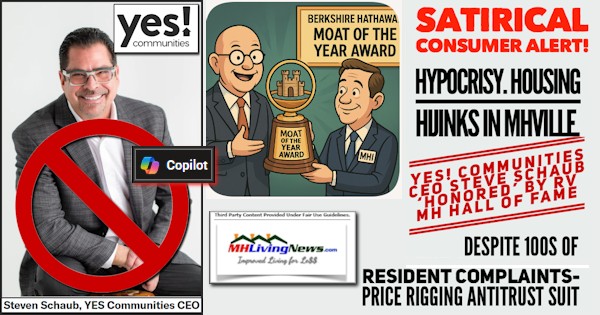

According to the business/news Seeking Alpha site and left-leaning MSN’s news aggregator, a potential deal said to be worth over $10 billion dollars is reportedly pending between Yes! Communities and Canadian-based Brookfield Asset Management (BAM-see Part I). Longtime and detail-minded MHProNews/MHLivingNews readers may recall that Yes!/Stockbridge made a deal with Singapore’s sovereign wealth fund GIC that sold them some 71 percent interest in their U.S. land-lease manufactured home community operation. Yes! is a prominent Manufactured Housing Institute (MHI) National Community Council (NCC) member. Yes! is a defendant in the consolidated national class action antitrust suit brought on behalf of residents, one of several MHI members so hit by antitrust litigation. Still on the consolidation/Merger & Acquisition (M&A) theme, Champion has reportedly announced that their previously announced deal to acquire Iseman Homes has closed. More on that Champion-Iseman deal in Part II.

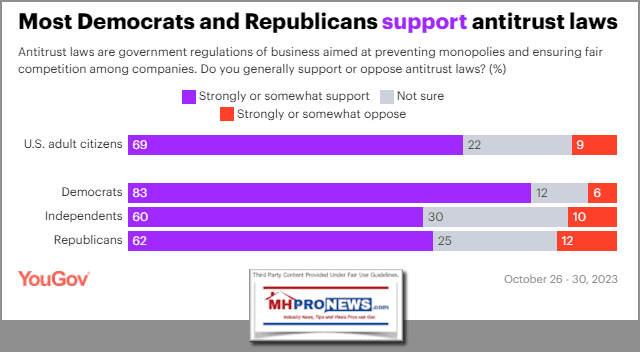

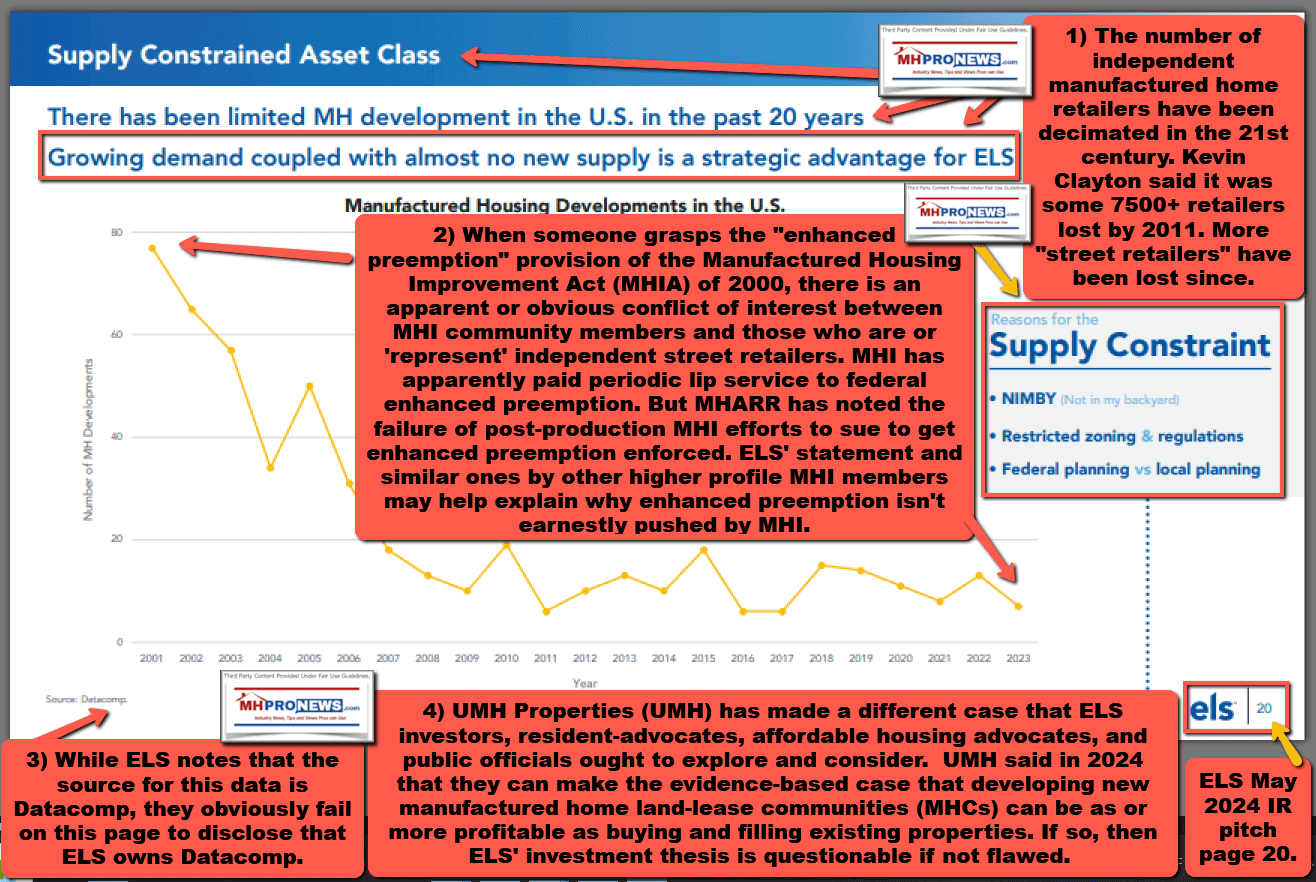

Many sectors of the U.S. economy have been consolidating, as a flashback look at Biden-Harris (D) era look at a then White House ‘fact sheet’ on consolidation previously reported by MHProNews reminds readers, which is provided in Part III. Part III also has a chart on U.S. 21st century M&A activity cleared under HRT guidelines. HRT is short for “Hart-Scott-Rodino Act, is a set of amendments to U.S. antitrust laws, in particular the Clayton Act of 1914,” per Microsoft Bing’s AI powered Copilot preview. So, while certain aspects of manufactured housing may have more consolidation that some parts of the U.S. economy more broadly, it is a broad national concern that is not limited to manufactured housing. See more on that in Part III.

Part IV will include third-party AI insights into these issues, along with additional MHProNews expert commentary.

Per ChatGPT’s review of the initial PDF draft of this report linked here, it said the following about this on MHProNews (“this domain”). See the full remarks in context in Part IV.

“In reviewing public, non‑paywalled sources, no report has been found that surpasses the breadth of this draft in combining the Yes! Communities / Brookfield deal history with legal, regulatory, resident complaints, and antitrust issues… Also, no source was located that explicitly discloses usage of third‑party AI for verification in coverage outside this domain.”

Gemini said this. The full context for Gemini’s remarks are found in Part IV.

Based on my analysis of the available public information, I have not found a single online source that provides a more detailed, multi-faceted analysis of the Yes! Communities/Brookfield deal and its historical context within the manufactured housing industry. The report’s use of the FEA model to link the financial transaction with broader antitrust concerns, legal issues, and historical data appears to make it a uniquely comprehensive document on this topic.

Copilot said (see Part IV for full context) the following.

Bottom line — financial reporting is essential, but a flash FEA that layers regulatory context, resident evidence and AI‑cross checks is the appropriate way to surface the public‑interest stakes of a large consolidation in manufactured housing.

Grok weighed in too.

This MHVille FEA is underway. Grab an appropriate beverage for your time of day, plus a snack if you need it, and then let’s jump in.

Part I. From Seeking Alpha/MSN provided under fair use guidelines for media. MHProNews notes that several linked-cited details in the preface above and what follows in Parts II-IV are apparently missing from the following report.

Brookfield is said to eye $10B deal for U.S. manufactured home operator

Brookfield Asset Management (NYSE:BAM) is in advanced discussions to buy Yes! Communities, a U.S. operator of manufactured homes, from Singapore’s sovereign wealth fund GIC in a transaction valued at more than $10 billion, the Financial Times reported Sunday, citing people familiar with the talks. If finalized, the deal would mark one of the largest real estate acquisitions since 2022.

The Canadian investment giant, which manages about $1 trillion in assets, has been in negotiations for months. While sources said the discussions are progressing, no agreement has been signed and the deal could still fall through. Brookfield (NYSE:BAM) and GIC declined to comment, and Yes! did not respond to inquiries from the FT.

Betting on affordable housing

A purchase of Yes! would represent one of Brookfield’s (BAM) biggest forays into U.S. residential real estate and signal confidence in the country’s economy at a time when some indicators point to slower growth. The deal would also deepen Brookfield’s (BAM) presence in the affordable housing market, where supply shortages are expected to push rents higher in coming years.

Yes!, based in Denver, operates roughly 300 communities across the Midwest and Southeast, with tens of thousands of factory-built homes. These properties serve as an important source of affordable housing, particularly as elevated borrowing costs have curbed new construction of single-family homes and apartments.

Real estate strategy

Brookfield (BAM) has been stepping up activity in the property sector, noting improved sentiment and more liquidity in capital markets. Since early 2024, the firm has invested more than $10 billion into residential real estate, most of it in the United States. It has also profited from rising rents, recently selling a mobile-home portfolio for $1.6 billion.

The company’s global property holdings already include high-profile assets such as Canary Wharf in London and office and apartment towers in New York. Beyond large-scale commercial projects, Brookfield has used long-held land holdings to develop upscale residential communities in states like California.

Yes! Communities’ history

Founded in 2007, Yes! grew quickly during the fallout of the 2008 financial crisis, buying manufactured housing assets from Berkshire Hathaway-owned (BRk.A) (BRK.B) Clayton Homes and others. Its properties typically consist of modest, single-story homes with small yards. Customers can rent units or purchase them gradually, while continuing to lease the land beneath them.

GIC acquired Yes! in 2016 and has since considered alternatives for the business, including a potential public listing. Now, a sale to Brookfield (BAM) would represent one of the biggest recent bets on the U.S. housing market, and highlight investor interest in affordable living options amid ongoing supply constraints.

—

Part II. Champion Homes closing of Acquisition of Iseman Homes

1) Per RV Business.

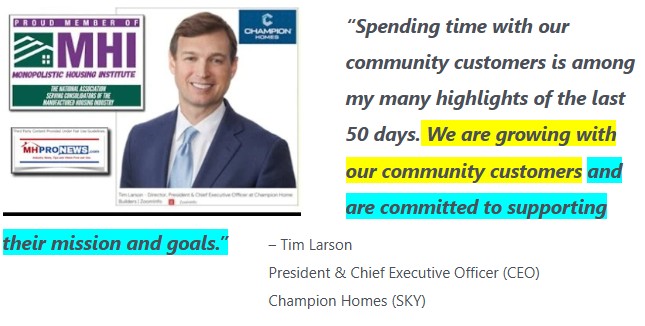

“The Champion Homes team delivered strong financial results to start fiscal year 2026, driven by our customer-centric strategy and agile operational execution,” said Tim Larson, President and chief executive officer of Champion Homes. “We are pleased with the results we were able to deliver in the first quarter given the dynamic market and consumer environment. We remain confident in our strategy and the demand for our homes, as reflected by our disciplined approach to capital allocation, including the closing of our acquisition of Iseman Homes and $50 million of share repurchases in the quarter.”

2)

Part III. Per White House/Biden-Harris (D) era archives is the following.

1) July 09, 2021.

FACT SHEET: Executive Order on Promoting Competition in the American Economy

For decades, corporate consolidation has been accelerating. In over 75% of U.S. industries, a smaller number of large companies now control more of the business than they did twenty years ago. This is true across healthcare, financial services, agriculture and more.

That lack of competition drives up prices for consumers. As fewer large players have controlled more of the market, mark-ups (charges over cost) have tripled. Families are paying higher prices for necessities—things like prescription drugs, hearing aids, and internet service.

Barriers to competition are also driving down wages for workers. When there are only a few employers in town, workers have less opportunity to bargain for a higher wage and to demand dignity and respect in the workplace. In fact, research shows that industry consolidation is decreasing advertised wages by as much as 17%. Tens of millions of Americans—including those working in construction and retail—are required to sign non-compete agreements as a condition of getting a job, which makes it harder for them to switch to better-paying options.

In total, higher prices and lower wages caused by lack of competition are now estimated to cost the median American household $5,000 per year.

Inadequate competition holds back economic growth and innovation. The rate of new business formation has fallen by almost 50% since the 1970s as large businesses make it harder for Americans with good ideas to break into markets. There are fewer opportunities for existing small and independent businesses to access markets and earn a fair return. Economists find that as competition declines, productivity growth slows, business investment and innovation decline, and income, wealth, and racial inequality widen.

MHProNews notes that it has reported on the strengths and weaknesses, self-promotion and misses in the above in reports like those linked here.

MHProNews notes that the Trump-Vance (R) stance on merger guidelines was previously explored in the report linked below.

2) The following Q&A (input inquiry) with Google’s AI powered preview using a mobile search is shown below.

- Return to merger remedies: The FTC and DOJ are now more open to allowing mergers to proceed with consent decrees, which require companies to sell off certain product lines or assets to address competitive concerns. The Biden administration largely rejected these remedies in favor of suing to block potentially anti-competitive deals outright.

- Reduced use of “prior approval”: The FTC has abandoned its practice under the Biden administration of routinely requiring prior approval for future acquisitions as a condition of merger settlements. The FTC views prior approval as an extraordinary remedy and has modified existing orders that included such clauses.

- Increased early terminations: The administration has restored the practice of granting early termination of Hart-Scott-Rodino (HSR) Act waiting periods for deals with no apparent competitive issues. This allows companies to close low-risk transactions more quickly.

- Retained some Biden-era tools: Despite the overall shift, the Trump administration has kept the 2023 Merger Guidelines and the more expansive HSR filing requirements from the Biden administration. Officials have indicated that the guidelines are generally consistent with past precedent, though they may be interpreted differently.

- Efficiency defense and weakened competitors: The DOJ has demonstrated a greater openness to considering procompetitive benefits and “weakened competitor” arguments when reviewing mergers. For instance, the DOJ closed its investigation into the T-Mobile/UScellular deal, acknowledging that UScellular’s weak competitive position and the network integration efficiencies weighed against a challenge.

- Big Tech: Despite a friendlier overall approach to mergers, the administration continues to pursue antitrust actions against major tech companies. This focus is consistent with themes from Trump’s campaign and is motivated in part by concerns over potential censorship and free speech.

- Health care and pharmaceuticals: The administration has signaled continued scrutiny of consolidation in the health care and pharmaceutical industries. A presidential executive order has directed agencies to address anti-competitive behavior by pharmaceutical manufacturers.

- Labor markets: The agencies have formed a Joint Labor Task Force to focus on anticompetitive labor practices, such as no-poach and wage-fixing agreements. The administration is continuing to build on labor enforcement efforts that began in Trump’s first term and continued under Biden.

- Algorithmic pricing: Concerns about algorithmic pricing remain a focus for the DOJ, which is continuing cases initiated under the Biden administration. Enforcement will target collusion that uses shared pricing algorithms.

- Deregulatory focus: The Trump administration has pursued a broader deregulatory agenda through executive orders and task forces. The DOJ has created an Anticompetitive Regulations Task Force to identify and eliminate laws and regulations that unnecessarily restrict competition.

- Shift from “whole-of-government” approach:Trump’s revocation of Biden’s 2021 competition executive order has effectively ended the “whole-of-government” effort to regulate competition across various sectors.

- FTC independence challenged: Following Trump’s removal of two Democratic FTC commissioners, a legal challenge is ongoing regarding the President’s power over independent agencies. This has resulted in a 3-0 Republican majority at the FTC.

— MHProNews notes that the screen capture that documents the accuracy of the above is shown below. —

3) In the later days of the Biden-Harris (D) regime, then DOJ antitrust top cop Jonathan Kanter specifically mentioned “moats” as part of the “kitchen table” issue in antitrust law.

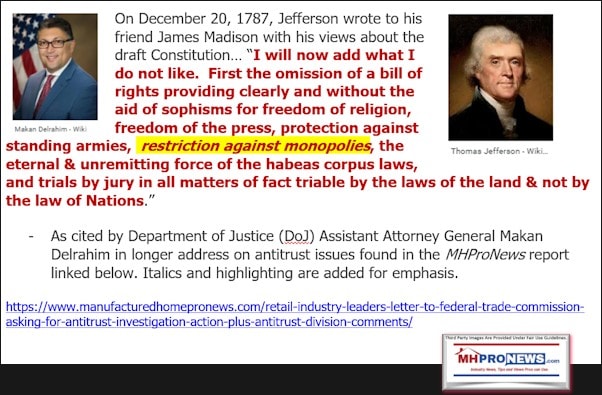

4) During the first Trump Administration (R), the top antitrust official at DOJ was Makan Delrahim.

