LAS VEGAS, NV – Tuesday, April 26, 2011. Members of the MHMSM.com team are present and share news of the morning sessions.

Over 700 have Pre-registered for MHI’s 2011 National Congress & Expo for Manufactured and Modular Housing, and the word is that many more have signed in at the registration desk who were not pre-registered. Hundreds of Industry professionals have gathered here in Las Vegas to get the latest and greatest ideas.

Here’s a quick look at some of the highlights of this morning’s sessions.

1. In the Opening Session, Dr. Henry Fishkind, PhD. (Fishkind and Associates) spoke on the recent economic data and events to evaluate their impact on housing markets. Taxation is not the answer; we must control spending, lest we end up like Portugal, Greece, etc. With the rise in interest rates and population (population over 65 will double by 2030), there is a tremendous opportunity to serve the 65+ market. With the excess supply of existing homes, depression in sales, slow processing of judicial foreclosures and the efforts to shrink the deficit, markets are likely to be down until 2014.

2. Rental and Lease-Purchase Option Programs for Homes in Communities was moderated by Richard Winkelman (Brookside Communities), with speaker Chris Parrish (Parrish Manor). A panel of experienced owners and managers discussed two community options: pure rental (RTO) and lease-purchase programs.

• Jim Anderson (Hometown America) noted over half the attendees are renting and more plan to do so. Michigan (MI) has been hardest hit. Getting a security deposit and a home in better condition from a renter is much better than home sales. He has been in the business for 19 years, but Hometown sales kept going down. Today Hometown is seeing stabilizing and increasing occupancy; 541 rentals in MI alone is leading to expansion, and they are rolling rentals out to other states. While he foresees being in the lease business in the next five years, they do have a 12-month exit strategy.

• Chris Parrish (Parrish Manor) commented that one family-owned community in Raleigh NC opened in 1998 and tried unsuccessfully to get a Freddie Mac long term lease, so they have done rentals and leases since 2003-2004. They purchased ten used homes a year to fill up the community. Their turnover was destroyed on foreclosures, but they’ve had no problems with rentals. In fact, there are fewer turnovers than apartments, apartments being their competition. MH 3BR homes are cheaper and bigger than an apartment; more square footage at a better price. Maintenance is the biggest expense with 8-9 calls a day for maintenance. It amounts to about $20,000 a month, which is a scary number, but better than empty homes and vacant lots.

• Richard Winkleman (Brookside Communities) got into sales in 2003, and shortly thereafter into finance. 2008 was a good year in sales and financing, and then 2009 dropped off. Though Brookside could offer financing, many prospects were not willing to commit to a long term decision (i.e., purchase). Brookside feared renters would not keep up the homes, and managers feared a heavier work load with too busy a schedule. But by end of 2009, there were 40 rentals on the books. Their rentals continue to evolve and become an ever larger part or their portfolio. It is not a short term fix; it is a long term strategy.

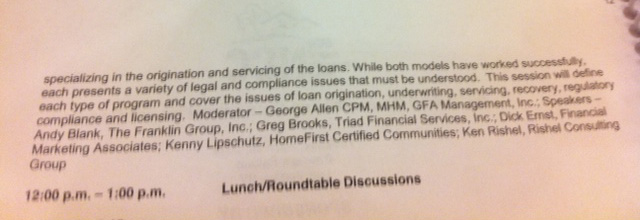

3. Operating In-house Finance Programs in Communities – Which Is Best for You? George Allen (GFA Management, Inc.), moderator, with Speakers Greg Brooks (Triad Financial Services), Andy Blank (Franklin Companies), Dick Ernst (Financial Marketing Associates), Kenny Lipschutz (HomeFirst Certified Communities) and Ken Rishel (Precision Capital Funding). These pros discussed two successful models of in-house financing programs, each of which has legal and compliance issues that must be understood.

• Dick Ernst (Financial Marketing Associates) proposed creating a direct lending platform, where the customer applies directly with SACU. This is targeted for MHCs large and small who do not want to deal with financing or licensing. Since MHC not lending, MHC invests in paper, CUFBL does license compliance.

• Kenny Lipschutz (HomeFirst Certified Communities) pulled out loans from 2004, 45 loans approved; 18 lenders on first page. Today eight MHCs have 539 loans in house with $16 million in loan balances. He works with in-house sales and finance team and uses an outside firm to make sure everything is legal. Month to month delinquency is 2.5 to 6 percent; last year under 4 percent delinquency. Properly managed, it works.

• Greg Brooks (Triad Financial Services) deals with 95 percent chattel lending. Being in lending is expensive, time consuming and distracts you from your core business. Triad dealt with 250 banks in its 50 year history. So they know how to do the required reporting. They have systems, capabilities and can do a variation of anything, but offer full service to community owners.

• Andy Blank (Franklin Companies) is an MHC operator. They can’t afford to do all the financing for themselves, so need a program similar to what Kenny Lipschutz described.

• Ken Rishel (Precision Capital and Rishel Consulting) spoke of the need to set up a separate business – not retailing, not MHC operations. Borrow at 5 percent; put it out at 12.5 percent. Precision Capital takes care of the legal and compliance issues, state and federal licensing. Their approach is: Buy here, pay here.

The panel also addressed two related questions: Who has the end game on 2-5 million portfolios? And how much cost is there in servicing these programs?

Lunch/Roundtable Discussions offered a welcome opportunity to interact with other attendees between morning and afternoon presentations.

# #