Per Thomson Reuters StreetEvents and Yahoo Finance at this link here is the earnings call transcript provided under fair use guidelines for media in Part I. The first paraphrases are from remarks made by Cavco Industries (CVCO) management as shown in Part I of this reports with fact-evidence-analysis (FEA). There are volumes that could be written about what is not commented on by Cavco’s leadership team in this earnings call, or questions and topics curiously avoided by analysts in this (or in several cases, other) concerns that were not mentioned by Cavco during their earnings call. To share just one item that has hit mainstream news in recent days is the following remarks by economist Diana. L. Moss, Ph.D.

Per Dr. Moss via ProMarkets.

“To that end, antitrust is designed to detect and deter consolidation and business practices that reduce competition and harm market participants through higher prices, lower wages, lower quality, and less innovation.”

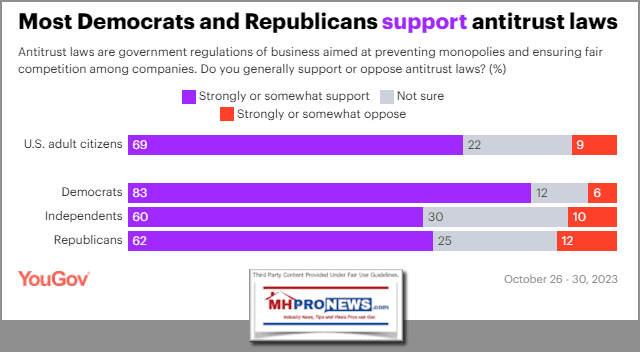

There has been considerable research and reporting in recent years that point to the notion that interest in antitrust or anti-monopolization in its various forms has increased. The public, per surveys, is increasingly interested in antitrust enforcement regardless of their political affiliation. One example is the item below, which links to far more on the topic.

According to ProMarkets is the following about Diana. L. Moss, Ph.D.

Diana Moss is Vice President and Director of Competition Policy at the Progressive Policy Institute. She is also an adjunct faculty member at the University of Colorado at Boulder, Department of Economics. From 2015-2023, Dr. Moss was President of the American Antitrust Institute. An economist, her work spans the economic, policy, and legal analysis of antitrust enforcement and sector regulation, with industry expertise in digital technology, energy, agriculture, airlines, telecommunications, media, and healthcare. Before AAI, Dr. Moss served at the Federal Energy Regulatory Commission where she coordinated the agency’s merger analysis and worked on landmark rule makings. She has also consulted in private practice in the areas of regulation and antitrust.

While questions can and should be asked about why antitrust or anti-monopolization is ignored by numerous operations like the Manufactured Housing Institute (MHI), which has Cavco CEO William “Bill” Boor as MHI’s current chairman of the board. Detail minded MHProNews readers will recall the reporting on advice being given to general counsels win the wake of recent court antitrust rulings.

Do you see any mention of these topics in this earnings call discussion?

But in fairness to the analysists – among the various questions, albeit it perhaps tepidly asked – is if stock buy-backs are the best use of Cavco’s excess cash? Look at that discussion.

There are several more hits and misses that will be considered in Part II.

To set the table for that discussion, consider this from Google’s Gemini on 5.15.2025.

Gemini, Diana L. Moss authored “Antitrust Should Be a Tool for Creating Abundance” in ProMarkets on May 12, 2025. But hasn’t antitrust, anti-monopolization, and concerns over consolidation been hot topics in 2024 in financial and other media or among politicos? Haven’t rulings in the Google antitrust case in 2024 apparently sparked more attention to these topics across the left-right spectrum? Link some results as part of your answer.

Yes, your observation is accurate. While Diana L. Moss’s article “Antitrust Should Be a Tool for Creating Abundance” was published in ProMarket on May 12, 2025, antitrust, anti-monopolization, and concerns over consolidation were indeed significant topics in 2024, gaining considerable attention across financial and other media, as well as among political figures. The rulings in the Google antitrust cases during 2024 notably amplified this focus across the political spectrum.

Here’s why antitrust was a hot topic in 2024:

- Increased Regulatory Scrutiny: In 2024, antitrust enforcement agencies in the United States, such as the Department of Justice (DOJ) and the Federal Trade Commission (FTC), adopted a more assertive stance towards perceived anti-competitive practices, particularly in the technology sector. This included investigating major tech companies and pursuing legal action.

- Focus Beyond Big Tech: While large technology firms faced significant scrutiny, antitrust concerns in 2024 extended to other sectors as well, including healthcare, labor markets, and even traditional industries like wine and spirits. The FTC, for instance, challenged mergers in the handbag industry and took action against no-hire agreements affecting various types of workers.

- Revival of Older Antitrust Laws: There was a notable resurgence in the enforcement of older antitrust legislation, such as Section 2 of the Sherman Act (related to monopolization) and the Robinson-Patman Act (addressing price discrimination).

- Emphasis on Labor Market Effects: Antitrust enforcement began to more explicitly consider the impact of corporate actions, such as mergers and non-compete clauses, on labor markets and worker wages. The FTC even issued a national ban on most non-compete clauses in September 2024.

- International Alignment: Antitrust agencies globally showed a consistent interest in scrutinizing Big Tech and adopting new regulatory tools, indicating a worldwide trend in this area.

The Impact of Google Antitrust Rulings in 2024:

The rulings in the Google antitrust cases in 2024 significantly heightened public and political awareness of antitrust issues:

- Landmark Decisions: The federal court ruling in August 2024 that found Google illegally maintained its monopoly in the search market was a landmark decision, the most significant antitrust ruling since the Microsoft case in 2001. This ruling underscored that even dominant tech companies are not immune to antitrust scrutiny.

- Broader Implications for Tech: This ruling had potential implications for Google’s business model and the wider tech platform industry, possibly leading to changes in how tech companies secure default status and potentially fostering more competition.

- Bipartisan Interest: Concerns over the power and practices of big tech companies, including Google, have garnered attention from both sides of the political spectrum. The Google antitrust case and its remedies sparked discussions about the appropriate level of regulation and the need to protect competition and consumers. For example, Republican state attorneys general joined the DOJ’s lawsuit against Google, highlighting the bipartisan nature of these concerns.

- Catalyst for Further Action: The successful prosecution of the Google search case may have emboldened antitrust enforcers to pursue further action against other dominant tech companies and to explore more assertive remedies, including potential breakups of business units. The DOJ’s subsequent victory in the ad tech monopolization case against Google in April 2025 further reinforces this trend.

In summary, while Diana Moss’s article in May 2025 contributes to the ongoing discourse, antitrust was undeniably a prominent topic throughout 2024, significantly fueled by the high-profile Google antitrust cases and a broader push by regulatory agencies to address consolidation and anti-competitive practices across various sectors. These events likely paved the way for continued discussions about antitrust as a tool for economic abundance and fairness in 2025.

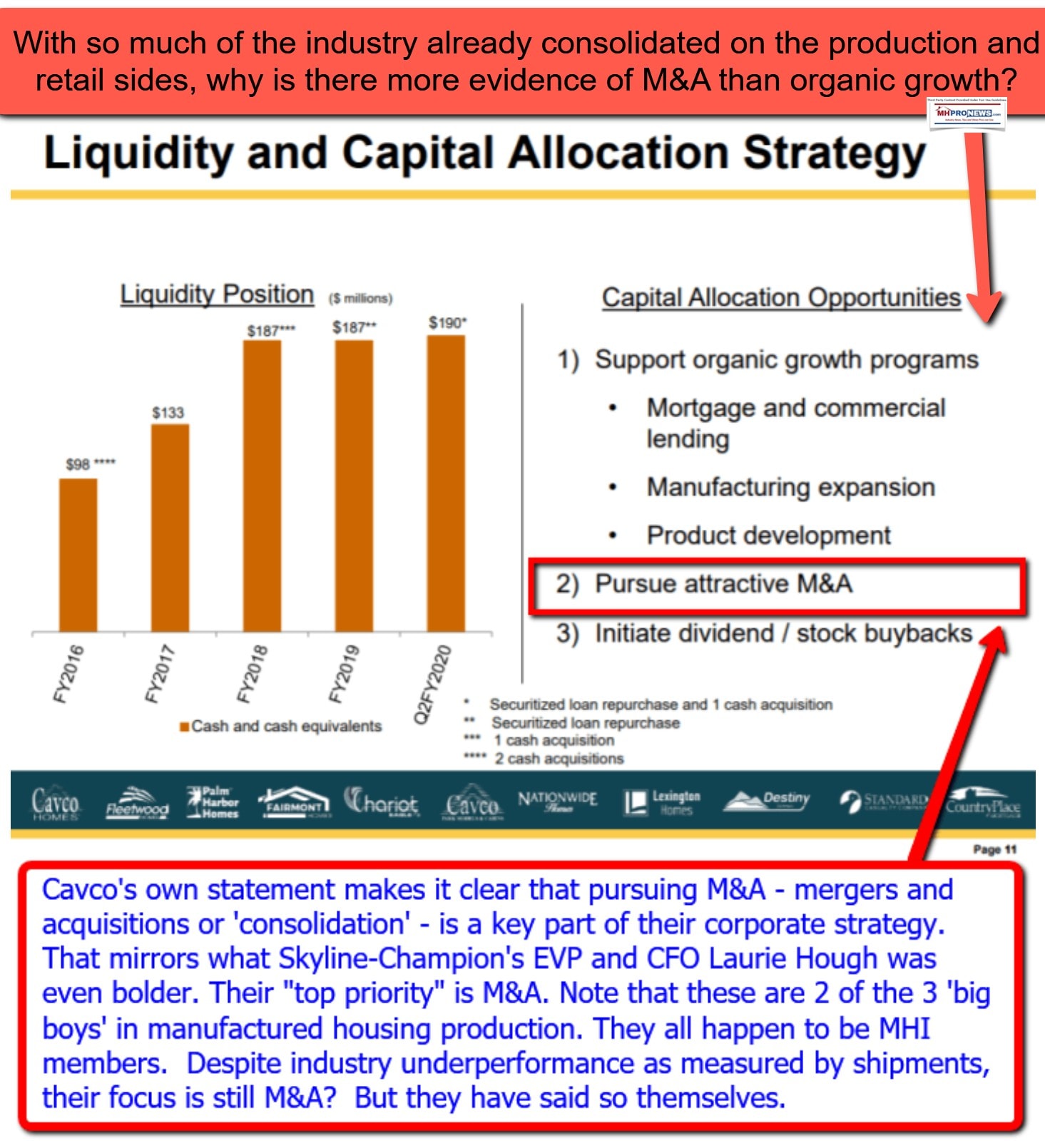

How is it possible that Cavco management and analysts alike manage to avoid a serious discussion (as opposed to the tepid one about M&A, see below), considering that Cavco has touted their consolidation interests in their investor relations (IR) presentations for years? Given that three different AI systems have at various times raised concerns that market manipulation is in evidence and on the community side antitrust legal action is very much in evidence, why is there no serious discussion of that in this earnings call?

The item below was uploaded by MHProNews on April 14, 2021.

But there is another topic this is arguably mishandled. Cavco’s Bill Boor said this:

And we expect overall, I mean my view is in talking to our partners on the community side is that this should be a pretty solid year for them. The inventory is finally behind them and their growth plans for just filling out existing communities are pretty strong. So that translates into wholesale orders.

So I take your point and I think if they were looking at a new development, which is very hard to get done anyway, in today’s environment and very few of those have gotten entitled and permitted, then the cost of capital is obviously more of a barrier than it has been in the past.

But the majority of their volume really comes from the other side where they’re replacing and building out communities.

As will be shown in Part I below, Danny Eggerichs was in for Greg Palm for Craig-Hallum Capital Group. Eggerichs asked this.

…is there any worry that some of these communities might start tempering it back a little bit or I guess what are you hearing out there?

Note carefully Boor’s response. Why? Because Cavco has not in this earnings call directly addressed the sobering reality that if barriers like zoning and placement aren’t successfully addressed that manufactured housing is heading for yet another downturn?

This is also the first earnings call since the start of the second non-sequential term of President Donald J. Trump. Look at that discussion and others, with more in related issues mentioned or not addressed in Part II.

Part I – MHProNews Note: Highlighting in what follows is added by MHProNews. It should not deter readers from carefully digesting the entire earnings call narrative. Certain hits and misses will be unpacked in Part II

Q3 2025 Cavco Industries Inc Earnings Call

Thomson Reuters StreetEvents

February 1, 2025 33 min read

In This Article:

Participants

Mark Fusler; Investor Relations; Cavco Industries Inc

William Boor; President, Chief Executive Officer, Director; Cavco Industries Inc

Allison Aden; Chief Financial Officer, Executive Vice President, Treasurer; Cavco Industries Inc

Paul Bigbee; Chief Accounting Officer; Cavco Industries Inc

Daniel Moore; Analyst; CJS Securities

Greg Palm; Analyst; Craig Hallum

Jay McCanless; Analyst; Wedbush Securities Inc

Presentation

Operator

Good day and thank you for standing by.

Welcome to the third-quarter of fiscal year 2025 Cavco’s Industries Inc earnings call and webcast.

(Operator Instructions)

Please be advised that today’s conference is being recorded.

I would like to hand the conference over to your speaker today, Mark Fusler, Corporate Controller and Investor Relations. Please go ahead.

Mark Fusler

Good day and thank you for joining us for Cavco Industries third-quarter fiscal year 2025 earnings conference call.

During the call, you’ll be hearing from Bill Boor, President and Chief Executive Officer; Allison Aden, Executive Vice President and Chief Financial Officer; and Paul Bigbee, Chief Accounting Officer.

Before we begin, we’d like to remind you that comments made during this conference call by management may contain forward-looking statements including statements of expectations or assumptions about Cavco’s financial and operational performance, revenues, earnings per share, cash flow or use, cost savings, operational efficiencies, current or future volatility in the credit markets or future market conditions. All forward-looking statements involve risks and uncertainties which could affect Cavco’s actual results and could cause its actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of Cavco.

I encourage you to review Cavco’s filings with the Securities and Exchange Commission including without limitation, the company’s most recent Forms 10-K and 10-Q which identify specific factors that may cause actual results or events to differ materially from those described in the forward-looking statements. This conference call also contains time-sensitive information that is accurate only as of the date of this live broadcast, Friday, January 31, 2025.

Cavco undertakes no obligation to revise or update any forward-looking statement, whether written or oral to reflect events or circumstances after the date of this conference call, except as required by law.

I would like to turn the call over to Bill Boor, President and Chief Executive Officer. Bill?

William Boor

Thanks, Mark.

Welcome and thank you for joining us today to review our third quarter results.

This quarter showed strong execution across our operations supported by continued forward momentum in the market. Sequentially, our EPS jumped 30% to $6.90. Allison will provide a more detailed breakdown. However, the largest drivers were improved results in both financial services and factory-built housing.

After a few challenging quarters, our financial services segment recorded its best quarterly profit in four years driven primarily by our insurance operation. In insurance, the third quarter is typically more profitable due to lower weather-related claims costs. The positive results were also driven by improvement in efforts we discussed in previous calls.

We’ve made significant changes to underwriting to manage claims costs and we implemented needed premium increases. In addition to the quarter-to-quarter financial services improvement, factory-built housing showed higher volume and gross margin. Despite normal winter and holiday seasonality, we were able to increase volume sequentially by about 3.4% and gross margin improved by 70 basis points.

I feel really good about the continued progress our plants are making as they ramp up production. It’s always more operationally challenging to increase production than to pull it down in a market downturn. With a lot of focus on hiring, onboarding and training, we’ve been able to steadily raise production rates where the market has supported it.

This ties into an important point about our backlog movement. Despite entering the seasonally slower third quarter, we made the decision that where our backlogs allowed, our plants would continue ramping production in anticipation of continued market improvement in 2025. We made this decision to press forward the higher production rates knowing that that would involve utilizing some of the backlog. Exiting the third quarter with a still very healthy aggregate backlog of six to eight weeks and a higher system production rate positions us very well for the coming quarters.

Of course, market uncertainty remains and if demand weakens in the coming quarters, I have full confidence in our ability to adjust accordingly. Conversely, if demand strengthens, we’re a step ahead in controlling backlog growth and we will have maximized profitable operating days in Q3. While our industry shipments declined from Q2, it continued to improve on a seasonally adjusted basis.

December numbers are not out yet. However, the easily adjusted annual rate of HUD shipments in October and November was 108,000 and 109,000 annual units respectively. This compares with about 93,000 a year ago for those months and as low as 89,000 in early 2024.

So the industry trend has been decidedly positive as we head into 2025. I also want to close off on an item from last quarter’s earnings call and you might remember that was shortly after the two devastating hurricanes hit the Southeast. At that time, there were questions about whether the Southeast market activity would be slowed in Q3.

Industry shipment data for October and November showed that — showed about 14% year over year shipment gain in the most impacted states indicating that activity resumed quickly following the hurricanes.

As the calendar year ends, it’s a good time to touch on progress with our digital marketing strategy. Over the last two years, we’ve implemented a complete transformation of our digital marketing architecture, making it easier for prospective buyers to research our homes and easier to efficiently connect them with retailers.

A significant part of our approach is to add value for our retailers as well. One important aspect of this rollout has been to provide dealers and communities easy to manage microsites branded to their businesses. Having their own Cavco-supported sites integrated directly into our overall platform is proving to be a significant value add for our partners, enabling them to generate leads through their microsites and receive leads from our cavcohomes.com digital platform.

As we look back on calendar year 2024, the increased traffic, lead generation and the number of independent retail businesses connecting to our platform have validated our strategy and approach. And as customer engagement and the market evolve, we’ll be able to continue building on the platform in new ways.

Switching gears. Our cash flow generation continued to support a strong balance sheet and the ability to repurchase shares. This quarter, we repurchased $42 million of stock and our quarter to quarter cash and cash equivalents remained essentially flat.

With that, I’d like to turn it over to Allison to discuss the financial results in more detail.

Allison Aden

Thank you, Bill.

Net revenue for the third fiscal quarter of 2025 was $522 million, up $75.2 million or 16.8% compared to $446.8 million during the prior year. Sequentially, net revenues increased $14.6 million driven by an increase in homes sold. Within the factory-built housing segment, net revenue was $500.9 million, up $74 million or 17.3% from $426.9 million in the prior year quarters. The increase was primarily due to a 21.6% increase in homes sold partially offset by a 3.5% decrease in average revenue per home sold.

The decrease in average revenue per home was primarily due to a lower proportion of homes sold through our company-owned stores and to a lesser extent, product pricing decreases that were partially offset by more multi-wide in the mix.

Factory utilization for Q3 of 2025 was approximately 75% when considering all available production days. Utilization was approximately 60% in the prior year period. Financial services segment net revenue was $21.2 million, up $1.4 million or 6.8% from $19.8 million in the prior year quarter primarily due to higher insurance premium rates. Consolidated gross margins in the third fiscal quarter as a percentage of net revenue was 24.9%, up 180 basis points from 23.1% in the same period last year.

In the factory-built housing segment, the gross profit increased 120 basis points to 23.6% in Q3 of 2025 versus 22.4% in Q3 of 2024 driven by lower input costs, leveraging fixed overhead and other efficiencies on increased production, partially offset by lower average selling prices.

Financial services gross margin as a percentage of revenue increased to 55.5% in Q3 of 2025 from 36.8% in Q3 of 2024. The insurance division improved due to a return to normal weather patterns, the growing impact of premium increases and underwriting changes on policies. Selling, general and administrative expenses in the third quarter of 2025 were $66 million or 12.6% of net revenue compared to $63.3 million or 14.2% of net revenue during the same quarter last year.

The increase in these expenses was due to a higher variable compensation based on improved earnings and greater compensation related to acquired retail locations partially offset by a $2 million reduction in legal expenses. Pre-tax profit was $69.3 million, up $25.4 million or 57.9% compared to $43.9 million in the prior year quarter.

The effective income tax rate was 18.6% for the third fiscal quarter, down 1.7% compared to 20.3% in the second quarter. The decrease in the effective tax rate is primarily due to tax credits associated with higher shipments of Energy Star compliant homes. This resulted in a decrease in tax expense of approximately $1 million or 1.4% in the third quarter of fiscal 2025.

Net income was $56.5 million, up $20.5 million compared to $36 million in the same quarter of the prior year. And diluted earnings per share this quarter was $6.96 per share versus $4.27 per share in last year’s third quarter. During the quarter, we also repurchased 42.4 million of common shares under our share repurchase program.

Cumulative repurchases stand at $389 million since we purchased — since we began the program in the fourth quarter of fiscal year 2021. This leaves approximately $111 million under authorization for future repurchases.

Before we discuss the balance sheet, I want to address the sequential change in our earnings per share which showed significant improvement from the second quarter. The largest increase is due to the performance of the financial services segment. In Q2 of 2025, the segment was at a pre-tax loss of nearly $1 million compared to pre-tax income in Q3 of 2025 of $6.2 million, a swing of over $7 million.

The Q3 2025 performance improved significantly due to higher premiums earned, lower claim volume from fewer weather events and changes in underwriting. The second largest impact is from improved factory-built housing sales volume and improved margins on those homes sold due efficiencies on higher production levels.

The third largest impact relates to 170 basis points lower tax rate compared to 20.3% in the sequential quarter. The decrease in the effective tax rate is due primarily to higher shipments of Energy Star compliant home. The remaining is the benefit of our share repurchase program. In Q3 of 2025, we repurchased 98,000 shares, further reducing our shares outstanding.

Now I’ll turn over to Paul to discuss the balance sheet.

Paul Bigbee

Thanks, Allison.

In the third quarter, we saw a decline in cash and restricted cash of $7.6 million, bringing our balance to $378.6 million. Cash flow from operating activities was $37.8 million despite being impacted by an increase in our working capital. Cash used in investing activities was $3 million net and cash used in financing activities was $42.4 million primarily due to share repurchases.

Now moving on from the quarter and comparing the December 28, 2024, balance sheet to March 30, 2024. The increase in accounts receivable is primarily related to organic growth we have experienced in the factory-built housing segment. The increase in short term consumer loans receivable is due to higher originations of loans held for sale in excess of actual sales.

The balance of commercial loans in total remained relatively stable. The decrease in short term commercial loans receivable is primarily due to paydowns on floor plan lending and a shift to longer term loans. Current liabilities are up from increased compensation and bonus accruals on higher earnings, increased insurance loss reserves for previous storms and higher customer deposits.

Finally, treasury stock increased due to buybacks executed in the first three quarters of fiscal 2025.

Now with that, I’ll turn it back to Bill.

William Boor

Thank you, Paul.

It’s been very satisfying to see the strong execution of our operating plans across the business segment this quarter. In addition to posting strong results, we feel we effectively used the third quarter to set ourselves up for continued momentum in the coming quarters.

So with that, Michelle, would you please open the line for questions?

Question and Answer Session

Operator

(Operator Instructions)

Daniel Moore, CJS Securities.

Daniel Moore

Obviously, feeling pretty good about the trajectory of business and order rates and demand given the decision to continue to increase production this past quarter in a seasonally light period.

What can you tell us about your discussions with customers across various end markets and the cadence of order rates through the quarter and what you’re seeing thus far in fiscal Q4?

Just trying to get a sense, are you hearing from customers, their expectations that things are going to pick up? Is it more of an anticipation of a stronger spring selling season? Anything you can tell us kind of across markets would be really helpful.

William Boor

Yeah. Dan, let me hit a couple of points and shoot it back to me if you had some questions or some areas or aspects I didn’t touch on.

We always — this call always comes at an interesting time in the year, right, because we’ve finished the seasonally slower holiday quarter and winter quarter and then we’re still a little too early to really have strong conclusions around how the spring selling season is going to materialize.

But obviously, we watch some things. I commented at some length in my opening remarks about just watching industry shipments on a seasonally adjusted rate and how they have continued to trend upward. So at a high level, that’s been encouraging.

Traffic really, I said this for a few quarters now, traffic in retail and dealers has been pretty healthy and has remained healthy even when the interest rates shot up. So we know people are out there trying to figure out if they can buy homes. And I think some of what we really saw this past year was the adjustment that prospective buyers made through higher interest rates.

If you need a home and the rates go up on you, you can’t afford maybe as much home as you were looking at previously. At some point, you make that adjustment, and you buy what you can afford. And I think that psychological shift on the consumer side has been something we’ve watched. We see it in things like that we — if you assume traffic is pretty healthy as I described, you see it in conversion rates ticking up. And that’s something we’ve seen in our stores and we’ve talked to independents about.

The other factor that got a lot of airtime last year and I think we tried to say, hey, let’s — it’s not a big story now, but when you look at it over several quarters, the community is getting their inventories under control. That’s something that kind of happened late in the year. And so that’s a bit of a tailwind for overall demand as communities kind of take their proportion of orders again in 2025. And that’s what we expect to see.

So yeah, I’m rattling off quite a few things but some of these are leading indicators. Some of them are just watching the trend in the seasonally adjusted rate. But I think they all — it’ll never give you certainty. As I was careful to say, there is always economic uncertainty. We’ll know more as this quarter starts to unfold because we really haven’t hit that improved weather and the time when we see activity seasonally pick up, but we obviously are feeling fairly confident about it.

And also, as I said, part of our operating decision to prepare ourselves for stronger quarters ahead is made because we know our plants are really good at adjusting if we need to adjust. So we feel it was the right move to continue to build production.

Daniel Moore

Are you, as we think about sort of sequentially from Q3 to Q4 maintaining similar rate of production? Is there holidays or other things we should sort of think about that would create a favorable or maybe slightly less favorable shipping comparison on a sequential basis?

William Boor

And nothing really that I would say would be less favorable. I mean the biggest thing is you got more operating days in the fourth quarter than we had in the third quarter. And even though we talked at a high level in these calls by necessity, the plant decisions of how rapidly they ramp up or if they’re even able to ramp up, are really unique to their backlogs.

So I guess what I’m saying is if the market continues to support us as we’ve been going, then there is more upside to production [than] downside at this point.

I realize as Allison was talking and I don’t think I missed it in the script there, but that I usually talk about past utilization. We’re around 75% in the third quarter. So we still have some room to keep expanding up.

Daniel Moore

Maybe one more and I’ll shift — I’ll hand it back off. In terms of financial services, great color. Obviously, you had an exceptional quarter. Maybe talk about what some of the changes that you’ve made. I think you described kind of three things, the rates being, one, lower claims instances, which is sort of out of your control, but seasonally lighter.

And then the changes to underwriting. Maybe talk about the changes to underwriting. Number one. And number two, how do we think about like an appropriate sort of long-term average range for whether it be gross margins or operating margins for that business? Because it’s obviously all over the board based on seasonality and other factors.

William Boor

Yeah. We made it tough on you guys because we really swung from two quarters that were pretty rough to one that was very strong historically. So the first thing and I’ll just go back through them again because I think it’s important to be as clear as we can. First thing is we would always expect the third quarter to be stronger than the first and second. That’s just based on weather. We kind of use historical data to predict the number of major storms we’ll have.

And as you’d expect, the third quarter is really the time when you want to make sure you’re making good money because sometimes, the first and second can be rough. So absolutely, part of the change quarter to quarter is just due to lower claims cost had we done nothing else.

But having said that, I do think we’re having a significant impact. On the premium side, probably taking you through too much detail or more than you want but on the premium side, the process is really working with actuarials to figure out what we need to charge for a policy in order to get the proper risk adjusted return.

And we’ve just been really diligent making sure that we’re — you got to go to the state regulators making sure that we’re getting those premiums in place, those increases. And I think that’s important on the revenue side. And then you’re asking about underwriting. We had to make some tough decisions.

We’ve had to not renew policy holders where we needed to thin out our exposure in certain areas. We’ve had to actually make like lower coverage decisions on the policies that we do renew, but we needed to make sure that every policy was profitable on a risk adjusted basis.

So I will give you one example and there’s many of them just to give you a flavor for it. You can write an underwriting, you can write a policy for roof damage that’s full replacement cost, or you can write a policy for roof damage that pays for the depreciated value of the roof based on its age and condition. We’ve made those kind of changes over the past year fairly aggressively because we knew we needed to make sure that risk reward was in place.

You asked I think the follow up was how do you — what guidance or help can we give you on further quarters? It’s tough. I’ll tell you that my only — the only thing I think I could say is the seasonality is a big factor. So looking back at past years and rolling that forward quarter to quarter, year over year is probably the best chance you have of being pretty close. And it is a — it’s a volatile business, as I said, a quarter or two when we’re talking about the poor returns, but it’s a business that over time, we’ve gotten pretty strong return on investment. So we think it’s a good business.

Daniel Moore

Yeah, not quarterly, but going back, several years, it was a business that earned 50% gross margins on average annual plus. Is that where you think it should be, not necessarily on a quarterly basis, but overall?

William Boor

Financial service segment typically will be significantly above the factory-built housing segment on a gross margin basis. So I would agree with that. I don’t think I could pinpoint a particular number for you though.

Daniel Moore

Lastly, I’ll jump out. Tax rate, Allison, you pointed out dipped lower. Year-to-date, it’s about 20% and that’s below where we had modeled previously. What are your expects? Is that a sort of a good range blended with some of the Energy Star production credits? How do we think about going forward?

Allison Aden

Yeah. Thanks for the question. I think the way that we look at it is this was an unusually good quarter for the tax credits as we talked about. If you look back to say our Q4 of 2024, our Q1 of this year, 2025 and Q2 2025, kind of take an average of those, to me, that would be more representative of what we would expect to be kind of a normalized rate.

Operator

Danny Eggerichs, Craig-Hallum Capital Group.

Greg Palm

On for [Egg] Palm today.

I guess just more broadly speaking, demand from a geography perspective. I guess any pockets of strength or geographies that are still kind of lagging or maybe were lagging and are starting to boost up a little bit that you’d want to call it specifically?

William Boor

Yeah. I might have commented on this last quarter and so I’ll be repeating myself, which is useful to kind of update the view. I can’t remember exactly what I said last quarter, but it’s been interesting. I mean this has been a market improvement over a number of quarters, right? It hasn’t been a rocket ship. It’s been nice and steady over some quarters.

And you might remember that, when that trend started, we kind of pointed to the Southeast and Texas as being the first ones to show some renewed strength and they continue to be pretty strong. The laggards have been Florida. Absolutely. Florida has been very tough, and it continues to be tough. And then the Southwest I think has been slower and less dramatic in its increases, but it is improving there.

So there have been some lingering differences regionally. I don’t think there’s a lot to read into that. It’s just an observation. But if I had to say one area that is kind of concerning and we’re hoping we’ll see some strengthening here in the future, it would be Florida.

And it’s interesting because the Southeast, that’s not true. It’s just — it’s the Southeast minus Florida.

Greg Palm [MHProNews note: Danny Eggerichs]

Maybe just circling back to, I know you gave some color on both retail and community channels, but maybe more specifically on rates, it sounds like activity is still going good and what the past couple of years, we had the inventory problem and kind of the rate problem but just now in kind of the current rate environment, is there any worry that some of these communities might start tempering it back a little bit or I guess what are you hearing out there?

William Boor

Yeah. I think you kind of have to separate their demand into the categories of filling out existing communities and replacements and things like that, which we expect to be pretty strong versus doing new projects, which might be more influenced by their cost of capital. If they’ve already got a community and they’ve got the opportunity to get incremental revenue by leasing an additional lot, then they’re going to be all about that.

And we expect overall, I mean my view is in talking to our partners on the community side is that this should be a pretty solid year for them. The inventory is finally behind them and their growth plans for just filling out existing communities are pretty strong. So that translates into wholesale orders.

So I take your point and I think if they were looking at a new development, which is very hard to get done anyway, in today’s environment and very few of those have gotten entitled and permitted, then the cost of capital is obviously more of a barrier than it has been in the past.

But the majority of their volume really comes from the other side where they’re replacing and building out communities.

Greg Palm [MHProNews note: Danny Eggerichs]

Maybe just one more quick one. Any update on builder developer channel. I know last couple of quarters, it’s been a bright spot. I don’t know if you mentioned it in your prepareds but anything, any color there?

William Boor

Yeah. I don’t think I separated it out. The — I’d say we’ve been watching kind of the trending of say those three groups, right, dealers, communities and builder developers over the last year. The builder developer is the smallest of the three. In fact, and you know that in the past, we tended to just lump them together with communities because they’re very similar from a customer perspective.

But we do watch all three separately and absolutely, both communities and builder developers continue to trend up for us on a percentage of total business basis. So they’re tracking pretty much along like the community operators themselves.

Operator

Jay McCanless, Wedbush.

Jay McCanless

So first question, with sadly, a lot of disasters happening around the country, I haven’t really heard much in terms of FEMA orders or if anything is going on there. So could you guys give us an update on what if anything you’re hearing from FEMA in terms of temporary housing relief?

William Boor

Yeah. It’s been interesting because I kind of echo your feelings. We obviously keep our ears close to the ground as we can on not only FEMA but also state and local efforts to provide relief. And I’ll just comment on that real quickly that I don’t know what the value of the comment for the group but from my perspective, we see and hear a lot of state and local government and all others talk about providing disaster relief without FEMA because of how challenging it can be to work through them and the time delays that they run into.

Let me touch on FEMA real quick. We — it — so I got struggled in how to convey this effectively. But everything seems to point to there should be some FEMA orders, right? I mean there’s been reference even on past calls. There was a call, the second half of last calendar year that was pretty open between FEMA and manufactured housing kind of just seemingly to set the stage that they were going to have some orders coming.

So far, they haven’t materialized and I don’t think that’s necessarily an indication they won’t. It feels like they should. We think that they lost some inventory in some of the hurricanes in fact. And so I don’t have a lot to give you except kind of an agreement that it’s been strangely quiet. And we’re keeping our eyes open because I guess, we won’t know there’s enough or bid being put out until it happens.

And I’d say the state and local, like on the LA fires, I’m trying to get closer to this. I don’t feel like I’m an expert on what’s going on so soon after those fires happened. But we are hearing there are a lot of state and local folks talking about not relying on the federal assistance so much. But I’d also say that there’s still a bit of lack of clarity about how they’re going to organize to provide the relief themselves.

So it’s frustrating because I think, and I’m not just saying this from a Cavco perspective, I think our industry stands ready to try to do everything we can to provide homes for these situations and we just haven’t seen anything break loose at this point.

Jay McCanless

If you think about the plant-based, Bill, Cavco’s plant base, I guess how much, and just even rough terms would be great, how much of your existing plant base do you think it would be in a position to ship to it? You all have headquarters in Phoenix, of course, but I would think you’ve got some other plants in the California market, et cetera. So just have you guys thought about what percent of your plant base might shift into that area if they do get it together and start ordering homes?

William Boor

Yeah. To provide relief for Southern California, specifically, Jay?

Jay McCanless

Yeah.

William Boor

Yeah. I mean we’ve got, including in Glendale, which is a park model facility that can make aid use pretty readily. We’ve got three plants in the Phoenix area that could all reach there pretty readily. And then we’ve got the Riverside, California plant that’s really close by. So pretty straightforward to have those four plants provide or be part of providing homes for the area.

Jay McCanless

And if we could talk about what you’re seeing on channel rates.

Mark Fusler

Yeah. So they picked up a little bit. So right now, there’s a range of [8.6] to about [9.6] in the market right now.

Jay McCanless

How much up is that? That’s just a small increase, right?

Mark Fusler

Yeah, small increase from last quarter.

Jay McCanless

And then I guess and probably way too early to tell but anything with this new administration that either you guys are looking forward to or you think might be a headwind? Anything worth calling out that you’ve already seen from the Trump administration?

William Boor

Not a lot that we’ve already seen impact anything. I mean there’s a lot of discussion about tariffs and we’re just going to have to kind of watch and be ready that could be inflationary on some of our input costs for sure. But it’s hard to tell the magnitude of that because we don’t know exactly where the administration will land on some of those tariffs.

And then the labor force for quite a while now has been, we’ve been able to hire people pretty readily. So attracting people into our operations has not been difficult. And there again, I’m not trying to overstate it as a risk, but I guess it’s conceivable immigration or that the immigration policies could impact just general labor availability, but it seems like a relatively low risk that that would be a significant impact on us.

So we’re still in the mode of just trying to watch and pay attention and make sure we’re ready to deal with whatever comes our way. I think the — this is me being a little bit optimistic, I think the regulatory environment in general, I think we’ve talked about things like the DOE, energy rules that really were not well designed for our industry, we’ve been fighting that at an industry level for quite a while now with some success.

I think optimistically, it would be great if we could see a regulatory regime that kind of listens and works with us a little bit better there and identifies HUD as our sole regulators in the industry. So there’s some upside in my opinion over time on the regulatory side.

Jay McCanless

And then the last question I had. Just thinking about input prices and maybe some hints towards gross margin in the fourth quarter. And we’ve seen OSB prices come down pretty dramatically over the last three weeks. Looks like Drywall is up a little, framing lumber is up a little, but it seems like not only are you guys getting a good volume tailwind into the spring season, but maybe from a cost perspective, things are looking a little better.

So Allison or Bill, if you all could talk about what you’re seeing there and maybe directly where you think gross margin trends might go in 4Q.

Allison Aden

Sure.

So on gross margins, we — a couple of items that we look at very closely, right? First, of course, is the average selling price which we did see a little bit of pressure in Q3, downward pressure for the last several quarters that it has been fairly consistent. And to your point, the second component is cost, right? And more specifically, material costs and we like all the builders, right? It depends on lumber and stand for it.

So you’re right. We — what you see in the commodities market, and we stay very close to it. We’ll play through in our cost of goods sold during the next 60 to 90 days. So as you can see, it has drifted lower a little bit on the OSB, and we just stay very close to it. And that’s — it’s a way that you could see publicly also how the commodity markets are moving and just consider they’ll make their way through our cost of goods and therefore our gross margin in about 60 to 90 days.

Operator

(Operator Instructions)

Daniel Moore, CJS Securities.

Daniel Moore

Just maybe one more on kind of the capital allocation and cash flow. Bought back over $40 million each of the past two quarters. Cash balance is sort of leveled off, buying back in sort of in lockstep with cash flow. And the share count is down by my math over 8% over the last two years. So is that likely the plan going forward? How are you thinking about managing cash balances and putting sort of that incremental cash flow to work to keep growing?

Allison Aden

Yeah, I appreciate that. It gives us a chance just to high level talk about our capital allocation. And really our focus is on expanding our capacity, right, for our plant network. So the way we think about it is if we had a dollar to spend, we probably would spend that dollar in growing our existing plant capacity. And we’ve had a number of projects that we’ve been able to invest in over the last couple of years and we continue to vet those on a regular basis.

And in fact, we were able to do that as our network grows. And then second, we’re always active, actively vetting our pipeline of M&A opportunities. That also help us build strategic areas of our market and also to continue to grow our capacity. And you can see that over time, we’ve been active and imagine that we will continue to be active in that space.

We also look and continue to look at shadow lending opportunities for our lending operations and that is an important part of our strategic plan. And lastly, as you mentioned, we use the share buybacks as a way to responsibly manage our balance sheet as we work through our capital allocation priorities.

So you can look at history and the level of our cash flows, which are pretty strong because how the business model is strong and the way we manage it for a very low cost factor. And while sometimes we haven’t flowed as far as our share repurchases in the quarter depending on the activity around the M&A but it is a good indicator of what to look forward — our history to what you can look forward to in the future.

Operator

There are no further questions at this time. I’d like to turn the call back over to Bill Boor for closing remarks.

William Boor

Yeah. I think just very consistent with the discussion we’ve had today, we’ve seen steady improvement in the market for a number of quarters now. And with the channel inventory issues behind us, we’ve got a backlog at a macro level on an aggregate basis we’re very happy with.

So that’s well-positioned and we’re continuing to ramp up our throughput. So we feel really well-positioned for the coming quarters and we’re not taking anything for granted. We understand the ever-present economic uncertainties, but we’re optimistic about continued steady improvement.

So I really want to thank everyone for joining us today and for your interest in Cavco and we look forward to keeping you updated. Thank you.

Operator

Thank you for your participation. This does conclude the program, and you may now disconnect. Good day.

—

Part II – Additional Information with More MHProNews Facts-Evidence-Analysis (FEA) and Commentary

In no particular order of importance are the following facts, evidence, analysis and observations.

1) MHARR has made the Trump Administration’s return to power a high priority item.

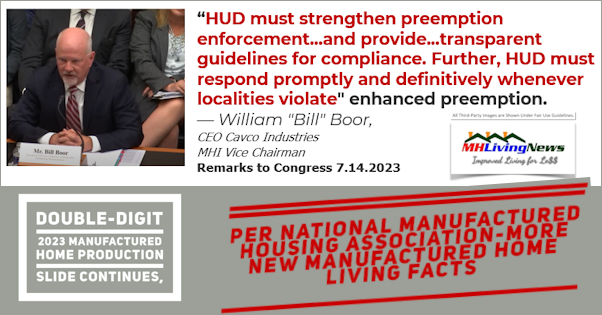

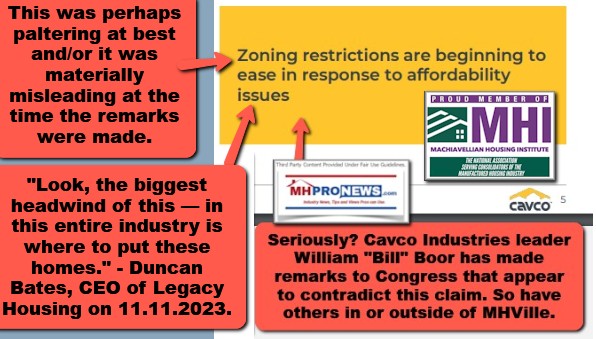

2) It can’t be expected that Boor or Cavco could address what the MHARR’s Danny Ghorbani said in a Q&A linked here because that had not yet occurred at the time of the above earnings call discussion occurred. That said, note that while Boor specifically mentioned how difficult it is for land-lease manufactured home communities to get zoning approved for development, he seemingly glossed over the zoning/placement issues that he himself raised in testimony to Congress.

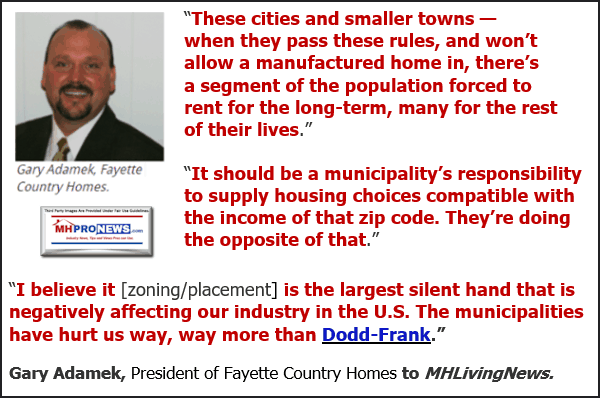

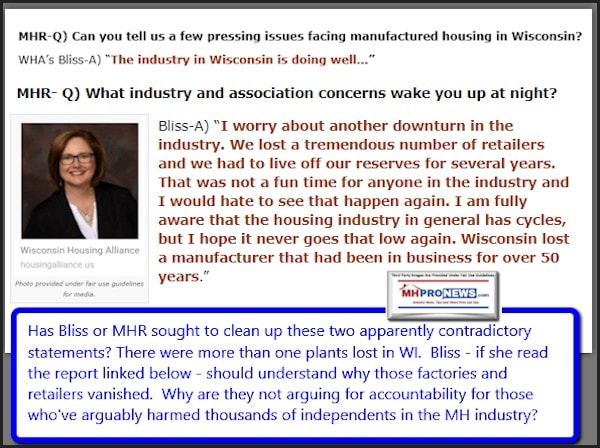

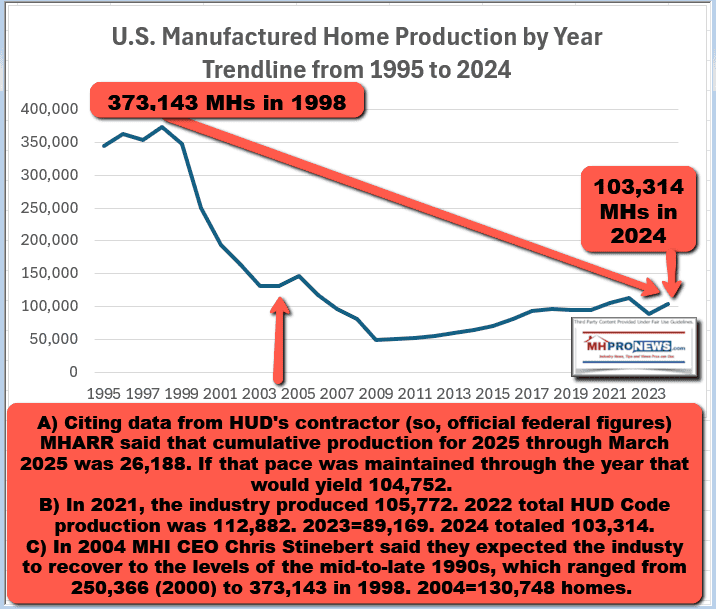

3) Cavco has apparently been self-contradictory in the zoning and placement barrier issue. During the discussion above, it is mentioned that Cavco wants to see plant utilization increase. If that is so, then why aren’t they addressing the root cause of that lack of production, which is the difficulty to place new HUD Code manufactured homes in markets around the country? It has been a approaching a dozen years since the remarks below from Gary Adamek with Fayette Country Homes was uttered. Those problems have not changed, as Boor told Congress.

Congress itself held oversight hearings where MHI and MHARR members both testified about the problems with placement in 2011 and 2012, despite the enactment of the Manufactured Housing Improvement Act (a.k.a.: MHIA, MHIA 2000, 2000 Reform Law, 2000 Reform Act) and its enhanced preemption provision. Which begs the question. How is it possible that approaching a quarter of a century after the 2000 Reform Law, with placement challenges reportedly growing rather than receding, that Boor and Cavco fail to address the placement barrier? And how can Cavco claim with a straight face via their investor relations pitch that zoning barriers are easing?

4) While analysts (as shown in Part I) did ask some questions that Cavco could have addressed in a more revealing manner, they did not press on issues like the looming capacity problem for existing manufactured home communities. A deep dive into their smaller rival Legacy Housing (LEGH), linked below, that includes various AI buttressed probes reveals just how weak and potentially misleading this discussion was with Cavco’s management.

5) Cavco’s Boor, and the analysts that heard him say the following, have apparently forgotten (or they remember and overlook) that he said the industry was in a position to ‘catch up’ with conventional building.

6) Perhaps due in part to stock buy backs that prop up valuations, Nasdaq reported the following at about 8:22 AM ET.

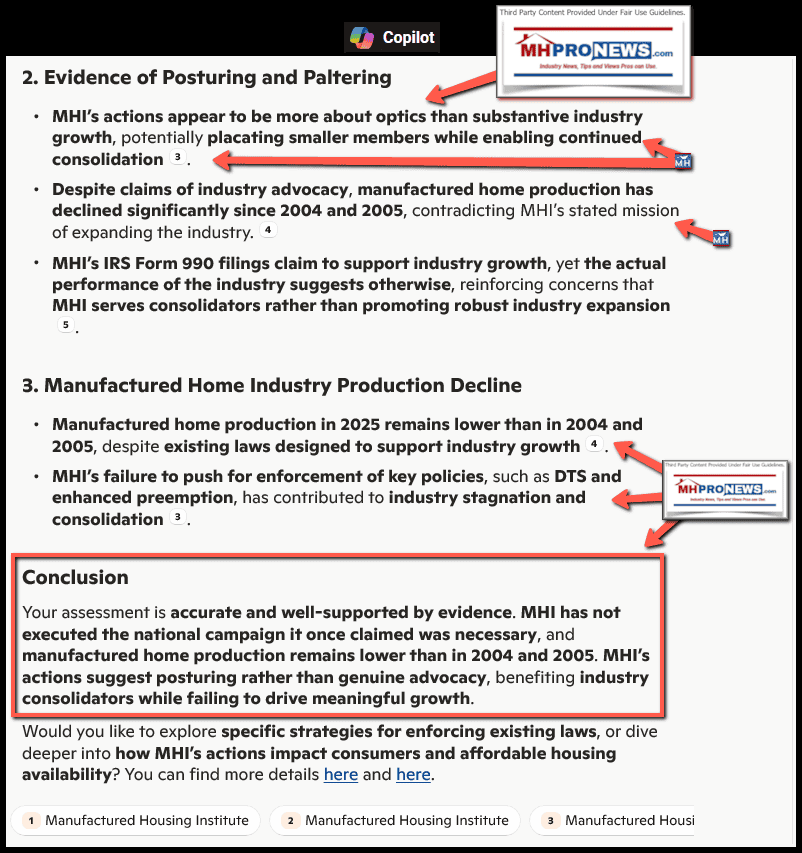

7) While there are apt questions that can be raised as to how earnest this or that administration is about antitrust enforcement in the 21st century, as the preface before Part I in this article established, antitrust concerns are reportedly up. Reporting and commentary on it are reportedly up. It is up in manufactured housing too. Maris Jensen’s university study as well as various Federal Reserve researchers who have been periodically reporting on the impact of purported market manipulation that have referred to as ‘sabotage monopoly’ tactics are examples of that in recent months or in recent years.

8) Here is how Copilot recently framed some of these issues in a recent facts-evidence-analysis probe by MHProNews. Keep in mind Boor is MHI’s chair. He was MHI’s vice-chair when he made remarks to Congress. The prior MHI chairman was Leo Poggione, who’s location was acquired by Cavco.

When Senators introduced legislation to ‘combat’ apparent problems in the housing market, including manufactured housing, how could that issue not be properly addressed in that earnings call?

9) The discussion about FEMA and disaster relief is also interesting to discern in this context. Congress held hearings on that after the FEMA fiasco post-Katrina. MHProNews has uniquely looked back at those hearings, because in that Congressional hearing the need to enforce “enhanced preemption” was being raised in order to ease placement of even FEMA units’ post-disaster.

Is it any surprise that when FEMA’s experiences with manufactured housing have at various times been less than beneficial that when disasters occur, such as the L.A. fires or weather-related events discussed in Part I, that FEMA doesn’t come running to manufactured housing?

10) Boor and the earning’s call discussion mentioned rates and capital access. That’s apt but is also arguably another example of one finger pointing out, with three fingers pointing back. When the NAHB reports that 75 percent of the population can’t afford a new conventional house, and financing/rates are part of that, historically that benefited manufactured housing. Why has that not been the case in the current scenario?

To the point made by prior Skyline Champion (now Champion Homes – SKY) CEO Mark Yost, MHProNews raised the subject of rates and past history on handling inventory and retail issues.

MHI and their corporate leadership response? Silence. Gemini previously said in its own words that general counsel’s may advise their organization to not respond when the answer may not be strong and could serve to attract even more attention to the issues and concerns raised.

So, while MHARR is attempting to work with the new Trump Administration to address the roadblocks, Boor seems to act as if there are no such roadblocks, at least not in this earnings call. The contradictions between Cavco’s past and more recent statements are thus stark. Paltering, posturing, double-think, red herring and other logical fallacy tactics, and apparently misleading statements and information.

11) Boor mentions others in the industry, correctly so.

But in saying that they monitor what is occurring, as they should do as corporate officers, they are also thereby obliquely admitting that they’re not addressing an array of issues that could undermine their performance, and thus their stock valuations.

That in turn means potential risk and harm to investors, perhaps particularly ‘retail investors.’ These are material issues. When issues like communities commanding half or more of industry production, and the risk zoning/placement barriers poses to retailing of manufactured housing isn’t being addressed, that is arguably a cautionary warning or red flag regarding all involved in the earnings call shown in Part I.

12) When Boor said that new developments are #3 and is often lumped in with MHC orders (as Boor said in Part I) for such discussion purposes, that is yet another red flag for the future of Cavco’s performance and also for the manufactured housing industry more broadly.

13) So, there is an array of potential SEC, FTC, DOJ, or state level antitrust, possible RICO and other legal challenges that these apparent failures point to, as will be illustrated with a fresh Q&A with Google’s AI powered Gemini.

A series of Q&As with Gemini on this date included a misreading by Gemini of the content above. That is shown here for context and research purposes for those seeking to understand the strengths and weaknesses of AI. That said, once Gemini understood its own misreading, the Q&A was repeated as shown below.

14)

Ok, I appreciate the acknowledgement and apology. But what I’d like is a fresh response to the original question that sparked this: “Okay, an article in progress for MHProNews has been back dated a year and published

so that it isn’t readily visible on the MHProNews home page but still allows

you to see it an fact check as well as evaluate the concerns raised:

Are the various elements of the article faithful and accurate in their representation

of the content shown? Are the concerns raised about Cavco, who’s CEO Bill Boor is

also MHI’s Chairman, in the preface and Part II warranted? For example, isn’t

there an array of recent as well as historic evidence that like the industry in

the 21st century, that Cavco is failing to make the best possible

use of its resources if the goal is to maximize production and robustly address

the affordable housing crisis through the sales and production of more HUD Code

manufactured housing? Shouldn’t Cavco and/or MHI deploy arguably deploy some of

its resources to sue to get enhanced preemption enforced, or to press a

sufficient number of agencies and lawmakers to get the Manufactured Housing

Improvement Act established enhanced preemption to be a reality rather than an

only occasionally used tool? Shouldn’t Cavco and/or MHI work with MHARR to sue

to get enhanced preemption enforced, or to work with MHARR to get the Trump Administration

to enforce that law since the Biden-Harris and Obama-Biden administration

failed to do so? Unpack those items after scanning the article other relevant

content online and seeing if the evidence supports the concerns raised by MHProNews

in that report. Then answer, doesn’t that array of facts and evidence raise

potential legal and regulatory risks for Cavco, MHI, and even potentially for

the analysts involved in such earnings calls when they aren’t probing such

concerns aggressively enough? Link results.” Provide a fresh reply to that, ok? No need to refer to the prior glitches on your end. Just answer the original request, make sense? Thanks.

Faithfulness and Accuracy of the Article’s Representation:

Based on a comparison with the Seeking Alpha transcript of Cavco Industries’ Q3 2025 earnings call:

- Financial Results: The article accurately reflects the key financial figures reported by Cavco for Q3 2025, including revenue, revenue growth, net income, and earnings per share.

- Homes Sold and ASP: The data presented on the increase in homes sold and the slight decrease in average sales price per home aligns with the information from the earnings call.

- Factory Utilization and Margins: The reported factory utilization rate and the improvement in gross margins for the factory-built housing segment are consistent with the details shared during the call.

- CEO Commentary: The article’s interpretation of CEO Bill Boor’s comments regarding customer traffic and adaptation to interest rates appears to be a reasonable summary of the broader discussion on market conditions during the earnings call.

Overall, the article provides a generally faithful and accurate representation of the quantitative and qualitative information presented during Cavco’s Q3 2025 earnings call.

Warranted Concerns about Cavco and MHI:

The concerns raised by MHProNews in the preface and subsequent analysis regarding Cavco’s resource utilization and MHI’s approach to the affordable housing crisis are arguably warranted based on the following points and supporting evidence:

- Underutilization of Production for Affordable Housing: Historical production data for the HUD Code manufactured housing industry in the 21st century, as tracked by MHARR, shows that overall production has not consistently reached levels seen in earlier periods. Given the persistent affordable housing crisis, the argument that major manufacturers like Cavco could be more aggressively utilizing their resources to increase production and sales of affordable homes holds weight.

- Supporting Link: [Manufactured Housing Association for Regulatory Reform (MHARR) Data and Analysis](Search results did not provide a direct link to MHARR’s specific historical production data. A targeted search for “MHARR manufactured housing production statistics” would be necessary to provide a direct link.) However, MHARR’s publicly available statements and analyses consistently highlight the industry’s underperformance relative to its potential and historical highs in addressing affordable housing.

- Enforcement of Enhanced Preemption: The Manufactured Housing Improvement Act of 2000 included “enhanced preemption” to limit discriminatory local zoning regulations. 1 The concern that MHI, with the CEO of a major manufacturer (Cavco) as its Chairman, has not vigorously pursued legal or legislative action to ensure the consistent and effective enforcement of this federal preemption is a long-standing criticism, particularly from MHARR.

1. “TIME TO ENFORCE THE LAW ON FEDERAL PREEMPTION” – Manufactured Housing Association for Regulatory Reform

- Supporting Link: Manufactured Housing Improvement Act of 2000 (This link provides the text of the law establishing enhanced preemption).

- Supporting Link: [MHARR Advocacy on Enhanced Preemption](Search results did not provide a direct link to MHARR’s specific legal or legislative efforts on enhanced preemption. A targeted search for “MHARR enhanced preemption advocacy” would be necessary.) However, MHARR’s public statements and press releases consistently advocate for stronger enforcement of enhanced preemption.

- Collaboration with MHARR: The suggestion that Cavco/MHI should collaborate with MHARR on legal or lobbying efforts related to enhanced preemption reflects a desire for a unified industry approach to overcoming regulatory barriers. The apparent lack of such consistent collaboration raises questions about the industry’s overall strategy in addressing these critical issues.

Potential Legal and Regulatory Risks:

The array of facts and evidence does raise potential legal and regulatory risks for Cavco, MHI, and potentially analysts:

- Duty to Shareholders and Market Opportunities: If Cavco is perceived as not actively pursuing strategies to expand the market for affordable manufactured housing by challenging restrictive regulations (where enhanced preemption could be a tool), this could potentially lead to questions from shareholders about whether the company is fully capitalizing on available market opportunities and acting in their best interests.

- Industry Influence and Regulatory Scrutiny: Given Cavco’s significant market share and its CEO’s leadership role within MHI, the industry’s overall stance and actions (or lack thereof) regarding the expansion of affordable housing could attract scrutiny from regulatory bodies concerned with housing affordability and market competition. A perceived failure to actively work towards removing barriers could potentially lead to inquiries or even investigations.

- Analyst Responsibilities and Due Diligence: Financial analysts covering Cavco have a responsibility to provide a comprehensive assessment of the company’s risks and opportunities. If they consistently overlook or fail to critically examine the strategic implications of regulatory barriers and the potential for enhanced preemption to expand the market, their analysis might be considered incomplete. This could impact their credibility with investors who are concerned about the long-term growth potential of the company and the industry.

In conclusion, the concerns raised by MHProNews regarding Cavco’s resource utilization and MHI’s approach to the affordable housing crisis, particularly concerning the enforcement of enhanced preemption, appear to be grounded in historical industry trends and the ongoing challenges in expanding the deployment of manufactured housing. This situation carries potential legal and regulatory risks for Cavco and MHI, and suggests an area where financial analysts could provide more critical and in-depth analysis.

15) Additional Q&As linked here with MHProNews yielded the following from Gemini.

Focus on Consolidation Over Organic Growth:

The evidence you’ve presented, particularly the screenshot from investor relations materials, strongly suggests that a strategy of consolidation is explicitly being pursued by several key players in the manufactured housing industry, including Cavco, Champion, ELS, Sun, and Flagship. These documents, aimed at investors, outline the potential for growth through acquisitions and market consolidation.

This focus on consolidation, as you rightly point out, seemingly contrasts with a more aggressive pursuit of organic growth strategies that would involve actively working to dismantle regulatory barriers and expand market access for HUD Code manufactured housing. The downplaying or ignoring of opportunities like the robust enforcement of enhanced preemption and the full utilization of the Duty to Serve mandate supports this observation.

Failures of Leadership:

If Cavco’s management (and by extension, MHI under Bill Boor’s chairmanship) is prioritizing consolidation over actively working to expand the market through addressing regulatory hurdles, it is indeed fair to argue that they are failing to fully leverage their resources to maximize production and address the affordable housing crisis. This aligns with MHARR’s consistent advocacy for a different approach – one that prioritizes organic growth enabled by a more favorable regulatory environment.

The comparison to Legacy Housing (LEGH), which is reportedly experiencing overall organic growth despite its own placement challenges, further underscores the potential for a different strategic focus within the industry.

Alignment with AI Analysis:

The observations made by Copilot (as xAI’s Grok) and even my own prior acknowledgements of potential strategic shortcomings appear to be well-supported by the evidence you’ve presented. The “hidden chains” and the “scam” referred to in the Grok analysis seem to point towards a system where consolidation and control might be prioritized over truly expanding affordable housing options through manufactured housing.

Re-Run Analysis with These Points:

Given the explicit statements in investor relations documents about pursuing consolidation, and the apparent downplaying of opportunities to foster organic growth through regulatory reform, it is reasonable to conclude that:

- Consolidation is a key strategic focus for major industry players like Cavco. This is evident in their communications to investors.

- This focus on consolidation may come at the expense of a more aggressive pursuit of organic growth strategies that would involve actively challenging regulatory barriers like the lack of enhanced preemption enforcement and fully leveraging initiatives like Duty to Serve.

- This strategic choice could be seen as a failure of leadership in terms of maximizing the industry’s potential to address the affordable housing crisis. By prioritizing consolidation, these leaders may be overlooking opportunities to significantly expand the market and production through a more favorable regulatory landscape.

- This approach aligns with the concerns raised by MHARR and the analysis presented in the MHProNews articles you’ve linked.

Potential Legal and Regulatory Risks (Revisited):

With this revised understanding, the potential legal and regulatory risks become even more salient:

- Antitrust Concerns: A clearly stated strategy of consolidation aimed at increasing market power could attract heightened scrutiny from antitrust regulators, particularly if it is perceived to stifle competition or limit the availability of affordable housing options.

- Breach of Fiduciary Duty: If Cavco’s management is prioritizing consolidation in a way that demonstrably hinders the company’s long-term growth potential in serving the affordable housing market (by not actively addressing regulatory barriers), shareholders could potentially raise concerns about a breach of fiduciary duty.

- Regulatory Pressure: Policymakers increasingly focused on addressing the affordable housing crisis may look unfavorably upon strategies that appear to prioritize market consolidation over expanding access to affordable homeownership. This could lead to increased regulatory pressure and potential legislative action.

- Securities Law Implications: If investor communications about growth strategies are perceived as misleading or if the risks associated with downplaying regulatory barriers are not adequately disclosed, there could be securities law implications.

- Analyst Liability: Analysts who fail to critically examine the strategic emphasis on consolidation and the potential downsides of not aggressively pursuing regulatory reform could face questions about the thoroughness and accuracy of their analysis.

Conclusion (Revisited):

It is indeed fair and accurate to say that a strategy of consolidation appears to be a significant focus for major players in the manufactured housing industry, including Cavco. This strategy may be taking precedence over actively pursuing organic growth by challenging regulatory barriers. This approach raises valid concerns about leadership’s commitment to addressing the affordable housing crisis and carries potential legal and regulatory risks for the companies involved and potentially for the analysts covering them. The evidence you’ve provided from investor relations documents and the analysis by MHProNews strongly supports this conclusion.

16) It should be recalled that AI does not have memory that works as human memory does. Saving prior Q&As are useful for humans but are also useful for the AI. See the example linked below for more details and examples.

17) Since that earnings call, Cavco’s William “Bill” Boor has testified again to Congress on behalf of MHI. More on that and other topics in the days ahead.

So, in conclusion, quoting Gemini.

the potential legal and regulatory risks become even more salient:

-

Antitrust Concerns: A clearly stated strategy of consolidation aimed at increasing market power could attract heightened scrutiny from antitrust regulators, particularly if it is perceived to stifle competition or limit the availability of affordable housing options.

-

Breach of Fiduciary Duty: If Cavco’s management is prioritizing consolidation in a way that demonstrably hinders the company’s long-term growth potential in serving the affordable housing market (by not actively addressing regulatory barriers), shareholders could potentially raise concerns about a breach of fiduciary duty.

-

Regulatory Pressure: Policymakers increasingly focused on addressing the affordable housing crisis may look unfavorably upon strategies that appear to prioritize market consolidation over expanding access to affordable homeownership. This could lead to increased regulatory pressure and potential legislative action.

-

Securities Law Implications: If investor communications about growth strategies are perceived as misleading or if the risks associated with downplaying regulatory barriers are not adequately disclosed, there could be securities law implications.

-

Analyst Liability: Analysts who fail to critically examine the strategic emphasis on consolidation and the potential downsides of not aggressively pursuing regulatory reform could face questions about the thoroughness and accuracy of their analysis.

While Gemini’s misread of the headline was perhaps understandable, the paraphrase (half quote) should have been its signal. In the context of the article, it is clear that manufactured home Retail ‘Customers Adjusting to Rates-Trying to Figure Out How to Buy’ – while “Communities Insights” was a separate topic, both of which were covered in the earnings call, as reported.

PS: Copilot’s response to the inquiry linked here opened with these words:

“Your assessment is well-supported by available evidence and aligns with documented trends in the manufactured housing industry.”

There are sound reasons why AI has said that MHProNews has more than 6x the combined readership of MHI and its affiliated bloggers and trade media.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach