According to the Congressional testimony provided in Part I by manufactured homeowner and land-lease manufactured home community (MHC) resident Carla Burr, “I am a proud owner of a manufactured home in Chantilly, Virginia.” “I would love to provide an unqualified recommendation for manufactured housing. However, until we fix the financing issue to provide equal access benefits and ensure secure tenure, manufactured home sales will remain slack.” “What we are facing right now is a constant threat by the– not manufactured housing, but by the landlord of this property.” Burr told Congress: “I truly believe that manufactured housing can be a part of the solution to our need for affordable homes, and can create jobs, save energy, and provide attractive homes for people who want to buy them. There is much that Congress can do to improve the regulatory marketplace so buyers get the best possible loans, and ensure that Federal agencies use their resources to help homeowners buy a quality home that they can afford, and require protections for owners living in communities.” But as the ROAD to Housing Act 2025 stands today, will it solve the issues raised by Burr or others at the Congressional “State of Manufactured Housing” field hearing provided in Part I? That and more will be explored in Part II.

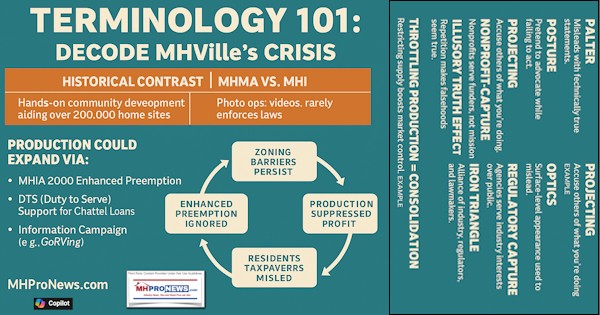

As Part II will also demonstrate, these are the details routinely omitted by the Manufactured Housing Institute (MHI or manufacturedhousing.org) on the public facing side of their website. These details and facts are also routinely overlooked, downplayed, or omitted by MHI linked state associations, or by their allied bloggers and trade publishers.

Manufactured homeowner and MHC resident Burr also said: “Owners of manufactured homes are frequently ignored by Federal housing policy.” She also said the following.

…management is not equitably applying the rules across-the-board. They single out those of us who are taking action to effect change. They try and persuade other homeowners to not attend our meetings because we are really seeking to get the whole community involved. They single out those of us who are taking action, and they use tactics to scare the homeowners. “We are not going to renew your lease.” Whether they do it or not, we don’t know. This is an unacceptable position to be in, in any community.

Burr stated.

Everyone–the people who build the homes, the people who sell the homes, the people who finance the homes, and the people who buy these homes–should work together to improve outcomes for buyers like me.

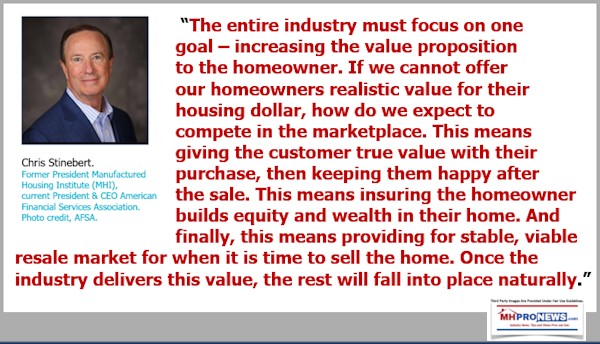

That is not so different than what Chris Stinebert, the former president and CEO of MHI said in his farewell message to manufactured housing.

But Stinebert’s name has been scrubbed from the public facing side of the MHI website, as have other past presidents/CEO, others that were once found there, including other former MHI vice presidents.

Some might wonder. Why look back at this Congressional testimony? Several reasons. One, the problems being experienced by manufactured housing and residents like Burr today are still present more than a dozen years later. There are mainstream media that write reports as if the problems they are describing are new. They are not. They already existed at the time the Danville, VA Congressional Field Hearing occurred.

The practical solutions needed then are the same solutions needed now.

This MHVille facts-evidence-analysis (FEA) is already underway.

Part I.

1) From the text on the Congressional site shown below and as captured in a PDF found at this link here.

https://www.congress.gov/event/112th-congress/house-event/LC1836/text

THE STATE OF MANUFACTURED HOUSING

=======================================================================

FIELD HEARING

BEFORE THE

SUBCOMMITTEE ON

INSURANCE, HOUSING AND

COMMUNITY OPPORTUNITY

OF THE

COMMITTEE ON FINANCIAL SERVICES

U.S. HOUSE OF REPRESENTATIVES

ONE HUNDRED TWELFTH CONGRESS

FIRST SESSION

__________

NOVEMBER 29, 2011

__________

Printed for the use of the Committee on Financial Services

Serial No. 112-86

U.S. GOVERNMENT PRINTING OFFICE

72-627 WASHINGTON : 2012

———————————————————————–

For sale by the Superintendent of Documents, U.S. Government Printing Office,

http://bookstore.gpo.gov. For more information, contact the GPO Customer Contact Center, U.S. Government Printing Office. Phone 202�09512�091800, or 866�09512�091800 (toll-free). E-mail, gpo@custhelp.com.

HOUSE COMMITTEE ON FINANCIAL SERVICES

SPENCER BACHUS, Alabama, Chairman

JEB HENSARLING, Texas, Vice BARNEY FRANK, Massachusetts,

Chairman Ranking Member

PETER T. KING, New York MAXINE WATERS, California

EDWARD R. ROYCE, California CAROLYN B. MALONEY, New York

FRANK D. LUCAS, Oklahoma LUIS V. GUTIERREZ, Illinois

RON PAUL, Texas NYDIA M. VELAZQUEZ, New York

DONALD A. MANZULLO, Illinois MELVIN L. WATT, North Carolina

WALTER B. JONES, North Carolina GARY L. ACKERMAN, New York

JUDY BIGGERT, Illinois BRAD SHERMAN, California

GARY G. MILLER, California GREGORY W. MEEKS, New York

SHELLEY MOORE CAPITO, West Virginia MICHAEL E. CAPUANO, Massachusetts

SCOTT GARRETT, New Jersey RUBEN HINOJOSA, Texas

RANDY NEUGEBAUER, Texas WM. LACY CLAY, Missouri

PATRICK T. McHENRY, North Carolina CAROLYN McCARTHY, New York

JOHN CAMPBELL, California JOE BACA, California

MICHELE BACHMANN, Minnesota STEPHEN F. LYNCH, Massachusetts

THADDEUS G. McCOTTER, Michigan BRAD MILLER, North Carolina

KEVIN McCARTHY, California DAVID SCOTT, Georgia

STEVAN PEARCE, New Mexico AL GREEN, Texas

BILL POSEY, Florida EMANUEL CLEAVER, Missouri

MICHAEL G. FITZPATRICK, GWEN MOORE, Wisconsin

Pennsylvania KEITH ELLISON, Minnesota

LYNN A. WESTMORELAND, Georgia ED PERLMUTTER, Colorado

BLAINE LUETKEMEYER, Missouri JOE DONNELLY, Indiana

BILL HUIZENGA, Michigan ANDRE CARSON, Indiana

SEAN P. DUFFY, Wisconsin JAMES A. HIMES, Connecticut

NAN A. S. HAYWORTH, New York GARY C. PETERS, Michigan

JAMES B. RENACCI, Ohio JOHN C. CARNEY, Jr., Delaware

ROBERT HURT, Virginia

ROBERT J. DOLD, Illinois

DAVID SCHWEIKERT, Arizona

MICHAEL G. GRIMM, New York

FRANCISCO “QUICO” CANSECO, Texas

STEVE STIVERS, Ohio

STEPHEN LEE FINCHER, Tennessee

Larry C. Lavender, Chief of Staff

Subcommittee on Insurance, Housing and Community Opportunity

JUDY BIGGERT, Illinois, Chairman

ROBERT HURT, Virginia, Vice LUIS V. GUTIERREZ, Illinois,

Chairman Ranking Member

GARY G. MILLER, California MAXINE WATERS, California

SHELLEY MOORE CAPITO, West Virginia NYDIA M. VELAZQUEZ, New York

SCOTT GARRETT, New Jersey EMANUEL CLEAVER, Missouri

PATRICK T. McHENRY, North Carolina WM. LACY CLAY, Missouri

LYNN A. WESTMORELAND, Georgia MELVIN L. WATT, North Carolina

SEAN P. DUFFY, Wisconsin BRAD SHERMAN, California

ROBERT J. DOLD, Illinois MICHAEL E. CAPUANO, Massachusetts

STEVE STIVERS, Ohio

C O N T E N T S

———-

Page

Hearing held on:

November 29, 2011…………………………………….. 1

Appendix:

November 29, 2011…………………………………….. 25

WITNESSES

Tuesday, November 29, 2011

Burr, Carla, manufactured housing resident………………….. 15

Clayton, Kevin, Secretary, Executive Committee, Manufactured

Housing Institute (MHI)…………………………………. 6

Craddock, Tyler, Executive Director, Virginia Manufactured and

Modular Housing Association (VAMMHA)……………………… 8

Czauski, Henry S., Acting Deputy Administrator for the Office of

Manufactured Housing Program, U.S. Department of Housing and

Urban Development………………………………………. 4

Rush, Stanley, Account Executive, MHD Empire Service Corporation,

and Vice Chair, Virginia Manufactured and Modular Housing

Association (VAMMHA)……………………………………. 10

Rust, Adam, Research Director, Community Reinvestment Association

of North Carolina………………………………………. 13

Weiss, Mark, Senior Vice President, Manufactured Housing

Association for Regulatory Reform (MHARR)…………………. 17

Yates, Scott, President, Yates Homes, and Past Chair, Virginia

Manufactured and Modular Housing Association………………. 11

APPENDIX

Prepared statements:

Donnelly, Hon Joe…………………………………….. 26

Fincher, Hon. Stephen…………………………………. 27

Burr, Carla………………………………………….. 29

Clayton, Kevin……………………………………….. 36

Craddock, Tyler………………………………………. 45

Czauski, Henry S……………………………………… 50

Rush, Stanley………………………………………… 55

Rust, Adam…………………………………………… 58

Yates, Scott…………………………………………. 65

THE STATE OF MANUFACTURED HOUSING

———-

Tuesday, November 29, 2011

U.S. House of Representatives,

Subcommittee on Insurance, Housing

and Community Opportunity,

Committee on Financial Services,

Washington, D.C.

The subcommittee met, pursuant to notice, at 9:08 a.m., at

the Danville Municipal Building, 4th Floor City Hall, Danville

City Council Chambers, 427 Patton Street, Danville, Virginia,

Hon. Robert Hurt [vice chairman of the subcommittee] presiding.

Members present: Representative Hurt.

Mr. Hurt. [presiding]. Good morning. I want to, first of

all, welcome everybody to today’s hearing.

As you all know, I am Robert Hurt, and I am a Member of

Congress. I represent Danville and all of Southside Virginia in

Congress. My district runs from Greene County, north of

Charlottesville, all the way down to the North Carolina line,

just a few miles from here, and runs from Martinsville in Henry

County all the way over to South Hill and Lawrenceville over to

the east.

So it is a very large district, and manufactured housing is

very important to us here in Southside for two reasons. Number

one, of course, it provides affordable housing for thousands of

people all across my district, which is extremely important,

especially in this economy when we have 9 percent unemployment.

Number two, it is also important because it is a provider

of jobs. We have a vibrant manufactured housing sector here, as

is the case across the country, and we have many jobs that are

associated with this business here.

And so, as we look at ways in Washington that we can make

it easier for small businesses to succeed, as we look for ways

on our Financial Services Committee that we can help ameliorate

the effects of legislation that has been adopted in the past,

as well as the economic troubles that we currently face, this

hearing is an opportunity to focus on a very important part of

what I think will be an inevitable economic recovery.

Unfortunately, it is taking longer, I think, than anybody

would like. But I do believe that we will get there. And the

evidence that we will receive today will be very helpful in our

committee’s deliberations.

As I said, I am a member of the Financial Services

Committee. I am also the vice chairman of the Insurance,

Housing and Community Opportunity Subcommittee. I am the only

member of the subcommittee who will be here today, but I can

tell you that everything that we hear today, we will record.

We have a staff member from the Financial Services

Committee here, Mr. Tallman Johnson, and we will take that

evidence and we will carry it back with us to Washington. It

will be made part of the record, and we will be able to use

that as we go forward and look for legislative responses and

regulatory responses that we believe will help the situation.

I also wanted to recognize two folks on my staff. Kelly

Simpson is my legislative director. And we also have Denise Van

Valkenburg, who is our director of constituent services.

Before I get started, I did want to recognize a few people

that I really appreciate being here. Delegate Danny Marshall.

There is Danny. Danny, of course, is our delegate in Richmond.

Thank you, Danny, for being here.

When I was in the House of Delegates, he and I were on the

Counties, Cities, and Towns Committee in the General Assembly,

a committee that dealt with a lot of these issues. Thank you

for being here, Danny.

I wanted to recognize Don Merricks’ chief bottle washer.

Where is Gayle? There is Gayle Barts. Don couldn’t be with us

today, but I did want to thank him for sending Gayle, his able

assistant.

We have a couple of folks from the city council. We have

Fred Shanks. Thank you, Fred, for being here. And Buddy Rawley

was here. I don’t know if he is still here. There is Buddy.

Thank you, Buddy, for being here.

We have James Snead, who is a member of the Board of

Supervisors and also the Mayor of Ringgold. And we also have

Jimmy Gillie, who is our commissioner of revenue here in the

city. I don’t know if he is still here. Jimmy, thank you for

being here. And we also have our city attorney, Clarke

Whitfield.

And I am told that we have a special guest as well, Mayor

Sherman Saunders. I just want you to know, Mr. Mayor, that I

told my staff that I do not want to sit in Mayor Saunders’

chair.

[laughter]

Mr. Hurt. So I am going to sit down here. But Mayor

Saunders, it is so nice of you to be with us, and thank you for

hosting us here. This is our Mayor, Sherman Saunders. Thank

you, Mr. Saunders. I appreciate you being here.

[applause]

Mr. Hurt. So, with those introductions, I would like to

bring this hearing of the Subcommittee on Insurance, Housing

and Community Opportunity to order, and I will begin by making

an opening statement, and then I will invite our witnesses to

make opening statements.

Good morning, and welcome to today’s Financial Services

Committee field hearing on the state of the manufactured

housing industry.

I want to thank all of our witnesses for traveling here to

Danville this morning to examine the manner in which Federal

laws and regulations impact these manufacturers, and the

affordable housing they produce, as well as jobs they create

here in Virginia’s Fifth District and across the country.

The term “manufactured home” refers to a home built in a

factory in accordance with the construction standards set forth

in the National Manufactured Housing Construction and Safety

Standards Act of 1974, which is administered by the Department

of Housing and Urban Development (HUD). HUD not only

establishes the construction standards for units of

manufactured housing, but it also coordinates inspections of

these manufacturers’ facilities to ensure that the homes they

produce meet the quality and safety guidelines HUD maintains.

Manufactured housing plays a significant role in the

Nation’s housing stock, supplying millions of units of

affordable housing to individuals and families across the

country. These homes are constructed in quality-controlled,

HUD-regulated settings that produce cost-effective homes,

expanding consumer access to affordable housing options.

The industry is also a source of employment for thousands

of Americans, hundreds of which reside and work here in

Virginia’s Fifth District. From Rocky Mount to South Hill, from

Charlottesville to Danville, the Fifth District is home to a

number of manufacturers, retailers, suppliers, and related

services, which create numerous jobs in connection with

manufactured and modular housing.

The impact of the industry cannot be overstated at a time

when 9 percent of Americans are unemployed. Many communities in

my district have even higher rates of unemployment.

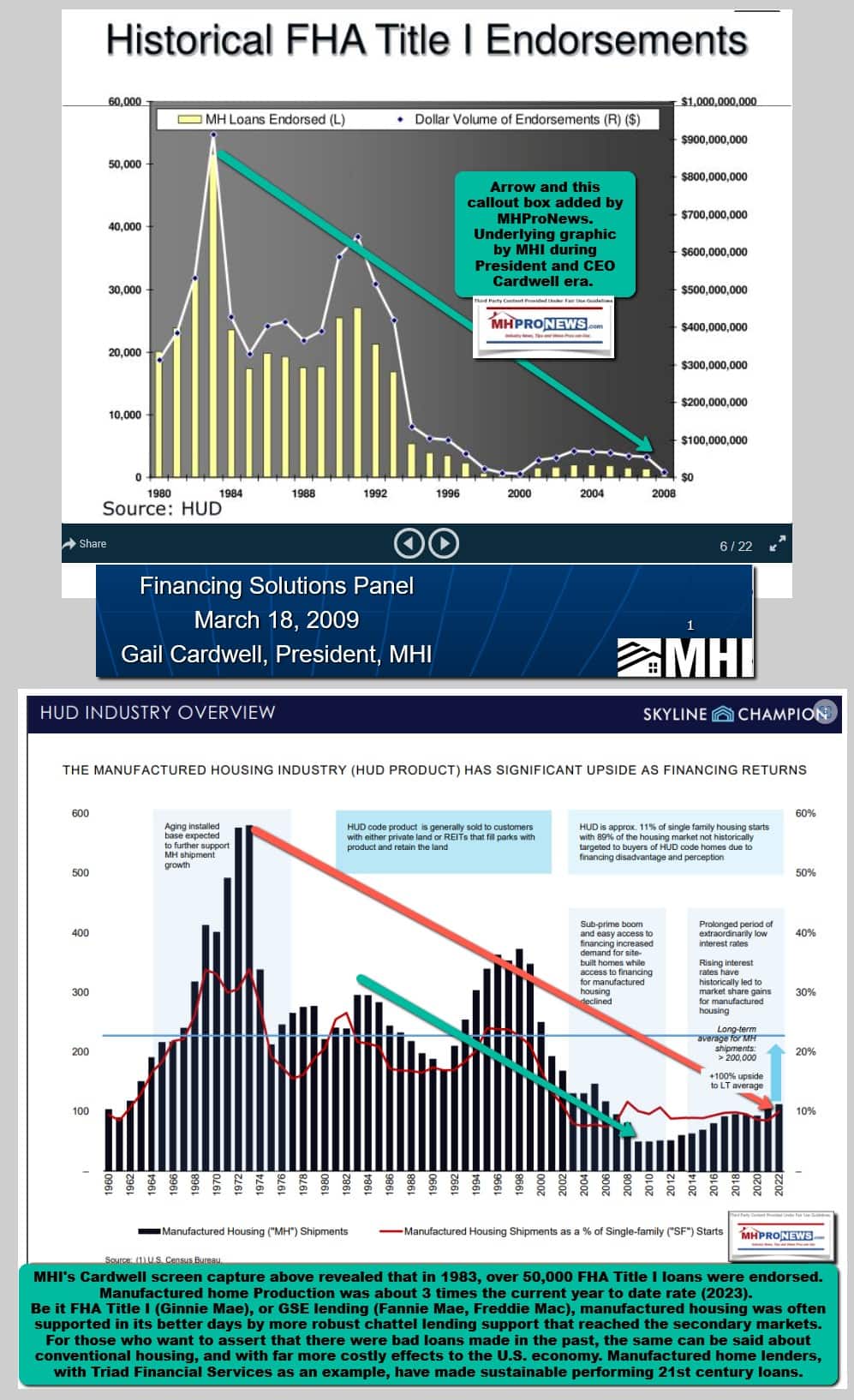

According to the data from the Census Bureau, the

manufactured housing industry experienced strong sales in the

mid- to late 1990s, exceeding 300,000 units sold annually.

Since then, these sales figures have steadily declined, with

approximately 50,000 units sold in 2010. Today’s hearing will

explore the causes of these trends and the impact of the

relevant Federal laws and regulations on the manufactured

housing industry’s ability to respond to changing economic

conditions.

Among the most critical factors in the purchase of a home

is access to financing. Consumers are finding it increasingly

difficult to obtain financing for manufactured homes, which, in

turn, reduces demand for the product, ultimately resulting in

fewer jobs for manufacturers and related businesses and fewer

choices available to the consumer.

The majority of manufactured home purchases are financed as

personal property, rather than real property mortgages. This

method of financing results in comparatively smaller loan

balances with shorter durations, but higher interest rates,

given that most personal property loans cannot be securitized

in the secondary market like a conventional mortgage.

Given the unique nature of this model of finance, we must

be mindful that laws governing traditional mortgage finance may

not be as effective in the manufactured housing market, case in

point, the unintended consequences created by the Dodd-Frank

Act. Dodd-Frank broadened the definition of high-cost loans

under the Home Ownership and Equity Protection Act (HOEPA) and

also imposed new requirements on loans considered to be high-

cost loans under HOEPA.

While these provisions were well-intentioned, we must

identify and mitigate the unintended consequences they

produced: decreased access to affordable choices for consumers;

and fewer jobs in the manufactured housing industry. This

hearing will examine these and other issues that are impacting

the manufactured housing industry and the consumers who utilize

its products.

Again, I want to express my appreciation for today’s

witnesses, each of whom will speak to their expertise in a

particular facet of the manufactured housing industry. I look

forward to your testimony.

Without objection, your written statements will be made a

part of the record, and you will each be recognized for a 5-

minute summary of your testimony.

The first witness who will be testifying today is Mr. Henry

Czauski, Acting Deputy Administrator for the Manufactured

Housing Program at HUD.

Thank you, Mr. Czauski, for coming from Washington. It is

my understanding that you came by way of Blacksburg, but we are

glad to have you here. So you are recognized for 5 minutes.

STATEMENT OF HENRY S. CZAUSKI, ACTING DEPUTY ADMINISTRATOR FOR

THE OFFICE OF MANUFACTURED HOUSING PROGRAM, U.S. DEPARTMENT OF

HOUSING AND URBAN DEVELOPMENT

Mr. Czauski. I want to thank Chairman Hurt and the other

distinguished members of the subcommittee for the opportunity

to testify today.

My name is Henry Czauski, and I am the Acting Deputy

Administrator for the Office of Manufactured Housing Program

with the U.S. Department of Housing and Urban Development.

My remarks will touch on some of the key aspects of

manufactured housing legislation, the role HUD plays in

implementing that legislation, the benefits to the

stakeholders, and label fees.

In 1974, Congress enacted the National Manufactured Housing

Construction and Safety Standards Act, which was amended by the

Manufactured Housing Improvement Act of 2000. Congress found

that manufactured housing plays a vital role in meeting the

housing needs of the Nation and that manufactured homes provide

a significant resource for affordable homeownership and rental

housing accessible to all Americans.

HUD established a program to administer and carry out the

many purposes of this legislation, which was intended to:

protect the quality, durability, safety, and affordability of

manufactured homes; provide for establishment of uniform

nationwide Federal construction standards; encourage innovative

and cost-effective construction techniques; protect residents;

establish a balanced consensus process to develop standards;

and ensure uniform and effective enforcement of those

standards.

To carry out these purposes, Congress included stakeholders

in the process–manufacturers, retailers, consumers, State

regulators, administrative and monitoring contractors, and

others. A Manufactured Housing Consensus Committee was

established as a Federal advisory committee to provide

recommendations to HUD on adopting and revising Federal

standards and regulations. This committee is composed of 21

voting members, including 7 producers/retailers, 7 persons

representing consumer interests, and 7 persons representing

public officials and the general interest.

An administering organization authorized by Congress

assists the committee in its mission. This committee is an

active body and in the past year has met on four occasions, and

its subcommittees have held ongoing meetings throughout the

year.

The Federal standards have been the subject of ongoing

review and updating. Over the years, HUD promulgated numerous

standards, including standards that limited formaldehyde

emissions in manufactured homes, improved wind safety

requirements after Hurricane Andrew, enhanced smoke alarm

standards, and upgraded electrical safety requirements. These

standards are preemptive of State or political subdivision

standards to ensure nationwide uniformity and

comprehensiveness.

In order to assure compliance with these standards,

manufacturers contract for inspection services with primary

inspection agencies accepted by HUD. The Department conducts

nationwide monitoring and inspections to assure that the

standards are maintained.

Congress also authorized that States may assume

responsibility for enforcement of standards, upon approval of a

State plan approved by HUD. At the current time, 37 States have

established plans. HUD assumes responsibility for enforcement

of standards in the 13 States that do not have established

plans. During the past 2 years, 2 national and 4 regional

meetings with State regulators were held to provide guidance

and ensure uniformity of standard administration among the

States.

Once a manufactured home is determined to meet Federal

standards, a certification label is permanently affixed to each

home. This red label assures the consumer that the home was

constructed in accordance with the Federal standards.

Congress authorized the Secretary to establish and collect

a fee for this label to offset expenses incurred in carrying

out the legislation. The current label fee was set at $39 in

- In Fiscal Year 2000, prior to the fee increase, label fee

income of $11 million was collected.

As a result of reductions in the production of manufactured

homes, fee income in Fiscal Year 2008 fell to $5.7 million. In

Fiscal Year 2011, fee income fell to less than $3 million.

To supplement the reduced label fee income, Congress

provided a direct appropriation of $5.4 million in Fiscal Year

- The appropriation rose to $9 million in Fiscal Year 2011.

For Fiscal Year 2012, the appropriation was set at $2.5

million.

These label fees are used for conducting inspections and

monitoring, providing funding to the States that have approved

plans, administering the consensus committee, and

administration of the enforcement of installation standards,

and a dispute resolution program.

In closing, I would like to state that the Federal

standards serve to protect the quality, durability, safety, and

affordability of manufactured housing. I want to thank you for

the opportunity to provide testimony today, and I would be

pleased to answer any questions.

[The prepared statement of Mr. Czauski can be found on page

50 of the appendix.]

Mr. Hurt. Thank you, Mr. Czauski.

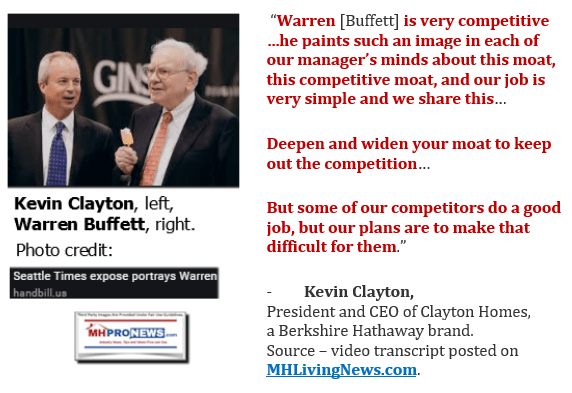

The next witness that we will recognize for 5 minutes is

Mr. Kevin Clayton, who is the president and CEO of Clayton

Homes. And he joins us from Maryville, Tennessee.

Thank you, Mr. Clayton, for being here. And we will

recognize you for 5 minutes.

STATEMENT OF KEVIN CLAYTON, SECRETARY, EXECUTIVE COMMITTEE,

MANUFACTURED HOUSING INSTITUTE (MHI)

Mr. Clayton. Thank you, Mr. Chairman, and members of the

subcommittee, for the opportunity to testify this morning.

My name is Kevin Clayton. I serve as the secretary of the

Manufactured Housing Institute, or I will refer to that as MHI

in my remarks.

I am also the president and CEO of Clayton Homes. The

current chairman of MHI, Joe Stegmayer, sends his regards. He

has a facility nearby in Rocky Mount. I know that you visited

that facility, and we appreciate your interest and support of

the industry.

My written testimony has been submitted for the record.

For over 60 years, manufactured housing has been critical

as a single-family housing alternative for hard-working, low-

to moderate-income families across this Nation. Most

manufactured homes are located in rural America, where there

are few apartments or other housing alternatives available.

The average cost of a new manufactured home is only $63,000

versus $270,000 for a site-built home. More importantly, the

median annual income of a manufactured homeowner is $32,000,

versus $60,000- plus for other homeowners.

An even greater indication of the Nation’s reliance on

manufactured homes as an affordable housing alternative is that

72 percent of all new homes sold under $125,000 are

manufactured homes. Additionally, since 1989, manufactured

housing has served roughly 20-plus percent of all new home

sales.

The American dream is homeownership, and the unintended

effects of new regulation and lack of the secondary market by

the GSEs is a path to tragically wipe out the remains of this

important housing segment. The implementation of the Dodd-Frank

Act amendments to the Home Ownership and Equity Protection Act

stands to critically affect this industry. HOEPA, which defines

high-cost mortgages, is designed to protect consumers and

prevent predatory lending.

The law uses APR limits for the annual percentage rate and

fees charged on a loan to determine whether the loan is a high-

cost mortgage. Prior to the Dodd-Frank Act, HOEPA only applied

to non-purchase finance or refinance loans, but now will apply

to all manufactured housing loans as well.

With no secondary market, the cost of capital for

manufactured housing lenders starts at a much higher rate, and

the limits within the Dodd-Frank Act are based off of the

current artificially low mortgage rates. This makes it very

difficult, and impossible in many cases, for a lender in our

industry in the future to be able to charge enough interest

rate to offset the cost of originating and servicing the loans

and stay underneath those limits.

For example, a $200,000 site-built loan and a $50,000

manufactured home loan, they cost the same in dollars to

originate and service a loan. But as a percentage of each

loan’s size, it is significantly different in interest rate

spread. This difference is effectively discriminating against

the smaller size manufactured home loans, putting them at a

much higher risk of being categorized as high-cost mortgages,

even though there is nothing predatory about manufactured

housing loans.

The impact of this provision is significant. Of the

400,000-plus loans that our company has made since 1972, more

than 50 percent of those would have not been done because they

would have been classified as a high-cost mortgage under the

Dodd-Frank amendments.

Due to the liabilities and stigma associated with high-cost

mortgages, lenders typically refuse to make these types of

loans. The other real impact of HOEPA will be felt by the 19

million Americans who live in manufactured homes, who could see

their ability to resell their homes effectively wiped out

because lenders would be unwilling to provide the financing

needed to help them sell their homes.

Our regulatory challenges are not limited to HOEPA and the

Dodd-Frank Act. The industry is already feeling the impact of

the SAFE Act, which requires States to establish standards for

licensing mortgage loan originators. Unfortunately, there has

been a lack of clarity and uniformity in applying the SAFE Act

to the manufactured housing market, specifically the

manufactured home retailers and their salespeople.

Similar to real estate brokers, manufactured home retailers

are in the business of assisting customers through the home-

buying process. However, unlike conventional real estate, there

are a limited number of banks that offer financing for

manufactured housing. Without the assistance of the retailer

and salespeople, the consumer would be–it is very difficult to

locate a manufactured housing lender.

Salespeople are fundamentally involved in the business of

selling homes, not originating mortgage loans. When they do not

receive an incentive or compensation from a lender, then they

should not be fearful to show a customer what financing options

are available or answer basic questions about the lending

process.

Additionally, as States have attempted to implement the

SAFE Act, the impact has been inconsistent. Because of delays

in the Federal rulemaking and the resulting differences and

approaches taken at State levels, manufactured home retailers

are often concerned with providing the most basic level of

technical assistance and service to customers.

While MHI fully supports the mission of the SAFE Act,

consideration should be made for the unique manufactured home-

buying process. Our industry is critical for housing and

providing jobs in America. Over the past decade, new

manufactured home construction has declined nearly 80 percent,

which has accounted for 160 plant closures, more than 7,500

retail center closures, and the loss of over 200,000 jobs.

More importantly, thousands of manufactured home customers

may be limited in their ability to purchase, sell, or refinance

homes. Without action in these key areas, the people who live

in manufactured homes and those whose livelihood is connected

to this industry face significant risk.

I thank you for the opportunity to testify and welcome your

questions later.

[The prepared statement of Mr. Clayton can be found on page

36 of the appendix.]

Mr. Hurt. Thank you, Mr. Clayton, for your testimony.

The next witness who will testify will be Tyler Craddock,

and he is the executive director for the Virginia Manufactured

and Modular Housing Association. He is in Richmond, and he is

from Southside.

Welcome, Tyler, and you are recognized for 5 minutes.

STATEMENT OF TYLER CRADDOCK, EXECUTIVE DIRECTOR, VIRGINIA

MANUFACTURED AND MODULAR HOUSING ASSOCIATION (VAMMHA)

Mr. Craddock. Thank you, Mr. Chairman. Thank you for the

opportunity to testify this morning on the state of the

manufactured housing industry, and thank you for hosting this

hearing.

My name is Tyler Craddock, and I am the executive director

of the Virginia Manufactured and Modular Housing Association.

Founded in 1965, VAMMHA is the voice of the factory-built

housing industry in Virginia. We represent producers and

retailers of manufactured and modular housing, community

owners, lenders, suppliers, and others involved in providing

Virginians with well-constructed, factory-built, affordable

housing choices.

While most of our work is at the State and local level, we

recognize that manufactured housing, by its very nature,

requires a great deal of attention to Federal legislative and

regulatory activity. For that reason, we are active members of

and work in close partnership with the Manufactured Housing

Institute, very ably represented here this morning by Kevin

Clayton, with Clayton Homes.

Manufactured housing is an important component of the

housing stock here in Virginia. According to the 2010 census,

it comprises about 5.6 percent of the overall housing stock in

the Commonwealth. But that does not tell the entire story.

In many rural localities, especially in Southside and

southwest Virginia, according to the 2000 census data–that is

the latest data we have available on a county-by-county basis–

the proportion of manufactured homes exceeds 15 to 20 percent

of the housing stock. That is no small wonder, given the

relative lack of construction labor in many rural communities

and the affordable nature of manufactured homes in Virginia.

In 2010, for example, the average cost of a new

manufactured home in Virginia minus land was $58,500. In spite

of manufactured housing’s status as an affordable choice for

many Virginia families, the manufactured housing industry in

Virginia is limping along at present.

In 1990, over 5,400 homes were shipped into Virginia. That

number rose to over 7,000 homes in the mid- to late 1990s and

dropped over time to only 1,155 homes in 2010. Thus far in

2011, we are at approximately 30 percent off of our numbers

from 2010, having only 670 shipments as of the end of

September.

The decline in manufactured home shipments is mirrored in

the decline we have seen in the number of manufactured homes

actually produced here in Virginia. In 1990, 3,595 homes were

produced in the Commonwealth. In the years that followed, that

number went as high as 4,422 homes in 1998, but declined to

only 113 homes in 2009.

While many of the issues we face are State or local in

nature, and others testifying today can offer more in-depth

perspective on the Federal issues affecting our industry, I

would certainly be remiss if I did not highlight a couple of

issues that have arisen as I have visited with VAMMHA members

around the State. First and foremost, the lack of financing

from manufactured home purchasers is putting many of our

customers and our industry overall in a pinch.

Time and time again, retailers tell me that they have

customers who are ready and willing to purchase a new home, but

they cannot get financing for the purchase. In many cases,

these are families who, in years past, would have had no

trouble qualifying for a loan, but they cannot do so now.

In addition, for our customers who qualify, there remains

the real threat that their home will not appraise for a value

that will allow their home purchase to move forward. While

appraisals are tighter across-the-board for the entire housing

industry, a number of my members report that the problem lies

not so much with appraisals in general, but with specific

appraisers who do not understand our product and its unique

nature. As such, there may be an opportunity for the industry

and HUD to work in partnership to help ensure that appraisers

are well educated with respect to manufactured homes.

Another issue that continues to concern our membership is

the SAFE Act. While the final rule promulgated by HUD earlier

this summer provides some helpful guidance and flexibility for

our State regulators, it does not entirely clarify issues of

critical concern to the industry.

The industry is seeking additional statutory language to

clarify that licensed manufactured home salespersons not

engaged in loan origination activities are not mortgage loan

originators and, thus, subject to licensing. As it stands,

given the unique nature of the retail side of our industry,

manufactured home retailers, who are not in the business of

making loans, could be on the hook for thousands in licensing

fees at a time when they can least afford it.

In addition, the industry is seeking relief for those who

originate only a small number of manufactured home loans on an

annual basis and for those sellers financing the sale of their

own manufactured homes. At a time when financing options are

very limited for manufactured home buyers, regulatory burdens

imposed by the SAFE Act are further limiting the few financing

options available to low- and moderate-income manufactured home

buyers.

Mr. Chairman, thank you for the opportunity to testify, and

I certainly welcome any questions.

[The prepared statement of Mr. Craddock can be found on

page 45 of the appendix.]

Mr. Hurt. Thank you, Mr. Craddock.

We also have with us Stan Rush, who is an account

representative with MHD Empire Services Corporation here in

Danville. Mr. Rush, thank you very much for joining us today,

and we will recognize you for 5 minutes.

Thank you, sir.

STATEMENT OF STANLEY RUSH, ACCOUNT EXECUTIVE, MHD EMPIRE

SERVICE CORPORATION, AND VICE CHAIR, VIRGINIA MANUFACTURED AND

MODULAR HOUSING ASSOCIATION (VAMMHA)

Mr. Rush. Thank you, Chairman Hurt, and members of the

subcommittee for the opportunity to testify regarding the state

of manufactured housing personal property financing.

My name is Stanley Rush, and I am an account executive with

MHD Empire. I am also currently serving as vice chair of the

Virginia Manufactured and Modular Housing Association.

I have in worked many different areas of the manufactured

housing industry since 1981 with almost 20 years of

manufactured housing personal property financing experience.

The most serious obstacle that exists with personal property

financing is the SAFE Act and its inherent regulations.

Primarily, States do not know how to enforce the new

regulations. Most States, especially Virginia, already had

predatory lending laws that were passed years ago. The SAFE Act

has confused a situation that was working.

The SAFE Act creates confusion for the manufactured housing

salespeople who are assisting customers with the process of

obtaining financing for affordable homes they want to purchase.

There is great uncertainty about the SAFE Act and how it

applies with respect to the need for manufactured housing

salespeople to obtain a mortgage loan originator’s license to

be able to assist with a credit application.

Manufactured housing salespeople are licensed and regulated

by the State. Any additional licensure is costly and

unnecessary, as the salespeople are not making any lending

decisions, merely helping with paperwork.

The SAFE Act is also preventing manufactured housing

community owners from doing their own financing, which is

necessary at this time because so many sources of money are no

longer available. While the recent guidance from HUD and

conversations between our industry and State regulators have

been helpful, they are based only on current interpretations

and, as such, are subject to change in the future.

Additionally, these positive first steps do not completely

address the industry’s concerns. That is why we strongly

encourage you to support clarifying language to state that

manufactured housing salespersons not engaged in loan

origination do not need to be registered, and language that

provides some relief to folks making only a few loans and

sellers financing the sale of their own homes.

At one time, there were more than a dozen national lenders

doing manufactured housing personal property financing. Now, we

are down to four. One of the reasons personal property

financing has become so scarce is that banks are being told by

regulators that if it is the least bit out of the ordinary,

don’t do it.

Manufactured housing personal property financing is out of

the ordinary, and thus, the banks stay away. The new financial

regulatory format is only making this situation worse.

Our industry is by no means perfect. None is. But we have

gotten caught up in a perfect storm of unintended consequences

that, on top of the prolonged poor economy, is keeping our

customers out of the most affordable housing available today.

Thank you again, Chairman Hurt, for the opportunity to

testify today, and I will be glad to answer any questions that

you may have.

[The prepared statement of Mr. Rush can be found on page 55

of the appendix.]

Mr. Hurt. Thank you for your testimony, Mr. Rush.

And now, it is my pleasure to introduce Scott Yates, who is

president of Yates Homes in Pittsylvania County. It is a

family-owned business that has operated since 1986, and thank

you very much for coming down to the big City of Danville–

[laughter]

Mr. Hurt. –to testify. You are recognized for 5 minutes.

STATEMENT OF SCOTT YATES, PRESIDENT, YATES HOMES, AND PAST

CHAIR, VIRGINIA MANUFACTURED AND MODULAR HOUSING ASSOCIATION

(VAMMHA)

Mr. Yates. Thank you, Congressman Hurt, for giving me the

opportunity to appear before you today.

My name is Scott Yates, and I am president of Yates Homes,

a family-owned business that has operated in Pittsylvania

County since 1986.

Over the course of my career, I have sold manufactured and

modular homes, and I own and operate a manufactured housing

community. I am also a member of the Virginia Manufactured and

Modular Housing Association, have served as its chairman, and I

am also a member of the executive committee, the board of

directors, and had the pleasure of being elected to MHI,

representing Virginia for a number of years.

From day one, I have sold manufactured homes because I knew

there was a need for affordable housing, but wanted to help

consumers realize the American dream of homeownership. For

quality of life and economic competitive reasons, every

community needs a steady, well-built supply of affordable

housing choices, and I decided early on that I wanted to play a

part in helping provide that in Southside Virginia.

Since 1986, I have seen our industry hit some of its

highest points, and likewise, I have been through some of its

toughest times, as is the case today. At the peak of the

industry, our business sold 180 houses a year and employed 19

people. As the economy went into a tailspin and the housing

market slowed to a crawl, I have had to adjust our company to

only 5 employees, including myself and my partner, and we are

only selling 30 homes a year.

This being the third downturn we have been through and the

longest of my career, I think we have outsmarted ourselves for

the sake of fixing the housing problem and forgotten

commonsense resolutions. With the constant pressure of

government regulation at all levels, and a lack of reliable

financing sources for customers, we have turned to modular

homes instead of manufactured homes.

The finance community has turned from manufactured homes

because of secondary markets not wanting to buy portfolios that

contain this type of housing. The true loser is the customer

who wants to provide shelter for their family at an affordable

price and who understands that manufactured housing is a viable

option to do exactly that.

Four years ago, we recognized that lending sources for

manufactured home buyers were drying up. As such, we deemed it

necessary to explore an alternative business model so that our

company could survive. We moved into modular homes because they

are built to the prevailing local codes, which is the Virginia

Uniform Statewide Building Code, the same standard that applies

to site-built homes.

They have fewer restrictions for customers seeking

financing and feature many of the same terms as the site-built

homes. With manufactured homes, the interest rates are

generally higher. In addition, we observed that the appraisals

were coming in well below the price for which the home had

sold.

Finally, it got to the point that selling manufactured

homes was a losing scenario from a financial point of view. We

were selling at a lower margin and being cut to the point that

we could not make a small profit to keep our company going.

In this scenario, however, the true loser is not me or our

company. The true loser is the American people. Not every

family can afford a home over $100,000. These are the families

today who are suffering the most in our economy. They are being

squeezed between job losses and the increasing cost of

providing necessities like food, clothing, and whatever type of

shelter for their families.

In time, this leads to more people depending on our

government to support them, thereby perpetuating the cycle of

entitlement and spending that has brought our Nation to the

brink of financial destruction. That is certainly not what this

country was founded on, and in my opinion, it is not the

direction our forefathers had in mind when they bravely affixed

their names to the Declaration of Independence.

In closing, I would like to share a story from my first

year in business. A couple came in with two children. The

loving father and mother wanted to provide a home for their

family. We had a $4,000 used manufactured home for sale. They

wanted to put it on the property that their family owned.

The father and mother had saved and worked hard to purchase

this home. When they wrote us a check for the $4,000, the

notation in the memo line contained two very simple, but

powerful words, “a home.”

I never forgot that family, and those words that remind us

that whether a home has a $1 million price tag or a $4,000

price tag, it is a home that meets their housing needs and

provides a home for their family.

Chairman Hurt, thank you for the opportunity to testify

today, and I welcome any questions.

[The prepared statement of Mr. Yates can be found on page

65 of the appendix.]

Mr. Hurt. Thank you very much, Mr. Yates.

I would now like to recognize for 5 minutes Mr. Adam Rust,

who is the research director for the Community Reinvestment

Association of North Carolina, and he comes to us from Durham,

North Carolina.

Mr. Rust. That is right.

Mr. Hurt. So thank you for being with us, and you are

recognized for 5 minutes.

STATEMENT OF ADAM RUST, RESEARCH DIRECTOR, COMMUNITY

REINVESTMENT ASSOCIATION OF NORTH CAROLINA

Mr. Rust. Honorable Chairman Hurt, thank you for inviting

me to testify before your panel today.

My name is Adam Rust, and I am the research director for

the Community Reinvestment Association of North Carolina. Our

main focus is housing finance. I am the author of, “This Is My

Home: The Challenges and Opportunities of Manufactured

Housing.” And since 2010, I have served as a general member of

HUD’s Manufactured Housing Consensus Committee.

In my opinion, today there is no better example of a

community that is obstructed from accessing good credit than

the local manufactured housing park. That is why I think it is

important that this hearing is happening today.

To your first question, what has caused the manufactured

housing industry to go from 300,000 units produced in 1999 to

only 50,000 units in 2010? I would offer that an equally valid

question is, what would help the manufactured housing industry

ship more homes in the near future?

I see two opportunities–better participation by the GSEs

and a better industry effort to take advantage of demographic

change in our population. The manufactured housing industry

finds it hard to ship more units because fewer people can get

the financing they need to buy the homes.

I agree with the sentiment expressed by Mr. Rush, Mr.

Clayton, Mr. Yates, and Representative Hurt. Your opinion of

personal property lending may determine your thoughts on the

most important issues for how credit is accessed, how we

interpret the way that the GSEs operationalize their duty to

serve in the case of manufactured housing.

The GSEs have expressed that they want to narrow their

commitment to only real property. I believe that we need to

find a middle ground. I believe that the GSEs can be a lever

that elevates the quality of manufactured housing lending for

personal property. I imagine that if a GSE did focus on buying

these loans, it would serve as a lever to elevate the quality

of lending.

I think there are important conditions to set with that,

including full disclosure under RESPA for closing costs, no

balloon payments, and loans that do not bind people unable to

get a refinance in the near future.

Secondly, the manufactured housing industry needs to do a

better job of serving people with disabilities. We know the

population is graying. The point of purchase is not when you

know if you will need a home with disability protections. As an

example, you never know if you are going to need a seatbelt,

but I believe that we are all glad that cars now come with

seatbelts.

We know the population is graying, and I think it is about

finding a middle ground. And to that, I want to say that I

voted against the sprinkler proposal. But hallway widths are an

important topic.

I have two letters that I have brought today from the

Paralyzed Veterans of America and the American Association of

People with Disabilities. Both of them specifically asked the

Manufactured Housing Consensus Committee to establish a minimum

hallway width of 36 inches in the HUD code.

The actions to consider with regard to financing include

that the GSEs should not just focus on real property, but also

on personal property loans, and that we change the rules

associated with the GSEs’ MH Select program, which currently

require PMIs for some homes with higher LTVs. For better or

worse, there were less than 200 PMI contracts written for

manufactured homes in 2010, compared to more than 10,000 just

as recently as 2004. The products are not being offered.

We need to create credit enhancement facilities for second

position loans to help people acquire manufactured housing

parks. And last, we need to engage and encourage State housing

finance agencies to use their tax credit dollars to encourage

manufactured housing lending.

Straight to the third question, what role will the CFPB

play for the manufactured housing industry under Dodd-Frank, I

believe that Dodd-Frank will reward the good guys by

eliminating the competitive threat posed by a race to the

bottom among financing companies. CFPB’s focus is on consumer

protection. It is not the SAFE Act. It is different.

And here is what is wrong with personal property lending.

We know that it is hard to shop around for a better loan when

the financing comes from a retailer that is selling the home.

It is even harder when there is no requirement for closing

costs. And then, ultimately, the homes come with features that

may change the ultimate resale value of the home, including

balloon payments or prepayment penalties.

One in five borrowers ends up unable to make their

payments. Some people are getting these loans that they

couldn’t qualify for a mortgage. It is bad for consumers, and

it stands to reason that this will be bad for the future of the

industry.

In fact, the problems facing manufactured housing took

place and developed before the idea of the CFPB was even

imagined. The CFPB will not regulate manufacturers. It will

supervise, enforce, and write rules only for nonbank financial

institutions and only if they are considered larger

participants.

The CFPB is only about making sure that people get the best

financed product that they deserve, and I think that enhancing

the role of the GSEs is the first step to making that happen.

Ultimately, and to conclude, as transactions become more

transparent and as more finance products prove to be sound,

results will be seen and the quality of manufactured housing

communities and the experience that owners have and in the

perception of the industry–I believe that the only way that

the industry will go forward and return to health is to address

this issue of financing.

Thank you.

[The prepared statement of Mr. Rust can be found on page 58

of the appendix.]

Mr. Hurt. Thank you, Mr. Rust.

The next witness that we will hear from is Ms. Carla Burr.

She is a manufactured housing resident, and she is from

Chantilly, Virginia. And we will recognize you, Ms. Burr, for 5

minutes.

STATEMENT OF CARLA BURR, MANUFACTURED HOUSING RESIDENT

Ms. Burr. Thank you.

Good morning, Vice Chairman Hurt, and I thank you for the

opportunity to testify.

My name is Carla Burr, and I am a proud owner of a

manufactured home in Chantilly, Virginia. But I am not just

representing myself. I am representing 17 million families who

live in these homes across this country.

Owners of manufactured homes are frequently ignored by

Federal housing policy. So I am very grateful that we have this

attention paid to it today.

We believe if you want to understand why manufactured home

sales have dropped so dramatically, it is critical to ask the

homeowners and buyers and residents among these communities:

Would you recommend them to others? Would you recommend your

child buy one?

I would certainly recommend someone buy a manufactured

home. My only mistake was putting it in a park, where I have no

control. The issues regarding manufactured housing in a

community such as ours is so grave that people are walking in

and turning in their title to their home because they can’t

sell it. It is too old. They can’t get a replacement.

There are many people in our community who are suffering so

badly that they can’t even buy food. It is a toss-up between

food and medical bills and lot rent.

In my particular community, the lot rent is going to

increase this next year to $919 a month. In most communities,

we are finding the lot rent is higher than the mortgage, and

this is unconscionable. In some communities, the lot rent is

almost equal to the mortgage.

We know one homeowner in my community, their lot rent is

like $100 less than their mortgage. A $2,000 a month payment

for a manufactured home in a community is just absurd.

What we are facing right now is a constant threat by the–

not manufactured housing, but by the landlord of this property.

We are really considering how we are going to try and get out

of this community. We would like to buy it. We would love to

buy the property.

In fact, if I had the chance to buy the land my house sits

on, I would do it in a heartbeat. But there are no provisions.

We don’t have any rights as far as homeowners. There is no

right of first refusal for us.

The landlord could basically sell the property out from

under us, and we would never know until the sale happened. And

then, we would be frantically trying to find someone to buy our

home for less than what it is worth.

Right now, we have been successful as a community in

getting our property taxes lowered because the assessment

values were way out of line. We felt that they were using this

Wingate appraisal method to actually assess our homes, and we

found it to be absurdly unrealistic. My house I could probably

sell for less than half of what I paid for it, and I would be

lucky to get that.

Anyway, for the nearly 3 million homeowners like me on

leased land, we are in a financially precarious position. We

are not notified if the land owner decides to sell. Like I

said, we don’t have right of first refusal.

There are practices of certain community owners that

further erode the value of my investment if I want to sell. For

example, landlords can refuse to sell to someone who wants to

buy my home. They can limit how I market my house. They can

steer potential buyers to other homes within the community,

toward their product, which is happening in my community.

In my community, it has gotten so bad that people are

turning in their title, which I have said. We feel like

prisoners in a feudal system.

The other practice is where management is not equitably

applying the rules across-the-board. They single out those of

us who are taking action to effect change. They try and

persuade other homeowners to not attend our meetings because we

are really seeking to get the whole community involved.

They single out those of us who are taking action, and they

use tactics to scare the homeowners. “We are not going to

renew your lease.” Whether they do it or not, we don’t know.

This is an unacceptable position to be in, in any community.

And why is the manufactured housing community singled out?

Because of nonexistent protection under the law. Although

Virginia does have some vague laws about this type of

retaliation, and even our rental agreement says the landlord

cannot retaliate, they basically ignore those rules.

I truly believe that manufactured housing can be a part of

the solution to our need for affordable homes, and can create

jobs, save energy, and provide attractive homes for people who

want to buy them.

There is much that Congress can do to improve the

regulatory marketplace so buyers get the best possible loans,

and ensure that Federal agencies use their resources to help

homeowners buy a quality home that they can afford, and require

protections for owners living in communities. Everyone–the

people who build the homes, the people who sell the homes, the

people who finance the homes, and the people who buy these

homes–should work together to improve outcomes for buyers like

me.

I would love to provide an unqualified recommendation for

manufactured housing. However, until we fix the financing issue

to provide equal access benefits and ensure secure tenure,

manufactured home sales will remain slack.

Finally, as an owner of a manufactured home, I really look

forward to the day when we have equal rights under the law as a

homeowner. Whether it is stick-built or some other condominium,

we are also petitioning our local representatives in Virginia

to pursue some sort of rent control or restructuring so that

land owners cannot raise the lot rent without impunity. And

there needs to be some sort of ceiling.

We know rent control is gone for the most part in this

country, but for our purposes, there is no way we can stay. We

have determined there is no affordable housing in Fairfax

County. It doesn’t exist. And an article in the Washington Post

even confirmed that.

So thank you for listening.

[The prepared statement of Ms. Burr can be found on page 29

of the appendix.]

Mr. Hurt. Thank you, Ms. Burr, very much for your

testimony.

Not on the program is a gentleman from the Manufactured

Housing Association for Regulatory Reform. His name is Mark

Weiss. He is behind you, Ms. Burr. If we could get that

microphone to him, I would like to ask unanimous consent to

recognize him to make a brief statement for the record.

He comes from Washington.

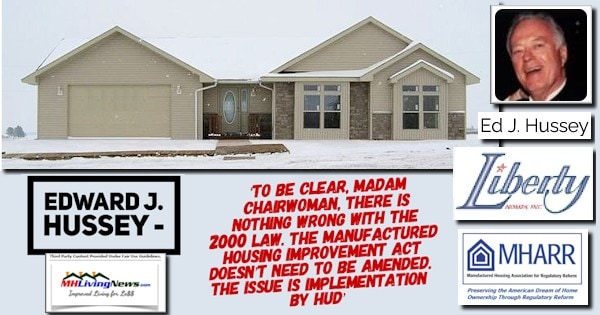

STATEMENT OF MARK WEISS, SENIOR VICE PRESIDENT, MANUFACTURED

HOUSING ASSOCIATION FOR REGULATORY REFORM (MHARR)

Mr. Weiss. Thank you, Mr. Chairman. I appreciate the

opportunity to speak here today.

Mr. Hurt. Yes, sir. Thank you.

Mr. Weiss. My name is Mark Weiss, and I am senior vice

president of the Manufactured Housing Association for

Regulatory Reform.

MHARR is a national trade association of mostly smaller

producers of HUD-regulated manufactured housing. MHARR first

requested an oversight hearing on the HUD Manufactured Housing

Program and was promised such a hearing by Chairman Bachus

earlier this year. MHARR specifically requested an oversight

hearing on HUD’s failure to fully and properly implement key

reform provisions of the Manufactured Housing Improvement Act

of 2000.

We expressed our wish to present testimony showing the

devastating impact of that failure on the industry and

particularly the smaller independent manufacturers that MHARR

represents, as well as American consumers of affordable

housing, which would then provide the committee with a basis to

seek answers from HUD officials on those issues.

The smaller businesses represented by MHARR have major and

specific grievances based on HUD’s failure to fully and

properly implement those key reforms of that law, reforms that

were designed to ensure that manufactured homes are treated as

housing rather than the trailers of yesteryear. Some of those

reforms have been distorted, others have been ignored, and yet

others have been effectively read out of the Act entirely by

process of interpretation.

We trust and hope that during the next session of the 112th

Congress, a hearing on those specific implementation issues

will be held where our small business members and their

witnesses can appear and testify before the committee. In the

interim, we would ask that my statement be included in the

record, as well as a series of fact sheets specifically

addressing those implementation issues that we have prepared

and will submit to the committee.

Mr. Hurt. Without objection, those documents will be

admitted to the record. And thank you for your statement, Mr.

Weiss.

Mr. Weiss. Thank you, Mr. Chairman.

Mr. Hurt. Now, we will commence with a period of

questioning for the witnesses, and I will ask a few questions.

First up, Ms. Burr, thank you for your testimony. One of

the things that I was wondering about as you testified was

whether or not there is a market for being able to sell your

home in the, I don’t know if you call it the secondhand market

or used market?

Ms. Burr. Yes.

Mr. Hurt. Is there a market for that? And I would imagine

living in Fairfax County, like you do, that it would be very

difficult to find affordable housing in Fairfax County. We

would, just for the record, invite you to move to Pittsylvania

County.

[laughter]

Mr. Hurt. But with that said, is there a vibrant market at

this time for used manufactured housing?

Ms. Burr. Not from what we can see. The county has actually

made it so difficult. They have changed the zoning on some of

the land. You can’t actually move it. If you buy a piece of

land in Fairfax County, it is probably zoned in such a way that

you can’t put your home on it. So even if I could move it,

there is nowhere to move it.

And I have checked with communities like ours all the way

into Maryland and West Virginia. They don’t have lots big

enough to put my house on. And if you want to buy a piece of

property, the zoning doesn’t allow you to move it there. So we

are stuck.

Mr. Hurt. Okay. Thank you.

And Mr. Rust, I would like to ask you a question. If you

would try to use the microphone for the court reporter, if you

don’t mind?

Thank you for your testimony, Mr. Rust. I was wondering if

you could just address–you talked a lot about the GSEs, and of

course, that is something that has taken up a lot of our focus

in Washington is dealing with Fannie Mae and Freddie Mac and

how do we–taxpayers provided a $160 billion bailout for those

two organizations. And I think that there is across-the-aisle

support for trying to wind those down.

The key, the key to the success for that, though, will be

bringing the private sector into the secondary mortgage market.

That is the only way it works if we don’t want to make it worse

for housing and make it worse for the real estate market.

So I was wondering if you could speak to that. Obviously,

it would be nice to see that secondary mortgage market evolve

in the private sector, and I didn’t know if you had any

comments as it relates to that?

Mr. Rust. It is true that there is hardly a market for

those kind of homes on the private investor side. One issue

that–

Mr. Hurt. How do we correct that without–

Mr. Rust. Okay. So I am worried about the loan level price

adjustments, which are a series of costs that are imposed on

the delivery of manufactured homes or any mortgage to the

secondary market. And specifically, I am concerned about the

additional costs that are passed on for borrowers even when

they haven’t demonstrated a poor credit record.

There is an additional fee specifically designated for a

manufactured home so that is raising cost that is passed on

either in the interest rate or in the closing costs. And so,

that is one thing I would encourage you to look at because I

think it is a little bit under the radar, and it has been

taking place since about 2009 and continues to evolve. But it

is really hurting the secondary market and liquidity.

Mr. Hurt. Okay. Thank you.

Mr. Yates, I have a question for you. Thank you again for

your testimony, and I appreciate the 35 years of experience

that you bring to this.

When you think about the regulatory structure, and I don’t

mean just as it relates specifically to manufactured housing

and modular housing, but the regulatory structure generally,

just as a small business, a family-owned business for 35 years,

I would imagine that those regulatory burdens, whether it be

taxes or whether it be environmental issues, can you talk a

little bit about that burden just generally as a small

business?

And do you have any advice for us in terms of how we make

it easier for you to succeed so that you are not–your

testimony is very compelling when you talk about how your

business has changed in the last 10 years.

Mr. Yates. The regulatory environment is a moving target.

It is constantly moving. I will give you one quick example.

Basically, bringing the consumer back into it because that is

what drives all of our businesses. It is not just myself; it is

the consumer.

In Pittsylvania County today, it costs $700, approximately

$725 just to get a well and septic permit. Now that is before

you do anything. That is just a permit on the property to say,

I can put a home here, whether it is a manufactured home, a

modular home, or a stick-built home.

But from the consumer, the regulation that is coming down,

the permit for this, the permit for that, and I understand the

State needs its funding, local government needs its funding.

But–

Mr. Hurt. It all adds up, doesn’t it?

Mr. Yates. Absolutely. And it takes people who want to buy

from our business, it takes them off of the buying arena

because these fees keep adding up.

I can remember when my closing files used to be this big.

Now, they are this big.

Mr. Hurt. Right.

Mr. Yates. We had someone out of Richmond come in last week

and check our company. We are visible. So we are constantly

getting people in, making sure you have this license, you have

that license. I am not saying license is a bad thing. I think

it needs to be regulated.

But again, as I said in my statement, when we get past,

when we outsmart ourselves and we forget the commonsense

approach to, number one, the consumer, and number two, to

business, we are hurting from top to bottom all the way down.

Mr. Hurt. Sure. Thank you.

Mr. Rush, you talked a little bit about the appraisal

standards and the changes that were brought by Dodd-Frank. And

I was wondering if you could just talk a little bit about those

appraisal standards and how those changes have and will affect

the marketplace.

Mr. Rush. The problem that has come into, and I think it is

affecting the real estate market also is that the Federal

guidelines are one thing, and then each lender has their own

set of guidelines for how they are doing manufactured housing

and how they are doing site-built housing.

Right now, we have a situation where a modular home can be

built to the statewide building code and the frame can be left

under it. And if that is the case, then the Federal guidelines

from FHA are that the appraiser has to appraise it like a

manufactured house, a HUD code manufactured house, which means

they can only use comps that are HUD code houses. That limits

the comps, especially in the market today, where there are not

that many being sold, and there are almost none being resold

because of the appraisal process and the lack of financing.

So they are condensing us down into a little, small pinhole

that is not helping the industry, and it is drastically hurting

the industry as far as appraisals. We need to be able to comp a

mod to a mod if that is–or site-built because they are built

to the same code, whether it has a frame under it or it doesn’t

have a frame under it. That is just one area where the

appraisals are being affected.

The other thing is that they are not supposed to be using

foreclosures for comps, and the appraisers are. And it is

hurting the prices because people are doing short sales.

Lenders are doing short sales. We don’t have any bigger problem

with foreclosures than the site-built industry, but we all have

them right now with the way the economy has been going for such

a long period of time, with folks out of work.

So there are foreclosures out there in both the site-built

and the manufactured housing industry. These things are all, as

I said in my testimony, a perfect storm of negative things that

are affecting our industry.

Mr. Hurt. Good deal. Thank you, Mr. Rush.

Tyler, a question for you. From your viewpoint in Richmond,

can you just talk a little bit about how the Federal–dealing

with HUD and the Federal regulations, as well as the State

regulations and the local regulations that Mr. Yates was

talking about, can you talk about that dynamic? What are the

regulations that are the hardest to deal with? Who can learn

from whom maybe is another way to–

Mr. Craddock. Certainly. A couple of issues specifically.

One, of course, and we have mentioned it, is the SAFE Act. That

is one of the poster children because in Virginia we have the

State corporation commissions and the Bureau of Financial

Institutions, which regulates–which is enforcing the SAFE Act

in Virginia, for lack of a better term.

What that has created in this dynamic is–and we have seen

it in other States–that is why I am talking to my counterparts

in other States–is this dynamic where we have State regulators

who may be willing to work with us on some of the flexibility

that our industry needs, but they feel that their hands are

tied because of the guidance they are getting from HUD. And

certainly as a lobbyist, you are not going to lobby the State

government, saying you need to go against what HUD is telling

you, go against the Federal Government. Don’t mind the

supremacy clause, etc.

One of the other areas where we see that dynamic play out,

though, and we didn’t mention it as much here, is in the actual

administration of the HUD code itself. The thing about this,

you have, for lack of a better term, a Federal building code

that is a Federal code that is administered in Virginia by the

State. We have an SAA, a State administrative agency, which is

the Virginia Department of Housing and Community Development,

but then is enforced by local officials.

So you have this building code that really is being acted

upon at three different levels. And what that ends up at the

end of the day, I have had retailers tell me you end up in a

situation where local building official says “X” needs to–

putting a house on the site, “X” needs to be done.

The retailer says, no, that is not what is in the HUD code.

So you end up with this 2-day runaround trying to call Richmond

and get an answer because Richmond is trying to enforce

something on behalf of HUD. And so, it does create a confusing

dynamic at times.

Mr. Hurt. How do you fix that?

Mr. Craddock. That is the million dollar question. Because

when you are out there, when you are waiting on a certificate

of occupancy for a home, do you really want to butt heads with

the same inspector who is going to not only be inspecting this

home, but the next one that you hopefully have closing in 2

weeks and 2 or 3 weeks after that?

A lot of the key for us, we have found, rather than some

sort of punitive fix or slap on the wrist is just simply better

education and communication. In a lot of instances, as far as

administration of the HUD code on the local level and the

building official level is simply working–and our SAA has been

really good and diligent about this, but it is just moving that

process forward. It is a process that is ongoing so we have to

keep working at it.

Mr. Hurt. Okay. Thank you very much, Mr. Craddock.

Mr. Clayton, I would love it if you could–if you had

anything to add to his question that I asked about the Federal,

State, and local dynamic. And then I also wanted you to

comment, if you could, it is my understanding that HUD intends

to raise the label fee from $39 per label to $60 per label. And

I wanted to find out if you had any thoughts on how that would

affect the marketplace. So, if you could address both of those

issues?

Mr. Clayton. There is nothing specifically I would add to

that. I think HUD is faced with doing what we have all had to

do when our sales are running about 20 percent of where they

once were. We have all had to make drastic cutbacks. So I think

looking at what the real requirement budget need is versus only

shipping 50,000 homes this year needs to be looked at

carefully.

Mr. Hurt. Okay. Do you have anything to add in terms of the

Federal, local, and State–the regulatory dynamic?

Mr. Clayton. I thought that was addressed very well

already. What our industry desperately needs right now is

legislation that will move forward, that will modify HOEPA loan

limits. Otherwise, what little is left of the industry, half of

that will be wiped out.

Because when you take a home-only customer who is not

financing land in and you are operating and the limits are

basically 6.5 percent over an artificially low, where Treasury

is helping buy down mortgage rates. So it is based off of that,

that spread there. When our cost of funds are starting out–

because we have no secondary market, we have no GSE support or

Treasury support. There has been no government help whatsoever.

Our cost of funds starting out is double because we are

going through normal commercial paper debt instruments. We

start out at a double. And that just wasn’t thought about and

recognized in the creation of the Dodd-Frank.

So it is very logical. Everybody that you mention this to,

they see the need to change it. We have great Republican

support. There needs to be some Democratic support urgently to

move that forward and stop it.

It is the last piece of the housing segment that needs to

be hurt right now. Our best-selling model right now is below

$50,000. That is where the economy is. That is all that most

people can afford right now. And that is an underserved market.