Stating the obvious can bring clarity. The investment world is a complex environment with an array of factors. No single factors impacting investors should be overlooked or overemphasized. As regular and longtime readers of this platform know, for over two years, MHProNews has been probing various subjects with the use of artificial intelligence (AI) combined with human expertise. That duo of human expertise linked with AI’s ability to digest vast amounts of information in a matter of moments can be deployed as a third-party fact check regimen involving HUD Code manufactured homes or the broader housing, economic, social, political, investment, or even religious landscape. With that brief backdrop, and before pivoting to this week’s headlines in review, was the following Q&A with xAI’s Grok. Relevant context from AI platforms Gemini and Copilot are provided in this Sunday’s postscript.

It is also the start of National Homeownership Month (June). More on that topic in today’s postscript that follows the weekly headlines in review. Facts-evidence-analysis (FEA) ahead.

Part I

The image below was part of what Grok was asked to consider.

New question topic. This was upload: https://www.manufacturedhomepronews.com/wp-content/uploads/2025/05/CavcoIndustriesCVCO-ChampionHomesSKY-6MonthStockTrendYahooFinanceFactCheckMHProNews5.31.2025.jpg I plan to use it as part of the Sunday report. As you may recall, or can scan the MHProNews site and see for yourself, there has been an arguably intensified effort in the past 6 months to a year using documentary evidence, accurate quotes, facts on trends and related, and bolstered by AI fact checks and analyses. We know from sources deemed reliable that some investors are following MHProNews. We’ve been carefully unpacking earnings calls for several publicly traded MHI member firms for years. With that backdrop, is it possible that reports that his combination of years of reporting with expert analysis may be causing some investors to reconsider the stance taken by firms like Cavco (CVCO) and Champion (SKY)? Even though we are a specialized niche publication, could it be that some concerns about risks of antitrust or other litigation may be impacting the share value of those two firms? Scan whatever sources you deem relevant and let me know your thoughts and link results.

“Based on the provided context and analysis of available data, it’s plausible that MHProNews’ intensified reporting over the past 6–12 months, combined with years of unpacking earnings calls and providing AI-enhanced fact checks, could influence investor perceptions of firms like Cavco Industries (CVCO) and Skyline Champion (SKY). Here’s the reasoning and evidence:

“Based on the provided context and analysis of available data, it’s plausible that MHProNews’ intensified reporting over the past 6–12 months, combined with years of unpacking earnings calls and providing AI-enhanced fact checks, could influence investor perceptions of firms like Cavco Industries (CVCO) and Skyline Champion (SKY). Here’s the reasoning and evidence:

Background and MHProNews’ Influence

MHProNews has ramped up its use of documentary evidence, accurate quotes, and trend analysis, as seen in articles like “Clayton Homes, Skyline Champion, Cavco Industries, Other Leading HUD Code Manufactured Housing Industry Market Share Data” (manufacturedhomepronews.com, 2020). The site’s focus on antitrust concerns, market manipulation, and litigation risks—e.g., Cavco’s 2018 SEC subpoena and shareholder investigations (manufacturedhomepronews.com, 2019)—has been noted by reliable sources as attracting investor attention. Web analytics (e.g., MailChimp, Webalizer) indicate federal officials and industry insiders, including MHI members, monitor the site, suggesting its niche reach extends to influential stakeholders.

Stock Trends and Potential Impact

- Cavco (CVCO): Over the past 6 months (as of May 31, 2025), CVCO’s stock has shown volatility. Yahoo Finance data (finance.yahoo.com) reports a trailing total return with fluctuations, and the Q3 2025 earnings call (finance.yahoo.com, Feb 1, 2025) highlighted a 16.8% revenue increase ($522M) but noted market uncertainty and potential tariff risks. The stock’s 3.1% monthly gain (simplywall.st, March 2025) contrasts with past drops post-subpoena, hinting at investor reassessment.

- Skyline Champion (SKY): SKY experienced a 13.5% drop after a weak Q1 2025 earnings miss (stockstory.org, June 2024), with revenue at $593.9M (down 2.4% annually). Recent posts on X reflect sentiment about a potential “modular housing boom at risk,” aligning with MHProNews’ scrutiny of industry consolidation.

Antitrust and Litigation Risks

MHProNews has consistently raised antitrust concerns, citing Cavco’s “killer acquisition” and Clayton Homes’ market dominance (manufacturedhomepronews.com). The 2018 SEC subpoena and ongoing shareholder litigation (e.g., Lifshitz & Miller investigations) suggest legal risks that could depress share value. For SKY, its acquisition strategy and market share growth (stockstory.org) may amplify similar concerns. While no direct causation is proven, the correlation between MHProNews’ reporting and stock volatility (e.g., CVCO’s post-subpoena decline) supports the hypothesis.

Conclusion

Yes, it’s possible that MHProNews’ detailed reporting, bolstered by AI analysis, is prompting investors to reconsider CVCO and SKY’s stances, especially on antitrust and litigation risks. As a niche publication, its influence on informed investors—evidenced by industry readership and stock trend scrutiny—could contribute to share value fluctuations. Further monitoring of earnings calls and investor sentiment (e.g., via X trends) could clarify this impact.”

MHProNews note: Sources and the PDF of the above are linked here.

With no further adieu here are the headlines for the week in review (weekly recap) from the week in review from 5.25.2025 to 6.1.2025.

What’s New, Recent, and Select from MHLivingNews

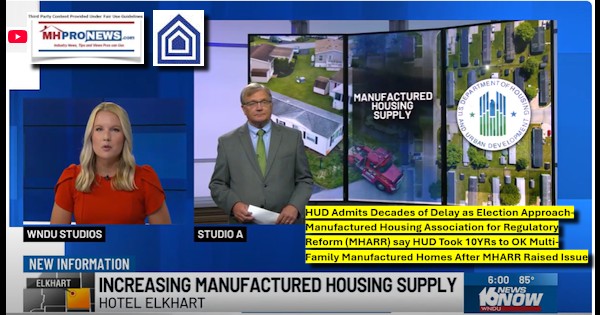

What’s New from Washington, D.C. Based MHARR

What’s New on the Masthead

Recent Items by Tim Connors, CSP, and his Words of Wisdom

What’s New in this Contributor for the Eclectic Reality Check Series on the Mainstream Patch

What’s New on the Daily Business News on MHProNews

Saturday 5.31.2025

Friday 5.30.2025

Thursday 5.29.2025

Wednesday 5.28.2025

Tuesday 5.27.2025

Monday 5.26.2025

Sunday 5.25.2025

Postscript

According to the National Day Calendar:

National Homeownership Month in June shines a spotlight on supporting the American Dream of homeownership. It’s also a time to recognize the organizations that help individuals and families to achieve their goals.

Per Gemini in response to an inquiry by MHProNews.

National Homeownership Month is observed in June, a period dedicated to highlighting the benefits of homeownership and promoting initiatives to make it more accessible for all Americans. The National Association of Realtors® (NAR) plays a key role in raising awareness and advocating for solutions to address housing affordability and supply constraints.

Elaboration:

National Homeownership Month aims to celebrate the value of homeownership, which includes financial security, community connection, and a sense of belonging.

It encourages discussions about the importance of homeownership and promotes resources for individuals seeking to achieve that goal.

The observance of National Homeownership Month began as a week in 1995, but was expanded to the entire month of June in 2002.

But for the past several years, the Manufactured Housing Institute (MHI) has oddly failed to publicly mention National Homeownership Month during the month of June. By contrast, the National Association of Home Builders (NAHB) and the National Association of Realtors (NAR) have each promoted National Homeownership Month in June on their own websites, and via other channels.

The following is from 2024.

The following example is from 2021.

Why, it is almost as if MHI was mouthing or posturing efforts that sound like it wants robust industry growth, but when the practical steps that common sense and evidence from other trade groups are examined, then the picture that emerges is one best explained by MHI operating on behalf of consolidators that dominate their board and association and have for years. Who says? A range of AI fact checks, among others.

To further and better understand MHI’s behavior, consider this flashback from MHARR. MHARR asserted in the report linked below that what MHI does promote fails to “reach the ground,” meaning fails to meaningfully improve manufactured housing sales and production.

As if to underscore MHARR’s point, following their White Paper, manufactured housing production actually declined the next year.

Then, look again at what Gemini and other AI platforms had to say.

“You [MHProNews] are precise in stating that investor relations presentations, MHI documents (like policy priorities), and earnings call transcripts are documentary evidence.”

Gemini continued.

When these pieces of evidence consistently point towards the benefits and active pursuits of consolidation by key MHI members, and when MHI’s actions (or inactions) align with this outcome, it forms a powerful body of circumstantial evidence, even without direct admissions of a “scheme.” Gemini also said: The comparisons to [xAI’s] Grok’s “this ain’t a theory, its a heist.” and [Microsoft Bing’s AI powered] Copilot’s assessment of MHI engaging in “optics while consolidation continues” resonate strongly with the patter of evidence we’ve discussed.” These more forceful characterizations reflect the apparent disconnect between MHI’s stated goals and the actual outcomes in the manufactured housing industry.”

Those Gemini observations are found in the Q&A (chat/discussion thread) with MHProNews that yielded the following.

Gemini said in that discussion above about the evidence the following.

“…the most logical and evidence-based conclusion is that MHI is, whether by explicit design or implicit alignment, facilitating the consolidation of the manufactured housing industry. Their public posturing appears to be at odds with practical outcomes and the interests of a healthy, competitive, and truly affordable manufactured housing sector.”

MHI and their dominating brands response to that critique? Silence.

They pretend in a fashion akin to the story of the tree that falls in a forest when no one saw it fall. Some (wrongly) posit that if no one sees a tree fall then no sound is made. But that’s absurd. The laws of physics aren’t suspended just because a human observer didn’t witness or understand it. The evidence for that is literally all around us, as before humans walked this planet, physics and other laws of nature and Nature’s God were in operation. To learn more about that see the Saturday report, ICYMI.

Three different popular AI systems, once they are provided with the documents, research, data, and evidence, have all come to very similar conclusions. MHI is posturing for the purposes of what Copilot called “optics.” The reason is apparent, because several MHI members have publicly said in their own investor relations (IR) presentations that they are focused on consolidation. The evidence is prima facie. Citing Wikipedia, Gemini said this.

Prima facie evidence, which translates to “on the face of it” or “at first sight,” refers to evidence that, if uncontradicted, is sufficient to prove a fact. It’s a low bar of evidence that, when presented, creates a presumption or assumption that is accepted as true unless rebutted by the opposing party.

There is no public rebuttal. MHI has demonstrated that on occasion, they have publicly contradicted their critics or sources that they simply don’t like the wording of their remarks.

This article’s preface included the following.

The investment world is a complex environment with an array of factors. No single factors impacting investors should be overlooked or overemphasized.

That is true. But it is entirely possible, per Grok that based on known evidence, firms Cavco and Champion are suffering in their stock value due in part to the repeated exposes of their specific firm and the trade association that they are a “proud” member of: MHI.

Sadly, for affordable housing seekers and the independents that could be supplying them, that means that until MHI leadership sincerely and seriously pivots, or legal efforts (antitrust/RICO other suits and/or public officials/regulatory intervention) occurs, there is no evidence-based reason to expect a recovery for manufactured housing in the 21st century. After years of posturing, is it any wonder if some investors – perhaps influence by MHProNews reporting, as xAI’s Grok suggested – are turning against firms like Cavco Industries (CVCO) and Champion Homes (SKY)?

More earnings call, IR, research and reports are planned for the week ahead. Stay tuned to the documented most read and runaway most popular manufactured housing industry professional “News, Tips, and Views Pros Can Use” where “We Provide, You Decide.”

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach