“We saw strong demand on the MH side of the business, with a 4.6% increase in rental revenue. In the quarter, we saw a decrease in residents moving out of our communities. We increased new home sales volume by 14% and the average purchase price increased by 10%. Our MH properties are currently 95% occupied.” That was Marguerite Nader, President and Chief Executive Officer of Equity LifeStyle Properties (ELS) as reported by the Motley Fool’s transcription service on July 21, 2020.

Nader said that they closed no new acquisitions, citing their selective bias toward 55 plus properties. Per Nader, “There is certainly transactions that are happening, some transactions are happening in — in kind of the all age MH space, which we have expressed that we’re not necessarily interested in.”

Paul Seavey, Executive Vice President (EVP) and Chief Financial Officer (CFO) at ELS said: “Our core MH rent growth of 4.6%, consists of approximately 4.1% rate growth and 50 basis points related to occupancy gains. We have increased occupancy at 103 sites since December, with an increase in owners of 156 while renters decreased by 53.”

Much of what follows in our featured focus are seemingly glowing items even as other segments of the U.S. rental market faces what the Aspen Institute has said is a possible “tsunami” of renter evictions.

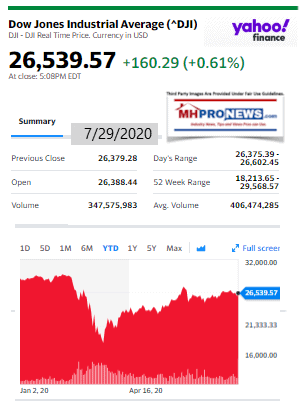

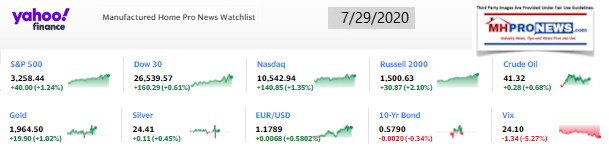

Tonight’s featured focus segment of this evening’s market report is found beyond the left-right headline news bullets and 2 of our 3 market snapshots at the close today. The manufactured housing industry connected stocks are near the end of the report each evening, after the featured focus and the related/recent report links.

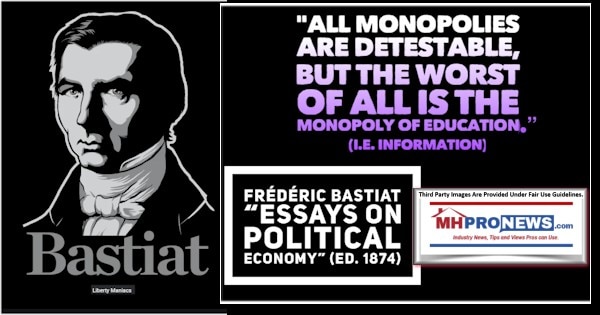

Quotes That Shed Light – American Social, Industry, National Issues…

Headlines from left-of-center CNN Business

- Tech titans in the hot seat

- WATCH LIVE CEOs of Amazon, Apple, Facebook and Google testify in biggest hearing of its kind

- Bezos acknowledges Amazon devices sometimes sold below cost

- Facebook can ‘always just buy any competitive startups,’ Zuckerberg said in 2012 email

- ‘Put on your mask!’ ‘Fringe conspiracy theories.’ Watch the fiery exchange

- Jeff Bezos gets his first question 2 hours into the hearing

- Zuckerberg defends Instagram acquisition

- Tim Cook: Apple isn’t dominant in any market

- ‘Big Tech’s out to get conservatives’

- See the CEOs get sworn in remotely

- Don’t expect this hearing to produce a breakup of Big Tech

- Antitrust law: a (brief) explainer

- A partial list of the antitrust probes into Big Tech

- OTHER TOP STORIES

- Anxious investors push gold prices to all-time highs

- LIVE UPDATES Stocks bounce higher after Fed hints at more stimulus

- Fed keeps interest rates near zero, says the recovery depends on the pandemic

- 14 charts that show the US economic recovery is stumbling

- Watch this technology detect which workers aren’t wearing a mask

- Snapchat’s workforce is just 4% Black

- Boeing lost $2.3 billion in three months

- The art world has a money laundering problem

- Lamborghini’s new supercar isn’t legal to drive

- British government invests in sex party startup

- MacKenzie Scott, formerly Bezos, says she has given away $1.7 billion of her wealth so far

- CANNA-BUSINESS

- Innovated CBD oil is displayed during the Cannabis World Congress & Business Expo in Los Angeles, California, U.S., on Thursday, Sept. 14, 2017. The 4th annual event is the leading forum for doing business in one of the fastest growing industries in the United States.

- CBD products are getting cheaper. Here’s why

- These firms want access to Covid-19 financial help

- Why more states could legalize cannabis in 2021

- So you want to legalize cannabis? Some dos and don’ts

- Smaller joints and less-potent buds: recession weed is here

- A SHOT OF CAFFEINE

- People walk outside Starbucks in midtown as New York City moves into Phase 3 of re-opening following restrictions imposed to curb the coronavirus pandemic on July 16, 2020. Phase 3 permits the reopening of nail and tanning salons, tattoo parlors, spas and massages, dog runs and numerous other outdoor activities. Phase 3 is the third of four-phased stages designated by the state.

- The coronavirus pandemic is still crushing Starbucks sales

- Most annoying thing about Starbucks app is changing

- Starbucks is expanding takeout options

- A UK startup is turning coffee into fuel

- Chinese coffee company delisted after scandal

Headlines from right-of-center Fox Business

- RAGE AGAINST THE MACHINES

- POLITICS

- FOLLOW LIVE: Congress grills top tech CEOs in blockbuster antitrust hearing

- Facebook CEO Mark Zuckerberg, Amazon CEO Jeff Bezos, Apple CEO Tim Cook, Sundar Pichai of Google are testifying before the House.

- TRUMP: ‘If Congress doesn’t bring fairness to Big Tech…I will do it myself…’

- WATCH: Tech giants not hitting panic button despite hearings, Gasparino reports

- THE FED

- Fed signals ongoing aggressive action to support US economy

- Tech leads stocks higher as CEOs testify and Fed keeps rates near zero

- Biden to urge bigger role for Federal Reserve to address racial wealth gap

- MARKETS

- Kodak stock up 2,189% after Trump backs pivot into drug industry

- Kodak has already proven it can fight ‘pharmaceutical blockage’ in US: CEO

- FOOD & DRINKS

- Trader Joe’s reverses decision, responds to complaints its packaging is ‘racist’

- OPINION

- Can you retire early? This checklist may surprise you

- OBAMA-ERA RULE REVERSED

- POLITICS

- Trump: Suburban voters won’t ‘be bothered’ by low-income housing

- GOOGLE PLAYS POLITICS

- CHINA

- Google CEO defends US military support, downplays work in China

- BLOWS AT TRADER JOES

- CRIME

- NYC Trader Joe’s workers attacked by duo who refused to wear masks: Police

- EXHAUSTING RULE

- TRAVEL

- Delta Air Lines bans this type of masks on all flights

- OUR NEW NORMAL?

- LIFESTYLE

- Parents shelling out big bucks for kids to attend neighborhood ‘micro-schools’

- CASH CALCULATOR

- MONEY

- Find out how much money you could collect from the next stimulus check

- HIDDEN FEES

- RETAIL

- Top fast food brands charging more for delivery orders, report claims

- SPENDING SPREE

- REAL ESTATE

- More Americans are signing contracts to buy homes

- PROFITS DRAINED

- LIFESTYLE

- SeaWorld attendance takes big hit after coronavirus reopening

- NO ‘HOUSE ADVANTAGE’

- MARKETS

- Coronavirus spikes deal harsh blow to gaming industry as bookings dry up

- BROUGHT TO LIGHT

- TRAVEL

- JetBlue will test UV cleaning to combat coronavirus inside planes

- ‘FALSE CLAIMS’

- SOCIAL MEDIA

- Instagram flags Madonna post for ‘inaccurate’ coronavirus information

- SIDING WITH TRUMP

- CORONAVIRUS

- Bill Gates says schools should reopen despite COVID-19

- ART OF THE STEAL

- LIFESTYLE

- How two sanctioned Russian billionaire brothers bought art anyway

- SWIPE RIGHT ON THE PRICE

- REAL ESTATE

- Tinder co-founder buys Lori Loughlin, Mossimo Giannulli’s mansion

- HEALTH CARE

- Food suppliers ordered to close after coronavirus cases go unreported

- SOCIAL MEDIA

- TikTok CEO accuses Facebook of anti-competitive behavior: ‘Bring it on’

- LIFESTYLE

- Major cruise line extends cancellations beyond CDC’s no-sail order

- MONEY

- Poll finds how many US jobs lost to coronavirus could be gone permanently

- MONEY

- Purdue Pharma ordered to stop some political contributions amid bankruptcy

- NEWS

- Arizona bridge burns, partially collapses after train derailment near Tempe Town Lake

- MEDIA

- Michelle Obama launches podcast, says working parents can’t afford what they used to

- POLITICS

- Giuliani tells Bartiromo: Democrats ‘want crime’ if it means defeating Trump

- MONEY

- A second stimulus check is likely — and 26M more people might get cash this round

- PERSONAL FINANCE

- Three 401(k) withdrawal rules that will help your retirement savings last

- MARKETS

- Wingstop’s earnings soar on digital orders in coronavirus

- MEDIA

- AMC and Universal reach deal for theatrical exclusivity and on-demand release

- ECONOMY

- Teachers threaten ‘safety strikes’ over schools reopening amid coronavirus

- MARKETS

- Boeing slashes production as coronavirus batters airline customers

- MONEY

- Treasury makes $10B coronavirus loan available to US Postal Service

- ROYALS

- Meghan Markle fights to keep friends anonymous in lawsuit against media

- VIDEO

- WATCH: Major drugstore chain secretly tracked shoppers with facial recognition

- MONEY

- Is $600 a week in extra unemployment aid deterring people from seeking work?

- SPORTS

- MLB insider reveals theory about what sparked Marlins outbreak

- MONEY

- Should I use a personal loan to consolidate debt?

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

Equity LifeStyle (ELS) is routinely an attention getter in manufactured housing news, discussions, and community sector discussions. ELS and Sun Communities are the clear top 2 and both are publicly traded firms, as regular readers know.

As the impact of the COVID19 pandemic on the economy and manufactured housing understandably draws interest, the contrast between what is occurring in the communities sector vs other parts of housing is insightful.

ELS’ chair Sam Zell recently made headlines, see that report linked below which will be followed by the most recent ELS earnings call transcript.

Equity Lifestyle Properties Inc (ELS) Q2 2020 Earnings Call Transcript

ELS earnings call for the period ending June 30, 2020.

Motley Fool Transcribers

(MFTranscribers)

Jul 21, 2020 at 3:30PM

Equity Lifestyle Properties Inc (NYSE:ELS)

Q2 2020 Earnings Call

Jul 21, 2020, 11:00 a.m. ET

Contents:

- Prepared Remarks

- Questions and Answers

- Call Participants

Prepared Remarks:

Good day everyone and thank you for joining us to discuss Equity LifeStyle Properties Second Quarter 2020 Results. Our featured speakers today are Marguerite Nader, our President and CEO; Paul Seavey, our Executive Vice President and CFO; and Patrick Waite, our Executive Vice President and COO.

In advance of today’s call, management released earnings. Today’s call will consist of opening remarks and a question-and-answer session with management relating to the company’s earnings release. As a reminder, this call is being recorded.

Certain matters discussed during this conference call may contain forward-looking statements in the meaning of the federal securities laws. Our forward-looking statements are subject to certain economic risks and uncertainties. The company assumes no obligation to update or to supplement any statements that become untrue because of subsequent events. In addition, during today’s call we will discuss non-GAAP financial measures as identified by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the comparable GAAP financial measures are included in our earnings release, our supplemental information, and our historical SEC filings.

At this time, I would like to turn the call over to Marguerite Nader, our President and CEO.

Marguerite Nader — President and Chief Executive Officer

Good morning and thank you for joining us today. Our second quarter results show the continued strength of our business. We continue to be able to safely and efficiently operate our properties under new operating condition. Paul will provide more details on collections, but across our organization, we have seen payment patterns consistent with last year. We have put in place a rent deferral program for residents facing hardship due to the impact of COVID-19, approximately 500 residents are enrolled in this program.

We saw strong demand on the MH side of the business, with a 4.6% increase in rental revenue. In the quarter, we saw a decrease in residents moving out of our communities. We increased new home sales volume by 14% and the average purchase price increased by 10%. Our MH properties are currently 95% occupied. Our residents are homeowners who have generally paid cash for their home. This capital commitment to our communities is an important differentiator in difficult times. Our overall occupancy consist of less than 6% renters.

Moving to our RV business, we have had an acquisition strategy over the years of buying RV resorts that are heavily focused on annual and seasonal revenue streams. 80% of our RV revenue is longer term in nature and 20% comes from our transient customers. In the second quarter, our properties were impacted by local shelter in place orders, which call for reduced or eliminated travel activity inside of jurisdiction. Our RV annual customer generally has developed roots with the community.

For the second quarter, the annual revenue which historically accounts for approximately 70% of our total revenue, grew by 4.7%. In the more — in the quarter, we were primarily close to transient traffic until the beginning of June. We followed shelter in place orders and reduced activity to protect our employees and customers from potential risks associated with transient traffic. We saw a significant increase in reservation activity and revenue in the month of June. The demand is high for customers to travel in a controlled environment.

I would like to close by thanking the entire ELS family. They have continued to react to the evolving climate in an impressive manner. The team has successfully adapted to new regulatory protocols and changes in the operating environment, with the primary focus on the safety and well-being of our employees, residents, and guests.

I will now turn it over to Paul to walk through the numbers in detail.

Paul Seavey — Executive Vice President and Chief Financial Officer

Thank you, Marguerite. Good morning everyone. I will review our second quarter results, highlight some of the topics mentioned in the COVID-19 update included with our earnings release and supplemental financial information, and discuss our balance sheet and liquidity position.

For the second quarter, we reported $0.47 normalized FFO per share. As disclosed in our earnings release, we incurred approximately $1.4 million in non-recurring COVID-19 related expenses during the quarter. We have added these expenses back in our calculation of NFFO. Our core MH rent growth of 4.6%, consists of approximately 4.1% rate growth and 50 basis points related to occupancy gains. We have increased occupancy at 103 sites since December, with an increase in owners of 156 while renters decreased by 53.

Core RV resort based rental income from annuals increased 4.7% for the second quarter and 6.1% year-to-date, compared to the same period last year. The driver of rent growth from annuals in the quarter was rate with occupancy essentially flat compared to the prior period. Year-to-date core resorts — year-to-date core resort base rent from seasonals increased 3.7% compared to 2019. Core base rent from transient decreased 47.7% in the quarter, as a result of the closures Marguerite mentioned in her remarks.

Membership dues revenue increased 3% compared to the prior year. During the quarter, we sold approximately 5,800 [Phonetic] Thousand Trails Camping Pass memberships. This represents a 12% decrease for the quarter, which we attribute to the impact of COVID-19. We experienced significant recovery in sales volume in June, which showed an increase of 43% over June 2019.

The net contribution from membership upgrade sales in the quarter was flat compared to last year. Sales volumes increased almost 12%, while the mix of product sold changed resulting in a lower average sales price. Core utility and other income was about $400,000 lower than second quarter 2019. Increases in pass-through and utility income, primarily resulting from pass-throughs of real estate tax increases that were effective in late 2019 were offset by reduced revenue resulting from our suspension of late fees as well as fees related to transient RV state.

Core property operating expenses were flat compared to second quarter 2019. The footnote disclosure included in our supplemental financial information package states that our core income from property operations includes approximately $1 million of non-recurring COVID-19 related expenses. Excluding these expenses, we realized a 90 basis point decline in core property operating expenses in the quarter compared to last year.

In summary, second quarter core property operating revenues increased 60 basis points and core property operating expenses increased 10 basis points resulting in an increase in core NOI before property management of 1%. Core NOI before property management, excluding COVID-19 related expenses increased 1.8%.

Income from property operations generated by our non-core portfolio, which includes our marina assets was $3 million in the quarter. Revenues from annual customers, at the marinas and other properties in the non-core portfolio generated more than 90% of total non-core revenues in the quarter and year-to-date period.

Property management and corporate G&A expenses were $25.4 million for the second quarter of 2020 and $51.3 million for the year-to-date period. Other income and expenses, generated net contribution of $1.7 million for the quarter. Ancillary retail and restaurant operations were impacted by COVID-19 and generated approximately $1.2 million less NOI during the quarter than last year. In addition, our joint venture income was approximately $2.4 million lower because of the refinancing distribution we recognized in 2019. Interest and related loan cost amortization expense of $26.2 million for the quarter and $53.2 million for the year-to-date period.

We included a COVID-19 update with our earnings release and supplemental financial information. All of our MH, RV and marina locations are open, though some have limited access to certain amenities pursuant to state and local guidelines. Our rent deferral program was in place from April through June. Through that program, we assisted 540 residents with the deferral of approximately $0.5 million of rent. We also provided assistance in the form of rent credits to annual customers at certain of our RV resorts, were openings were delayed because of shelter in place orders. Those credits will be applied to future charges and total approximately $900,000. We have also continued suspension of late fees in the month of July.

Since the outset of the COVID-19 pandemic, we have not experienced meaningful negative impact to our rate of rent collection. For the second quarter, our overall collection rate for our MH, RV and TT properties was 99%, consistent with the second quarter of 2019. Our month-to-date collections in July are consistent with the collections at this time in April, May and June, 2020.

Now some comments on debt markets in our balance sheet. Market conditions have stabilized somewhat since our April call. Current secured financing terms available for MH and RV assets range from 55% to 75% LTV, with rates from 2.75% to 3.5% for 10 year money. We continue to see lenders place high value on sponsor strength and ELS continues to be highly regarded. High quality age qualified MH assets will command preferred terms from participating lenders.

Our cash balance after funding our July dividend is more than $50 million. We have available capacity of $350 million from our unsecured line of credit, we have approximately $141 million of capacity under our ATM program, and we have no scheduled debt maturities for the next 12 months. We continue to place high importance on balance sheet flexibility and we believe we have multiple sources of capital available to us. Our interest coverage ratio was 4.9 times and our debt to adjusted EBITDAre is 5 times. The weighted average maturity of our outstanding secured debt is 12.5 years.

Now, we would like to open it up for questions. Jonathan?

Questions and Answers:

Operator

Certainly. [Operator Instructions] Our first question comes from the line of John Kim from BMO Capital Markets. Your question please.

John Kim — BMO Capital Markets — Analyst

Thanks, good morning. You had a strong quarter as far as the collection rate and your RV parks are now almost fully open. Can you just discuss why you didn’t reinstitute earnings guidance for the year?

Marguerite Nader — President and Chief Executive Officer

Sure, John. So every year as you know, we issue guidance well in advance of the start of the year. I think we’ve historically been among the first to release guidance and we’re really focused on making certain that — that the investors appreciate the assumptions that go into the range we provide. We feel very good about our business going forward. It really has shown the true strength during this pandemic, but we did feel that with the uncertainty in the regulatory and specifically the health environment, it was prudent to wait to reissue guidance and provide it at a time when there is more clarity with respect to that environment. Our MH and RV annual revenue line items have performed remarkably well during these tough times, but the part of our revenue with more moving pieces like seasonal and transient revenue, they are more difficult to forecast and that really factored into our decision to wait on reissuing guidance.

John Kim — BMO Capital Markets — Analyst

How much of this decision was based on concerns of the unemployment benefits expiring and additional government stimulus as well? Did that factor into your decision at all?

Marguerite Nader — President and Chief Executive Officer

No, I mean I think — what I just — what I kind of covered there at the end with the seasonal and transient was really the drivers of the decision. As you’ve seen in our — in our MH platform, really good collection, high occupancy rates, great sale. So that wasn’t — well, that wasn’t really a factor.

John Kim — BMO Capital Markets — Analyst

Okay. And then last quarter you suspended notice of rent increases in MH. So I’m just wondering if that has — if that’s continued or if now you’re increasing rents?

Paul Seavey — Executive Vice President and Chief Financial Officer

John, if you refer to our June investor presentation, we had talked about the fact that we are reinstating them in June. And in fact, we did do that at the end of June. So there was a very brief suspension for the month of April and May on those rent increases, but we effectively had a catch-up of those notices in June.

John Kim — BMO Capital Markets — Analyst

Great, thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks, John.

Operator

Thank you. Our next question comes from the line of Samir Khanal from Evercore. Your question please.

Samir Khanal — Evercore ISI — Analyst

Yeah, good morning Marguerite. I guess, can you talk about the changes you’re seeing, maybe trends in the properties in Florida, Arizona, and even California. We’ve seen some news reports that sort of flare-ups in the fires there. Any notable changes in those properties?

Marguerite Nader — President and Chief Executive Officer

I mean those properties right now for us are in the — that not as busy season. So you really — we have our annual — our RV annual fair and our RV — and our MH there. So it’s not as busy of a season. So it’s not — not impacting us currently. We’re certainly looking toward — toward how the — how that changes and how — how the virus changes over time and how that impacts. And that’s why I touched on –impacts our transient and seasonal reservations into the third quarter and fourth quarter.

Samir Khanal — Evercore ISI — Analyst

Okay. And I guess my second question is just on kind of — just general market in terms of opportunities that you’re seeing, the acquisition side, portfolios one-offs, whether it’s RVs or MH, I guess what is out there today and kind of your expectation sort of on the other side of the virus here in the next sort of six months to 12 months?

Marguerite Nader — President and Chief Executive Officer

Yeah, I mean I think there is — we didn’t close on any new communities in the quarter. We are in due diligence on deals and we’ll update you on the kind of the timing of the closing. There is certainly transactions that are happening, some transactions are happening in — in kind of the all age MH space, which we have expressed that we’re not necessarily interested in. But I see that there is I think there are some deals that are coming to market now where people are interested in selling. I think that’s consistent with the years past where it’s just kind of the timing is right, and I’m not necessarily having anything to do with the pandemic.

Samir Khanal — Evercore ISI — Analyst

Got it. Okay, thanks so much.

Marguerite Nader — President and Chief Executive Officer

Thanks, Samir.

Operator

Thank you. Our next question comes from the line of John Pawlowski from Green Street Advisors. Your question please.

John Pawlowski — Green Street Advisors — Analyst

Thanks for taking my question. Just curious on the uncertainty around the US-Canada border being closed or the closure being extended, is that impacting kind early indication as snowbird traffic being able to come down into the Southern states or intent to come down. Any risk to the seasonal RV demand in the back end of this year?

Marguerite Nader — President and Chief Executive Officer

Sure. So let me give you a little just overview of our Canada — our Canadian customers. I think our Canadian — overall Canadian revenue is $18 million and a little more than half of that is annual. And the largest portion of those Canadian customers stay with us in Florida and Arizona and Texas. It’s basically about 7% of our total revenue. In the first half of the year I think represents about 60% of the full year revenue. So that’s kind of already collected and accrued. We do have approximately I think it’s 98% of the annual RV customer is already — has their park model RV on site in the south. So then now we’re just kind of dealing with the seasonal and the uncertainty on the — around that travel. And so it’s something that we’re watching. I don’t think it’s something that we’ll have clarity on until the border — was — the border closure was extended to I believe August 22 or the end of August. So we’ll see and we’re watching that closely, but it’s something that something that we’re paying attention to and in fact it’s really December and into next year January and February.

John Pawlowski — Green Street Advisors — Analyst

Right. But if the border is closed on the annual side I understand the — then individuals homes are still in place, but in terms of rent refunds and pro-rated rent that would be a risk to the annual bucket as well right?

Marguerite Nader — President and Chief Executive Officer

You know we haven’t kind of gotten there yet I mean at this point — in some cases the customer is in — is in Florida right now or in Arizona right now. So, it not something, it’s not something that we discuss certainly not something we discuss with our customers yet. And unlike as you remember John in the North there was, you know we were not able to open the properties and so people couldn’t have access to properties. This is not the same, people can have access certainly to these properties.

John Pawlowski — Green Street Advisors — Analyst

Okay. And then last one from me, I apologize if I missed this in your opening remarks, but could you share how the July transient RV reservation pace is shaping out versus a year ago?

Marguerite Nader — President and Chief Executive Officer

Sure. I didn’t share it, so happy to. So our July — and I think just, I’m not providing guidance, but I want to kind of touch on a couple of items relative to what we’ve seen already, not what we’re seeing in the future, which is July month-to-date transient results and to put some parameters on that which in 2019 I think that represented about 40% of the third quarter. It’s in line with last year. So we’re tracking last year. Our online camping pass sales in June, they increased 100%. And then since the beginning of June, we’ve seen an increase in leads from our RV dealer program of about 71% and then our RV dealer activations increased 20%. So some pretty significant, kind of demand indicators that we’ve seen really since the start of June.

John Pawlowski — Green Street Advisors — Analyst

Okay, thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks John.

Operator

Thank you. Our next question comes from the line of Joshua [Phonetic] Dennerlein from Bank of America. Your question please.

Joshua Dennerlein — Bank of America — Analyst

Hi, Marguerite. Hey Paul. Maybe just a follow-up on John’s question there on the transients, any color you can provide us on maybe forward indicators on the RV side, like bookings that you’re seeing come through on the Internet?

Marguerite Nader — President and Chief Executive Officer

Sure. We’ve seen — we’ve seen I think over the last four weeks or five weeks, we’ve seen significant increases to our booking channels. I think in some cases 100% increase over the last I think three weeks or four weeks. Now along with those records, we also are also seeing some cancellations that is offsetting some of that — some of that new revenue. In some locations where we’re able to operate — where we were able to operate at full capacity, but the surrounding area and attractions are problematic, we are seeing that. We’re seeing some issues there, but — so those are the kind of demand indicators that we’re seeing.

Joshua Dennerlein — Bank of America — Analyst

Okay, thanks. And then in the second quarter you had elevated costs from COVID, I think it was $1 million, is that — is that the past us now or is that kind of going to travel through into the third quarter and kind of continue at that run rate until the pandemics over or does it throttle down?

Paul Seavey — Executive Vice President and Chief Financial Officer

Yeah, I think what we highlighted, the total of $1.4 million, $1 million of which impacted the core expense base. Those really represents the non-recurring expenses related to COVID. We focus very closely on the SEC guidance around COVID disclosure and the team worked very hard to differentiate between really what one-time costs related to development of the protocols around operations of the properties at this time as well as the employee time off program, the property employee appreciation bonuses. So that’s not really indicative of, excuse me, of run rate. Now the incremental costs that we incurred associated with cleaning, meaning supplies and so forth, those are included in our expenses and weren’t separated or excluded as COVID related expenses. It’s a little bit difficult at the moment to kind of project what those will be on a go-forward basis, primarily because a lot of it is driven by the experience at the property, the timing of the opening of the amenities and so forth.

Joshua Dennerlein — Bank of America — Analyst

Okay. Did you disclose that somewhere the level of kind of the increased supply? I didn’t see it, thought I might have missed it though.

Paul Seavey — Executive Vice President and Chief Financial Officer

We did not separately disclose that. It’s not a significant amount. It was a couple of hundred thousand dollars in the quarter.

Joshua Dennerlein — Bank of America — Analyst

Okay, all right. Thank you. Thank you both.

Marguerite Nader — President and Chief Executive Officer

Thanks Josh.

Operator

Thank you. Our next question comes from the line of RJ Milligan from Baird. Your question please.

RJ Milligan — Robert W. Baird & Co. — Analyst

Hey, good morning. I wanted a little bit more color, if you could, on the rent increases. You guys mentioned that, you reinstated them at the end of June and that there would be a catch-up. So does that imply that third quarter you’re going to see outsized growth from the increases?

Paul Seavey — Executive Vice President and Chief Financial Officer

We won’t see outsize growth. I think the way that we framed it on the call in April was the suspension to the extent that it continued through the end of the year, the impact would be about 50 basis point, just doing the math. The impact would have been about 50 basis points in rent growth. I think the resuspension for those couple months that changes the impact to being just about 10 basis points on growth.

RJ Milligan — Robert W. Baird & Co. — Analyst

Okay, that’s helpful. That’s all I have. Thanks.

Marguerite Nader — President and Chief Executive Officer

Thanks RJ.

Operator

Thank you. Our next question comes from the line of Nick Joseph from Citi. Your question please.

Nick Joseph — Citi Research — Analyst

Thanks. Just a question on the amenities that are not open, due to some of the state local guidelines, does that impact either pricing or refunds at all in terms of if some of the amenities just won’t be opened for use?

Patrick Waite — Executive Vice President and Chief Operating Officer

Well, let me — this is Patrick, Nick, let me touch first on MH and then we’ll get to RV. On the MH fronts that’s not — that’s not impacted any sort of concession on rents. We have managed through the process of first closing those amenities and then reopening and predominantly across our portfolio amenities are open particularly on the MH side of the portfolio. We have protocols in place to ensure that you know our employees are safe and safely interact with one and another and our customers all of our employees are required to wear masks when in proximity to one another, our offices by appointment only and we have cleaning protocols in place. And as I’ve mentioned in the last call we have a relationship with a national vendor that is specialist in the industrial hygiene to ensure that we’re following CDC guidelines.

On the RV side of the world I mean we’ve just done you know with respect to that the previous quarter you know the amenities and that were closed were really part of properties that were closed. And that was the driver of the refunds in those instances for annuals in the northern campgrounds across the south. We are out of season right now, so it’s a lower demand and then at this point it’s not impacting any sort of rent payments for any of the annual season and transients.

Nick Joseph — Citi Research — Analyst

Okay, great, thanks. And then just back to the acquisition environment, I was wondering, specific to RVs, has there been any disruption or kind of increased opportunities given what happened in the second quarter or on the private side have many owners been able to weather that storm?

Marguerite Nader — President and Chief Executive Officer

I think, I think that most have been able to weather the storm. I — there may be some opportunities just people like I said, I think it’s just that the time is right in their lifetime, in their cycle. But I don’t see a lot of opportunities coming as a result of people seen the effects because I think the effects were really good both on the MH and the RV business, save for the transient for a couple of months. And I think people saw that as a once in a lifetime kind of thing. And not to be repeated and so I don’t know that there will be opportunities come as a result of that. It’s more of a personal kind of preference and people’s willingness to sell now.

Nick Joseph — Citi Research — Analyst

Thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks Nick.

Operator

Thank you. Our next question is a follow-up from the line of John Pawlowski from Green Street Advisors. Your question please.

John Pawlowski — Green Street Advisors — Analyst

Thanks. Paul, curious how municipalities are approaching property taxes this year and less about the impact of EOS in 2020 and just more from a real estate lens, any color from on the ground conversations with municipalities?

Paul Seavey — Executive Vice President and Chief Financial Officer

No direct color. You know I don’t think for us it translates into you know delays in timing, although there could be extensions of time for payment, but not seeing that happen yet. And you know not seeing — we’re not seeing just a little bit hard — that the timeframe, though it feels like this has been going on for such a long time, the timeframe really isn’t that long. And so when you think about it the typical attachment cycle and so forth that results in the bill that any impact on income that may drive the valuations for the purpose of the assessors, does not have time to make its way through the system.

John Pawlowski — Green Street Advisors — Analyst

Okay. There is no — there is no chatter in the next, call it 12 months where municipalities have to fill a bigger hole in their budgets to kind of come after residential a little harder and particularly when other property types really can’t carry the weight?

Paul Seavey — Executive Vice President and Chief Financial Officer

I mean there is, there is chatter, there has been that type of chatter for some time now. I don’t — I don’t — don’t hear it on the ground being louder than been before. I will say, obviously California has the issues that they’re working through. I’m kind of setting that aside and thinking about the rest of the country.

Marguerite Nader — President and Chief Executive Officer

And then John, we also have our — at the level of Florida, for instance, where we have the ability to pass through real estate taxes. We have a lot more kind of help in front of local municipalities to not do that so that it’s not, it’s not just a big kind of corporate transaction, it’s at the level of the property.

John Pawlowski — Green Street Advisors — Analyst

Okay, thank you.

Marguerite Nader — President and Chief Executive Officer

Thanks, John.

Operator

Thank you. And this does conclude the question-and-answer session of today’s program. I would like to hand the program back to Marguerite Nader for any further remarks.

Marguerite Nader — President and Chief Executive Officer

Great. Thank you for joining us today. We look forward to updating you on the next quarter’s call.

Operator

[Operator Closing Remarks]

Duration: 29 minutes

Call participants:

Marguerite Nader — President and Chief Executive Officer

Paul Seavey — Executive Vice President and Chief Financial Officer

Patrick Waite — Executive Vice President and Chief Operating Officer

John Kim — BMO Capital Markets — Analyst

Samir Khanal — Evercore ISI — Analyst

John Pawlowski — Green Street Advisors — Analyst

Joshua Dennerlein — Bank of America — Analyst

RJ Milligan — Robert W. Baird & Co. — Analyst

Nick Joseph — Citi Research — Analyst

##

Additional ELS and community-sector related reports are linked below.

Related, Recent, and Read Hot Reports

More Surprises – Equity Lifestyle Properties (NYSE:ELS) – Unpacking Official Investor Statements

“Madder Than Hell” – Meddling “in Business Deal” – plus Sunday Weekly Headlines Review

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

-

-

Summer 2020…

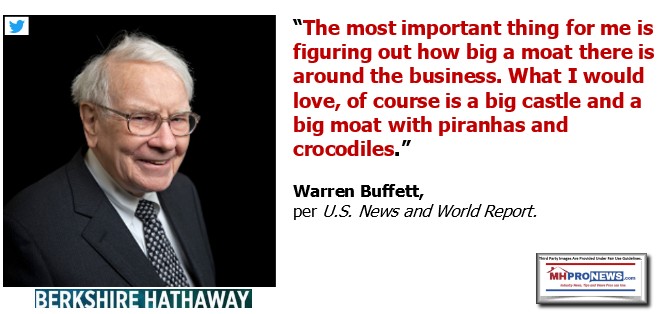

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our tenth anniversary and is in year 11 of publishing.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

https://www.manufacturedhomepronews.com/celebrating-10-years-of-goal-and-solution-oriented-manufactured-home-industry-innovation-information-and-inspiration-for-industry-professionals/

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.