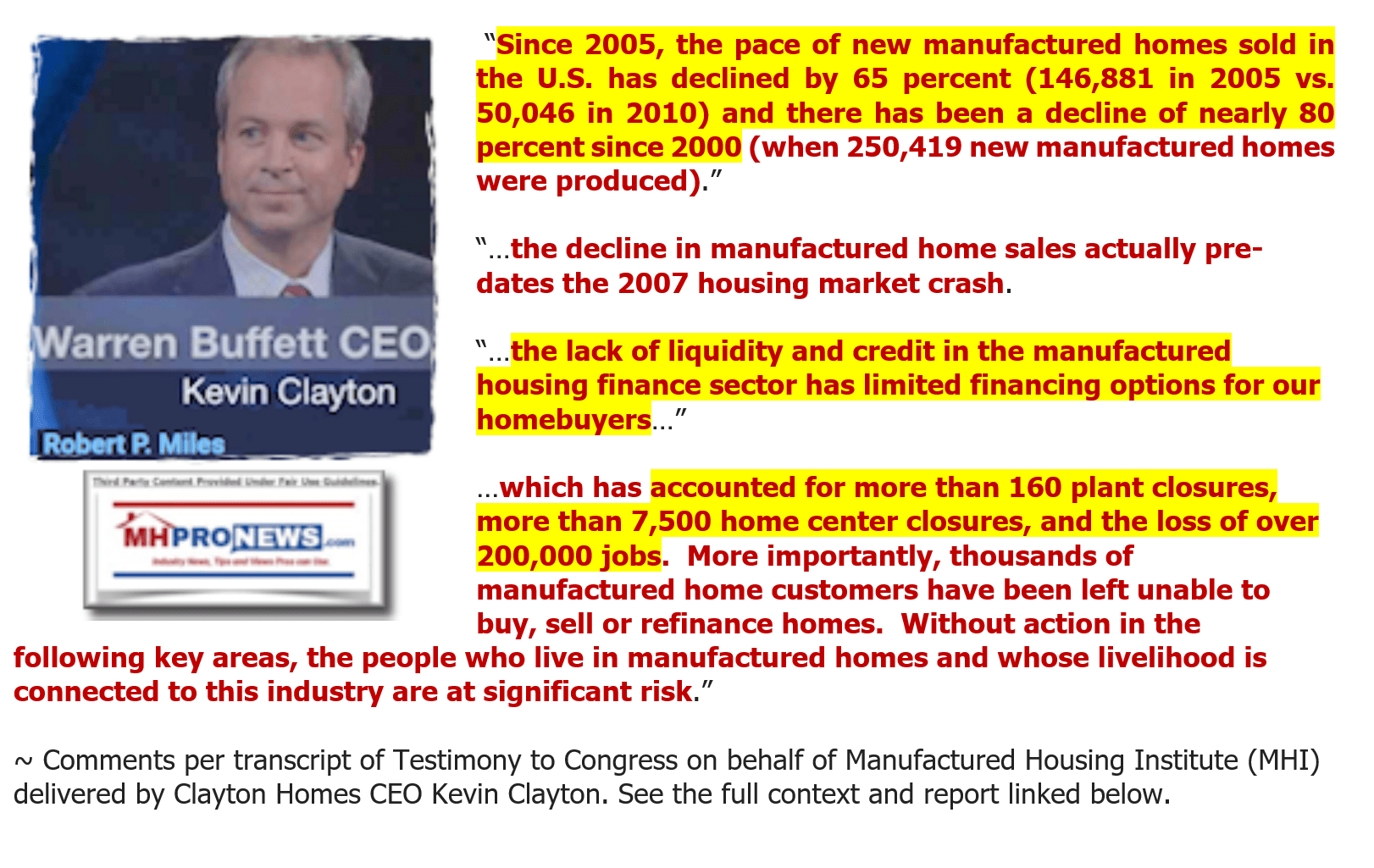

In such a hypothetical public defense by MHI, they might point to the fact that on the Duty to Serve (DTS) issue manufactured home land-lease communities are routinely benefiting from loans obtained that get DTS ‘credits.’ That said, the FHFA’s own annual data makes it clear that virtually no loans have been made that fit the DTS bucket. MHI has admitted as much. Ironically, so too has prominent MHI member Kevin Clayton, President and CEO of Clayton Homes.

To the points raised by MHARR on HUD and federal “enhanced preemption,” once again, MHI is on record admitting what MHARR has alleged.

Outside of the manufactured home industry, Samuel Strommen with Knudson Law has quite pointedly accused MHI of operating on behalf of its major brands in a fashion that he said violates federal antitrust laws in a manner that appears to be a “felony” violation. Questions about RICO and other law violations also exist.

Former MHI state association affiliate-members have broken ranks with MHI due to failure to perform. So, MHARR's thesis is supported by voices, past and present, within MHI.

One could go on and on with such supportive evidence that underscores MHARR's 7.25.2022 White Paper thesis. But the final words perhaps ought to be to refer back to their 2017 White Paper that recommended that manufactured housing should organize a new post-production representation.

Additionally, given that Congress has already probed these issues before – and the testimony at such hearings often supported MHARR’s contentions above – it is entirely reasonable for them to press the notion that Congress should probe these issues again.

But a different wrinkle that MHARR has presented in this new White Paper is this closing point. Until such things occur, “MHI should, in the future, clearly explain to industry members (and consumers) as to how it intends to fully implement a federal manufactured housing finance and mortgage funding assistance program, ensuring that it is a workable and practicable program on the ground, and not merely a device for self-promotion while amounting to a dead-end for its supposed beneficiaries.”

In short, MHI should do its claimed job properly as opposed to merely posturing and paltering.

Failure to do so should result in substantive punitive action against MHI staff and/or board leadership who are required to act on the industry’s behalf. ###

[cp_popup display="inline" style_id="139941" step_id = "1"][/cp_popup]

Stay tuned for more of what is 'behind the curtains' as well as what is obvious and in your face reporting that are not found anywhere else in MHVille. It is all here, which may explain why this is the runaway largest and most-read source for authentic manufactured home “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. "Tony" Kovach - for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He's a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC's and/or the writer's position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.