CNN Business and the American Enterprise Institute (AEI) Housing Center are both reporting surprisingly strong results on mainstream housing. Left-of-center CNN Business put it this way, “Nothing short of miraculous: The housing market continues to hold up.”

- An MHI member firm told MHProNews that they are back to 94 percent of pre-COVID19 levels.

- Publicly traded firms have reported that they took a hit in late March or early April, often followed by a steady climb later in April and heading into May. Others are providing a darker report, but the overall trend appears to be heading toward pre-pandemic recovery.

- Manufactured home land-lease community operators have said that they are seeing near-normal collection rates.

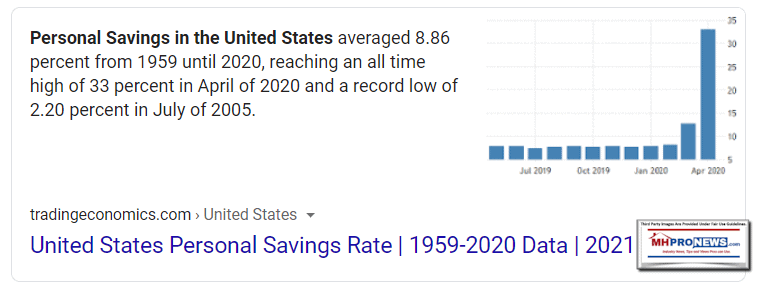

Despite tens of millions laid off, household savings rates are reportedly at record highs.

TradingEconomics put it this way. “Personal Savings in the United States averaged 8.86 percent from 1959 until 2020, reaching an all time high of 33 percent in April of 2020 and a record low of 2.20 percent in July of 2005.”

Right-of-center Fox Business reports that “While many parts of the economy are still waiting to open and rebound, the housing market has proven to be resilient in the current environment. We expect this trend to continue and for housing to be a significant driver of employment and rebound for the broader economy,” Lennar Executive Chairman Stuart Miller said in a statement.

AEI told MHProNews today about their methodology that “Nowcasting is the prediction of present economic trends using alternative data sources that are both detailed and high-frequency. This report uses real-time information on a weekly basis.” Rephrased, they are confident in their data.

There are certainly numerous issues to navigate.

But on a day when the overall equities markets rebounded on the types of headlines that will follow in our left-right news headlines, tonight’s featured focus will be the AEI data. It should provide manufactured housing professionals with some encouragement.

Quotes That Shed Light – American Social, Industry, National Issues…

Headlines from left-of-center CNN Business

- A reckoning is coming

- WASHINGTON, May 18, 2020 — A pedestrian wearing a mask walks by the U.S. Federal Reserve building in Washington D.C., the United States on May 18, 2020.

- One star investor says that markets may crash so badly that the Fed has to start buying stocks

- How the rise of supermarkets left out black America

- America just had its biggest monthly surge in retail sales ever. But that’s not the full story

- Dow hangs onto rally after soaring more than 800 points

- A wall of money outweighs virus fears — for now

- Nothing short of miraculous: The housing market continues to hold up

- ‘Pandemic pricing’ is here. Rents are dropping across the US

- Ursula Burns is tired of corporate America making excuses for not hiring more black executives

- McDonald’s is back in business. But…

- Hilton lays off 22% of its corporate staff

- Zoom is now worth more than nearly 85% of the S&P 500 stocks

- Ex-Trump adviser John Bolton’s book elicits angry reaction from Trump

- Tesla could soon open another factory in the United States

- A real estate agent shows a prospective home buyer a house for sale in Peoria, Illinois, U.S., on Thursday, May 30, 2019. The National Association of Realtors is scheduled to release existing homes sales figures on June 21.

- Opinion: The housing market will bounce back. Not everyone will benefit

- Boston Dynamics’ robot dog is now on sale for $74,500

- Working parents are hitting a wall. Employers don’t want to lose them

- MARKETS

- DIVERSITY IN THE C-SUITE

- Government and industry leaders hold a press conference on Monday 11th July 2016 to discuss the capabilities of the F-35 Lightning II fighter aircraft and efforts to cut costs for the airframe and engine. Bob Leduc, President, Pratt & Whitney (left), is joined by President and CEO of Lockheed Martin, Marilyn Hewson, and Frank Kendall, the Pentagon’s Under Secretary of Defense for Acquisition, Technology and Logistics. According to Pratt & Whitney, the company has cut the cost of the F135 engine by half since 2009. The company signed a $1.5 billion contract for 99 engines ahead of the Farnborough Air Show.

- Another woman CEO steps down: Lockheed Martin’s Marillyn Hewson

- Number of black leaders at US companies is dismal

- She was the highest-paid CEO in the S&P 500 last year

- He was one of America’s first black CEOs

- PwC chairman: How Corporate America can stop failing black workers and diversify its ranks

- HOW WE SHOP NOW

- Customers shop at a Walmart store on May 19, 2020 in Chicago, Illinois. Walmart reported a 74% increase in U.S. online sales for the quarter that ended April 30, and a 10% increase in same store sales for the same period as the effects of the coronavirus helped to boost sales.

- Look out, Amazon: Walmart.com is getting bigger

- Walmart enters the secondhand clothing market

- Secondhand clothing stores boom during pandemic

- Our pandemic shopping habits are here to stay

- Shoppers are trickling back into stores. It might not last

Headlines from right-of-center Fox Business

- RETAIL

- Dow jumps 526 points on retail sales rebound

- Seventy-six percent of U.S. CFOs with production in China say at least some manufacturing will shift out of the country.

- SHOPPING SPREE: Retail sales post record-breaking gain as states reopen

- Top economists write letter demanding more coronavirus relief

- NEWS

- Coronavirus speeds up American suppliers’ exodus from China

- WATCH: US economy will be even better than before, Trump says

- ECONOMY

- Fed’s Powell warns Congress that US deficit is on ‘unsustainable’ path

- Chairman: Full US economic recovery ‘unlikely’ until this happens

- NEWS

- ‘Stand for something’: Publix worker quits after boss sends him home for wearing this

- Trump signs executive order on police reform, chokeholds in wake of protests

- OPINION

- How to choose the right real estate agent during one of life’s most challenging times

- ‘JUST KILLED YOUR BRAND’

- NEWS

- Domino blasted over 2012 tweet thanking Trump official for compliment

- ‘MAJOR BREACH OF TRUST’

- RETAIL

- Trader Joe’s says it will reopen Seattle location near ‘CHOP’ zone after remodel

- HELPING HAND

- SPORTS

- ‘Heartbroken’ NFL star selling shirts to support Black Lives Matter movement

- NO ‘MAGIC SOLUTION’

- MONEY

- Former Obama adviser weighs in on ‘defund the police’ movement

- CEO SHAKE DOWN?

- MONEY

- San Francisco weighs ‘overpaid executive’ tax on city’s businesses

- FACING FIVE YEARS

- LEGAL

- Harvard professor pleads not guilty to hiding ties to China

- ‘NOT THEIR FAULT’

- NEWS

- Police chief defends Dunkin’ after employee reportedly turns officer away

- HOLD OFF THE PRESS

- MEDIA

- Newspapers ditch mugshots amid concerns they advance stereotypes

- EMPTY NEST EGGS

- MONEY

- The median retirement savings balance among baby boomers is shockingly low

- TENNIS, ANYONE?

- SPORTS

- Cuomo announces US Open tournament will take place, but with 1 big change

- THE SHOPS WANT COPS

- MONEY

- Seattle CHOP zone businesses worry about slow police response times

- HEAVY LIFT

- MARKETS

- Gold’s Gym CEO explains plan to comeback from bankruptcy

- LOUD AND CLEAR

- MARKETS

- T-Mobile faces FCC investigation into ‘unacceptable’ outages

- ASHES TO ASHES

- UTILITIES

- PG&E pleads guilty to 84 deaths in 2018 California wildfire

- NEW BOARDING PASS

- TRAVEL

- Major airlines won’t allow customers on planes if they aren’t doing this

- SOCIAL MEDIA

- Twitter hires former top FBI lawyer involved in Trump campaign investigation

- RETAIL

- Apple reopens 70+ more US stores after coronavirus shutdown

- LEGAL

- SBA sued over excluding convicted felons from PPP loans

- MARKETS

- Record number of big money managers say stocks overvalued after virus rally

- HEALTHCARE

- Coronavirus deaths in nursing, long-term-care facilities pass grim milestone

- NEWS

- Nathan’s announces whether this year’s hot dog eating contest will happen

- MARKETS

- Hilton to terminate thousands of jobs globally

- S.

- Seattle reaches deal with ‘CHOP’ to remove temporary roadblocks, replace with concrete barriers

- ECONOMY

- Conservative leaders urge Trump to rein in coronavirus spending as US deficit swells

- PERSONAL FINANCE

- The CARES Act lets you tap your retirement savings early — but most people aren’t doing that

- POLITICS

- Joe Biden fundraiser headlined by Elizabeth Warren rakes in record haul

- FOOD & DRINKS

- Popular burger chain reacts after cops hospitalized for possible poisoning

- ENTERTAINMENT

- Taxpayers forced to pay big price for Meghan Markle, Prince Harry’s stay

- NEWS

- China expands lockdowns as coronavirus cases top 100 in new outbreak

- TECH

- Amazon introduces social-distancing tool that alerts employees when they’re too close

- HEALTH

- Casinos push for cashless transactions to avoid bills amid virus outbreak

- CARS

- SEE IT: Ford to roll out new Bronco model on infamous passenger’s birthday

- OPINION

- Varney: US economy back on the ‘road to prosperity’

- FOOD & DRINKS

- McDonald’s same-store sales slightly down in May after April coronavirus plunge

- MARKETS

- Tesla reportedly in talks with Texas county for new assembly plant

- REAL ESTATE

- Leading home builder reveals ‘significant driver’ of jobs, economic rebound

- TECH

- Cellular networks respond to reports of widespread service outages

9 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

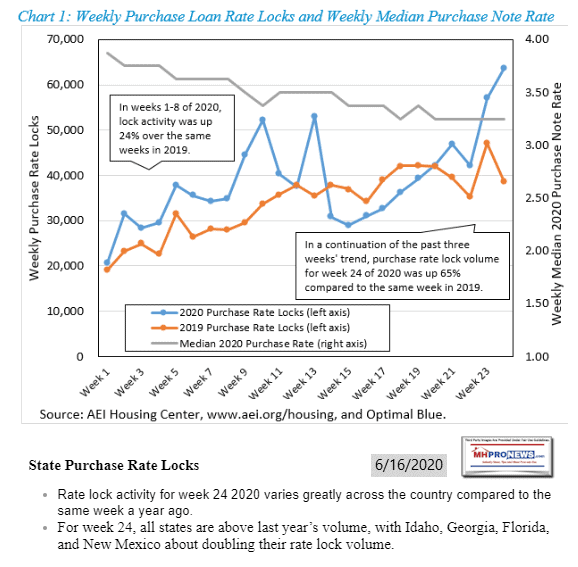

From their release to MHProNews, the following snapshot from the AEI Housing Center today.

- In a continuation of the last three weeks’ strong upward trend, purchase rate lock volume for the week of June 6 (week 24) jumped 65% from a year ago. This provides further evidence that the worst of the near term effects of the COVID-19 pandemic lockdown may be behind us on a national level.

- This jump was in part driven by low mortgage rates, which for certain weekdays of week 24 fell to a low of 3.125%, after they had fluctuated between 3.25% and 3.375% for the past 9 weeks.

- Purchase rate lock volume is back to its level from before the onset of the pandemic (weeks 1 to 8), when purchase rate lock volume was up 24% on average compared to 2019.

- Over the past 4 weeks, the market has not only recovered from weeks 14-18 when the average weekly year-over-year decline was 15%, but it has exceeded volume for the same weeks in 2019.

- As a result of the last three weeks’ strong purchase lock volume, combined with strong volume in weeks 1-13, year-to-date volume is now running 14% ahead of last year.

- However, much of the Northeast, Midwest, and West continue to lag the national trend.

- National home price appreciation (HPA) exceeded the rate before the pandemic, which may indicate the home price boom will likely continue due to low rates and heavy demand.

- For week 24, national HPA stood at 7.5%, which is slightly above week 10’s HPA of 7.3%.

- This recovery comes after HPA had decelerated to 3.7% in week 18.

| Key Takeaways:

· In a continuation of the last three weeks’ strong upward trend, purchase rate lock volume for the week of June 6 (week 24) jumped 65% from a year ago. This provides further evidence that the worst of the near term effects of the COVID-19 pandemic lockdown may be behind us on a national level. o This jump was in part driven by low mortgage rates, which for certain weekdays of week 24 fell to a low of 3.125%, after they had fluctuated between 3.25% and 3.375% for the past 9 weeks. o Purchase rate lock volume is back to its level from before the onset of the pandemic (weeks 1 to 8), when purchase rate lock volume was up 24% on average compared to 2019. o Over the past 4 weeks, the market has not only recovered from weeks 14-18 when the average weekly year-over-year decline was 15%, but it has exceeded volume for the same weeks in 2019. o As a result of the last three weeks’ strong purchase lock volume, combined with strong volume in weeks 1-13, year-to-date volume is now running 14% ahead of last year. o However, much of the Northeast, Midwest, and West continue to lag the national trend. · National home price appreciation (HPA) exceeded the rate before the pandemic, which may indicate the home price boom will likely continue due to low rates and heavy demand. o For week 24, national HPA stood at 7.5%, which is slightly above week 10’s HPA of 7.3%. o This recovery comes after HPA had decelerated to 3.7% in week 18. Note: This Nowcast is published every other week unless we observe notable market changes. Using newly acquired data from Optimal Blue, a rate lock software provider covering roughly a third of the market, the AEI Housing Center Housing Market Nowcast provides near-real-time insights on the single-family residential housing market convulsing from the effects of the coronavirus pandemic. While Optimal Blue data are used, Edward Pinto and Tobias Peter are solely responsible for the analysis contained herein. |

Data

After extensive historical analysis of Optimal Blue data going back 7 years, we have concluded that these rate lock data track closely those reported in our National Mortgage Risk Index (NMRI), which cover 99% of the agency market. As a result, today’s Housing Market Nowcast will provide an advance look at tomorrow’s housing market as today’s rate locks will become next month’s home purchases and mortgages.

Purchase Loan Rate Locks

In a continuation of the last three weeks’ strong upward trend, purchase rate lock volume for the week of June 6 (week 24) jumped 65% from a year ago. This provides further evidence that the worst of the near term effects of the COVID-19 pandemic lockdown may be behind us on a national level.

- This jump was in part driven by low mortgage rates, which for certain weekdays of week 24 fell to a low of 3.125%, after they had fluctuated between 3.25% and 3.375% for the past 9 weeks.

- Purchase rate lock volume is back to its level from before the onset of the pandemic (weeks 1 to 8), when purchase rate lock volume was up 24% on average compared to 2019.

- Over the past 4 weeks, the market has not only recovered from weeks 14-18 when the average weekly year-over-year decline was 15%, but it has exceeded volume for the same weeks in 2019.As a result of the last three weeks’ strong purchase lock volume, combined with strong volume in weeks 1-13, year-to-date volume is now running 14% ahead of last year.

- However, much of the Northeast, Midwest, and West continue to lag the national trend.

We derive trends in application volume from counts of Optimal Blue rate locks. To analyze the impact of the coronavirus pandemic, we overlay 2019 data on top of 2020 data.

State Purchase Rate Locks

- Rate lock activity for week 24 2020 varies greatly across the country compared to the same week a year ago.

- For week 24, all states are above last year’s volume, with Idaho, Georgia, Florida, and New Mexico about doubling their rate lock volume.

| State Purchase Rate Lock Activity by Period

· The recovery evidenced in weeks 21-24 varies greatly by state and region. It is the strongest and most consistent in the South and Southwest and lags generally in the Northeast, Midwest, and West. ## |

The skinny summary from the manufactured housing industry’s vantagepoint ought to be this. If conventional housing can rebound so strongly, why not manufactured homes?

See the recent related reports for more industry specific data points.

Related and Recent Reports:

Cavco Industries “Killer Acquisition,” CVCO’s New Controversy Tests Antitrust Resolve

“Trailer Sales” Surge, Per Mainstream Media – Takeaways for Manufactured Home Independents?

Manufactured Housing Industry Production Drops During COVID19 Closures

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

Spring 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our tenth anniversary and is in year 11 of publishing.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

https://www.manufacturedhomepronews.com/celebrating-10-years-of-goal-and-solution-oriented-manufactured-home-industry-innovation-information-and-inspiration-for-industry-professionals/

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

http://latonykovach.com Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

AEI Flash Housing Market Indicator