Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- 22 million fewer insured under Senate GOP bill

- Tech giants bolster counter terror efforts

- Tech industry on travel ban: The fight goes on

- Silicon Valley can’t get enough of India PM Modi

- Jeff Bezos to bring hundreds of jobs to Alabama

- Study casts doubt on Seattle’s $15 minimum wage

- Senate health care bill: Who it hurts, who it helps

- Republican health bill would slash Medicaid

- Washington awaits CBO score on health care bill

- Hedge fund star Dan Loeb bets $3.5 billion on Nestle

- Amazon’s Echo Show is rough but promising

Selected headlines and bullets from Fox Business:

- CBO: Senate health bill will lower premiums, increase uninsured by 22M

- Health care battle: Senate conservatives begin negotiations

- S&P 500, Dow edge up; tech weighs on Nasdaq

- Oil closes higher; growing U.S. supply limits gains

- Supreme Court sides with Missouri church: What does ruling mean for taxpayers?

- Anthem: Senate health care bill will stabilize market, moderate costs

- Loretta Lynch faces possible felony if alleged DNC emails exist: Judge Napolitano

- Fmr. CBO acting director: I support GOP health care plan to reform Medicaid

- ESPN exec on bias allegations: ‘We have no political agenda whatsoever’

- GOP donors close checkbooks, frustrated with lack of progress on taxes, health care

- Takata bankruptcy may put recall costs squarely on automakers

- Nintendo ‘Super NES Classic’ console to hit shelves in September

- Avis scores Waymo deal, Hertz said to work with Apple on self-driving cars

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

9 key market indicators, ‘at the closing bell…’

S&P 500 2,439.07 +0.77 (+0.03%)

Dow 30 21,409.55 +14.79 (+0.07%)

Nasdaq 6,247.15 -18.10 (-0.29%)

Crude Oil 43.48 +0.47 (+1.09%)

Gold 1,244.90 -11.50 (-0.92%)

Silver 16.54 -0.11 (-0.64%)

EUR/USD 1.1182 -0.0001 (-0.01%)

10-Yr Bond 2.137 -0.007 (-0.33%)

Russell 2000 1,416.64 +1.86 (+0.13%)

