The following is from the Urban Institute report dated August 21, 2020, and is provided under fair use guidelines. It will be followed by additional information, MHProNews analysis and commentary.

Note that the figure numbers below were added by MHProNews as is our third-party image graphic. The collage below is from the Urban Institute, but beyond noted commentary, the text and images are as in the original.

22 Million Renters and Owners of Manufactured Homes Are Mostly Left Out of Pandemic Assistance

These 22 million renters and owners tend to have lower incomes and work in industries that are vulnerable to the pandemic, yet these households mostly fall outside the protections offered by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. As policymakers negotiate the next round of coronavirus relief, will they support these families?

Occupants of manufactured homes work in industries and occupations that are most vulnerable to COVID-19

Owners and renters of manufactured homes are more likely than residents of other housing types to work in industries that have suffered significant job losses during the pandemic. For example, 35 percent of owners of manufactured homes work in the five industries that have lost the most jobs during the crisis (food and accommodation, retail, construction, entertainment, and other services), compared with 24 percent of owners of single-family homes. Additionally, 43 percent of renters in manufactured homes work in the five most vulnerable industries, compared with 27 to 35 percent of renters in other types of rental units. In fact, the owners of manufactured homes are slightly more vulnerable on this measure than renters in other types of housing.

Manufactured home owners and renters working in industries vulnerable to COVID-19

We see similar results among occupations: 13.5 percent of owner-occupants of manufactured homes are service workers, versus 8.2 percent of owner-occupants of single-family homes. The same is true for 20 percent of renters of manufactured homes, higher than for any other property type except that of renters in two-to-four-unit buildings, another group that is particularly vulnerable during this pandemic.

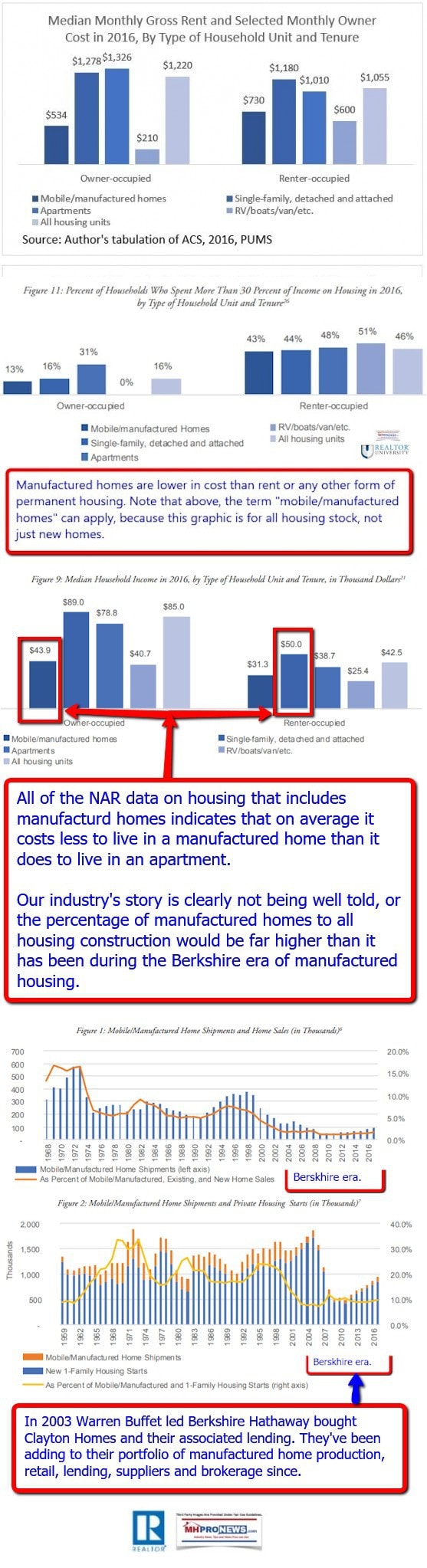

Occupants of manufactured homes have lower incomes and pay less for housing

The median income of manufactured homeowners ($38,087) is well below the $79,800 for single-family owner-occupants. In fact, the median income of manufactured home owners is comparable with that of renters in other housing types. The median income of manufactured home renters is lower than for any other group.

Median income of homeowners and renters by housing type

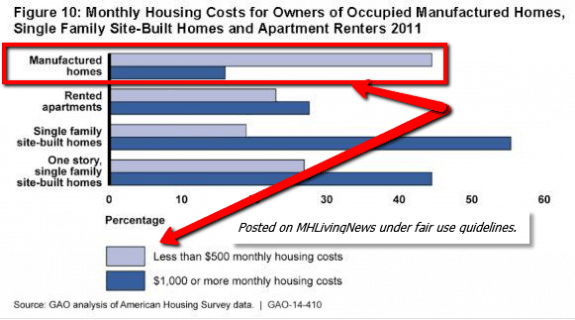

It is important to note that the cost of living in manufactured housing is well below the cost of living in other housing types. The monthly housing payment in manufactured homes is $505 for owners (which includes loan payments, lot rental payments, utilities, insurance, and property taxes) and $670 for renters (which includes rent and utilities), versus $1,168 for single-family owner-occupants and $1,079 for single-family renters.

Median monthly housing payment of owners and renters by housing type

Occupants of manufactured housing have received little government support to weather the pandemic

Despite their greater vulnerability, most owners of manufactured homes do not qualify for CARES Act forbearance relief, because 77 percent of all new manufactured homes are titled as “personal property” rather than “real estate.” Of the homes titled as personal property, only Federal Housing Administration (FHA) Title 1 loans (which allow for the purchase of the structure alone and are a tiny subset of the market) qualify for CARES Act forbearance. To take out a mortgage, the manufactured home must be titled as real property. In most states, this requires the borrower to own both the structure and the land it is sited on. Some mortgages on manufactured homes are federally backed, hence triggering CARES Act coverage, but others are not. Mortgages on manufactured home structures alone are called chattel loans, which are generally held in the portfolio of the originating institution and serviced by this institution. It is therefore up to each mortgage servicer to determine whether it wants to offer forbearance and on what terms.

Most chattel lenders are offering forbearance, but some are requiring quicker payback periods than the standard terms afforded to FHA and government-sponsored enterprise borrowers. And in many cases, the forborne amount must be repaid with interest. In short, manufactured home borrowers, who often have low incomes, generally receive forbearance on less favorable terms than wealthier borrowers with federally backed mortgages. The Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act, if passed, would extend the benefits of federal forbearance programs to households without federally backed mortgages and applies similar forbearance and repayment programs for personal debt, which would include chattel loans on manufactured homes.

Renters also did not receive immediate relief. The CARES Act eviction moratorium, which expired July 24, did not apply to most renters in manufactured homes, with two exceptions: the manufactured home parks financed with federally backed mortgages (2,400 out of 45,000) and the few investor-owned properties with federal loans. Eviction moratoriums that some cities and states imposed are also expiring. And though many manufactured home renters received the weekly $600 federal unemployment benefits, those expired on July 31, and the status of a replacement payment is unclear at the time of this writing.

The only hope for struggling renters is either an extension of unemployment benefits or passage of the HEROES Act. The latter includes eviction protections and rental assistance programs for those who cannot make their rental payments, regardless of whether the landlord has a federally backed loan.

In developing policies to keep people safely housed during the COVID-19 pandemic, it is important to identify the most vulnerable groups and the sources of their vulnerability. The 22 million renters and owners living in manufactured homes are particularly vulnerable during the pandemic because of their service-industry-focused jobs and their low incomes. They also need support during the next round of funding.”

## End of Urban Institute report, found at this link here. ##

Additional Information, MHProNews Analysis and Commentary

“To take out a mortgage, the manufactured home must be titled as real property.” That statement is demonstrably inaccurate. There are mortgages that have been Government Sponsored Enterprise (GSE) loans executed in land-lease, as MHProNews has previously reported.

Their statement that “Of the homes titled as personal property, only Federal Housing Administration (FHA) Title 1 loans (which allow for the purchase of the structure alone and are a tiny subset of the market) qualify for CARES Act forbearance,” has its evidence-based point, but fails to identify the reasons why that is so. The 10/10 rule is not mentioned, which has kept most lenders from entering into the FHA Title I lending market. Thus, the three lenders who say that they make such loans all happen to be MHI members, 21st Mortgage Corporation, Vanderbilt Mortgage and Finance (VMF) and Cavco Industries’ CountryPlace Mortgage. 21st has reportedly suspended making those loans, VMF makes them only for Clayton Homes, and the volume by CountryPlace is reportedly nominal.

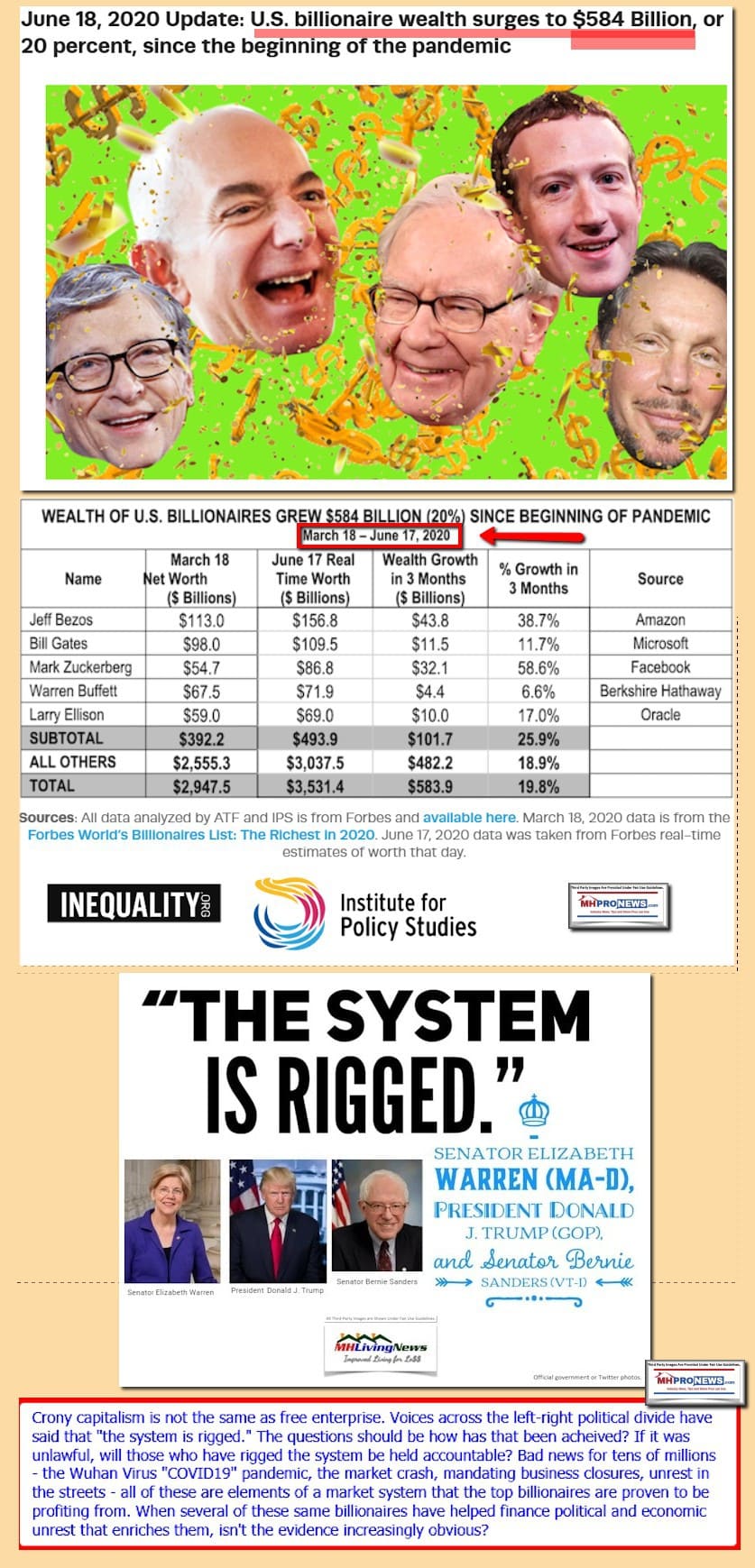

When the Urban Institute says “Mortgages on manufactured home structures alone are called chattel loans, which are generally held in the portfolio of the originating institution and serviced by this institution,” an important set of disclaimers is missed. The largest portfolio lenders are 21st and VMF. They are owned by Berkshire Hathaway. The chair of Berkshire is one Warren Buffett. Buffett is listed as a “lifetime trustee” of the Urban Institute on their page linked here. So, in fairness while that is disclosed on their website, it is not apparent on the page where this new Urban Institute article appears.

The bit from the above that “The only hope for struggling renters is either an extension of unemployment benefits or passage of the HEROES Act” is either sophistry, spin, ignorance or some cover for the agenda that Berkshire-supported MHI is backing along with their “coalition” of housing nonprofits.

In fairness, some of the information supplied by the Urban Institute is an affirmation of previous data published by the National Association of Realtors or the Government Accountability Office (GAO), which cited Fannie Mae.

But isn’t that the pattern of paltering? A mix of true, problematic, and deceptive statements?

That roofline in their photo appears to be a Cavco Industries (CVCO) new class of homes image, which suggests that MHI – as in prior Urban Institute research reports – is lurking in the background, but is doing so unnamed.

This Urban Institute report thus is framed to support a Democratic initiative in the midst of the 2020 election campaign between Democratic billionaire-backed Democratic nominees former VP Joe Biden and Senator Kamala Harris (CA-D). That implies an opposition to President Donald J. Trump and Vice President Mike Pence.

While numerous other data-points could be made, the following one should suffice to make the point. Beyond support and involvement from Warren Buffett and his interests, The Gates Foundation has donated millions to the Urban Institute, per the source shown below.

Gates and Buffett are strongly opposed to Trump as their public statements and donations have made clear.

Despite posturing, there is an evidence-based argument to be made that Gates, Buffett and other so-called progressive billionaires have for years supported causes that posture racial or economic sensitivity but in fact are working against the interests of minorities or others in the middle class.

The Republican National Convention (RNC) has just finished a week of their case for a more inclusive economy that works for everyday Americans of all backgrounds, ethnic, religious, or other groups. Part of their argument has been that Democrats have had decades in numerous cases to help urban minority groups, but there policies have in fact failed.

The thinly veiled partisan plea for a Democratic backed initiative that critics say would support private equity owned rentals is reason to suspect the motives behind this specific Urban Institute research report.

The Urban Institute logo uses the tag line, “Elevate the Debate.” They are policy advocates that provide fodder that politicians often point towards in their talking points. It is one more example of how the left arguably seeks to frame issues in a way that often benefits their billionaire benefactors.

It is just one of several apparent ways that “the system is rigged” to enrich the few while posturing ‘philanthropy’ that claims, but routinely fails, to benefit the many.

For authentic information and analysis of manufactured housing issues, turn to MHProNews and MHLivingNews. Others do.

Stay tuned for more of what is ‘behind the curtains’ as well as what is obvious and in your face reports. It is all here, at the runaway largest and most-read source for authentic manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

Related References:

The text/image boxes below are linked to other reports, which can be accessed by clicking on them.

“Follow the Money” – Controversial Urban Institute Report on Manufactured Housing

Urban Institute says Preservation, Manufactured Homes are Solutions to Affordable Housing Crisis