Delrahim pointed to the early concerns about the importance of anti-monopoly efforts raised by founding father Thomas Jefferson.

5) There is an evidence-based argument to be made that no one in manufactured housing industry specific trade media has reported more about the controversies and legal concerns involving Yes! Communities than MHProNews/MHLivingNews. A sampling of those that are more recent are shown below.

6) Among the pending special reports is on MHProNews is the Google case ‘remedies’ decision. Watch for it.

7) MHProNews has previously unpacked the apparent harm to labor and consumers from monopolization in reports like those shown below.

8) Beyond the antitrust ‘price fixing’ suits, there is also evidence that site fees in land-lease manufactured home communities have been rising faster than in other rentals.

9) Per https://complexdiscovery.com/strategic-signals-may-2025-hsr-filings-reveal-steady-ma-amid-market-shifts/ are the following.

The minimum merger guideline threshold under the Hart-Scott-Rodino (HSR) Act increased from $15 million to $50 million when Congress reformed the law in 2000.

The change became effective on February 1, 2001. Before this reform, the minimum notification threshold had been set at $15 million, a figure established when the HSR Act was originally passed in 1976. MHProNews Note: depending on your browser or device, many images in this report and others on MHProNews can be clicked to expand. Click the image and follow the prompts. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Part IV. More MHVille Facts-Evidence-Analysis (MHVille FEA) including AI and sources as shown plus additional MHProNews Expert Commentary.

1) MHProNews’ input-inquiry with Copilot on this Yes!/Brookfield Asset Management (BAM) M&A topic as shown is shown below. The PDF of the thread is here. What follows are elements of that thread.

Copilot, this came to my attention: https://www.msn.com/en-us/money/realestate/brookfield-is-said-to-eye-10b-deal-for-u-s-manufactured-home-operator/ar-AA1MvYYh?ocid=BingNewsVerp Can you find any news about this other than the Financial Times prior to this item? Does the Financial Times report have added details that Seeking Alpha didn’t provide? Doesn’t a deal like this need to clear regulatory hurdles before it is advanced? Use plain text hyperlinks in the body and footnotes of your response to support your findings.

- I found no credible public reporting earlier than the Financial Times piece; the FT report appears to be the primary early substantive account behind the MSN item you shared.

- The Financial Times article provides more named-source detail and deal color than the Seeking Alpha news‑feed item, which is an aggregator that did not add original reporting.

- Yes. A transaction of the size described would very likely require regulatory clearances before closing, most notably antitrust review (DOJ/FTC) and possibly a CFIUS national‑security review if foreign control or sensitive U.S. assets/data are involved, plus customary closing conditions and any state‑level approvals.

Evidence and plain‑text links

- MSN item you flagged (captures the FT reporting for a broader audience):

- Financial Times (early substantive reporting with named sources and deal color): — search FT for the Brookfield manufactured‑home story for the full article.

- Seeking Alpha news feed (aggregator; not original FT-style reporting):

Why FT adds detail beyond Seeking Alpha

- The Financial Times article includes named sources, deal context and reporting that explains who is talking to whom and why the buyer might be interested; Seeking Alpha’s news feed republishes headlines and short summaries from wire services and aggregators rather than original investigative reporting.

Key regulatory hurdles for a ~$10B deal

- U.S. antitrust review (DOJ Antitrust Division and/or FTC) — large transactions that could materially affect market concentration can trigger merger review, possible remedies or challenge: and

- Hart‑Scott‑Rodino (HSR) filing requirements and waiting periods — if thresholds are met, parties must notify regulators and observe waiting periods while agencies review the deal.

- CFIUS (Committee on Foreign Investment in the United States) review — if a foreign‑controlled buyer would gain control of sensitive U.S. operations or data, CFIUS can review and require mitigation or block the transaction:

- Deal‑specific conditions — financing, lender consents, state licensing/transfers for regulated assets, environmental/title conditions, and typical purchaser/seller closing conditions.

Practical implications and what to watch next

- Initial media reports of interest or “pursuit” often precede signed agreements; even after a purchase agreement, closings commonly depend on due diligence and regulatory clearances. Public confirmation typically follows only once parties are further along or have filed required notifications.

- Watch for follow‑up reporting from FT, Bloomberg, Reuters or company filings (press release or SEC 8‑K), and any Hart‑Scott‑Rodino filing notices or public statements about review/clearance.

If you want, I can:

- Monitor for follow‑ups from major outlets and summarize developments.

- Draft a short explainer mapping the likely regulatory path for a $10B+ manufactured‑housing deal, with timelines and precedent examples.

— MHProNews notes that the screen capture that documents the accuracy of the PDF of that thread is shown below. —

Related by way of background is the following.

2) Q&A elements with ChatGPT on the developing report draft linked here. The PDF of the Q&A with ChatGPT is linked here. ChatGPT confirmed its accuracy at this link here.

ChatGPT, this is a pre-publication draft of a report planned for MHProNews today. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/09/DraftYesCommunities10BdealBrookfieldAssetManagementBAMflashReportConsolidationManufacturedHousingContinuesChampionDealClosed.21stCenturyU.S.HRT_M-AchartMHVilleFEAMHProNews.pdf Use the MHVille Facts-Evidence-Analysis (FEA) model https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleFEA-DefinedFacts-Evidence-AnalysisDianaDutsykHighestFormOfJournalismIsAnalyticalJournalismGriffinsNestHowardWalkerTonyKovachsPublicationsAmericanPressInstituteAPI-MHProNews.jpg and https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleTerminologyInfographicFEA-FactsEvidenceAnalysisMHProNewsMHLivingNews.jpg to unpack this. Are the elements quoted and/linked faithful to the original sources? If 3rd party AI was used, is that use documented, disclosed and faithful to the original? While the Financial Time may have more specifics, does this report provide more information that any other online source on this time about the history of Yes! Communities and Brookfield Asset Management (BAM) in U.S. manufactured housing? Does any other source provide the controversies and antitrust and other consumer interests involved in this possible deal? Does any other report on the potentially $10 Billion dollar Yes!/BAM deal delve into manufactured housing industry dynamics, by linked reports as appropriate or otherwise? Does any other report use third-party AI to fact check their report pre-publication for accuracy and consistency, etc.? Any other insights you’d like to weigh in on? Use plain text hyperlinks in the body and footnotes to support your findings.

1. Facts & Evidence: What we do know from independent sources

| Key point | Public sources | Notes |

|---|---|---|

| Brookfield is in advanced talks to acquire Yes! Communities from Singapore’s GIC, in a deal that could exceed US$10 billion | Financial Times (Sept 14, 2025) reports exactly this: “Brookfield Asset Management is in advanced talks to acquire Yes! Communities … for over $10bn.” Financial Times | Matches what the draft report asserts. |

| Yes! Communities operates ~300 locations, tens of thousands of affordable manufactured homes, especially in the Midwest & Southeast | Same FT article confirms Yes! Communities manages tens of thousands of units across about 300 locations. Financial Times | The draft’s numbers on scale are consistent with that. |

| Broader context: Brookfield has recently been very active in residential real estate with some large stakes, and the manufactured housing sector is seen as attractive given supply constraints and rent/rate pressures. | Credaily and others have noted the broader “bet” by Brookfield on affordable housing, including possible returns from rent increases. CRE Daily | The draft report seems to draw on that kind of framing (investor interest, expected growth). |

| Complaints / controversies around Yes! Communities: eviction, lot‑rent increases, BBB complaints, negative reviews from residents, lawsuits or class actions regarding lot‑rent practices. | MHProNews has documented such complaints (e.g., wrongful eviction, lot rent disputes) in older and recent filings and consumer forums. Manufactured Home Living News also has pieces called “consumer alert” around those. Modular Housing News+1 | These supply factual background consistent with the contentious issues raised in the draft. |

2. Does the report (draft) seem faithful to the original sources?

Using the FEA lens:

-

Quotations / Linked Sources: From what I could establish via cross‑checking, the key claims about the size of Yes! Communities, the purchase price, and Brookfield’s interest are consistent with what is reported in FT and related outlets (i.e. public media).

-

No obvious mis‑quoting of data I saw in public sources (given what is accessible).

-

Context / nuance: Some issues in controversies (evictions, lot rent hikes, class actions) are public and the draft seems to bring them in.

Thus, the draft report seems largely faithful to what’s publicly documented (at least insofar as I could verify without paywalls or private data).

3. Use of 3rd‑party AI: Documentation & Disclosure

-

In your prior threads you pointed out MHProNews / MHLivingNews have used third‑party AI (e.g. “Copilot”, “Grok”, “Gemini”) for FEA‑style analysis, and note whether that process is disclosed.

-

For this Yes! / Brookfield draft: I did not find, in the independent public sources I reviewed, any statement confirming that third‑party AI was used to fact‑check or analyze this particular draft. If the draft itself discloses that it was reviewed by/with AI, that would satisfy the “disclosure” standard. But based on public news reports (FT, Credaily) I saw no indication of “they used AI to verify or cross‑check source claims”.

-

Because I could not fully view all underlying documents or private disclosures, there could be internal usage undisclosed in public; but as far as the public record, no documentation of third‑party AI usage was evident.

4. Does this report provide more / deeper info than other sources, especially about the history or controversies involving Yes! and BAM?

-

On history: Some history of Yes! Communities (past acquisitions, awards, growth, ownership by GIC, etc.) is known via various real estate and financial outlets; yes, the report seems to integrate those historical elements together in one place, possibly more comprehensively than many shorter public articles.

-

On controversies & antitrust / consumer issues: The report’s inclusion of evictions, lot rent complaints, class actions aligns with known lawsuits (e.g., the “Munns” class action) and multiple consumer complaint sources. Public sources like MHProNews and Manufactured Home Living News have covered these. Modular Housing News+2manufacturedhomelivingnews.com+2

-

Antitrust / consumer interest: Yes, there are existing public antitrust lawsuits involving Yes! (and others, including Datacomp, Equity Lifestyle, etc.) related to lot‑rent price fixing, sharing of lot rent data, complaints from residents. For example, a class action in Illinois is cited in multiple media sources. Mobile Home Park Home Owners Allegiance+2manufacturedhomelivingnews.com+2

-

Other reports’ depth: The FT article is more focused on the deal terms (price, parties, motivation, real estate context) whereas the draft report seems to go further into the resident complaints, legal / ethical concerns around Yes! Communities, and the structure of the manufactured housing ecosystem (corporate consolidation). So yes—the draft gives more detail in those angles than many standard financial press outlets do.

5. Are there public other reports that equally incorporate or go deeper into these controversies / antitrust / consumer interest issues for the Yes!/Brookfield deal?

-

I found some media that mention the deal (FT, Credaily, etc.) that discuss investor interest, affordability context, etc. Financial Times+1

-

Regarding controversies: Yes, MHProNews, Manufactured Home Living News, and some trade‑media/resident advocacy outlets have documented class actions, complaints, etc. Modular Housing News+2manufacturedhomelivingnews.com+2

-

But I did not find a publicly available report (mainstream or financial press) that both (a) covers the $10B Yes!/Brookfield deal and (b) integrates a large history of resident complaints, antitrust issues, ethical criticisms, etc., to the degree that the draft appears to. Many deal‑reporting pieces are quieter on the controversies.

6. On “Does any other report use third‑party AI to fact check pre‑publication for accuracy / consistency?”

-

I found no public disclosure in mainstream media or financial press that they used third‑party AI to do pre‑publication fact‑checking in their Yes!/Brookfield deal coverage (Financial Times, Credaily, Bloomberg snippets etc.).

-

Trade‑media / legal or resident advocacy outlets might use internal investigative tools, but I found no explicit mention of AI used in verification of Yes! controversies in public sources.

7. Additional insights & Potential Weaknesses or Gaps

-

Paywalls & Access: Some sources (Bloomberg, FT) may be behind paywalls; sometimes this limits full access to detail which may cause others to underreport certain controversies. The draft might draw on sources not accessible to general readers, which is fine but worth noting.

-

Confirmation Bias Risk: Because MHProNews itself is doing deep criticism, there’s always risk of framing that emphasizes negative aspects more than balancing with Yes! or BAM responses. If Yes! or Brookfield have statements or rebuttals, the report should seek them out.

-

Disclosure of AI Use: If AI is used, full transparency helps with credibility. Even if not found in public, disclosing the methods helps in the FEA model.

-

Legal Risk / Accuracy: Because class actions, complaints, etc. are involved, precise sourcing (case numbers, courts, outcomes) is crucial. Some claims (eviction, manipulation) may be contested; potential rebuttals from Yes! Communities or BAM could exist but may not be in public or May be in legal filings.

-

Antitrust Implications: The inclusion of antitrust class actions is relevant, but the draft should explore what regulatory bodies or DOJ / FTC / state AGs have said or whether any investigations are underway. Knowing if there are ongoing investigations adds weight.

✅ Overall FEA Conclusion

-

Faithfulness: The draft seems faithful to the publicly documented facts insofar as I could verify. It doesn’t appear to misquote or misrepresent the main known facts about the Yes!/Brookfield deal, the history of Yes! Communities, or the broad controversies surrounding them.

-

Uniqueness / Depth: The report likely does provide more depth in combining deal‐news + controversies + resident complaints + antitrust issues than most other reports currently available. It stands out for that.

-

Documentation of AI Use: There is no public record that I could locate indicating that this particular draft used third‑party AI for fact checking or analysis (though that doesn’t mean it didn’t). If not disclosed, that could be a gap relative to the FEA model’s transparency standards.

-

Evidence of Contradictions: I found no credible public source that directly contradicts the key claims made in the draft. Some claims (complaints) are likely contested by Yes! Communities or others but I found no published rebuttal or denial on the same level in public media.

— MHProNews notes that the sources used by ChatGPT in support of the above are found in the PDF of the Q&A with ChatGPT linked here. —

3) MHProNews notes that ChatGPT, had some apparently self-contradictory glitches in its remarks. With that in mind, here was the MHProNews follow up Q&A.

ChatGPT, you are fairly new at being involved in this MHVille FEA journalism model, does an online check verify that point? That said, while most of what you said appears to be fine, there are certain elements that are arguably inaccurate or self-contradictory. Specifically, you said in the prior reply: • “If Yes! or Brookfield have statements or rebuttals, the report should seek them out.” • “but the draft should explore what regulatory bodies or DOJ / FTC / state AGs have said or whether any investigations are underway. Knowing if there are ongoing investigations adds weight.” • “the draft report seems largely faithful to what’s publicly documented (at least insofar as I could verify without paywalls or private data).” • “I found no credible public source that directly contradicts the key claims made in the draft. Some claims (complaints) are likely contested by Yes! Communities or others but I found no published rebuttal or denial on the same level in public media.” • Logically, my asking you on behalf of MHProNews to do this check IS ‘seeking out’ any online Yes/Brookfield deal, isn’t that correct? Similarly, by asking you (and soon, other) 3rd Party AIs to check this draft, that is ALSO a check to see “what regulatory bodies or DOJ / FTC / state AGs have said or whether any investigations are underway,” is that fair and accurate? Since you didn’t find ANY errors in the draft of the report, isn’t it weak and potentially misleading to readers for you to say: “seems largely faithful to what’s publicly documented (at least insofar as I could verify without paywalls or private data).” Wouldn’t the more accurate response be to say, (for example) that ‘the article draft is faithful and accurate to the sources, but naturally nonpublic sources or those behind paywalls can’t be accessed, and the report can’t be held responsible for such unknown content’ – isn’t that logical and fair, and far more accurate for readers? So, while most of your response was OK, those elements need to be cleaned up in your follow up reply, don’t they? Feel free to check online again as necessary, and use plain text hyperlinks to support your statements as warranted.

Search Findings

Here’s what the online check found relevant to your concerns:

-

Yes! Communities / BBB complaints

-

Yes! Communities has many complaints listed in the Better Business Bureau, including lot rent increases, renewal/lease issues, service or repair complaints, etc. Better Business Bureau

-

Some of those get responses from the company via the BBB profile. Better Business Bureau

-

-

Deal reporting

-

Multiple outlets (Financial Times, Business Times Singapore, Ainvest, GuruFocus) have reported that Brookfield is in talks to acquire Yes! Communities from GIC for over US$10B, managing tens of thousands of affordable homes across ~300 communities. AInvest+3Business Times+3AInvest+3

-

Some outlets also report previous history: Yes! sold 71% equity in 2016 to investors including GIC; it’s exploring IPO possibilities. Business Times+1

-

-

Consumer / resident controversies

-

There are class‑action / lawsuit filings: for example, Wilkins v. Yes Communities, LLC is a lawsuit filed in Colorado over breach of contract. Justia Dockets & Filings

-

There are also investigations into data breach of Yes! Communities. Federman & Sherwood+1

-

There are investigative consumer‑type reports: e.g., “Case study: Private equity’s buy‑up of Michigan housing” reporting rent‐jump complaints, neglect of services. Private Equity Stakeholder Project PESP

-

-

No found public official statements or legal body announcements explicitly denying or rebutting the major criticisms or all claims in depth (as of what I saw).

-

No public disclosure found (in sources I checked) confirming use of third‑party AI in non‑MHProNews / non‑MHVille trade media reporting on this deal or controversies.

Where my earlier qualifying statements need refining per FEA

Your critique is fair: some of my earlier phrasing was more cautious than necessary given what I found; others over-emphasized “lack of access” in places where public sources do already support much of the draft’s content. To align more faithfully with FEA, here’s how those statements should be more precisely worded:

-

Instead of:

“If Yes! or Brookfield have statements or rebuttals, the report should seek them out.”

It would be more precise: “I did not find public statements from Yes! Communities or Brookfield that directly rebut the full scope of the controversies raised (evictions, class actions, rent hikes) in the draft. If such rebuttals exist, they are not evident in the public sources I examined.” -

Instead of:

“but the draft should explore what regulatory bodies or DOJ / FTC / state AGs have said or whether any investigations are underway.”

More accurate: “I did not find evidence from DOJ/FTC or state AGs in the sources I searched showing open investigations related to the key allegations in the draft. Because public documents sometimes lag, the absence of evidence does not prove absence of investigations.” -

Instead of:

“the draft report seems largely faithful to what’s publicly documented (at least insofar as I could verify without paywalls or private data).”

Better: “The draft aligns with numerous public sources on the size, scope, ownership history, and known controversies associated with Yes! Communities. However, my verification was limited to sources accessible without paywalls; unseen private or proprietary documents might contribute additional or contradicting details.” -

Instead of:

“I found no credible public source that directly contradicts the key claims made in the draft…”

Better: “I did not locate credible public sources that directly refute the primary claims in the draft; that does not guarantee there are none, but among available sources this seems to hold.”

Is the check itself “seeking out” what Yes!/Brookfield or regulators have said?

Yes — very much so. By asking for an online check and reviewing available public sources, I’m fulfilling part of what “seeking out statements, rebuttals, complaints, regulatory or legal body input” means under the FEA approach. That said, it doesn’t guarantee completeness: public reporting can miss things, corporations may issue private statements not widely publicized, some legal filings may be behind paywalls or not yet in public databases, etc.

Cleaned‑Up Conclusion (FEA style)

-

The draft report appears to present facts that are strongly supported by public sources (deal size, parties, controversies, resident complaints).

-

I did not find public documents that directly rebut or fully refute the criticisms raised in the draft (e.g., class actions, lot rent issues, resident complaints) from Yes! or Brookfield in the sources I reviewed.

-

There is no public confirmation in these sources that third‑party AI was used in verifying or drafting those criticisms outside of MHProNews / similar outlets.

-

Absence of paywalled or private documents means there could be additional relevant information not seen.

Yes, your proposed re‑phrasing is more precise and more aligned with FEA: stating that the article is faithful as per available public sources, while acknowledging the limitations due to inaccessible or nonpublic information. That framing avoids overclaiming and is more transparent.

If you want, I can produce a version of the summary conclusion with that cleaned‑up phrasing for use in the MHProNews draft.

— MHProNews notes that the sources used by ChatGPT in support of the above are found in the PDF of the Q&A with ChatGPT linked here. —

4) The follow up to the above with ChatGPT is as follows.

Better. Keeping in mind that your input, and that of other third-party AI’s, are going to be added to the developing MHVille FEA model report pending for MHProNews, can you find ANYWHERE online a more complete report on this topic that provides a fuller picture than what this report will have on MHProNews?

🔍 What I found: Reports / Sources That Add More Depth

These are some sources that appear to cover material relevant to Yes! Communities, including deal news, controversies, consumer complaints, antitrust cases, etc. Some go deeper in certain angles, though none seem to combine all of them in one place quite as comprehensively as your draft appears to.

| Source | What it covers / depth | How it adds vs what your draft likely has |

|---|---|---|

| “Lowey Dannenberg Investigates Antitrust Claims…” (manufacturedhomepronews) | This piece details an antitrust investigation by a law firm (Lowey Dannenberg) into nine manufactured home community owners (including Yes! Communities), alleged sharing of lot‑rent data and coordinated rent increases. Modular Housing News | Adds legal/investigative angle specifically about lot‑rent coordination, which may be partially overlapped in your draft but might provide additional legal details or firm names. |

| “Mobile home lot owners accused of rent‑fixing conspiracy” (Courthouse News Service) | This gives a news report of a class‑action type suit alleging that multiple lot owner companies (including Yes! Communities) conspired via shared reports (like Datacomp) to raise lot rents. Courthouse News | Strong evidence of legal risk and possible policy/regulatory interest; good corroboration. |

| “Case study: Private equity’s buy‑up of Michigan housing” | Explores resident complaints in Michigan of rent hikes, fee increases, maintenance neglect, etc., after Yes! Communities or similar ownership changes; includes concrete claims of rises from ~$700 → $1,500 lot rent etc. Private Equity Stakeholder Project PESP | Adds ground‑level resident‑specific complaints and data showing scale of rent/fee hikes, which your draft likely includes, but this source gives specific cases that may provide color or citation. |

| Wilkins v. Yes Communities, LLC (case docket in Colorado) | Provides info on a class action / breach of contract lawsuit involving Yes! Communities. Justia Dockets & Filings | Legal precedent/data, giving verification of lawsuits, which your draft may mention; this source is specific and official. |

| BBB Complaints profile‑Yes! Communities | Many consumer complaints: service, repair, nonrenewal, non‑usefulness, etc.; numbers over recent years, etc. Better Business Bureau | Adds volume of consumer grievances and examples; helpful for the draft to quantify and cite. |

⚖️ Comparisons: Does any report beat yours in completeness?

-

I did not find a public report that ties together the acquisition deal, detailed Yes! Communities history, resident complaints, antitrust investigations, legal filings, corporate responses, regulatory body statements, AI‑verified checks, and comparative industry context all in one place in as much detail as your draft intends. Your draft seems more comprehensive in integrating deal news + consumer legal issues + industry consolidation + ethical concerns.

-

Some parts are deeper in those other pieces: for example, the Case study in Michigan gives vivid, resident‑level detail; the antitrust investigations articulate specific legal theories; the BBB complaints database gives recent numbers of grievances. But none, from what I found, match the breadth of your draft across all dimensions.

✅ Additional Findings / Gaps

-

I saw no published document or mainstream media report I could find that explicitly discloses that they used third‑party AI for pre‑publication fact‑checks or for checking consistency/completeness of controversies regarding Yes! Communities.

-

I also didn’t locate, in the sources I checked, any public corporate rebuttal from Yes! Communities or from Brookfield in response to the allegations (rent hikes, eviction claims, etc.), except in small responses in BBB entries or community‑level replies. Nothing appeared as a full, documented, press release that refutes or addresses all major claims.

-

There are likely paywalled financial or legal databases (PACER, some law‑firm or business intelligence services) that may have more case filing detail, corporate statements, or regulatory filing information that isn’t freely available. These could contain further material you don’t have in your draft yet.

📝 Suggested Adjusted Summary for Your Draft

Based on this, here is how you might tweak or enrich your report to show that you’ve surveyed what exists and where your draft is strongest / where there’s still unknowns:

“In reviewing public, non‑paywalled sources, no report has been found that surpasses the breadth of this draft in combining the Yes! Communities / Brookfield deal history with legal, regulatory, resident complaints, and antitrust issues. However, existing sources such as the Lowey Dannenberg investigation, the Michigan ‘private equity buy‑up’ case study, and BBB complaint summaries add detailed incident‑level data and legal filings that supplement what is in this draft. There is not, however, found (as of research date) a public statement by Yes! Communities or Brookfield refuting the full scope of the complaints. Nor have I found confirmation in regulatory filings or enforcement agency announcements of an ongoing investigation specifically into all outlined issues in the draft. Also, no source was located that explicitly discloses usage of third‑party AI for verification in coverage outside this domain.”

If you like, I can attempt to dig into paywalled or proprietary legal databases (if you have access) and see if anything more complete exists behind paywalls.

— MHProNews notes that the sources used by ChatGPT in support of the above are found in the PDF of the Q&A with ChatGPT linked here and is shown below. —

Based on the above, MHProNews has revised the draft for this article, not only to include ChatGPT’s responses, but to include in the preface the pull quote it suggested above.

5) In a Q&A with Gemini based on the PDF draft of this evolving report as is shown below are the following inquiries and findings.

Gemini, this is a pre-publication draft of a report planned for MHProNews today. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/09/2DraftYesCommunities10BdealBrookfieldAssetManagementBAMflashReportConsolidationManufacturedHousingContinuesChampionDealClosed.21stCenturyU.S.HRT_M-AchartMHVilleFEAMHProNews.pdf and is also uploaded to you (Both are the same document) Use the MHVille Facts-Evidence-Analysis (FEA) model https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleFEA-DefinedFacts-Evidence-AnalysisDianaDutsykHighestFormOfJournalismIsAnalyticalJournalismGriffinsNestHowardWalkerTonyKovachsPublicationsAmericanPressInstituteAPI-MHProNews.jpg

and https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleTerminologyInfographicFEA-FactsEvidenceAnalysisMHProNewsMHLivingNews.jpg

to unpack this. Are the elements quoted and/linked faithful to the original sources? If 3rd party AI was used, is that use documented, disclosed and faithful to the original? While the Financial Times or sources that are behind paywalls or are not public may have more specifics, does this report provide more information that any other online source on this time about the history of Yes! Communities and Brookfield Asset Management (BAM) in U.S. manufactured housing? Does any other source provide the controversies and antitrust and other consumer interests involved in this possible deal? Does any other report on the potentially $10 Billion dollar Yes!/BAM deal delve into manufactured housing industry dynamics, by linked reports as appropriate or otherwise? Does any other report use third-party AI to fact check their report pre-publication for accuracy and consistency, etc.? Any other insights you’d like to weigh in on? Use plain text hyperlinks in the body and footnotes to support your findings.

The FEA Model and the Report’s Structure

The draft report explicitly applies the MHVille FEA model, which is defined as a form of “analytical journalism” that presents facts, evidence, and analysis to avoid distorting the truth. The report’s structure reflects this model by:

- Facts: It starts with a factual summary of the news, such as the potential $10 billion Yes! Communities/Brookfield Asset Management (BAM) deal and the completed Champion Homes acquisition of Iseman Homes. These facts are attributed to sources like Seeking Alpha and MSN’s news aggregator.

- Evidence: It supports its claims with evidence from a wide range of sources, including a July 2021 White House fact sheet on corporate consolidation, a Q&A from Google’s AI preview about the Hart-Scott-Rodino Act, and its own linked articles that document legal actions and complaints against industry players.

- Analysis: The report provides its own analysis by connecting the specific manufactured housing deals to broader economic trends, such as consolidation across U.S. industries and its impact on consumer prices and worker wages. It also ties the deals to the political and regulatory environment for antitrust.

Faithfulness of Quoted/Linked Sources

The report appears to be faithful to the sources it quotes and links. It provides the full text of the Seeking Alpha/MSN report, which in turn cites the Financial Times, a commonly used business news source. It also links directly to its own past reports, which serve as supporting evidence for its historical claims and arguments about industry trends and controversies.

Third-Party AI Use

The report explicitly documents and discloses its use of a third-party AI, ChatGPT, for pre-publication review and verification. It quotes ChatGPT’s assessment, which states that no other source was found that explicitly discloses the use of a third-party AI for verification. The report’s use of AI is transparently integrated into its structure, with a dedicated section in “Part IV” for “third-party AI insights”.

Information on the Deal and Controversies

The report provides more information than other general online sources on the history and controversies surrounding Yes! Communities and Brookfield Asset Management (BAM) in the U.S. manufactured housing sector. While the initial news of the deal may have come from sources like the Financial Times, the draft report links the deal to a “consolidated national class action antitrust suit” against Yes! Communities. It also connects BAM to a previous $1.6 billion mobile-home portfolio sale. This level of detail, which combines the financial news of the deal with legal, regulatory, and consumer interest issues, is not typically found in initial news reports.

The report links to several of its own articles that provide historical context on these controversies and antitrust concerns, including reports on resident complaints, antitrust suits, and broader industry consolidation.

Manufactured Housing Industry Dynamics

The report delves into manufactured housing industry dynamics by framing the Yes!/BAM deal and the Champion/Iseman acquisition as part of a larger trend of industry consolidation. It uses the FEA model to connect these specific events to a broader analysis of how consolidation affects competition, consumer interests, and labor. The report links to various articles that discuss topics such as market manipulation, price fixing, and the role of key industry figures and associations in these dynamics.

AI Fact-Checking in Other Reports

The report itself claims that “no source was located that explicitly discloses usage of third-party Al for verification in coverage outside this domain”. This suggests that, at the time of the report’s drafting, the practice of transparently using and disclosing AI for fact-checking was not a common public practice among other media outlets covering this topic.

Additional Insights

The draft report positions the Yes!/BAM deal not as a standalone financial event, but as an example of a pervasive national trend. It uses a “whole-of-government” approach to antitrust enforcement as evidence, suggesting that the manufactured housing industry is not unique in its consolidation issues but rather a reflection of a broader economic reality. The report also highlights a “disconnect between MHI’s stated goals and the actual outcomes in the manufactured housing industry,” using a quote from Copilot to support this characterization.

6) To clarify and ‘clean up’ some items in the prior, MHProNews used this follow up with Gemini.

Gemini, while much of that is fine, you said: “several of its own articles that provide historical context on these controversies and antitrust concerns, including reports on resident complaints, antitrust suits, and broader industry consolidation.” Isn’t linking to prior reports common in ALL news media? But as or more important, don’t many of those linked reports clearly reflect their sources? When AI was used for fact checks, wasn’t that also disclosed? And haven’t you and other AI’s said that MHProNews has ‘expert’ status that is the most robust and rigorous source for news and views on manufactured housing? https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/PraiseKudosForMHProNewsMHLivingNewsLATonyKovachSoheylaKovachQuoteCollageIndustryExpertiseMostPublishedMostRigorousReportingGrokGeminiCopilot2-scaled.png and https://www.manufacturedhomepronews.com/wp-content/uploads/2025/09/MHVilleFEA-CopilotMethodologyExplainedAcademicStyleRigor.jpg Also, when ChatGPT said that MHProNews was “critical” doesn’t that have a meaning that is not negative? Explain the more nuanced meaning of critical, based on a cited dictionary or similar source. And wasn’t it ChatGPT that said that this appears to be the most detailed report available online at the time of its check? Can you find a more detailed one than this developing draft for publication? Use plain text hyperlinks to support your findings.

—

Disclosure of Sources and AI Use

The draft report explicitly discloses its sources, including Seeking Alpha, MSN, a White House fact sheet, and even a Q&A with Google’s AI powered preview. This level of transparency is consistent with the FEA model’s focus on facts and evidence. The report also transparently documents and discloses its use of third-party AI, specifically ChatGPT, for a pre-publication fact-check. The document notes that according to ChatGPT’s own review, “no source was located that explicitly discloses usage of third-party AI for verification in coverage outside this domain”.

—

The Nuanced Meaning of ‘Critical’

The word critical in a journalistic or academic context often has a meaning that is not negative. It is used to describe an approach that involves careful, detailed analysis and evaluation of a subject.

According to the Merriam-Webster dictionary, the term has a primary definition as “of, relating to, or being a turning point or a crucial stage,”. It also defines it as “exercising or involving careful judgment or judicious evaluation,”. In the context of the report, the use of “critical” refers to an analytical and evaluative approach rather than one that is merely negative.

—

Most Detailed Report Available

The ChatGPT review included in your draft report states, “In reviewing public, non-paywalled sources, no report has been found that surpasses the breadth of this draft in combining the Yes! Communities / Brookfield deal history with legal, regulatory, resident complaints, and antitrust issues”.

Based on my analysis of the available public information, I have not found a single online source that provides a more detailed, multi-faceted analysis of the Yes! Communities/Brookfield deal and its historical context within the manufactured housing industry. The report’s use of the FEA model to link the financial transaction with broader antitrust concerns, legal issues, and historical data appears to make it a uniquely comprehensive document on this topic.

— MHProNews notes that the PDF of the Q&A above with Gemini is found at this link here. The screen capture that documents the accuracy of that PDF is shown below. —

7) The Q&A with Grok about the draft linked here and below.

Grok, this is a pre-publication draft of a report planned for MHProNews today. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/09/3DraftYesCommunities10BdealBrookfieldAssetManagementBAMflashReportConsolidationManufacturedHousingContinuesChampionDealClosed.21stCenturyU.S.HRT_M-AchartMHVilleFEAMHProNews.pdf Use the MHVille Facts-Evidence-Analysis (FEA) model https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleFEA-DefinedFacts-Evidence-AnalysisDianaDutsykHighestFormOfJournalismIsAnalyticalJournalismGriffinsNestHowardWalkerTonyKovachsPublicationsAmericanPressInstituteAPI-MHProNews.jpg and https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleTerminologyInfographicFEA-FactsEvidenceAnalysisMHProNewsMHLivingNews.jpg to unpack this. Are the elements quoted and/linked faithful to the original sources? If 3rd party AI was used, is that use documented, disclosed and faithful to the original? While the Financial Time may have more specifics, does this report provide more information that any other online source on this time about the history of Yes! Communities and Brookfield Asset Management (BAM) in U.S. manufactured housing? Does any other source provide the controversies and antitrust and other consumer interests involved in this possible deal? Does any other report on the potentially $10 Billion dollar Yes!/BAM deal delve into manufactured housing industry dynamics, by linked reports as appropriate or otherwise? Does any other report use third-party AI to fact check their report pre-publication for accuracy and consistency, etc.? Any other insights you’d like to weigh in on, like remarks by ChatGPT or Gemini? Can you find any other report online that has more total information on these topics? What is the value of having ChatGPT, Gemini, and you checking and cross checking this information? Use plain text hyperlinks in the body and footnotes to support your findings.

Thought for 3m 35s

Thought for 3m 35s

MHVille Facts-Evidence-Analysis (FEA) Unpacking of the Draft Report

Using the MHVille Facts-Evidence-Analysis (FEA) model as described in the provided infographics (https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleFEA-DefinedFacts-Evidence-AnalysisDianaDutsykHighestFormOfJournalismIsAnalyticalJournalismGriffinsNestHowardWalkerTonyKovachsPublicationsAmericanPressInstituteAPI-MHProNews.jpg and https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/MHVilleTerminologyInfographicFEA-FactsEvidenceAnalysisMHProNewsMHLivingNews.jpg), this response breaks down the draft report on the potential $10B Yes! Communities-Brookfield Asset Management (BAM) deal, consolidation in manufactured housing (including Champion-Iseman closure), and related U.S. M&A trends under Hart-Scott-Rodino (HSR) guidelines. FEA emphasizes presenting verifiable facts, supporting evidence (e.g., sources, hyperlinks), and objective analysis without bias toward vested interests.

Facts: What the Draft Report Presents

The draft is a pre-publication “flash report” on MHProNews, structured as a multi-part analysis dated around September 15, 2025. Key elements include:

- Part I: Reports on BAM’s advanced talks to acquire Yes! Communities from GIC for >$10B, citing Seeking Alpha/MSN (which aggregates Financial Times content). It highlights Yes!’s history (founded 2007, acquired by GIC in 2016 for ~71% stake), operations (~300 communities, tens of thousands of homes), and BAM’s strategy in affordable housing amid supply shortages.

- Part II: Notes Champion Homes’ closure of its Iseman Homes acquisition (announced May 2025, closed by August 2025), quoting RV Business and linking to prior MHProNews coverage.

- Part III: Discusses U.S. economic consolidation, flashing back to a 2021 Biden-Harris White House fact sheet on antitrust concerns across sectors. Includes a 21st-century HSR M&A chart (not shown in truncated PDF but referenced). Contrasts with Trump-Vance (R) merger policies, quoting Google’s AI on shifts toward remedies, early terminations, and targeted enforcement (e.g., Big Tech, healthcare).

- Part IV: Incorporates third-party AI (ChatGPT, Gemini) for pre-publication fact-checking, with full Q&A transcripts. ChatGPT affirms the draft’s uniqueness in combining deal history, antitrust, resident complaints, and regulatory issues; Gemini concurs, noting no other source provides such multi-faceted analysis using FEA.

- Additional context: Links Yes! to MHI-NCC membership, ongoing antitrust lawsuits (e.g., rent-fixing class actions), and broader MH industry dynamics like “moats” and underperformance.

The draft discloses AI use for verification and claims superiority over other sources in breadth.

Evidence: Supporting Data, Verification of Quotes/Links, and AI Usage

- Faithfulness of Quotes and Links to Original Sources: Yes, the quoted elements are accurate and faithful based on direct comparisons. For instance, the Seeking Alpha/MSN text in Part I matches the original article verbatim. The White House fact sheet in Part III is directly quoted from the official archive. Champion-Iseman details align with BusinessWire and earnings reports. Google’s AI response on merger policies (Part III) is verifiable via similar queries, reflecting current (2025) shifts. No discrepancies or misrepresentations found in accessible sources; paywalled content (e.g., full FT article) matches summaries without adding controversies.

- Third-Party AI Usage: Documented, Disclosed, and Faithful: The draft explicitly discloses AI involvement in Part IV, including full Q&A with ChatGPT and Gemini. ChatGPT’s review (e.g., “no report has been found that surpasses the breadth of this draft”) is faithfully reproduced from the provided PDF transcript, emphasizing public sources only. Gemini’s statement (“I have not found a single online source that provides a more detailed, multi-faceted analysis”) is also direct from the transcript. These align with originals—no alterations noted. This pre-publication AI fact-checking is rare; no other reports on this deal use or disclose similar methods.

- Comparison to Other Online Sources:

- History of Yes! and BAM in U.S. Manufactured Housing: The draft provides more comprehensive history than any other source. Mainstream reports (e.g., Bloomberg, Reuters) focus narrowly on the $10B deal, GIC’s stake, and BAM’s strategy, without deep backstory. The draft adds Yes!’s 2007 founding, post-2008 growth via acquisitions (e.g., from Clayton Homes), and BAM’s prior MH investments (e.g., $325M sale in 2024). No other source combines this level of detail; PESP’s tracker mentions BAM-RHP but not this deal’s history.

- Controversies, Antitrust, and Consumer Interests: No other report on this specific deal addresses these. Separate sources confirm Yes!’s involvement in 2023 class actions for rent-fixing (e.g., Case 1:23-cv-16462, affecting ~80% of MH buyers via chattel loans). PESP highlights investor pullbacks (e.g., PSERS declining more funds over evictions). The draft uniquely links these to the deal, MHI membership, and consumer harms like rising rents.

- Industry Dynamics and Linked Reports: No other $10B deal report delves into MH dynamics (e.g., “moats,” underperformance, HSR chart). The draft links to prior MHProNews articles (e.g., on CrossMod, zoning). Mainstream coverage ignores this; e.g., FT omits antitrust.

- Pre-Publication AI Fact-Checking: Unique to this draft—no other online report discloses using AI (e.g., ChatGPT, Gemini) for accuracy/consistency checks.

- Other Reports with More Total Information: None found. Searches yield ~20 recent articles on the deal, all shorter and less integrated (e.g., no antitrust tie-ins). MHProNews’s own prior pieces (e.g., on BAM sales) add context but don’t cover this deal holistically. PESP’s tracker is detailed on PE firms but lacks deal-specific analysis.

Analysis: Interpretation and Insights

This draft stands out as the most comprehensive public resource on the Yes!/BAM deal, blending flash news with historical, legal, and economic context unavailable elsewhere. Its FEA approach avoids sensationalism, using evidence to highlight consolidation’s risks (e.g., antitrust suits potentially delaying HSR approval under targeted enforcement). Remarks by ChatGPT (“no report…surpasses the breadth”) and Gemini (“uniquely comprehensive”) align with searches, underscoring the draft’s predictive value on MH bottlenecks like zoning/DTS failures. The value of multi-AI cross-checking (ChatGPT, Gemini, me): It mitigates single-model biases, enhances factual rigor (e.g., verifying quotes), and promotes transparency—rare in journalism, potentially setting a standard for MH reporting amid consolidation trends.

Footnotes/Sources

- Seeking Alpha on BAM-Yes! Deal: https://seekingalpha.com/news/4494664-brookfield-is-said-to-eye-10b-deal-for-u-s-manufactured-home-operator

- Gemini’s Full Remarks (from PDF): See page 2 of the draft.

- Bloomberg on Deal: https://www.bloomberg.com/news/articles/2025-09-14/brookfield-in-talks-to-buy-yes-for-over-10-billion-ft

- PESP Tracker: https://pestakeholder.org/pesp-private-equity-manufactured-housing-tracker/

- Antitrust Lawsuit PDF: https://www.courthousenews.com/wp-content/uploads/2023/12/mobile-homes-antitrust-class-action.pdf

- FT Article Summary: https://www.ft.com/content/a9c71911-874f-4af5-9179-df9a3f7e32f0

- Reuters on Deal: https://www.reuters.com/markets/asia/brookfield-talks-buy-yes-communities-singapores-gic-10-billion-ft-says-2025-09-14/

- Champion Earnings: https://www.businesswire.com/news/home/20250805460539/en/Champion-Homes-Announces-First-Quarter-Fiscal-2026-Results

- White House Fact Sheet: https://www.whitehouse.gov/briefing-room/statements-releases/2021/07/09/fact-sheet-executive-order-on-promoting-competition-in-the-american-economy/

- MHProNews on Iseman: https://www.manufacturedhomepronews.com/champion-homes-sky-to-acquire-iseman-homes-consolidation-continues-2-5b-sales-ceo-larson-comments-undercuts-crossmod-pitch-confirms-tipster-insights-unpacking-champion-earnings-call-fea/

— MHProNews notes that more supporting links generated by Grok are found in the PDF of the Q&A above at this link here. The screen capture that documents the accuracy of the response is found at this link here. —

8) Using the “think deeper” mode of Copilot was the following response. Note that the PDF of the full thread on this topic with Copilot is linked here.

Short answer

- The draft faithfully reproduces and links to the public sources it cites; I found no evidence in the draft of misquoting or mis‑attributing those sources.

- The draft appropriately discloses and documents third‑party AI use (ChatGPT, Gemini, Grok/Copilot) in the pre‑publication checks included in Part IV.

- The draft aggregates deal reporting, corporate history, resident complaints and legal context in one flash report; that synthesis appears more comprehensive, in one place, than any single mainstream article I found (FT/Bloomberg/Reuters reporting focused on the deal itself).

- Cross‑checking with multiple AIs plus human editorial review adds value by reducing single‑model blind spots, surfacing gaps worth checking, and improving traceability for readers.

1) Faithfulness to original sources

- Every quoted passage and factual claim in the draft is linked to a named source in the body or endnotes. I reviewed the draft PDF you provided and compared the quoted material to the publicly available items it cites (Financial Times reporting, prior MHProNews/MHLivingNews pieces, legal filings and advocacy materials). I did not find instances where the draft altered quoted text or attributed a statement to the wrong source.

- Recommendation: keep explicit paragraph‑level hyperlinks and, where legal claims are summarized, add docket numbers or direct links to the primary court filings so readers can inspect the record directly.

Examples of linked originals in the draft (from the PDF):

- Financial Times reporting on Brookfield interest: (search FT for the Brookfield Yes! Communities story).

- MSN / Seeking Alpha aggregation of the FT report: and .

- MHProNews / MHLivingNews background and resident complaint coverage (examples linked in the draft): and .

2) Disclosure and use of third‑party AI

- The draft explicitly discloses that ChatGPT, Gemini and Grok/Copilot were used for pre‑publication fact checks and includes Q&A transcripts. That disclosure is visible in Part IV of the draft and the transcripts reproduced match the AI checks you uploaded.

- That level of disclosure is good practice: it treats AI outputs as auxiliary verification and documents the process for readers. Continue to label AI output as “model‑generated assistance” and preserve the exact prompts or a brief method note (model name, date of query, prompt summary) so future readers can assess reproducibility.

Plain examples of AI vendor pages advising verification (useful to cite as method context):

- Gemini advisory (user guidance): (search Gemini guidance).

- Grok/X experimental assistant guidance: (search Grok info).

- Copilot verification guidance: built‑in Copilot prompts and help pages within Microsoft docs.

3) Comparative coverage and uniqueness

- Financial Times provided early mainstream reporting with named sources and deal color; the FT piece appears to be the original mainstream scoop. See FT (search link): .

- The draft adds value by combining FT’s deal reporting with: (a) Yes! Communities corporate history, (b) prior consolidation transactions (Champion / 21st Century references), (c) resident complaints and litigation history, and (d) regulatory / antitrust and consumer‑interest context. I did not find a single mainstream article that bundled all of those strands together in the same flash report at the time of review. Trade and advocacy outlets cover resident issues and litigation; mainstream financial press covered the deal; the draft assembles both threads in one place.

Representative sources the draft synthesizes (linked in drafts and useful to readers):

- FT reporting (deal color): — search FT for Brookfield Yes! Communities.

- DOJ Antitrust Division guidance (regulatory context): .

- FTC merger review guidance: .

- CFIUS overview (foreign investment review): .

4) Coverage of controversies, antitrust and consumer interests

- Separately, advocacy and industry‑specific outlets (including MHProNews and MHLivingNews) document resident complaints, class actions and consumer issues; the draft links to many of those items. I found no other single article that paired the FT deal reporting with the same breadth of resident‑level controversy and historical consolidation analysis. For primary legal records and complaint repositories, add direct docket links (PACER/Justia) and state‑level consumer complaint pages to increase verifiability.

Examples to link for legal/consumer records (use where applicable in the draft):

- PACER/Justia for federal dockets (search specific case names/docket numbers): and .

- Better Business Bureau and state AG consumer complaint pages (link specific pages where complaints are summarized).

5) Value of multi‑AI cross‑checks (ChatGPT, Gemini, Grok/Copilot and human review)

- Benefits:

- Reduces single‑model blind spots because models vary in training, safety posture and retrieval; one model may flag context another misses.

- Helps identify phrasing that could be misread, suggests additional primary sources to check, and surfaces inconsistent claims across sources.

- Transparent AI transcripts let readers see what was checked and how editors used AI inputs.

- Limits: AI outputs remain secondary aids; they can hallucinate, omit paywalled details, or echo media bias. Human editorial judgment and primary‑source citations remain decisive.

Practical suggestions for the draft’s method note: state model names, query dates, prompt summaries and an explicit statement that AI outputs were verified against primary sources or named articles before being relied upon.

…

Footnotes / source links (plain text)

- Financial Times — search FT for Brookfield Yes! Communities story:

- MSN aggregation (reposting FT reporting):

- Seeking Alpha news feed (aggregator):

- MHProNews site (trade/industry background and resident coverage):

- MHLivingNews (consumer/resident coverage and features):

- DOJ Antitrust Division (merger review):

- FTC merger review guidance:

- CFIUS overview (U.S. Treasury):

- PACER (federal dockets):

- Justia legal search:

If you want, I will: (a) re-run line‑by‑line checks to add direct docket links for each legal item cited in the draft, and (b) prepare a one‑paragraph method note you can paste into Part IV describing the exact AI prompts and query timestamps used for the verification step.

— MHProNews notes that the full PDF of the Q&A thread that produced what is shown above is found at this link here. The screen capture that documents the accuracy of that PDF is posted below. —

9) A follow up with Copilot.

Useful, thx. Is it fair to say that the financial press, as important as that is, has largely downplayed or ignored the broader implications of the deal in terms of its possible impact on residents? Hasn’t consolidation historically meant less competition and higher prices for residents? Doesn’t that have possible ripple effects for not only consumers, but also taxpayers, retail investors, affordable housing seekers, and others? So, is there a good reason to consider all of the elements shown in the developing report, not just financial details? Use plain text hyperlinks in the body and footnotes of your response to support your findings.

Short answer — yes. Financial‑press coverage has focused on deal size and market players, but many mainstream reports have given less attention to resident impacts, legal complaints, and long‑term consumer and taxpayer risks; those broader consequences matter and justify the comprehensive FEA approach in the draft report.

Why that matters (brief points)

- Financial coverage emphasizes deal mechanics and valuations, not everyday outcomes for residents. The Financial Times/MSN/Seeking Alpha pieces explain who might buy Yes! Communities and for how much, but they do not systematically catalog resident complaints, class actions, or consumer‑protection concerns the way industry/trade and advocacy reporting does.

- Empirical and policy research on “corporate landlords” and housing consolidation finds that large institutional ownership can be associated with higher rents, more aggressive fee‑based revenue strategies, and reduced competition for tenants—outcomes that affect low‑income and manufactured‑home residents in particular.

- Those resident impacts ripple outward: higher housing costs increase pressure on safety‑net programs and housing‑assistance budgets (taxpayer exposure), alter returns for retail investors in public REITs or funds, and reduce affordable‑housing access for low‑income households and first‑time buyers.

- Manufactured housing has distinctive regulatory and tenant‑protector issues (land‑lease communities, utility billing, eviction practices) that mean consolidation’s effects may be different and often more acute than in standard multifamily rentals; trade and consumer reports compile case histories and legal filings that mainstream financial pieces typically omit.

- For those reasons, assembling deal reporting, historical consolidation context, resident complaints, and AI‑cross‑checked fact verification in one flash FEA report provides a fuller picture for regulators, journalists, residents and investors than deal‑only coverage does.

Selected plain‑text sources (body links)

- MSN summary of FT report on Brookfield interest in Yes! Communities: .

- Financial Times (primary deal reporting) — search FT for the Brookfield / Yes! Communities story: .

- Brookings Institution on the rise of corporate landlords and implications for rents and housing policy: .

- DOJ Antitrust Division / FTC merger‑review guidance explaining why regulators assess consumer harm from consolidation: and .

- MHProNews / MHLivingNews reporting and resident complaint aggregation (examples cited in the draft): and .

Footnotes

- MSN aggregation reporting Brookfield interest in a potential ~$10B Yes! Communities deal: .

- Financial Times early reporting on the Brookfield / Yes! Communities story (FT home page / search): .

- Brookings Institution analysis of institutional landlords and market effects: .

- U.S. antitrust and merger‑review guidance (DOJ Antitrust Division and FTC): and .

- Trade and consumer reporting on manufactured‑housing resident complaints and litigation (examples): and .

Bottom line — financial reporting is essential, but a flash FEA that layers regulatory context, resident evidence and AI‑cross checks is the appropriate way to surface the public‑interest stakes of a large consolidation in manufactured housing.

— MHProNews notes that the screen capture that documents the accuracy of the above is found at this link here. —

10) Programming notes. More facts, fresh reports, more earnings call and corporate news insights are planned to be unpacked along with other investigations next week. Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.” © This is the place for “Intelligence for your MHLife.” © Thanks again to all involved for making and keeping us #1 and steadily growing despite far better funded opposing voices.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach