- In addition, as with 9/11 and the 2008-2009 recession, we expect there to be business to pick up as a result of suppliers that have difficulty coming back from this.

- Further, customers in manufactured housing and specialty vehicles were less impacted by recent disruptions and were contributors to growth in the adjacent market segments.

- But like we also said in our comments, I think that there is an unprecedented opportunity for the RV business and the marine business.

MHProNews has made the argument that the need for affordable housing will grow during and post-the COVID19 pandemic. With over 33 million jobs lost, and a report a few weeks ago that half a million Americans that were “millionaires” pre-stock crash that lost that status during the market sell off, there are several reasons to think that an opportunity exists.

LCII’s insights mentioned manufactured housing, which they supply, but focus on the marine and RV industries. Those are more discretionary than affordable housing. They offer serious reasons to think that manufactured homes could be poised to grow, given the right leadership.

See that beyond our left-right headline bullets, thought provoking standard fare, plus the market snapshot graphics in our featured focus segment.

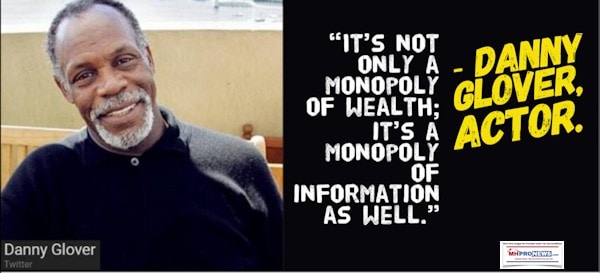

Quotes That Shed Light…

Headlines from left-of-center CNN Business

- Paychecks just got bigger

- A pedestrian holding an umbrella passes in front of a closed Nike Inc. store in the SoHo neighborhood of New York, U.S., on Tuesday, March 17, 2020. In New York City, the virtual shutdown from the coronavirus pandemic is threatening to create massive holes in the budget as billions of dollars in tax revenue disappears.

- Hourly wages are up, but that’s not the good news you’d expect it to be

- Apple will start reopening some US stores next week

- INTERACTIVE The real unemployment rate is worse than we thought. Here’s why

- US hits worst unemployment rate since the Great Depression

- Dow climbs after worst jobs report on record

- Devastating job losses: Here’s who got hit the hardest

- Why unemployment claims are so high in these 3 states

- Facebook, Google and others will let employees work from home til 2021

- Business is booming for these 14 companies

- How to land a job in the middle of a pandemic

- These companies are hiring tons of people during the crisis

- How Covid-19 misinformation is still going viral

- Elizabeth Warren, other Massachusetts Democrats probe Walmart on store with more than 80 coronavirus cases

- Singapore deploys robot ‘dog’ to encourage social distancing

- OTHER TOP STORIES

- A Bugatti Divo is displayed at the Paris Motor Show at Parc des Expositions Porte de Versailles on October 3, 2018 in Paris, France. From October 4 – October 14, the famous motor show will showcase new cars and products from major motoring manufacturers.

- Will the world still want multimillion-dollar supercars? Bugatti’s about to find out

- WUHAN, CHINA – APRIL 21:(CHINA OUT)A job applicant makes a call as other Job applicants read recruitment information at an on-site job fair on April 21, 2020 in Wuhan, Hubei Province,China. An on-site job fair was held in Wuhan on Tuesday with strict epidemic prevention measures. Over 1,600 job vacancies from more than 40 enterprises were offered to applicants, involving a variety of industries like food, pharmaceuticals, logistics, manufacturing, garment, agriculture, etc. To offset COVID-19's impact on the job market, China has taken measures to ensure employment and promote work resumption, according to the Ministry of Human Resources and Social Security

- 80 million Chinese are already out of work. 9 million more will soon be competing for jobs, too

- Meet OAN, the little-watched right-wing news channel that Trump keeps promoting

Headlines from right-of-center Fox Business

- FEATURES

- Truckers suffer colossal coronavirus job losses in April

- Overall, the U.S. lost a record 20.5 million jobs last month, as the unemployment rate ballooned to 14.7 percent.

- Stocks surge as economic recovery hopes put record unemployment in the rearview mirror

- Industries devastated in April’s record unemployment

- GOVERNMENT

- Proposal to give $2,000 per month to Americans gains traction in Senate

- Stocks jump as phaseout of lockdown overshadows record unemployment

- Despite coronavirus crisis, Fed says US banks still in good shape

- CHINA

- Is Smithfield Farms owned by China?

- LIFESTYLE

- Coronavirus outbreak at meat processing plant spreads like wildfire

- Tyson launches coronavirus health care partnership to help employees

- OPINION

- After coronavirus, China threatens US aviation: Ex-national security official

- CHECK PLEASE

- MONEY

- How to know if your stimulus payment is correct and what to do if it isn’t

- VACCINE DATA ATTACKED

- CORONAVIRUS

- Iran-linked hackers targeted Gilead Sciences as it works on COVID vaccine

- FRA CHECK

- MONEY

- Most important Social Security chart you’ll ever see

- BACK IN BUSINESS

- CORONAVIRUS

- Kushner sees a comeback from coronavirus lockdown crisis

- CAN’T KEEP A GOOD WORKER DOWN

- RETIREMENT

- How most Americans feel about retiring after COVID trounces markets

- BACK SO SOON?

- CORONAVIRUS

- White House says CDC writing new guidelines for reopening America

- TAKE IT OR LEAVE IT

- PERSONAL FINANCE

- Coronavirus and Social Security: Should you consider collecting benefits early?

- KING SIZE CASE

- NEWS

- Prince Andrew sued over $7.25M property bill

- MIGHTY HAVE FALLEN

- OPINION

- Natural Gas no longer US crown jewel

- SWING AND A MISS

- SPORTS

- ‘The Last Dance’: Michael Jordan’s baseball career examined

- TOWER OF ‘TONED’

- RICH & FAMOUS

- Bravo TV star’s California beach house listed for $2.7M

- COURT BATTLE LOOMS

- RICH & FAMOUS

- Judge denies Lori Loughlin’s latest dismissal attempt

- CRYPTO CLIMBS

- MARKETS

- Bitcoin nears $10,000 as change looms for crypto mining

- Amazon attacks Microsoft, calls Pentagon JEDI decision ‘fatally flawed’

- $10B AT STAKE

- DEFENSE

- Amazon attacks Microsoft, calls Pentagon JEDI decision ‘fatally flawed’

- BANK ACCOUNT TAKES OFF

- MARKETS

- Richard Branson cleared to sell $1B of Virgin Galactic stake: Report

- CITY SLICKERS

- LIFESTYLE

- Wealthy New Yorkers are shooting guns, relaxing at ‘sporting retreats’

- GHOST TOWNS

- LIFESTYLE

- Airport restaurants, retailers seeking coronavirus relief from congress

- NOT BUDGING

- MONEY

- Trump doubles down on capital gains, payroll tax cuts to stimulate economy

- BUSINESS LEADERS

- Sheryl Sandberg warns coronavirus burnout will cost employers

- 2021

- TECHNOLOGY

- Coronavirus prompts majority of Google’s staff to say home until 2021

- INDUSTRIALS

- Coronavirus meat shortage stems from lost labor, supplier says

- LIFESTYLE

- Amtrak to reopen vital train route with new rules for passengers

- APPLE

- Apple to reopen select US stores next week

- NBA

- Mark Cuban on why he’s not letting his team practice at the Mavericks facility

- FOOD & DRINKS

- McDonald’s rewards employees with coronavirus-related bonuses

- LIFESTYLE

- Texas salon owner freed after defying governor’s coronavirus orders

- LIFESTYLE

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus – Where Business, Politics and Investing Can Meet

LCI Industries’ CEO Jason Lippert told Fox Business recently about the ability of an RV to provide temporary housing that allows families to self-isolate, while still providing travel options for those itching to get away after weeks of being locked down.

“RVs and boats provide attractive alternatives to vacation more safely as families are eager to get out of the house,” said Lippert. “At the same time, RVing and boating offer a great solution to social distancing for families that want to travel the country and experience the great outdoors.”

Miranda Lambert posted this on her Instagram feed. Where is our industry’s version of this type of promotion?

In manufactured housing, there are mixed reports, which will be the focus of an upcoming report. But by contrast, there are indications that RVs could be getting a boost after the initial hit on their industry following the partial lockdowns in several states.

With that backdrop, here is the report LCI’s May 5, 2020 investor relations call on their Q1 2020 results.

LCI Industries (LCII) Q1 2020 Earnings Call Transcript

LCII earnings call for the period ending March 31, 2020.

(MFTranscribers)

May 5, 2020 at 3:31PM

Logo of jester cap with thought bubble.

IMAGE SOURCE: THE MOTLEY FOOL.

LCI Industries (NYSE:LCII)

Q1 2020 Earnings Call

May 5, 2020, 8:30 a.m. ET

Contents:

Prepared Remarks

Questions and Answers

Call Participants

Prepared Remarks:

Operator

Ladies and gentlemen, thank you for standing by and welcome to the Q1 2020 LCI Industries’ Earnings Conference Call. [Operator Instructions]

I would now like to hand the conference over to Victoria Sivrais, Investor Relations. Please go ahead.

Victoria Sivrais — Founding Partner

Good morning, everyone, and welcome to LCI Industries’ first quarter 2020 conference call.

I am joined on the call today by the members of LCI’s management team, including Jason Lippert, President, CEO and Director; and Brian Hall, Executive Vice President and CFO. Management will be discussing their results in just a moment.

But first I’d like to inform you that certain statements made in today’s conference call regarding LCI Industries and its operations may be considered forward-looking statements under the securities laws and involve a number of risks and uncertainties. As a result, the Company cautions you that there are a number of factors, many of which are beyond the Company’s control, which would cause actual results and events to differ materially from those described in the forward-looking statements. These factors are discussed in the Company’s earnings release and in its Form 10-Q and its other filings with the SEC. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made except as required by law.

With that, I would like to turn the call over to Jason Lippert. Jason?

Jason D. Lippert — President & Chief Executive Officer

Good morning, everyone, and welcome to LCI’s first quarter 2020 earnings call.

In what rapidly evolved to be the most challenging operating environment in our Company history, we delivered solid performance during the first quarter. Our first quarter was off to a strong start until the first week of March, so we are very encouraged about our trajectory. I’m incredibly proud of the agility of our team in response to the escalating COVID-19 pandemic late in the quarter. Thanks to the team’s efforts, we were able to make necessary steps to protect the health and safety of our team members, while effectively manage costs to mitigate downside risk to our business.

During the quarter, we reported revenues of $660 million, up 11% compared to last year. This top line growth was largely driven by the successful execution of our diversification strategy and the efficient integration of the nine acquisitions we completed over a 12-month span, in addition to outperforming in the RV OEM space.

Before I discuss our results in more detail, let me quickly touch on the impact we have seen as a result of COVID-19 as well as the steps we are taking to confront challenges brought on by the pandemic. To prioritize the well-being of our team members, maintain compliance with federal and state mandates and better align our production with current demand levels, on March 25 we announced the temporary suspension of our production at select manufacturing facilities across the US and Europe. During the shutdown, 15 of our sites remained active and operational, continuing to produce items deemed essential. At these sites, we’ve operated with a heightened focus on safety, utilizing reduced staff as appropriate, adhering to social distancing guidelines and implementing increased cleaning and sanitization processes.

Our team members have always been the most valuable part of our organization, and over the past six weeks, our efforts have focused on providing support to them and the communities where over 90 facilities operate as we work to do our part to help combat this virus. For team members facing the most extreme difficulties due to the COVID-19 health crisis, we have established a temporary emergency fund to be utilized for immediate aid, and we will continue to encourage and support team member initiated volunteer efforts.

In addition, we have donated personal protective equipment and other supplies throughout our local communities. We are also manufacturing 60,000 medical face shields for doctors and nurses in Italy to help those on the front lines in the fight against COVID-19.

As government mandates have begun to lift nationwide, our customers have largely come back online inquiring levels of production, and accordingly, we began restarting most of our plants last week and this week. As our production continues to start back up, we will be following the guidance of the World Health Organization as well as state and federal governments, implementing our COVID-19 health and safety playbook where new protocols help create a safer environment for our team members in this post COVID environment.

During this challenging time, we’ve continued cultivating our dealer, distributor and e-commerce relationships. Encouragingly, during the last couple of weeks, we have seen positive signs from RV and boat dealers selling significantly more inventory than expected as the weather is turning and customers are preparing to get out and behave more normally again. That said, our teams have properly adjusted the business cost to prepare for what we expect to be the new volume in the coming months.

In addition, as with 9/11 and the 2008-2009 recession, we expect there to be business to pick up as a result of suppliers that have difficulty coming back from this. We have had to make a lot of difficult decisions in order to adjust the business to operate efficiently in light of the COVID-19 pandemic. But we are well positioned to move forward and emerge from this a stronger company. Our ability to react very, very quickly to withstand a prolonged downturn scenario has been a proven strength of our business over the last two large economic disruptions.

Our financial position remains strong, supported by ample liquidity and cash on hand. However, as market demand continues to shift, we have implemented critical cost saving measures to enhance our flexibility, ensuring that we will be able to further manage through this challenging environment for the foreseeable future.

Two of our Senior VPs and I have reduced our base salaries 25%, while other members of the executive leadership team, general managers and executives across the business are participating in meaningful temporary adjustments to their respective base salaries as well. Our Board of Directors has also reduced each director’s quarterly retainer by 25%. We have not yet established a duration of these temporary compensation adjustments, but we’ll continue to carefully review executive and director compensations as well as other salaried personnel costs as we get back to a more normalized environment. We have taken the unfortunate but necessary steps to adjust our workforce by reducing staff, freezing travel and acting temporary hiring freezes in all locations and implement furloughs where necessary and many other measures to match the new demand of the business.

Capital expenses are being delayed where practical and we are also reducing or eliminating non-critical business expenses. And lastly, we will be engaging in ongoing discussions with customers and vendors to determine pricing and input cost adjustments where possible, closely monitoring inventories and implementing aggressive strategies around working capital management in order to preserve our cash flow generation.

While COVID-19 presents a level of uncertainty many of us have never seen, we believe the fundamentals of the RV and the boating industries remain very strong, now more than ever. As a result of this crisis, we have an incredible opportunity to introduce more people to RV-ing and boating. We anticipate that most will be significantly altering their summer vacation plans as air travel, hotel stays, cruises and travel to large metro areas are going to be largely reduced.

RVs and boats provide a wonderful alternative for people to get outside and vacation safely with their families in this new normal environment. Whether short or long trips, RVs and boats allow families to control the destination, who they are around, and most importantly, the place they stay. After an extended duration of self-quarantining, family, community and the outdoors have become increasingly more important to people which is what the RV and boating lifestyle embodies in the first place. We believe that there will be a new vacation normal and feel that RV and boats are in a prime position to check all the boxes that families will be looking to check, including that of affordability.

Lastly, people are getting outdoors in significant numbers as experiences are what people are craving at this moment. Our industries have a great answer for families considering new ways to vacation and it certainly doesn’t seem like there has been a better time to consider a boat or an RV. In addition, the same fundamental and secular drivers for our business that have historically moved our Company forward are still relevant today, and we believe they will drive further growth long after the pandemic has passed.

Turning to the segment results for the quarter. We started the year off strong, with RV OEM retail sales trending positively and largely outperforming industry expectations in January and February. While RV dealers spent the majority of the last year working to right-size their inventories, the industry was certainly well positioned heading into 2020 as inventory levels were largely normalized. Global RV OEM sales were $345 million for the quarter, down 5% versus the prior year period. This decrease was largely due to the impact of COVID and the final two weeks of March.

Despite this lower demand and production environment, content per towable RV, adjusted to remove Furrion sales from prior periods, increased 3% year-over-year to $3,354, driven by new product innovation, market share gains and the reversal of the de-contenting trend we have seen over prior quarters. We saw a slight decline in content per motorhome RV, which decreased 5% year-over-year to $2,327, driven by a shift in wholesale mix toward smaller Class C units. Our diversification strategy has proven critical in navigating through this challenging operating environment, positioning us for the long-term growth in an extended downturn scenario.

Adjacent markets, aftermarket and international markets now make up more than 46% of our total net sales for LCI, a significant increase compared to 39% of total sales at this time last year. Given the progress we are making each quarter, we remain on track to reach our target of having these markets make up 60% of our total revenues by 2022.

We have successfully doubled quarterly revenues in our aftermarket and international segments to $127 million and $61 million respectively, which mitigated what would have been a larger impact from COVID-19 on our overall performance. Ultimately, our diversification program allowed us to outperform the larger core markets. Our long-term strategy remains solidly intact, and we will remain focused and diligent on expanding our presence outside of the North American RV business through both continued organic growth and acquisitions.

Revenue in our adjacent market category for the first quarter increased 10%, with solid growth at the start of the year partially offset by the temporary production shutdown throughout marine and other adjacent businesses. As a reminder, marine is our largest channel in the adjacent market segment and has been a continued area of growth for us. Despite the disruption to production in marine, we remain focused on growing our product portfolio, integrating our latest acquisitions into the business and strengthening our presence in this market. After introducing new cutting-edge technology and innovative sunshade awning systems through the acquisitions of PWR-ARM brand of electric biminis and SureShade electric awnings for larger boats in 2019, we are now the predominant player in North America and Europe for marine shade solutions. Being the predominant player will help position us nicely for more innovation in the marine segment in the years to come.

Further, customers in manufactured housing and specialty vehicles were less impacted by recent disruptions and were contributors to growth in the adjacent market segments. As we look forward, we continue to seek new opportunities to build market share across all our adjacent markets and add content in a wide range of industries. Our aftermarket segment experienced tremendous growth, more than doubling revenues on a year-over-year basis, largely the result of our acquisition of the CURT Group in late 2019. As anticipated, the aftermarket has continued to offset weakness experienced in our core OEM markets, which will continue to be a competitive advantage for LCI.

In recent weeks, we only saw a 35% reduction in revenues in the aftermarket business as many of our aftermarket products are considered essential items. Although showrooms are closed, many RV dealers continue to navigate leads online and get creative with the consumers for the sale and service of RVs. The integration of CURT is progressing as planned. We continue to take advantage of new cost synergies and have already benefited from some of the cross-selling synergies, including new distribution channels, expanded dealer and customer networks and broadened product offerings.

In addition, CURT has an incredibly strong reputation for product innovation, engineering and brand excellence. We are continuing to launch and sell through to new customers their latest products like BetterWeigh and Echo and are excited about the innovation and R&D capabilities of their overall business and strategies. As we continue to grow the business, integrate our recent acquisitions and innovate new products for the aftermarket, we are confident we will be able to drive market share growth and use our size, product breadth and customer relationships to strengthen our leadership position here.

Our international business also doubled during the first quarter compared to the prior year due to the series of acquisitions we recently completed. In January of this year, we closed on the acquisition of the Netherlands based Polyplastic Group, a leading manufacturer of acrylic window products and a strong supplier and innovator for the European caravan industry. This latest acquisition, combined with our acquisitions of Lewmar Marine, Lavet, Femto and Ciesse in 2019 provide us with the necessary products, brand power, innovation capabilities and leadership teams to really grow our presence in the caravan, rail and marine industries across Europe.

As in the case of North America, the ultimate impact of COVID-19 on the European market is still unknown. Several of our manufacturing facilities in Europe temporarily shut down to ensure the health and safety of our team members and comply with federal and local mandates. Despite any near-term headwinds we may face, we are confident in the long-term outlook for these markets in Europe and believe our growing presence, product breadth, leadership and influence in Europe will deliver promising results in the future.

Innovation is and will continue to be the lifeblood of LCI. It’s what we are known for in our core markets. While we have taken aggressive steps to optimize our cost structure, we continue to invest strategically in R&D to ensure that we are delivering on the needs of our customers. Our team’s R&D expertise and ability to introduce sophisticated industry leading products and technology across all our business end markets is a competitive advantage for us. While many companies in a difficult environment will pull back investments across the board, we believe our innovation strategy will ensure that we will emerge a stronger competitor. We have several new product launches coming this year that we will be excited to talk about in the coming quarters.

Our capital allocation strategy remains unchanged. However, in light of the uncertainty we are all facing, our balanced approach will be more focused on preserving cash, paying down debt and realizing synergies from our most recent acquisitions.

In closing, I want to thank our team members for the resilience during these uncertain times. Most importantly, we want to say thanks to thousands of men and women [Technical Issues] several divisions that remained open during the past six weeks [Technical Issues] that have been severely impacted by the COVID-19 pandemic, especially our medical front line workers all over the country [Technical Issues] customers. As the situation continues to evolve, we will be ready to respond and leverage our inherent strengths as an organization in order to maintain growth and preserve long-term value for our shareholders.

I will now turn the call over to Brian Hall, our CFO, to discuss in more detail our first quarter financial results.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Thank you, Jason, and good morning, everyone.

Our consolidated net sales for the first quarter increased 11% to $660 million compared to the prior year. The increase in year-over-year net sales was driven by continued growth in the Company’s adjacent, OEM, aftermarket and international markets as we continue to integrate our latest acquisitions in each of those markets. This growth was partially offset by temporary production shutdowns related to COVID-19 which resulted in a loss of approximately $45 million in sales during the last two weeks of March. Q1 2020 sales to RV OEMs declined 5% compared to the prior year due to the previously mentioned production shutdowns and lower consumer demand due to COVID-19.

Sales in North American RV OEMs, which represents 96% of our RV OEM sales, was negatively impacted by the termination of the Furrion on distribution agreement and a related loss of $24 million in net sales or 7%. This loss was offset by a 3% increase in content per towable RV unit and a slight increase in wholesale RV shipments for the quarter. The remaining 4% of our RV OEM sales related to international RV sales, which were negatively impacted by COVID-19 a few weeks prior to North America and declined 12%.

Content per towable RV unit increased 3% to $3,354 and per motorized unit decreased 5% to $2,327 compared to the prior year, excluding the impact of Furrion in 2019. Content per unit growth in towables has improved further due to the reversal of the de-contenting trend while motorized content continues to be impacted by the shift in wholesale mix toward smaller Class C units. As Jason mentioned, we continue to remain focused on product innovation and believe our towable content growth rate can continue in the range of 3% to 5%.

Despite a challenging macroeconomic environment, we are seeing solid growth in non-RV markets as we can execute on our diversification strategy. Q1 2020 sales to adjacent markets grew 10% to $187 million compared to the prior year. Sales to North American adjacent industries, which represents 78% of our adjacent industries sales, declined 7% due primarily to a 14% decline in marine OEM sales, offset by growth in manufactured housing and other emerging markets [Technical Issues] increased over 200% due to the acquisitions, partially offset by the impact of COVID-19.

Our first quarter aftermarket segment sales [Technical Issues] $127 million compared to the prior year and international sales increased 81% to $61 million. Acquired revenues were $99.5 million, primarily affecting aftermarket and international sales.

While sales in April declined 76% from the prior year, we were encouraged by the results as they exceeded initial expectations. Our diversification efforts proved positive as aftermarket and other adjacent industries performed much better than core markets. The resumption of operations by many of our customers in May is significant, and current expectations are for May sales to decline only 29% compared to the prior year, excluding Furrion. While significant uncertainty remains, we believe sales should gradually improve from the May run rate as the consumer continues to gain its footing and we slowly return to growth.

Operating margins decreased roughly 140 basis points, largely the result of purchase price accounting from the acquisition of CURT Group, which lowered operating margins by 90 basis points, as well as the impact of COVID-19. This was partially offset by favorability from the dissolution of our distribution agreement with Furrion and other efficiencies gained through continuous improvement initiatives.

Due to our high variable cost structure and our ability to respond quickly, we were able to adjust our cost structure, removing over $30 million in quarterly fixed cost. While April resulted in a net loss, we anticipate May results to return to profitability. From a free cash flow perspective, we burned approximately $15 million of cash in the month of April and May is anticipated to completely offset the loss, which is extremely encouraging.

While gross profit margins had improved to 24%, the absorption of fixed costs on lower sales volume during the upcoming second quarter are estimated to reduce the gross profit margin to 20% to 21%. As anticipated, SG&A costs increased during the first quarter due to the additional SG&A costs from acquisitions, along with the related amortization of intangible assets. Due to the actions taken to reduce costs, SG&A costs are anticipated to be $85 million to $90 million for the second quarter.

Adjusted EBITDA increased 14% to $75 million for the first quarter, which excludes the impact of the inventory step-up. This growth was driven by additional efficiencies gained through our operating improvement initiatives implemented over the past year, further optimizing labor and other operating costs.

Non-cash depreciation and amortization was $24.6 million for the first quarter while noncash stock-based compensation expense was $3.3 million. GAAP net income in Q1 2020 was $28.2 million or $1.12 per share compared to $34.4 million or $1.38 per share in Q1 2019. Adjusted net income for Q1 2020 was $32.9 million or $1.31 per diluted share, excluding the non-cash charge recognized in cost of sales related to the inventory fair value step-up for CURT, net of tax.

Cash generated from operating activities was $45 million for the quarter, while using $96 million for business acquisitions, $8 million for capital expenditures and returning $16 million to our shareholders in the form of dividends.

We maintain a healthy balance sheet, bolstered by our current cash on hand and available borrowings. At the end of the first quarter, cash and cash equivalents totaled $98 million, up from $35 million at the beginning of the year. At the end of the quarter, as Jason mentioned, we took several broad-based actions to enhance our cash position and liquidity for the long term to mitigate the impact from COVID-19 as much as possible. We are evaluating additional options to further reduce operating costs and preserve margins, and are continuing to closely monitor inventories and implement aggressive strategies around working capital management.

For the full year 2020, we are targeting capital expenditures between $20 million and $30 million, significantly below our prior expectations as we delay nonessential expenditures. During March and April, we increased borrowings under our revolving credit facility to further increase our cash position and provide financial flexibility, and as of April 30, 2020, we had outstanding borrowings of approximately $438 million under our existing revolving credit facility and remaining availability of approximately $159 million. In the coming months, we will remain in close contact with our strategic banking partners regarding options available to maintain our future financial liquidity.

At the end of the first quarter, we had an outstanding debt position of $769 million, with no significant debt maturities until 2022 and remain in compliance with our loan covenants. Currently, our leverage position relative to EBITDA stands at just over 2.8 times, and we are focused on further paying down debt in the near term. We are quite comfortable with our current leverage and overall financial position, which will enable us to operate efficiently in this current environment as well as for the foreseeable future.

That is the end of our prepared remarks. Operator, we’re ready to take questions. Thank you.

Questions and Answers:

Operator

[Operator Instructions] First question comes from Scott Stember with CL King. Go ahead.

Scott Stember — CL King & Associates — Analyst

Good morning. Thanks for taking my questions.

Jason D. Lippert — President & Chief Executive Officer

Good morning, Scott.

Scott Stember — CL King & Associates — Analyst

Jason, just going back to the comments about your customers coming back online, the comments I guess that sales in May should not be down nearly as much as what we saw in April, and June, it looks like it will probably get a little bit better from there. But can you maybe talk about what you’re seeing or hearing on the end demand? You did say that you’re hearing about an abatement in some of the decreases in recent weeks. Maybe just frame that out a little bit. Are we talking returning to growth or flatness or we just talk about less bad than what we saw earlier in the month?

Jason D. Lippert — President & Chief Executive Officer

Yeah. So, I mean, our experience is probably really similar to what the OEMs are telling us right now. I mean, they’ve got a very close connection with the dealer base and dealer body. And I think that they looked at things at the end of March, beginning of April and started calling dealers and zeroing out all the orders that they had. And I’m trying to figure out by the end of April what a real backlog actually looks like. And that’s how we ended up with where we’re at in May, and I think we said that our May looks like about 70% of what we were in February, early March, before this whole thing hit. So it’s a lot better than what we would have anticipated.

I mean, in early April, we were hoping we could start out at 40% or 50% of where we were. So 70% feels good. It feels right now like June could be a little bit better. Just the temperature at a lot of the bigger dealers out there is that late April activity was pretty solid, considering the circumstances. There seems to be a lot more Internet traffic and leads and everybody is having to work a little bit harder for making leads into actual sales. But like we also said in our comments, I think that there is an unprecedented opportunity for the RV business and the marine business. I’d like to take advantage of just where consumers are positioned today with respect to how they’re going to vacation and the new vacation normal. Does that help?

Scott Stember — CL King & Associates — Analyst

Yeah. Very good. Thanks. And on the aftermarket side, there was comment about how in recent weeks, I guess in April, that sales were down 35%. Was that organic? Or is that including CURT in the mix?

Jason D. Lippert — President & Chief Executive Officer

So, that was more organic. I mean, our aftermarket divisions in general were down about 35%. We didn’t know what to expect, coming in to April, just because we didn’t know how active consumers were going to be. But consumers stayed pretty active. To most people’s count, there was about 1 million full-time RV-ers on the road. So you’ve got the service that needs to continue to be maintained on those units and people that are readying for vacation or maybe you have just finished with a trip on an RV. So whether it was an upgrade or service, there was quite a bit of activity on the aftermarket side, which was good to see.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Yeah, I think, Scott, I would add there that we were very encouraged. If you really looked at it on a weekly basis, when we entered April, there was a thought that aftermarket sales could decline all the way down to 70%, 80% of what it had been running. And we really never saw it get to those levels. So that was very encouraging, and we’re excited to see the investments we made in the aftermarket business bear some fruit during this type of time. It probably got down to maybe during a week at 50% of prior rates, but then quickly flattened out and started to climb back up toward the end of the month.

Jason D. Lippert — President & Chief Executive Officer

And total aftermarket numbers, after acquisitions, is more than double what we had same period last year.

Scott Stember — CL King & Associates — Analyst

Got it. And just the last question just on costs. You talked about high variable cost structure. Just remind us how much of your cost structure is variable. And then just lastly, on your comments about April not being profitable and May should at least offset that. Your view about being profitable, the possibility to being profitable and free cash flow positive in the second quarter? Thanks.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Yeah. Scott, it’s Brian. First of all, from a cost structure, we’ve always talked about our incremental margins being around 20% to 25%. But that’s kind of in a normal case scenario. When you really break down all of our costs, 80% to 90% of them are variable costs, meaning they can be adjusted. So we cut deep. As I said in our prepared remarks, for just second quarter alone, we let variable costs slack like they normally would and then took out an additional $30 million worth of cost just for the second quarter. So we made some pretty significant swings there to right-size the business.

So from a profitability perspective, yes, $52 million worth of sales during the month of April, not possible to be profitable at that rate. But we were very encouraged by the cash flow burn rate. I mentioned around $15 million, $16 million worth of cash burn during the month of April. You’ve heard me say in the past, probably pre entering into this COVID-19 world, that our cash burn rate was somewhere around $40 million. So we took quite a bit of an adjustment there. And then, given the volume and really managing our [Technical Issues] offset that completely from a cash perspective during the month of May and return to some profitability.

So, to give you an idea, I think I said in the prepared remarks that we should be around — at least we’re estimating around 20% of prior year sales for the month of May. So very nice rebound from being down 76% in the month of April. A typical December for us — we’re really not that far off from breakeven at those kind of sales a month. So the cost adjustments that we’ve made — I would tell you the month of May would, probably under old Lippert cost structure, be about a breakeven month but we’re looking to show some profitability and generate some cash because of the adjustments we’ve made. Hopefully, that gives you a little more color.

Jason D. Lippert — President & Chief Executive Officer

And I’d just add to that. So that’s probably the best news of the day is that, we’re pretty blessed and fortunate to be sitting maybe at the end of the May, based on current volume and orders for the May bookings that we can sit and say that cash is neutral or around neutral, considering what we’ve all been through. There’s not many businesses that can probably claim that after the next 30 days from now. So the good news on that front that we’ve been aggressive with the cost cutting and we’ve got a fairly solid order booking for May.

Scott Stember — CL King & Associates — Analyst

Got it. That’s all I have. And thanks. A great job, guys.

Jason D. Lippert — President & Chief Executive Officer

Thanks, Scott.

Operator

Next question is from Kathryn Thompson with Thompson Research.

Brian Biros — Thompson Research Group — Analyst

Hey, good morning. This is actually Brian Biros on for Kathryn. Thank you for taking my questions. The first one, I guess, could you touch more on what you’re hearing from the RV OEM production levels as they get back to operations in May? We heard roughly 50% capacity [Indecipherable]. I guess what are you guys hearing? Are there differences between product types for that capacity? And then, if they are at 50% or whatever the level is, do you guys match that level or how do you operate based on what they’re doing?

Jason D. Lippert — President & Chief Executive Officer

Yeah. So, for the RV business, we look at it kind of weighted [Technical Issues] unlike many suppliers we supply every single customer a bunch of products. So we looked at our May bookings for orders that we have for May. It shows that they are right around 69% compared to where they were beginning of March before COVID hit. So we’ve scraped it and scraped it and scraped it and the OEMs have been revising production schedules up till this week when they launched production, which is when we launched production.

So we feel pretty comfortable that that number is going to stick for May, and we feel optimistic that it could be, maybe, a little bit better for June based on how the selling season comes along and how many buyers get out, how much pent-up demand there is, how much new demand there is. So we’ll be able to update that in the coming months.

Brian Biros — Thompson Research Group — Analyst

Thank you. Just following up on the strong trends — or I guess better than expected trend so far and expected throughout May and hopefully into June. Are you hearing any differences among product types? Towables versus motorhomes or even marine? I mean, how does that break down?

Jason D. Lippert — President & Chief Executive Officer

I don’t think that there is any new trends there. I mean, entry-level stuff continues to be probably pretty dominant. And I think that if we do see an influx of demand from new buyers that are considering the ways of vacation, I really think that that will continue to play on the entry-level products. They’re very affordable like we’ve talked about.

The average towable RV is a $22,000 RV that you can get $200 a month payment on. When you do the math or backwards math on what it costs to take a family on airfare or in a long trip and stay in a hotel, you’re at least easily matching that on one vacation a year. So it’s affordable. We feel that the entry-level products will continue to be popular. Certainly, you can buy an RV for a couple — if there’s two people RV-ing, an entry-level product for $10,000, but most of the products we see are in that $22,000 range.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Hey, Brian, going back to the second part of your previous question. I think we missed answering that. As we’re hearing RV OEMs come back around approaching 70%, it’s not consistent across all brands. It varies by week. So we’re being very intentional about bringing our costs back slightly slower than that so that we can work through it efficiently and effectively. And so I think that’s an important point. So we’re not anticipating having 70% of our cost come back. We’re going to be below that.

Jason D. Lippert — President & Chief Executive Officer

That’s right.

Brian Biros — Thompson Research Group — Analyst

Okay. Yeah. Very helpful. Thank you.

Operator

Next question comes from Craig Kennison with Baird.

Craig R. Kennison — Robert W. Baird & Co. — Analyst

Hey, good morning. Thanks for taking my questions. Jason, what’s your best guess at wholesale shipments for the RV and marine industries for 2020?

Jason D. Lippert — President & Chief Executive Officer

That’s a loaded question, Craig. I don’t really feel comfortable answering that. Like I said, I’m optimistic. I think that we were on a north of 400,000 unit a year trend. So we would love to end up in that. If you peel April out of the equation, I’d love to be 85% of that. But we’ll see. I think that we have to see how the next several months play out with respect to some of the new buying opportunity that we see that is definitely going to be in the mix.

And on the marine side, I think you might see, if optimistic, view is 85% on RV for example. And I’m not saying that’s where it plays out. Marine might be a little bit less than that because the products are generally a little bit more expensive, but you can certainly get into towable RVs a lot cheaper than you can on an entry-level powerboat or something like that. So April is obviously going to take a huge chunk out of the total units for this year. So I think you have to kind of factor April out of it and look at what’s the best guess for the remaining months.

Brian M. Hall — Executive Vice President & Chief Financial Officer

And I think, Craig, to add to that. I’ve looked at your estimates and have always been relatively close to them. But to Jason’s point, a lot of it just depends on the rate that it increases once we get beyond this May-June time frame. Unfortunately, we’ve got to see the consumer come back, we’ve got to determine how healthy they are and what buying rate they return with. So there is a lot of uncertainty beyond June. But at this point, at least the modeling that we do internally, it’s not too far off from the numbers that you’ve published.

Craig R. Kennison — Robert W. Baird & Co. — Analyst

Thanks. And then how sensitive do you think demand is going to be to the timing of these economic reopenings across the country? Just seems to me there may be a point at which the average consumer says it’s too late to do this in 2020, but I’ll consider this for 2021. Do you think there is a lot of sensitivity to the timing of the reopen given how seasonal your business is?

Jason D. Lippert — President & Chief Executive Officer

I mean, the way I think about it is, how bent are people to get out and do something different. If you’re in an area where you’ve been literally locked down and there was nothing to do, I would say that you’re going to start looking around for opportunities that — if you’re talking about a summer vacation, for instance — I mean, we’ve canceled a couple of trips and I know a lot of other families are, and I’ve said it — and think about this as there is hundreds of thousands of families across the country that are saying gee, we have to cancel our vacation, what are we going to do.

RV-ing and boating certainly fit into the opportunities that are available. The question is just how bad the people want to get out. I think there’s going to be a few months before we see how that all plays out. But I think that you can certainly make the argument with limited things to do over the next couple of months, and certainly some states are going to pause a lot of the openings and delay. And some of the states that have opened up like Indiana — certainly, not everything is open to the public and some things won’t be open until July August for us. So I think people are going to be really considering what their options are, and RV-ing and boating certainly play into it. So we’re anxious to see how it plays out, for sure.

Craig R. Kennison — Robert W. Baird & Co. — Analyst

Thanks. And then just one question on your aftermarket business. Obviously, you’ve worked really hard to diversify the business, which will serve you well down the road. I’m curious, just to what extent do you have direct to consumer options with CURT or other brands so that as some of these channels may be shut down just due to social distancing, you can still get product to consumers? And to what extent do you think maybe this pandemic creates an opportunity for you really to invest in some of these direct to consumer options?

Jason D. Lippert — President & Chief Executive Officer

Yeah. So I think we’re not too different from a lot of the other businesses out there that this whole pandemic has expedited a lot of the online purchasing which is going to push companies to get online quicker. So we’re no different. Over the last month or so, we’ve put several thousand SKUs online. So the people that are roaming around, looking for products, whether they’re upgrades or service parts that we can supply for RVs, boats and other vehicles, were more available than we ever have been, and probably that’s going to continue to — I mean, not probably, it’s going to continue to move forward where we put more and more of our SKUs online and make them available to consumers that are trying to get that. And likewise, we’re doing more marketing around upgradable products, how to upgrade your RV, how to upgrade your boat with certain components that we supply.

Craig R. Kennison — Robert W. Baird & Co. — Analyst

Great. Well, thank you.

Jason D. Lippert — President & Chief Executive Officer

Thanks, Craig.

Operator

Next question comes from Fred Wightman with Wolfe Research.

Fred Wightman — Wolfe Research — Analyst

Hey guys, good morning. Jason, in your prepared remarks, you’d mentioned some pricing and input cost discussions with customers. Can you just give a bit more detail on what those conversations have been like and what segments they cover?

Jason D. Lippert — President & Chief Executive Officer

Yeah. So, we’re priming the pump right now and evaluating where all of our costs are. So, certainly with volumes where they’re at, the changed volumes and some of the new normal costs, we’ve got to figure out how to mitigate those. So we’ll be having those conversations with vendors and with our customers over the coming months, and probably have a lot more to give you update on next quarter.

Fred Wightman — Wolfe Research — Analyst

Okay. And then, as you guys restart production and the OEMs restart production, are there any signs of labor-staffing issues or people who don’t want to come back to work?

Jason D. Lippert — President & Chief Executive Officer

No, I mean, in terms of — I wouldn’t anticipate anybody have staffing issues. There’re so many people sitting on the sidelines right now unfortunately waiting to get called back, and even by August, there’s probably still going to be people waiting. So I don’t anticipate any labor shortages or issues. And from what we’ve seen in some of the peers around the industry that we’ve talked to over the last couple of weeks that people have been slowly coming back online in the RV and boat businesses.

People are excited to come back to work. I was talking to one of our general managers this morning, and he said that he came into work at 5:00 AM early to make sure he was there to greet everybody that came in the door and there was a guy there waiting and he was crying and he was so happy to be back to work. So I think people in general are excited to be back around their work peers and work family and break up the mundane routine that they’ve had, sitting at home with nothing to do for the last month or so.

Fred Wightman — Wolfe Research — Analyst

Great. Thanks a lot.

Operator

Next question comes from Daniel Moore with CJS Securities.

Daniel Moore — CJS Securities — Analyst

Thanks, Jason and Brian for the color. Maybe just your updated view on inventory levels, particularly after the OEMs essentially obviously shut production in March. As we look forward, do you expect wholesale to be more in line with retail? You see an opportunity for wholesale to outpace if things are a little better than maybe expected? Any thoughts there would be great.

Brian M. Hall — Executive Vice President & Chief Financial Officer

I think certainly coming into it, there was a sense that inventories were where they needed to be. Depending on the region of the country it’s a different story right now. We certainly have touchpoints within some of the Midwest and Mid-Southern states where inventory has continued to move. There’s certainly demand there and wholesale should perk right up to match that retail demand. There is going to be other parts of the country that it’s not going to be the same case. I mean, I’m sure, New York is going to have a different scenario versus what maybe a Texas does or a California. So it’s really varying by state. So we got to see a lot of that play out.

But certainly, I think if you went back to last time we all talked, there was a sense that we were in a good position. I think as that progressed, we all knew that we were in a good position. I mean, retail was outpacing the prior year, which was the first time in quite a few months. So inventories, certainly, I think were in the right place. So now I think we got to see it play out a little bit. But I don’t think it’s too far off. Certainly, nothing to the extent like we’ve been dealing with for the last 18 months. If it is a little heavy right now, I think we can move to it quicker than we did the last cycle.

Daniel Moore — CJS Securities — Analyst

Helpful. And you mentioned in the prepared remarks — I think it was Jason — the opportunity to perhaps pick up incremental revenue or share if you look back at prior downturns, 9/11, the Great Recession. Can you give us any color or sense of either from a dollar revenue or percentage revenue, the opportunity that you saw coming out of those prior downturns, maybe picking up share from some more distressed smaller players?

Jason D. Lippert — President & Chief Executive Officer

Yeah, I can give you the numbers but I don’t have that at my fingertips. But certainly, after both of those devastating events, we increased share coming out of both. And as we said in our prepared remarks, we anticipate more of that. I mean, there were a few people that were — a few supplier peers that were wounded coming into this. I have no doubt that they’ll be in a worse position coming out of it and there’ll be opportunities there. We’ve done a really good job and we have a really good playbook for picking up those pieces. We’re obviously close to the customers. We do business with every customer, so we’re not going to come up on a customer we don’t have that’s being supplied by one of these businesses. So we’ll be right there as the pieces are ready to pick up.

And certainly, again, from the perspective of cash, I mean there’s not too many companies coming out of May that will be sitting here saying, man, we were cash neutral after the last two months. I mean, there’ll be a lot of companies hurting pretty badly. So like I said, we’re fortunate, but at the same time we’re going to take advantage and be opportunistic of some of these opportunities that pop up. Whether there are market share or acquisition opportunities down the road, there’ll be both.

Daniel Moore — CJS Securities — Analyst

Perfect.

Brian M. Hall — Executive Vice President & Chief Financial Officer

I would add the following.

Daniel Moore — CJS Securities — Analyst

Go ahead. Sorry, Brian.

Brian M. Hall — Executive Vice President & Chief Financial Officer

I would add to that, Dan, just from an RV content perspective. We stated that towable content was up 3%, and as we’ve been saying for a number of quarters now, that’s against a headwind of price reductions that we’ve been giving as steel and aluminum has decreased over the last 12 to 18 months. So we’re turning in some nice content growth numbers despite that headwind.

Daniel Moore — CJS Securities — Analyst

Well, that kind of leads to my last question, which is looking back again at prior downturns, maybe the impact of — we know what shipments did, but in terms of content, remind us — do you expect to kind of level set at a potentially lower level? Do you see that — maybe being a little bit more neutral, obviously it’s a difficult crystal ball question, but what have you seen in prior downturns in terms of the impact on content?

Brian M. Hall — Executive Vice President & Chief Financial Officer

Yeah. I mean, I still think — I mean, focus on towables, towables — 3% to 5% is still very reasonable for us given the innovation, new products in the pipeline, just the landscape that we’re all faced with, given some of the comments that Jason made. So I still think that 3% to 5% is very reasonable for us even in this time. Probably the big unknown is, is there a further shift toward more entry-level products that certainly can have an impact on it. But I don’t think in a meaningful enough way to take us well outside of that range.

Jason D. Lippert — President & Chief Executive Officer

Yeah. And I’d also add that, I could argue pretty easily that after — whatever — 2001, we were pretty small, a few hundred million. In ’08, ’09, we were maybe a little bit bigger than that. But we’ve got such breadth and size today that when it comes to these types of opportunities, our innovation machine, there’s just a lot more going on there, there’s a lot more opportunities we’re able to take advantage of today versus 10 or 20 years ago, if you go back that far at these last two disasters. So I think we’re in a better position to pick up more content market share, organic growth and acquisition opportunity than we were in the last couple of devastating times we went through.

Daniel Moore — CJS Securities — Analyst

All right. Thanks again. Stay safe.

Jason D. Lippert — President & Chief Executive Officer

Thank you.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Thank you.

Operator

Next question comes from Marc [Phonetic] [Indecipherable] with Jefferies. Please go ahead.

Marc — Jefferies — Analyst

Good morning, and thank you for taking my questions. Thinking about the aftermarket segment, you had a strong quarter. And I was just wondering if you can give some additional detail on how the CURT Group performed and maybe what mix of the aftermarket channel is related to more non-discretionary demand.

Jason D. Lippert — President & Chief Executive Officer

Yeah. So, CURT saw the disruption right about the same time the rest of our business did. People just froze. So fast forward to this past week. Numbers started getting close to, on the CURT side of things, back close to our budget plan. So that’s good to see. Consumers are freeing up and starting to look around and spend money on their products. So we’re working on synergies there. We continue to look at purchasing synergies, cross-functional synergies between our operations, between the CURT and LCI groups, we’ve got selling synergies on both sides of the business and we’re really trying to pull in RV dealers. They sell a lot of hitch and towing products and that’s a huge opportunity for us. Those would be the highlights on CURT.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Yeah, I think we’ve talked initially about at least an initial expectation in the beginning of the year of high single-digit type percentage growth for them, and they were certainly performing at that level and above. So they were performing exactly as we expected them to from a cost perspective and some of the synergies that we’ve had talked about. We hadn’t given a ton of color on that, but certainly as we’ve dug in and identified opportunities there to get 2% to 3% of sales in synergies, which would be pretty typical for us, we’ve certainly seen those opportunities. So I would say everything on CURT is performing at or above what we had originally anticipated.

Jason D. Lippert — President & Chief Executive Officer

A big difference on that side of the business is there is a huge cyclical swing in the summer time. So their peak season is — we’re coming into it right now. And their winter months are much lower volumes.

Marc — Jefferies — Analyst

Okay, great. And then given the kind of scale and magnitude of some of the recent business disruptions, are you seeing any sourcing headwinds in the current environment?

Jason D. Lippert — President & Chief Executive Officer

No, I’d tell you that things are pretty smooth there. I mean, China was running through some problems in February. It would have caused some disruptions for us certainly in the spring time. But because we have the disruption and fell back on volume, there is less risk there. We also sourced outside of some of our Asian suppliers. We sourced offshore Asia quite significantly after the tariffs hit, so we reduced some of our risk there. But all in all, I mean, we have meetings every week on where our supply bases how sourcing looks, and we look pretty good right now, but a lot of that’s due to the reduced volumes that we’ve got on the OEM side of the business. If we were running to the 100 plus percent, we probably have a couple of issues, but we’re OK right now.

Marc — Jefferies — Analyst

Okay. Great. Thank you very much, guys.

Jason D. Lippert — President & Chief Executive Officer

Thanks, Marc.

Operator

Next question comes from Brandon Rolle with Northcoast Research.

Brandon Rolle — Northcoast Research — Analyst

Good morning. Thank you for taking my questions. I was hoping you could comment on the market trends you’re seeing internationally for RV and marine versus what you’re seeing in North America. And as a follow-up, also I was hoping you could touch on used inventory levels in North America for RV and marine with people moving down the price spectrum. Thank you.

Jason D. Lippert — President & Chief Executive Officer

Yeah. I have talked to a few dealers over the last couple of weeks, and it sounds like used — I don’t know where used inventory is, but used sales is probably up just a little bit. And as far as the European products go and consumers and OEMs, it feels pretty similar, for marine and RV, where the industries are there compared to here. So, they might be a little bit more bullish on volume, and we’ve got some OEMs over there that are looking at 80% as they come back here, and they’ve got others that are a little bit less than that. But I think we just have to wait and see how things play out. We have May in the book, certainly for both areas, both regions. But June could be better, it could be a little bit worse. We just won’t know until we see how the consumer is going to react over the course of the next 30 days or so.

Brandon Rolle — Northcoast Research — Analyst

Okay. Great. Thank you.

Operator

[Operator Instructions] Next question is from Steve O’Hara with Sidoti.

Stephen O’Hara — Sidoti & Company — Analyst

Yeah. Hi, good morning. Thanks for taking the question. Just going to the aftermarket. Maybe you touched on this, but in terms of the margins that were put up, it looks like operating profit — I mean, I assume that the $6.3 million kind of hits within the aftermarket segment. I mean, even with that, you’ve had kind of I think basically doubling its aftermarket sales and operating profit in that segment, assuming that adjustment is flat. I mean, is the right way to think about maybe — and I guess under a normal scenario where those aftermarket margins should be maybe shorter term and then longer term, assuming you kind of get back to more normalized business environment.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Hey, Steve. It’s Brian. A couple of things. First off, because we haven’t talked about it a whole lot. We provided a lot of additional color within this release and the prepared remarks than what we had in the past, one being the focus on the EBITDA because I know initially when you look at the results, it looks like there is quite a bit of decline there. But from an EBITDA perspective, we’ve actually improved over [Phonetic] 14% from the prior year. So we’ve seen significant growth there because of our own efficiencies, and then the CURT business is a pretty high EBITDA margin business as well.

Now, from a straight GAAP financial perspective, there’s quite a bit of amortization. So the additional thing that we provided within the release that I’d point you to is, we’ve split up the amortization and the depreciation by both the segment so that you can see the waiting between the two. So I think that should help you get a little bit of color there. I think that — I lost my train of thought. Oh, and then the additional step-up on the inventory. Yes, you’re correct, that is all 100% sitting in the aftermarket segment.

So, going into this year, we talked quite a bit about all of those items and the impact that it would have on our aftermarket margins because when you weighed in all of that amortization, the CURT business margin from a GAAP perspective, it is very similar to our overall consolidated margin. So it certainly does dilute our traditional aftermarket margin and bring it down to that level. The other thing to note is that it’s very seasonal. So, as Jason mentioned, the winter months, it’s much lower margin business. But then during the summer at their peak volumes, that’s when they tend to make more money.

So, anyway, that’s a lot of the moving pieces there. I know I just threw a lot at you, but I think we tried to provide more color within the release to help kind of bridge [Speech Overlap]

Jason D. Lippert — President & Chief Executive Officer

It’s probably important to know, the business is only six to seven years, young. So there’s still acquisition opportunity there. Not that we’ve run our course on the OEM side, but we’ve certainly had a lot more activity over the last 20 years on OEMs than we’ve seen in the last six or seven years on the aftermarket side as we’ve grown and developed that business. So we still feel there’s a lot of runway there.

Stephen O’Hara — Sidoti & Company — Analyst

Okay. All right. That’s helpful. And then, we talked about picking up share in downturns. Let’s say, if you expect to pick up 5 or 10 points of share, I mean, how much of that do you expect to come from essentially taking over someone’s business because they can no longer come up for availability? Thanks.

Jason D. Lippert — President & Chief Executive Officer

Well, let me make sure I answer your question right here. So, I’d say that overall, you look at the opportunity we’ve had just this year so far. I mean, if you take — peel Furrion sales out of our revenues, we’re almost 18% up, which is incredible for first quarter. We did say, as we mentioned earlier, we’ve got suppliers that we know were wounded coming into this event, so they’re going to have problems coming out. I can’t tell you what the market share gains could or should be. We just know that there is plenty of opportunity to grow. And we’ll give more color on that in the next quarter if we were able to take advantage of that and show that in this product area or that product area we’ve taken business or gained share.

As far as acquisitions go, I just don’t see anybody being open to it right now because the business has changed so much. So whether it’s a valuation problem or whether it’s an issue where they just have to get their arms around the business to figure out what they’re left with, there is probably going to be some delay there. But when the discussions are ready to be had, we’re going to be one of the first at the table. Our balance sheet is strong. Like I said, there is not many businesses right now that will be sitting end of May in a position where they could say, hey, based on May bookings, cash flow is neutral between April and May, which is what it looks like right now.

So we’ll be in a prime position to take advantage of, if we got to fire up some new product lines or take advantage of a supplier that they can’t supply or whether we’ve got to look at — taking a look a strategic acquisition later this summer or later this year when companies decide they’re ready to sell or if they have to sell. So, we’re excited either way. Does that answer your question?

Stephen O’Hara — Sidoti & Company — Analyst

Okay. No, that’s very helpful. Yep, that’s exactly what I was wondering. But thank you. Appreciate the time.

Jason D. Lippert — President & Chief Executive Officer

Thanks. Have a great week.

Brian M. Hall — Executive Vice President & Chief Financial Officer

Thanks, Steve.

Operator

And at this time, I will turn the call over to Mr. Jason Lippert.

Jason D. Lippert — President & Chief Executive Officer

Yeah. So, just want to thank everybody for tuning into the call today. It’s been an extremely challenging time, the last six weeks. I think that our management team has done an exceptional job getting through this as we did the last couple of acquisitions, and I’m certainly proud of everybody. We’ve had extraordinary efforts from everybody in our leadership team to get us through this in the shape that we described and color today. So appreciate your time, and we’ll see you next quarter. Thank you.

Operator

[Operator Closing Remarks]

Duration: 61 minutes

Call participants:

Victoria Sivrais — Founding Partner

Jason D. Lippert — President & Chief Executive Officer

Brian M. Hall — Executive Vice President & Chief Financial Officer

Scott Stember — CL King & Associates — Analyst

Brian Biros — Thompson Research Group — Analyst

Craig R. Kennison — Robert W. Baird & Co. — Analyst

Fred Wightman — Wolfe Research — Analyst

Daniel Moore — CJS Securities — Analyst

Marc — Jefferies — Analyst

Brandon Rolle — Northcoast Research — Analyst

Stephen O’Hara — Sidoti & Company — Analyst

###

MHProNews Analysis in Brief

Several of the facts that emerge from this report spotlight a point we made in January prior to the pandemic’s full weight was understood. See that in the report linked below.

The bottom line?

Manufactured housing could be doing far better than it has been. The industry’s independents should seek not a return to the status quo ante COVID19, but rather a bold new vision to utilize the good laws that already exist.

Related Reports:

“Never Let a Good Crisis Go To Waste” – COVID19 Pandemic – Problems and Solutions

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

-

-

-

-

-

-

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

-

-

-

-

-

Spring 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our tenth anniversary and is in year 11 of publishing.

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.https://www.manufacturedhomepronews.com/celebrating-10-years-of-goal-and-solution-oriented-manufactured-home-industry-innovation-information-and-inspiration-for-industry-professionals/· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.https://www.manufacturedhomepronews.com/2019-year-end-totals-reveals-decline-in-new-hud-code-manufactured-home-production-shipments/

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.

http://latonykovach.com Connect on LinkedIn: http://www.linkedin.com/in/latonykovach

AEI Flash Housing Market Indicators