If you’re new, already hooked on our new spotlight feature – or are ready to get the MH professional fever – our headline reports are found further below, just beyond the Manufactured Housing Composite Value for today.

The evolving Daily Business News market report sets the manufactured home industry’s stocks in the broader context of the overall markets.

Part of this unique feature provides headlines – from both sides of the left-right media divide – that saves readers time, while underscoring topics that may be moving investors, which in turn move the markets.

Readers say this is also a useful quick-review tool that saves researchers time in getting a handle of the manufactured housing industry, through the lens of publicly-traded stocks connected with the manufactured home industry.

MH “Industry News, Tips and Views, Pros Can Use.” ©

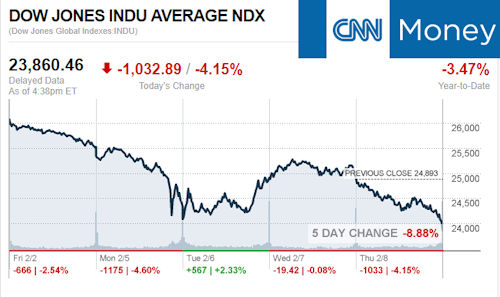

Selected headlines and bullets from CNN Money:

- Dow closes down 1,033 points

- This is why the Dow is plunging

- Trump Fed nominee could face trouble

- Twitter left hundreds of Russian propaganda videos up

- The greenification of junk food

- At the wheel of the most expensive Rolls-Royce

- Hope Hicks: The enigma of the Trump administration

- How Congress plans to ‘raise’ the debt ceiling

- Airline bumpings at lowest rate in over two decades

- MoviePass surpasses two million subscribers

- Why aren’t more people selling their homes?

Selected headlines and bullets from Fox Business:

- Dow’s wild ride clips 1,032 points off average

- The Dow’s worst single-day drops

- White House says long-term economic fundamentals are strong

- US jobless claims unexpectedly drop to near 45-year low

- Richest US Winter Olympians: Lindsey Vonn, Shaun White top 2018 field

- Retirement savings: Money in accounts like IRAs, on average, now tops $100,000

- $1 million model train set a Texas-sized inheritance

- How to protect your retirement nest egg from market volatility

- Amazon to deliver Whole Foods groceries within two hours for free

- Winter Olympics: North Korea sanctions tested by Nike, Samsung products

- Ackman’s foe Herbalife lobbies Congress to curb short-sellers

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

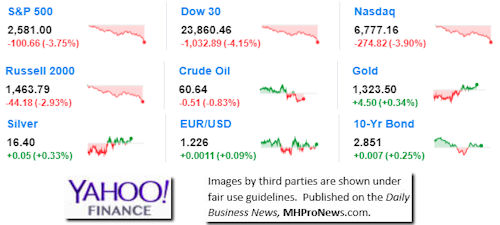

Today’s markets and stocks, at the closing bell…

S&P 500 2,581.00 -100.66(-3.75%)

Dow 30 23,860.46 -1,032.89(-4.15%)

Nasdaq 6,777.16 -274.82(-3.90%)

Russell 2000 1,463.79 -44.18(-2.93%)

Crude Oil 60.64 -0.51(-0.83%)

Gold 1,323.50 +4.50(+0.34%)

Silver 16.40 +0.05(+0.33%)

EUR/USD 1.2261 +0.0012(+0.10%)

10-Yr Bond 2.851 +0.007(+0.25%)

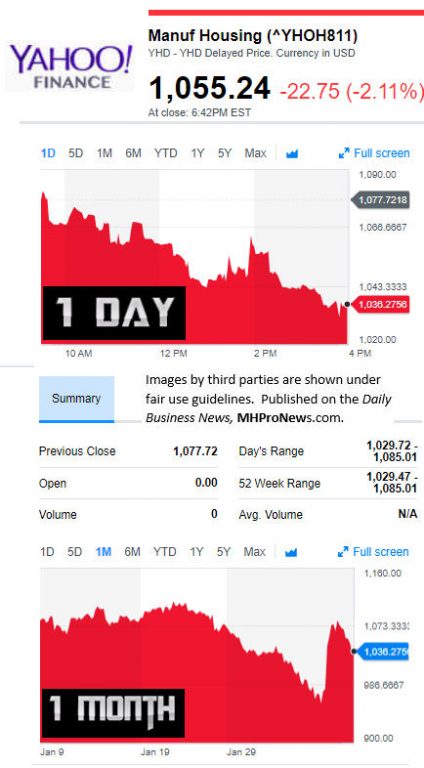

Manufactured Housing Composite Value

Today’s Big Movers

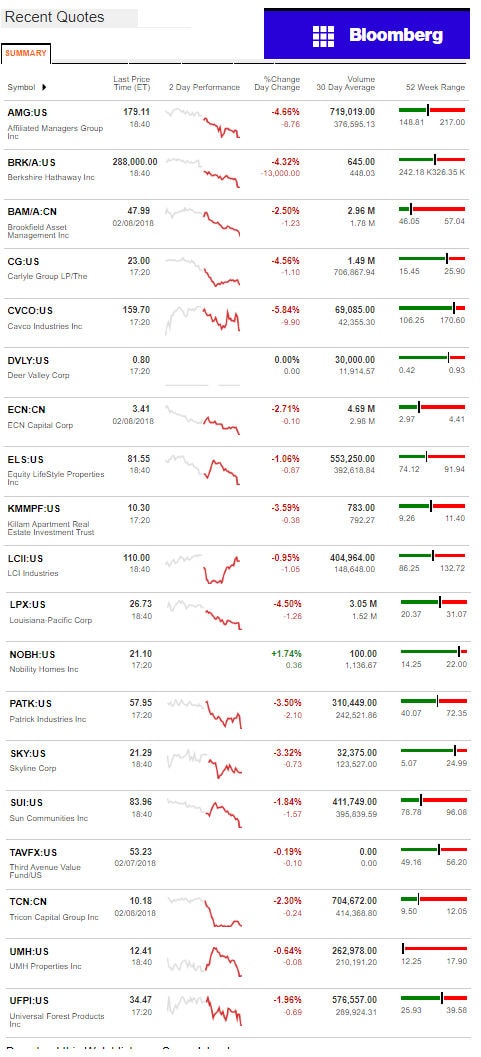

For all the scores and highlights on tracked manufactured home connected stocks today, see the Bloomberg graphic, posted below.

Today’s MH Market Spotlight Report –

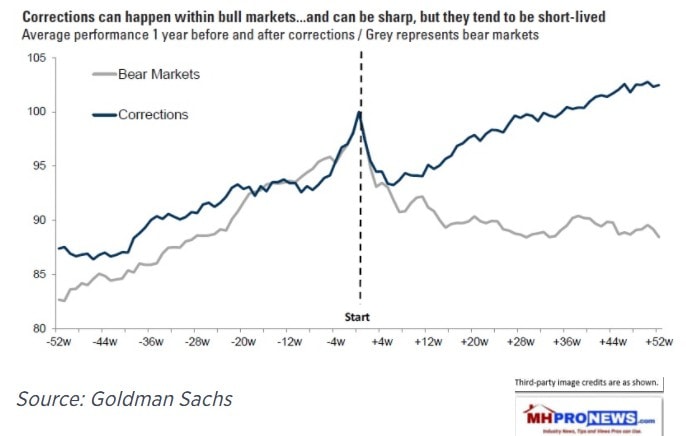

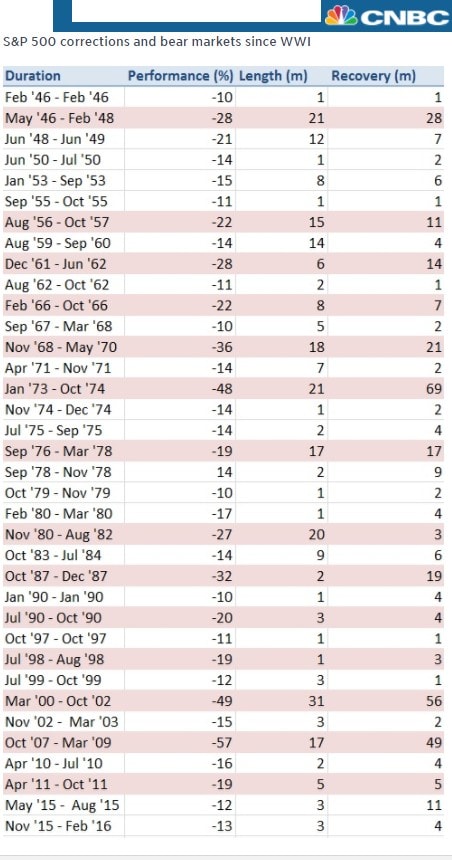

The stock market is officially in a correction.

Here’s what usually happens next, per CNBC, will be our feature for today.

- “The average bull market ‘correction’ is 13 percent over four months and takes just four months to recover,” Goldman Sachs Chief Global Equity Strategist Peter Oppenheimer said in a Jan. 29 report, per CNBC.

- But the pain lasts for 22 months on average if the S&P falls at least 20 percent from its record high — past 2,298 — into bear market territory, the report said. The average decline is 30 percent for bear markets.

- The last week of stock market drops has taken the S&P 500 into correction territory for the first time in two years.

- One of Fox Business’ latest take on the correction, but the strong fundamentals still in place in the market.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

Profitable Insight$ – POTU$ Trump Effect on MH Stock$ at 1 Year, Part 4

Trump Effect – 1 Year Election Impact on Manufactured Housing Connected Stocks, Part 2

Just the Facts – Trump Effect on Manufactured Home Connected Stocks, Part 1

NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

NOTE: The chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

LCI Industries, Patrick, UFPI and LP all supply manufactured housing.

AMG, CG and TAVFX have investments in manufactured housing related businesses.

Your link to a recent round of industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)