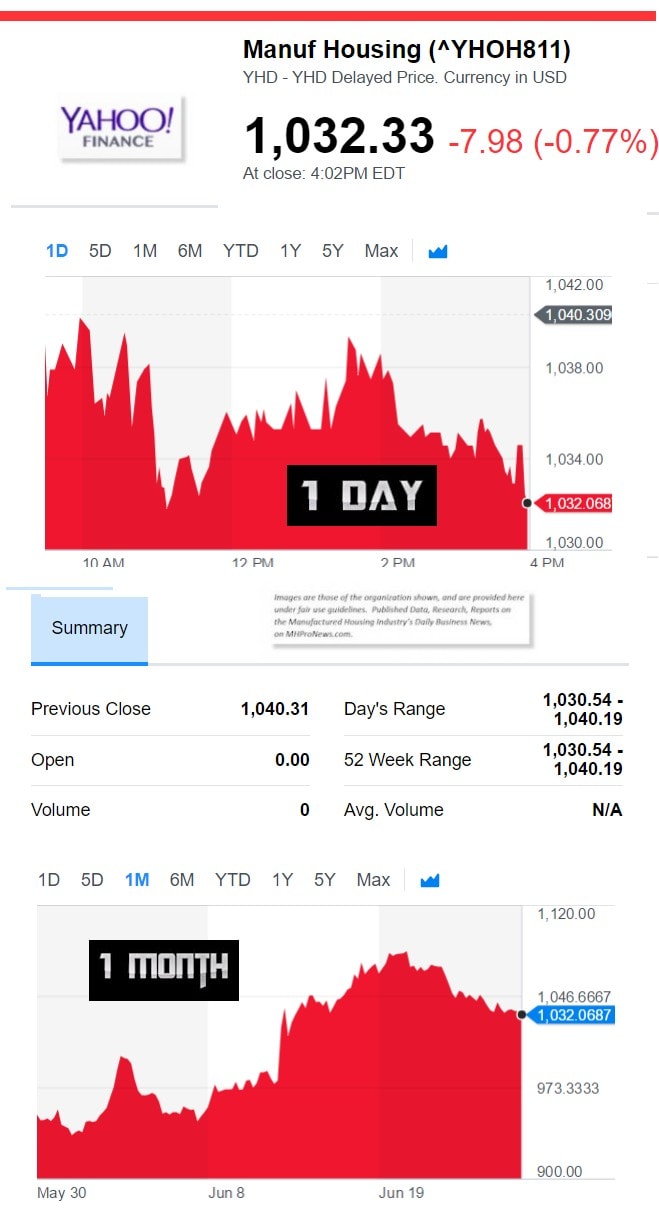

Manufactured Housing Composite Value 6.26.2017

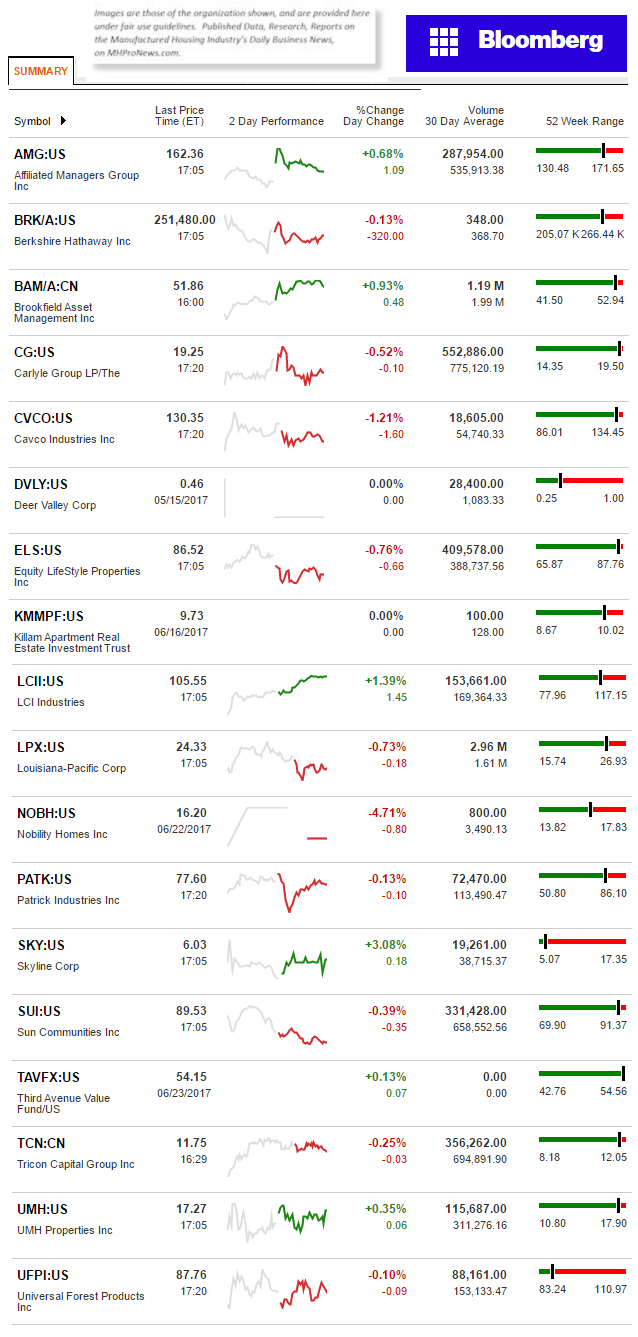

Manufactured Housing Connected Stocks

Today’s Big Movers

Skyline and LCI lead the gainers. Cavco and LPX lead the decliners. See below for all the ‘scores and highlights.’

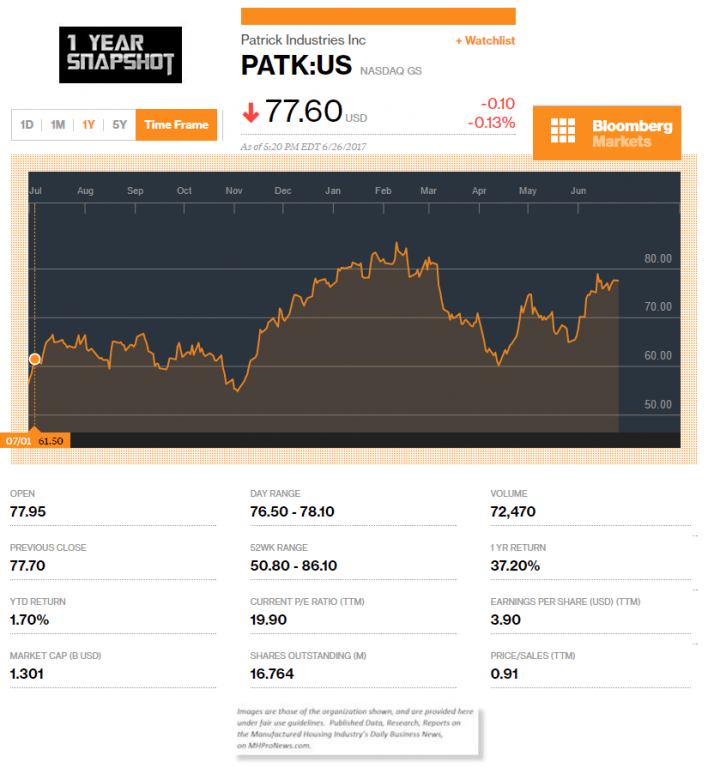

Today’s MH Market Spotlight Report – Patrick (PATK)

Per the Utah Herald,

“Analysts See $1.17 EPS for Patrick Industries, Inc. (PATK)”

“Analysts expect Patrick Industries, Inc. (NASDAQ:PATK) to report $1.17 EPS on July, 27. They anticipate $0.07 EPS change or 6.36% from last quarter’s $1.1 EPS.

PATK’s profit would be $19.68M giving it 16.52 P/E if the $1.17 EPS is correct.

(NASDAQ:PATK) has risen 37.12% since June 26, 2016 and is uptrending. It has outperformed by 20.42% the S&P500.”

Insider Trades

“Since January 4, 2017, it had 2 insider buys, and 9 selling transactions for $3.77 million activity. On Wednesday, May 17 WELCH M SCOTT bought $332,500 worth of Patrick Industries, Inc. (NASDAQ:PATK) or 5,000 shares. 4,848 Patrick Industries, Inc. (NASDAQ:PATK) shares with value of $404,154 were sold by GENDELL JEFFREY L ET AL.

The insider Rodino Jeff sold 700 shares worth $56,005. On Wednesday, January 4 Cleveland Todd M sold $801,583 worth of Patrick Industries, Inc. (NASDAQ:PATK) or 10,000 shares. WELLS WALTER E sold 3,000 shares worth $236,991.”

Major Investor Moves

Again, per the Utah Herald, “Investors sentiment decreased to 1.15 in 2016 Q4. It’s down 0.20, from 1.35 in 2016Q3.

It is negative, as 16 investors sold Patrick Industries, Inc. shares while 57 reduced holdings.

32 funds opened positions while 52 raised stakes.

13.01 million shares or 2.07% less from 13.29 million shares in 2016Q3 were reported. 3,747 are held by Stanley. Jpmorgan Chase & invested in 0.01% or 310,322 shares.

Dimensional Fund Advisors L P reported 0.03% stake. Cadence Limited has invested 0.08% in Patrick Industries, Inc.

Royal State Bank Of Canada accumulated 1.61 million shares.

California State Teachers Retirement Systems stated it has 0% in Patrick Industries, Inc.

Wexford Limited Partnership holds 0.04% or 5,665 shares.

Creative Planning owns 7 shares for 0% of their portfolio.

Pitcairn Comm reported 0.03% of its portfolio in Patrick Industries, Inc.

Gendell Jeffrey L has invested 8.25% in Patrick Industries, Inc.

State Of Alaska Department of Revenue has 1,580 shares for 0.01% of their portfolio.

Wedge Mgmt L Lp Nc invested 0% in Patrick Industries, Inc.

Hood River Cap Ltd Liability Corp invested 0.75% of its portfolio in Patrick Industries, Inc.

Shaker Invests Limited Com Oh holds 15,000 shares.

State Street Corporation accumulated 308,225 shares or 0% of the stock.”

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII)

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)