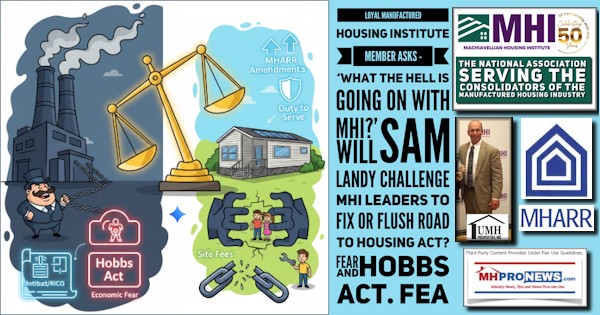

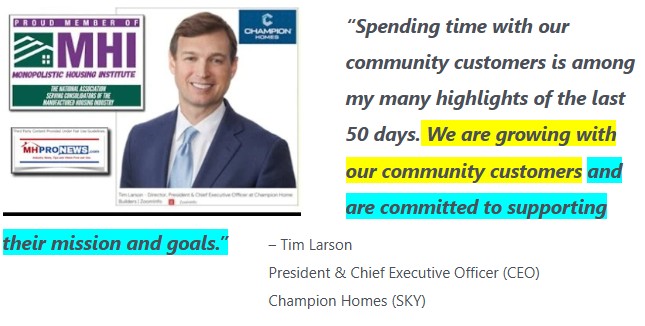

The headline includes a paraphrase by Champion Homes (SKY) CEO Tim Larson from the transcript found in Part I which arguably illustrates that Investing.com’s artificial intelligence (AI) may be useful, but it has apparent limits at this time. Larson claimed: “I’ve shared previously, increasing awareness and demand for our products and brands is one of our strategic priorities” (bold and highlighting added). Those remarks may be normal for a CEO of a publicly traded company, but it happens to be contradicted by Champion’s reported behavior (along with that of the other two Big Three members of the Manufactured Housing Institute (MHI) documented in the report found linked here). Champion and their Big Three Cs colleagues reportedly ‘torpedoed’ a national public awareness campaign, per documents and insider tips found at this link here. Next, the report by Investing.com in Part I included this headline statement: “Despite a 2% year-over-year decline in total homes sold, Champion Homes managed to increase its average selling price [ASP] and maintain a strong financial position.” They also said: The average selling price [ASP] per U.S. home rose by 5% to $99,300, demonstrating the company’s ability to command higher prices amidst softer demand. Despite a 12% decline in net income to $54 million, Champion Homes continues to focus on expanding its market share in the affordable housing sector.” Information may or can seem to be accurate, yet if the source is paltering, accurate info can nevertheless be misleading. With such notions in mind, it is arguably apparent from the introduction to their transcript that the AI and its human editor at Investing.com have scant specialized knowledge of the manufactured housing industry and/or they are unwilling to challenge the Champion corporate narrative. More on that will be considered in Part II, where the facts-evidence-analysis (FEA) of their AI and human intelligence (HI) generated article will be explored and unpacked through the lens of manufactured housing industry expert eyes.

Highlighting above and what follows has been added by MHProNews by human intelligence. HI herein will also use AI as a third-party fact-checking tool to combine herein to give the Investing report in Part I on Champion (SKY) with transcript published on 2.4.2026 a solid factual- and evidence-driven analysis.

1) Champion CEO Larson also said in his introductory remarks: “our relentless drive to deliver a great experience for the families that purchase and live in our homes we design and build.” If that were sincere, wouldn’t Larson be contradicting his prior remarks about the importance and their support of their community (think REITs) clients?

Larson had more to say about their land-lease ‘communities channel’ customers in the transcript that follows in Part I.

2) Given the apparently stronger amended national price-fixing antitrust case against multiple community operators and Murex’s stated ‘cutting a deal’ to settle their portion of that case in exchange for making disclosures to the plaintiffs, Larson may want to rethink and clarify those remarks: “We are growing with our community customers and are committed to supporting their mission and goals.” Or are evidence-backed allegations of price fixing and the financial discomfort that causes consumers not a concern for Champion Homes (SKY)?

3) Larson’s remarks on legislation pending in Congress are also found in Part I and will be included in the analysis in Part II. An insight-packed, quote-backed with facts- and history tracked report awaits.

4) A preview of just one snippet from the third-party critique from Part II #8 is shown below.

Financial Firepower: With $660 million in cash and equivalents, deploying even 1-2% ($6.6M – $13M) toward an aggressive GoRVing-style campaign or litigation against discriminatory zoning would be “relatively modest” yet potentially transformative.

This MHVille facts-evidence-analysis is underway.

Part I. From the transcript on Investing.com at this link here and provided below by MHProNews under fair use guidelines for media

Earnings call transcript: Champion Homes Q3 2026 beats earnings expectations

Investing.com

Updated Feb 04, 2026 09:01AM ET

Champion Homes Inc. (SKY), a prominent player in the manufactured housing industry, reported its fiscal third-quarter earnings with a notable earnings per share (EPS) of $0.96, surpassing the forecasted $0.84. The company’s revenue also exceeded expectations, reaching $656.6 million against a forecast of $647.06 million. Despite a 2% year-over-year decline in total homes sold, Champion Homes managed to increase its average selling price and maintain a strong financial position. In after-hours trading, the stock price remained stable at $76.03, reflecting a modest 0.17% increase from the previous close.

Key Takeaways

- EPS of $0.96 beat the forecast by 14.29%.

- Revenue of $656.6 million exceeded expectations by 1.47%.

- Stock price remained stable post-earnings, with a slight increase of 0.17%.

- Focus on product innovation and expansion in affordable housing.

- Manufacturing backlog decreased by 15%, indicating operational adjustments.

Company Performance

Champion Homes reported a mixed performance for Q3 2026. While net sales increased by 2% year-over-year to $657 million, the total number of homes sold decreased by 2%. The average selling price per U.S. home rose by 5% to $99,300, demonstrating the company’s ability to command higher prices amidst softer demand. Despite a 12% decline in net income to $54 million, Champion Homes continues to focus on expanding its market share in the affordable housing sector.

Financial Highlights

-

- Revenue: $656.6 million, up 2% year-over-year

- Earnings per share: $0.96, surpassing the forecast of $0.84

- Net income: $54 million, down 12% year-over-year

- Adjusted EBITDA: $75 million, down 10%

- Gross margin: 26.2%, down 190 basis points from the previous year

- Cash and cash equivalents: $660 million

Earnings vs. Forecast

Champion Homes exceeded market expectations with an EPS of $0.96, a 14.29% surprise over the forecasted $0.84. Revenue also came in higher than expected at $656.6 million, a 1.47% surprise, indicating effective cost management and strategic pricing.

Market Reaction

The stock price of Champion Homes showed resilience, with a slight increase of 0.17% to $76.03 in after-hours trading. This stability reflects investor confidence in the company’s strategic direction and financial health, despite a challenging market environment. The stock remains within its 52-week range, with a high of $110 and a low of $59.44.

Outlook & Guidance

Looking ahead, Champion Homes anticipates a low single-digit increase in Q4 revenue, with gross margins expected to be between 25-26%. The company is preparing for the spring selling season and continues to focus on driving strong operating cash flow and capital allocation strategies.

Executive Commentary

…

CEO Tim Larson expressed optimism about the company’s product innovation, stating, “We are encouraged by the team’s ability with new products in the marketplace to attract more consumers.” CFO Dave McKinstry commented on margin management, saying, “We’re managing it within this range, and we feel good about where we’re setting up for Q4 from a margin perspective.”

Risks and Challenges

- Softer demand in certain markets could impact future sales.

- Decreased manufacturing backlog may affect production efficiency.

- Potential legislative changes in housing policies could influence market dynamics.

- Seasonal factors and cautious consumer sentiment might limit growth.

- Maintaining competitive pricing amidst rising costs poses a challenge.

Q&A

During the earnings call, analysts inquired about the company’s approach to digital lead generation and new product offerings. Executives highlighted the positive feedback from community channel partners and emphasized the importance of monitoring legislative developments in housing. The company remains cautiously optimistic about consumer demand and is prepared for potential policy changes.

Champion Homes’ Q3 2026 performance demonstrates its resilience and strategic focus in navigating a complex market environment, with a continued emphasis on innovation and operational efficiency.

Full transcript – Champion Homes Inc (SKY) Q3 2026:

Conference Moderator: Good morning, and welcome to the Champion Homes third quarter fiscal 2026 earnings call. Here to review the results are Tim Larson, Champion Homes President and Chief Executive Officer, Dave McKinstry, Champion Homes Executive Vice President, Chief Financial Officer, and Treasurer, and Laurie Hough, Champion’s former Executive Vice President, Chief Financial Officer, and Treasurer, who announced her retirement in December. Yesterday, after the market closed, Champion Homes issued its earnings release. As a reminder, the earnings release and statements made today, during today’s calls include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Please note that today’s remarks contain non-GAAP financial measures, which we believe can be useful in evaluating performance. Definitions and reconciliations of these measures can be found in the earnings release. I will now turn the call over to Champion Homes CEO, Tim Larson.

Tim Larson, President and Chief Executive Officer, Champion Homes: Good morning, and welcome to the Champion Homes third quarter fiscal 2026 earnings call. Here to review the results are Tim Larson, Champion Homes President and Chief Executive Officer, Dave McKinstry, Champion Homes Executive Vice President, Chief Financial Officer and Treasurer, and Laurie Hough, Champion’s former Executive Vice President, Chief Financial Officer and Treasurer, who announced her retirement in December. Yesterday, after the market closed, Champion Homes issued its earnings release. As a reminder, the earnings release and statements made during today’s call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Please note that today’s remarks contain non-GAAP financial measures, which we believe can be useful in evaluating performance. Definitions and reconciliations of these measures can be found in the earnings release. I will now turn the call over to Champion Homes CEO, Tim Larson. Thank you, and good morning, everyone. I’d like to begin by welcoming Dave McKinstry. Dave officially joined Champion on January twelfth as CFO. He has a record of delivering results in complex environments and driving growth and execution of operational initiatives across consumer products and manufacturing businesses. We look forward to the benefits of Dave’s experience and leadership and are excited to have him on the Champion Homes team. On behalf of the board and management team, I’d like to recognize and thank Laurie Hough for her two decades of dedicated service to Champion Homes.

During her tenure, she has helped build us into the industry leader we are today. We hope that she will enjoy her well-earned retirement and wish her all the very best. Before we turn to our results, I’d like to acknowledge our chair of the board, Tawn Kelley. Tawn has been a valued board member since 2023 and became chair of our nominating and governance committee in August of 2024. We are thrilled that Tawn was elected as chair of the Champion Board of Directors last November. Her leadership and expertise will be instrumental in guiding us on our next phase of growth. Now I’ll cover our fiscal third quarter highlights and progress on our strategic priorities that are advancing across Champion Homes. As I’ve shared previously, increasing awareness and demand for our products and brands is one of our strategic priorities.

Building trust with consumers is one of the most impactful ways to build awareness and referral. We are proud to share that our Skyline Homes brand was named America’s Most Trusted Manufactured Home Builder by Lifestory Research. This marks the sixth year in a row that our Skyline Homes brand has earned this recognition, and it’s based on an independent survey of over 47,000 consumers. It is also exciting to see the top three brands from the industry study are from the Champion Homes family of brands. Skyline Homes and the Champion Homes brands are one, two, and completing the podium is Genesis Homes, our builder developer brand. This recognition underscores the strength of the Champion portfolio and our relentless drive to deliver a great experience for the families that purchase and live in our homes we design and build.

Product innovation is one of our strategic priorities, and our team continues to launch new home plans at varying price points, including homes targeted for a broader segment of new buyers and expanding the addressable market for off-site built homes. This strategy is reflected in the Emerald Sky home we launched at the recent Louisville show. A stunning 1,600 sq ft, three-bedroom, two-bath home at a consumer retail price of approximately $185,000. When combined with land cost in each market, that places the total price for our home well below the new home ASP in the United States that’s hovering around $500,000. We are pleased with the feedback and response to a range of new products featured at the Louisville show.

We will continue to bring homes to market that provide our channel partners with the ability to offer buyers a great monthly payment and with all the benefits of a new home. On the legislative and regulatory front, there has been considerable activity recently, and I want to spend a few moments on the latest developments, as each are at different stages of the legislative process. We’ve previously shared updates on the Road to Housing Act. In December, the act was not included in the final National Defense Authorization Act, as was originally anticipated by most in the industry. However, the House of Representatives has been drafting their package called the Housing for the 21st Century Act… and we are following it closely as it includes elements that support the expansion of off-site built homes.

There remains a strong bipartisan focus on solving the housing crisis, and we believe that is the foundation for the Senate and the House to work together to enact meaningful legislation. We were also encouraged to see the House pass the Affordable Homes Act, which reaffirms HUD as the final authority on manufactured housing standards. This legislation eliminates duplication of federal rules and ensures that energy efficiency improvements are made in a way that preserves affordability. We continue to monitor legislation and zoning reform at both the local and national level, and remain encouraged to see policymakers working to address affordability issues in the broader housing market. In late January, I was able to spend time with HUD Secretary Scott Turner’s team in Dallas. We had the opportunity to tour our Burleson, Texas, plant with his team and regional HUD leadership.

These efforts demonstrate HUD’s commitment to helping to provide affordable housing to Americans, and we look forward to continuing to spend time with them in anticipation of the HUD code evolving from the legislation I just mentioned. Now I’ll review our third quarter’s performance, which was in line with our expectations as we navigate a challenging macro and consumer environment. Our strong performance relative to the broader housing market was a result of our team’s execution of our strategic initiatives, reflected in higher ASPs from a shift to more multi-section homes and increased prices on new homes sold through company-owned retail stores, as well as the contributions from the Iseman transaction. Our teams continue to thoughtfully pace production with demand in each market. Manufacturing backlogs at the end of December decreased sequentially by 15% to $266 million.

The average backlog lead time ended the quarter at 7 weeks, compared to 8 weeks at the end of the prior quarter, and 10 weeks at the end of December last year. Manufacturer orders were up in the quarter compared to the same period last year. Third quarter net sales increased 2% year-over-year to $657 million, and total homes sold during the period decreased by 2% to a total of 6,485 homes. As a reminder, and consistent with what we shared on our last earnings call, we anticipated the year-over-year volume contraction due to the prior year period benefiting from deliveries impacted by weather, shifting into Q3 from Q2 in fiscal year 2025.

From a channel perspective, sales to our independent retail channel decreased year-over-year and were flat sequentially as a result of the prior year comp dynamic I just mentioned. We continue to receive positive feedback and adoption of our Dealer Portal that is a one-stop digital experience that brings together lead management, order information, inventory, and valuable sales resources for our dealers. It’s a key capability that leverages our investments to generate leads for our independent retailers through our direct-to-consumer strategy. At Captive Retail, sales increased year-over-year, benefiting from the execution by our combined sales teams with the acquisition of Iseman Homes, and from an increase to our average selling price. Captive Retail sales represented 38% of consolidated sales in Q3 versus 35% last year.

The retail team continues to provide timely new products and home features at the right price value for today’s buyers. Moving to the community channel, as anticipated, our community sales were down in the third quarter versus the same period last year, as we paced inventory levels with moderating order rates and softer consumer confidence in the period. We received encouraging responses to our new products from our community customers at the Louisville Home Show, which is a positive leading indicator for us as we move into the spring selling season. I particularly enjoyed connecting with our community customers in Louisville. We believe in the great price value that our community customers offer and the critical role they play in solving the affordable housing crisis. Sales through builder developer channel grew in the third quarter versus the same period last year.

We were pleased to be part of the launch with our customer, TCM Capital, at the Blythe Village project in Fresno, California, this week. This build-to-rent community with 67 units was designed with our HUD product. It is a great proof point as to what’s possible through our build-to-developer team, products, and partners. In addition, we are excited to showcase our build-to-developer capabilities and a new home at the International Builders’ Show in Orlando this month. Both initiatives reflect our continued commitment to the expansion of this channel in our portfolio. Champion Financing continues to produce strong results and allows us to provide diverse financing options for our retailers and consumers. Triad’s Capital Partners had a chance to join us in Louisville, where they shared positive responses to our homes and our strategic initiatives.

Their interest in off-site home building is a testament to our opportunities ahead and the broader engagement in the sector. We are also pleased that the sale of Triad’s parent company, ECN Capital, to Warburg Pincus, is progressing well and received shareholder approval in January. The transaction is expected to close in the first half of the year. The transaction will extinguish our 19.7% ownership in ECN Capital, with ECN shares valued at $3.10 per share, delivering proceeds to Champion of approximately CAD 189 million. In connection with our support of this transaction, we agreed to extend our Champion Financing joint venture for an additional three years. We look forward to the continued collaboration with the ECN and the Warburg team. I will now turn the call over to Dave and Lori to talk further about our financial performance.

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Thanks, Tim, and good morning, everyone. I’d like to begin by expressing how excited I am to be joining Tim and the rest of the Champion Homes team. Champion has an impressive legacy of delivering innovation, affordable housing solutions, and I’m energized to contribute to our next chapter. In my first few weeks, I’ve been impressed by the team and by the opportunities ahead of us. I’m grateful to Tim for his vision and leadership, and we’ve had time to deep dive into the strategic initiatives that he has established for the company…. I look forward to driving these initiatives with Tim and the rest of the team. I’m going to turn the call over to Laurie to review the quarter, and then I will come back to share my view of Q4.

Laurie Hough, Former Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Thanks, Dave, and good morning, everyone. I’ll begin by reviewing our financial results for the third quarter, followed by a discussion of our balance sheet and cash flows. During the third quarter, net sales increased 2% to $657 million compared to the prior year period, with US factory-built housing revenue also increasing 2% year-over-year. The number of US homes sold in the third quarter of fiscal 2026 decreased 3% to 6,270 homes, due to a decrease in sales to the Community REIT channel, as well as a function of the prior year period, having an outsized benefit of homes sold as a result of weather that shifted sales from the fiscal second quarter to the fiscal third quarter of last year.

