By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry- in this business daily posting – through the lens of publicly traded stocks.

MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- 32 million lose coverage if Obamacare repealed

- World’s Top Employers for New Grads

- What the National Enquirer published about Mika and Joe

- The weird rules in the fine print of sports

- Stocks had a great first half despite D.C. drama

- Here’s where the minimum wage is going up

- Analysis: The presidency hasn’t changed Trump Trending

- Waymo’s self-driving vans learn how to drive near police

- Trump could slap big tariffs on steel soon

- Star VC apologizes for his role in tech’s sexist culture

- British banks have stopped selling Qatari cashSelected headlines and bullets from Fox Business:

- High-tax Connecticut fails to pass budget as fiscal situation worsens

- Wall St ends bumpy week, strong 1st half with modest gain

- Oil up as U.S. rigs decline; prices set for first-half drop

- Alan Greenspan: Entering ‘very tough’ period of stagflation

- I love Trump’s tweets, yesterday’s Mika tweet was fantastic, Ann Coulter says

- Trump praises $25B LNG deal between Cheniere and South Korea

- Kendall and Kylie Jenner apologize after their t-shirt line featuring iconic artists is yanked

- Trump’s ‘Morning Joe’ tweets further proof he’s mentally unfit, Rep. Sheila Jackson Lee says

- Nike protests Rob Gronkowski logo for similarities to Jordan ‘Jumpman’

- Facebook, Amazon, Microsoft interns hit pay dirt and perks

- How car shoppers can save money by flying cross-country

- Illinois takes step toward defusing financial crisis, challenges remain

- Oscar Mayer may have found a way to make hot dogs ‘healthier’

- Bar Rescue’s Jon Taffer: I’m not sure I would open a bar today

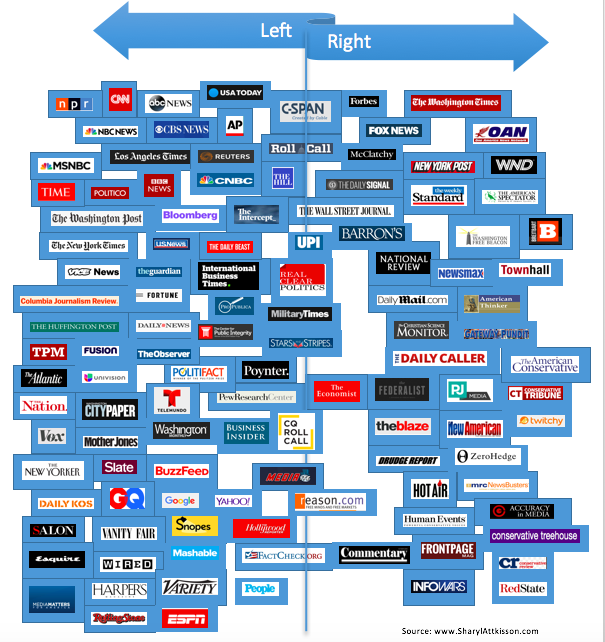

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

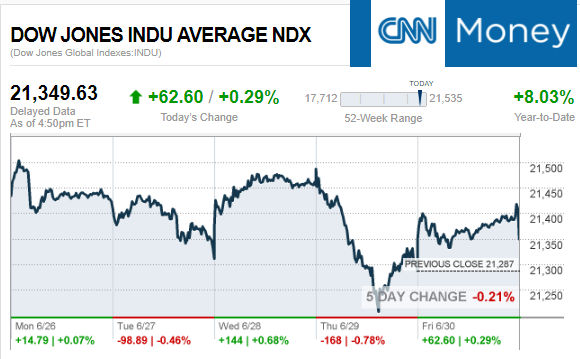

9 key market indicators, ‘at the closing bell…’

S&P 500 2,423.41 +3.71 (+0.15%)

Dow 30 21,349.63 +62.60 (+0.29%)

Nasdaq 6,140.42 -3.93 (-0.06%)

Crude Oil 46.34 +1.41 (+3.14%)

S&P 500 2,423.41 +3.71 (+0.15%)

Nasdaq 6,140.42 -3.93 (-0.06%)

Gold 1,241.20 -4.60 (-0.37%)

Silver 16.57 -0.02 (-0.10%)

EUR/USD 1.1427 -0.0013 (-0.12%)

10-Yr Bond 2.302 +0.035 (+1.54%)

Russell 2000 1,415.36 -0.84 (-0.06%

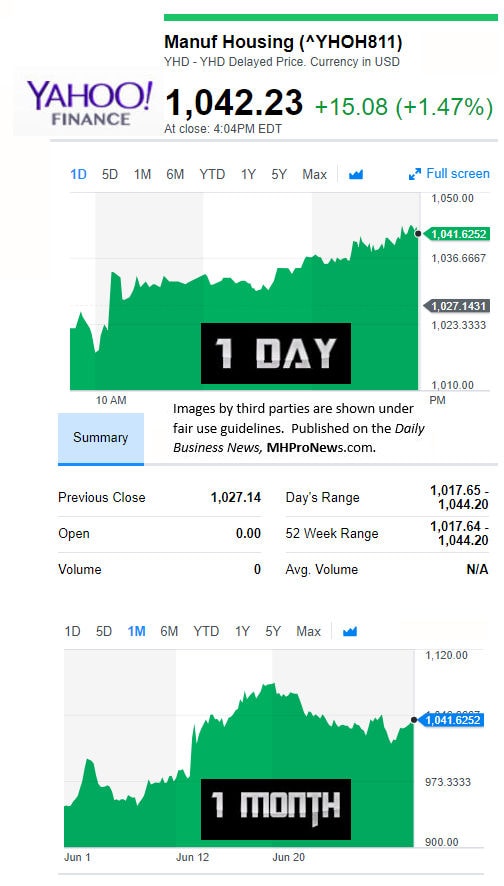

Manufactured Housing Composite Value

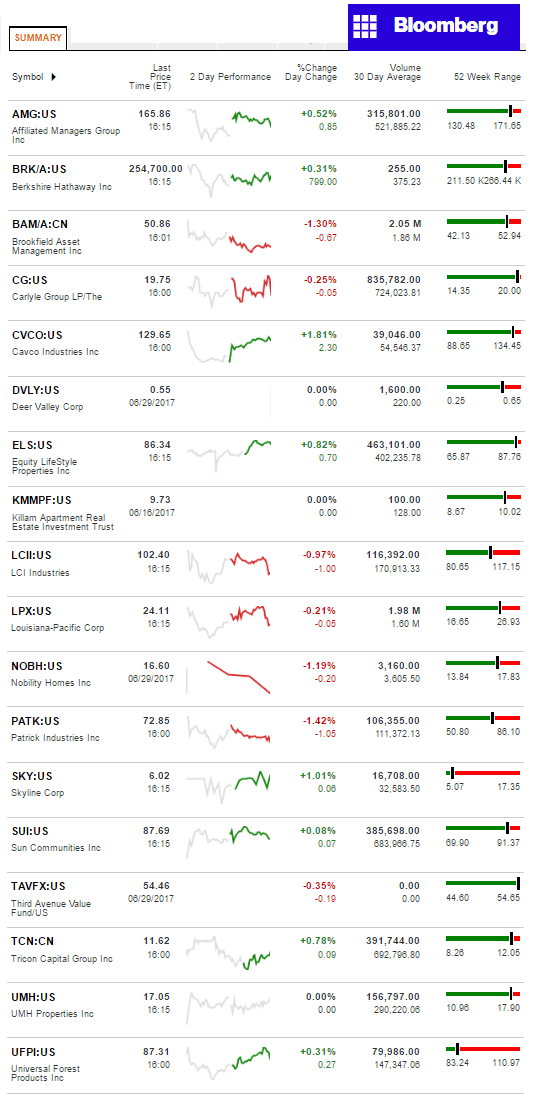

Manufactured Housing Connected Stocks

Today’s Big Movers

Cavco and Skyline lead the upwardly mobile movers. Patrick lead those that gave some back today.

See below our spotlight report, you can see all of the ‘scores and highlights.’

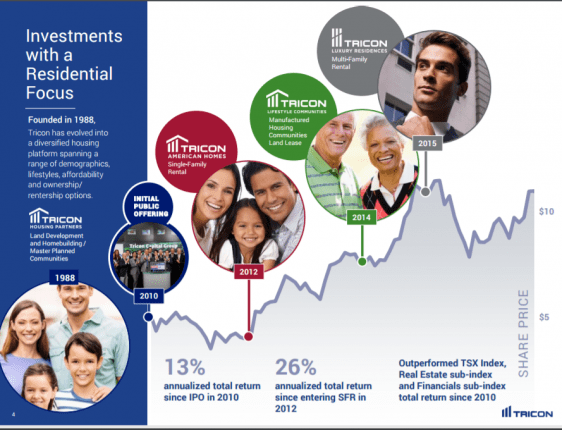

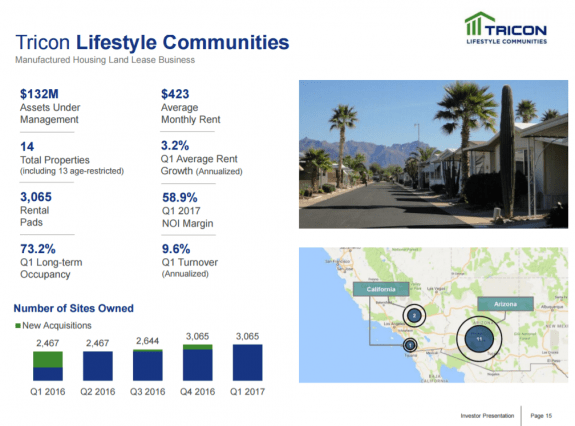

Today’s MH Market Spotlight Report – Tricon

Tricon Capitol says they have some 3065 land lease community sites. Another, more focused report on TCN found on the Daily Business News is available at this link here.

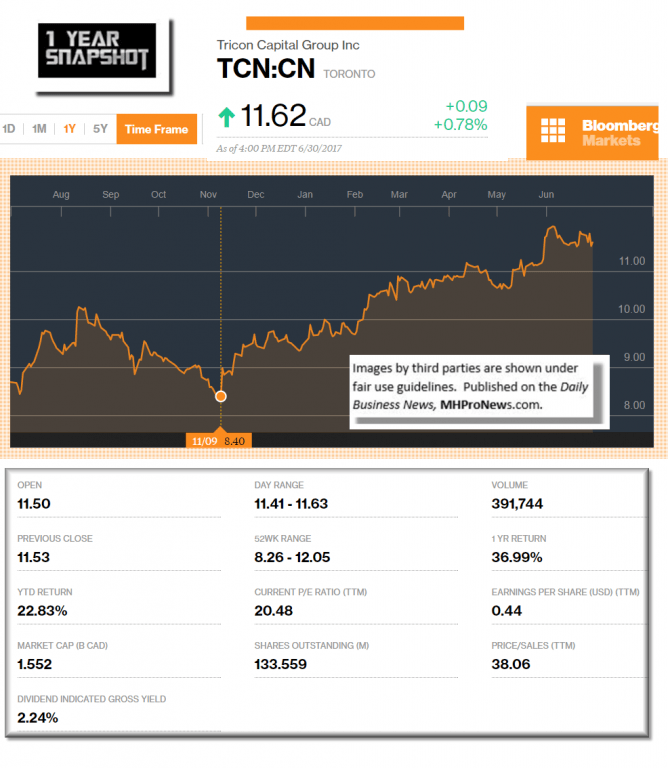

But as is the case of Carlyle, they are part of a larger investment fund. Their investor power point says is “$4.5 Billion Total Assets Under Management. Founded in 1988 and listed on the TSX in 2010 Headquartered in Toronto with a Regional Office in San Francisco About Tricon Capital Group (TSX: TCN) All figures in U.S. dollars unless otherwise indicated Share Price (May 11, 2017) Quarterly Dividend (Annualized yield %) Basic Shares Outstanding (May 9, 2017) Market Capitalization Enterprise Value C$11.04 C$0.065 (2.4%) 133 Million C$1.5 Billion C$2.0 Billion.”

On June 28th, the Weekly Register reported that, “In a research report revealed to clients on Wednesday morning, RBC Capital Markets reconfirmed their “Outperform” rating on Tricon Capital.”

Two days earlier, they said that analysts were “bullish” on Tricon.

Sports Perspectives reports that, “Director Ira Gluskin purchased 62,300 shares of Tricon Capital Group stock in a transaction dated Tuesday, May 16th. The shares were acquired at an average cost of C$11.23 per share, with a total value of C$699,629.00. “

On Tuesday, March 21st, “Ira Gluskin bought 50,000 shares of Tricon Capital Group stock. The stock was purchased at an average cost of C$10.72 per share, with a total value of C$536,000.00.”

Cerbat Gem said, “…insider David Veneziano sold 9,502 shares of Tricon Capital Group stock in a transaction dated Monday, May 15th. The shares were sold at an average price of C$11.05, for a total transaction of C$104,997.10.”

Are you feeling the love that these reports are shining on Tricon?

Let’s look at a more in depth, and recent, report.

Per Financial Newsweek…

“Tricon Capital Group Inc. (TSX:TCN) boasts a Price to Book ratio of 1.617407. This ratio is calculated by dividing the current share price by the book value per share. Investors may use Price to Book to display how the market portrays the value of a stock.

Checking in on some other ratios, the company has a Price to Cash Flow ratio of -15.893397, and a current Price to Earnings ratio of 21.958319. The P/E ratio is one of the most common ratios used for figuring out whether a company is overvalued or undervalued.

Tricon Capital Group Inc. (TSX:TCN) has a current MF Rank of 6727. Developed by hedge fund manager Joel Greenblatt, the intention of the formula is to spot high quality companies that are trading at an attractive price. The formula uses ROIC and earnings yield ratios to find quality, undervalued stocks. In general, companies with the lowest combined rank may be the higher quality picks.

There are many different tools to determine whether a company is profitable or not. One of the most popular ratios is the “Return on Assets” (aka ROA). This score indicates how profitable a company is relative to its total assets. The Return on Assets for Tricon Capital Group Inc. (TSX:TCN) is 0.060585. This number is calculated by dividing net income after tax by the company’s total assets. A company that manages their assets well will have a higher return, while a company that manages their assets poorly will have a lower return.

The Piotroski F-Score is a scoring system between 1-9 that determines a firm’s financial strength. The score helps determine if a company’s stock is valuable or not. The Piotroski F-Score of Tricon Capital Group Inc. (TSX:TCN) is 5. A score of nine indicates a high value stock, while a score of one indicates a low value stock. The score is calculated by the return on assets (ROA), Cash flow return on assets (CFROA), change in return of assets, and quality of earnings. It is also calculated by a change in gearing or leverage, liquidity, and change in shares in issue. The score is also determined by change in gross margin and change in asset turnover.

Further, we can see that Tricon Capital Group Inc. (TSX:TCN) has a Shareholder Yield of 0.013456 and a Shareholder Yield (Mebane Faber) of -0.11800. The first value is calculated by adding the dividend yield to the percentage of repurchased shares. The second value adds in the net debt repaid yield to the calculation. Shareholder yield has the ability to show how much money the firm is giving back to shareholders via a few different avenues. Companies may issue new shares and buy back their own shares. This may occur at the same time. Investors may also use shareholder yield to gauge a baseline rate of return.

Checking in on some valuation rankings, Tricon Capital Group Inc. (TSX:TCN) has a Value Composite score of 58. Developed by James O’Shaughnessy, the VC score uses five valuation ratios. These ratios are price to earnings, price to cash flow, EBITDA to EV, price to book value, and price to sales. The VC is displayed as a number between 1 and 100. In general, a company with a score closer to 0 would be seen as undervalued, and a score closer to 100 would indicate an overvalued company. Adding a sixth ratio, shareholder yield, we can view the Value Composite 2 score which is currently sitting at 52.

Investors may be interested in viewing the Gross Margin score on shares of Tricon Capital Group Inc. (TSX:TCN). The name currently has a score of 46.00000. This score is derived from the Gross Margin (Marx) stability and growth over the previous eight years. The Gross Margin score lands on a scale from 1 to 100 where a score of 1 would be considered positive, and a score of 100 would be seen as negative.

Volatility/PI

Stock volatility is a percentage that indicates whether a stock is a desirable purchase. Investors look at the Volatility 12m to determine if a company has a low volatility percentage or not over the course of a year. The Volatility 12m of Tricon Capital Group Inc. (TSX:TCN) is 22.086900. This is calculated by taking weekly log normal returns and standard deviation of the share price over one year annualized. The lower the number, a company is thought to have low volatility. The Volatility 3m is a similar percentage determined by the daily log normal returns and standard deviation of the share price over 3 months. The Volatility 3m of Tricon Capital Group Inc. (TSX:TCN) is 15.724400. The Volatility 6m is the same, except measured over the course of six months. The Volatility 6m is 18.062900.

The Price Index is a ratio that indicates the return of a share price over a past period. The price index of Tricon Capital Group Inc. (TSX:TCN) for last month was 1.05840. This is calculated by taking the current share price and dividing by the share price one month ago. If the ratio is greater than 1, then that means there has been an increase in price over the month. If the ratio is less than 1, then we can determine that there has been a decrease in price. Similarly, investors look up the share price over 12 month periods. The Price Index 12m for Tricon Capital Group Inc. (TSX:TCN) is 1.41647.”

As a reminder to periodic or new readers, MHProNews has no positions in any stock on this index, which leaves us free to share insights and research without favor.

“We Provide, You Decide.” ©

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)