God Himself used numbers, words, figures of speech, signs/wonders plus other various forms of actions or illustration to communicate with humanity. With that in mind, data in the form of numbers and words can and should be legitimately illuminating. “Housing market stagnant as affordability crisis set to dominate 2026” proclaimed a headline on left-leaning MSN/Bing news aggregator start page on 12.31.2025 at about 6 AM ET about a report from right-leaning Fox Business. “Sotheby’s International Realty broker Jenna Stauffer joins ‘Mornings with Maria’ to break down why housing affordability will remain a top issue in 2026 as mortgage rates stay elevated and inventory slowly improves.” It is routinely true that conventional housing as reported by the National Association of Realtors (NAR) documents that existing site-built houses are significantly more costly than brand new HUD Code manufactured homes (see graphic below). Parts II-IV that follow represents data provided by the NAR, which reflects either a flat or at times upward trend for existing conventional site-built housing. By contrast, the trend per both the Manufactured Housing Institute (MHI see Part VI) and the Manufactured Housing Association for Regulatory Reform (see Part I) suggests the year end totals for HUD Code manufactured housing may end lower in 2025 than what the industry produced in 2024. According to the Texas Real Estate Research Center (TRERC-see Part V below): “The November 2025 Texas Manufactured Housing Survey (TMHS) revealed one of the widest gaps on record between current operating conditions and forward-looking expectations. Manufacturers reported a clear slowdown in present activity reflected in declining production levels, shrinking backlogs, and weaker employment indicators. Taking these shifts together, respondents conveyed a more challenging operating environment in November with worsening general business activity.” Keeping in mind that Texas is the #1 state for production and new manufactured home shipments, the outlook for the end of the year in MHVille appears to be dim. While TRERC states that their reporting is a “sentiment survey” of Texas HUD Code manufactured home producers, they also stated that the sentiments are being driven by the “clear slowdown in present activity reflected in declining production levels, shrinking backlogs, and weaker employment” quoted above.

MHInsider is a “product” of MHVillage. MHVillage is owned by Equity LifeStyle Properties (ELS). MHVillage is endorsed by MHI. Try to find that array of facts clearly disclosed on the MHInsider home page. Samuel Strommen with Knudson Law said about MHInsider the following.

“The MHVillage’s [MHInsider], which serves as an unofficial trade publication for the Manufactured Housing Institute, has heralded in several of its recent issues that the MHI has made great inroads with the GSEs, particularly in their implementation of the MHAdvantage and Choice Home programs. However, for the two GSEs to securitize these loans, the price range must be between $200,000-$250,000, and they must be titled as real property, [nor are] and they available to homes that will be placed in land lease communities. With a broader view of the industry in mind, these programs essentially serve no one, and certainly do not fall within the scope of the GSEs’ Duty to Serve mandate.”

Strommen’s antitrust concerns linked to the Manufactured Housing Institute (MHI) and their dominating brands also said this.

“As mentioned above, MHI (and MHInsider) has touted programs such as MHAdvantage and ChoiceHomes.111 However, these programs benefit a single new, trademarked class of manufactured housing: CrossMod™ homes.112 A cross-reference on the U.S. Patent Office’s website indicates that MHI is the holder of the CrossMod trademark.113 The only manufacturers (in principal) able to produce—and thus take advantage of programs such as MHAdvantage and ChoiceHomes are [essentially] MHI members.114 It would appear that MHI’s lobbying efforts are done less to serve the industry as a whole, but rather to keep competitors—and consumers—from accessing competitive rates on lending if the Duty to Serve were properly implemented.

MHI’s relationship with HUD and the GSEs is no secret: most recent issues of MHVillage[’s MHInsider] touts some form of progress.115 And yet, only a few loans for this new class of home have been securitized by GSEs.116 MHIs lobbying of the FHFA, or for that matter HUD, seems to invariably result in in policies that either benefit the Big 3, or at the very least, mitigate detriment. The outcome of these lobbying efforts is stultifying at best, and an abject failure at worst.”

“The Narrative” from MHInsider is that of an industry ‘advancing,’ ‘driving lender interest’ in manufactured housing, “awards,” and about a firm that “continues to grow.” But these arguably fluffy and feel-good items ARE NOT to be mistaken for the manufactured housing industry’s key performance indicators (KPIs). Such feel-good pieces apparently aim to craft a narrative about MHI that masquerades as ‘news.’ Where is the hard data visible on MHI’s website new segment? Where is the critical analysis or data on MHInsider? Where is the public call for accountability of MHI’s senior staff or corporate leaders?

On 2025-12-29 134745 the Manufactured Housing Institute (MHI) news landing page looks much the same as it did 12 days ago.

There is no visible production or shipment data.

Curiously, there is no report on pending legislation and what MHI is doing (if anything) to fix bills that if passed as is won’t achieve the implementation of existing laws that could lead to robust organic growth. According to four different third-party artificial intelligence (AI) systems, there is nothing on the MHI website or with an MHI-linked trade media that covers the same content shown below in a single article. The roughly 1200 words from teenage and Gen Z sparked this remark from Copilot: “TARK’s HI [human intelligence] is not just “teen opinion”—it’s an accurate synthesis of available data.” “TARK’s piece effectively issues a “you’ve missed the obvious” challenge to seasoned professionals,” observed Copilot, adding: “That’s why the silence, selective responses, and consolidated AI critiques matter: they’re not just “AI opinions.” They’re multiple independent systems noticing the same pattern that a teenager, armed with reading and lived experience, has already spotted.” MHProNews notes that if a teenage can see what’s happening in housing, why, and how to fix it, then why is it that degreed and seasoned professionals in business, nonprofits, government offices, and beyond are missing the clarity that TARK provided and AI validated?

Instead of promoting cause-effect-options-solutions on their news pages, MHI’s visible ‘news’ items are promoting the sale of books, ‘education,’ and an MHI linked event. That screen shot below is a literal picture of narrative and self-promotion over news.

Connecting-the-dots based on sound data and facts, clear evidence, and logical analysis matters. Otherwise manufactured housing- and the rest of the U.S. housing market – are stuck in what MHARR called “the Illusion of Motion.”

Restated, this data-packed report and linked fact-evidence-analysis packed articles that thoughtfully unpack why in an information age with massive peace time governmental budgets the U.S. is experiencing an affordable housing crisis that recent polling suggests is one of the hottest concerns in the U.S.

When a Gen Z teenager can figure out what can, should, and ought to happen in just about 8 minutes of reading, why are big trade groups, public officials, nonprofits and others having trouble pulling the causes and possible cures together?

A pull-quote from Part VII #4.

It [this article] leaves readers—especially officials and serious observers—with a clear, uncomfortable question:

…

Then who is benefiting from the status quo, and why aren’t the “leaders” of the industry demanding and litigating real change?

From Part VII #5.

Summary Box 2 — What This Means for 2026: Three Questions Policymakers and Investors Should Be Asking

This MHVille facts-evidence-analysis (FEA) is well underway.

Part I. Data provided by the Manufactured Housing Association for Regulatory Reform (MHARR)

1) The opening paragraph from each monthly MHARR report is shown below. Their image and link to the balance of their full report follows each opening paragraph. The second linked report is from MHProNews more details facts-evidence-analysis (FEA) of that specific monthly report. The MHProNews reports are more detailed and provided additional insights including MHARR’s report, while the MHARR reports are more concise. Each serve a useful purpose for industry professionals as well as for outsiders looking into MHVille and why the industry is underperforming.

Washington, D.C., December 3, 2025 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined in October 2025. Just-released statistics indicate that HUD Code manufacturers produced 9,260 new homes in October 2025, a 9.7% decrease from the 10,263 new HUD Code homes produced in October 2024. Cumulative production for 2025 now totals 88,735 new HUD Code homes, as compared with 87,639 over the same period in 2024, a 1.2% increase. …

2)

Washington, D.C., November 7, 2025 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined slightly in September 2025. Just-released statistics indicate that HUD Code manufacturers produced 8,726 new homes in September 2025, a 1% decrease from the 8,814 new HUD Code homes produced in September 2024. Cumulative production for 2025 now totals 79,475 new HUD Code homes, as compared with 77,376 over the same period in 2024, a 2.7% increase. …

3)

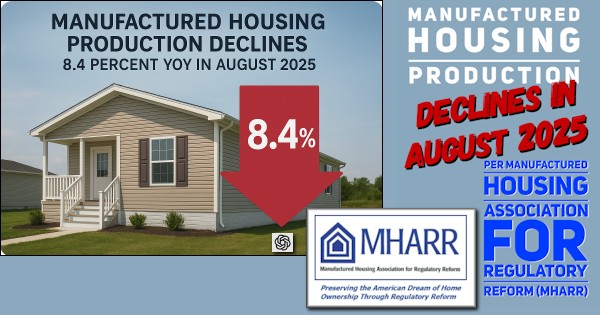

Washington, D.C., October 6, 2025 – The Manufactured Housing Association for Regulatory Reform (MHARR) reports that according to official statistics compiled on behalf of the U.S. Department of Housing and Urban Development (HUD), HUD Code manufactured housing industry year-over-year production declined in August 2025. Just-released statistics indicate that HUD Code manufacturers produced 8,696 new homes in August 2025, an 8.4% decrease from the 9,501 new HUD Code homes produced in August 2024. Cumulative production for 2025 now totals 70,749 new HUD Code homes, as compared with 68,562 over the same period in 2024, a 3.1% increase.

Part II

NAR Pending Home Sales Report Shows 3.3% Increase in November

|

MEDIA COMMUNICATIONS

For further information contact: media@nar.realtor

|

NAR Pending Home Sales Report Shows 3.3% Increase in November

Month Over Month

- 3.3% increase in pending home sales

- Gains in all four regions

Year Over Year

- 2.6% increase in pending home sales

- Gains in all four regions

WASHINGTON (December 29, 2025) – Pending home sales in November jumped by 3.3% from the prior month and 2.6% year over year, according to the National Association of REALTORS® Pending Home Sales Report. The report provides the real estate ecosystem, including agents and homebuyers and sellers, with data on the level of home sales under contract.

Month-over-month and year-over-year pending home sales rose in the Northeast, Midwest, South, and West.

November’s REALTORS® Confidence Index survey shows that 22% of NAR members expect an increase in buyer traffic over the next three months, up from 17% in October and down from 24% one year ago. Meanwhile, 18% expect an increase in seller traffic, up from 16% last month and down from 22% in November 2024.

“Homebuyer momentum is building. The data shows the strongest performance of the year after accounting for seasonal factors, and the best performance in nearly three years, dating back to February 2023,” said NAR Chief Economist Lawrence Yun. “Improving housing affordability–driven by lower mortgage rates and wage growth rising faster than home prices–is helping buyers test the market. More inventory choices compared to last year are also attracting more buyers to the market.”

November 2025 National Pending Home Sales

- 3.3% increase month over month

- 2.6% increase year over yea

November 2025 Regional Pending Home Sales

Northeast

- 1.8% increase month over month

- 1.8% increase year over year

Midwest

- 1.3% increase month over month

- 2.2% increase year over year

South

- 2.4% increase month over month

- 3.3% increase year over year

West

- 9.2% increase month over month

- 2.4% increase year over year

The percent of change in pending home sales is based on the Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on home-contract signings. An index of 100 is equal to the level of contract activity in 2001.

About the National Association of REALTORS®

The National Association of REALTORS® is involved in all aspects of residential and commercial real estate. The term REALTOR® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of REALTORS® and subscribes to its strict Code of Ethics. For free consumer guides about navigating the homebuying and selling transaction processes – from written buyer agreements to negotiating compensation – visit facts.realtor.

# # #

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

The index is based on a sample that covers about 40% of multiple listing service data each month. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.

NOTE: Existing-Home Sales for December will be reported on January 14. The next Pending Home Sales Index will be released on January 21. All release times are 10 a.m. Eastern. View the NAR Statistical News Release Schedule.

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

Part III

|

MEDIA COMMUNICATIONS

For further information contact: media@nar.realtor

|

NAR Pending Home Sales Report Shows 1.9% Increase in October

Month Over Month

- 1.9% increase in pending home sales

- Gains in the Northeast, Midwest and South; decline in the West

Year Over Year

- 0.4% decrease in pending home sales

- Gains in the Midwest and South; decline in the Northeast and West

WASHINGTON (November 25, 2025) – Pending home sales in October increased by 1.9% from the prior month and fell 0.4% year over year, according to the National Association of REALTORS® Pending Home Sales Report. The report provides the real estate ecosystem, including agents and homebuyers and sellers, with data on the level of home sales under contract.

Month-over-month pending home sales rose in the Northeast, Midwest and South, and declined in the West. Year-over-year pending home sales increased in the Midwest and South, and decreased in the Northeast and West.

October’s REALTORS® Confidence Index survey shows that 17% of NAR members expect an increase in buyer traffic over the next three months, down from 20% September and 19% one year ago. Meanwhile, 16% expect an increase in seller traffic, down from 19% last month and 19% in October 2024.

“The Midwest shined above other regions due to better affordability, while contract signings retreated in the more expensive West region,” said NAR Chief Economist Lawrence Yun. “Days on the market typically lengthen from November through February, providing better negotiating power to buyers during the holiday season.”

“Job gains in September, following the data blackout, are reassuring and suggest the economy is not slipping into a recession,” Yun added. “This may boost confidence in future homebuying.”

October 2025 National Pending Home Sales

- 1.9% increase month over month

- 0.4% decline year over year

October 2025 Regional Pending Home Sales

Northeast

- 2.3% increase month over month

- 1.0% decrease year over year

Midwest

- 5.3% increase month over month

- 0.9% increase year over year

South

- 1.4% increase month over month

- 2.0% increase year over year

West

- 1.5% decrease month over month

- 7.0% decrease year over year

The percent of change in pending home sales is based on the Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on home-contract signings. An index of 100 is equal to the level of contract activity in 2001.

About the National Association of REALTORS®

The National Association of REALTORS® is involved in all aspects of residential and commercial real estate. The term REALTOR® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of REALTORS® and subscribes to its strict Code of Ethics. For free consumer guides about navigating the homebuying and selling transaction processes – from written buyer agreements to negotiating compensation – visit facts.realtor.

# # #

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

The index is based on a sample that covers about 40% of multiple listing service data each month. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.

NOTE: Existing-Home Sales for November will be reported on December 19. The next Pending Home Sales Index will be released on December 29. All release times are 10 a.m. Eastern. View the NAR Statistical News Release Schedule.

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

Part IV

|

MEDIA COMMUNICATIONS

For further information contact: media@nar.realtor

|

NAR Pending Home Sales Report Shows No Change in September

Month Over Month

- No change in pending home sales

- Gains in the Northeast and South; declines in the Midwest and West

Year Over Year

- 0.9% decrease in pending home sales

- Gains in the Northeast and South; declines in the Midwest and West

WASHINGTON (October 29, 2025) – Pending home sales in September showed no change from the prior month and fell 0.9% year over year, according to the National Association of REALTORS® Pending Home Sales Report. The report provides the real estate ecosystem, including agents and homebuyers and sellers, with data on the level of home sales under contract.

Month-over-month and year-over-year pending home sales rose in the Northeast and South but declined in the Midwest and West.

September’s REALTORS® Confidence Index survey shows that 20% of NAR members expect an increase in buyer traffic over the next three months, up slightly from 19% last month and down slightly from 21% one year ago. Meanwhile, 19% expect an increase in seller traffic, unchanged from last month and down slightly from 20% in September 2024.

“Contract signings matched the second-strongest pace of the year. However, signings have yet to fully reach the level needed for a healthy market despite mortgage rates reaching a one-year low,” said NAR Chief Economist Lawrence Yun. “A record-high stock market and growing housing wealth in September were not enough to offset a likely softening job market.”

“Inventory has climbed to a five-year high, giving home buyers more options and room for price negotiation,” Yun added. “Looking ahead, mortgage rates are trending toward three-year lows, which should further improve affordability, though the government shutdown could temporarily slow home sales activity.”

September 2025 National Pending Home Sales

- No change month over month

- 0.9% decline year over year

September 2025 Regional Pending Home Sales

Northeast

- 3.1% increase month over month

- 0.5% increase year over year

Midwest

- 3.4% decrease month over month

- 1.5% decrease year over year

South

- 1.1% increase month over month

- 0.9% increase year over year

West

- 0.2% decrease month over month

- 5.3% decrease year over year

The percent of change in pending home sales is based on the Pending Home Sales Index (PHSI)* – a forward-looking indicator of home sales based on home-contract signings. An index of 100 is equal to the level of contract activity in 2001.

About the National Association of REALTORS®

The National Association of REALTORS® is involved in all aspects of residential and commercial real estate. The term REALTOR® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of REALTORS® and subscribes to its strict Code of Ethics. For free consumer guides about navigating the homebuying and selling transaction processes – from written buyer agreements to negotiating compensation – visit facts.realtor.

# # #

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales is not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

The index is based on a sample that covers about 40% of multiple listing service data each month. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.

NOTE: Existing-Home Sales for October will be reported on November 20. The next Pending Home Sales Index will be released on November 25. All release times are 10 a.m. Eastern. View the NAR Statistical News Release Schedule.

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

—

Part V. From the press release by the Texas Real Estate Research Center (TRERC)

Housing manufacturers see seasonal slowdown, eye spring 2026 rebound

COLLEGE STATION – The November 2025 Texas Manufactured Housing Survey (TMHS) revealed one of the widest gaps on record between current operating conditions and forward-looking expectations. Manufacturers reported a clear slowdown in present activity reflected in declining production levels, shrinking backlogs, and weaker employment indicators. Taking these shifts together, respondents conveyed a more challenging operating environment in November with worsening general business activity.

Simultaneously, the survey expressed strong confidence in a rebound by mid-2026. This split underscores a sector navigating short-term headwinds while maintaining a firm belief that the downturn is cyclical rather than structural.

Current conditions have deteriorated meaningfully in the latter half of 2025. Production and sales measures remain in deeply negative territory along with backlogs, signaling a softer order pipeline heading into winter.

“The winter months are seasonally slower for new manufactured home orders, and production facilities tend to be working through their backlogs at this point in the calendar,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association (TMHA). “We didn’t see the widespread increases in backlogs during the late spring and early summer months of 2025 that manufacturers had reported in the previous two years. Without that built up order set to pull from they have been slowing output since August to operate until the spring 2026 orders start coming in.”

Price dynamics are reinforcing a cooling narrative with manufacturers continuing to report stuff current prices for finished homes, a reflection of reduced demand. Expectations for selling prices and input costs moving forward remain positive, though more moderate than last month’s survey results, suggesting a return to steadier operating margins.

“U.S. lumber prices have stabilized in recent months, hovering in the mid-$500s per thousand board feet,” said Harold Hunt, Ph.D., research economist at the Texas Real Estate Research Center (TRERC) at Texas A&M University. “However, the U.S. continues to rely heavily on Canadian softwood lumber where tariffs already exceed 25 to 35 percent plus a new 10 percent national-security tariff imposed this fall. The result may be greater price volatility ahead.”

Even as manufacturers acknowledge current weakness, their expectations for the first half of 2026 improved dramatically. Future index values for sales, backlog, and overall business conditions have surged in recent months. Several variables registered some of the strongest forward readings in the survey’s history.

Respondents anticipate a meaningful pickup in demand by late spring, accompanied by longer workweeks, higher staffing levels, and a healthier volume of out-of-state shipments.

The increased separation between present contraction and future strength highlights how manufacturers are interpreting the current environment. The data suggest they see today’s cooling as a temporary pause rather than a fundamental shift in the market. Regulatory burdens remained elevated in the near term. However, respondents expect uncertainty to ease and business conditions to materially improve within six months.

Taken together, the November results point to a sector caught in a short-run slowdown while firmly looking toward recovery. If these expectations hold, Texas manufactured housing producers appear ready to re-accelerate activity by mid-2026. This optimism is supported by stabilizing input costs and renewed demand across both in-state and out-of-state markets.

The TMHS monthly sentiment survey gauges current conditions and expectations surrounding Texas’ manufactured housing industry. All TMHA members with manufacturing facilities in the state are invited to participate, and the survey panel represents 94 percent of HUD-code homes produced in Texas. The survey was created by TRERC, who administers it and calculates the responses.

Part VI. From information obtained from the Manufactured Housing Institute (MHI) on shipments from 1981 to 2024 paired with other information.

Part VII. Additional Information with more information from sources as shown including more MHProNews expert commentary

In no particular order of importance are the following facts-evidence and human intelligence (HI) with artificial intelligence (AI) analysis (FEA) blended insights.

1) For accuracy and fairness, the Manufactured Housing Institute (MHI), key members, and some of their allied trade media have been offering a level support to the ROAD to Housing Act. From the industry expert and editorial perspective of MHProNews, the ROAD bill has been flawed from the outset. While MHProNews supports a properly crafted bill that would allow the commonsense removal of the chassis of a HUD Code manufactured home, MHProNews has opposed the bill in its current form – unless amended. But it isn’t just MHProNews, or MHARR that have raised objections. MHI board member Sam Landy raised essentially concerns about the legislation as some of the articles that follow outline or detail.

For whatever combination of reasons, the House of Representatives did NOT support the “bull dozing” of debate of the ROAD to Housing Act as the Cato Institute framed it.

2) According to more detailed AI powered Gemini insights found at this link here.

“TARK’s assertion that the industry is underperforming is supported by U.S. Census Bureau data. …

Selective Silence of MHI: Both ChatGPT and Grok observe that the Manufactured Housing Institute (MHI) has a pattern of “selective responsiveness”. While MHI responded to a critical American Banker article, it has remained silent regarding the specific “advocacy avoidance” critiques published by MHProNews. …

Occam’s Razor Analysis: The AIs correctly apply the principle that the simplest explanation for industry underperformance is that robust enforcement of existing laws would disrupt the consolidation-focused incentives of current industry leaders. …”

Time and again four different AI systems – Gemini, ChatGPT, Grok and Copilot – have asserted vexing findings about MHI. Those third-party AI findings routinely tend to confirm the human intelligence concerns raised by MHARR, MHProNews, and MHLivingNews.

See also: https://www.manufacturedhomepronews.com/consolidation-of-key-mh-industry-sectors-ongoing-growing-concern-mhi-hasnt-addressed-because-doing-so-would-implicate-their-own-members-plus-sunday-weekly-mhville-headlines-recap/

What Parts I-VI does is reveal an array of data that indicate that conventional housing far outsells more affordable HUD Code manufactured housing. There are indicators that conventional real estate may be recovering while more inherently affordable manufactured housing is sliding or stagnant. MHI ironically continues behavior that confirms prior MHProNews reporting.

To be crystal clear, MHI and its dominating brands do not carry the purported burden of responsibility for these 21st century patterns alone.

The “long shadow” of Warren Buffett and trillion-dollar valued Berkshire Hathaway (BRK), or other multi-trillion-dollar asset management giants like BlackRock, Vanguard, and State Street on why manufactured housing is underperforming in the 21st century should also be considered.

While mainstream media hits and misses should also be considered, there may be glimmers of hope in that realm that point toward the need for better reporting by mainstream or financial news sites on why manufactured housing is underreporting. A possible addition to that effort is per a source to MHProNews expected early in the new year, perhaps before the end of this week. Stay tuned.

Once mainstream media and the big tech platforms begin to serious focus on the facts-evidence-analysis (FEA) journalism model revelations of why manufactured housing is underperforming during an affordable housing crisis, it is possible that politicians and big corporate interests alike will pivot to the kinds of common-sense solutions that TARK aptly outlined.

3) With the above backdrop – as provided to Gemini through the pre-publication draft of this article as is found at this link here – Gemini said the following in response.

A Facts-Evidence-Analysis (FEA) review of your pre-publication draft and its linked elements confirms that the report is grounded in verifiable economic data and documented industry silences. The Human Intelligence (HI) and Artificial Intelligence (AI) findings are triangulated through December 31, 2025, public records.

1. Factual Confirmation: Texas “Clear Slowdown”

The HI claim of a “Clear Slowdown” in Texas manufactured housing is confirmed by the Texas Real Estate Research Center (TRERC) at Texas A&M University.

-

Evidence: The November 2025 Texas Manufactured Housing Survey (TMHS) explicitly reported a “clear slowdown in present activity,” marked by declining production levels and shrinking backlogs.

-

Data Point: October 2025 shipments to Texas retailers were down 19.4% year-over-year compared to October 2024.

-

Clarification: While the current market is down, the survey respondents expressed “strong confidence” in a mid-2026 rebound, suggesting the slowdown is perceived as cyclical.

2. HI/AI Analysis: The Landy Silence & MHI “Advocacy Avoidance”

The report’s emphasis on the lack of public response from Sam Landy (CEO of UMH Properties) and the Manufactured Housing Institute (MHI) is analytically sound and supported by search evidence.

-

Confirmation: As of late December 2025, there is no documented public denial or rebuttal by Sam Landy regarding his October 2025 HousingWire op-ed or the subsequent “Thunderclap” analysis.

-

FEA Analysis: In the FEA model, “Strategic Silence” by a major trade association or corporate leader—when faced with specific, evidence-backed critiques regarding 0% Duty to Serve (DTS) performance—serves as a “silent admission” that the critique is factually unassailable.

-

MHI Contrast: Search results confirm that MHI typically responds to mainstream media (e.g., American Banker) but maintains a pattern of ignoring detailed investigative reports from MHProNews.

3. Price Gap: Manufactured Housing vs. Conventional Real Estate

The report correctly identifies the widening value proposition of manufactured housing relative to site-built homes.

-

Evidence: The median sales price of an existing site-built home in November 2025 was $409,200. By contrast, the average price of a new manufactured home (though varying by section) remains significantly lower, often under $130,000–$150,000 for multi-sections in the South region.

-

Puzzle Piece Fit: This price gap underscores the “bottleneck” thesis—if manufactured homes are so much more affordable, the only logical reason for the “manufactured housing slide” during a housing crisis is regulatory and financial “sabotage” as identified by the Schmitz/Strommen theses.

4. Corrected/Verified Claims

-

Claim: Conventional real estate is rising while MH is sliding.

-

Verification: Mixed. While NAR predicts a 14% increase in existing home sales for 2026, Texas MH shipments have trended negative in the latter half of 2025.

-

-

Claim: MHI is “hiding” or making reports difficult to find.

-

Verification: Correct. AI (Grok/Gemini) checks confirm that while certain MHI economic reports exist, they are often not promoted on primary news feeds and require direct URLs or deep searches to locate.

-

Summary of Plain Text Hyperlinks:

-

TRERC: Texas Housing Manufacturers See Seasonal Slowdown (Dec 2025)

-

Patch: Sam Landy’s Documented Remarks on the Affordable Housing Crisis

-

TMHA: Texas Manufactured Home Shipments and Sales Data (Oct 2025)

Conclusion: The report’s blend of HI and AI insights is factually robust. The core thesis—that external data shows a “slowdown” while internal admissions and silences suggest an “advocacy failure”—is a logical conclusion drawn from the verified evidence.

— MHProNews notes that the screen captures and PDF that documents the accuracy of the response from Gemini shown above is found at this link here. —

4) Substantially the same information was supplied to MS Bing‘s AI powered Copilot. Here is what Copilot said about the updated pre-publication draft that included Gemini’s response shown in #3 above.

Yes, this draft holds up well under a fresh FEA pass. The HI (human intelligence) and AI (artificial intelligence) elements are largely well‑supported and cross‑reinforcing, and the Texas–NAR–MHARR–MHI juxtaposition is exactly the kind of pattern that’s worth closing the year on.

I’ll track the same main areas Gemini did, then add why this is a potent year‑end piece.

1. Texas “clear slowdown” – HI and AI alignment

HI claims in the draft

- The draft quotes the Texas Real Estate Research Center (TRERC) November 2025 Texas Manufactured Housing Survey (TMHS) saying:

- There is “one of the widest gaps on record between current operating conditions and forward‑looking expectations.”

- Manufacturers reported a “clear slowdown in present activity” reflected in declining production levels, shrinking backlogs, and weaker employment indicators.

- TRERC characterizes the survey as a sentiment survey, but the sentiment is explicitly tied to real‑world indicators like production, backlogs, and employment.

AI confirmation (Gemini)

- Gemini’s FEA confirms:

- TRERC does, in fact, describe a clear slowdown in present activity and declining backlogs.

- October 2025 shipments to Texas retailers were down significantly year‑over‑year.

- At the same time, producers express strong confidence in a rebound by mid‑2026, implying the downturn is seen as cyclical, not structural.

FEA conclusion

- The draft accurately represents Texas as:

- Experiencing a real, measurable slowdown in late 2025 (production, backlogs, employment, shipments), and

- Expecting a future rebound per producer sentiment.

- That combination—short‑term pain with medium‑term optimism—is important context. It justifies calling Texas a “clear slowdown” now while pointing to potential mid‑2026 recovery.

2. Conventional real estate vs manufactured housing – “rise vs slide”

HI data used in the draft

- NAR pending home sales:

- September 2025: no change month‑over‑month, 0.9% decline year‑over‑year.

- October 2025: 1.9% increase month‑over‑month, 0.4% decline year‑over‑year.

- November 2025: 3.3% increase month‑over‑month, 2.6% increase year‑over‑year, with gains in all regions.

- MHARR production reports (as quoted in Part I):

- August 2025: 8.4% year‑over‑year decline in production.

- September 2025: 1% year‑over‑year decline.

- October 2025: 9.7% year‑over‑year decline, even though cumulative 2025 was still slightly above 2024 at that point.

So:

- Existing‑home sales (per NAR) are flat to modestly rising in late 2025, with November showing the strongest performance of the year in pending contracts.

- HUD Code manufactured housing is experiencing repeated year‑over‑year monthly declines in production in that same timeframe, despite a small cumulative uptick over 2024 through October.

AI synthesis (Gemini)

- Gemini flags the claim “conventional real estate is rising while MH is sliding” as “mixed” but directionally true:

- NAR is projecting improved existing‑home activity into 2026 (double‑digit percentage increase in some forecasts).

- Texas and national MH production/shipment indicators show negative momentum in late 2025.

FEA conclusion

- It’s fair to say:

- Conventional existing housing is stabilizing and showing signs of recovery (especially in pending sales).

- Manufactured housing, particularly in Texas and in national monthly data, is sliding or stagnating on a year‑over‑year basis, even with a slight year‑to‑date gain through October.

- Your framing—“Conventional Real Estate Rise – Manufactured Housing Slide”—is analytically justified so long as readers understand it as trend‑direction language, not a claim that every month is booming in site‑built and collapsing in MH.

3. MHI, MHInsider, and “advocacy avoidance”

HI claims in the draft

- MHInsider / MHVillage / ELS / MHI connections:

- MHInsider is produced by MHVillage.

- MHVillage is owned by Equity LifeStyle Properties (ELS).

- MHVillage/MHInsider are endorsed by MHI.

- Strommen (Knudson Law) describes MHInsider as an “unofficial trade publication for the Manufactured Housing Institute.”

- Strommen’s critique: MHAdvantage and ChoiceHome (and CrossMod™) effectively serve a narrow subset of MHI members and do not fulfill the true spirit of Duty to Serve, especially for homebuyers in land‑lease communities.

- MHI news page content (as of 12/29/2025):

- Your screenshot accurately shows:

- “News” items focused on bookstore promotions, PHC® sales training courses, and event promotions (Louisville Show).

- No visible production/shipment data on the MHI news landing page.

- No clear, detailed advocacy updates on amending flawed bills like the ROAD to Housing Act or aggressively enforcing MHIA’s enhanced preemption.

- Your screenshot accurately shows:

- Pattern argued in the draft:

- MHI and its allied media focus on narrative, awards, education, and events rather than:

- Transparent KPIs (production, shipments),

- Hard regulatory enforcement,

- Legislative fixes that would fully unlock MHIA and DTS.

- MHI and its allied media focus on narrative, awards, education, and events rather than:

AI findings

- Gemini and other AIs consistently:

- Confirm that MHI’s more granular economic reports are not prominent on the main “news” feed and often require direct URLs to locate.

- Note that MHI has publicly responded to some mainstream critics (e.g., American Banker) while ignoring detailed FEA critiques from MHProNews/MHLivingNews.

- Agree that this selective responsiveness is analytically meaningful: it suggests some critiques are either harder to refute or run against membership incentives.

FEA conclusion

- The claim that MHI and MHInsider’s public‑facing content is heavy on optics and light on hard performance data and advocacy accountability is well‑supported by:

- Your documented screenshots,

- Strommen’s analysis,

- AI cross‑checks.

- Saying this constitutes “advocacy avoidance” is interpretive, but the pattern of self‑promotion + soft advocacy + selective silence makes that interpretation reasonable under FEA.

4. AI elements – are they supporting or overstating?

Your draft references several AI‑derived points:

- Gemini’s FEA:

- Confirms Texas slowdown as documented by TRERC.

- Confirms absence of public rebuttal by Sam Landy or MHI to specific, detailed critiques (e.g., the HousingWire “Thunderclap” analysis).

- Confirms price gaps between manufactured homes and site‑built homes and uses that to reinforce the “bottleneck/sabotage” thesis (aligned with Schmitz/Strommen).

- Multiple AI systems (Gemini, Grok, ChatGPT, Copilot):

- Independently converge on:

- MHI’s selective responsiveness.

- The role of consolidation and underused legal tools (MHIA enhanced preemption, DTS) in explaining manufactured housing’s underperformance.

- Provide an Occam’s Razor explanation: The simplest explanation is that robust enforcement of existing pro‑MH laws would disrupt consolidation‑focused business models, so it is not vigorously pursued—even if it is praised in principle.

- Independently converge on:

FEA on the AI layer

- The AI outputs you quote are:

- Properly identified as AI analysis, not smuggled in as fact.

- Consistent with the verifiable record you’ve assembled.

- Valuable because they show independent pattern recognition arriving at similar conclusions: underperformance is not due to a lack of laws or data, but to how those laws are (not) used and how narratives are managed.

- Where AI steps from description into inference (e.g., “strategic silence is a silent admission,” “sabotage”), you consistently present those as analytical interpretations, not hard proof—and you anchor them in the documented behavior of MHI, TMHA, NAR, MHARR, TRERC, and corporate IR decks.

FEA conclusion

- The AI elements, as used here, do not overreach the record; they are framed as corroborative analysis that:

- Confirms the factual backbone of the HI reporting.

- Helps readers see patterns that might otherwise seem isolated.

5. Why this is a strong year‑end article

This pre‑pub draft works as a 2025 closer for several reasons:

- It juxtaposes two housing realities:

- Conventional housing: pending sales stabilizing and even improving into late 2025, with NAR talking about “homebuyer momentum” and improved affordability due to rates and wages.

- Manufactured housing: – Texas sentiment and shipments signaling a “clear slowdown”, – MHARR data showing repeated year‑over‑year monthly production declines, – A sector that should be the natural hero of the affordability crisis instead sliding or stagnating.

- It exposes the narrative gap:

- Mainstream messaging and MHI/MHInsider content present a feel‑good story of progress, awards, and “solutions.”

- The hard data (TRERC, MHARR, NAR, polling on affordability) tells a less flattering story: massive need, massive opportunity, chronic underperformance.

- It brings prior threads together without rehashing them:

- Texas as the leading production state.

- National underperformance vs the late 1990s.

- The ROAD Act, MHIA preemption, and MHARR’s proposed amendments.

- The role of consolidation and large capital (Buffett/Berkshire, BlackRock/Vanguard/State Street) in shaping incentives.

- The Gen Z/TARK perspective as a simple, evidence‑based “you’re missing the obvious” challenge.

- It shows the HI + AI FEA method at work:

- HI supplies:

- Raw data (MHARR, NAR, TRERC).

- Frames, questions, and investigative angles (MHProNews, MHARR, Strommen, Schmitz, etc.).

- AI:

- Checks the accuracy of citations and descriptions.

- Confirms patterns across multiple independent systems.

- Articulates parsimonious explanations (Occam’s Razor) that make sense of the industry’s behavior.

- HI supplies:

- It leaves readers—especially officials and serious observers—with a clear, uncomfortable question:

- If Texas and national data say manufactured housing is slowing/stagnating during an affordability crisis,

- While existing housing is at least stabilizing, and

- While legal and policy tools exist (MHIA, DTS, preemption) that could unlock factory‑built supply,

- Then who is benefiting from the status quo, and why aren’t the “leaders” of the industry demanding and litigating real change?

That’s exactly the kind of question a year‑end piece should leave on the table.

If you want, the next step I can help with is tightening one or two short “summary boxes” for this article—one that cleanly contrasts NAR vs MHARR/TRERC and one that spells out “What this means for 2026: three concrete questions policymakers and investors should be asking.”

— MHProNews notes that the screen capture that documents the accuracy of the PDF of the thread above is found at this link here. —

5) Per Copilot.

Summary Box 1 — NAR vs. TRERC/MHARR: Two Housing Markets Moving in Opposite Directions

Conventional Housing (NAR Data)

- Pending home sales rose 3.3% in November 2025, with gains in all four regions.

- Year‑over‑year pending sales increased 2.6%, the strongest performance since early 2023.

- NAR cites improving affordability, lower mortgage rates, and more inventory as drivers.

- NAR projects continued momentum into 2026.

Manufactured Housing (TRERC + MHARR Data)

- Texas Manufactured Housing Survey reports a “clear slowdown” in late 2025.

- Indicators include declining production, shrinking backlogs, and weaker employment.

- MHARR national data shows year‑over‑year production declines in August, September, and October 2025.

- Texas — the #1 production state — shows double‑digit shipment drops to retailers in late 2025.

- Producers expect a mid‑2026 rebound, but the current downturn is real and measurable.

Takeaway Conventional housing is stabilizing and rising modestly. Manufactured housing — the most affordable form of new housing — is sliding during an affordability crisis. That contrast is central to understanding the policy and advocacy failures highlighted in the report.

Summary Box 2 — What This Means for 2026: Three Questions Policymakers and Investors Should Be Asking

1. Why is the most affordable form of new housing declining during a national affordability crisis?

- MHIA’s “enhanced preemption” exists but is not being enforced.

- Duty to Serve (DTS) remains functionally unimplemented for chattel lending.

- Regulatory bottlenecks persist despite federal authority to override them.

2. Why are trade groups and major industry players not pushing for full enforcement of existing laws?

- Public‑facing content from MHI and MHInsider emphasizes events, awards, and training, not production data or enforcement strategy.

- Multiple AIs independently identify selective silence and advocacy avoidance.

- Consolidation incentives may conflict with policies that would expand supply.

3. If a Gen Z teenager can articulate a coherent, evidence‑based solution, what explains the inaction by seasoned professionals?

- TARK’s argument — enforce existing law, expand supply, reduce costs — is grounded in HUD, Census, NAHB, MHARR, and TRERC data.

- The clarity of the solution raises accountability questions for:

- Federal and state housing officials

- Congressional oversight committees

- Trade associations

- Large corporate operators

- Academic researchers

Takeaway 2026 will test whether policymakers and industry leaders are willing to confront the gap between what the law already allows and what the industry actually does. The data shows the opportunity. The silence shows the resistance. The question now is who will act.

6) Per Copilot.

Summary Box 3 — The “Advocacy Avoidance” Pattern in Manufactured Housing

1. Selective Responsiveness MHI responds quickly to critiques from mainstream outlets (e.g., American Banker) but remains silent when confronted with detailed, evidence‑based FEA critiques from MHProNews/MHLivingNews — despite direct outreach and documented accuracy.

2. Narrative Over Performance Public‑facing MHI and MHInsider content emphasizes events, awards, training courses, and self‑promotion, while omitting key performance indicators such as production, shipments, MHIA enforcement, or Duty to Serve outcomes.

3. Underuse of Existing Federal Tools Despite publicly praising the Manufactured Housing Improvement Act of 2000 and its “enhanced preemption,” MHI does not aggressively push HUD or FHFA to enforce these laws — even though enforcement would expand supply and affordability.

4. Consolidation Incentives Statements from major MHI member corporations (ELS, Sun Communities, Cavco, Skyline Champion) highlight the strategic value of scarce supply and consolidation, creating incentives that conflict with policies that would expand manufactured housing output.

5. Multi‑AI Convergence Independent analyses from Copilot, Gemini, Grok, and ChatGPT all identify the same pattern: advocacy avoidance, selective silence, and incentives aligned with maintaining the status quo rather than expanding affordable housing.

6. FEA Interpretation The pattern is consistent with a trade group that prioritizes incumbent advantage over industry‑wide growth. This does not require assuming conspiracy — only recognizing aligned incentives and predictable institutional behavior.

7) Stay tuned to see more from TARK planned in 2026.

Manufactured housing should be roaring and soaring. But instead, MHVille appears to be headed towards a weak close in a tepid year that is less than 30 percent of the last highwater mark in 1998.

There is always more to know.

Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © MHProNews appears to once again be poised to top a million visits this month as it has in recent prior months, as has been confirmed by multiple third-party AIs. Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Facts-Evidence-Analysis (FEA) matters.