Hours before a press release arrived about the headline topic, a source from the finance side of the manufactured home industry sent a short note to MHProNews that had a dark tone.

The essence of their comment was don’t hold your breath waiting for the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac to implement the Duty to Serve mandate.

That was not the only such comment from well-placed sources in manufactured housing or working for the federal government, either recently or over the years, that had this common theme. The Duty to Serve (DTS) ‘mandate’ on the GSEs was essentially a farce, a head-fake, and listening sessions are ‘feel good’ shows purportedly fostered by insiders at the GSEs working in concert with key Manufactured Housing Institute (MHI) members. Fully implementing the DTS on manufactured housing chattel loans, for example, would cost Berkshire Hathaway financing profits – say those sources.

When you look at where the bulk of the profit is in manufactured housing from the Berkshire annual statement, you can see why that would not be appealing to Warren Buffett or Berkshire shareholders.

That makes for an apt preface to what follows, but it must be stressed that those purported head fakes include Berkshire Vice-Chair Charlie Munger and Buffet himself, as the video on the page linked below arguably reminds us all. Some conglomerates have the power to influence the federal government in direct or subtle ways. It has been so for years, long predating the Trump Administration. Why has the Berkshire brands operating in manufactured housing and the Arlington, VA based Manufactured Housing Institute (MHI) that they seemingly dominate worked to promote a ‘new class’ of manufactured homes, but not all HUD Code manufactured housing? It can be summed up in a single word. Profits. Berkshire makes more money in interest on consumer loans on manufactured homes that carries a higher rate than if those same loans had a lower interest rate.

Among the loudest complaints, albeit off-the-record, has been from MHI member-producers who felt that the entire DTS and ‘new class of homes’ plan was a flawed concept from the outset. One such report is linked below. But readers must bear in mind that there have been warning signs from the outset about this ‘new class of homes’ projects. Those concerns originated in several cases here at MHProNews, while this operation was still an MHI member.

Their leadership knew it.

Given that the powers that be in manufactured housing finance associated with Berkshire and MHI knew of our concerns, is it any wonder that they wanted to invite us to leave MHI so that we couldn’t make those concerns know during their meetings?

“What Are We, Chopped Liver?” MHI Member December 2018 Reactions

So, given what is known by MHProNews from various sources, it is no surprise that the latest document from the Federal Housing Finance Agency (FHFA) is the latest letdown for those consumers and manufactured housing industry professionals who were hoping for something that represents an advancement. Don’t hold your breath.

In fact, what this report that follows indicates, the latest word from the FHFA and the GSEs reflects a retreat from the previously stated goals, which were already miniscule. The numbers of target loans to be made by the GSEs has been dramatically dropped in the most recent announcement, not increased. This should construed as the latest warning sign to consumers, advocates, and all independent manufactured housing professionals.

Here is MHARR’s report to MHProNews.

FOR IMMEDIATE RELEASE Contact: MHARR

(202) 783-4087

FHFA DOCUMENT VINDICATES LONG-STANDING MHARR POSITION

ON FANNIE MAE AND FREDDIE MAC’S FAILURE TO IMPLEMENT DTS

Washington, D.C., October 28, 2019 – A “Request for Input on Fannie Mae and Freddie Mac Proposed Modifications to their 2018-2020 Duty to Serve Plans” (RFI) (see, relevant excerpts of this document, attached), published by the Federal Housing Finance Agency (FHFA) on October 24, 2019, fully vindicates the Manufactured Housing Association for Regulatory Reform’s (MHARR) longstanding position that the Government Sponsored Enterprises (GSEs) continue to harm both the industry and American consumers of affordable housing by refusing to fully and timely implement the Duty to Serve Underserved Markets (DTS) mandate of the Housing and Economic Recovery Act of 2008 (HERA).

While nearly 80 percent of the mainstream affordable manufactured housing market financed through personal property (i.e., chattel) consumer loans remains unserved by the GSEs more than a decade after Congress’ adoption of DTS, Fannie, Freddie and their erstwhile FHFA regulators – as consistently pointed out by MHARR — have made much of their alleged support for the comparatively tiny portion of the total manufactured housing market represented by real estate loans. Now, though, even that flimsy “commitment” to manufactured home loan purchases would be undermined and delayed by the proposed modifications to Fannie Mae’s 2018-2020 DTS Plan.

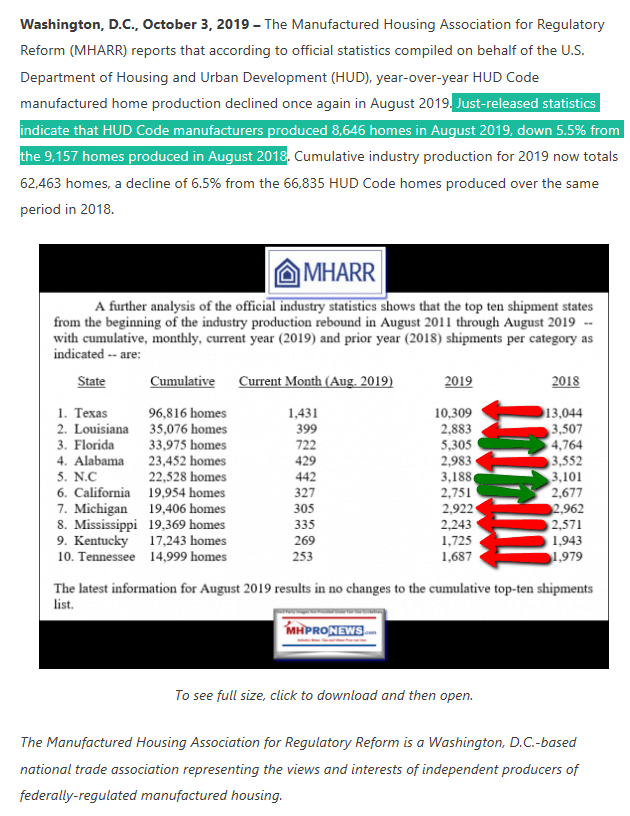

Under the proposed modifications, Fannie Mae’s 2020 “loan purchase target” for mainstream manufactured homes titled as real estate would drop from an already miniscule 450 loans to a mere “100” loans (i.e., 0.1% of the entire manufactured housing market, based on 2018 production). Further, under its separate alleged DTS undertaking to “develop an enhanced manufactured housing loan product for quality manufactured homes and purchase loans” (emphasis added) (i.e., its highly-touted “MH Advantage” program for higher-cost manufactured homes), Fannie Mae is totally removing any commitment to purchase such loans in 2019 and 2020, and is reducing its loan purchase “goal” from 500-750 such loans to a mere 25, (see, Fannie Mae proposed DTS modifications, p. 3 of 5), brazenly asserting that 25 loans “is a meaningful loan purchase target” in that it “represents a significant increase in purchase volumes as compared to 2018 and 2019.” Thus, as has been the case throughout the DTS process, Fannie effectively claims that its total failure to serve any component of the manufactured housing market in the past constitutes justification for its continuing and ongoing failure to do so.

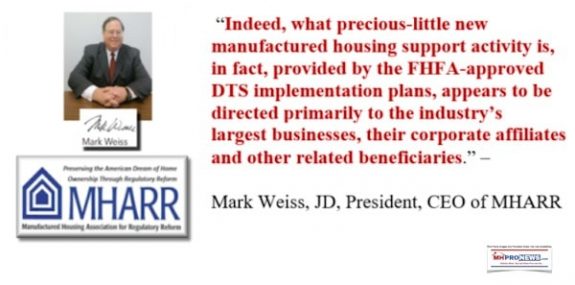

By failing to implement any aspect of DTS for mainstream manufactured homes in a market-significant manner – or at all – for major sections of the HUD Code market, the GSEs and FHFA are seriously harming lower and moderate-income American homebuyers by helping to sustain needlessly high-cost interest rates, particularly for personal property loans. This inures to the specific benefit of the industry’s largest manufacturers and their captive lenders, while it discriminates against – and unduly harms – smaller, independent producers while undermining competition within the industry as a whole.

If there were any doubt, however, that the GSEs and FHFA are continuing to cater to the special interests of the industry’s largest producers and their captive finance companies, the following statement from the Fannie Mae proposal regarding the MH Advantage program is telling: “first loans were purchased through homes in a subdivision development and all of the top 3 manufacturers are making this a priority in 2020 and beyond.” (Emphasis added) (Id.). This shows – as MHARR has consistently maintained — that MH Advantage was established to help the industry’s largest producers sell more costly manufactured homes outside of the mainstream manufactured housing market; that it disregards the market-segment served by smaller and medium-sized independent producers; that it therefore fails to serve the vast bulk of the manufactured housing market and the vast bulk of the manufactured housing real estate sub-market; and that it is a diversion from and avoidance of the legitimate purposes of DTS, which allows the GSEs to claim that they are implementing DTS when, in fact, they are not and are simultaneously leaving the mainstream manufactured housing market and lower and moderate-income American homebuyers nearly entirely unserved.

As MHARR has noted previously, the alleged “implementation” of DTS by Fannie Mae and Freddie Mac is a brazen and misleading charade and shell-game by entities with no interest in actually serving the mainstream HUD Code manufactured housing market and the lower and moderate-income American homebuyers that Congress specifically sought to help. As such, all elements and all aspects of the phony DTS “implementation” process should be investigated by the U.S. Congress, and both Houses of Congress should hold full-scale hearings to hold to account all those responsible for the virtual gutting of DTS for 11 years. In light of this unacceptable failure by the GSEs, MHARR will now pursue this matter further with both Congress and the Trump Administration.

The Manufactured Housing Association for Regulatory Reform is a Washington, D.C.-based national trade association representing the

views and interests of independent producers of federally-regulated manufactured housing.

— 30 —

The MHARR attachments are linked here – which includes the FHFA factoids, statements, and request for comments, plus MHARR’s release at this link here as downloads.

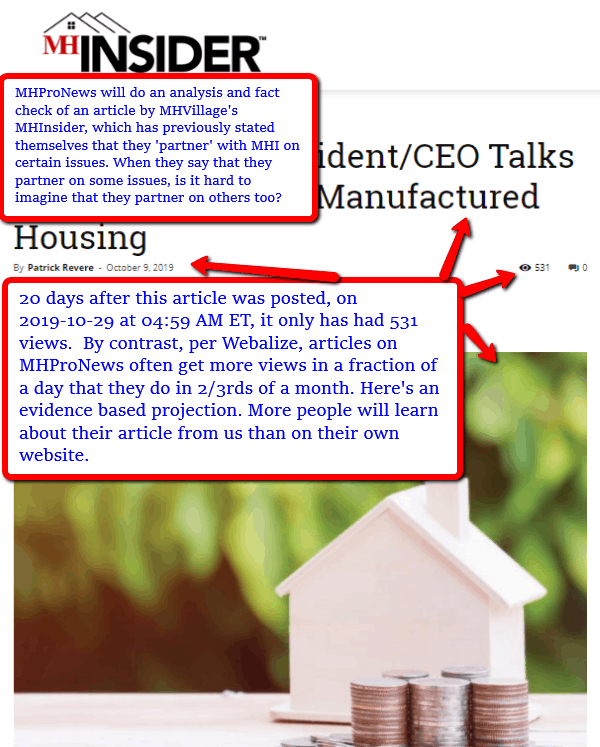

If there is any doubt as to who the sources of head-fakes and gaslighting within manufactured housing arise from, the latest from the FHFA should logically make it clear. MHARR, MHProNews, MHLivingNews, and others have sounded alarms for years. Meanwhile, MHI toadies and mouthpieces are purportedly proving to me cheerleading for a lot of hot air that arguably even lacks the balloon to give that gas shape. It arguably reflects the disrespect that MHI and their Omaha-Knoxville masters have for even their affiliated trade writers, because they are making them looking like fools, aren’t they? While MHInsider, George Allen or others posture and prance on behalf of the Omaha-Knoxville-Arlington axis, their masters have arguably pulled out the rug from under them once again.

No wonder those other trade media sources in manufactured housing get relatively few readers. Generally speaking, one can only fool people so many times, before the targets of deception finally get tired of being fooled. One of the highest visibility personalities in all of manufactured housing, in an ‘interview’ with MHInsider has had scant readers, per their own data.

It will be fascinating to see what the Omaha-Knoxville-Arlington axis and their blogging spin-machines will make out of this latest development being announced by the FHFA and the GSEs. . Aren’t the industry’s propagandists running out of running runway for the train of excuses to the long-promised ‘progress’ on DTS? Keep in mind that HERA 2008 – which gave birth to the Duty to Serve manufactured housing is now over a decade old.

Facts, evidence, common sense, and ‘following the money’ trail are how the truth is discerned by investigators and the wise when falsehood and deceptions are at play.

While conventional housing is rising, how is it that manufactured housing is sliding during an affordable housing crisis? Given that the Omaha-Knoxville-Arlington axis and their mouthpieces are ‘the leaders’ of the industry, is there a logical conclusion that someone can come to that explains why the industry’s new home production is in decline for a year? Is this MHI’s idea of “momentum?”

See the related reports that are linked below the byline and notices for more. Good, bad, or indifferent, look no further than the industry’s runaway #1 news source – MHProNews – to get your daily reality-check. That’s your first installment today of manufactured home “Industry News, Tips, and Views Pros Can Use” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. Connect with us on LinkedIn here and and here.

Related Reports:

Click the image/text box below to access relevant, related information.

Lesli Gooch, PhD, Manufactured Housing Institute EVP Reveals DTS Financing Con Job

A Tale of Two Cities, Affordable Housing, Manufactured Homes, and You