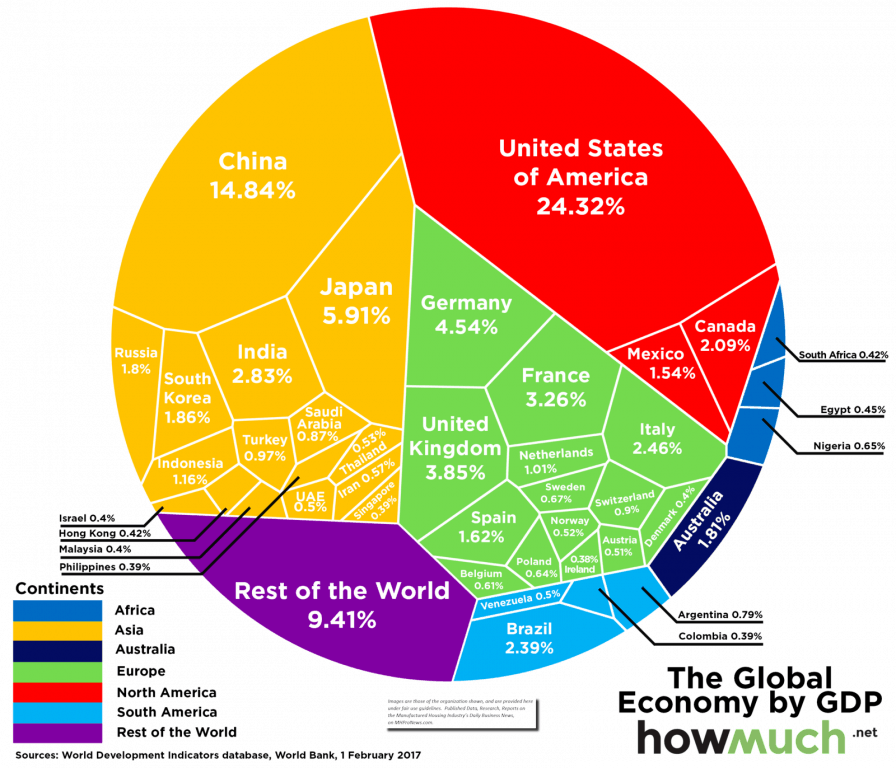

Labor Day is an apt time to seriously ponder the impact of decades of U.S. trade policies on American workers and U.S. companies.

The Congressional Research Service (CRS) updated their report, China’s Economic Rise: History, Trends, Challenges, and Implications for the United States on June 25, 2019.

From page 5 of that CRS report is the following.

“…Many U.S. companies have extensive operations in China in order to sell their products in the booming Chinese market and to take advantage of lower-cost labor for export-oriented manufacturing.3 These operations have helped some U.S. firms to remain internationally competitive and have supplied U.S. consumers with a variety of low-cost goods. China’s large- scale purchases of U.S. Treasury securities (which totaled $1.1 trillion as of April 2019 have enabled the federal government to fund its budget deficits, which help keep U.S. interest rates relatively low.4

However, the emergence of China as a major economic power has raised concern among many U.S. policymakers. Some claim that China uses unfair trade practices (such as an undervalued currency and subsidies given to domestic producers) to flood U.S. markets with low-cost goods, and that such practices threaten American jobs, wages, and living standards. Others contend that China’s growing use of industrial policies to promote and protect certain domestic Chinese industries or firms favored by the government, and its failure to take effective action against widespread infringement and theft of U.S. intellectual property rights (IPR) in China, threaten to undermine the competitiveness of U.S. IP-intensive industries. In addition, while China has become a large and growing market for U.S. exports, critics contend that numerous trade and investment barriers limit opportunities for U.S. firms to sell in China, or force them to set up production facilities in China as the price of doing business there.”

One could unpack those two paragraphs for hours, because there is so much meaning to them for businesses, including builders of housing, along with policy makers, advocates, labor, investors, and the manufactured home industry too.

Over time, more and more components going into American housing – including manufactured homes – have originated in China. Purchases of goods in China implies that those same items are not being produced in the U.S.

Among the U.S. companies doing business with suppliers from China is Berkshire Hathaway owned Clayton Homes. Recall our prior report on Kevin Clayton’s televised lament about the tariffs and trade tensions, linked below. For the subsidiary of a company whose leader preaches long-term thinking – see a recent Warren Buffett video interview further below – Clayton makes a short-term thinking argument that their critics would say is easily debunked.

Few companies will publicly admit that their policies may harm the interests of their own workers, labor in general – or their customer base.

- Clayton Homes says they are moving toward more automation. That in turn would also reduce their dependence on American labor.

- Clayton’s push some years ago to source components from China put manufactured housing competitors in a difficult spot. If other builders of HUD Code manufactured homes didn’t source as many lower cost components as they could from China, then the disparity between Clayton and other producers would grow.

Highly placed sources with independent manufactured home producers told MHProNews recently that they and others that they know are all buying various levels of items made in still Communist China.

A now-retired senior executive with a non-manufactured housing company that is in the Fortune 100 told MHProNews that it is “now or never” on curbing China’s economic growth, military, cyber, and intellectual property (IP) threat to the U.S. economy.

That dovetails with a growing number of voices in Washington, D.C., including President Donald J. Trump. In his 2015-2016 campaign, then candidate Trump made the famous pledge captured in the meme below. It is a refrain he still shares at his rallies. Note the related report, further below.

For several months, Senate Minority Leader Chuck Schumer (NY-D) has urged President Trump to “hang tough on China.” It is an uncommon area of agreement on the need to deal with this issue now. Prior administrations – Democrats and Republicans – have kicked this trade imbalance can down the road for decades. That road with China is coming to an end, as the CRS report and other research indicates. There have been voices in both major parties that have warned that China had to be deal with.

The Not So Hidden Costs of Large Trade Imbalances

A significant share of U.S. defense spending is primarily due to the threats posed by China and Russia. Where is the logic in paying hundreds of billions annually for ‘cheaper’ goods that in turn cost Americans more:

- lost jobs,

- lower wages,

- higher social safety net spending,

- and reduced opportunities to invest in the U.S.,

all because of trade advantages handed to China on a silver plater – something that has gone on for decades?

Warren Buffett on Long Term Planning and China

The elephant in the room in our industry is Berkshire Hathaway, led by Chairman Warren Buffett. Here below is a recent interview with Buffett, who early in the interview is making the case for long-term thinking when it comes to business and investing. But near the end – without saying so – Buffett essentially flips to a shorter-term thought when it comes to China and trade. Where was the follow up question on that dichotomy?

With that noted, is it any surprise that Kevin Clayton said what he did in the report linked here and above?

The Trump Trade Strategy – Is it Working?

One America News (OAN) reported on Friday that, “So far, Beijing has relied on a combination of fiscal stimulus and monetary easing to deal with the economic slowdown [in China], including hundreds of billions of dollars in infrastructure spending and tax cuts for companies.

But analysts note infrastructure investment growth has remained subdued despite the earlier pump-priming measures, underlining the need for additional support.”

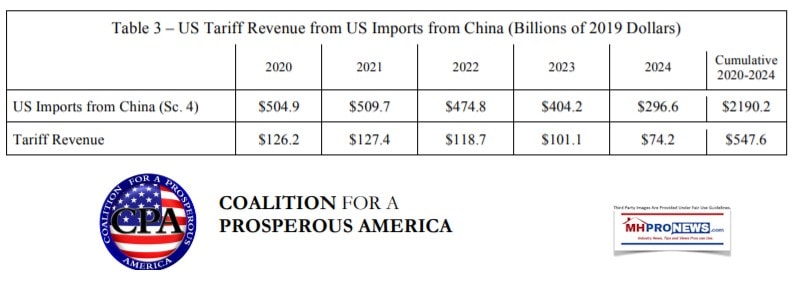

Additional bullets that indicate that the Trump Administration trade strategy appears to be working, based on data, are noted below.

- Factory activity in China shrank in August 2019 for the fourth month in a row.

- Export orders fell for the 15th straight month in August, according to Reuters and OAN, although at a slower pace.

- Total new orders – from China and abroad – continued to fall, indicating their domestic demand remains soft, despite a flurry of growth-boosting measures over the past year.

With that tee up, ICYMI, the report below provides useful related insights from the White House.

Does President Trump Get It About American Labor and Business?

Undermining Freedom and National Interests?

“America will never be destroyed from the outside. If we falter and lose our freedoms, it will be because we destroyed ourselves.” – Abraham Lincoln, per BrainyQuotes. In 1860 American tariff rates were among the lowest in the world. But the passage of the Morrill Tariff immediately raised these averages to about 26% overall or 36% on dutiable items, said Wikipedia, which added “Customs revenue from tariffs totaled $345 million from 1861 through 1865, or 43% of all federal tax revenue…” That sum didn’t nearly cover civil wartime military spending, but it was nevertheless the top source of federal income.

One may wonder if Lincoln would have been shocked by American companies shipping jobs overseas to nations that in turn threaten our national and economic security?

“Freedom is never more than one generation away from extinction. We didn’t pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same, or one day we will spend our sunset years telling our children and our children’s children what it was once like in the United States where men were free.” ― Ronald Reagan, cited by BizPac Review. Freedom can be limited in a variety of ways, as President Reagan understood. During his tenure, millions of jobs were created, fueling the economic freedom of the middle class.

China is not the only challenge to American freedom, but it is on several levels a large threat. The Trump Administration’s efforts to close trade deals include the awaited ratification by Congress of the U.S. Mexico and Canada (USMCA). Per sources, that would begin to address the problems that caused hundreds of American firms to go south of the border. A tentative trade agreement with Japan is now also reportedly within reach. That is coming on the heels of a deal with the U.S. and South Korea. Ratifying deals such as those would arguably help seal a better deal with China, or make the pressure for getting a deal less urgent.

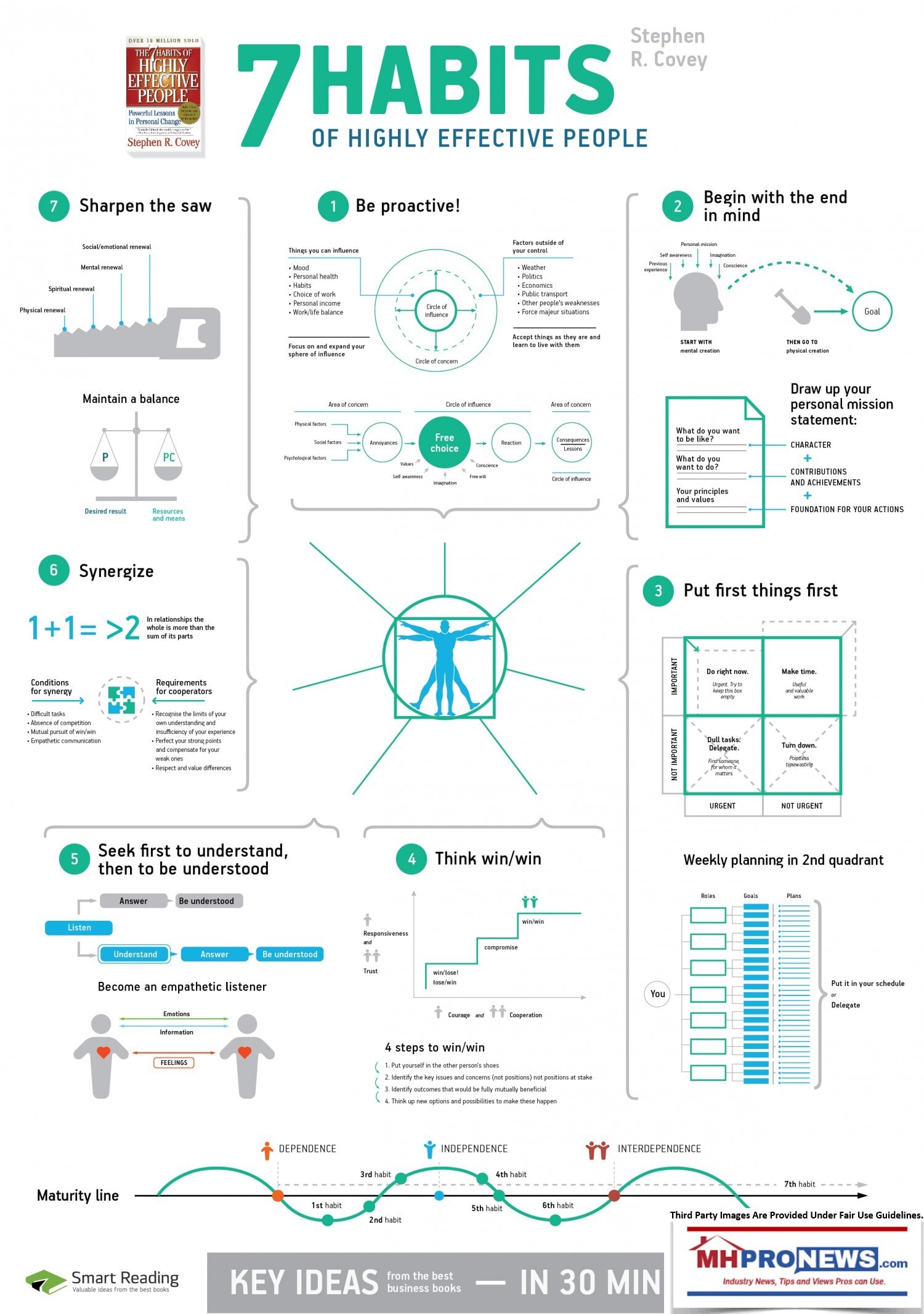

Labor, Management, and Investing

While there has long been tension between labor and management, in the ideal, management should treat labor fairly with the expectation that workers will respond accordingly. It would be difficult to find a modern business coach publicly advising leaders to treat labor badly. As unemployment has dropped, wages have risen. That means the buying power of workers is up. That’s a prudent strategy.

The very notion of leadership and team building is to make workers feel appreciated, encouraged, and compensate them to do good work, perhaps providing incentives to achieve targeted goals.

Finally, it is workers of all kinds who are the largest market for housing purchases.

Summed up, mutual victories between management and workers is what Dr. Stephen Covey called the “win-win” in his famous Seven Habits of Highly Successful People.

But when smaller companies feel pressured by larger competitors to follow their lead and de facto ship jobs overseas by buying products from other nations that could be purchased in the U.S., that’s shorter-term thinking. It is also win-lose thinking. In the long run, the case can be made that everyone in that picture could lose. The ongoing protests in Hong Kong are a sobering reminder that those closest to China fear what that nation does to its own people.

“As of 2018, it is estimated that the Chinese authorities may have detained hundreds of thousands, perhaps millions, of Uyghurs, Kazakhs, Kyrgyz, Hui (Muslims) and other ethnic Turkic Muslims, Christians as well as some foreign citizens such as Kazakhstanis, who are kept in these secretive internment camps,” says Wikipedia. Where is the long-term logic in feeding a regime that does that to an estimated 1 to 2 million of its own citizens?

The president’s strategy, hopefully with strong bipartisan support, is in the long-term better for American workers and businesses alike.

The full CRS updated study, cited at the top, is linked here as a download. See the related reports below the byline for more insights.

That’s your third installment on this Labor Day of healthy, addictive insights for professionals, investors, and advocates. It’s all found here on MHProNews — your home for “News Through the Lens of Manufactured Homes and Factory-Built Housing,” © where “We Provide, You Decide.” © ## (News, fact-checks, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Big Picture – China-U.S. Trade War, White House Statement, Manufactured Home Pro Alert

Pain Before Gain, Kevin O’Leary, Trade War “Starting to Work,” plus Manufactured Home Stock Updates

Chinese PreFabs, Modulars Are Selling in the USA, Here’s an Example

Chinese Flat-Packed Prefabs Target U.S., International Markets – Video, Details