“UMH Properties, Inc. is a public equity REIT (real estate investment trust) headquartered in Freehold, NJ. The Company owns and operates a portfolio of 126 manufactured home communities with approximately 23,800 developed homesites. These communities are located in ten states: New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland, Michigan, Alabama and South Carolina. In addition, UMH owns approximately 1,800 acres of land for the development of new sites.” So says the UMH Properties (UMH) Investor Relations home page. Sources with fellow Manufactured Housing Institute (MHI) National Community Council (NCC) member Green Courte Partners (GCP) told MHProNews that UMH was previously mocked at an MHI meeting by their leadership. Specifically, GCP Chairman Randy Rowe was named.

Rowe, prior to the shift in UMH described below, reportedly mocked them in the company of other MHI and GCP team members present for being ‘a $10 stock.’ Heads nodded.

GCP’s David Lentz and others there could not be reached by email for comment. That noted, the sources are reliable. Nor would it be the first or last time that one MHI member in some sense undermined one or more other members. The evidence for that later point is strong. It comes from sources both inside and outside of MHI/NCC, and from sources inside and outside of manufactured housing. A prior interview with Sam Landy, J.D., is linked here.

Be that as it may, either way, UMH are not a $10 stock any more.

As a disclosure, MHProNews holds no position in this firm, nor others that are part of our business-daily manufactured housing market publicly traded firms. Our most recent previous report published is linked here.

UMH company’s operating results on 5.6.2021 that disclosed their first quarter which ended on March 31, 2021 is the following.

05/06/2021

FREEHOLD, NJ, May 06, 2021 (GLOBE NEWSWIRE) — UMH Properties, Inc. (NYSE:UMH) reported Total Income for the quarter ended March 31, 2021 of $43.1 million as compared to $37.6 million for the quarter ended March 31, 2020, representing an increase of 15%. Net Income Attributable to Common Shareholders amounted to $6.8 million or $0.16 per diluted share for the quarter ended March 31, 2021 as compared to a Net Loss of $42.8 million or $1.04 per diluted share for the quarter ended March 31, 2020.

Funds from Operations Attributable to Common Shareholders (“FFO”), was $8.4 million or $0.19 per diluted share for the quarter ended March 31, 2021 as compared to $6.1 million or $0.15 per diluted share for the quarter ended March 31, 2020. Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), was $8.7 million or $0.20 per diluted share for the quarter ended March 31, 2021, as compared to $6.1 million or $0.15 per diluted share for the quarter ended March 31, 2020.

A summary of significant financial information for the three months ended March 31, 2021 and 2020 is as follows (in thousands except per share amounts):

| For the Three Months Ended | ||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| Total Income | $ | 43,132 | $ | 37,573 | ||||

| Total Expenses | $ | 36,188 | $ | 31,819 | ||||

| Increase (Decrease) in Fair Value of Marketable Securities | $ | 10,219 | $ | (38,593 | ) | |||

| Net Income (Loss) Attributable to Common Shareholders | $ | 6,839 | $ | (42,838 | ) | |||

| Net Income (Loss) Attributable to Common Shareholders per Diluted Common Share |

$ | 0.16 | $ | (1.04 | ) | |||

| FFO (1) | $ | 8,381 | $ | 6,089 | ||||

| FFO (1) per Diluted Common Share | $ | 0.19 | $ | 0.15 | ||||

| Normalized FFO (1) | $ | 8,701 | $ | 6,089 | ||||

| Normalized FFO (1) per Diluted Common Share | $ | 0.20 | $ | 0.15 | ||||

| Diluted Weighted Average Shares Outstanding | 43,275 | 41,173 | ||||||

A summary of significant balance sheet information as of March 31, 2021 and December 31, 2020 is as follows (in thousands):

| March 31,

2021 |

December 31,

2020 |

|||||||

| Gross Real Estate Investments | $ | 1,127,528 | $ | 1,108,483 | ||||

| Marketable Securities at Fair Value | $ | 108,155 | $ | 103,172 | ||||

| Total Assets | $ | 1,120,024 | $ | 1,087,214 | ||||

| Mortgages Payable, net | $ | 468,833 | $ | 469,279 | ||||

| Loans Payable, net | $ | 75,790 | $ | 87,009 | ||||

| Total Shareholders’ Equity | $ | 545,248 | $ | 501,808 | ||||

Samuel A. Landy, President and CEO, commented on the results of the first quarter of 2021.

“We are pleased to announce another solid quarter of operating results and an excellent start to 2021. During the quarter, we:

- Increased Rental and Related Income by 13%;

- Increased Community Net Operating Income (“NOI”) by 14%;

- Increased Normalized Funds from Operations (“Normalized FFO”) by 43% and Normalized FFO per share by 33%;

- Improved our Operating Expense ratio by 80 basis points to 44.3%;

- Increased Same Property NOI by 16%;

- Increased Same Property Occupancy by 320 basis points from 83.1% to 86.3%;

- Increased our rental home portfolio by 218 homes from yearend 2020 to approximately 8,500 total rental homes, representing an increase of 3%;

- Increased rental home occupancy by 80 basis points from 94.6% at yearend 2020 to 95.4% at quarter end;

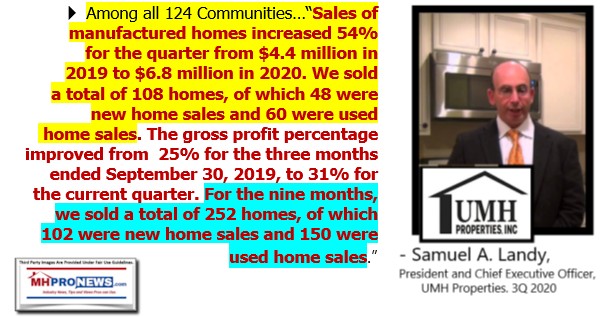

- Increased Sales of Manufactured Homes by 37%;

- Acquired two communities containing approximately 337 homesites for a total cost of approximately $8.0 million;

- Raised our quarterly common stock dividend by 5.5% to $0.19 per share or $0.76 annually;

- Issued and sold approximately 352,000 shares of Common Stock through an At-the-Market Sale Program for our Common Stock at a weighted average price of $19.08 per share, generating gross proceeds of $6.7 million and net proceeds of $6.6 million, after offering expenses;

- Issued and sold, through At-the-Market Sale Programs for our Preferred Stock, 1.3 million shares of Series D Preferred Stock at a weighted average price of $24.85 per share, generating total gross proceeds of $31.4 million and total net proceeds of $30.9 million, after offering expenses;

- Reduced our Net Debt to Total Market Capitalization from 34% at yearend 2020 to 29% at quarter end;

- Subsequent to quarter end, issued and sold approximately 2.1 million shares of Common Stock through an At-the-Market Sale Program for our Common Stock at a weighted average price of $19.41 per share, generating gross proceeds of $39.8 million and net proceeds of $39.2 million, after offering expenses; and

- Subsequent to quarter end, issued and sold, through At-the-Market Sale Programs for our Preferred Stock, 911,000 shares of Series D Preferred Stock at a weighted average price of $24.93 per share, generating total gross proceeds of $22.7 million and total net proceeds of $22.4 million, after offering expenses.”

Mr. Landy stated, “We are proud of the results that we were able to achieve in 2020 and are happy to report that we have produced similar results for the first quarter of 2021. Normalized FFO was $0.20 for the quarter representing an increase of 33% year over year. During the quarter, we raised our common stock dividend 5.5% to $0.19 per quarter or $0.76 per year.”

“UMH continues to deliver industry leading operating results. These results highlight the strong demand for affordable housing in all of our markets. Same property occupancy was up 320 basis points year over year to 86.3%. This increase in occupancy was the result of the addition of 218 new rental homes to our portfolio and a 37% increase in home sales. Our occupancy gains and rent increases generated same store NOI growth of 16%.”

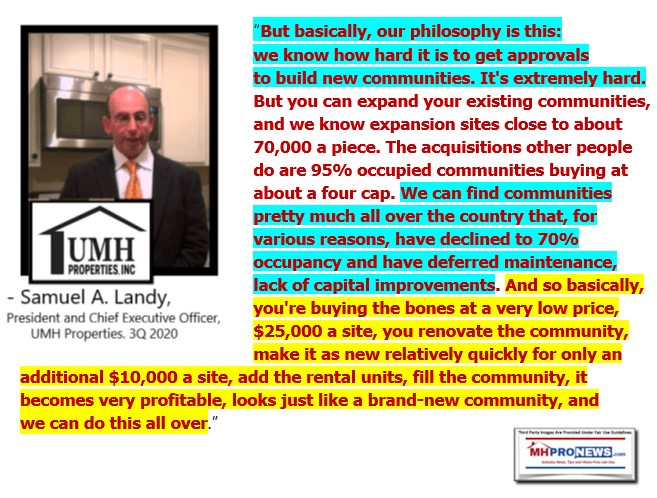

“These results are only possible because of our years of hard work laying the foundation for tremendous earnings growth and value appreciation. Our business plan has created a runway for us to deliver organic growth for years to come. We currently have 3,500 vacant sites within our existing communities that we intend on filling with homes for rent and sale. We also have 1,800 acres of undeveloped land that can be developed into 7,200 home sites. We also continue to seek additional external growth opportunities. During the quarter, we closed on the acquisitions of two communities containing 337 sites for a total purchase price of $8 million. These acquisitions are in new markets, Alabama and South Carolina, and we intend on acquiring additional communities in these states. Our internal and external growth opportunities pave the way for continued FFO and dividend growth for the foreseeable future.”

UMH Properties, Inc. will host its First Quarter 2021 Financial Results Webcast and Conference Call. Senior management will discuss the results, current market conditions and future outlook on Friday, May 7, 2021 at 10:00 a.m. Eastern Time.

The Company’s 2021 first quarter financial results being released herein will be available on the Company’s website at www.umh.reit in the “Financials” section.

To participate in the webcast, select the webcast icon on the homepage of the Company’s website at www.umh.reit, in the Upcoming Events section. Interested parties can also participate via conference call by calling toll free 877-513-1898 (domestically) or 412-902-4147 (internationally).

The replay of the conference call will be available at 12:00 p.m. Eastern Time on Friday, May 7, 2021. It will be available until August 1, 2021 and can be accessed by dialing toll free 877-344-7529 (domestically) and 412-317-0088 (internationally) and entering the passcode 10153820. A transcript of the call and the webcast replay will be available at the Company’s website, www.umh.reit.

UMH Properties, Inc., which was organized in 1968, is a public equity REIT that owns and operates 126 manufactured home communities containing approximately 23,800 developed homesites. These communities are located in New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan, Maryland, Alabama and South Carolina. In addition, the Company owns a portfolio of REIT securities.

Certain statements included in this press release which are not historical facts may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any such forward-looking statements are based on the Company’s current expectations and involve various risks and uncertainties. Although the Company believes the expectations reflected in any forward-looking statements are based on reasonable assumptions, the Company can provide no assurance those expectations will be achieved. The risks and uncertainties that could cause actual results or events to differ materially from expectations are contained in the Company’s annual report on Form 10-K and described from time to time in the Company’s other filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements whether as a result of new information, future events, or otherwise.

Note:

(1) Non-GAAP Information: We assess and measure our overall operating results based upon an industry performance measure referred to as Funds from Operations Attributable to Common Shareholders (“FFO”), which management believes is a useful indicator of our operating performance. FFO is used by industry analysts and investors as a supplemental operating performance measure of a REIT. FFO, as defined by The National Association of Real Estate Investment Trusts (“NAREIT”), represents net income (loss) attributable to common shareholders, as defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”), excluding extraordinary items, as defined under U.S. GAAP, gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, the change in the fair value of marketable securities, and the gain or loss on the sale of marketable securities plus certain non-cash items such as real estate asset depreciation and amortization. Included in the NAREIT FFO White Paper – 2018 Restatement, is an option pertaining to assets incidental to our main business in the calculation of NAREIT FFO to make an election to include or exclude gains and losses on the sale of these assets, such as marketable equity securities, and include or exclude mark-to-market changes in the value recognized on these marketable equity securities. In conjunction with the adoption of the FFO White Paper – 2018 Restatement, for all periods presented, we have elected to exclude the gains and losses realized on marketable securities investments and the change in the fair value of marketable securities from our FFO calculation. NAREIT created FFO as a non-U.S. GAAP supplemental measure of REIT operating performance. We define Normalized Funds from Operations Attributable to Common Shareholders (“Normalized FFO”), as FFO excluding certain one-time charges. FFO and Normalized FFO should be considered as supplemental measures of operating performance used by REITs. FFO and Normalized FFO exclude historical cost depreciation as an expense and may facilitate the comparison of REITs which have a different cost basis. However, other REITs may use different methodologies to calculate FFO and Normalized FFO and, accordingly, our FFO and Normalized FFO may not be comparable to all other REITs. The items excluded from FFO and Normalized FFO are significant components in understanding the Company’s financial performance.

FFO and Normalized FFO (i) do not represent Cash Flow from Operations as defined by U.S. GAAP; (ii) should not be considered as alternatives to net income (loss) as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity.

The reconciliation of the Company’s U.S. GAAP net loss to the Company’s FFO and Normalized FFO for the three months ended March 31, 2021 and 2020 are calculated as follows (in thousands):

| Three Months Ended | ||||||||

| 3/31/21 | 3/31/20 | |||||||

| Net Income (Loss) Attributable to Common Shareholders | $ | 6,839 | $ | (42,838 | ) | |||

| Depreciation Expense | 11,008 | 10,227 | ||||||

| Loss on Sales of Depreciable Assets | 23 | 107 | ||||||

| (Increase) Decrease in Fair Value of Marketable Securities | (10,219 | ) | 38,593 | |||||

| Loss on Sales of Marketable Securities, net | 730 | -0- | ||||||

| FFO Attributable to Common Shareholders | 8,381 | 6,089 | ||||||

| Non- Recurring Other Expense (2) | 320 | -0- | ||||||

| Normalized FFO Attributable to Common Shareholders | $ | 8,701 | $ | 6,089 | ||||

The diluted weighted shares outstanding used in the calculation of FFO per Diluted Common Share and Normalized FFO per Diluted Common Share were 3.2 million shares for the three months ended March 31, 2021 and 41.5 million for the three months ended March 31, 2020. Common stock equivalents resulting from stock options in the amount of 898,000 shares for the three months ended March 31, 2020 are included in the diluted weighted shares outstanding. Common stock equivalents resulting from stock options in the amount of 355,000 shares for the three months ended March 31, 2020 were excluded from the computation of Diluted Net Loss per Share as their effect would have been anti-dilutive.

The following are the cash flows provided (used) by operating, investing and financing activities for the three months ended March 31, 2021 and 2020 (in thousands):

| 2021 | 2020 | |||||||

| Operating Activities | $ | 13,215 | $ | 17,295 | ||||

| Investing Activities | (18,726 | ) | (20,477 | ) | ||||

| Financing Activities | 16,971 | 6,387 | ||||||

(2) Consists of special bonus and restricted stock grants for the August 2020 groundbreaking Fannie Mae financing.

# # # #

The above should be construed through the lens of the prior UMH Properties business model. Prior to Dodd-Frank and the Consumer Financial Protection Bureau (CFPB) impacts imposed by the Obama-Biden Administration, UMH Properties was focused on selling homes. The firm’s leaders politely but clearly lamented the problems caused by those trends.

But UMH ‘discovered’ rentals, part of a broader shift in the manufactured home community sector post-Dodd-Frank. They learned, as have others, that the profit margins on renting manufactured homes versus selling them could be good. They also learned that renting a unit was easier than selling a manufactured home.

In this recent statement above, Landy did not mention the actual total number of sales.

But in a prior earnings call, illustrated by the pull quotes above, Landy made it clear that those total sales are low, and that the bulk of their activity is in rentals. It did not use to be so, pre-Dodd-Frank, as the video and related below make clear.

While UMH is apparently on a more profitable footing now, what is missing in this equation are several key points. Among them? The fact that manufactured homeowners and potential consumers are the losers, because most new customers are renters – not buyers.

When so-called ESG considerations are being increasingly touted by so many firms, including UMH, one might think that the long-term interests of the home ownership thirsty public would matter more? In fairness, UMH has not stirred up as much negative dust as many of their colleagues at MHI. But they are still part of the club, why is that so?

Freedom is never free. The time to select sides is here. See the linked and related reports to learn more.

Notice: While the layout of this business daily report has recently been modified, several elements of the basic concepts used previously are still the same. The headlines that follow below can be reviewed at a glance to save time while providing insights across the left-right media divide. Additionally, those headlines often provide clues as to possible ‘market moving’ reports.

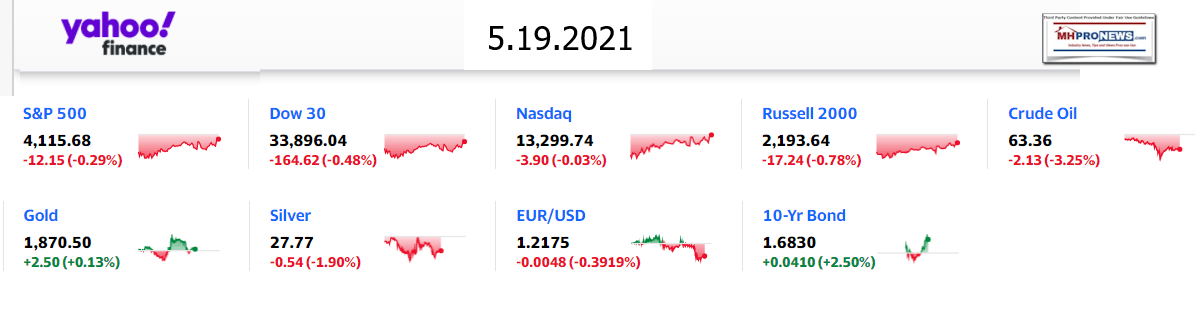

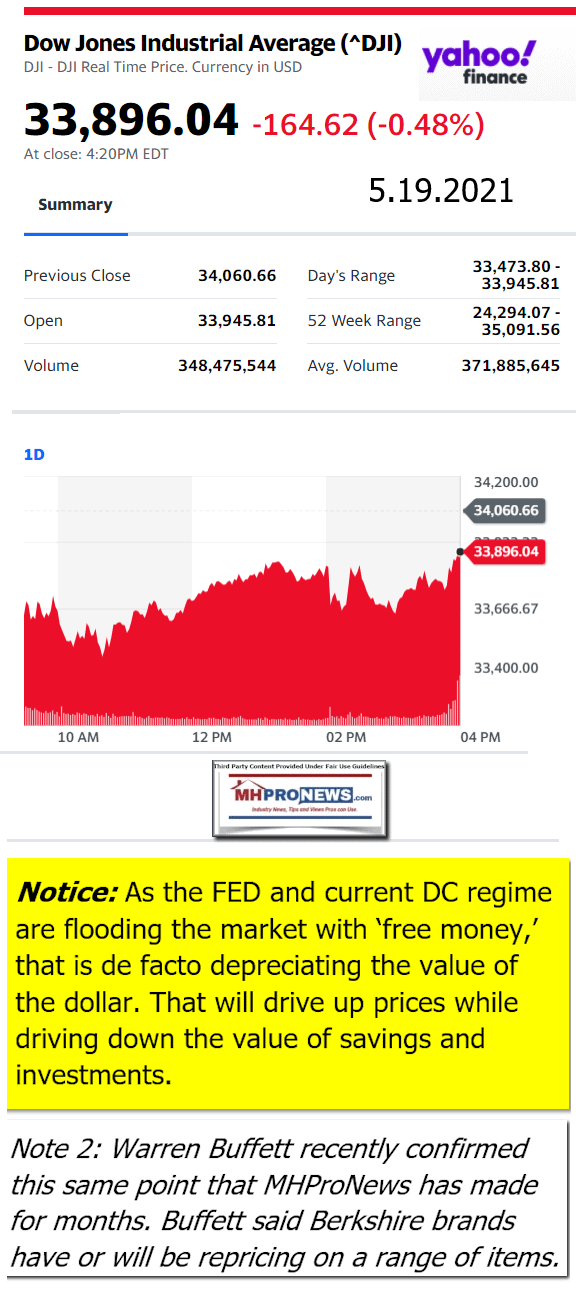

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Headlines from left-of-center CNN Business = evening of 5.19.2021

- Help wanted

- Allied Universal security services.

- This company wants to hire 35,000 people. But finding workers won’t be easy

- Elon Musk is holding steady on bitcoin as crypto markets tumble

- Watch: Cryptocurrency expert says Elon Musk knows ‘virtually nothing’

- LIVE UPDATES Institutional investors are ditching bitcoin for gold

- Bitcoin plunges below $40,000 as China widens its crypto crackdown

- Bitcoin 101: Everything you need to know about bitcoin

- Amazon is lifting its mask mandate for some fully-vaccinated US employees

- Lipstick sales are making a comeback as social calendars fill up again

- Have Americans forgotten the ghosts of inflation past?

- Soaring metal prices spell trouble for China’s recovery

- Here’s how much HBO Max with ads will cost

- Oatly could be worth $10 billion after New York IPO

- Burger King launches new chicken sandwich nationwide

- How two brothers went from nearly jobless to multi-millionaires with a bizarre crypto bet

- When a Black homeowner concealed her race, her home’s appraisal value doubled

- Buying a home? Skip the ‘love letter’ to the seller

- American Airlines Embraer ERJ-145 regional jet aircraft as seen on final approach landing at New York JFK international airport in NY, USA on February 13, 2020. The flight is operated by American Eagle, a regional branch of American Airlines (Envoy Air). The commercial airplane has the registration N605KS. American Airlines is a major US carrier with headquarters at Fort Worth. AA AAL is the largest airline in the world by fleet and passenger and member of Oneworld aviation alliance.

- Exclusive: American Airlines’ largest regional carrier gets FAA warning

- RISING PRICES

- Used cars sit on the sales lot at Autometrics Quality Used Cars on March 15, 2021 in El Cerrito, California.

- Just about everything is getting more expensive in the United States

- Here’s what’s getting more expensive

- Price spikes squeeze low-income Americans

- Rising wood prices make toilet paper cost more

- Prepare to pay the sticker price for a car

- AUTONOMOUS VEHICLES

- A Waymo self-driving car fumbles In a construction zone.

- Traffic cones confused a Waymo self-driving car. Then things got worse

- Tesla is pushing ahead with ‘full self-driving’

- Self-driving tractors could make farming greener

- Toyota snaps up Lyft’s self-driving cars unit

- Your self-driving car still isn’t ready. Smarter roads might change that

- WHAT TO WATCH

- Watch this trippy simulation of a star being born

- President Joe Biden stops to talk to the media as he drives a Ford F-150 Lightning truck at Ford Dearborn Development Center, Tuesday, May 18, 2021, in Dearborn, Mich.

- See Biden floor it in electric Ford pickup truck

- Barack Obama on UFOs: We don’t know exactly what they are

- Bank of America CEO on raising minimum wage: It’s an investment in our teammates

- Watch self-driving car struggle to understand traffic cones

Headlines from right-of-center Newsmax – evening of 5.19.2021

- Court Pack Push? Biden’s US Supreme Court Commission Meets to Explore Revamp

- The first meeting of the panel came just two days after the high court, now weighted toward conservatives, announced it was diving back into one of the most divisive issues of the day: abortion rights and the protections afforded under 1973’s landmark case Roe v. Wade. Many liberals and Democratic lawmakers are urging the administration to set in motion changes to the court that could include adding more seats and more justices.

- The Biden Presidency

- Biden to Coast Guard Grads: COVID Readied You for Any Mission

- McLaughlin Poll: 64% Say Biden Won’t Run in 2024, Trump Beats Harris

- Biden on Harris’ Busing Attack: ‘That Was Some F-ing Bulls**t’

- US to Waive Sanctions Related to Russia’s Nord Stream 2 Pipeline

- Israel-Hamas Conflict Further Complicating Longtime Biden-Netanyahu Friendship

- GOP, White House Talks on Infrastructure Yield No Breakthrough

- Report: US Encouraging Israel to Wind Down Offensive

- Poll: Less Than 58% of Dems Would Vote for Biden in ’24 Primary

- More The Biden Presidency

- Newsfront

- Donald Trump: New York’s ‘Criminal’ Probe a ‘Political Witch Hunt’

- Donald Trump: New York’s ‘Criminal’ Probe a ‘Political Witch Hunt’

- If these prosecutors focused on real issues, crime would be obliterated, and New York would be great and free again!…

- Poll: Dems Blame Israel for Violence

- Americans are divided over who is to blame for the ongoing violence [Full Story]

- Related

- Democrats Drop Israel Arms Sale Opposition

- Netanyahu: ‘Determined to Continue’ Gaza Operation

- Biden Pressures Our Longtime Ally as Terrorists Strike

- Israel-Hamas Conflict Further Complicating Longtime Biden-Netanyahu Friendship

- Facebook Deploys Special Team as Israel-Gaza Conflict Spreads Across Social Media

- Jill Biden After Kamala Harris Ambushed Joe at Debate: ‘Go F*** Yourself’

- Kamala Harris’ infamous busing ambush of Joe Biden during the first

- Looking to listen to Newsmax TV while in your car, exercising, or

- Military Feeling Effects of US Childhood Obesity Epidemic

- The U.S. military is having trouble finding recruits that aren’t too

- Trump Rallies Resume Next Month – But What Can Attendees Expect?

- What scene could be more emblematic of a return to pre-pandemic life

- Chicago Mayor Lightfoot Granting Interviews Only to Black or Brown Journalists

- Chicago Mayor Lori Lightfoot issued a statement on Twitter Wednesday

- NEWSMAX PODCAST: The Hypocrisy of the Left on the Middle East

- PLUS: Newsmaxs Rob Schmitt talks to Rick Grenell

- The ‘Dirty Little Secret’ the Fed is Afraid to Tell You

- SPONSOR: A new kind of financial system

- Texas Gov. Abbott Signs Law Banning Abortions Early as 6 Weeks

- Republican Gov. Greg Abbott on Wednesday signed a law that bans

- Leader McCarthy, GOP Doctors Seek to Roll Back House Mask Rule

- Minority Leader Kevin McCarthy, R-Calif., and the House Republican

- Police Forces Face Recruiting Crisis Nationwide Due to Low Morale

- Police departments nationwide are having a difficult time finding

- Jewish Diners Attacked in L.A. by Pro-Palestinian Caravan

- Disturbing video that appears to show two Jewish men being viciously

- Mark McCloskey to Newsmax TV: Running for Senate to Bring ‘Real Change’

- Mark McCloskey, the St. Louis attorney who gained national

- McConnell Comes Out Against Creating Jan. 6 Commission

- Senate Minority Leader Mitch McConnell announced his opposition on

- ‘QAnon Shaman’ Attorney Defends Use of Vulgar Language for Client

- Albert Watkins, the attorney representing “QAnon Shaman” Jacob

- Banks Push Back on Black, Minority Farm Loan Relief Program

- Banks are resisting the Biden administration’s push to provide $4

- Biden’s Supreme Court Commission to Meet as Abortion Debate Looms

- President Joe Biden’s commission to study potential changes to the

- Sparks Fly in Arizona Recount

- A faction of Arizona Republicans is actively feuding with the GOP-led

- Israeli Airstrikes Kill 6 Across Gaza Strip

- Israeli airstrikes killed at least six people across the Gaza Strip

- Grenell to Newsmax TV: ‘Woke’ Undermines US Security

- Wokeness “is undermining our military and our ability to protect

- Conservative Group Running Ads Targeting CEOs of ‘Woke’ Corporations

- McLaughlin Poll: 64Percent Say Biden Won’t Run in 2024, Trump Beats Harris

- Former President Donald Trump defeats Vice President Kamala Harris

- Biden Administration Has Allowed 61K Illegal Immigrants Into US

- More than 61,000 immigrants who illegally entered the United States

- Las Vegas Strip Rules to End for Vaccinated

- The Las Vegas Strip and surroundings will fully reopen to vaccinated

- US Expands Citizenship for Children of Surrogates

- The United States on Tuesday made it easier to pass citizenship to

- FDA’s Dr. Peter Marks: Vaccinated People May Need COVID Booster Within a Year

- Manufacturers of the COVID vaccines and the scientific community are

- FBI Probes Campaign Donations to U.S. Senator Susan Collins

- The Federal Bureau of Investigation has been reviewing a possible

- ‘American Idol’ Judges React to Singer Being Dropped for Previous KKK Video

- The American Idol judges break their silence in the wake of country

- Tim Scott Rips WashPost for Headline Criticizing Israel’s Iron Dome

- Tim Scott, R-S.C., on Tuesday hit out at The Washington Post for

- McConnell Hits ‘Pause’ on Dems’ Effort to Create Jan. 6 Panel

- Senate Republicans are signaling that they will try to block – or at

- S&P 500 Backs Off on Weak Telecom Stocks Despite Strong Retail Earnings

- S. stocks ended lower on Tuesday as a sharp decline in telecom

- The States Where Americans Don’t Want to Live Anymore

- More Newsfront

- Finance

- Bitcoin Plunges Below $40,000, Wipes $500B From Value

- The crypto bubble that inflated Bitcoin’s value past $1 trillion and added billions to nonsense digital tokens overnight is bursting. Bitcoin plunged as much as 29%, wiping out more than $500 billion in value from the coin’s…

- Bayer Seeks Approval of $2 Billion Settlement to Limit Roundup Claims

- Bristol Myers Could Pay $1.56 Billion to Develop, Sell Experimental Cancer Therapy

- Apple Censors Apps, Stores Data Locally in China: Report

- Bank of America Raising US Minimum Wage to $25 by 2025

- More Finance

- Health

- How Dogs Can Help Sniff Out COVID-19

- COVID-19 testing may be going to the dogs. As the prevalence of antigen testing for COVID-19 declines, scientists and dog trainers around the world are harnessing their powerful sense of smell to sniff out COVID-19 infections…

- Two-Fifths of Americans With COPD Live Far From Lung Rehab

- Less Than 6 Hours of Sleep Tied to Higher Cardiovascular Risk

- Starting Rehab Earlier Boosts Outcomes for Heart Failure Patients

- Scientists Say It’s Time to Forget About Herd Immunity

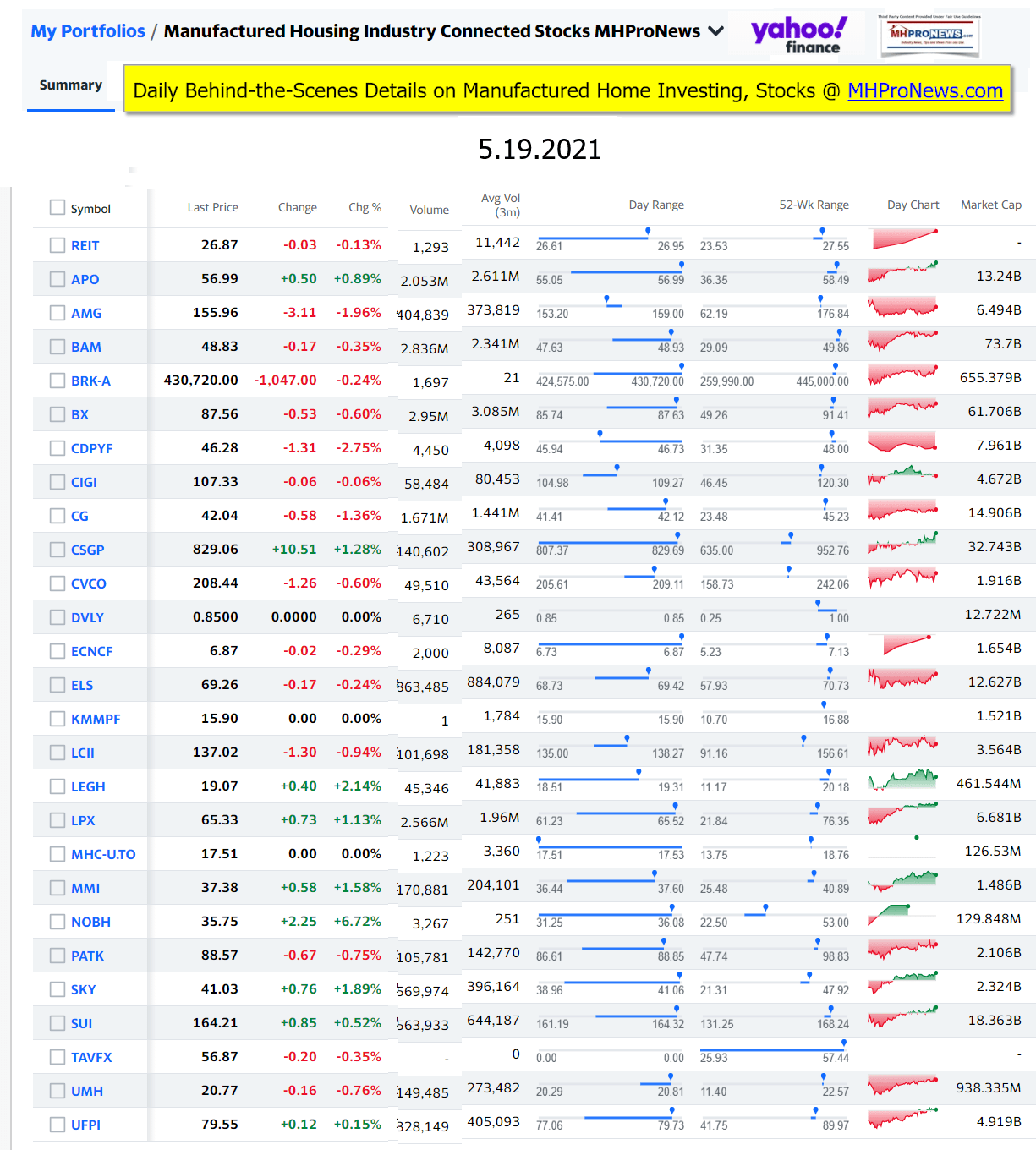

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

-

-

-

-

-

-

-

-

-

-

-

Spring 2021…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

It is now 11+ years and counting…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.