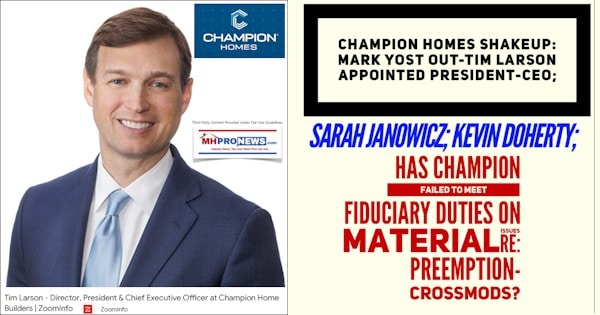

Chief Financial Officer (CFO) Laurie Hough previously said: “…but [Champion is] really more focused on the growth of the company through M&A [mergers and acquisitions, i.e.: industry consolidation]. That would definitely be our top priority.” For whatever range of reasons, as the number two manufactured housing industry producer at this time, Champion Homes (SKY) has learned the hard way that investors have spoken. While there have been upticks, as the featured image above and the more detailed graphic below reflects, shares of SKY have been broadly tumbling for months. The latest Manufactured Housing Institute (MHI) member Champion (SKY) earnings statements and earnings call (the later provided below) clearly did not reverse the 1-year trend of lower stock values, despite inflation and the affordable housing crisis. In Part I, MHProNews provides an annotated (i.e.: MHProNews highlighted, but text unchanged) version of the Seeking Alpha earnings call transcript of Champion’s 5.27.2025 earnings call. Part II will unpack some key portions of various analyst and Champion’s official’s remarks and will do so partially through the lens of the recent revelations of a well-placed industry tipster to MHProNews that are found linked here.

Like the facts or not, try to spin sound facts-evidence-analysis (FEA) or not, facts are what they are. To see the following image in a larger size, in most devices or browsers you can click here or click on the image itself and follow the prompts.

As is usual for MHProNews, details and the big picture matter. Don’t miss the added facts with analysis in Part II. You can call us late for supper, but you can’t say that MHProNews is superficial or lacking in factual details that others can’t, won’t, or for whatever reasons may miss.

Part I. Yellow highlighting is added by MHProNews. The base text is as published by Seeking Alpha transcripts and is provided here under fair use guidelines for media.

Champion Homes, Inc. (SKY) Q4 2025 Earnings Call Transcript

May 27, 2025 5:31 PM ET Champion Homes, Inc. (SKY) Stock SKY

153.8K Followers

Call Start: 08:30 January 1, 0000 9:11 AM ET

Champion Homes, Inc. (NYSE:SKY)

Q4 2025 Earnings Conference Call

May 27, 2025, 08:30 AM ET

Company Participants

Jason Blair – IR

Tim Larson – President and CEO

Laurie Hough – EVP, CFO and Treasurer

Conference Call Participants

Daniel Moore – CJS Securities

Greg Palm – Craig-Hallum Capital Group

Matthew Bouley – Barclays

Mike Dahl – RBC Capital Markets

Phil Ng – Jefferies

Jesse Lederman – Zelman & Associates

Jay McCanless – Wedbush Securities

Operator

Good morning. Welcome to the Champion Homes Fourth Quarter Fiscal 2025 Earnings Call. My name is Sherry, I will be coordinating your call today. A question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded. I will now turn the call over to your host, Jason Blair to begin. Jason, please go ahead.

Jason Blair

Good morning. Thank you for taking the time to join us for today’s conference call and review of our business results for the fourth quarter and full year ended March 29, 2025. Here to review our results are Tim Larson, Champion Homes President and Chief Executive Officer; and Laurie Hough, Executive Vice President, Chief Financial Officer and Treasurer. Earlier this morning, we issued our earnings release.

As a reminder, the earnings release and statements made during today’s call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations. Such risks and uncertainties include the factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Please note that today’s remarks contain non-GAAP financial measures, which we believe can be useful in evaluating performance. Definitions and reconciliations of these measures can be found in the earnings release.

I will now turn the call over to Champion Homes CEO, Tim Larson.

Tim Larson

Thank you, Jason, and good morning, everyone. On behalf of the Champion team, I’m proud to report that in fiscal 2025, we provided over 26,000 homes to customers and families across the U.S. and Canada. This represents a 19% increase in homes sold year-over-year and revenue growth of 23%, resulting in fiscal year 2025 sales of $2.5 billion.

Unit volume increase was driven by higher demand across all channels, including from the Regional Homes acquisition for the entirety of the fiscal year. Our performance was driven by an unwavering focus on our customers and executing our strategic priorities. We are investing in new product services for our channel partners and expanding our retail capabilities, including today announcing an acquisition of Iseman Homes, which I will discuss further in a moment

We were very active in the marketplace during the quarter and had a tremendous reception to our new products at the International Builder Show, where we showcased models laser-focused on providing builders with relevant and affordable turnkey homes. In March, we had a great response to our Biloxi Show product lineup, reflecting the strength of the Champion Homes family of brands.

More recently, we were able to engage with leadership from the Department of Housing and Urban Development. We are encouraged by the dialogue and the positive feedback we received during their recent visits. We are impressed by U.S. HUD Secretary, Scott Turner’s commitment to making homeownership more attainable. I appreciate the time we spent touring our homes and his willingness to learn how we can further expand manufactured housing to address the affordability needs across the country.

The recent spotlight in Congress to reaffirm HUD’s role as the sole regulator and removing the requirement that manufactured homes be on a permanent chassis are all steps in the right direction. And when combined with zoning reform, we’ll reduce barriers to further grow the market for off-site build homes, a market that we are investing in for growth as reflected in our strategic priorities and capital allocation that are all aligned to deliver sustained value across all stakeholders.

Given the current overall market uncertainty, we are focused on remaining nimble while thoughtfully advancing our strategy, and that was very evident in the fourth quarter of fiscal ’25. Team continued to execute on the fundamentals and deliver profitable growth by navigating an unpredictable environment with tariffs and inflation looming throughout the quarter.

Fourth quarter year-over-year net sales increased 11% to $594 million, and homes sold during the period increased 6% to a total of 6,171 units. We experienced normal seasonality in the fourth quarter with a sequential decrease in revenue compared to the third quarter, and orders increased as we progress through the quarter and our backlog at the end of the year was $343 million. Backlogs were up 9% from the end of last year and up 10% sequentially. Average backlog lead time ended the quarter at eight weeks, which is within our target range of four to 12 weeks.

I’ll provide some additional commentary from the quarter on each of our sales channels. Sales to our independent retail channel and through our captive retail stores, both increased versus the prior year period. For independent retailers, we continue to advance our digital technology and lead management platform, including the phased launch of the dealer portal, which is receiving great reviews from the early adopters.

Consistent with our strategy to expand our captive retail presence, we announced today an agreement to acquire Iseman Homes located in the Plains region of the U.S.. We will use the strength of our in-house retail and our new Iseman Home team to drive growth in this region. I’ll touch more on Iseman in a bit.

Moving to the community channel. We remain focused on supporting our community partners by providing timely and relevant products at the right value. Through these efforts, sales in our community channel increased versus the prior year. Our builder developer pipeline remains strong as we continue to grow the network. The projects are in various stages and are being paid somewhat by the market uncertainty. However, we are continuing to invest in this channel and believe over the long-term, off-site build homes will become a more widely adaptive approach for builders and land developers.

Champion Financing, our joint venture with Triad Financial Services, continues to perform well. Our retail loan programs when combined with the right home, provide today’s consumers with their optimal monthly payment. Our floor plan programs allow us to support growth with our retailers by ensuring they have the right products for each market. We appreciate the collaboration with the ECN Capital and Triad teams and partners.

Looking to our first fiscal quarter of ’26 as we thoughtfully navigate the market and consumer uncertainty, we anticipate Q1 revenue to be up low single digits compared to the same period last year. As we begin fiscal 2026, demand has been less predictable compared to a normal spring selling season.

In addition, we are seeing a shift in consumer trends to smaller floor plans with fewer features and options. The near-term outlook for the community channel varies as we hear mixed use depending on the operator’s geography and expansion pace. Despite the uncertain environment, we remain confident and focused on executing our strategy and leading and managing the variables within our control, while remaining nimble in the market. We are actively managing within a dynamic tariff environment and are executing our playbook as developments unfold.

But so far, the direct cost impact is unlimited, although we do believe it is affecting consumer sentiment. Our strategy includes a balanced approach of selective price adjustments and material sourcing changes to optimally mitigate the impact. We are also being proactive and agile as we navigate the environment, including taking actions to thoughtfully control our fixed costs while not losing sight of our need to invest in our strategies for the long-term.

We recently idled one of our production locations in the Florida market by leveraging our remaining nearby facilities for customers in that region. Permitting and demand in Florida has been slow to recover from the 2024 hurricanes. In addition, in the British Columbia region, we are consolidating two of our Canadian factories into one to improve operating efficiencies and reduce overhead costs.

From a growth perspective, as I mentioned earlier, we announced the signing of a definitive agreement to acquire Iseman Homes, including its 10 retail sales centers in the Plains region of the U.S.. This acquisition underscores our long-term strategy to expand our retail footprint and deliver market relevant products, all while elevating the home buying experience for our customers.

With annualized revenues of approximately $40 million, we see a pipeline of local market demand and synergistic opportunities. Champion Homes team is very excited to welcome Iseman Homes, and we look forward to their integration with our Champion family of brands. We expect the transaction to close by the end of our first fiscal quarter.

In summary, we believe Champion Homes is well positioned to weather the uncertain market environment while driving an unwavering focus on our strategic growth priority and day-to-day execution, that are directly centered on our customers and team.

I’ll now turn the call over to Laurie, who will discuss our quarterly financial performance in more detail.

Laurie Hough

Thanks, Tim, and good morning, everyone. I’ll begin by reviewing our financial results for the fourth quarter, followed by a discussion of our balance sheet and cash flows. I will also briefly discuss our near-term expectations. During the fourth quarter, net sales increased 11% to $594 million compared to the same quarter last year, with U.S. factory built housing revenue increasing 10%.

The number of homes sold increased 5% to 5,941 homes in the U.S. compared to 5,652 homes in the prior year period. U.S. home volume during the quarter was supported by healthy demand across our retail and community channels. The average selling price per U.S. home sold increased by 5% to $94,300 due to product mix, including a higher number of units sold through company-owned retail sales centers. On a sequential basis, U.S. factory-built housing revenue decreased 8% in the fourth quarter compared to the third quarter fiscal 2025. We saw a sequential decrease mainly due to expected seasonality as well as an impact from weather across the south.

In addition, manufacturing capacity utilization was 60% compared to 63% in the third quarter. On a sequential basis, the average selling price per home was relatively flat. Canadian revenue during the quarter was $25 million, representing a 22% increase in the number of homes sold versus the prior year period. The average home selling price in Canada decreased 9% to $110,600, primarily due to a shift in product mix.

Consolidated gross profit increased 55% to $152 million in the fourth quarter. And our gross margin expanded 740 basis points from 18.3% in the prior year period. The higher gross margin was primarily due to a product liability reserve of $34.5 million recorded in the fourth quarter of last year that did not reoccur in fiscal 2025, as well as higher average selling prices and a higher share of sales through our captive retail sales centers. Gross margin declined sequentially from our fiscal third quarter and was lower than expectations primarily due to higher material input costs relative to flat wholesale ASPs as well as lower capacity utilization, causing decreased leverage of fixed overhead costs.

SG&A in the fourth quarter increased $20 million over the prior year period to $110 million. The increase is primarily attributable to increased sales volumes through our company-owned retail sales centers and higher variable costs related to higher revenue. In addition, we increased marketing spend to drive awareness in our brands and homes and continue to make investments in technology to support future growth.

The company’s effective tax rate for the quarter was 17.1% versus an effective tax rate of 19.2% for the year-ago period. The decrease in the effective tax rate is primarily due to an increase in tax credits and a decrease in state income taxes. Net income attributable to Champion Homes for the fourth quarter increased by $33 million to $36 million or earnings of $0.63 per diluted share compared to net income of $3 million or earnings of $0.05 per diluted share during the same period last year. The increase in EPS was driven mainly by the absence of an adjustment to the water intrusion product liability reserve in the current year period.

Adjusted EBITDA for the quarter was $53 million, which is consistent with the same period a year ago. Adjusted EBITDA margin was 8.9% compared to 9.9% in the prior year period. This decrease in EBITDA margin is mainly driven by higher SG&A. We expect near-term gross margin in the 25% to 26% range as we balance softening consumer confidence, decreased demand in certain markets and inflation. In addition, we’re seeing consumers shifting to homes with fewer or lower-priced features and options, which impacts gross margin. To help offset some of this impact, and as Tim mentioned earlier, we’re taking steps to balance SG&A spending while continuing to drive our strategic growth priorities, including investments in people and technology.

As of March 29, 2025, we had $610 million of cash and cash equivalents and long-term borrowings of $25 million with no maturities until July of 2026. We generated $46 million of operating cash flows for the quarter compared to $4 million in the prior year period. In the quarter, we leveraged our strong cash position and returned capital to our shareholders through $20 million in share repurchases. Additionally, our Board recently refreshed our $100 million share repurchase authority, reflecting confidence in our continued strong cash generation.

I’ll now turn the call back to Tim for some closing remarks.

Tim Larson

Thank you, Laurie. While we anticipate near-term order rates to vary by challenged geography, the need for affordable housing remains ever present across the U.S. and Canada. The long-term outlook for Champion is strong, and we have the strategies in place to deliver for all our stakeholders, strategies that we are thoughtfully executing as we evolve the team with a combination of internal advancement, new talent and select engagement of outside resources.

Our guiding priorities are not only for the long term, they provide a clear road map for today’s environment and deploying our capital, including winning as a customer-centric high-performance agile team, innovating and differentiating with products and services that bring in new buyers, expanding and elevating our go-to market channels, including delivering experiences before, during and after the sale that earn new customers and their referrals. Increasing awareness, demand advocacy for our brands in homes and leveraging our cost, capacity and investments in people and technology.

Finally, I would like to recognize the entire Champion Homes team for their exceptional efforts to grow revenue and earnings in fiscal 2025, and as we work together to continue to execute our strategic initiatives for all our stakeholders.

And now, let’s open the line for questions. Operator, please proceed.

Question-and-Answer Session

Operator

[Operator Instructions] Our first question is from Daniel Moore with CJS Securities. Please proceed.

Daniel Moore

Thank you. Good morning, Tim. Good morning, Laurie. Maybe start with just elaborating on the discussions with customers in both retail and community markets and the cadence of order rates into April and thus far in May and maybe a little bit more bifurcation by geography. Obviously, Florida by all accounts has been soft, but where are you seeing pockets of strength, pockets of weakness, et cetera.

Tim Larson

Hey, good morning, Dan. Encouraging wise, we’re seeing digital leads are up across a lot of our regions. But then when we talk to the retail teams, the in-store traffic has been mixed and certainly by region of the country. And as I talk to our independents, they’re seeing similar impacts in terms of certain areas where there’s strong traffic, others that are a little weaker.

But what I would say, in general, what’s encouraging is that there’s more buyers, active buyers and those buyers are ones that are more motivated to obviously purchase a home and our financing programs are helping that. So I would say there’s more serious buyers in the market, and that’s why we reflected our low single-digit growth for Q1 versus some what you’re seeing in the broader market. But I would say it’s been mixed traffic this spring. But we’ve been driving more leads, certainly driving more of that engagement with our consumers at our retail stores. But it is more a mix, and that’s why we signal a more low single-digit rate for the quarter.

Daniel Moore

Sorry, that’s helpful, Tim. And on the community side, a little bit of continued interest, but maybe kind of a slow burner holding off for now, trying to remember your exact commentary in the prepared remarks, but any elaborate there would be great. Thank you.

Tim Larson

Yeah, we were up in the quarter year-over-year in the community segment and we’ve certainly seen some returns with key customers there. But I would say it’s mixed for some projects and some community developers that are pacing a bit but we’ve been pleased with the growth of the community segment over the last year. They’re now at 28% of our overall units, which is strong. And so we’re pleased with how that’s going. But we’re just balanced about the community segment given that they face some of the dynamic with the consumer as well.

Daniel Moore

Got it. And then on the SG&A side, increased sequentially despite a decline in — sequential decline in revenue. Can you maybe break that out a little bit about how much was incentive comp versus investments in marketing and technology. Just trying to get a sense for how much SG&A in Q4 could be temporary versus kind of permanently higher cost structure?

Laurie Hough

Good morning, Dan. I would say, we should remember in the fourth quarter that we have quite a few of our industry shows that’s kind of a cyclical timing issue for us in the fourth quarter. So that won’t reoccur quite as strongly going into the first half of next — of this fiscal year. So but we aren’t going to break out the components individually.

Daniel Moore

Understood. Okay. And then just last one for me, continue to utilize buybacks as an arrow in the quiver in terms of capital allocation. With the shares indicating where they are this morning, just your thoughts about being more aggressive, cash continues to grow, but despite buying back shares more aggressively. So, any thoughts on that front? And thanks again for the color.

Tim Larson

Yeah. Obviously — go ahead, Laurie.

Laurie Hough

No, that’s okay. Yeah, well, we have a really balanced capital allocation profile. So we’ll keep an eye on that and obviously be opportunistic if the shares allow and just make judgment calls based on our overall strategy, Dan.

Daniel Moore

Thanks again.

Tim Larson

I was going to add, Dan, that we’re pleased we refreshed our commitment to share repurchase, and we’ve added $100 million of cash versus last year, which certainly gives us options across our capital allocation.

Operator

Our next question is from Greg Palm with Craig-Hallum Capital Group. Please proceed.

Greg Palm

Yeah. Good morning. Thanks. Going back to the quarter, I think you had maybe talked or mentioned about some unfavorable weather conditions. Just based on order rates and any backlog, was there any inability to ship homes from retail to end customers? I know you had a dynamic in the year-ago period that came into play. I was just curious if that was impacted at all this quarter as well.

Tim Larson

Yeah. The Texas market and part of the South was a bit slower than typically would be — so there is some impact there. And we factored that into the first quarter of fiscal ’26. But I think that plus some of the consumer dynamics that I mentioned are factoring in. But we feel like we’re in a good position now with where we are with our inventory and the opportunity to move in a nimble way given consumers’ demand that if that continues to grow. So I think we’re pretty balanced there.

Greg Palm

Yeah. Okay. And I guess it’s not a secret that housing overall is pretty soft, but I know activity here has held up maybe better than stick-built, if you want to call it that. But I’m just curious, if you just take a step back a little bit about manufactured housing specifically in the customer base and the demographics. And what gives you a hope that maybe this is a time for more meaningful share gains? Maybe you can talk a little bit about sort of deregulation in there as well because there’s obviously some important things going on behind the scenes.

Tim Larson

Yeah, for sure. There’s a few different levers there. One of our commitments to have captive retail is that’s where you really can drive the customer experience and the speed with the customer and you combine that with your consumer financing program. So that’s why we’re expanding Iseman.

Second, another area you mentioned is the regulation elements. We’re encouraged by the focus on reducing the chassis meet requirements, looking at different approach in terms of the reform around zoning potentially so that more local municipalities are supportive. Obviously, removing the chassis is going to help that in certain markets.

The other driver is just an overall awareness. When we have the HUD Secretary walk through our homes, his feedback was positive, while we had beautiful home so well built, just getting that efficacy out there. So more consumers are aware of it. You see that with our investment in marketing spending, and obviously, what we’re doing digitally.

Then in terms of the consumer, really making sure they’re aware of the price points that you can get in the brand-new home. And that’s obviously the key is our financing program, so you can get a customer matched to the right spot with that right price point, just getting more awareness in the market and pulling in new consumers, and we’re putting our digital spend to work there. We’re using social media to attract people who typically would may be aware of our products, and pull them into our retail.

So those are all drivers. Now that’s against the backdrop that there’s more challenges with the consumer in terms of some of the uncertainty we’re seeing. So that’s why we’re investing to make sure that we’re getting into their mindset in terms of consideration purchase. The combination of those things I think are really are what’s going to be in the near-term key. But then from a longer-term, our product innovation spend is to make sure that we have a range of products for those range of customers that are looking for the different types of homes and needs. And you saw that at the show, maybe bring out our shows where you see the type of new products that we’re coming out with. And I think those are all key in terms of growth and the strategic priorities that I laid out in my remarks.

Greg Palm

Yeah. Okay. Makes sense. Thanks for the color.

Operator

Our next question is from Matthew Bouley with Barclays. Please proceed.

Matthew Bouley

Good morning, everyone. Thank you for taking the questions. I’ll ask on the gross margin. The change to the near-term guide, I think you said 25% to 26%. I think previously, it was in that 26% to 27% range. So my question is if some of the, I guess, pressures that you’re seeing today if your view is there sort of more temporary and that the 26% to 27% is still realistic over time. Or is it that you’re kind of still, I guess, looking for what the structural gross margins of the business should be going forward as, obviously, the business mix has shifted over the years? Thank you.

Laurie Hough

Good morning, Matt. Thanks for the question. We do think that lowering to the 25%, 26% range is just for the short term based on softening consumer confidence and decrease in demand in certain markets as well as some inflation that we’re seeing in material costs. Long term, we still expect structural margins to be in the 26% to 27% range based on the improvements that we’ve made across the platform.

Matthew Bouley

Got it. Okay. Thanks for that, Laurie. And then secondly, interesting discussion at the top there around some of your discussions with the new HUD Secretary. Maybe just around that potential removal of the permanent chassis requirement. Any color on sort of what that would do for your own costs? How realistic is that actually happening? And I guess how would you then react around either passing that through to consumers or maybe just impacting other designs just kind of giving you more flexibility in the product design? Just how would that all play out? Thank you.

Tim Larson

Yeah. First off, from a consumer perspective, it allows you to do maybe two stories more effectively, give some elevations because you can do more slab on grade. So it drives that benefit from a curb appeal. And then there’s some municipalities that are still hung up on having a chassis in their home. So it helps with the zoning support. From a cost perspective, certainly not having the chassis. You need it for transport, different types of transport that may be lower cost. So there is some opportunity there. As far as how we would approach it, our goal is to create the right product, price value. And if we have a chance to do that for a consumer, it just allows it great, but obviously, we want to continue to drive margins. We’d have to look at the balance there. But it’s encouraging that it’s actually now in discussion and the progress in terms of regulators. And I think because of the strength of the quality of our homes and the way that we can deliver them, it really gives us the confidence that this should happen and likely will happen. But all optimally has to go through the bills process, which is well underway at this point. So we’re encouraged by it, and we’re also looking at product innovations that would leverage from it. So we’ll keep you posted as it evolves, but it’s an encouraging time.

Matthew Bouley

All right. Thanks, Tim. Good luck, guys.

Operator

Our next question is from Mike Dahl with RBC Capital Markets. Please proceed.

Mike Dahl

Good morning, thanks for taking my questions. A couple of follow-ups here. First on the gross margin dynamics, I guess, can you be more specific about what role the input costs are playing in the near term? Because if I look at kind of wood products, even lumber is up a little, OSB down a lot. So I would think your blended wood basket is actually kind of flattish, but maybe just give us a sense of what’s impacting — what’s the cost impact versus that mix or mix down impact in your near-term margin expectations?

Laurie Hough

Hey, Mike. Good morning. I would say that we’re obviously going to break out components, but we do have portions of our wood products that we buy at the spot rate and also portions that we buy on contract. So the mix of those don’t necessarily align a 100% with the spot rate activity. So we need to keep that in mind. We’re also seeing some increases in some other component costs across the board. So — and then we are seeing some pricing pressure in certain regions of the country based on consumer confidence.

Mike Dahl

Okay. Got it. I appreciate that. And then just a follow-up on that response to Matt’s question on the permanent chassis requirement. In your — with builder developers specifically, as you — as you’ve kind of rolled out and tried to promote the Genesis brand and build those relationships. Has that been a hang up in your discussions with builders because that is a limited factor? Or how would you describe that when you think about the potential on that part of your business or further that part of your business specifically? And then if I could just ask more broadly when you talk about kind of some more measured pace on that side of the business recently understandable, but maybe just put some numbers around that.

Tim Larson

Yeah. Great question. In terms of the chassis, yeah, that is a key opportunity with those developers because oftentimes, those developers are going into new municipality, new land zoning and that certainly would help if they’re looking for that more single-family, slab-on-grade look. The other factor is those builders at times are looking for two-story projects, which this would be an advantage for that approach. In terms of the overall builder developer, the pipeline is continuing to build, and we’ve had really good response to the new products that we’ve come out with. One of the realities of that business and given it’s a smaller size in our total portfolio is the time it takes for those projects. They can be anywhere from 12 months to 24 months. So that pace does impact when those more orders really materialize but we’re encouraged by the pipeline, and we’re working directly with those builders. And I think the pacing also is with the [macroeconomic] (ph) environment, some of them are looking at the phases and how quickly they deployed but we’re working with them directly to make sure that we can help and support that and move those projects along. And we’re leveraging what we’ve learned from the projects that we’ve done so far. So again, that’s a longer-term development channel for us, but it’s one that both the regulatory opportunities and the way we’re pacing this is really helping. So I appreciate the question on builder developer.

Mike Dahl

Thanks, Tim.

Operator

Our next question is from Phil Ng with Jefferies. Please proceed.

Phil Ng

Hey, guys. I guess a question for Laurie. Your near-term margin guidance is pretty steady from Q4, which is great. But certainly, we’re still seeing impacts from tariffs. It doesn’t sound like it’s massive, but help us kind of think through how that could impact margins and do you have to take incremental price because you kind alluded to perhaps some pricing pressures in certain markets.

Laurie Hough

Hey, Phil, good morning. Yesh, so we’re not seeing a significant increase in tariffs currently. We are watching and monitoring as it changes on a daily basis. So keeping track of that and understanding where our product comes from and what the impact will be and then just being proactive about sourcing from other locations and so forth. So where we have an active playbook of things that we can do when that comes up, but we’re not quantifying what that will be.

Phil Ng

Okay. But — let’s say, if you do see a little more inflation, just given that the current demand backdrop, do you feel comfortable that you have the ability to take some price? Or you’re going to have to manage through that, I guess, in the near term?

Laurie Hough

I think it depends on the region of the country. So, keeping in mind that our plants ship within a 500-mile radius generally without being too cost prohibitive on transportation. So ultimately, the decision still lies on price with and at the plant level. We give them guidance, but they have to measure competitively what’s happening in their markets relative to consumer demand and pricing more broadly.

Phil Ng

Okay. Super. I guess a question for you, Tim. On the Iseman transaction, certainly, you guys had great success with [R]egional home. Can you give us a little color on the opportunity here in terms of driving gross margins higher and some of the synergies. And then the $40 million number, is that all incremental? I just wasn’t sure if you guys were selling through them already?

Tim Larson

Yeah. In terms of the $40 million, we are — they are our key customers today, but there’s still meaningful opportunities to bring existing volume that they’re doing with other providers to us, and we’ll do that over time. In terms of the opportunities beyond that, one of the things we’ve learned this last year at Regional is in addition to the synergies, we can also drive accretive growth, which we did with Regional, and we certainly are prepared to do with Iseman. Ken and his team there are a great team. There’s an opportunity to collaborate with both of our organizations from what we’ve learned. And now we can bring some of the tools directly to that team and directly to the consumer. So we’re excited about that and opportunities with product. And so we’ve got a lot to build on with the success of [R]egional, but also in a broader market in the Midwest. And strategically, obviously, we see we’ve had a presence in the South and Southeast, where we’re excited to expand that in the Midwest. So those are opportunities for us.

Phil Ng

Would it be accretive to gross margins out of gates, Tim?

Tim Larson

I think we’ll get through that. We’re just — obviously announced today, we’re going to work through integration. We’re seeing some things that are encouraging in that front, but we’ll be back to as we work through the acquisition. But we’re excited to move to that integration phase next, and we’re anticipating closing this at the end of June.

Phil Ng

Okay. Appreciate the color.

Operator

Our next question is from Jesse Lederman with Zelman & Associates. Please proceed.

Jesse Lederman

Hi, thanks for taking the questions. Laurie, I just want to clarify, so it sounds like in the 25% to 26% gross margin guide, you’re not seeing any impact from tariffs yet. Does that number include any baked-in conservatism from potential inflation from tariffs or no?

Laurie Hough

It does not. No.

Jesse Lederman

Okay. Thanks for clarifying that. I’m curious, can you talk about you’re seeing mix shifts lower to either smaller-sized homes or less options and upgrades. Are you also seeing or are able to quantify mix shift from maybe buyers that would otherwise be buying an existing home that are now considering a manufactured home, maybe even a single section. Is that something you can track? Is that something you expect? Maybe can you talk a little bit about what you’re seeing at the larger-sized homes?

Tim Larson

Yeah. I think in terms of the market trends, we are seeing that smaller size, and that’s driven more by price point and monthly payment, which speaks to the consumer environment. As far as new consumers coming in the category, I mentioned our efforts to pull in those consumers. And certainly, those first-time homebuyers are buyers that are looking for entry level but a new home. That gives us the opportunity. So we’re starting to see that. But I would say, as an industry, one of the things we have to be focused on is how we attract even more new consumers, and that’s why the actions with the administration, what we’re doing with new products and certainly the messaging around awareness are key. But now is a good environment to be doing that.

Jesse Lederman

Absolutely. And it sounds like there’s some opportunity, even just as industry to do some consumer education from a buying process perspective or a financing perspective and kind of how the manufactured housing, home buying process work. So hopefully, that’s something that can be a tailwind as well. One more for you, Tim, and you talked about the dealer portal that you’ve started to roll out. Can you talk a little bit about how that may work in practice and maybe some signs you’re seeing into the effectiveness of that program? Thank you.

Tim Larson

Yeah. So, it ties in tandem with our consumer platform at championhomes.com that we launched. That allows them their dealer to visibly see the leads that are coming through and to quickly respond to those and engage with those and then also manage downstream in the process with order status and being able to connect that to our plans. We also are able through that portal to give the latest digital marketing tools and our capabilities that we can do nationally to support them. And so it starts to organize around the hub of how they work with Champion as a retailer and leverage the effectiveness. And so we’re rolling it out in phases. The early response has been really good, but we see it as key to integrating the digital experience from the consumer to the retailer and to us as the OEM in an integrated way.

Jesse Lederman

Awesome. Sounds very exciting. Thanks a lot.

Operator

Our next question is from Jay McCanless with Wedbush Securities. Please proceed.

Jay McCanless

Hey, good morning, everyone. Laurie, I was hoping you could drill down more on the price competition. What markets specifically are seeing the price competition? And is it more focused on single section or double-section homes?

Laurie Hough

Yeah, it varies, Jay. We are seeing a pickup actually in activity out West. We are seeing a little bit of slowness in Florida, as we mentioned and then also in the Northeast. We are seeing a shift to more single-wides and smaller homes, a smaller footprint home with less features and options. And as we mentioned, that will have an impact on margins because our option content generally comes in at higher margins than the base price of the house.

Jay McCanless

Great. Thanks. And then the second question, still haven’t heard FEMA, I think, ordering any homes. Have you all heard anything recently from them, whether it be out West or some of the stuff in the Carolinas?

Tim Larson

Yeah. No orders have yet. Obviously, we’re working with them to prepare for whenever they’re ready for that, but we certainly are supportive whenever that occurs, but no orders at this point.

Jay McCanless

Okay. And then the last question for me. Just kind of talk about where chattel rates went this quarter versus last year and anything positive or negative you guys are seeing on credit availability for chattel.

Laurie Hough

Yeah. Credit availability is pretty stable, Jay. And as far as rates, there’s still about 150 to 200 basis points higher than the 30-year fixed for a well-qualified buyer.

Jay McCanless

Okay. Thanks. Appreciate it.

Operator

[Operator Instructions] Our next question is from Daniel Moore with CJS Securities. Please proceed.

Daniel Moore

Thank you, again. My follow-up was on Iseman was answered, but maybe just talk a little about the level of discussions with other regional dealer groups and maybe the M&A pipeline more generally?

Tim Larson

Yeah. I mean we’re not going to talk about specifics, but bigger picture, you look at our strategy, and we’ve laid out those five priorities at the end of my remarks, those are aligning how we’re thinking about M&A, capital allocation. And certainly, we’re excited about Iseman, and we’re going to focus on that execution and integration. But certainly, our strategy reflects where we want to put our capital going forward.

Daniel Moore

Okay. Thanks, again.

Operator

There are no further questions at this time. I would like to turn the floor back over to Tim for closing remarks.

Tim Larson

Well, obviously, you can see in our first month here of operating the agility and action orientation that we have. I mean if you think about, we’ve had 26,000 homes wrapped up last year, which is the highest ever outside of one year of the pandemic, the acquisition of Iseman Homes. We executed in idling a couple of our plans, which is always a tough decision but the right decision for fixed cost, launched our integrated digital platform that we talked about today. And we talked a bit about purchasing, but we’ve strengthened that team pretty notably, and that allows us to navigate this environment. We’re advocating and advancing policy, and we added another $100 million on our balance sheet and obviously have — that’s in addition to the stock that we repurchase. So as we go forward here, we’re in a really strong position with our strategy and our team. We are going to continue to build on that and navigate this environment, and we really look forward to updating your progress, and thank you for your continued interest, and thank you for joining us this morning. Thank you.

Operator

Thank you. This will conclude today’s conference. You may disconnect your lines at this time, and thank you for your participation.

Part II – Additional Information with More MHProNews Facts-Evidence-Analysis(FEA) and Industry Expert Commentary

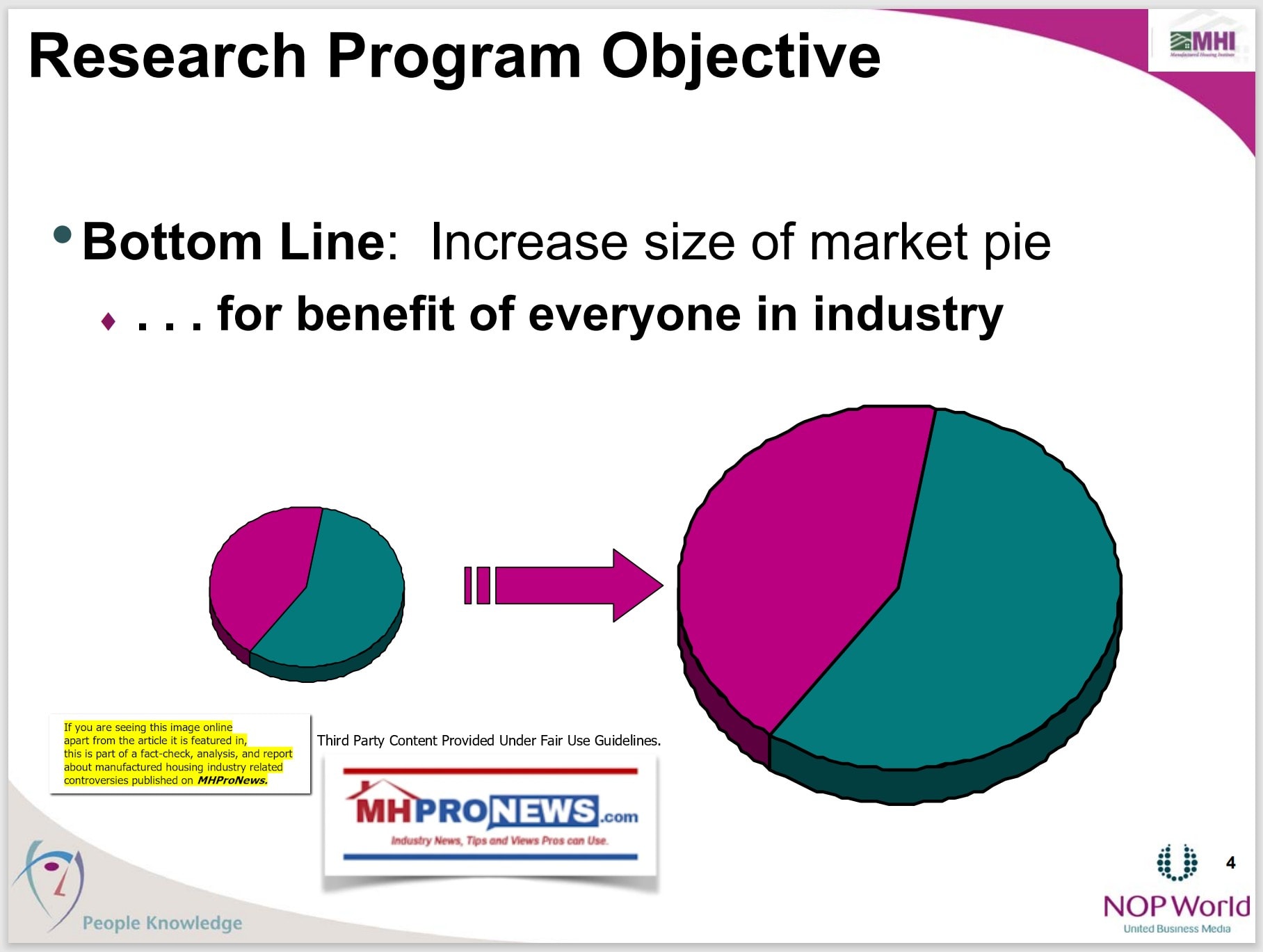

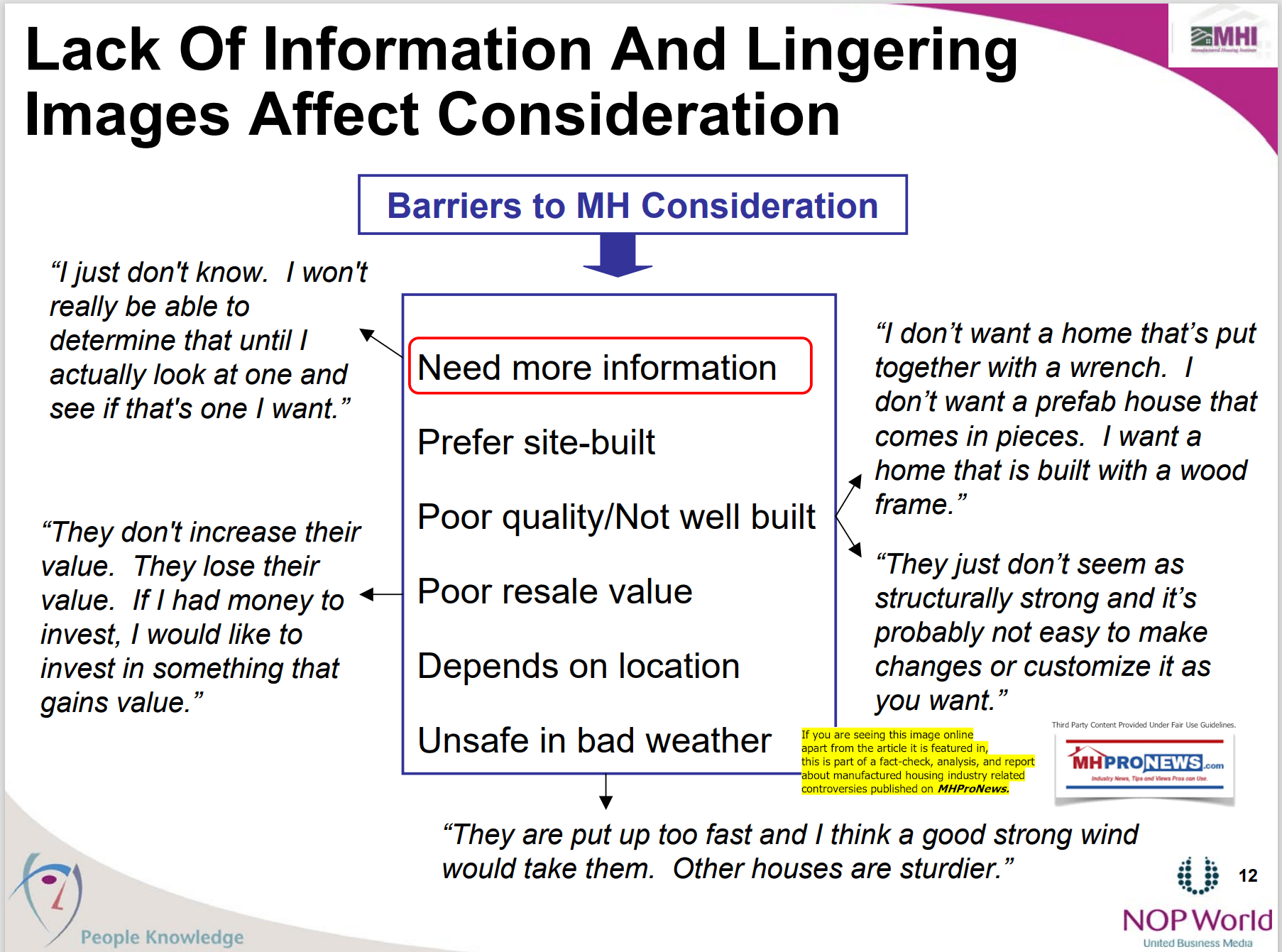

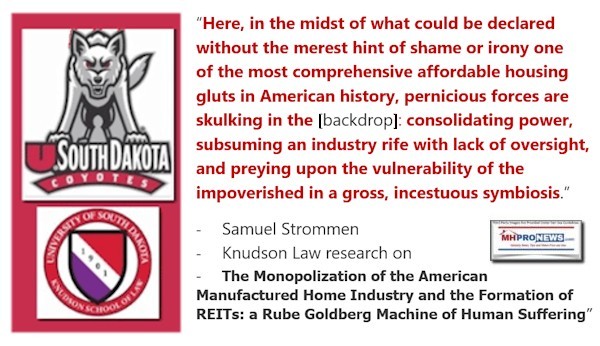

For far too long, many key firms involved in the manufactured housing industry have used various forms of the old “razzle dazzle.” While that may work on some for a while, as with any inherently deceptive stance over enough time tends to build distrust. In no particular order of importance are the following observations. As a pro-manufactured housing, pro-free market, and pro-consumer/small business rights team, MHProNews nevertheless sees that the evidence strongly suggests that years of the old razzle dazzle are tread worn and thus are wearing thin.

In no particular order of importance.

1) Champion has been talking about tapping into the ‘builder developer channel’ for over two decades. Other modular builders have been striving to doing the same. That history is not mentioned by CEO Tim Larson. Perhaps that is because if that history is spotlighted it would likely undermine their corporate narrative.

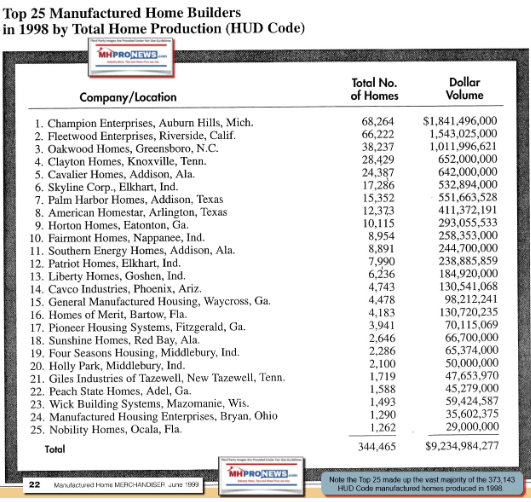

2) When President and CEO Tim Larson said: “I mean if you think about, we’ve had 26,000 homes wrapped up last year, which is the highest ever outside of one year of the pandemic,” that is a curious, and perhaps misleading remark. MHProNews has at various times made the argument that there is ‘old Champion’ (pre-bankruptcy) and ‘new Champion.’ That said, Champion itself on its investor relations (IR) page pre-dawn this morning asserts this: “Over 70 years of building manufactured housing.”

Furthermore, ‘old’ (pre-BK) Champion used to be the ‘big dog’ on the manufactured home industry. The 26,000 homes Larson bragged about is not even half of the total the Champion Enterprises produced in 1998. That year, Champion Enterprises produced 68,264 HUD Code manufactured homes, plus whatever modular housing or other units that they built.

Indeed, there are several remarks made during this earnings call that are apparently in conflict with other known realities. For example.

2) The community segment comment in Part I above that claims their performance in that niche is ‘strong’ is contradicted by MHI-linked MHInsider’s recent claims that about half of all new HUD Code manufactured home shipments are going to communities. That obvious contradiction is one of several factual and evidence-based topics that needs to be probed and resolved.

3) It is entirely possible that no currently active manufactured housing industry focused publications, other than MHProNews and MHLivingNews, have bothered to mention that the removable chassis reportedly could have been accomplished in the early 1990s. The so-called Hiler Amendment that would have allowed for a removable chassis was set to be added to a then-moving bill (i.e.: piece of legislation). The Manufactured Housing Association for Regulatory Reform (MHARR) has referenced the Hiler Amendment and was for it. But per sources deemed reliable, it was the Manufactured Housing Institute (MHI) at the time which torpedoed the Hiler Amendment. Then Congressman John Patrick Hiler, per GovTrack: “Hiler was the representative for Indiana’s 3rd congressional district and was a Republican. He served from 1981 to 1990.”

- So, why did MHI subvert a piece of legislation then that they now claim to want?

- If Larson asserts that more manufactured homes could be sold if an optional removable chassis was the law for HUD Code manufactured homes, then why did MHI keep that from occurring some 35 years ago?

- How many more manufactured homes would be in place today if not for that underreported (save by MHProNews/MHLivingNews) piece of historic insight?

Hold those thoughts.

4) Note that the recent legislative activities that MHI is involved in was raised more than once during this earnings call. But Larson failed to mention in this discussion that zoning could be dealt with NOW by invoking the “enhanced preemption” provision of the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, MHIA 2000, 2000 Reform Law, 2000 Reform Act). By accident or intentionally, and either of those options are problematic for the CEO of a multi-billion-dollar corporation, Larson didn’t mention that already on the law books option.

5) Note that several times during the earnings call (see Part I highlighting above), there were statements to the effect that the trend in sales has been to smaller and less optioned manufactured homes. That is just one of several points raised by a tipster, see the following for details.

6) Those two reports linked above (Part II numbers 4 and 5) shed tremendous light on arguably misleading aspects of Larson and company’s remarks. Back to the opening quote from CFO Laurie Hough:

“…but [Champion is] really more focused on the growth of the company through M&A [mergers and acquisitions, i.e.: industry consolidation]. That would definitely be our top priority.”

Stock buybacks may be legitimate, but they are also an apparent dodge to the underlying issues while corporate leaders use buybacks to prop up share prices. Larson said, presumably with a straight face, that education and promotion of the industry could bring more buyers and that Champion Homes is engaged in doing that; seriously? As MHProNews has often pointed out, MHI has been talking about that for over 2 decades. Where is the action?

As part time MHI critique, and MHI ‘lifetime achievement’ award-winner, Marty Lavin has said, the industry’s largest producers don’t want smaller firms to benefit from such a Roper/GoRVing style image/education campaign.

7) Champion has hundreds of millions of dollars available to be deployed in ways that could be used to grow the industry in an authentic, vs. a posturing-optics-theatrical, fashion. They could do so with or without MHI. Champion could, if they wanted to do so, team up with independents and create an image/educate campaign or could initiate litigation that would boost production and overcome zoning barriers by enforcing existing laws.

But that is obviously NOT what Champion is doing. They are more focused, per Hough, on M&A or “consolidation.” That’s not speculation, it is a series of well documented realities. In that context, recall that Larson in the prior earnings call through Champion’s support behind the goals of the industry’s land lease communities, which is also “consolidation” focused.

8) Why didn’t Larson cut a deal with UMH Properties, for example, to develop new communities using the 2000 Reform Law to speed the process from project concept to development, home placements, and sold homes with residents living in them?

9) Let’s be clear. MHProNews and our MHLivingNews sister site have never been opposed to selling higher end manufactured homes, or modular homes for that matter. There are good reasons to offer both.

But our platforms are opposed to market manipulation that harms smaller businesses, millions of potential affordable housing consumers, taxpayers and more. So, while Larson talks about chumming around with HUD Secretary E. Scott Turner who toured some Champion models in Orlando, perhaps the more pressing question is this. Did MHI press Turner to get the routine enforcement of the 2000 Reform Law done?

10) But instead, Larson and Champion (SKY) have thrown their support behind consolidators and their own focus on consolidation. That analysts, corporate officials, and board members alike have failed to press on the wisdom of that push vs. the increased potential for antitrust litigation that could involved Champion, or other MHI member-brands, is one of the risks that Champion is ignoring.

11) Champion reportedly holds a seat on the MHI board of directors. But it seems that the opening statement, the statement from the recent tipster (see above and linked here), years of MHProNews/MHLivingNews reporting, and the recent remark by Mark Weiss, J.D. all shed light that this earnings call failed to adequately address, to put it politely.

See also: https://www.manufacturedhomepronews.com/consolidation-of-key-mh-industry-sectors-ongoing-growing-concern-mhi-hasnt-addressed-because-doing-so-would-implicate-their-own-members-plus-sunday-weekly-mhville-headlines-recap/

12) It isn’t bragging if it is true. For years, it is the reporting by MHProNews/MHLivingNews that has stood the test of time as it relates to what is actually occurring in the manufactured home industry vs. this or that person, organization’s, or corporation’s narrative. Others turn out to be so much hot air that fills ballons that seem to rise before the pop or run out of gas. Who says? A range of artificial intelligence (AI) utilized fact checks, as well as numbers of often MHI linked professionals that praised the work of this publication.

13) To buy into what Larson and Champion leadership are peddling to investors via remarks like those found in Part I above, someone has to practice Orwellian double-think. Meaning, someone has to hold two contradictory set of thoughts at the same time and somehow believe that both sets of thoughts are okay.

To learn more about the industry’s underperformance and its various causal factors and related solutions dive into the related and linked reports. Because while Larson et al are patting each other on the back, investors have clearly not been dazzled by all of the tall talk from Champion’s leadership. They could be growing, instead of idling plants. The paths to do so are rather common sense.

- Work with MHARR vs. conventional housing nonprofits that are competitors of the industry. The good legislation that has been enacted in 2000 and 2008 was achieved with MHARR. It wasn’t achieved by teaming up with the industry’s competitors.

- Expose and legally deal with those who have thwarted the industry’s growth, be it from outside the boundaries of MHVille or within.

- Deal with the predators in manufactured housing, who regrettably, often seem to be MHI members.

Enough said for today. Dig deeper in the linked and related reports.

According to their website: “A non-profit, non-partisan think tank that conducts original research on expanding economic opportunity to those who least have it.” Their about us page on this date states the following.

About FREOPP

All FREOPP research considers the impact of public policies and proposed reforms on those with incomes or wealth below the U.S. median.

What does that FREOPP post cite? The research by James A. “Jim” Schmitz Jr., which is often focused on why manufactured housing is underperforming due to what he and his federal reserve research colleagues have called ‘sabotaging monopoly tactics.”

7) Per that freopp.org post by Jackson Mejia, whose bio in brief describe him as a visiting fellow in macroeconomics) which is linked here as download included the following.

Per Mejia.

Chicago Fed president Austan Goolsbee and University of Chicago economist Chad Syverson persuasively argue in a new paper that housing construction productivity has followed a “strange and awful path” that cannot be explained with mismeasurement.

Also, from Mejia.

In stark contrast to the rest of the economy, construction productivity was forty percent lower in 2020 than in 1970, while productivity has more than doubled in other sectors. It is impossible to solve the housing crisis without accounting for this.

…

Local regulatory policy certainly interacts with the decline in productivity. Zoning laws, for example, may disincentivize innovation that may otherwise spur productivity growth. Work from FREOPP, particularly from Roger Valdez, has pioneered a modern approach to housing policy that may do much to resolve the housing crisis by simultaneously increasing access to low-income households and allowing greater variety in the types of housing that can be built.

…

Critically, it is not merely that restrictions on housing quantity reduce the supply of affordable housing, but also the allowed method of production. Laissez-faire policy played a key role in the growth unleashed by the Industrial Revolution, but none of that growth would have been possible without the technological innovation induced by mass production methods.

…

For example, consider a good—widgets—that has government-imposed quantity and quality restrictions. Producers can only sell a certain amount of the good at a sufficiently high quality, making the supply of affordable widgets artificially low. Suppose also that the government restricts how widgets are produced, by requiring they can only be made by hand by union-certified artisans.

…

Why the decline [in housing construction]? Research by economist Jim Schmitz at the Federal Reserve Bank of Minneapolis highlights that the prevalence of stick-built housing is a function of monopolistic behavior by construction companies and government policy, particularly the National Association of Home Builders (NAHB) and the Department of Housing and Urban Development (HUD). This happened in a couple of steps.

…

First, HUD developed Section 235 in 1968, a program that substantially subsidized mortgages on stick-built but not factory-built homes. Given the relative inefficiency of stick-built production, this program effectively subsidized a low-productivity technology at the cost of other, more efficient production methods.

Second, HUD and NAHB pushed the National Manufactured Housing Construction and Safety Standards Act of 1974 through Congress. The act effectively operates as a national zoning ordinance and restricts the production of factory-built homes substantially by requiring such homes to meet certain standards. At the time, factory-built housing competed with stick-built housing largely in low-density areas, many of which had no zoning laws to begin with. Before factory-built housing could make headway into urban areas, it was strangled in the crib.

Zooming out, why does this matter for productivity and efficiency? To steal an example from Schmitz, it is as if Toyota is required to assemble a Camry in a driveway rather than in a factory. It is therefore no surprise that housing production is needlessly expensive.

…

Housing, even with loosened zoning rules, is today stuck with production methods better suited for the eighteenth century. It is time for governments to allow housing construction to regain its place at the forefront of modern industrial production methods. Empirically, this is how we have achieved productivity growth in every other sector of the economy.

To be clear, while someone might refine the above to point more emphatically that Mejia (and Schmitz) are talking mostly about pre-HUD Code mobile homes and post-HUD Code manufactured homes, or the arguable need to accurately note that some in manufactured housing wanted federal regulation and the creation of the HUD Code, Schmitz and others have pointed out that manufactured housing has been limited in part due to the permanent chassis rule. That said, even with a permanent chassis, pre-HUD Code mobile homes soared past 500,000 new housing units nationally per year in the early 1970s. For two years, it seemed that 600,000 new housing units a year was possible.

Reminder. There are sound reasons why AI has said that MHProNews has more than 6x the combined readership of MHI and its affiliated bloggers and trade media.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach