But there you have it, and that will be in the backdrop of our featured report for tonight.

If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected headlines and bullets from CNN Money:

- 2017 was a great year to be rich

- Homeowners line up to pre-pay property taxes

- Elon Musk promises a Tesla pickup – again

- Son of Washington Post publisher Kay Graham dies at 69

- Oil hits $60 a barrel for the first time in 2.5 years

- Why your holiday returns may end up in a landfill Trending

- Retail’s toughest year: A record for store closings

- North Korea slapped with more sanctions

- So, you got a tax cut. Now what?

- Amazon unveils the top holiday gifts this season

- Is the iPhone X a disappointment?

Selected headlines and bullets from Fox Business:

- What to expect for your personal finances in 2018

- US home prices surged 6.2% from a year ago

- Oil soars, U.S. crude hits $60 per barrel for first time since mid-2015

- Wall Street slips on tech sector weakness

- US industries can start counting their benefits from tax law

- Holiday travel tips: How to avoid headaches at the airport

- Retail Apocalypse: 21 big retailers closing stores in 2017

- Auto industry eyeing cooler sales, new tech in 2018

- Bitcoin recovers some losses after its worst week since 2013

- GOP tax reform and changes to your paycheck

- Apple, suppliers drop on report of weak iPhone X demand

- Tax Calculator: What tax reform means for you

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

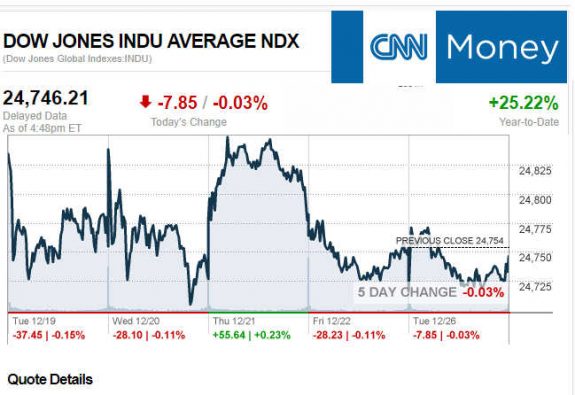

Today’s markets and stocks, at the closing bell…

S&P 500 2,680.50 -2.84(-0.11%)

Dow 30 24,746.21 -7.85(-0.03%)

Nasdaq 6,936.25 -23.71(-0.34%)

Russell 2000 1,544.23 +1.30(+0.08%)

Crude Oil 59.80 -0.17(-0.28%)

Gold 1,286.90 -0.60(-0.05%)

Silver 16.62 +0.02(+0.13%)

EUR/USD 1.1859 -0.0001(-0.01%)

10-Yr Bond 2.47 -0.02(-0.72%)

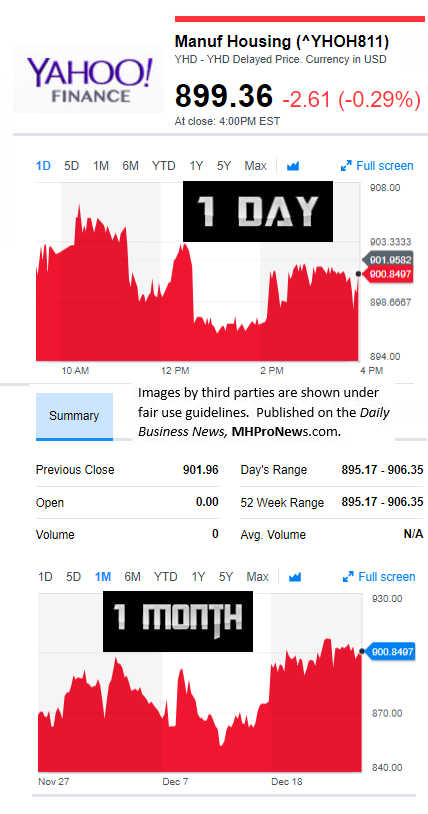

Manufactured Housing Composite Value

Today’s Big Movers

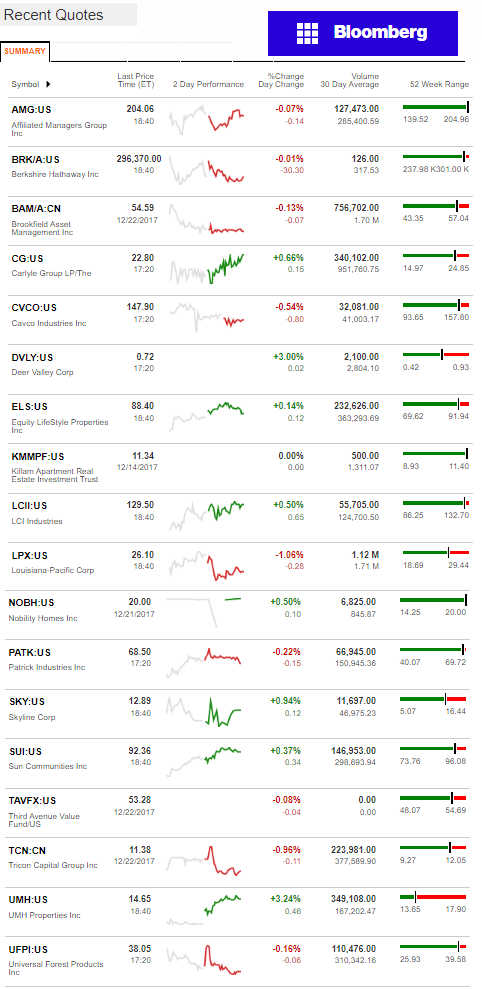

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

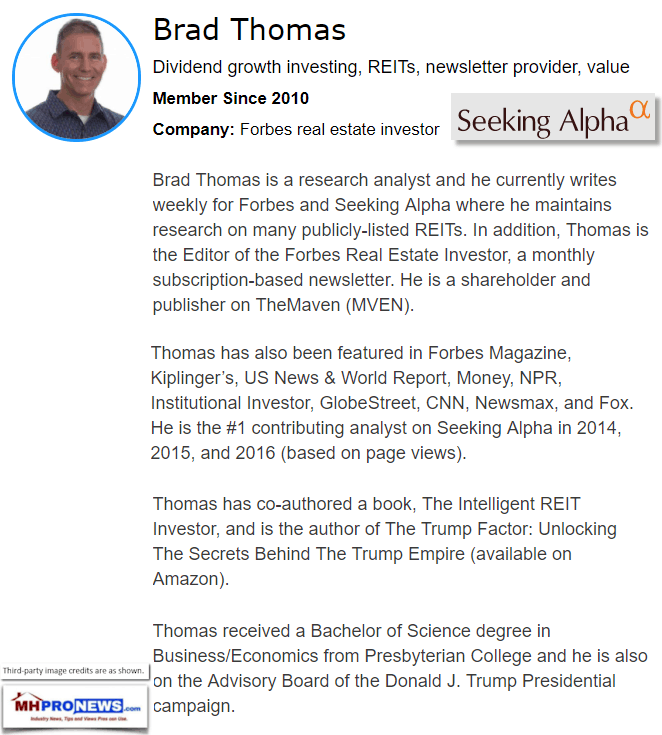

The graphics and links that follow are by the Daily Business News, but the commentary in brown is by Brad Thomas.

Warren Buffett Should Buy MHC REIT,

Alpha’s, Forbes’ Brad Thomas Said

Thomas’ Summary

I decided to increase my stake in UMH Properties because of the continued growth being generated within a sub-sector of housing that I find most attractive.

With tax reform now a “done deal,” every income group should see a tax cut, and the manufactured housing REITs are well positioned to participate in the ongoing recovery.

It has taken a while for the broader market to come to appreciate the tremendous growth characteristics in the manufactured housing industry.

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.” – Warren Buffett.

“Last week, fellow Seeking Alpha contributor Dane Bowler wrote an article titled “UMH Properties: Our Top REIT Pick Heading Into 2018.” I want to commend Dane for the excellent research, and it is because of his work that I decided to double down.

Dane wrote: “There are plenty of other industries where we have seen strong demand not translate into growth for the associated REITs… we think UMH is well positioned to reap the benefits of growing demand. 3 things are working in its favor: (1) Location, (2) Barriers to entry, and (3) Built-in expansion.”

Specifically, I decided to increase my stake in UMH Properties

(NYSEMKT:UMH) because of the continued growth being generated within a sub-sector of housing that I find most attractive.

Warren Buffett was smart to buy a maker of manufactured homes in 2003, when Clayton Homes was acquired by Berkshire Hathaway Inc. in 2003 for $1.7 billion. Clayton Homes builds nearly half the new manufactured homes sold in this country every year and sells them through its more than 300 retail lots and through independent dealers. The company finances more mobile home loans [sic] than any other lender by a factor of more than seven.

With tax reform now a “done deal,” every income group should see a tax cut, and the manufactured housing REITs are well positioned to participate in the ongoing recovery of the US housing market.

With tax reform now a “done deal,” every income group should see a tax cut, and the manufactured housing REITs are well positioned to participate in the ongoing recovery of the US housing market.”

Buffett, Baseball, Berkshire 55 Years Ago Today, Plus MH Markets Update$

We’re not debating Thomas’ analysis, because we published reports that defended UMH’s value when Seeking Alpha previously was among those that disrespected their growth plans.

But MHProNews will observe a point that similar prior comments have overlooked.

Warren Buffett spun off Clayton Homes communities after he acquired the company. That became the core of what today is Yes! Communities. The story line at the time was that Buffett didn’t want to be seen as ‘raising the ground rents on grandma.’

That noted, there’s a prior Alpha report that MHProNews and market watchers need to grasp. It’s Buffett and his partner Charlie Munger’s view of moats and business. Quoting that SA report:

“Buffett’s partner at Berkshire Hathaway, Charlie Munger, uses “four essential filters” in determining whether to invest in a company.

- A business with a moat.

- A business that can be understood by the investor.

- Management in place with integrity and talent.

- A business that can be bought at an attractive price that gives an attractive margin of safety.

In 2007, here’s what Buffett said about No. 1 on Munger’s list:

I don’t want a business that’s easy for competitors. I want a business with a moat around it. I want a very valuable castle in the middle. And then I want … the duke who’s in charge of that castle to be honest and hard-working and able. And then I want a big moat around the castle …”

Related Update

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

Profitable Insight$ – POTU$ Trump Effect on MH Stock$ at 1 Year, Part 4

Trump Effect – 1 Year Election Impact on Manufactured Housing Connected Stocks, Part 2

Just the Facts – Trump Effect on Manufactured Home Connected Stocks, Part 1

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)