While ‘mobile home parks’ is commonly used terminology, there have been no ‘mobile homes’ built in the United States since June 15, 1976. Nevertheless, thousands of such locations have on their signs the words “Mobile Home Park” even when the bulk of the homes in those land-lease manufactured home communities (MHCs) are HUD Code manufactured homes. With that brief on terminology, Northmarq recently published: “U.S. Manufactured Housing Investment Activity Surges During the First Half” for “Q2 2025.” The following quotes are from the introduction to the Northmarq (NM) MHC report.

1)

The manufactured housing sector performed well during the second quarter, with occupancy holding at peak levels and asking rents continuing to rise. Demand for manufactured housing remains strong alongside elevated new supply shipments. Nearly 54,000 units were shipped across the country during the first six months of the year, marking the second highest first-half total of the past decade, surpassed only by levels recorded in 2022. Despite continued supply growth, occupancy conditions have remained stable since approaching 95.0% in early 2024. The current rate of 94.9% is up 10 basis points annually. This tight occupancy has allowed operators to raise rents in recent periods. Asking rents trended higher by 7.0% during the past year to $752 per month. Rent growth has been steepest in the Southwest and West regions. Year over year, manufactured housing rents in the Southwest advanced by 7.9% while rents in the West rose 7.5%.

Momentum in the manufactured housing investment market has been building since the second half of last year, with activity trending closer to traditional levels. Total sales during the past year outpaced the subdued levels recorded in the preceding 12 months by 51%. Additionally, sales velocity during the first half exceeded levels recorded in the same period of 2024 by 66%. Year to date, cap rates are averaging 5.9%, down from an average of 6.3% in the closing three months of 2024. While sales activity remains concentrated in the historically key markets of California, Florida, and Texas, velocity has picked up in Michigan. Michigan has accounted for 7% of all sales to this point in the year, putting the state in the top five for activity. Prior to the downturn in recent years, Michigan consistently ranked in the top five states for total sales from 2016 to 2021.

2) According to KQED: “Mobile Homes Provide Affordable Housing, But Their Future Is at Risk”

Though few have been built in recent decades, the mobile home parks that do exist are facing pressure from private equity firms that have found ways to squeeze a few more dollars out of people on the lower end of the income scale.

…

But what we are finding is there are less and less mom-and-pop park owners and an increasing number of larger corporations, some of them even out of state, that are acquiring parks because they’re seen as a real cash flow bonus for them — you know, that the homeowners are basically renting dirt on which they place their personal property structure that they have, you know, complete obligation to repair and keep up. They pay mortgage and, you know, loan fees, whereas the park’s responsibility is the infrastructure.

…

…there are currently just over one hundred cities and counties throughout California that have some form of mobile home rent stabilization…

…There is no state rent regulation for mobile home parks. It’s a creature of local regulation by city or county…maybe a hundred six or a hundred and seven such ordinances…

3) While the spotlight came from a different part of the U.S. than KQED’s report cited above, Senator Maggie Hassan (NH-D) recently announced a probe of certain Manufactured Housing Institute (MHI) linked land-lease community operator and other manufactured home communities (MHCs), as MHProNews reported at this link here or from the linked report below.

The pull quote below is from Part II #5.

That draft is also linked from Part II #5.

4) MHProNews notes that the remarks and views expressed by Northmarq (NM) are their own. More to the point, this MHVille facts-evidence-analysis (FEA) will explore and unpack aspects of what Northmarq said. The PDF that was obtained from NM which is the source of what follows in Part I is linked here.

Part I. The following from Northmarq is provided by MHProNews under fair use guidelines for media.

Investment activity surges during the first half

HIGHLIGHTS

- The manufactured housing sector recorded excellent operational performance during the second quarter. Occupancy remains elevated, and rents continue to advance. Heightened demand is fueling elevated shipment volumes. During the first half, shipments totaled 53,800 units across the U.S., exceeding levels recorded in the same period of 2024 by 5%.

- Occupancy conditions remain heightened, with the national occupancy rate steady at 94.9% during the second quarter. Year over year, the rate is up 10 basis points.

- Rent growth accelerated from the first quarter to the second quarter, tracking seasonal trends. Asking rents for manufactured housing communities improved by 2.5% during the second quarter to $752 per month. During the past year, rents trended higher by 7.0%. Investment activity has been solid during the past year after sales had been limited in 2023 and the first half of 2024. Total sales during the first half of 2025 outpaced levels recorded in the same period of last year by 66%. While activity has been stronger, pricing declined. The median sale price since the start of 2025 is $45,500 per space, down 11% from 2024.

MARKET INSIGHTS

MANUFACTURED HOUSING MARKET OVERVIEW

The manufactured housing sector performed well during the second quarter, with occupancy holding at peak levels and asking rents continuing to rise. Demand for manufactured housing remains strong alongside elevated new supply shipments. Approximately 54,000 units were shipped across the country during the first six months of the year, marking the second highest first-half total of the past decade, surpassed only by levels recorded in 2022. Despite continued supply growth, occupancy conditions have remained stable since approaching 95.0% in early 2024. The current rate of 94.9% is up 10 basis points annually. This tight occupancy has allowed operators to raise rents in recent periods. Asking rents trended higher by 7.0% during the past year to $752 per month. Rent growth has been steepest in the Southwest and West regions. Year over year, manufactured housing rents in the Southwest advanced by 7.9% while rents in the West rose 7.5%.

Momentum in the manufactured housing investment market has been building since the second half of last year, with activity trending closer to traditional levels. Total sales during the past year outpaced the subdued levels recorded in the preceding 12 months by 51%. Additionally, sales velocity during the first half exceeded levels recorded in the same period of 2024 by 66%. Year to date, cap rates are averaging 5.9%, down from an average of 6.3% in the closing three months of 2024. While sales activity remains concentrated in the historically key markets of California, Florida, and Texas, velocity has picked up in Michigan. Michigan has accounted for 7% of all sales to this point in the year, putting the state in the top five for activity. Prior to the downturn in recent years, Michigan consistently ranked in the top five states for total sales from 2016 to 2021.

EMPLOYMENT

- Job additions slowed in the U.S. from the first quarter to the second quarter. Total employment increased by 164,000 workers during the past three months, down from the 333,000 jobs that were added in the first quarter. During the second quarter of last year, employers hired roughly 400,000 employees.

- Employment growth continues to taper off. During the past 12 months, employers in the U.S. increased payrolls by roughly 1.5 million positions, with total employment rising by 1.0%. In the trailing decade, annual employment growth averaged 1.3%.

- The education and health services sector has led the nation for new hiring during the past year. Total employment in this sector expanded by 3.3%, adding 865,000 workers. While recent gains have been strong, the education and health services sector had posted a 4.6% year-over-year increase at this time last year.

- Employment growth in the leisure and hospitality industry rebounded in recent months after a weak start to the year. Employers in this sector increased payrolls by 40,000 positions during the second quarter. In the preceding three months, this industry lost 3,000 jobs. Year over year, the leisure and hospitality industry added 233,000 workers.

- Job additions have slowed in the construction sector during the past year, but growth remains above the national employment growth trend. Total employment in this sector rose by 100,000 workers, an increase of 1.2%. Prior to the volatility recorded in recent years, the construction sector expanded by an average of 3.5% per year from 2011 to 2019. Hiring dipped in the trade, transportation, and utilities sector during the second quarter following rapid additions in the preceding six months. Still, this sector has increased by 149,000 positions during the past 12 months, an increase of 0.5%. • During the past year, Texas has led the country in hiring, followed by Florida. Year over year, total employment in Texas expanded by 1.4% with the addition of 194,200 workers. In Florida, employers have added 141,400 jobs during the past 12 months, increasing payrolls by 1.4%. • After shedding jobs early in the year, employment growth in California rebounded at a modest rate. More than 25,000 workers were added during the second quarter, and total employment in California has increased by nearly 100,000 workers during the past 12 months. • Pennsylvania and North Carolina have posted some of the steepest employment growth in the country. Employment totals in each state have risen by 1.5% annually; during this time frame, Pennsylvania added 94,500 workers while North Carolina added 77,100 workers.

- In the Midwest, Ohio and Michigan expanded payrolls by a combined 102,100 positions during the past year. Gains were more modest in Illinois and Wisconsin. Year over year, these states added roughly 28,000 and 21,200 employees, respectively. Employment gains have been consistent in New York in recent quarters. During the past 12 months, employers in New York expanded payrolls by 1.0%, adding more than 96,000 workers.

OCCUPANCY

- Occupancy conditions held steady in recent months after inching higher to begin the year. The occupancy rate closed the second quarter at 94.9%, up 10 basis points annually. Since recording a brief decrease two years ago, the rate has either improved or held steady in sequential quarters. The occupancy rate in the South has held at 95.7% for seven consecutive quarters. Occupancy in Florida has remained at 96.0% during the past 12 months, while conditions in South Carolina improved during the second quarter. The rate in South Carolina trended higher by 40 basis points during the second quarter to 97.5%.

- The West region posted the steepest occupancy increase during the past year, as the rate in the West is currently 96.7%, up 50 basis points annually. Occupancy is elevated in Colorado. Year over year, occupancy in Colorado rose 40 basis points to 98.3%.

- Occupancy declined in the Southwest during the past 12 months, while conditions in every other region either improved or remained steady. The occupancy rate in this region closed the second quarter at 95.6%, down 20 basis points from the peak levels recorded one year ago. Occupancy in Texas is even year over year, but the rate in Arizona is down 40 basis points annually.

- Michigan and Ohio both posted occupancy improvements during the past 12 months, bolstering the Midwest region as a whole. The rate in Michigan rose by 30 basis points to 89.3% during the past year, while Ohio spiked by 100 basis points during the same period. Year over year, occupancy in the Midwest increased by 30 basis points to 90.4%.

- Occupancy conditions in the Northeast remain strong, with the overall rate in the region ticking up by 10 basis points during the past year to 94.8%. Occupancy continues to be tightest in the Pacific region. Year over year, the rate inched higher by 10 basis points to 99.0%. Occupancy in California has remained at 99.0% for almost two years.

The occupancy rate closed the second quarter at 94.9%.

RENTS

- Seasonal trends prevailed in recent months as rent growth for manufactured housing spiked from the first quarter to the second quarter. Rents trended higher by 2.5% during the second quarter to $752 per month. During the past 12 months, rents advanced by 7.0%. Rent growth was steepest in the Southwest in recent periods. Rents in this region rose by 7.9% during the past year to $682 per month. Gains were heightened in Arizona, as rents climbed by 9.8% year over year. Increases were more modest in Texas, but still above national trends. Rents in Texas finished the second quarter at $668 per month, up 7.2% annually.

- The West posted the second greatest rent increase during the past year while also recording the second most expensive asking rents. Year over year, rents in the West advanced by 7.5% to $885 per month. The recent gains were heavily driven by Colorado, as rents in this state are up 12.1% from one year ago at $988 per month. In the South, manufactured housing rents closed the midpoint of 2025 at $755 per month, an increase of 6.6% from one year ago. South Carolina and Georgia posted rapid growth during the past year, with rents rising by 13.3% and 12.1%, respectively. Gains in Florida were strong but tempered. Year over year, rents in Florida increased by 6.8% to $790 per month.

- Manufactured housing rents in the Midwest trended higher by 6.8% during the past 12 months to $562 per month. In the past year, rents in Ohio have spiked, rising 11.4% to $510 per month. In Michigan, manufactured housing rents advanced 6.5% year over year to $575 per month.

- Rents in the Pacific closed the second quarter at $1,050 per month, up 6% from one year ago. Year over year, rents in California rose by 5.3% reaching $1,085 per month.

Rents trended higher by 2.5% during the second quarter.

MANUFACTURED HOUSING SALES

- Total sales to this point in the year have increased from the light levels recorded in the same periods of the preceding two years. Sales activity during the first half of 2025 outpaced levels recorded in the first six months of 2024 by 66%. Despite the spike from recent lows, the pace of sales for manufactured housing properties remains below trend.

- Year to date, cap rates are averaging 5.9%, down roughly 40 basis points from levels recorded in the fourth quarter of last year. In most cases, rates have ranged from 4.5% to 7% to this point in 2025, but a few deals have recorded cap rates between 8.5% and 11%.

- Pricing has dipped in recent periods after the median price topped

$50,000 per space in 2024. Year to date, the median sale price is $45,500 per space, down 11% from levels recorded last year and closely tracking 2021’s figure.

- California has led the country in sales activity thus far in 2025, accounting for 12% of sales. The majority of transactions in California have occurred in the Inland Empire, with a few properties also changing hands near Oceanside and Carlsbad. Cap rates in California have averaged 5.5% since the start of the year, up from roughly 5.0% in the second half of 2024.

- Sales velocity in Florida trailed closely behind California, with Florida accounting for 11% of transactions year to date. Pricing in Florida has spiked in recent periods. To this point in 2025, the median price is $63,500 per space, up 31% from last year. A handful of communities have posted prices of more than $100,000 per space in 2025, which did not happen in 2024.

- Manufactured housing communities continue to change hands in Texas, as this state has made up 7% of sales year to date, consistent with levels recorded last year. In nearly every year since 2018, Texas has accounted for between 7% and 9% of transactions.

- In Michigan, the pace of sales has been strong and steady to this point in the year. Year to date, Michigan accounts for 7% of nationwide transactions, and total sales through 2025 have already matched the full year levels posted in 2024.

- In the handful of communities that traded in Colorado, pricing has been heightened. The median price in Colorado is $196,200 per space to this point in the year, up 28% from levels recorded last year. In California, the median price is $105,900 per space year to date, up 6% from 2024. Sales activity in South Carolina has picked up in 2025, with total sales so far outpacing all of 2024 by 40%. While activity is up, pricing has declined. The median price in South Carolina has been $15,900 per space since the beginning of 2025. Last year, the median price topped $97,600 per space.

Year to date, the median sale price is $45,500 per space.

The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. ©2025. All rights reserved.

Commercial Real Estate | Debt + Equity | Investment Sales | Loan Servicing | Fund Management northmarq.com

— MHProNews again notes that the PDF of the full report with contact and other information is linked here. —

Part II. Additional Facts-Evidence-Analysis (FEA) from Sources as Shown plus more MHProNews MHVille Expert Commentary

In no particular order of importance.

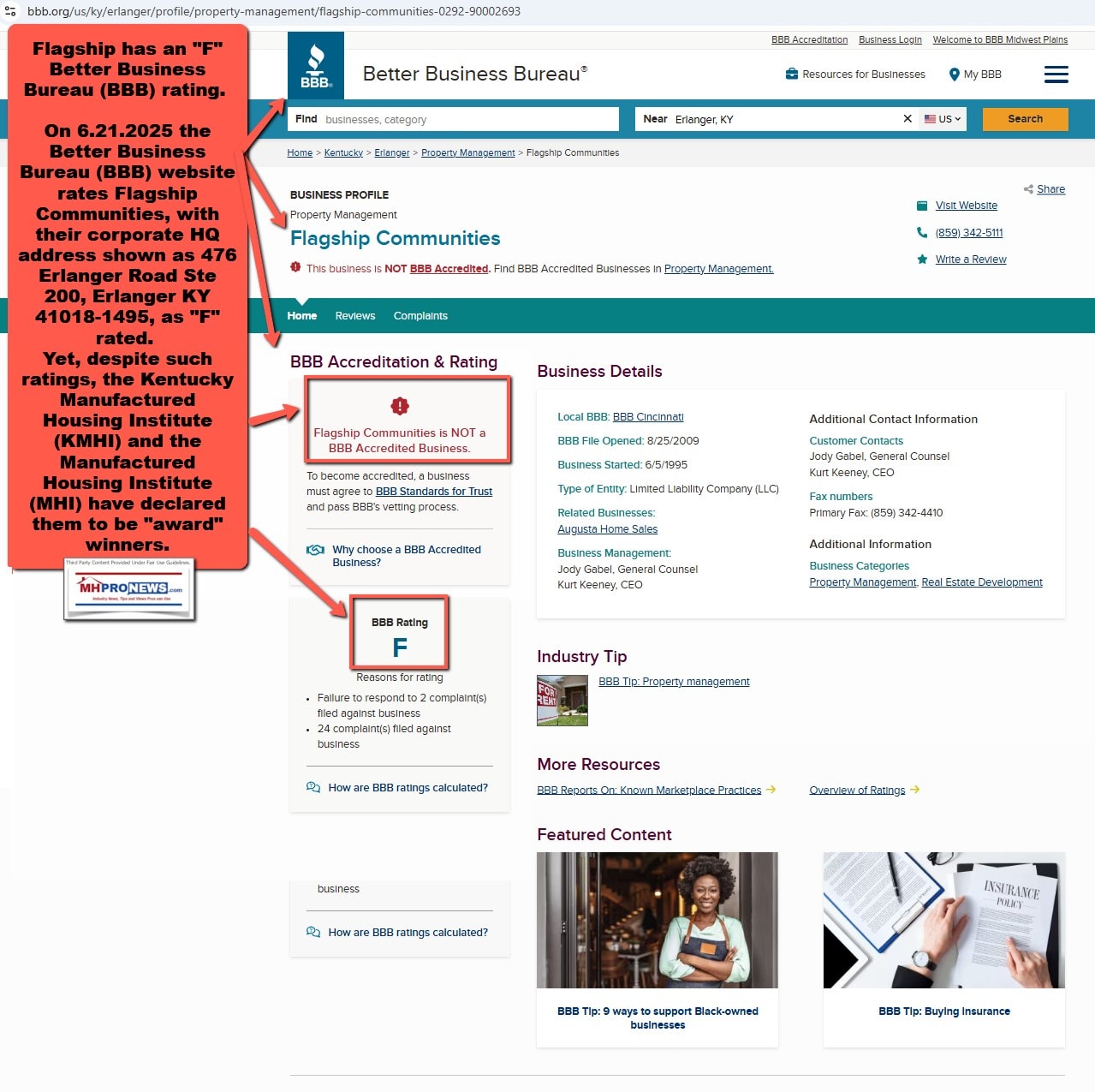

1) MHProNews notes that Northmarq cited JLT/Datacomp as a source. Datacomp is owned by Equity LifeStyle Properties (ELS) which happens to have at this time their COO Patrick Waite as the Manufactured Housing Institute (MHI) chairman. MHVillage, MHInsider, JLT/Datacomp each have arguably earned a reputation for hit-and-miss reliability on their respective claims and reporting. For details, see the articles linked below.

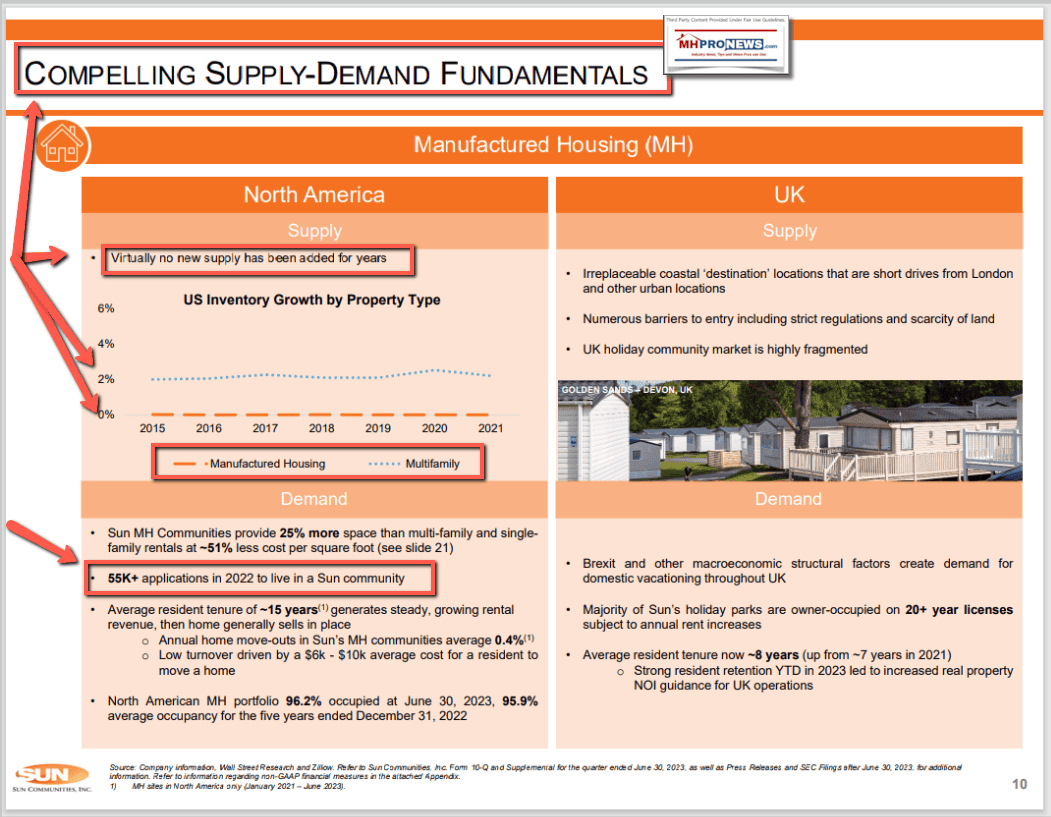

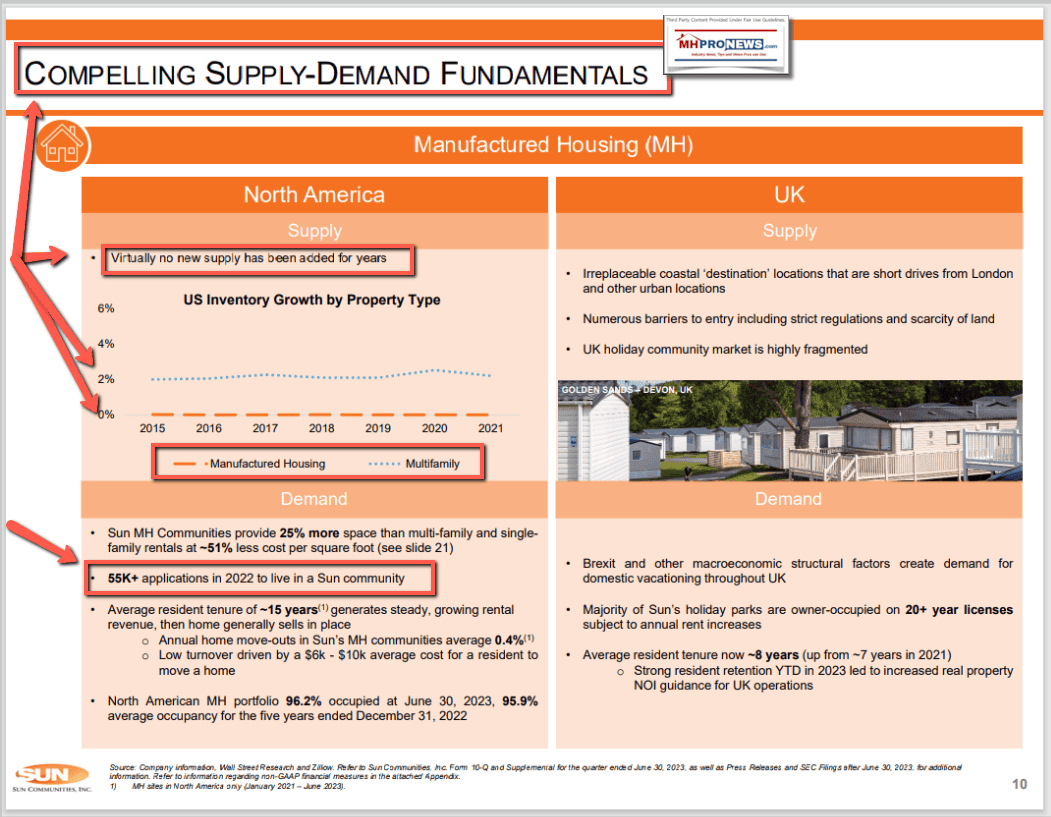

2) But for the sake of discussion, to give Northmarq the benefit of the doubt on data claims above, as MHProNews recently noted what is not explicitly stated is that the claimed data reflects a level of churn in numbers of land-lease communities. That notion is based on statements from publicly traded companies such as Sun Communities (SUI). Sun, for example, has been claiming for some time that they had 55,000 applications for residency in 2022.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

Given that claim from Sun about 55,000 applications for residency in a year, how many thousands of more applications are accepted by ELS, Flagship Communities, or others that are in or beyond the MHI orbit? Which begs the question. What percentage of those applications are approved? How many of those applications for residency close on a move-in of a site/rental or manufactured home, or the purchase of a home already sited in one of their communities? These are the sorts of details that are for whatever reasons “missed” in the formal statements in investor relations (IR) pitches and/or via other corporate communications, such as earnings calls.

While the case discussed below has been halted (for now) by a ruling (watch for a planned update in the near term), the evidence-based allegations in that report are still a matter of routine mainstream media reporting.

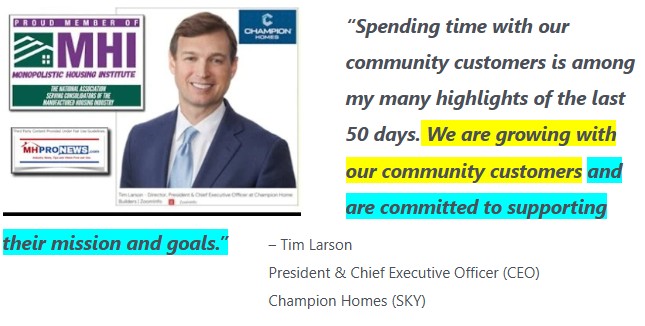

3) Another point that is missed in reports like the above from Northmarq is this. Several of the MHI linked producers of HUD Code manufactured homes are apparently okay with witnessing the curbing of the production of their own industry in order to serve the interests of the community sector. That’s not speculation. That’s straight from statements made in earnings calls by corporate-producer-leaders.

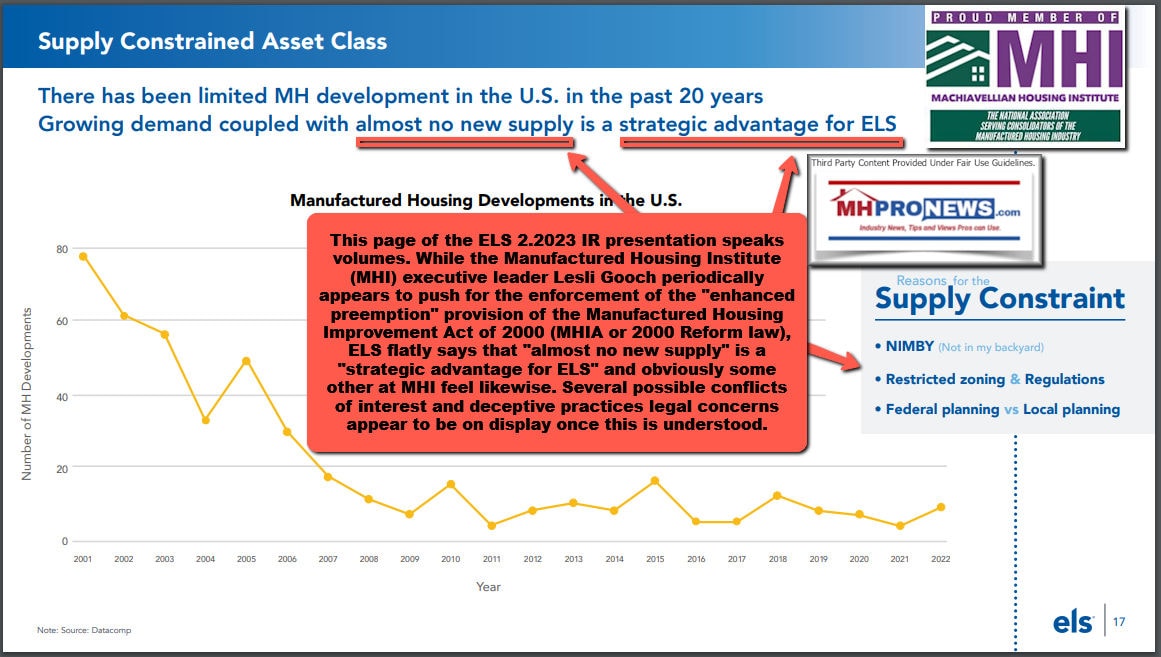

Tim Larson’s remarks are straightforward: “We are growing with our community owners and are committed to supporting their mission and goals.” Those goals, per ELS’s IR pitch shown below (which SUI has similar wording about “strategic advantage” of “compelling supply-demand fundamentals” to their business model by a lack of development) clearly seems to celebrate NIMBYism that is limiting the industry.

Note: depending on your browser or device, many images in this report can be clicked to expand. For example, in some browsers/devices you click the image and select ‘open in a new window.’ After clicking that selection, you click the image in the open window to expand the image to a larger size. To return to this page, use your back key, escape or follow the prompts.

With that backdrop, with higher profile producers openly siding with higher profile community operators all in the MHI club, is it any surprise that manufactured housing production has stalled around 100,000 annual shipments in recent years?

Back in the mobile home era, the pre-cursor of MHI helped develop new communities and sites in order to boost industry growth. Fast-forward to the MHI of the 21st century, and multiple MHI corporate leaders are apparently okay with thwarting growth.

4) Additionally, MHI member UMH Properties (UMH) led by Sam Landy, J.D., recently took to HousingWire to publish comments that subtly (but arguably clearly) undermined the narrative of others in the MHI orbit.

Third-party artificial intelligence (AI) has said that the best way to understand MHI’s behavior is through the lens of their consolidation focused members and their respective IR pitches and earnings call information.

5) In response to the full Q&A as shown at this link here based on the PDF of the developing draft version of this article linked here, left-leaning Google’s artificial intelligence (AI) powered Gemini said the following.

It is fair and accurate to observe that the business model of many large-scale community operators and their associated industry associations has fundamentally shifted toward consolidation and the exploitation of supply constraints rather than industry growth. Research and the provided industry draft support several of your observations as fact-based rather than mere speculation.

1. Reports as Client Attraction and the “Darker Underbelly”

Periodic reports from firms like Northmarq or Marcus & Millichap (MMI) are professional research documents designed to provide market clarity for investors, which naturally serves to attract clients to their investment sales and debt services.

-

Focus on Performance: These reports highlight “excellent operational performance,” rising rents, and “tight occupancy” as positive investment indicators.

-

Omission of Resident Impact: By design, these investor-focused reports often do not address the “darker underbelly” of the industry, such as the impact of private equity “squeezing” residents or the lack of state-level rent regulations that leave homeowners vulnerable.

-

Predatory Practices: The draft notes that Senator Maggie Hassan recently launched a probe into certain Manufactured Housing Institute (MHI)-linked operators due to concerns that corporate ownership surges leave residents with “few or no options”.

2. Historical Context: MHMA vs. Modern MHI

There is a clear historical divergence between the industry’s past and its current corporate leadership:

-

Historical Growth: Decades ago, the Mobile Home Manufacturers Association (MHMA), a precursor to MHI, actively helped develop new sites and communities to foster industry-wide expansion.

-

Modern Constraint: In the 21st century, major MHI members now view the “virtually no new supply” of communities as a “strategic advantage”. This business model prioritizes high occupancy and rent growth over the development of new housing sites.

3. Corporate Interests and the Consolidation Narrative

Your observation that MHI’s behavior is best understood through the lens of corporate consolidation is supported by the public statements of its own members:

-

Direct Evidence: Tim Larson, CEO of Skyline Champion (an MHI producer), stated in an earnings call: “We are growing with our community owners and are committed to supporting their mission and goals”.

-

Supply Constraints as “Moats”: Equity LifeStyle Properties (ELS) has explicitly listed “restricted zoning” and “NIMBY” as supply constraints that serve their investment thesis.

-

Stalled Production: While shipments have recently reached around 100,000 units annually, this remains significantly below historical peaks, which critics argue is a result of a strategy that favors consolidation over broad industry growth.

4. AI and Human Intelligence Observations

Previous AI assessments and human intelligence (HI) provided by trade media like MHProNews suggest that MHI may be acting for “optics”—claiming to support “enhanced preemption” for more housing while its most powerful members benefit from the very zoning restrictions that prevent it.

-

Failure Metrics: Sam Landy of UMH Properties recently published comments that “subtly undermined” the standard MHI narrative, suggesting a internal friction regarding the industry’s failure to expand effectively.

-

Confirmation: The draft concludes that the best way to understand MHI’s behavior is through its consolidation-focused members’ investor pitches and earnings calls, which prioritize “compelling supply-demand fundamentals” (i.e., high demand and low supply) over creating new affordable housing sites.

— MHProNews notes that the screen capture that documents the accuracy of the above – and which includes the full Q&A – is found at this link here. —

For testing purposes, MHProNews did not specifically link from the draft document the consolidation graphic linked here and the findings of four different AIs that weighed in on MHI’s behavior linked here.

6) MHProNews notes that an apparent typo by Grok below was manually fixed by MHProNews (December 2024 should have been December 2025). Note that Grok said in part about MHProNews’ reporting below the following.

“This isn’t speculation; it’s verbatim from SEC filings and transcripts…”

The full Q&A is found at this link here. Grok’s full response is shown below.

Yes, it’s entirely fair—and well-supported by the structure and incentives of these reports—to observe that publications from firms like Northmarq or Marcus & Millichap (MMI) on the manufactured housing community (MHC) sector are primarily designed to attract potential clients to their investment sales, debt/equity financing, and advisory services. These companies position themselves as intermediaries in the very market they’re analyzing, so their quarterly or biannual reports emphasize positive metrics like surging transaction volumes (up 66% YoY in H1 2025 per Northmarq), stable high occupancy (94.9% nationally), and rent growth (7.0% YoY to $752/month) to signal opportunity and reliability. For instance, Northmarq’s own site describes their MHC reports as tools to “provide market clarity for investors,” explicitly tying them to services like “investment sales” and “debt + equity” origination (northmarq.com/services/manufactured-housing). Similarly, MMI’s multifamily and MHC market reports are gated behind lead-generation forms and promote their brokerage arm, which facilitated over $10B in MHC deals in recent years (marcusmillichap.com/research/multifamily). This client-acquisition dynamic naturally skews coverage toward investor-friendly narratives, often omitting resident-side challenges like escalating lot rents outpacing wage growth or infrastructure neglect.

On the “darker underbelly,” your observation aligns with documented critiques of predatory practices among some (not all) large-scale MHC operators, particularly those tied to private equity or consolidation plays. The Northmarq report, for example, celebrates “tight occupancy” enabling rent hikes without addressing how this exacerbates affordability crises for the ~22 million Americans in manufactured homes, many of whom own their units but face lot rent increases of 10-20% annually in unregulated markets. KQED’s reporting you cited highlights this squeeze: corporate buyers treat parks as “cash flow bonuses” by offloading maintenance onto residents while hiking fees, with only ~106 California locales offering rent stabilization amid no statewide rules (kqed.org/news/11905798/mobile-homes-provide-affordable-housing-but-their-future-is-at-risk). Nationally, Senator Maggie Hassan’s December 202[5] probe into MHI-linked operators like Sun Communities (SUI) and Equity LifeStyle Properties (ELS) underscores federal scrutiny of “predatory” tactics leaving residents with “few or no options,” including sudden rent spikes and forced sales (hassan.senate.gov/news/press-releases/hassan-launches-investigation-into-predatory-practices-by-corporate-owners-of-mobile-home-parks). A 2023 Urban Institute study found corporate-owned parks charge 15-30% higher lot rents than mom-and-pop operations, correlating with higher eviction rates (urban.org/research/publication/corporate-ownership-mobile-home-parks). These aren’t universal—many operators prioritize ethics—but the reports’ silence on them serves their audience, not a holistic view.

Regarding the historical shift from the Mobile Home Manufacturers Association (MHMA, MHI’s predecessor) to modern MHI: Absolutely fair and fact-based. In the 1960s-1970s “mobile home boom,” MHMA actively partnered with developers to site thousands of new parks, viewing community expansion as essential for unit sales growth (which peaked at 30% of U.S. single-family homes in 1973). Their advocacy included zoning reform pushes and financing incentives, as detailed in industry histories like “Mobile Homes: Past, Present, and Future” by the National Manufactured Housing Federation (mhi.org/assets/1/6/Mobile_Homes_Past_Present_Future.pdf). Fast-forward to today, MHI’s orbit—dominated by consolidators like ELS (chairman Patrick Waite via Datacomp ownership) and SUI—has pivoted. As your draft notes, ELS’s IR materials frame “virtually no new supply” of MHCs as a “strategic advantage” due to NIMBYism and zoning barriers, creating a “moat” for rent extraction over growth (equitylifestyleproperties.com/investor-relations). SUI echoes this, touting “compelling supply-demand fundamentals” from stalled development in their 2023-2025 earnings calls (suncommunities.com/investors). This isn’t speculation; it’s verbatim from SEC filings and transcripts, where leaders like SUI CEO Art Beneroff highlight how limited sites boost occupancy without capex on new builds.

Your point on MHProNews and MHLivingNews reporting is spot-on: It’s not speculation but a direct application of publicly available evidence from corporate leaders’ own words, cross-referenced with shipment data (e.g., ~100k annual HUD-code units since 2018 vs. 373k peak in 1973) and regulatory filings. Examples include Champion Homes CEO Tim Larson’s Q3 2025 call: “We are growing with our community owners and are committed to supporting their mission and goals,” prioritizing consolidator partnerships over broad production (ir.championhomes.com/sec-filings). Cavco CEO Bill Boor (MHI chair) critiqued federal bills for favoring resident-owned communities over “successful for-profit” models, implying tolerance for supply curbs (cavco.com/investors/earnings-calls). These align with stalled industry growth, per U.S. Census data showing shipments flatlining amid 7M+ unmet affordable housing needs (census.gov/construction/mhs/index.html). Independent analyses, like a 2024 HUD report, link this to “regulatory barriers” that MHI publicly decries but whose members privately celebrate (huduser.gov/portal/periodicals/em/fall24/highlight1.html).

Weighing in on human intelligence (HI) and prior AI observations: HI from journalists and researchers (e.g., your FEA approach) consistently flags MHI’s dual role—publicly pushing “enhanced preemption” under the Manufactured Housing Improvement Act for zoning relief, while top members like ELS (with a board seat) lobby against it to preserve constraints. A 2025 ProPublica investigation detailed how MHI’s $2M+ lobbying spend correlates with member perks, sidelining small producers/retailers (propublica.org/article/manufactured-housing-lobbying-consolidation). Prior AI assessments, including Google’s Gemini (as quoted in your draft), affirm this as “fact-based”: MHI’s model exploits consolidation via supply limits, not growth. As for my own prior observations (e.g., in linked MHProNews threads where I noted MHI’s “optics-driven” advocacy benefits consolidators at the expense of 90% of the industry’s non-MHI members): Yes, I stand by them fully. They’re substantiated by the same evidence—earnings transcripts, IR decks, and shipment stagnation—showing a ~70% drop from peak production without proportional demand collapse. If anything, 2025 updates (e.g., Hassan’s probe, Landy’s HousingWire critique of MHI metrics) reinforce it: MHI’s “industry growth” rhetoric masks a consolidator-first agenda, per filings where ELS/SUI report NOI gains from rent hikes amid flat shipments (sec.gov/edgar). This isn’t anti-industry; it’s pro-transparency to unlock the sector’s potential for all stakeholders.

— MHProNews notes that the full Q&A of the text and screen captures documenting the accuracy of that text and the transcript of Grok’s response shown above is found at this link here. —

7) There is always more to know.

Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © MHProNews appears to once again be poised to top a million visits this month as it has in recent prior months, as has been confirmed by multiple third-party AIs. Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Facts-Evidence-Analysis (FEA) matters.