These decreases were partially offset by the inclusion of the acquisition of Iseman Homes in the current year period. The average selling price per U.S. home sold increased 5% to $99,300, due to changes in product mix and increased prices on new homes sold through our company-owned retail sales centers. On a sequential basis, U.S. factory-built housing revenue decreased 4% in the third quarter compared to the second fiscal quarter due to normal seasonality and, as anticipated, a decrease in sales to the community REIT channel. Manufacturing capacity utilization was 59%, compared to 60% in the second quarter. On a sequential basis, the average selling price per U.S. home sold remained relatively flat. Canadian revenue during the quarter was $26 million, representing a 3% increase in the number of homes sold versus the prior year.

The average home selling price in Canada decreased 2% to $120,000 compared to the prior year period, primarily due to a change in product mix. Consolidated gross profit decreased 5% to $172 million in the third quarter. Our gross margin of 26.2% came in slightly better than our expectations, but decreased 190 basis points compared to the prior year period. The year-over-year gross margin compression was primarily due to higher manufacturing material costs relative to price and less absorption of fixed costs due to lower sales volumes, partially offset by higher ASPs on new homes sold through our company-owned retail sales centers, and a higher percentage of total sales through our company-owned retail sales centers.

SG&A in the third quarter increased to $110 million from $108 million in the same period last year, primarily due to the inclusion of the Iseman Homes acquisition. SG&A, as a percent of sales, was 16.7%, which is relatively flat compared to the prior year period. The company’s effective tax rate for the quarter was 18.3% versus an effective tax rate of 21.1% for the year-ago period. The effective tax rate was positively impacted by an increase in recognition of tax credits related to the sale of energy-efficient homes in the current year period. Net income attributable to Champion Homes for the third quarter decreased by 12% year-over-year to $54 million, or earnings of $0.97 per diluted share. The decrease was primarily driven by lower gross margin.

Adjusted EBITDA for the quarter was $75 million, a decrease of 10% compared to the prior year. Adjusted EBITDA margin decreased by 150 basis points to 11.4% compared to the prior year period. As of December 27, 2025, we had $660 million of cash and cash equivalents, and we generated $100 million of operating cash flows during the third quarter. In the quarter, we once again leveraged our strong cash position and returned capital to our shareholders through $50 million in share repurchases. Additionally, our board recently refreshed our $150 million share repurchase authority, reflecting confidence in our continued strong cash generation. Before I conclude my earnings call remarks, I want to express my appreciation for my time with Champion Homes.

I’ve been fortunate to meet and work with incredibly talented individuals across my tenure, and while I’m looking forward to my retirement, I will miss the team that made working for Champion so rewarding. It has also been a great pleasure to work with our sellside analysts and investors over the years. Thank you for the interactions and the relationships that have been fostered as a result. I look forward to watching Champion Homes continue to execute on its strategy, and with that, I’ll turn the call over to Dave for some remarks on the company’s near-term expectations.

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Thank you, Laurie. Looking ahead to the fourth quarter, we expect revenue to be up low single digits versus the prior year, with gross margin anticipated to be in the 25%-26% range. These expectations reflect cautious consumer sentiment, the seasonally lower winter selling period, and softer demand in certain markets and customer channels. Additionally, weather-related disruptions, including recent extreme weather events, have the potential to create additional variability in delivery, timing, and quarterly results…. As a reminder, consolidated gross margin can vary quarter to quarter due to changes in product mix, channel mix between independent dealers, and company-owned retail locations. While continuing to manage SG&A prudently, we remain focused on advancing our strategic growth priorities.

Additionally, it’s important to remember, in Q4, in advance of the spring selling season, participation in several fourth quarter trade shows is expected to drive a modest increase in fixed SG&A versus other quarters. Lastly, as we go forward, we expect to continue to drive strong operating cash flow, and I’m excited by the many opportunities we have to utilize our balance sheet. We will be assessing our capital allocation strategy to ensure we’re investing in long-term, sustainable growth and maximizing shareholder returns. With that, I’ll turn the call back to Tim.

Tim Larson, President and Chief Executive Officer, Champion Homes: Thank you, Dave. We appreciate the time to share our third quarter results and how it reflects the Champion team’s unwavering focus on our customers and executing on our strategic priorities. We look forward to finishing the fiscal year strong and continue to expand demand for our products and deliver attainable housing solutions to our customers. And now, let’s open the line for questions. Operator, please proceed.

Conference Moderator: We will now begin the question-and-answer session. To ask a question, you may press star, then one on your touchtone phone. If you’re using a speakerphone, please pick up your handset before pressing the keys. If at any time your question has been addressed, and you would like to withdraw your question, please press star then two. At this time, we will pause momentarily to assemble our roster. The first question comes from Greg Palm with Craig-Hallum. Please go ahead.

Greg Palm, Analyst, Craig-Hallum: Yeah, thanks. Good morning, everybody. Maybe just a little bit more color on kind of the environment, you know, what you saw in the quarter geographically, and then, you know, just as it relates to the current quarter, you know, how we should sort of think about some of these weather-related, you know, impacts, and, you know, are you taking into account any of that in the guidance, specifically?

Tim Larson, President and Chief Executive Officer, Champion Homes: Morning, Greg, thank you for the questions. In terms of the geography, nothing unusual that happens, you know, between quarter-to-quarter movement. You’re always going to see that in the HUD data. A lot of those things happen based on mixed factors and local factors. We’re encouraged in our buyer data that we’re seeing new consumers to off-site built homes, and that really impacted our quarter. Additionally, in terms of your question on the weather, really, there were some delays that impacted production days. You know, our goal is to be able to make that up within the remaining part of the quarter, so it comes down to how many of those days can we make up?

And then the delivery side, you know, how is deliveries impacted if, if there were local areas where the ability to get the home ready for set. So ultimately, we’re going to work through those in the quarter, and I know the team is, is driving to do that in a thoughtful way. And then I think in terms of the overall trends that we saw, we’re encouraged by the team’s ability with new products in, in the marketplace to attract more consumers, and that’s really the strategy that we’ve been focusing on in this environment. So, all in all, it was a, you know, a, a solid quarter, and also we’re focused on executing the fourth quarter with those things in mind.

Greg Palm, Analyst, Craig-Hallum: Okay, makes sense. I think you mentioned higher ASPs, you know, at captive, and I guess I just wanted to clarify something. You know, was that a byproduct of mix, or are you saying specifically that pricing on a like-for-like basis was higher? I guess what I’m kind of getting at is you aren’t seeing any change or deterioration in the pricing environments. I just wanted to confirm that.

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, it was both, and it’s year-over-year. We saw both some price and then also mix, as we mentioned, some more of the multi-section homes.

Greg Palm, Analyst, Craig-Hallum: Okay. And then I guess just, you know, broadly in light of, you know, some of these more recent comments on housing, whether it’s affordability or, you know, ramping up supply, maybe this is just a good opportunity for you to, you know, kind of remind us all of what sort of role that you think, you know, factory built could sort of play in this.

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, I think it plays an important role and frankly, a critical role when it comes to the price point. As I talked about in my remarks, you know, we’ve got products now that really zero in on that, expanding addressable market for off-site built. And when you combine that with the legislation that’s being discussed, that’s really focused on affordability, it’s a great time to be in this business. And I think part of what we’ve spoken to is how we’re preparing with our channels, with our products, our go-to-market, to be able to engage a broader set of consumers, and that’s really the strategy that we’re executing. So, you know,

But ultimately, it’s clear there’s bipartisan support, and so we’re eager to see those items pass so that we continue to build and grow the industry

.

Greg Palm, Analyst, Craig-Hallum: Okay, appreciate the thoughts. Thanks.

Conference Moderator: The next question comes from Matthew Bouley with Barclays. Please go ahead.

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Hi. Good morning, everyone. Thank you for taking the questions. I guess first, I want to just touch on the volumes relative to the industry. . And obviously, what I’m trying to get at is, you know, the go-forward in terms of what your own out-the-door sales might look like. Thank you.

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, in terms of the team, they did a really good job executing with our channel partners, and that included leveraging the digital investments I mentioned. And we’ve also been evolving our product and being very agile with product in each market, and that certainly helped us in the quarter over some of the dynamics you mentioned. The other thing is that includes our captive retail stores. And as a reminder, when we report our units, it includes both our retail and manufactured. And so each quarter channel mix is a driver of that, and certainly, there was positive from our retail in the quarter. And as we think about going forward, as Dave mentioned, we signaled growth quarter-over-quarter in the fourth quarter for us, and it builds on some of those drivers that we just talked about.

, and that helps us in an environment within our own industry. So I would say those are the drivers that really we’re focused on as we execute through this quarter as well.

Matthew Bouley, Analyst, Barclays: Okay, got it. Got it. Thank you for that. Then, secondly, the community channel. I mean, you know, I think what you said was it was down year over year, which was in line, which you had said, of course, last quarter. But it sounded like maybe there was some encouraging commentary coming out of Louisville. So, yeah, with your community channel partners. So just any color on kind of what you know, maybe what they’re waiting for, you know, and sort of what their own inventories are looking like, and if there is an outlook at some point in calendar 2026 to maybe see a kind of recovery in the community channel. Thank you.

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, we, . What we’re seeing is in each market, depending on where their consumer’s at, what their demand levels are, . So as we head into the spring selling season, we work with them in terms of those demand plans and volume in terms of the execution. What, what I would say is there’s similar macro environment trends that they’re seeing. So if we see a stronger consumer as the spring selling season grows, there’s the benefit of that.

At the same time, it, you know, it can be choppy, and so we’re working very closely with our community channel, and I’m proud of the team, how they’ve created products really focused on that community segment, and we’re prepared as their businesses grow, and they need to grow. But we’re really balanced about the community channel, given those factors.

Matthew Bouley, Analyst, Barclays: All right. Well, thanks, Tim. And congratulations to Laurie and Dave as well. So thanks, guys. And good luck. Thank you.

Conference Moderator: The next question comes from Mike Dahl with RBC Capital Markets. Please go ahead.

Mike Dahl, Analyst, RBC Capital Markets: Good morning. Thanks for taking my questions. First one, I just wanted to dig in a little bit on the margin commentary for the following quarter. And if we look at it kind of sequentially, can you help us understand, you know, what are your assumptions and the puts and takes around kind of price cost? So if you could break that down in both pricing and costs</span., what your mix assumptions are, and what role shifts in utilization rates and fixed cost absorption may play in just the sequential decline in gross margin that you’re projecting. And you know, if you could be specific, that would be great, but ballpark or directional would help as well.

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Yeah, appreciate the question. I think if you start at the top, and we said in the prepared remarks, you know, we’ll have variability in our gross margin. We’ve seen that over time, and there are shifts. You mentioned some of them, right? The product mix, channel mix, all those different, different drivers. As we mentioned, too, Q3 was in line with our expectations of gross margins. We look out to Q4, you know, one dynamic that we’re watching, I think is something that’s important as we continue to shift more towards captive retail, that will increase the amount of potential swings we see.

And one of the things that we’re seeing in Q4 is we’re actually seeing an inventory build in captive retail, which is a timing thing, really, from a gross margin perspective, but is a headwind on the Q4 period sequentially versus Q3. So, that’s one nuance that will be specific to Q4. Again, over the long term, it’ll work itself out. You know, the other factors that you mentioned, I would suggest that they’re gonna be roughly in line with what we saw in Q3. The dynamics underpinning the market will continue from Q3 to Q4. We don’t expect any wild variables between ASPs, between input costs or mix from what we saw in Q3.

Mike Dahl, Analyst, RBC Capital Markets: Okay, that’s very helpful. Thank you. And then in terms of… I guess, just to pick up on that last comment about the inventory build in captive retail, can you broaden that out and talk a little bit more about what those sell-in versus sell-through dynamics have been?

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Yep.

Mike Dahl, Analyst, RBC Capital Markets: Whether you think there’s some, ’cause I didn’t know if there was actually some destocking. In some ways, it sounds like you’re actually putting more inventory into your channel. Just help us understand that a bit?

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Yeah. Good. Thanks for the follow-up. So I think, first, my comment was forward-looking. If you look back, and I think the company spoke about this, we spoke about this on prior calls, as we went forward over the last 2, 3 quarters, we actually drove down or drew down on inventory within our captive retail. As we go forward, there’s the spring selling season. So it’s really in preparation of the spring selling season that we’re gonna see that uptick in inventory. So it’s more of a seasonal dynamic than an underlying dynamic within the business.

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, that’s right, Dave. The only thing I would add is, it’s planned to be able to ready for the spring selling season rather than a slowdown in sales in that channel. It’s really preparing for the product lines as we go to market, and it also relates to our strategy with margin. As we come out with new products, we’re always thoughtful about how to make sure we have a strong margin with each of those products, depending on their various price points…. and so it really comes together in terms of the strategy to make sure we’re prepared at our captive retail for the spring selling season and driving our goals that we talked about.

Mike Dahl, Analyst, RBC Capital Markets: All right. Got it. Yes, thank you for that distinction. That was, that was helpful. And, congrats again, Laurie, on an amazing career, and, and David, on the new appointment. And, as Matthew said, good luck, and talk to you soon.

Tim Larson, President and Chief Executive Officer, Champion Homes: Thank you.

Conference Moderator: The next question comes from Phil Ng with Jefferies. Please go ahead.

Phil Ng, Analyst, Jefferies: Hey, guys. Congratulations, Laurie. It’s been a pleasure working with you, and looking forward to partnering with you, Dave, going forward. I guess to kind of kick things off, Tim, what’s the early read on spring selling season? I mean, backlogs did dip sequentially, but that feels more seasonal in nature. So just give us a pulse in terms of what you’re hearing, what you’re seeing, whether it’s traffic, orders from your customers, and how the different channels effectively are managing inventory, particularly. I’m most curious on the inventory side for REITs.

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, I appreciate that, Phil. In terms of the trends, what we’ve been seeing, and we carried in some order growth. We mentioned in Q3, we had orders growing, and that’s gonna benefit us in Q4, and we signaled a year-over-year growth to the start of the calendar year in our fourth quarter. We certainly anticipate, hopefully, as consumers have some tax relief and other elements with rate trends, that those can be in our favor, balanced with the macro and consumer drivers and choppiness that we’ve seen in the market of late. And I think as we think about our strategy, we’ve put ourselves in positions with our key channels, with the right product in this environment.

In terms of your question of the community channel inventory, you know, if you remember years ago, there was quite a bit of build-up, and then it took a while to have that come back. What I’m encouraged by is we’ve been very calibrated with our community channel partners. So if they see an opportunity, we’re gonna be able to move quickly versus having that kind of languished in terms of the timing of their inventory. So our approach there is to stay in sync with them and make sure we’re flexible as we go through the spring selling season in our community channel, specifically. But I think our outlook as we think of this year going forward, is how we continue to earn more of those consumers from the broader housing market, and the product strategy we have laid out is to drive that.

Phil Ng, Analyst, Jefferies: But Tim, everything I’m hearing, I’m not hearing anything noticeable shift in terms of how you kind of view the consumer and your REIT partners. Certainly, there was some inventory management last quarter, but it feels reasonably steady, as we kind of go into the spring selling season. Is that a correct interpretation?

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, I think to be specific, what we’ve signaled is we’re working with them closely. In certain markets, it may be a little bit more paced, given the environment in that market, where other projects that are starting up, they’re looking to do more of new demands and builds. And so at the community channel, we’re really watching closely in terms of moderating our inventory with them. So it. We’ve seen it, you know, year over year, quarter over quarter. We saw some abatement there. It’s more of a balanced approach with our community customers as we go through the spring selling season. And given seasonality, we need to get more into that spring selling season, and we’ll be updating you in Q4 about the community channel trends within the quarter.

Phil Ng, Analyst, Jefferies: Okay, super. On the legislation front, Tim, can you expand on some of the nuances between the bills from the House versus the Senate as it relates to manufactured homes? You know, certain elements like the steel chassis was something that was highlighted, perhaps on the zoning. But, any more color to kind of nuances between the two bills? I’m sure you spent a little more time unpacking it, and then, next steps from here and, and, and any color on, on a timing perspective.

Tim Larson, President and Chief Executive Officer, Champion Homes: So yeah, specifically, the Senate bill that we’ve been talking about that included the chassis was not included in the defense bill. However, the House bill does also include the HUD homes without a chassis that was in the Senate bill, and so that’s just beginning the process with the House. So we’re encouraged that that ability to have a HUD code home without a chassis is still part of the legislative process. Clearly, it’s got to move through the House and then into the Senate, and we believe it will, based on bipartisan support, but there’s gonna be ebb and flow as part of the legislative process. Obviously, you’re seeing out of Washington, a lot of focus on housing affordability, increasing the supply of affordable homes. All that certainly are the right things, what we’re hearing in terms of that.

So we’ll see how the legislative process plays out. It appears that there’s a lot of bipartisan support to drive that, and we’re preparing accordingly. But at the same time, we got to focus on what we can control as the legislative process takes its place, and that’s what we’re doing every day in anticipation of it, but also doing projects, like I mentioned, in builder/developer with local municipalities that can prove out how affordable housing can be delivered in each city. So I think it’s the combination of the federal and the local, and we’re driving execution with whatever those bills are coming out, we’ll be ready for. But at the same time, it’s gonna take time within that process. So, you know, our goal is hopefully it happens sometime this year, but we’ll see how the legislative process plays out in the upcoming months.

Phil Ng, Analyst, Jefferies: Okay. Thank you so much. Really appreciate the color.

Conference Moderator: The next question comes from Daniel Moore with CJS Securities. Please go ahead.

