Several statements made during the latest Third Quarter (Q3) Cavco Industries (CVCO) conference call ought to be of interest to retailers, communities, investors, and regulators. How so? The implications and meaning of Boor’s and his colleague’s statements such as “record,” “simplify product offerings,” and “turning away business” will be among several examined herein. That will be revealed during and after the course of the transcript published by Seeking Alpha financial news that follows. These results follow in the wake of ongoing revelations, legal proceedings, and accusations against prominent Manufactured Housing Industry (MHI) member Cavco. Bringing together various facts, evidence, and insider tips and insights based on those will culminate in the analysis and commentary found in this exclusive report.

On a minor level, note the transcript from Seeking Alpha (SA) has some apparent spacing and other errors. MHProNews has edited in brackets [like this] with corrections and observations that aim to correct or clarify apparent errors or oddities.

Note too that highlighting has been added by MHProNews, but does not change the text as provided by SA.

Following the transcript will be additional information, some MHProNews analysis, commentary, and related linked insights.

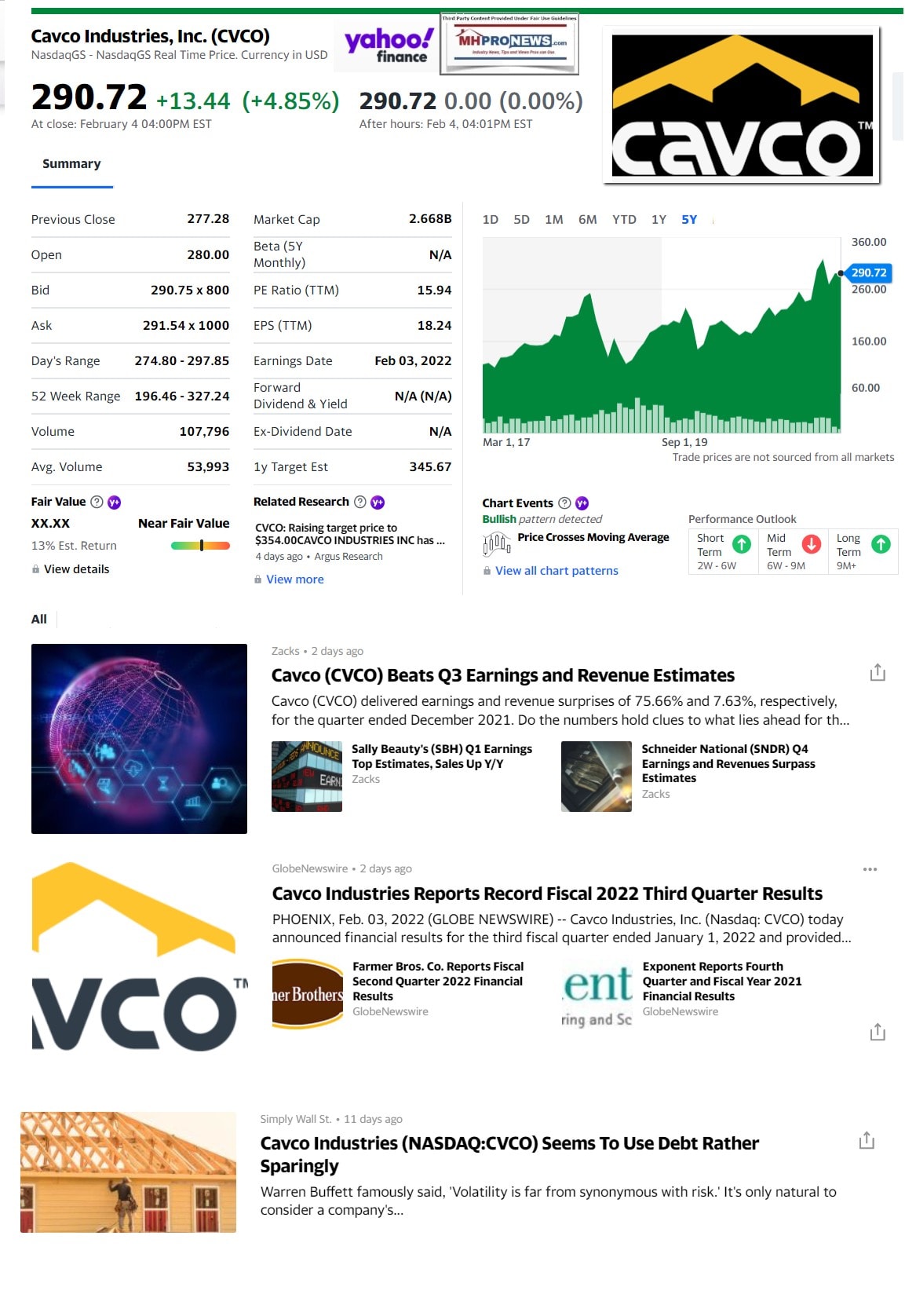

Cavco Industries, Inc. (CVCO) CEO William Boor on Q3 2022 Results – Earnings Call Transcript

Feb. 04, 2022 6:08 PM ET Cavco Industries, Inc. (CVCO)

Q3: 2022-02-03 Earnings Summary

EPS of $8.57 beats by $5.09 | Revenue of $431.71M (49.50% Y/Y) beats by $27.93M

Cavco Industries, Inc. (NASDAQ:CVCO) Q3 2022 Earnings Conference Call February 4, 2022 1:00 PM ET

Company Participants

William Boor – President, CEO & Director

Mark Fusler – Director, Financial Reporting & IR [Investor Relations]

Allison Aden – Chief Financial Officer [CFO]

Paul Bigbee – CAO [Chief Accounting Officer] & Principal Financial Officer [“The CAO is responsible for overseeing all accounting functions such as ledger accounts, financial statements, and cost control systems,” says AccountingNow. It is also an area that the Securities and Exchanges Commission (SEC) has pointedly accused Cavco of failing in during the Joe Stegmayer leadership era. See the specifics in the SEC pleadings linked here. Note too Cavco’s attempt to get the charges dismissed was recently rejected. See that report linked here.]

Conference Call Participants

Daniel Moore – CJS Securities

Gregory Palm – Craig-Hallum

Jay McCanless – Wedbush Securities

DeForest Hinman – Walthausen and Company

Ethan Steinberg – SG Capital

Operator

Thank you for standing by. Welcome to the Third Quarter Fiscal Year 2022, Cavco Industries Earnings Call Webcast. At this time, all participants are in listen-only mode after the speaker’s presentation, there will be a question-and-answer session. To ask a question during the session, [Operator Instructions]. Please be advised that today’s conference is being recorded. I would now return the conference over to your speaker today, Mark Fusler, Director of Financial Reporting and Investor Relations. Please go ahead.

Mark Fusler

Good day and thank you for joining us for Capital [i.e. should be Cavco] Industries, Third Quarter Fiscal Year 2022 Earnings Conference Call. During this call, you’ll be hearing from Bill Boor, President and Chief Executive Officer, Allison Aden, Executive Vice President and Chief Financial Officer, and Paul Bigbee, Chief Accounting Officer. Before we begin, we’d like to remind you that the comments made during this conference call by management may contain forward-looking statements under the provisions of the Private Securities Litigation Reform Act of 1995, including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or used, cost saving, operational efficiencies, current or future volatility in the credit markets, or future market conditions.

All forward-looking statements involve risks and uncertainties which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco. I encourage you to review Cavco’s filings with the Securities and Exchange Commission, including without limitation the company’s most recent forms, 10-K and 10-Q which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements. This conference call also contains time sensitive information that is only accurate as of the date of this live broadcast, Friday, February 4th, 2022. Cavco undertakes no obligation to revise or update any forward-looking statements, whether written or oral, to reflect events or circumstances after the day of this conference call, except as required by law. Now, I would like to turn the call over to Bill Boor, President and Chief Executive Officer. Bill.

William Boor

Thank you, Mark. Welcome and thank you everyone for joining us today to review our results for the third quarter of fiscal year 2022. We’re very happy to report another record quarter for revenues and earnings. Revenues increased nearly 50% year-over-year, and diluted EPS was $8.57 compared to $2.12 in the year-ago quarter. EPS included a large positive impact from non-recurring tax credits, which Allison and Paul will explain in more detail. It’s really important to recognize it, even excluding that impact, EPS was up about a 150% due to outstanding results from our operations. This was a quarter that showed operational gains resulting from improvements set in motion over a long period of time. And we expect to continue that momentum. Our plants achieved a higher production level, and we reached capacity utilization of approximately 80% this quarter. This is in line with our pre-pandemic utilization, and it was accomplished despite persistent labor challenges and supply inefficiencies.

The improved throughput is a result of the focused effort across all of our plants to . And it’s also the result of work underway for some time to improve staffing and retention. The combination of a more stable and higher skilled team and our rationalized product offering is paying off. Our backlog remained consistent with last quarter at $1.1 billion, which represents 36 weeks to 38 weeks of production . You might recall that this is down a few weeks from last quarter, which is purely a function of our higher production rate. The takeaway is that the backlog remains large with continuing strong orders and improving production to meet those orders . On a related point, strong backlogs exist across the industry. So we’re not seeing any pressure on wholesale pricing.

While our consolidated average selling price is down slightly compared to Q2. This is the result of a number of factors, including the mix of retail and wholesale sales, and the addition of Commodore. So on a same plant basis, both volume and pricing continued to improve upward during the quarter. I’d like to come back to labor. It would be difficult to say one way or another whether the general availability of labor has really improved at this point, if it has been a modest improvement. However, we have made significant progress which has directly enabled the operating improvements I’ve already commented on. While still below target levels, we’ve been able to increase plant staffing. The improvement we’re now seeing is a result of long-term efforts in recruiting, on-boarding, learning and development, investment in the workplace, and improved pay and benefits. It’s been a very holistic approach that started before the labor disruption of the last 18 months to 24 months.

Continued progress in staffing and retention will enable even higher levels of productivity. We expect to continue the recent momentum we’ve seen in our people strategies. Demand for our products remains strong as we’ve discussed for some time, demographic housing drivers in the large housing deficit build-up over the past 10 to 15 years provide a very positive demand outlook. These drivers apply particularly to manufactured housing due to the intensifying need for affordable homes. Of course, short-term economic factors impact the industry. However, when you consider the extraordinarily strong demand, we’ve been experiencing for a number of quarters, despite significant home price increases in LinkedIn [MHProNews note: “LinkedIn” appears to be a transcription error] backlogs. It really reinforces the growing housing shortfall that exists and the need for what we do. With regard to some of our larger growth investments, we remain on the same schedule previously communicated for starting up the new Glendale, Arizona facility, which will be in the second quarter of this calendar year.

To remind folks, Glendale will double our park model capacity while freeing up a line at our Goodyear facility for additional HUD [Code manufactured home] production. We’re now one full quarter into the Commodore acquisition, we’re very happy with how everything’s going. The hardest work comes after a deal closes when transition activities require a lot from everyone involved. And this has certainly been the case over the last quarter. I want to express sincere appreciation to all the folks at Commodore and within Cavco who have worked so hard on various aspects of integration. They accomplished a lot in the transition while at the same time staying very focused on the work of getting homes to customers. Commodore’s contribution to our volume has been right in line with our expectations this quarter, and their margins are improving as they work off lower priced homes in their backlog. With that, I’ll turn it over to Allison to discuss the quarterly results in more detail.

Allison Aden

Thank you, Bill. We’re pleased to report that Cavco achieved record breaking net revenue and net income results for the third quarter of fiscal 2022. The revenues for the period were $431.7 million up 49.5% compared to $288.8 million during the prior year’s third fiscal quarter. The Commodore homes acquisition contributed $73.1 million of this increase. Sequentially from the second quarter of 2022, net revenues increased by 20.1% with Commodore’s first full quarter of results being the main driver for the increase. Within the factory-built housing segment, net revenues increased 52.7% to $413.6 million from $270.8 million in the prior year quarter. The increase was primarily due to the full quarter of Commodore’s operation and a 24.4% increase in average revenue per home sold. The increase in average revenue per home sold was driven by product pricing increases and a mixed shift to more multi-section homes. The total units sold increased by 22.8% to 4,424, up from 3,603 units in Q3 of 2021. Our factory utilization increased from 75% last quarter to 80% in Q3 of 2022, a highest level since the pandemic.

This improvement in utilization as a result of an increase in factory labor headcount, coupled with a reduction in production hours per module. Our field operations continue to be successful in overcoming hiring challenges unpredictable employee absenteeism, and building material supply disruptions. Financial services segment net revenues increased 0.6% to $18.1 million from $18 million due both to a higher number of insurance policies and higher home loan sales compared to the prior period. In addition to year-over-year increases in revenue for the quarter, we also expanded our gross margin percentage, consolidated gross profit in the third fiscal quarter as a percentage of net revenue was 26.7% up from 20.5% in the same period last year, driven largely by the factory-built housing segment. The gross margin for the factory-built housing segment increased to 25.2% in Q3 of 2022 versus 17.4% in Q3 of 2021. This was driven by pricing, operational improvements, and declines in lumber prices experienced last summer, that continue to flow through cost of sales in the quarter.

As Bill explained, though our average selling price on a consolidated basis was down slightly compared to quarter two of 2022. We still generated a 110 basis point improvement. The acquisition Commodore negatively impacted gross margin percentages from purchase accounting-related items, as no gross profit was recognized on the sale of homes from inventories that were acquired in the transaction. As required by GAAP these assets were written up to fair value on the acquisition date. All acquired inventory has now been realized in net sales and future periods will not be impacted. Additionally, we continue to work through sales of homes that were in [C]ommodore’s backlog that [were] priced, protected. And therefore had lower gross margins. We are working our way through these homes and gross margins improved as we progressed the quarter. Gross margin as a percentage of revenue and financial services decreased to 61.2% in Q3 of 2022 from 68% in Q3 of 2021 due to higher weather-related events and lower realized and unrealized gains on marketable equity securities in the current period.

Selling general and administrative expenses in the third quarter of fiscal 2022 were $60.3 million or 14% of net revenue compared to $35.4 million or 12.3% of net revenue during the same quarter last year. The increase is due to $8.7 million from the addition of Commodore homes, costs associated with third-party consultants to review the non-recurring energy tax credits and greater incentive and commission wages on improved earnings. Net other income this quarter was $4.3 million compared to $2.2 million in the prior-year quarter. This increase is primarily driven by $1.5 million higher unrealized gain on marketable equity securities and higher interest income earned on our commercial loan balances. Pretax profit was up 147.4% this quarter to $58.9 million from $24.9 million from the prior year period. The effective income tax rate was a benefit of 35.1% for the third fiscal quarter compared to an expense of 23.9% in the same period last year. Our Q3 2022 income tax included a non-recurring benefit at $34.4 million for tax credits related to the sale of energy efficient homes. Excluding this one-time item our tax expense as a percentage of pretax income would have been 23.3% consistent with prior period levels.

Let me take a minute to expand on the non-recurring $34.4 million tax benefit recorded this period. Under the Internal Revenue Code, Section 45L, the company qualified for credits related to the sale of certain energy efficient homes between fiscal year 2018 and the third quarter of fiscal 2022. These credits are available for manufactured homes that meet specific energy efficient levels as established under the Federal Energy Policy Act of 2005, which was extended in the Consolidated Appropriations Act through the end of calendar year 2021. The company enlisted a third-party qualify expert to examine the information on manufacturers home sold and determine which units qualify for energy efficient tax credits under the program. This federal program ended on December 31, 2021, and as such, the company will not benefit from these tax credits in fiscal 2023 unless the program is extended or modified by future legislation. In total after considering the net tax credits and associated expenses, diluted net income per share for the three months ended January 1, 2022 was favorably impacted by $3.23 per share.

Cash related to these credits will be received in the form of lower estimated tax payments approximately $14.2 million for this year’s tax return. Cash refunds related to previous periods are expected to be received through fiscal year 2024. As we amend the associated tax returns. Net income attributable to Cavco shareholders was up 303.1% to $79.4 million compared to net income of $19.7 million in the same quarter of the prior year. Net income per diluted share this quarter was $8.57 per share versus $2.12 per share in Q3 of 2021. Now I will turn it over to Paul to discuss the balance sheet.

Paul Bigbee

Thanks, Allison. So I’m going to highlight some of the changes in the balance sheet from January 1, 2022 compared to April 3, 2021. The cash balance was $267.3 million down $55 million from $322.39 million months earlier. The decrease was primarily due to cash used for the acquisition of Commodore repurchases of common stock and higher inventory purchases. These decreases were partially offset by net income reduced for non-cash items, changes in working capital, and sales and collections on consumer loans. A number of accounts increased as a result of Commodore including accounts receivable, commercial loans receivable, inventories, property plant and equipment, goodwill and intangibles, accounts payable and accrued expenses. Consumer loans, receivable decreased from principal collection on loans held for investment in it’s now open cash.

Prepaid, and other assets increased from the income tax receivable related at 45L energy efficient tax credits, Allison just discussed. Accrued expenses and other current liability balances increased from deferred payroll tax payments under the CARES Act and higher volume rebates and customer deposits received due to greater order rates. And last, stockholder’s equity was $806.2 million as compared to January 1 of — I’m sorry. It was $806 million from up a 122.6 million from 683.69 million months previously.

William Boor

Thank you, Paul. Catherine, let’s turn it over for questions.

Question-and-Answer Session

Operator

Thank you. [Operator Instructions]. Our first question comes from Daniel Moore with CJS Securities. Your line is open.

Daniel Moore

Thank you. Bill, Allison, Paul. Good morning out there and thanks for taking questions. Start with Commodore, I think you said it contributed $73 million, if I heard that right, in the quarter. How many units did they ship? Just trying to get a sense of what the organic shipment growth looks like.

William Boor

We’re not going to go down the path of separating out Commodore shipments. But like I said in my comments, they were pretty well in line with what we expected when we talked in the acquisition that they had about 25% to our overall capacity and shipment expectations.

Daniel Moore

Okay. Maybe obviously demand and backlog remained exceptionally strong. Just elaborate on that, I think you described a moderate decline in order rates. Is that just normal seasonality from your perspective? Or are we slowing beyond that? Any comments or color there would be great.

William Boor

I don’t know where we said a moderate decline to be honest, and the order rates continue to be very strong and there is some, I guess I feel like after a period of about 12 months from mid-20’to mid-21’, which the order rates for just unbelievably high. We’ve gotten back to where we are seeing a seasonal shape to the order rates but there are still above 2019 levels which were strong. So we’re still — demands does not seem to be a problem and in fact, we’re still in a mode where we talk about backlogs and we talk about industry shipments and things, but we’re still in a mode where we’re turning away business at this point. So demand is holding up really well.

Daniel Moore

That’s helpful. Thank you. Talking about gross margin a little bit, there’s some moving parts in there, how much of a benefit would you say you experienced during the quarter from timing of raw material, lumber purchases? Conversely, how much did selling Commodore’s price protected homes in backlog impact margin in the quarter? Just trying to get a sense for what a really normalized gross margin would look like.

Allison Aden

Yes. Thank you, Dan. The lower lumber prices from late last summer, they continue to flow through our third quarter cost of goods sold. And the backlog is still supporting us a strong price for prior host. Costs, essentially of every input, including labor are increasing. And the commodities remain also and unpredictable in the near-term. I think if really if we think a step back at just a high level inside of quantify what the impact in the quarter was from Commodore the right up. It’s fair to say it was about 50 basis points.

Daniel Moore

Okay. That was very helpful. Go ahead.

Allison Aden

Yes. Specifically related to the accounting issue?

Daniel Moore

Right. Is that runoff in fiscal Q4 or we have another quarter or so to go?

Allison Aden

No, we were able to, as we’ve shared with you last quarter, this quarter we did in fact run through them.

Daniel Moore

Perfect. And then just one more for me. We are at 80% capacity utilization, obviously doing a great job despite some lingering headwinds of getting more through the plant. How do we think about unit growth sequentially into fiscal Q4 and maybe the first couple of quarters do we expect to see some modest pickup sequentially? Can we get a few more homes through just in terms of production capacity utilization? Any comments would be helpful. Thanks.

William Boor

That’s still really good about where we’re heading. I remember the last several quarters we’ve pointed out the folks on these calls that when — I still am preparing a lot of things back to pre-pandemic because they’re good solid comparisons to be made there. And the comments the last several quarters when we’ve talked, we’re — how we’re getting our volumes up, even though we had dramatically less production employee hours. So the fact that we’ve now gotten back to 80% and we’re still challenged with labor and we’re still challenged with supply inefficiencies that gives me confidence that we are able to keep pushing production. And I think the momentum is there right now. I’m getting a little bit ahead of myself here. I’m going to say I think we should be able to keep climbing up.

Daniel Moore

Very helpful. I’ll jump back in queue with any follow-ups. Thanks.

William Boor

Thank you, Dan.

Allison Aden

Thank you.

Operator

Thank you. Our next question comes from Greg Palm with [C]raig-Hallum. Your line is open.

Gregory Palm

Thanks. Congrats on the good results, everyone, and thanks for taking the questions here.

William Boor

Thanks, Greg.

Gregory Palm

I’m curious, maybe if I can start with Commodore. Any initial thoughts on synergy capture there?

William Boor

Yeah. I mean, we’ve didn’t over-blow or put too much out there about synergies that began with we do believe there are some we think that my opinion they come in to big forms that are more operational than cost-oriented. One is the opportunity to optimize our customer I guess, and we talked about this with other transactions in the past. I remember Destiny this was something we talked at length, being able to work with dealers and customers that they brought to the company with. And get more of our products into those change and vice versus always an opportunity. The other thing we’ve talked quite a bit about is operational improvements.

And Commodore has done some things with manufacturing technologies that I’ve talked about quite a bit before, and after being together, you’re for a couple of ones I feel really excited about the opportunity to — will bring some best practices and thoughts there operations, but certainly it’s going to go both directions and Commodore can really bring a lot to our broader system around technologies that improve quality, improve safety, and reduce end of the labor content going into the production process. Those are the things that we’re most focused on. I think from a cost perspective and overhead we could talk about those things. But for right now, similar to the transactions we’ve done in the past. We’re just looking to stabilize things and figure out where we go long term. We’re not wishing for any synergies of that nature.

Gregory Palm

Got it. And the factory utilization number was that driven at all by inclusion of Commodore, if I recall, they had a pretty big utilization number, I think you had mentioned when you acquired it.

William Boor

Yeah, interestingly, they’re rate at the rest of the system. I would say it’s no effect up or down, they rate 98% range as well.

Gregory Palm

Got it. Okay. I mean, given that, what are your thoughts on really the appetite for new plant opening. So you got the park model plant coming online here soon, a new hotline. What about green fielding? Can you remind us — I don’t know if you have any — if you still have an idle facility outside of that, but what are your sort of thoughts on increasing capacity outside the existing footprint?

William Boor

I think the industry frankly needs more capacity. So we’re constantly looking at how we can participate in that. Glendale is a big move in that direction. We’ve got a couple of things that we’re working through to try to figure those things out. We have one production line at our Plant City, Florida plant that many years ago was idled to call it a production line probably is a little bit of an overstatement. It’s a building that used to produce manufactured housing, but it would be a project to bring it back up. We’re evaluating that currently. And not to belabor this or sound like this means that we won’t be doing those kinds of products — projects.

The near-term concerns about adding capacity from a physical perspective, you could get up pretty rapidly that concerns our staffing and supplies. And so that’s the only thing that really gives you any pause when you dig into those kinds of opportunities. So we’re working on things. I think, as I said in my comments, there will be ebbs and flows due to near-term economic factors. I don’t think we’re of the mind that this is no longer a cyclical industry to a point, but the underlying demand is fantastic and the drivers of the underlying demand so we’re pretty confident from a demand perspective when we’re thinking about kind of projects decisions.

Gregory Palm

I guess there, maybe dovetails into my last question about demand. I mean, do you have a sense like I’ve asked this question before, but where the demand is the strongest, either by channel, by demographic? What are you seeing out there in terms of buyers?

William Boor

Yeah. Well they’re a couple of different dimensions to it that are interesting I mean, from a channel perspective, and you guys know the history. There was a period of time when — well before the pandemic, most of the growth in this industry was coming from community business. There about a third or 30% or so of the total endpoint for manufactured housing. But before the pandemic, that’s where the growth was coming. As we steadily we’re building back up as an industry. And as you guys know, I mean, pandemic hit and for a period of time at business, all that channel almost stopped. They held orders and took a wait and see attitude, and dealers really picked up. It’s been quite a few quarters now where I don’t think you could really separate the demand from either of those channels.

They’re both looking for more homes than we’re being able to produce, so both channels are really strong. From a demographic or from market perspective, I think it is pretty interesting to think about what’s gone on when prices have shot up so much. But manufactured housings advantage relative to site-built grows in a cost inflationary market as we’ve talked. What most of — what I think we’re seeing right now in the industry is that interface between the upper end of what manufactured housing does and the price points that site builders just can’t hit anymore. As I really think we’re taking a meaningful increase share in that kind of zone. And conversely, affordability at the lower end is worse. So folks that couple of years ago could’ve afford this single module home at the lower price points they’re priced out. And that demand still exists and hopefully we’ll be able to find ways to get those people in homes too. But it’s been a shift more to the upper end of what manufactured housing does and I think you’ve seen that in continuing shift to more multi-section homes relative to the single-family. So that’s really the movement that I’ve seen in the industry over the last several quarters.

Gregory Palm

That’s helpful. And last one for me, I mean, everybody in the industry is facing the same capacity issues that you’re talking about and the need to increase production rates. Would you talk about turning down orders? Where are those orders coming from? And more importantly, where are they going? If everybody in the industry is sort of in the same spot. My guess or assumption is that there’s even more pent-up demand out there that we don’t even really know that’s not really even showing up in the numbers in the orders in the backlog. Is that right or not necessarily?

William Boor

I think you’re absolutely right. I mean, the — yeah. I think industry shipments and we’ve been talking this for quite a while to industry shipments don’t reflect demand by any means and orders probably what we believe orders really understate true underlying demands. When we talk about turning away orders, it’s really a couple of things, mainly, dealers that we haven’t worked with are looking for homes and they’re coming to us saying, can I place some orders and we’re just basically saying we’re not taken on new points of distribution. So that’s a form of turning down orders. And the other is really — there is a lot of demand in that community, the [Indiscernible] and the community operators for projects. Many homes in an order. And we’re just telling them we can’t take that on given our backlogs. So yes, I think the conclusion — I’m very comfortable with the conclusion that backlogs and shipment that are not reflective of total demand right now.

Gregory Palm

Interesting. All right, I’ll leave it there. Thanks and good luck.

Operator

Thank you. [Operator Instructions]. Our next question comes from Jay McCanless with Wedbush Securities. Your line is open.

Jay McCanless

Hey, good morning, everyone. So my first question on Commodore, if that was a 50 basis point drag this quarter, should we expect that to turn around and be a tailwind going forward, and maybe even a little bit more? I can’t remember if you guys have broken out, what Commodore’s gross margins look like versus legacy Cavco.

Allison Aden

We haven’t broken it out specifically, but to focus on the — the write up of the inventory that we assumed at the time of the acquisition of 50 basis points. We would see that having been gone through this quarter it would not be there as a drag in the coming quarter. Also, as we’ve taken a step back, we’ve also mentioned the fact that their backlog that we inherited during the acquisition also was price protected. So as we work through that lower margin, we would expect to see over time and that backlog being worked down to zero. They’re lifting up their margins to be comparable to our overarching network margins.

William Boor

I want to make sure it’s really clear that the 50 basis points is specific to that purchase accounting need to write up their inventory at acquisition. That was just isolating that piece. Their overall impact on our margins was a bit larger than that because of the backlog pricing issue. I’m not sure if that’s clear or not, I want to make sure it was.

Jay McCanless

Yeah, it is. Thank you, Bill.

William Boor

And I’d echo Alice’s comments to that. We got backlog to work through, but our expectation is that Commodore plants will be on par as far as profitability with the rest of our system, that’s the goal.

Jay McCanless

Okay. I guess the next question on that — and just because looking at the gross margin you did in 2Q was 24% without Commodore and then you have a little bit of a drag. And I’d love it if you guys could break out the benefit of lumber if you have that for the third quarter. It just looks like moving up to this mid-20s gross margin is the natural path over the next few quarters. What do you guys think about that?

Allison Aden

So we don’t — we won’t think that making out the specific impact of lumber, but I think as we’ve seen from the last several quarters, it’s hard to speculate from a margin perspective. I mean, the really good news is the Backlogs will still provide the ability to price and cost increases while I’m trying to show them that we’ve done a good job with that, but we don’t really expect to see any relief on the variety of materials of supply that go into our homes. And we’ve seen as we all have a recent uptake in lumber commodities. So the main wildcard does remain lumber and OSB cost.

Jay McCanless

Any chance you guys could give us the average backlog price or what you think the average price for this quarter that you’re about to deliver, just trying to figure out what the balance on prices between Commodore and Cavco’s product.

William Boor

Sure. Say again what you’re looking for Jay?

Jay McCanless

Just the — if you have just the average price for what’s in backlog now, or if you have an idea of what the average price that you think they’re going to be able to deliver this quarter would be just still trying to figure out the difference between Commodore’s price and Cavco’s price. I mean, we’ve done a rough number on it in our model. But if you guys would be willing to share some of that, that would be helpful as well.

Allison Aden

I don’t think there’s anything specific that we would want to achieve at this point between the differentiation in the pricing between the overarching network and Cavco curved out since the two are beginning to integrate very much.

William Boor

Our backlog, excluding Commodore I think you can think of is all price to current market. So it’s a matter of them continuing to work through their lower price backlog which has happened. I mean as I think Allison said in her comments, they left the quarter with higher margins than they went into it with because they are working down that lower price stuff, we’re not going to be able to just specifically separate their pricing from the rest of the system at this point.

Jay McCanless

Your competitor a couple of days ago had some very favorable comments about chattel rates staying low, as well as some new money potentially coming into the manufactured housing space I’m assuming for both chattels. And land home deals, would love to get an update what you guys are seeing on that front and also just maybe an idea of where chattel rates are now and what you guys are seeing.

William Boor

Yeah. I generally agree with what Mark said. Chattel rates has stayed very stable since they took a big drop. I think of the timing it’s probably been a year-and-a-half ago, time flies, but they’re in the high fours to low fives, low-to-mid 5% rate. And that really hasn’t moved up over the last month or two. It’s been very stable. So the — well, it’s essentially a different market. We always say chattel rates are really not correlated to mortgage rates are much more stable. If you compare that to land home rates at this point, I can’t imagine it’s ever been close to this tight. And there’s another discussion about the premium load manufactured housing, land, home loans compared to site built or what the GSE call single-family, non MH loans.

And I think that’s been pretty stable too. That’s kind of been about a 50-basis point range. That premium for an MH product. So chattel is very stable. MH land home is kind of just moving right up as mortgage rates are at this point. Was there more to your question? I might have missed something there.

Jay McCanless

No. I mean, that was that, I mean, I’ll ask you the same follow-up that I asked Mark. I thought it was very interesting that the FHFA projected the duty to serve submissions from the GSEs would love to hear what you guys are hearing, if anything, from the GSEs right now and [Indiscernible] an expanded duty to serve be something that might help the manufactured housing industry.

William Boor

And we’d love to see it. Frankly, we and I’m not saying this bitterness. We just haven’t seen a lot come out of the duty to serve over time and again, I don’t mean that in an overly negative or accusatory way it’s just the fact and yet, capital is very interested in the MH lending space. So we’re seeing really good interest from the investors we sell loans to and it really hasn’t been an issue. If people are qualified, they’re able to get good loans at this point in time. The [GSEs] really aren’t driving much there.

Jay McCanless

Got it. Great. Well, thanks for taking my questions.

Allison Aden

Thank you.

Operator

Thank you. Our next question comes from DeForest Hinman with Walthausen and Company. Your line is open.

DeForest Hinman

Thanks for taking questions from shareholders. On the Gross margin commentary, the 50 basis points, just so we’re clear, is that the consolidated Gross margin or is it the segment Gross margin for MH?

Allison Aden

You are right. That’s on the consolidated gross margin.

DeForest Hinman

Okay. Thank you. And furthering the discussion on the credit side, the mortgage side, do you have any insights in terms of credit quality on the inbound from FICO score? Any color you can provide there. Is the demand coming from quality customers that are going to be able to pay longer-term?

William Boor

Yeah. I mean, we’ve generally in our lending business, I think there’s a you had disclosed in our filings, we generally are working in what I would consider higher [FICO] scores. And we’ve continued to see strength and applications there. I really don’t think we’ve seen any real shift that would cause you to think that by industries lending to skewing more to lower credit applications at this point. No industry — the force, the lending industry has been I think, very disciplined. And I guess that makes sense too, when you are in industry, that’s really supply constrained there’s really no need and we haven’t seen chasing credit down.

DeForest Hinman

No, it’s very helpful. I mean, I’m glad you provided lots of color on this call because I think over the last couple of weeks there has been this overhang on the whole space around rising rates and demand is going to fall off the table. And I think it’s becoming more clear to everyone that that’s not the case. And there seems to be, I don’t know if you want to use the word fundamental change in demand and I’m glad you’re spending time discussing this, but into further that discussion, you talked about units being turned away. You have mentioned the communities and the REIT space. But is there anything you can share with us in terms of just how big that opportunity might be? And I’m not even thinking about the next year.

I’m thinking further than that because — I’m sure you’ve done some analysis and you looked at some of these park customers that have done business with you, and they’ve made some disclosures publicly, and maybe sometimes not publicly, but the parks have a certain amount of acreage, you can do some math in terms of units per acre and you look at some of the returns at some of these parks. The public greets [likely-REITs] are making from a return perspective and their availability of capital. It’s very attractive to build out these communities. So any color you could provide, you have anything there that says, look, these guys need 50,000 units, a 1,000 units over the next five years. So just so people can really understand how you guys are framing the demand because you are obviously making positive comments, but any facts or figures you could give the shareholder community would be very appreciated to just understand just how you’re looking at things.

William Boor

I don’t know if we have a big number projection over a certain number of years, I guess what we most immediately see is just the interaction with our customers. And as I said earlier, they — it’s not a comfortable position to be as a manufacturer to not be able to come close to filling the orders that they’re asking us for, so we certainly haven’t seen any let up over a number of years in the communities’ interest in buying a large number of homes. And I know that it does get talked about the availability of land and certainly zoning as it impacts us. But it doesn’t feel like we’re close to that being a constraint. And I know that’s a very general answer to your question. Of course I wish I could give you something more specific, but we see it being strong and we see it stand strong for a while from what we can tell them now.

I also want to come back because you did touch on it and with rising interest rates, you kind of commented that — I think your comments were that causes people to be really concerned about demand. It impacts us. If interest rates go up, monthly payments go up, and that’s the basis our customers buy on. The thing is you got to weigh that off against — let’s just talk about loans first. Weigh that off against the increase length of loans that we’ve talked about last quarter. That helps lower monthly payments, so that’s been a positive new for people’s affordability. And then you look at the demographic as I alluded to. So it has to be the rising interest rates are a downward near-term pressure when they go up. But it affects manufactured housing and my opinion significantly less than it affects site builders. Because the flow toward affordability comes right to us. And I think history shows that, I think you’ve seen in rising interest rate environments a muted impact on manufactured housing. Not that there’s no impact. And so we’re going to keep our eyes on all these things. There’s a lot of pressures upward and down. But man, if you look at the demographic drivers over time, I’m very confident about the ability to invest into that.

DeForest Hinman

No. That’s very helpful. That’s a good — very good color for everybody. And then just on the, I think I know the answer, but I’ll ask the question anyway is on the raw material front, can you just give us an update in terms of what’s the — where are the paying points in terms of products that you’re dealing with, and are you seeing any improvement, staying the same or things getting worse than before with any of these given raw materials that you’re struggling with?

William Boor

Yeah, it’s a continuing and very challenging situation and I’ve said before, I do feel like a broken record because it’s across-the-board. We’re actually on the phone with our operating guys this morning and just a rattle off from my notes installation fasteners, electrical parts. We’ve had plants that have been told that they’re months out from getting refrigerators, for example. One of the interesting things it’s really a hot button right now is overhead flex dot [likely duct]. So my point is in so much these specific items, it’s the fact that it’s across-the-board, and I would say it’s affecting us from efficiency perspective, every bit today as it has been.

The interesting dynamic now is that trucking, and this isn’t news really, but trucking issues are a major part of the story, where sometimes we’re ordering a given supply and the supply is available, but the trucks late, significantly late. So logistics are a big part of the supply thing. So I’m not — I mean — I feel like our guys have really managed it well and it’s been a drag on efficiency and yet we’ve been able to push our throughput mark up. So I’m really confident in how we’re approaching it, but every day we feel like we’re little bit on the edge about whether a given plant is going to be able to continue running, and you never know which supply it is that’s going to cause them to stop if they stop. Overall, we’ve had some but minimal true shutdowns, but a lot of efficiency impact from this. Really hard to quantify.

DeForest Hinman

Thank you. And then just a last question on the energy tax credit. Can you just give us color there? I mean, is this something we just we’re missing over the last 5 or 10 year? Something came up with an audit review, how were we not accruing for that previously?

Allison Aden

Thanks for the questions and good one, we always evaluate — continue to evaluate opportunities that are for tax incentives. And this opportunity was identified as part of our overarching continuous process to identify those. As you can appreciate, the complex and the IRS Kota [?] complex, and we’ve been researching this credit for some time now, and after a great deal of review and specifically consultation with a third-party expert, and actually some of our homebuilding peers, we did determine that we were able to utilize this [tax] credit and move forward with what was a fairly lengthy process. And as you can tell the balance was the size of the credit. To estimate the impact in the current period and under GAAP, you have to take all of the periods into one fair swoop, which is what you see encapsulated in this quarter’s earnings.

DeForest Hinman

Okay, perfect. And then last question on share repurchases. I know you had this odd situation with this energy credit. Did that preclude us from buying stock at any point during the fourth quarter? And if it did, should we be anticipating a higher level or accelerated pacing of share repurchases going forward.

Allison Aden

So this particular item did not preclude us from purchasing shares, and buybacks still is a very important lever for us to be able to return excess cash to our shareholders. We were able to accomplish about $9 million in the quarter and if you’ll recall, we have about $100 million in the purchase authorization and we’ve burned through about a third of that. So we still view this as a very proactive way for us to deploy and return excess cash to the shareholders.

DeForest Hinman

So is $10 million probably the right number or is it more or less?

Allison Aden

We’ve been — we won’t be guiding to a particular outcome. I think that if you look over the last couple of quarters, it probably gives an indication that it was very some quarter to quarter to pace, depending on the information that the company has to be in the marketplace.

DeForest Hinman

Okay. Thank you for taking all my questions.

William Boor

Thanks DeForest.

Operator

Thank you. Our next question comes from Ethan Steinberg with SG Capital. Your line is open.

Ethan Steinberg

Hey guys. Thanks for taking the call, great job on the execution. [Indiscernible] 50 basis points was just on the accounting for the acquisition. Can you give us a sense of how much drag there was from just working through the low priced backlog?

Allison Aden

I would say that working through the low priced backlog was probably 2 percentage points to 3 percentage points in the quarter.

Ethan Steinberg

200 or 300 basis points?

Allison Aden

Yes. That’s correct.

Ethan Steinberg

So the total gross margin?

Allison Aden

Yes, that’s correct.

Ethan Steinberg

Can you get a sense of how much of that is left it sounds like that’s been worked down quite a bit?

Allison Aden

[Indiscernible] specific price point, but as we progress through the quarter, of course, it becomes less and less if you think about their average lines of the backlog that gives some indication how we might think about the uplift in the coming quarters.

William Boor

[Indiscernible] backlog [Indiscernible] on a ratio basis star. So it’s not just to give you a feel for the backlog.

Ethan Steinberg

So when we are thinking about the 25% run rate in the building of 26 and change blended. There’s a lot of upward momentum to that sequentially from here based on those 2 factors, it seems like. Is that the right interpretation?

Allison Aden

With regards to those two factors in isolation, that’d be fair.

Ethan Steinberg

That’s a lot of tailwind. And then also want to check applied that units, you still feel pretty good about growing units nicely from here, absent big surprises on operations?

William Boor

I do. I mean, like I said, I’m always more nervous getting ahead of myself, but we’ve got momentum and we’re driving it with what I would consider fundamentals. And we’ve — I think it’s a huge accomplishment for our operations to get to 80% while we still do have these labor and supply challenges. And if we can get the 80% with these challenges by continuing to make progress on labor, which we’re doing. And with hope that someday suppliers will settle out then you would be natural to think you ought to be able to go higher.

Ethan Steinberg

What do you think you’re mostly done on working down that low priced product, maybe not 100% of it? But when do you think it’s something that we don’t get to see your measure that much anymore. You think that’s done by the end of this quarter?

Allison Aden

I think it’s hard to pinpoint. I would say into the quarter they are very aggressive projection, probably something that more tend to or see the timing of the backlog that we have with them, which is similar to ours.

William Boor

And it will dwindle down.

Ethan Steinberg

But the degree of pressure diminishes?

William Boor

Yes.

Allison Aden

Yes. That’s correct.

William Boor

If you think about it, you got [Indiscernible] that’s got a stratification of prices. It’s not perfectly this way, but the homes we’re making today or the oldest one’s in the backlog, the lowest price. So the impact will dwindle down over the next several quarters, will be a way to think about it.

Ethan Steinberg

Yeah, that makes sense. Last thing is just that it was helpful getting that color on the moving pieces, on the average price based on what’s in the backlog should the price still be going up sequentially generally from here or not?

William Boor

Still — I always say this that we’re in an industry that has long backlogs, so we do talk about it quite a bit appropriately of being in relation to costs, but there’s not much foreign price down for sure. So we manage price at a local plant basis or local — like our local plants talking with us. But it’s pretty much unique to their cost inputs and their market dynamics. I made the comment in my remarks during the third quarter. We still want a same plant basis; we’re still seeing increasing prices. So there’s still some room there potentially.

Ethan Steinberg

That’s great, I thought of one more thing. Was there any acquisition one time – ish cost in SG&A or OpEx anywhere?

Allison Aden

No, not his quarter

Ethan Steinberg

Okay. Great job. Thank you.

Operator

Thank you. And we have a follow-up from Daniel Moore with CJS Securities. Your line is open.

Daniel Moore

Thank you again. And Allison if you gave this, forgive me but what was the SG and impact from the consultant fees during the quarter related to the tax benefit?

Allison Aden

Yes. So it was a high level expert that we used in a pretty protractive process that we went through. So the fees in total estimated to be right around $5.8 million.

Daniel Moore

Very helpful. Thank you.

Operator

Thank you. And there are no other questions in the queue. I would like to turn the call back to Bill Wolfenden for closing remarks.

William Boor

Thanks, Catherine, I’m — we do feel like it was a really strong quarter from all the operational improvements that we talked about, beyond quarter clearly favorable market forces we made great strides in many areas that ultimately led to operating improvement. So we really appreciate everyone’s interest, and we look forward to keeping you updated as we go forward. Thanks.

Operator

This concludes today’s conference call. Thank you for participating. You may now disconnect. ##

Additional Information, More MHProNews Analysis and Commentary

As a disclosure, there is no assertion by MHProNews that the suggested edits in the SA transcript are now perfect. There are minor and other edits possible. But based on the text alone, the bracketed edits provided either clarify or correct the apparent meaning.

That noted, there are aspects to the above that could be the subject of books on topics like the negative impacts of increasing consolidation of an industry such as manufactured housing. There are also what is arguably contradictory statements in Cavco statements on issues such as labor. That the questions posed did not focus at all on the SEC controversy is a stunning oversight, if it was an ‘oversight’ vs. perhaps a pre-arranged agreement by the parties to the call on what would and would not be discussed. With no particular order of importance, the following are of keen interest and bear scrutiny going forward.

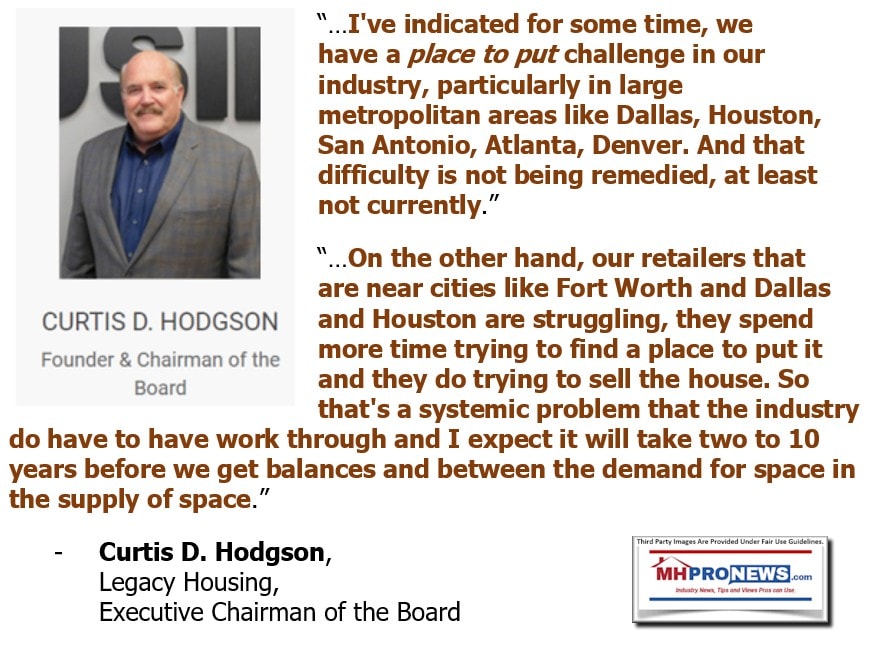

- Cavco’s Boor oddly said in relation to the limiting aspect of zoning and placement barriers the following:

“talked about the availability of land and certainly zoning as it impacts us. But it doesn’t feel like we’re close to that being a constraint.” Excuse me, please? The evidence against the logic of that claim is ample. From two fellow MHI members to Cavco:

How investors could fail to follow up on that statement by Boor, especially in the light of MHI’s apparent 2+ decades of failure to get the Manufactured Housing Improvement Act (MHIA) of 2000 (sometimes referred to by the Manufactured Housing Association for Regulatory Reform (MHARR) as the 2000 reform law) and its so-called “enhanced preemption” provision is nothing short of stunning. That Cavco hasn’t publicly pressed this issue, along with others at MHI, points to possible collusion that has as an outcome reduced sales. Perhaps Cavco has made the calculus that they can take fewer risks by limiting supply and thus increasing profits per unit? If so, the statements on pricing of their various divisions bears attention too. Our sources in Cavco suggest that they read MHProNews/MHLivingNews as well as MHARR news and views, where such discussions are ample. There is no way they are ignorant of these issues. So why wasn’t Boor pressed on that statement and its limiting implications for Cavco’s potential?

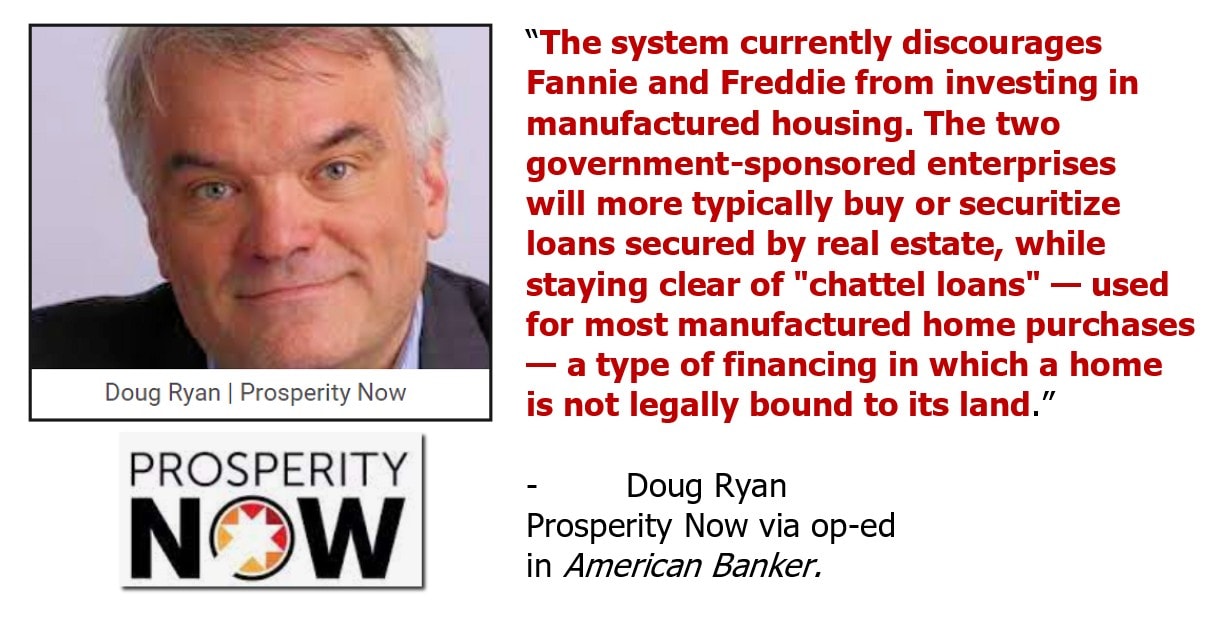

- Regarding the Duty to Serve (DTS) mandated by the Housing and Economic Recovery Act (HERA) of 2008, Boor said: “we’d love to see it [i.e.: DTS be implemented]. Frankly, we and I’m not saying this bitterness. We just haven’t seen a lot come out of the duty to serve over time and again, I don’t mean that in an overly negative or accusatory way it’s just the fact and yet, capital is very interested in the MH lending space. So we’re seeing really good interest from the investors we sell loans to and it really hasn’t been an issue. If people are qualified, they’re able to get good loans at this point in time. The [GSEs] really aren’t driving much there.” Pardon me? While it is fascinating to know that “capital is very interested in the MH lending space,” it is contrary to reason for Cavco’s CEO not to be pressing DTS directly and/or via MHI, if they were in fact desirous of more sales and access to more capital for manufactured homeowners and buyers. As indicators of the oddity of this assertion by Boor are the following.

Why would Cavco be buying back stocks when the opportunity to expand plants or build new ones are apparent, based upon their own statements? When S2A and others say they are planning an aggressive growth plan based on dozens of new production centers, why aren’t MHI’s dominating brands – including Cavco – not executing a similar expansion of production, given long backlogs and “turning away” business?

While Cavco may be trying to thread the needle of the SEC, and other current and potential litigation involving shareholders, consumers, independent retailers, state and/or federal agencies. But numbers of these earnings call statements provide ample grounds for questions posed to the firm’s leadership in statements taken under oath. As MHProNews led the charge in reporting, MHI has repeatedly postured support for “enhanced preemption” without actually doing the logical things – such as litigation – that would make the law’s potential come to life for the benefit of “all segments” of manufactured housing.

Look carefully at MHI’s leadership’s response to questions on DTS and the MHIA, particularly the “enhanced preemption” provision of that law. Compare and contrast what MHI said with what MHARR’s Mark Weiss stated.

When even the Los Angeles Times (LA Times) has tossed out the word “conspiracy” in the context of manufactured housing consolidation, isn’t it time for ‘white hat,’ pro-consumer, pro-independent business public officials, investors and others to seriously probe why HUD Code manufactured housing is underperforming during an affordable housing crisis?

One of MHI’s blogging mouthpieces reached out this past weekend to say that if MHProNews was an MHI member, we would know what MHI has told their readers about advances toward DTS. Clearly that source is ignorant (not necessarily a negative term) about a range of facts. Or that generally pro-MHI source is attempting to influence or distract MHProNews from our fact-, evidence- and commonsense reasoning-focused reporting. Some in the MHI-mouthpiece camp may be high due to smoking their own supply.

To learn more, the Samuel “Sam” Strommen thesis is still perhaps one of the most potent and devastating outsiders looking in legal analysis of why manufactured housing is underperforming during an affordable housing crisis.

SHS Conferences said: “Monopolies are able to make super profits by raising prices, limiting the supply of their products, restraining the growth of production capacity, inhibiting the introduction of new, cheaper products, directing technical research to the development of such products and technologies that not only do not reduce the cost…” along with other impacts, such as depressing wages. MHProNews/MHLivingNews stands essentially alone in reporting on the harms caused on the public and broader economy due to monopolization. Those engaging in such practices are unlikely to openly admit it, as this opens them up to possible felony charges. “The Sherman Act imposes criminal penalties of up to $100 million for a corporation and $1 million for an individual, along with up to 10 years in prison,” says the FTC website.

Books could be written on aspects of these issues, including Cavco’s arguable role in forging oligopoly style monopolization with respect to manufactured housing. See the related reports herein to learn more.

Postscript, plug, programming note, and disclosure. In partial response to that pro-MHI mouthpiece referenced above, there are reasons why new readers are signing up for MHProNews x2 weekly emailed news updates. Sign up free in seconds via the link below. Note: MHProNews has no stake in the equities being reported on.

Join those who are signing up for the Manufactured Housing Industry’s

#1 News, Tips, and Views Source! Thousands ‘get it,’ perhaps you should too.

Click the below and sign up free in seconds.

Our thanks to you, our sources, and sponsors for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.