At the root of the word ‘responsibility’ is the simple idea of ‘an ability to respond.’

Is there some degree of responsibility within parts of the manufactured housing industry for the crash post-2008?

Teeing Up the 21st Mortgage Corp Document

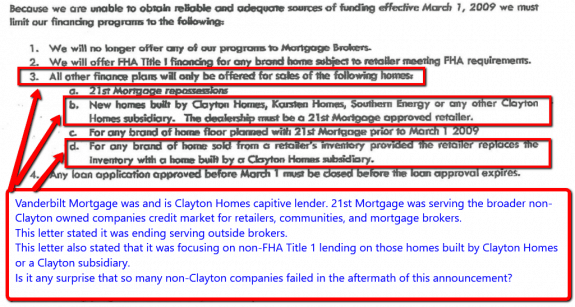

To set the stage for understanding the importance of a document from 21st Mortgage Corp – a Berkshire Hathaway owned sister company to Clayton Homes and Vanderbilt Mortgage – some fact-based background and expert analysis are warranted.

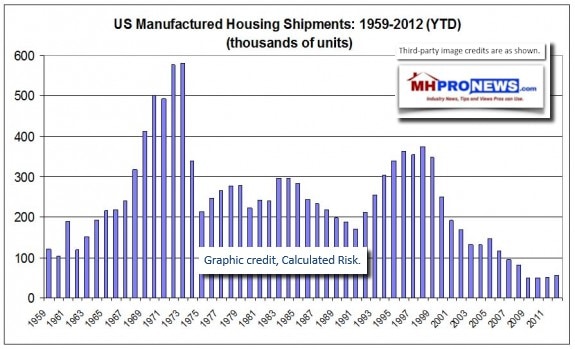

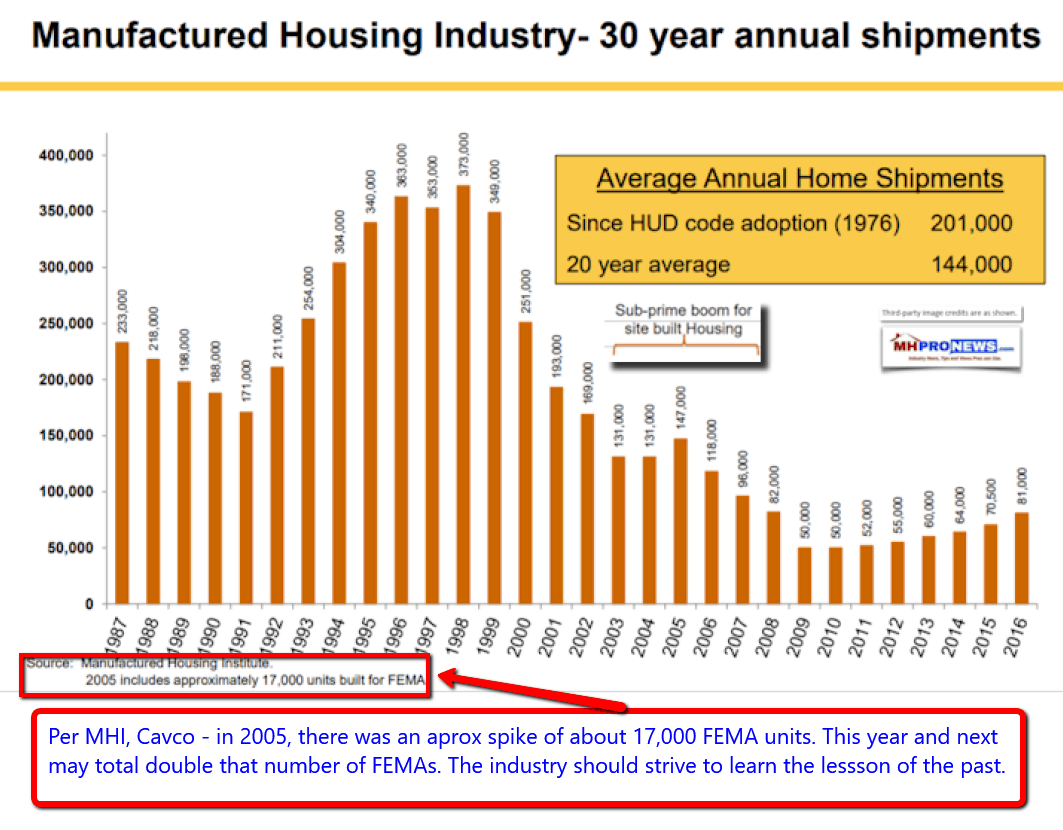

The industry’s decline in new home sales/shipments began after it reached its most recent peak in 1998 (see graphics below).

But while the industry was already sliding, Eric Belsky Executive Director for the Joint Center for Housing Studies at Harvard University said, “There are multiple reasons to expect manufactured housing to do better than site built housing in the current decade.”

That quote by Harvard’s Belsky was cited by the Manufactured Housing Institute (MHI) circa 2002 in a report in the Daily Business News published at the link below.

Appealing Manufactured Housing Institute (MHI) Marketing, Finance Booklet Reviewed

Not many would dispute Harvard’s prestige.

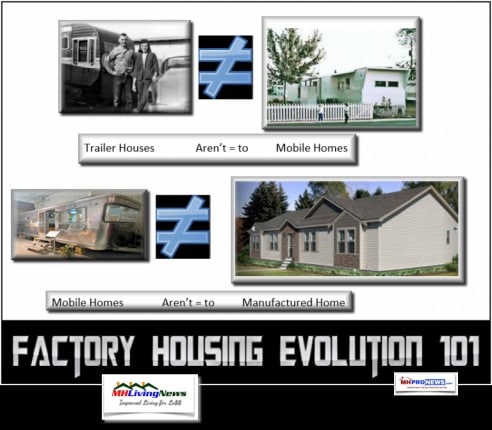

Then, and since Belsky’s statement, many have believed that modern manufactured homes are an obvious part of the solution for the affordable housing crisis that is hiding in plain sight.

Bloomberg, HousingWire, Realtor and Fox all suggest Manufactured Homes as Important Solution for Affordable Housing in America – manufacturedhomelivingnews.com

While housing becomes more and more expensive across the United States, there’s a simple solution. For those who either want to be frugal and still get great quality or those who have limited funds, but desire to be a homeowner – the answer, suggests and HousingWire – could be modern manufactured homes.

Why were Belksy and company so wrong about their prediction for the MH Industry success in the 2000s? Or since then?

Appealing Manufactured Housing Institute (MHI) Marketing, Finance Booklet Reviewed

The year after that MHI booklet – found at the link above – was published (circa 2002), the following event occurred.

Warren Buffett’s Berkshire Hathaway Buying Clayton Homes, VMF & 21st Mortgage

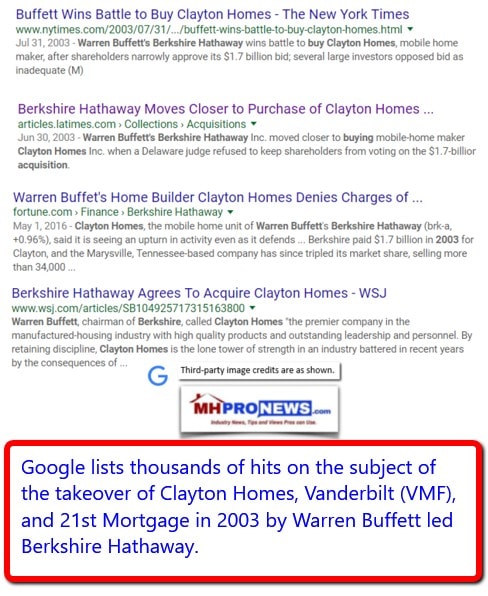

There was significant controversy, including litigation, that surrounded the buyout of Clayton Homes by Warren Buffett led Berkshire Hathaway. A screen capture of some of the headlines at the time provides a quick sense of what went down.

Buffett’s Berkshire ultimately prevailed, and the buyout was accomplished in 2003.

Berkshire purchased Oakwood Homes, later that same year. That Clayton/Oakwood combination made Clayton Homes the largest manufactured housing (MH) producer in the industry. Industry sources, and those outside of MH, believe that Berkshire Hathaway’s Clayton Homes dominates the Manufactured Housing Institute (MHI).

For example, two of the four executive committee seats of MHI have been held by Berkshire Hathaway MH industry unit officers for several years.

MHI former President Chris Steinbert gave a written farewell address to the industry. While one can disagree with some of his suggestions and conclusions, it is nevertheless relevant to note how Steinbert reflected on the importance of lending/finance to the industry and its future

See Steinbert’s farewell article as a download, linked here.

We could also quote:

- ELS’ Chairman – and MHI/NCC member – Sam Zell,

- the Manufactured Housing Association for Regulatory Reform (MHARR),

- and numerous other industry references and data-points to make the point.

But for simplicities sake, it is widely believed that financing is essential for the success of high-ticket item sales. That includes the need for lending on conventional site-built housing, as well as for manufactured homes.

Cut off lending, and home sales drop – and their values – plunge with it. That’s part of the lesson of the 2008 housing/mortgage meltdown.

Special Report Said Red Flags Raised in 2001

The Bush Administration raised red flags in 2001, says this Fox News Special Report video below about the run-up to the mortgage crisis. Is there any reason to think that Warren Buffett, who is famous for his reading, study, and research, was unaware of such concerns?

By 2003, those warnings and discussions in Washington, D.C. grew louder.

Then Treasury Secretary John Snow, said in some testimony on the issue in 2003, “Housing finance is so important to our national economy that we need a strong, world–class regulatory agency to oversee the prudential operations of the GSEs and the safety and soundness of their financial activities consistent with maintaining healthy national markets for housing finance.”

Barney Frank (D-MA) was pushing back, saying that Fannie and Freddie were “not in a crisis.” Frank and others in Congress were receiving campaign contributions from the GSEs.

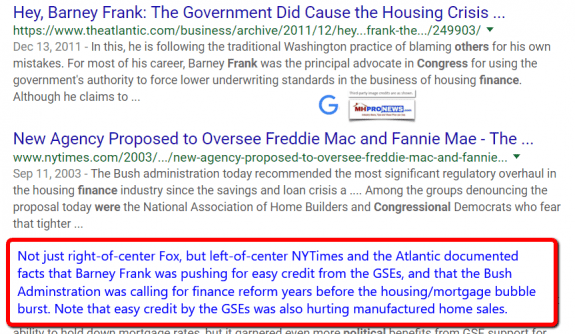

It wasn’t just right-of-center Fox, but left-of-center media outlets too that were reporting on some of the facts and concerns noted above and herein.

When the housing/mortgage bubble burst, other floorplan and manufactured home lenders were cutting back, or pulling out of the industry. Or as Tim Williams told MHProNews in an exclusive interview, “Within five years of starting 21st Mortgage, there were about sixty companies started with plans to offer manufactured housing financing on a national basis. Of that group of companies we are the only survivor.”

See that full interview with Tim Williams, linked here.

Another C-Suite Level Tip

Another C-Suite level executive, a non-MHARR member independent HUD Code manufactured home producer, told MHProNews’ publisher, circa 2008-2009, the following. That HUD Code home building executive personally said to this writer that Warren Buffett’s Berkshire Hathaway was going to use a contraction of lending to drive their competition out of business. He provided no documents, but he did make the claim.

That outcome that C-suite level executive predicted in fact occurred.

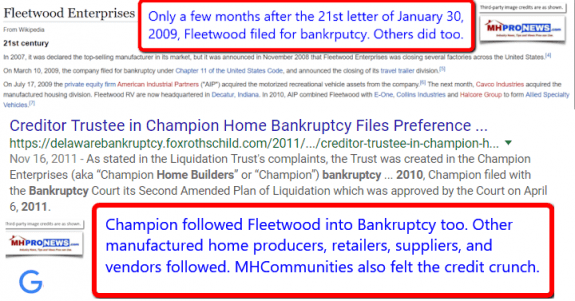

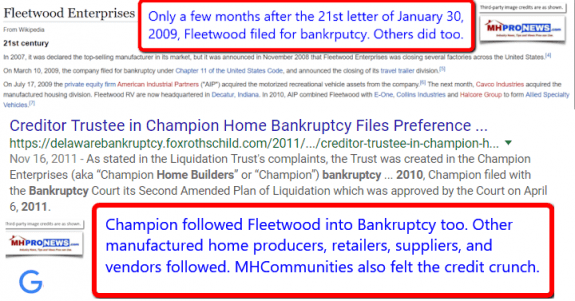

Note that Fleetwood and Champion were the previous #1 and #2 producers for manufactured housing in the industry at the turn of the century. They both filed for bankruptcy (see below). So did others, while various additional MH operations sold off to larger competitors, including those owned by Berkshire Hathaway.

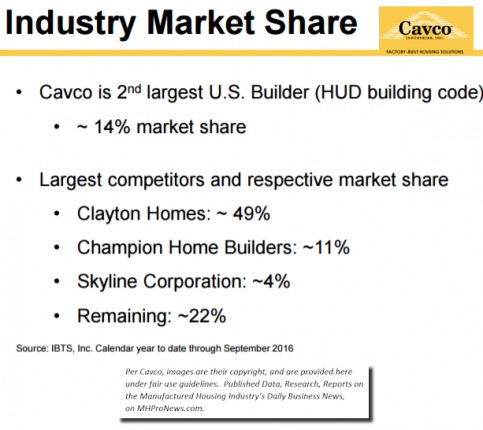

Today, Clayton has roughly 50 percent of the industry’s production, per MHI/Cavco released data, see below.

The 21st Letter/Document Announcing their Lending Changes

It was in such an environment that this 21st Mortgage Corp letter – see download, linked here – was issued on the date shown.

A key part of the letter is highlighted below. It specifies the steps that 21st was about to take, which would impact other manufactured home (MH) producers, retailers – and even MH communities – in the industry.

Note that this 21st document linked above was provided as a news tip by another C-suite level industry reader of MHProNews.

Note too that Warren Buffett very publicly backed then Senator Barack Obama, who championed the institution of Dodd-Frank.

Warren Buffett later championed Secretary Hillary Clinton in the last campaign. Clinton was pro-Dodd-Frank.

Obama and Clinton both opposed changes to Dodd-Frank.

Manufactured Housing Institute VP Revealed Important Truths on MHI’s Lobbying, Agenda

MHI’s then vice president in government relations said in writing that once Obama won re-election in 2012, that it would be very hard to get MHI’s flagship bill, Preserving Access to Manufactured Housing enacted into law. MHI VP Jason Boehlert proved to be correct in that forecast. Why did MHI waste millions and years in that effort?

Nevertheless, with Warren Buffett backing Clinton, then MHI Chairman Tim Williams – president of 21st Mortgage – was pushing Preserving Access as a modification for Dodd-Frank.

Democrat Maxine Waters and some of her colleagues have called Clayton Homes a ‘near monopoly.’ They and others in media have referred to MHI as the puppet of Berkshire Hathaway.

But this question of Berkshire Hathaway’s domination of the industry should not be seen as a partisan issue.

There are voices in both major parties – and those outside of those two political groups – that believe Berkshire has – as Waters said – a monopolistic hold over manufactured housing, and certainly wields great influence over MHI.

There are many more facts, concerns, and allegations that have been raised by industry members, MHARR, and this publication.

What is difficult to dispute are the following.

- First, the contraction of credit in the post 2008 housing/mortgage crisis ended up driving several Clayton competitors out of business. See two major examples in the screen capture below, and the quote from Tim Williams, above.

- Note again that those bankruptcies occurred after the Tim Williams/21st Mortgage letter. Final nail in their coffin?

Since that date, MHI has followed a pattern of alleged activity that could best be described as favoring Clayton and a few larger companies, at the expense of most small to medium sized firms. That in turn has led to closures and consolidations.

ELS’ Sam Zell – Compliance Costs Destroys Smaller Businesses = Consolidation

In the absence of an understanding that what has motivated MHI’s behavior for years – meaning, in ways that favor Berkshire Hathaway, Clayton and a limited number of companies – one is left with policies and behaviors that would otherwise make little or no sense.

Because if Preserving Access failed – as it has failed so far – Berkshire Hathaway lenders benefited, because of the regulatory and market burdens that surprised competition.

If Preserving Access passed – then 21st and VMF can charge higher rates and fees.

Either way, the billionaires won.

As award winning retailer Alan Amy noted in the video clip below, the industry’s billionaires still get the point that manufactured housing’s best days can be in the near future.

A Call for Federal Investigation

MHProNews initially began over a year ago questioning why MHI was issuing misleading written statements to their own members. We questioned Richard “Dick” Jennison and Lesli Gooch, and called for their removal.

Then MHI Chairman Tim Williams backed them both. Note they never refuted the allegations that they had weaponized their own news to members, in a manner that was misleading to the industry.

We called for transparency, and a release of information on several issues. MHI used attorneys they pay, surrogates and others to threaten this publisher/publication in unwarranted ways. Note that none of their threatened legal actions ever took place – nor should they have – because we were acting within our rights and arguably in the best interests of the industry at large.

Then, MHI removed us from their membership, because we were a news publication, claiming they had no membership category for that role. That was arguably bogus, as what we do was known when we applied years ago, also because they have others who publish as members, and they – as well as we – provide other services besides publishing.

At the Deadwood, SD meeting MHI Sr VP and General Counsel Rick Robinson refused in front of dozens of industry members to take any questions from MHProNews on the many brewing issues such as:

- HUD,

- Duty to Serve/GSEs,

- DOE,

- and Preserving Access.

Deadwood, the Manufactured Housing Revolution, and You – manufacturedhomelivingnews.com

The sun rose slowly over Deadwood, SD that day. The hills and trees offered cover for a variety of animals, including big horn sheep, and mountain goats. Outside the Inn at Deadwood, the manicured landscaping yielded naturally to the glass doors that welcomed tourists, gamers, and business professionals.

Isn’t it clear that MHI is hiding something?

Maxine Waters and her colleagues have called for a federal investigation of Clayton and their sister units.

The Toledo Blade recently referred to the Clayton/Clinton Foundation/Hillary Clinton’s work in Haiti as “corrupt.”

From within the industry, and outside of it, members of both sides of the political aisle have raised concerns about Berkshire Hathaway, Clayton Homes, VMF, 21st Mortgage, MHI and their allegedly monopolistic practices. Reports from inside and outside of Clayton Homes says they are continuing their push for industry dominance.

“We Provide, You Decide.”

At MHProNews, we’ve kept digging, which is perhaps why MHI – and those behind them – have allegedly kept targeting us as publishers/service providers.

In spite of prior praise by Tim Williams and a host of other industry leaders – MHI and those who pull their strings – have attempted to financially pressure and subvert the pro-industry/pro-consumer work of this publication and our sister site, MHLivingNews.

We’ve said for over a year that there’s a troubling pattern of activity that warranted MHI opening up their books. They’ve even refused to provide their own bylaws, which as a member or prospective member, they are obliged to do.

A long-time industry leader with deep ties to MHI has told MHProNews that the big boys have learned how to get the smaller companies to pay for what the big boys wanted, via their control over MHI.

Isn’t it time for members to at least suspend their payments to MHI, until they have a third party forensic examination of their emails, documents, and records?

We are also joining the call for the Department of Justice (DoJ), and the now Trump Administration-led Consumer Financial Protection Bureau (CFPB) and any other agency with competent jurisdiction to examine the cause of the collapse of the manufactured housing industry, and the parallel surge ahead of Warren Buffett led Berkshire Hathaway units including Clayton Homes, VMF, 21st Mortgage, et al.

Nothing changes until it is challenged.

Isn’t the truth hiding in plain sight? Watch for part two of this series, planned for next week. “We Provide, You Decide.” © (News, analysis, commentary.)

2 Week Notice: MHProNews will be on a somewhat modified publication schedule from now through January 2nd, resuming normal scheduling in 2018. More details, click here.

Note 2: Looking for our emailed MH Industry headline news updates? Click here to sign up in 5 seconds. You’ll see in the first issue or two why big, medium and ‘mom-and-pop’ professionals are reading them by the thousands, typically delivered twice weekly.

Note 3: News Tips – email at the link here – iReportMHNewsTips@mhmsm.com – with News Tip in the subject line.

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)

http://www.linkedin.com/in/latonykovach

Managing Member, LifeStyle Factory Homes, LLC – parent company to MHLivingNews, MHProNews and the business development and expert professional services provided