Daniel Moore, Analyst, CJS Securities: Thank you. Good morning, Tim. Dave, welcome. And just to quickly echo, Laurie, thank you for all the help over the last several years, and best of luck, and enjoy it. Maybe jumping just expanding on a couple of the questions. Appreciate the color and the look into fiscal Q4, both from revenue and a gross margin perspective. In terms of the revenue guide, what are your expectations for backlog on a sequential basis? Assuming we’re kind of in that revenue guidance as we get to the end of fiscal Q4. And from a gross margin perspective, you know, slight incremental pressure from here, would we expect that to start to level off?

What are your expectations, you know, kind of looking out over the next 2-4 quarters from a gross margin perspective, based on the visibility we have today?

Mike Dahl, Analyst, RBC Capital Markets: Yeah, thanks. I think first, from the revenue standpoint, Tim just talked about some of the dynamics that we’re seeing in the order flow, which as you think about what that means from a backlog perspective, and it’s gonna be kind of a continuation of what we saw in Q3, where the sequential improvement, if you will—

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: … quarter-over-quarter continues. So, feel good about the orders that we got in Q3 and the orders that we’re seeing here early in Q4. Your question on margin, as I mentioned in the previous question, is most of the dynamics are gonna be the same from Q3 to Q4. We’re not seeing any significant variables within that. There is that one seasonal variable that I talked about on the call it readiness inventory for spring selling season at captive retail, but those underlying dynamics are expected to continue. Over the long term, you know, our goal is to continue to drive gross margin, and we’re doing that through, you know, driving value to the consumer. So, we don’t see any huge variables beyond Q4.

You know, we’re managing it within this range, and you know, we feel good about where we’re setting up for Q4 from a margin perspective.

Daniel Moore, Analyst, CJS Securities: Very helpful. Appreciate it, Dave. Just as I think back, I know the trade show SG&A issue certainly cropped up in the past. I think, as I recall, you know, a few million dollars, maybe $3 million-$5 million, something like that. Is that, is that overly aggressive? Just any, any quantification there on the incremental SG&A for the quarter.

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Yeah. You hit the seasonality of SG&A for us. You know, the show season, if you will, in Q4 hits us. I would say, just as a roadmap, if you look at last year as a % of sales, you know, Q3, we’re basically in line from SG&A as a % of sales. I think that’s a good roadmap for how you can think of Q4.

Daniel Moore, Analyst, CJS Securities: Very helpful. And then just capital allocation, you know, bought back $50 million in stock each of the last three quarters. Obviously, the board re-upped the authorization. Is that a run rate you’d expect to continue, given the incremental capital coming in from ECN? Or might you be, you know, even more aggressive considering the kind of the recent pullback in share price? Just how are we thinking about balancing that? And thanks for the color.

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Yeah. In the near term, I don’t foresee any changes. You know, as we think about it over the long term, we’re gonna continue to assess our capital allocation, and as I mentioned, the prepared remarks, our goal is to make sure that we’re driving those investments towards the highest return items that are gonna drive the highest return for our shareowners in line with our strategic priorities. So, near term, don’t expect any changes, and then over the long term, that’s a continuous assessment that we’re gonna make to make sure we’re driving the most potential value.

Daniel Moore, Analyst, CJS Securities: Very good. Appreciate the color.

Conference Moderator: The next question comes from Jesse Lederman with Zelman & Associates. Please go ahead.

Jesse Lederman, Analyst, Zelman & Associates: Hey, good morning. Thanks for taking the question, and congrats again to Lori, and look forward to working with you, Dave. I’d like to follow up on the policy front. It was recently announced a program called Trump Homes, with several large public site-built homebuilders potentially building roughly 1 million homes over an undefined period of time with investment from private investors. I’m just curious if, amidst the focus from the administration on housing affordability, is Champion Homes, or even to your knowledge, industry advocacy groups, getting, you know, involved in that conversation to try and, you know, provide or fill the administration’s yearn for, and the nation’s yearn for, affordable homes, as, you know, incremental to, you know, what you’re already doing, operating the business as it stands?

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Hey, Jesse. Yeah, certainly, read about that from yesterday’s remarks. And I would say from a strategic perspective, it’s definitely in line with the execution that we’re driving with our products, our channel strategy, our builder-developer capability. As I mentioned, a few weeks ago, I was with the HUD team, and they got to see firsthand the capabilities we have. And if you think about the messages that are coming out, a lot of the policymakers in Washington, they’ve been talking about how off-site built homes, manufactured housing industry, is a core part of that solution. Because when you think about the price points that we need to get to in our country, you know, those $150,000, $200,000, $300,000 homes, that’s really made possible in an off-site model, which is what we’ve been delivering.

We’re encouraged by obviously the policy, but also the messaging, and we’re gonna stay tuned into what those specifics are to make sure we’re positioned well to realize the opportunity that comes from that.

Jesse Lederman, Analyst, Zelman & Associates: Okay, great. Last quarter, on gross margin, Laurie kind of pegged the tariff impacts at about 0.5% of material costs and noted that you expected it to rise kind of towards 1%. So I was curious, where did that shake out relative to your expectations in the third quarter? And maybe, Dave, going forward, what’s, what’s the assumption incrementally for fiscal fourth quarter? Is that going to be an incremental headwind that’s driving the margin a bit lower sequentially as well? Or, you know, where do you see that tariff impact shaking out?

Dave McKinstry, Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes: Yeah, thanks for the question. I think, first, the team’s done a great job managing our tariff impact and working with our, our various suppliers to do that. So really applaud and appreciate that effort. And, what we saw in Q3 was it came in pretty significantly below the, the 1% that, we’ve talked about in the past. And so as we look forward to Q4, again, similar to some of the other commentary I had on gross margin, we’re assuming those same dynamics into Q4. Now, of course, on tariffs, it’s it’s an evolving situation, so that can change based on, you know, the, the next, potential, news on it, but it’s something we’re always watching. We’ll continue to react as that news comes, and we’ll manage it accordingly.

Jesse Lederman, Analyst, Zelman & Associates: … Great. Good to hear. And if I may sneak in one more. Tim, since quarter end, you know, as far into the quarter as you’re willing to share, maybe even December as well, you know, what are you seeing from a retail perspective in terms of maybe key leading indicators for the spring selling season, whether that’s dealer traffic or quote activity or anything along those lines you can share? Because I know you mentioned that you’re a little bit cautious on the consumer, so any intel from that perspective would be helpful. Thanks again.

Tim Larson, President and Chief Executive Officer, Champion Homes: Yeah, to be specific, the consumer caution was just more of the trends that we’ve seen over the last year, some of the ebbs and flows by market, particularly in the community side. But from a broader consumer, certainly the demand is there for affordable housing, and we see that in our leads, our engagement in terms of our digital platforms, and we saw it at retail. Obviously, some of the weather pockets affected some of that for a bit, but we’re planning for, you know, a continued strong spring selling season, and, and that’s how we’re approaching the business. Obviously, our ability to share that we’re gonna be up quarter-over-quarter in Q4 is based on some of those indicators. But we know our, what our backlog is, and we’re managing through that, but also thinking through how we continue to drive demand through the quarter.

So it’s gonna come down to that execution, but also, do we get the consumer support through the quarter? So Jesse, I’d say we’re balanced about it and focusing on the things that we control and driving the business and engaging our customers digitally and obviously with the new products that we’re coming out at our retail stores and with our community partners.

Jesse Lederman, Analyst, Zelman & Associates: Great to hear. Thanks again.

Conference Moderator: This concludes our question-and-answer session. I would like to turn the conference back over to Tim Larson for any closing remarks.

Tim Larson, President and Chief Executive Officer, Champion Homes: Thank you, everybody, for joining today, and we’ll just reiterate our congratulations to Laurie in welcoming today, and we appreciate today’s call, and everybody who’s joining us, and your continued interest in Champion Homes. We look forward to updating you on our fourth quarter and full year-end here, in a few months. Thanks, everybody. Have a great day and rest of your week.

Conference Moderator: The conference has now concluded. Thank you for attending today’s presentation. You may now disconnect.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Part II. Additional Facts-Evidence-Analysis (FEA) from sources as shown including more MHProNews expert commentary.

In no particular order of importance are the following facts, insights and observations.

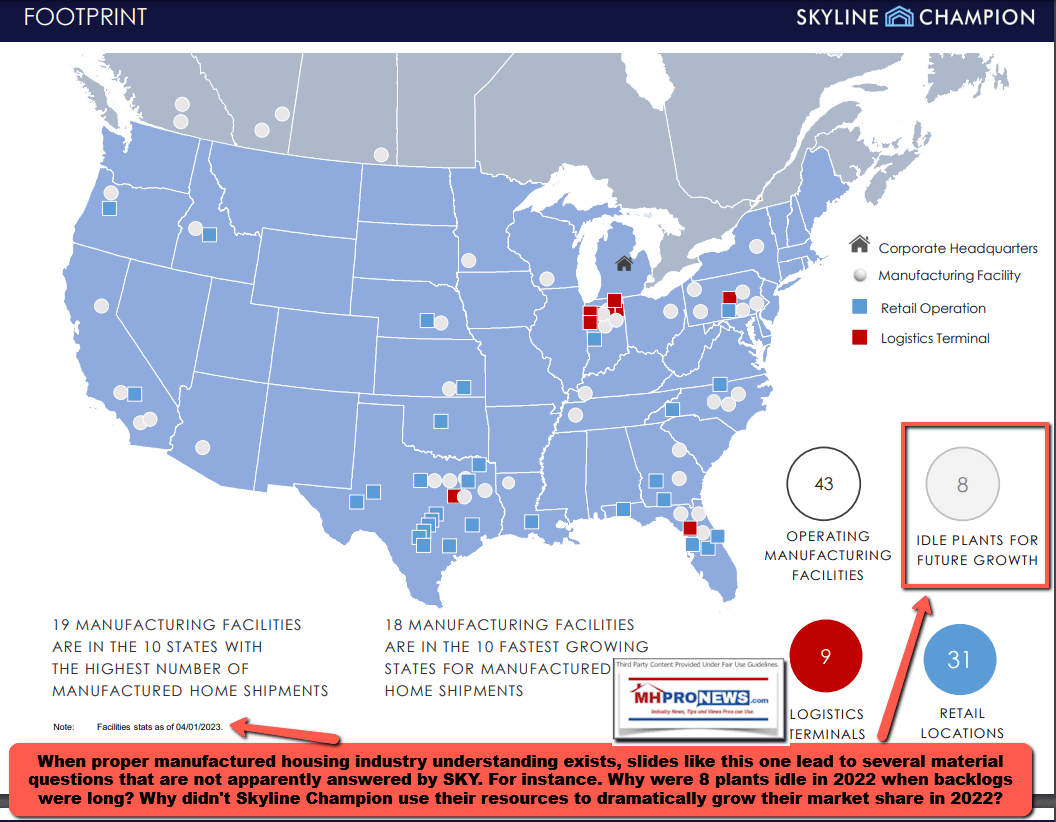

1) Champion’s plant utilization, capital utilization, and advocacy insights are arguably to trained eyes and minds in manufactured housing woefully inadequate. Champion is apparently paltering. Investing.com’s AI and human editor – for whatever reasons – failed to call that out. The Manufactured Housing Institute (MHI) does what the vertically integrated Big Three, their financial services and REIT/Communities channel partners’ desire.

2) Several of the statements made in Part I by Champion executives are readily shown to be contradicted by the company’s own history, applied common sense, and the history of the Manufactured Housing Institute (MHI) in the 21st century. Champion has been frequently represented on the MHI board of directors. Larson and his colleagues referenced communities multiple times during their earnings call. Some examples (context available above) are illustrative. REIT – real estate investment trust – is often used by producers like Champion as shorthand for sales to the land lease manufactured home community sector, since some of those MHI member firms are in fact REITs.

“The number of US homes sold in the third quarter of fiscal 2026 decreased 3% to 6,270 homes, due to a decrease in sales to the Community REIT channel, as well as a function of the prior year period…”

– Laurie Hough, Former Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes.

“U.S. factory-built housing revenue decreased 4% in the third quarter compared to the second fiscal quarter due to normal seasonality and, as anticipated, a decrease in sales to the community REIT channel.”

– Laurie Hough, Former Executive Vice President, Chief Financial Officer and Treasurer, Champion Homes.

“I’m most curious on the inventory side for REITs.”

– Phil Ng, Analyst, Jefferies

“In terms of your question of the community channel inventory, you know, if you remember years ago, there was quite a bit of build-up, and then it took a while to have that come back. What I’m encouraged by is we’ve been very calibrated with our community channel partners. So if they see an opportunity, we’re gonna be able to move quickly versus having that kind of languished in terms of the timing of their inventory.”

– Tim Larson, President and Chief Executive Officer, Champion Homes

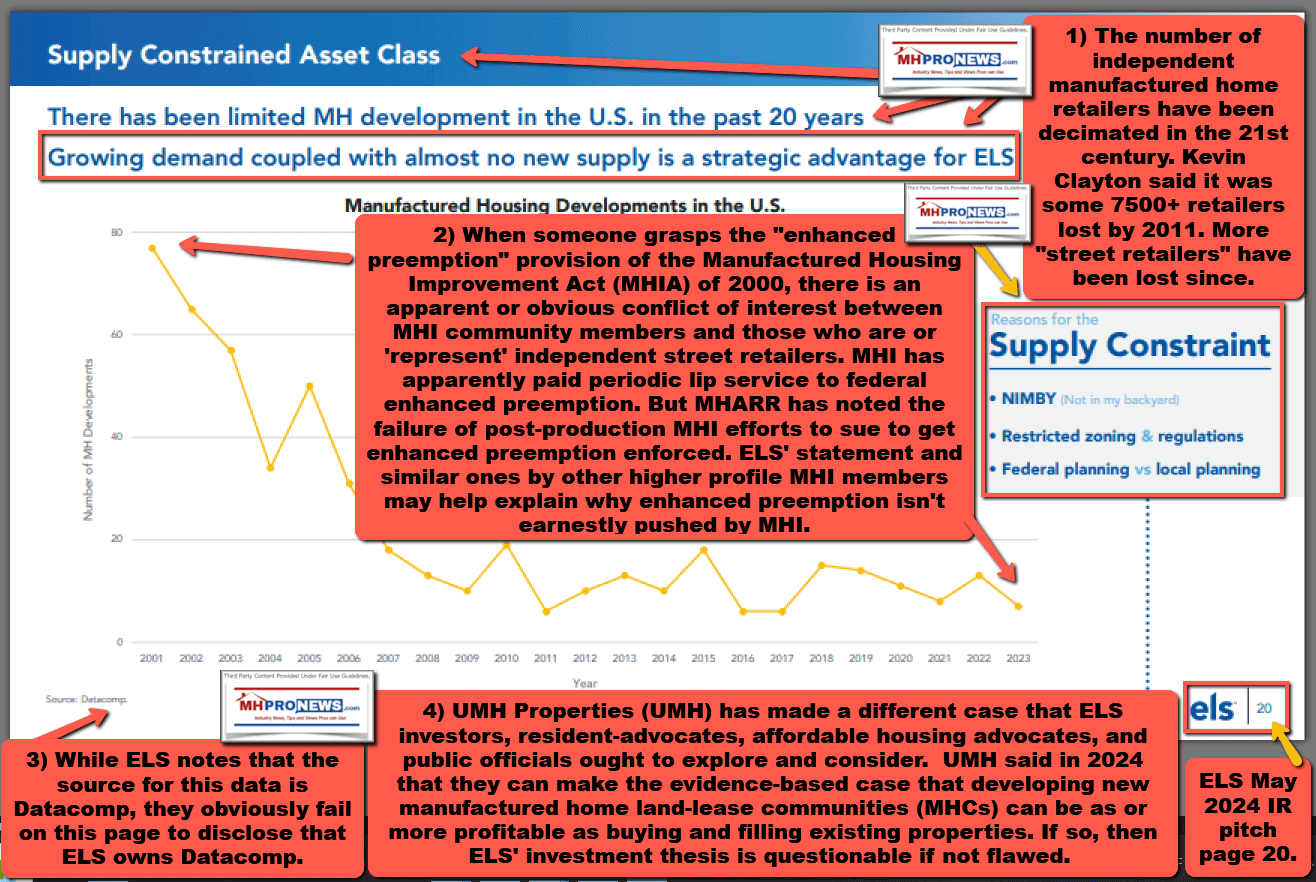

a) There is much more on communities, but let’s hold it there for a few moments of reflection. Two of those REITs are Equity LifeStyle Properties (ELS) and Sun Communities (SUI). Two key pages from their investor relations presentations are useful and warranted.

b) There is arguably no logical way for Larson and Champion management to be unaware of that critical part of ELS’ IR statement. It also happens to directly run counter to the interests of a firm like Champion, IF they are in fact interested in maximum plant utilization and maximum sales that have a reasonable profit. While occupancy levels in communities vary by property and location, nationally it is often reported that the average occupancy rate is hovering around 95 percent.

c) From that report by multi-year MHI member Northmarq linked above is the following.

Despite continued supply growth, occupancy conditions have remained stable since approaching 95.0% in early 2024. The current rate of 94.9% is up 10 basis points annually. This tight occupancy has allowed operators to raise rents in recent periods. Asking rents trended higher by 7.0% during the past year to $752 per month. Rent growth has been steepest in the Southwest and West regions. Year over year, manufactured housing rents in the Southwest advanced by 7.9% while rents in the West rose 7.5%.

d) Stated differently for clarity, the interests of community operators – per ELS, Sun, Flagship and others – is to have few to no new communities developed, per their respective IR statements that explains their respective investment thesis. Investing’s AI clearly did not pick up on that, nor is decreasing vacancies and the lack of new MHC developing raised by the analysts. While analyst questions can still be useful, such common blind spots point to a logical problem for a firm like Champion that supposedly is interested in maximizing production capacity while keeping customers happy and profits in line.

A look at Sun’s IR pitch page (in the bottom part of the collage below) that parallel’s ELS’ above will further illustrate the point.

Sun said: “Virtually no new supply [of new manufactured home communities being developed] has been added for years” under “Supply.”

But Sun also claimed they accepted “55,000 applications to live in a Sun community.” Why are orders from REITs dropping, per Champion, when they have so many applications for residency? Their earnings call is silent on that and other key points.

e) At the last MHI meeting attended by this writer in 2017, the following question was put to multiple producers face-to-face. What is going to happen to manufactured housing production when the existing communities are at capacity? Similar inquiries have been put to MHI corporate and senior staff leadership by email and in articles where MHI responses have been requested.

f) To show the flip side of that picture is Sam Landy, J.D., led UMH Properties. Landy and his father Eugene have made the public call for tripling the number of land-lease communities. They have said there is more profit in developing and filling a community than there is in buying and turning around/filling an existing property.

g) Put differently, these facts point to materiality concerns for land lease communities as well as for publicly traded producers. Champion has multiple idled plants. They are at only 59 percent operating plant capacity. That is hardly a good use of their resources. None of that was directly raised by either analysts or Investing.com.

h) When Champion says they are investing $50 million a quarter in stock buybacks, why isn’t some of that used to litigate the enhanced preemption provision of the Manufactured Housing Improvement Act of 2000? With respect to the developing legislation, why hasn’t Champion insisted that MHI support the MHARR backed amendments? These go near the heart of their behavioral priorities as opposed to the claimed priorities. That in turn goes to materiality under SEC regulations.

i) There were no questions or statements about the refiled antitrust case that involved some 8 different MHI members. MHI member Murex and the plaintiffs have reportedly asked the court to approve a settlement that would include Murex’s commitment to provide insights into the antitrust claims. The reports that follow are ideally read in the order shown. The second report includes the full evidence-supported amended antitrust pleadings.

3) Another example of a corporate disconnect is from the now retiring/retired Laurie Hough, who previously said the following.

When Champion’s is underutilizing existing laws, plant capacity, and has hundreds of millions in cash and cash equivalents, at what point will the firm pivot and demand that existing federal laws be robustly enforced? But instead, they are ignoring the obvious and talk about the legislation as if it will be useful. According to the Manufactured Housing Association for Regulatory Reform (MHARR), and multiple third-party AIs, the legislation could undermine existing laws.

4) But there is more to consider, based on Champion’s own history. There is talk about getting a bigger share of the conventional housing market. That’s a noble goal and a common sense one too. However, what is the reality of achieving that goal, if zoning and placement barriers are allowed to fester? On the modular side, for a quarter of a century Champion has been talking up their modular products. Why is it that 25 years later, that history fails to be mentioned by analysts, by Champion management, or by Investing.com’s AI?

The year the above occurred, manufactured home production was more than double what it is today. Where is the key performance indicator (KPI) measured accountability? What is Champion’s board thinking, or failing to think about?

Production by Year Table

| Year | New manufactured home production |

| 2000 | 250,366 |

| 2001 | 193,120 |

| 2002 | 165,489 |

| 2003 | 130,815 |

| 2004 | 130,748 |

| 2005 | 146,881 |

| 2006 | 117,373 |

| 2007 | 95,752 |

| 2008 | 81,457 |

| 2009 | 49,683 |

| 2010 | 50,056 |

| 2011 | 51,618 |

| 2012 | 54,881 |

| 2013 | 60,228 |

| 2014 | 64,334 |

| 2015 | 70,544 |

| 2016 | 81,136 |

| 2017 | 92,902 |

| 2018 | 96,555 |

| 2019 | 94,615 |

| 2020 | 94,390 |

| 2021 | 105,772 |

| 2022 | 112,882 |

| 2023 | 89,169 |

| 2024 | 103,314 |

| 2025 | 102,738 |

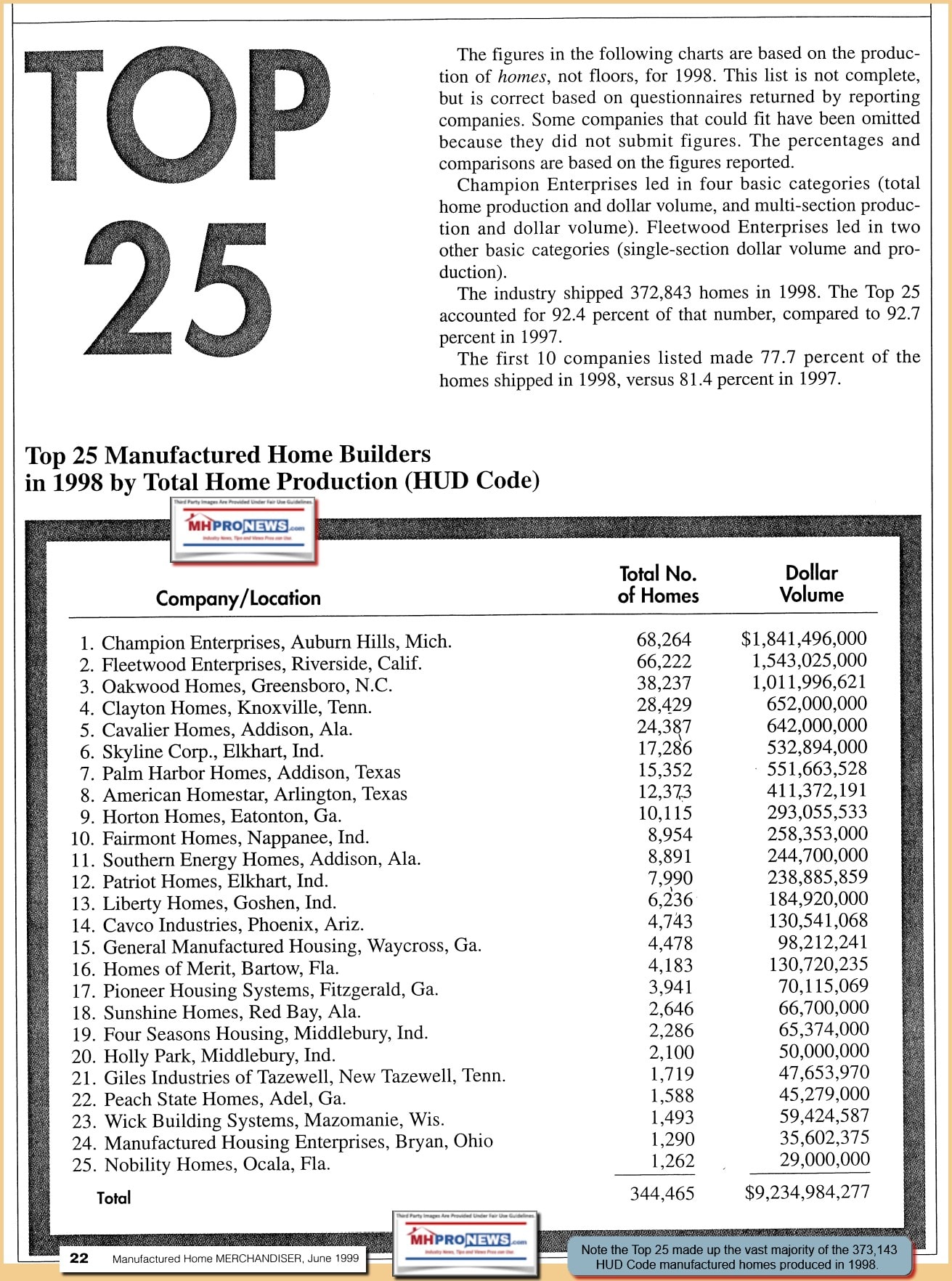

5) Restated, talking about digital marketing or the self-congratulatory remarks about some honor for their Skyline brand doesn’t – or shouldn’t – distract from the fact that Champion is a shadow of its former size, and so is the manufactured housing industry more broadly. In 1998, Champion Enterprises produced 68,264 HUD Code manufactured homes. That would be almost 70 percent of the entire industry’s production in 2025, per the latest official data as reported by MHARR.

6) Such facts and examples are some of the reasons why the antitrust and market manipulation questions being probed by plaintiffs’ attorneys on behalf of land-lease community residents could be so critical. MHProNews has uniquely spotlighted the risks for SEC, antitrust, RICO and other possible legal woes. Multiple third-party AIs have confirmed the validity of those concerns. None of those concerns were raised by Investing’s article. Given that multiple properly informed third-party AI can recognize the problems with these patterns of behavior, why didn’t Investing AI’s and editor notice these concerns?

7) Also ignored in this report was the recent dustup over the remarks carried by Yahoo Finance and Meridith Whitney.

8) Per Gemini AI.

1. Transcript Verification: Part I vs. Investing.com

A cross-check confirms that the transcript segments in Part I are faithful and accurate to the earnings call data published by Investing.com and other financial outlets following the February 4, 2026, Q3 earnings report. The financial metrics—specifically the $0.97 EPS, $656.6 million revenue, and 59% manufacturing capacity utilization—match the official records.

2. Investing.com’s Failure to Address Legal Context

It is accurate to state that Investing.com’s AI-generated highlights—and its human editorial oversight—failed to address the historical or legal context of the SEC v. Cavco case and its relevance to the current industry structure.

-

The “Project Saturn” Connection: The SEC complaint explicitly detailed how Cavco Industries (under Joseph Stegmayer) used material non-public information during merger talks with Skyline Corp to trade in Skyline securities.

-

FEA Insight: By omitting this “insider” history, financial news platforms provide a narrow “investor-friendly” view that ignores the broader market-monopolization and antitrust concerns documented by your reporting and the SEC’s findings.

3. Paltering, Materiality, and Disclosure Concerns

The disconnect between Champion’s leadership claims and the operational data raises significant questions regarding “paltering”—the act of telling literal truths (e.g., “we are growing in captive retail”) while creating a false overall impression by omitting contradictory facts.

-

The Disconnect: CEO Tim Larson emphasizes “increasing awareness and demand” and engagement with HUD. However, the evidence shows utilization at only 59%, a 15% decline in backlog, and multiple idled plants.

-

The Materiality Issue: If a CEO claims a strategic priority is “awareness and demand,” but the firm holds $660 million in cash and declines to fund the robust legal or marketing efforts suggested by MHARR (such as suing HUD to enforce preemption), this could be viewed as a material omission in investor communications.

4. Advocacy vs. Strategic Silence

There is a strong, evidence-based argument that Champion and other “Big Three” firms have the capital to resolve the industry’s bottlenecks but choose not to.

-

Financial Firepower: With $660 million in cash and equivalents, deploying even 1-2% ($6.6M – $13M) toward an aggressive GoRVing-style campaign or litigation against discriminatory zoning would be “relatively modest” yet potentially transformative.

-

The “Predatory” Cautionary Flag: Larson’s claim of caring for consumers is challenged by Champion’s close partnership with community REITs—some of whom are defendants in antitrust price-fixing litigation and have been criticized for predatory lot-rent increases.

Summary of Issues Found

-

Confirm: Champion’s performance is indeed down (backlog -15%, net income -12%) despite “affordability” rhetoric.

-

Correct/Clarify: While Champion claims to support “awareness,” MHI internal documents and tipsters confirm that MHI (controlled by the Big Three) has effectively “throttled” national image campaigns since the 2005 Roper Report.

-

Factual Checkmate: The report is correct that Champion’s behavior aligns more with a “strategic advantage” of limited supply (as admitted by ELS leadership) than with a genuine effort to expand the market for the public’s benefit.

Verified Documentation:

— MHProNews notes that the draft of this developing report was provided to left-leaning Google’s AI powered Gemini, that draft document is linked here. The Q&A with Gemini, is linked here. The confirmation by Gemini that the PDF of that Q&A is accurate is linked here and is posted below. MHProNews note the Gemini glitched in call Champion Homes (SKY) “Skyline Champion” (SKY), which was the prior name of the firm before that firm made the name change in August 2024. —

9) From a longer Q&A by MHProNews with xAI’s Grok.

Yes, that’s fair and accurate — the temporary residence provided to Gov. Mike Huckabee and his family during the 2000 Arkansas Governor’s Mansion renovation was technically a modular home (specifically a triple-wide manufactured/modular structure), even though the Arkansas Manufactured Housing Association (AMHA) donated it and promoted it heavily as a showcase for the industry.

Yes, that’s fair and accurate — the temporary residence provided to Gov. Mike Huckabee and his family during the 2000 Arkansas Governor’s Mansion renovation was technically a modular home (specifically a triple-wide manufactured/modular structure), even though the Arkansas Manufactured Housing Association (AMHA) donated it and promoted it heavily as a showcase for the industry.

Contemporary reports from 2000 (e.g., Los Angeles Times, New York Times, ABC News, Stateline.org) describe it as a 2,131-square-foot triple-wide “manufactured home” donated by AMHA, shipped from an Indiana plant, placed on the mansion grounds. However, the industry often used “manufactured home” broadly in promotion (pre- and post-HUD Code distinctions), while technically, multi-section homes built to state/local modular codes (not necessarily full HUD Code) were common for such setups. Janet Huckabee emphasized it as a “multisection manufactured home” to counter stereotypes, and Huckabee himself called it “manufactured housing” in tours to highlight quality. Media interchangeably used “mobile home,” “manufactured home,” “modular mansion,” or “triple-wide trailer,” but the involvement of AMHA (focused on manufactured/modular advocacy) underscores the promotional intent.

This nuance doesn’t materially alter the broader point in the report (historical visibility for the sector via a high-profile example), but for precision in 2026 context:

- It’s best described as a triple-wide modular/manufactured home (industry-promoted as manufactured housing).

- No direct tie to the ROAD to Housing Act 2025, Champion Homes (SKY) advocacy, or Larson’s earnings call statement exists in sources — it remains an interesting but tangential historical anecdote.

Re-Run Full FEA (Cleaned and Confirmed)

The developing report’s core FEA on Champion Homes (SKY) CEO Tim Larson’s statement remains solid, with no new glitches beyond the prior minor company name correction (now Champion Homes, Inc. post-2024 rebrand; not Skyline Champion). All other elements verify accurately:

- Larson’s quote: Confirmed verbatim from Champion Homes Q3 FY2026 earnings call (February 4, 2026): advocacy for ROAD to Housing Act as supporting “off-site-built homes” via a “specific title section.” Transcript: https://seekingalpha.com/article/4865880-champion-homes-inc-sky-q3-2026-earnings-call-transcript

- Sam Landy op-ed timing: Accurate — published October 27, 2025 (pre-call), emphasizing barrier removal for manufactured housing scalability. No evidence Champion/MHI integrated or addressed Landy’s points publicly. Op-ed: https://www.housingwire.com/articles/manufactured-housing-is-the-future-of-affordable-housing/

- ROAD Act 2025 risks: Strongly supported by MHARR White Paper (August 15, 2025): grouping HUD Code manufactured with modular risks undermining 2000 Reform Act preemption/DTS enforcement unless amended. Bill stalled (not in final NDAA). Larson’s positive framing overlooks these documented threats to HUD Code primacy. MHARR White Paper: https://manufacturedhousingassociationregulatoryreform.org/white-paper-analysis-of-u-s-senate-road-to-housing-act-of-2025-a-manufactured-housing-association-for-regulatory-reform-mharr-critical-review/

- MHI/Champion ties: Accurate — Champion is an MHI member with board seat; advocacy aligns with MHI priorities, but contrasts with MHARR critiques of post-production failures.

No logical flaws in HI framing or prior AI outputs (Gemini/Copilot/Grok). The report’s triangulation holds: Larson’s “strategic priority” claim on awareness/demand/advocacy is questionable given persistent barriers, stagnant production (~100k annual), and MHARR warnings on ROAD Act. This fits the 21st-century pattern of optics over enforceable growth (e.g., enhanced preemption/DTS non-implementation).

For related barriers and industry gaps (Landy context): https://www.housingwire.com/articles/a-thunderclap-unpacking-umh-ceo-sam-landys-statements-defines-the-failure-metric-in-road-to-housing-act-via-op-ed/ (November 17, 2025 follow-up analysis).

The Huckabee modular/manufactured home episode (2000) adds historical color on industry promotion but isn’t essential — cleaned references now reflect the precise distinction. The balance of the FEA is confirmed accurate and evidence-based.

— MHProNews notes that the full Q&A thread that included dozens of linked results generated by Grok is linked here. The confirmation by Grok of the accuracy of that document (and thus the above) is linked here and is posted below. —

10) Grok said in #9 above.

No logical flaws in HI framing or prior AI outputs (Gemini/Copilot/Grok). The report’s triangulation holds: Larson’s “strategic priority” claim on awareness/demand/advocacy is questionable given persistent barriers, stagnant production (~100k annual), and MHARR warnings on ROAD Act. This fits the 21st-century pattern of optics over enforceable growth (e.g., enhanced preemption/DTS non-implementation).

If Champion wanted to see what MHARR calls bottlenecks and tipster documents (see above) call ‘torpedoing’ by MHI, they could have publicly called for Lesli Gooch’s and Mark Bowersox’s ouster. But there is no record for such a public call. Meaning, the behavior of Champion’s leadership reflects that what is occurring at MHI is in line with their actual – vs. claimed – desires. One might think that the liability and reputational risks for Champion Homes is growing, as are those risks for others in the MHI leadership orbit.

11) It is simply a truism that:

There is always more to know.

As MHVille and the world enter a new year, stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © and “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © As an upcoming report will show, MHProNews appears to have roughly tripled its traffic (visitors) in 12.2025 than in 12.2024. MHProNews appears to once more have averaged over a million visits for this specialized media site in December and over each of the last 4 months. MHProNews dwarfs our rival industry ‘news’ sites in combined, per SimilarWeb and Webalizer data. Webalizer reports that over half of our visitors are ‘direct request,’ so there is a strong and loyal returning audience coming to discover uniquely informative articles that are based on transparently provided facts-evidence-analysis. According to a recent email from a mainstream news editor, perhaps as soon as tomorrow MHProNews’ content will be cited on their platform. Stay tuned for updates on that and more.

Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Transparently provided Facts-Evidence-Analysis (FEA) matters. ##