A senior management team member for a HUD Code manufactured housing (MH) production company told the Daily Business News about the emerging plan for MH Communities, according to a REIT moving towards capacity.

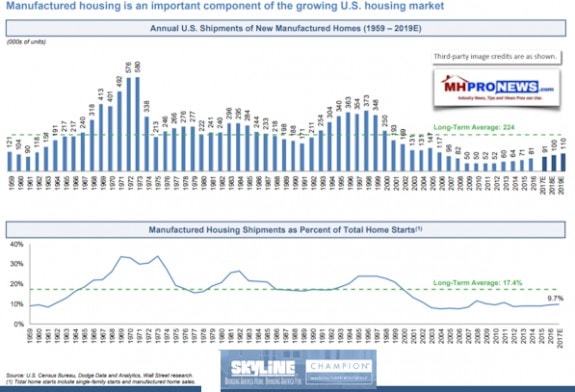

As MHProNews has reported, a third or more of new manufactured home shipments are going into land-lease communities.

While new homes are being purchased by communities of all sizes, large numbers are being ordered by “portfolio operations,” including Real Estate Investment Trusts (REITs), such as Sun Communities (SUI), Equity LifeStyle Properties (ELS), and UMH Properties (UMH).

As an Manufactured Housing Institute (MHI) member company president told the Daily Business News, if new home shipments going into land lease community are factored out, then new home production is essentially flat. In some states, shipments of new homes are still declining since the official bottom for the industry was hit in 2009.

While Manufactured Housing Overall Rises, Some Slip Sliding Away

Another MHI member producer’s president and vice president both said that based upon current trends, they expect a three to five year window, before MH Communities fill their vacancies of existing home sites.

Against that backdrop, a new MHI production source tells MHProNews about his insights learned from the plans that Sun Communities (SUI) and another major portfolio operation.

Sun, a titan in the MH Communities sector, are planning beyond their current vacancies. They, per our source, are looking beyond vacant lots, and planning on replacing older homes on occupied but dated home sites. Some of those sites are odds sizes by today’s standards, he explained, which may require special models of homes designed to fit certain lots.

If that replacement of aging inventory becomes a trend, as rental units did after Dodd-Frank, such a replacement process may continue the orders coming from giant land lease operations.

That means the production cliff some are concerned about could be extended beyond the thousands of now vacant home sites in MHCs.

That may sound like good news for HUD Code home producers. But those replacement plans are not likely to be as busy as the current infill in the dwindling numbers of vacancies in MHCs, coming primarily from homes being offered as rental units.

The fact that so many homes are being sold as rentals instead of sales to home buyers as was the historic norm is in itself a troubling trend, per producers.

The Take Aways

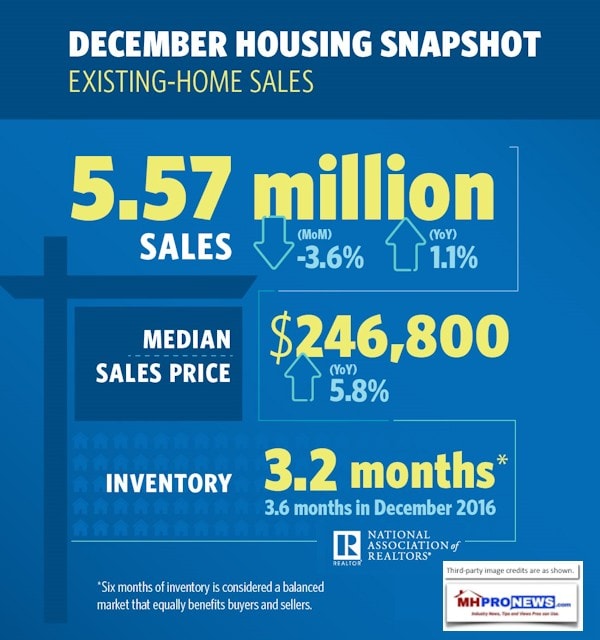

All of the above implies a coming new home shipment cliff in manufactured housing, unless some new trend or development takes place.

While the industry’s members are in several cases understandably celebrating modestly rising new home shipment levels, the underlying realities are not as rosy.

Given the nature of their business, MH production companies have to be aware of such trends.

As another HUD Code MH producer – an MHI member and careful reader of MHProNews – has said, MHI’s official policies, plans and positions “have made no sense” for “several years.”

All of the reports noted herein are from MHI only member companies, not from members of the Manufactured Housing Association for Regulatory Reform (MHARR).

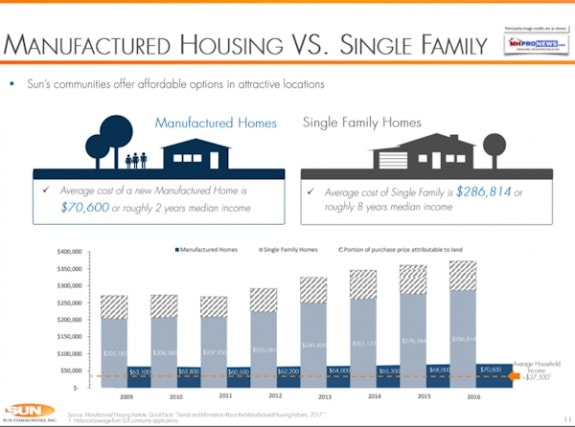

Given the affordable housing crisis, and MHI’s indirect admission of their failed industry promotion and marketing plans, industry professionals and public officials alike ought to take notice.

Some producers told MHProNews that they are “open” to being acquired by larger companies.

So the data like the above ought to be of concern to independents, including MH retailers and other industry operations who want to remain independent.

Among independent factory home builders, even those planning to sell at some foreseeable point, should realize that Warren Buffett and another larger player are both known for trying to buy “cheap” rather than at full value. If historic normal shipment levels existed today, it would translate as more value for those firms who are thinking about selling.

The latest report by the Manufactured Housing Association for Regulatory Reform (MHARR) lays out step-by-step examples of how MHI was on the wrong side of issues that both associations were engaged with. In case after case, MHI had to pivot toward MHARR’s original and steady stance. How can that be so consistently true?

In all of this, per sources, MHI is being revealed as de facto working mainly for the interests of major consolidators, while posturing “activities” that in fact has proven time and again to largely be fruitless. A look at the dues structure of MHI, and who three of the four MHI Executive Committee seats are held by paints a picture.

The Daily Business News review of the MHARR report is linked here. The full length version without commentary of MHARR’s report is linked here. “We Provide, You Decide.” ©. (News, analysis, and commentary.)

Related Reports:

“Razzle Dazzle,” Says Former Manufactured Housing Institute Member

“Winners and Losers,” L2 Founder, Prof Scott Galloway on Monopolies

(Third party images, cites are provided under fair use guidelines.)

Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates. You’ll see in the first issue or two why big, medium and ‘mom-and-pop’ professionals are reading these headline news items by the thousands. These are typically delivered twice weekly to your in box.

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.