Facts are nettlesome things.

Fact-checks and comparisons of behavior are useful for intelligent, inquiring professional and investor minds. It is arguably crucial for the majority of manufactured housing independents, in all sectors of the industry.

The Backdrop

On January 2nd, current House Financial Services Committee Chairman Jeb Hensarling issued a statement, found further below in its entirety, on the topic of the Government Sponsored Enterprises (GSEs).

The Daily Business News on MHProNews wanted to see how the two major national association’s responded to this release. On Nov 5th, Manufactured Housing Institute (MHI) issued a ‘Housing Alert’ to their members. On November 6th, Manufactured Housing Association for Regulatory Reform (MHARR) issued their statement.

With those two statement now available from the Arlington, VA based Manufactured Housing Institute (MHI) and the Washington, D.C. based Manufactured Housing Association for Regulatory Reform (MHARR) now known, each of them will be shared below, so MHProNews readers can examine them in their entirety.

MHARR’s full statement, published yesterday, is shown below.

MHI’s full statement? There wasn’t one, even though their housing alert went out 3 days after Chairman Hensarling’s press release.

On financing – a critical issue to thousands of manufactured housing industry professionals, why didn’t MHI weigh in? MHI’s topic from January 5, is shown in the screen capture below, and failed to mention this press release from Chairman Hensarling. What the MHI release did was pat themselves on the back for more emails received on a comments. But what did MHI and their emails actually accomplish? Why didn’t they mention this press release from Chairman Hensarling?

For long-time MHProNews readers, isn’t the MHI pattern becoming clear? They posture doing something, send in nice sounding words, but what do they actually accomplish on behalf of the majority of the industry?

Conflicts of Interest?

There are a growing number of indicators that members of MHI and their state association affiliates are beginning to see just how conflicted they are between their claims of representing “all” of manufactured housing, when in fact they purportedly perform in ways that are demonstrably in favor of their Berkshire Hathaway owned companies.

When polling manufactured housing industry professionals – retailers, communities, producers, others – live in public gatherings by a show of hands, financing is routinely one of their top interests and concerns.

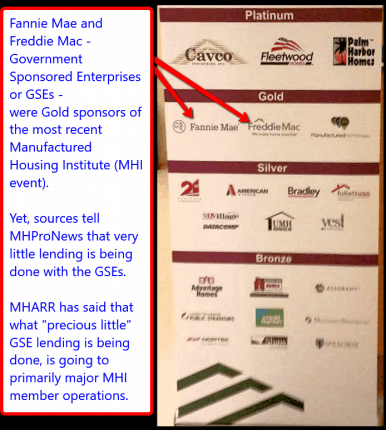

A decade after Congress passed the Duty to Serve (DTS) Manufactured Housing, as part of the Housing and Economic Recovery Act of 2008 (HERA), MHI admits that the GSEs are still doing zero chattel loans. What has their hand-wringing and public posturing actually accomplished?

What MHI hasn’t admitted is what MHProNews reported. Namely, that MHI’s past chairman arguably worked against the GSEs getting into the market at all. ICYMI, see related reports, further below.

Further, as MHProNews has exclusively reported, both of the GSEs are paying MHI. What precisely are they paying for? To NOT lend money on chattel loans?

MHARR’s statement is found below. That MHARR statement will be followed by the statement from FSC Chairman Hensarling. Note that this article was drafted before the outcome of the midterms was known. An initial analysis will follow later on Wednesday.

Hensarling: The GSE model is a failure,

|

WASHINGTON – House Financial Services Committee Chairman Jeb Hensarling (R-TX) released the following statement on Government-Sponsored Enterprise’s (GSE’s) third-quarter reports:

“It’s a continued danger to mistake quarterly reports of dividends paid by Fannie Mae and Freddie Mac to Treasury for good news. In reality, the GSEs, and the more than $5.3 trillion in combined financial liabilities they currently hold, pose a greater systemic risk to our entire economy today than at any point since the financial crisis a decade ago.

“Because Congress has failed to enact reform, taxpayers remain on the hook for every penny of those liabilities, both explicitly and implicitly, when the next housing crisis comes. Meanwhile, the GSEs, which operate only because of their government charters and access to hundreds of billions of dollars of U.S. Treasury backing, continue to grow bigger, riskier, and more unsustainable, accounting for nearly half of all mortgages securitized this year alone.

“Fannie and Freddie apologists want you to believe they’ve learned their lesson, and it’s safe to let them go back to their old, pre-crisis market monopolies. Do not be fooled: the GSE model is a failure, and it is time for it to end. Congress must enact meaningful housing finance reform legislation that protects taxpayers, encourages greater private sector participation, and once and for all ends repeals the GSEs’ government charters.”

###

NOVEMBER 6, 2018

TO: HUD CODE INDUSTRY RETAILERS, COMMUNITIES, DEVELOPERS

AND FINANCE COMPANIES

FROM: MHARR

RE: FINANCIAL SERVICES CHAIRMAN CALLS FOR END OF GSEs

Rep. Jeb Hensarling (R-TX), retiring Chairman of the House Financial Services Committee, has called for an end to the two Government Sponsored Enterprises (GSEs) – Fannie Mae and Freddie Mac – and the repeal of their federal government charters.

In a Press Release (copy attached) issued on November 2, 2018, the Chairman of the House Committee with oversight responsibility for the GSEs’ federal regulator – the Federal Housing Finance Agency (FHFA) – and, by extension, the GSEs themselves, called the “GSE model a failure,” and asserted that “it is time for it to [be] end[ed]” through “meaningful housing finance reform legislation that protects taxpayers, encourages greater private sector participation, and once and for all … repeals the GSEs’ government charters.”

Perhaps nowhere else has the GSEs’ failure to comply with their respective charters — and their failure to serve the lower and moderate-income homebuyers that they were specifically created to help – had a more profoundly negative impact than in the manufactured housing market and, most especially, the 80% of the manufactured housing market comprised of personal property, or “chattel” loans.

Even in the face of an express statutory directive from Congress to finally begin serving the manufactured housing market, including the chattel loans relied upon to finance the industry’s most affordable homes (i.e., the “Duty to Serve Underserved Markets” mandate of the Housing and Economic Recovery Act of 2008), the GSEs – which for decades have refused to provide securitization or secondary market support for manufactured housing loans – have remained defiant and non-compliant, refusing to provide any level of market-significant support for the vast bulk of manufactured home chattel loans. The resulting harm to lower and moderate-income American homebuyers, in the form of either total exclusion from the housing market or higher interest rates than would be the case otherwise, is indefensible and should be unacceptable to the industry, Congress and FHFA. Moreover, these extreme negative impacts have been facilitated and exacerbated by the absence of independent, national representation for the industry’s post-production sector in the nation’s capital to aggressively address this matter, not only with FHFA and the GSEs, but with Congress and the Administration as well.

Accordingly, regardless of whether the House of Representatives, following today’s election, is controlled by Democrats or Republicans, the underlying failure of the GSEs and the “GSE model” has been exposed, and the GSEs’ continuing failure to properly serve the manufactured housing chattel market – despite the DTS mandate — will be a major issue going forward, potentially providing the industry’s post-production sector with a second chance to ensure that securitization and secondary market support for manufactured housing and manufactured home chattel loans are provided by the GSEs on a market-significant basis.

This issue will be discussed in more detail at MHARR’s upcoming Board of Directors meeting.

Manufactured Housing Association for Regulatory Reform (MHARR)

1331 Pennsylvania Ave N.W., Suite 512

Washington D.C. 20004

Phone: 202/783-4087

Fax: 202/783-4075

Email: MHARRDG@AOL.COM

###

Once more, as was true for our first article today, this report is being drafted prior to the outcome of the midterms. Polls are still open at 6:26 PM ET. Our initial post-midterm flash-analysis will follow later Wednesday, 11.7.2018. That’s manufactured housing “Industry News, Tips, and Views Pros Can Use,” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

While GSEs Play Footsy with MHI, Congressional Leadership Demands Answers on FHFA

MHARR Exposes GSES’ Failure On Chattel Financing Before Congress | Manufactured Housing Association Regulatory Reform

FOR IMMEDIATE RELEASE (202) 783-4087 Contact: MHARR Washington, D.C., September 27, 2018 – The Manufactured Housing Association for Regulatory Reform (MHARR), in a submission (copy attached) to the House of Representatives’ Financial Services Committee in conjunction with a September 27, 2018 oversight hearing on regulation of the two “Government Sponsored Enterprises” (GSEs) – Fannie Mae and Freddie Mac – strongly criticized the Federal Housing Finance Agency (FHFA), for failing to implement federal law and, instead, sanctioning the GSEs’ continuing discrimination against lower and moderate-income American consumers seeking to purchase manufactured homes through personal property, or chattel loans.