The evolving Daily Business News market report sets the industry’s stocks in the broader context of the overall market stocks. By spotlighting the headlines – from both sides of the left-right media divide – this report also helps readers see what are the trends and topics that may be moving the investors that move the markets.

Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

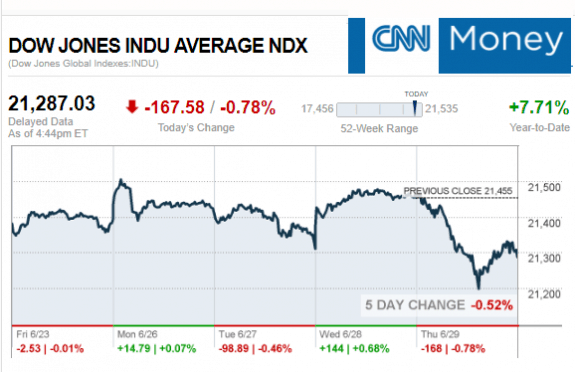

Selected bullets from CNN Money:

- Stock market madness returns as techs plunge

- How to dress like a grownup without breaking the bank

- Martin Shkreli investor testifies: ‘I trusted Martin’

- Greta Van Susteren out at MSNBC after six months

- Debt ceiling deadline: US could risk default by October

- How Illinois became the most messed-up state

- 10 years later: How the iPhone changed the world

- Why Trump’s tweets don’t get him kicked off Twitter

- Illinois is starving state colleges and universities

- Trump attacks Morning Joe’s Mika in tweets Trending

- ISIS is losing Mosul and most of its income

Selected headlines and bullets from Fox Business:

• Stocks turn red as traders retreat from tech

• Oil prices edge up to two-week high on dip in U.S. output

• Connecticut, nation’s wealthiest state, spiraling into financial despair

• NJ millionaires-on-welfare bust: More arrests to come, prosecutor says

• Mnuchin announces sanctions on Chinese bank over North Korea

• North Korea is desperate to avoid military conflict: Author Michael Malice

• Nike posts higher-than-expected quarterly revenue

• GOP donor holding money ransom until Trump agenda passed

• GOP adds $45 billion in opioid money to health care bill

• Trump tweets praise of new sugar pact with Mexico

• Illinois’ financial crisis: How bad is it?

• NFL names Terri Valenti first female instant replay official in its history

• Trial of former Pilot executives could take up to 6 weeks

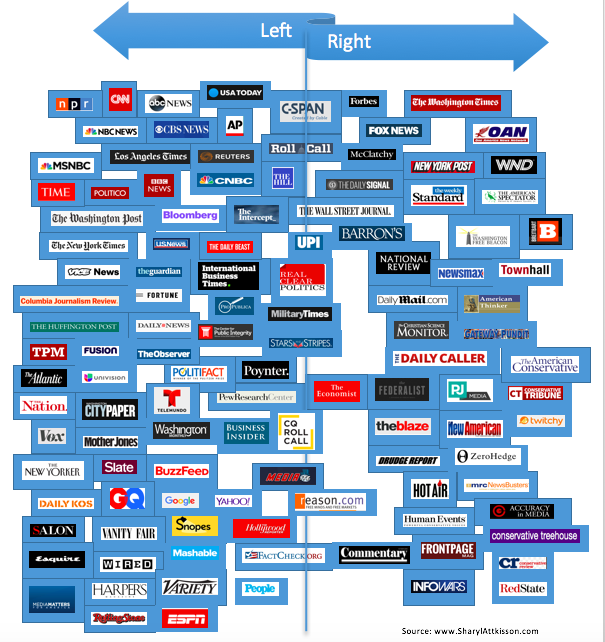

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

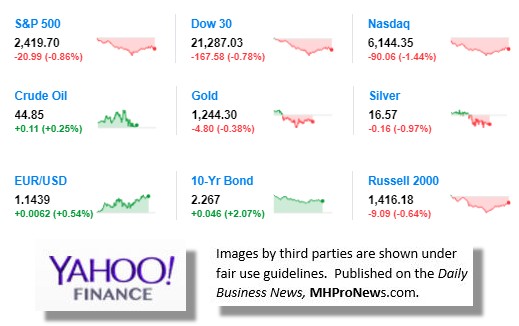

9 key market indicators, ‘at the closing bell…’

S&P 500 2,419.70 -20.99 (-0.86%)

Dow 30 21,287.03 -167.58 (-0.78%)

Nasdaq 6,144.35 -90.06 (-1.44%)

Crude Oil 44.85 +0.11 (+0.25%)

Gold 1,244.30 -4.80 (-0.38%)

Silver 16.57 -0.16 (-0.97%)

EUR/USD 1.1441 +0.0064 (+0.56%)

10-Yr Bond 2.267 +0.046 (+2.07%)

Russell 2000 1,416.20 -9.07 (-0.64%)

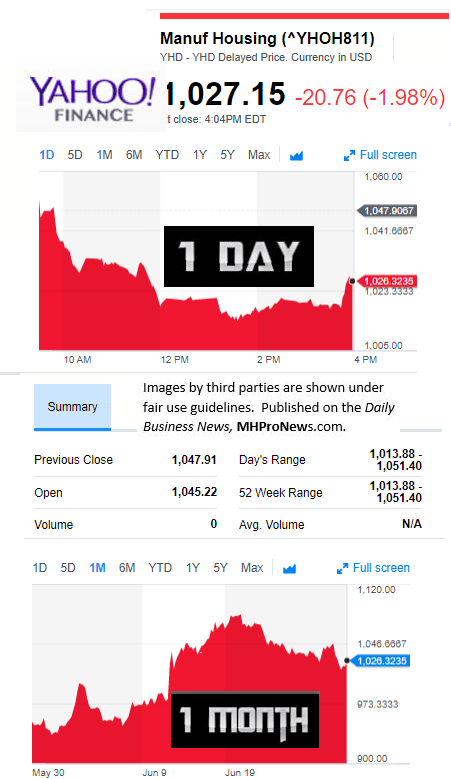

Manufactured Housing Composite Value – 6.29.2017

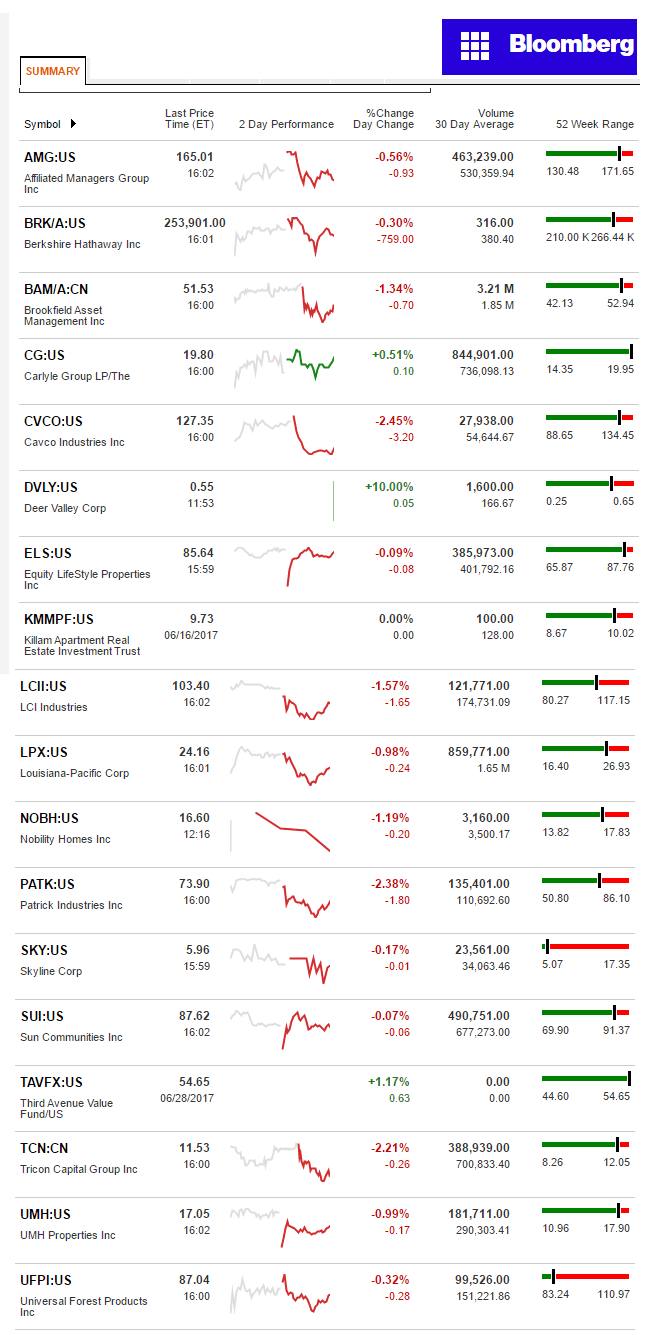

Manufactured Housing Connected Stocks

Today’s Big Movers

Deer Valley and Carlyle Group lead the gainers. Most other tracked stocks declined or where flat.

See below our spotlight report for all the ‘scores and highlights.’

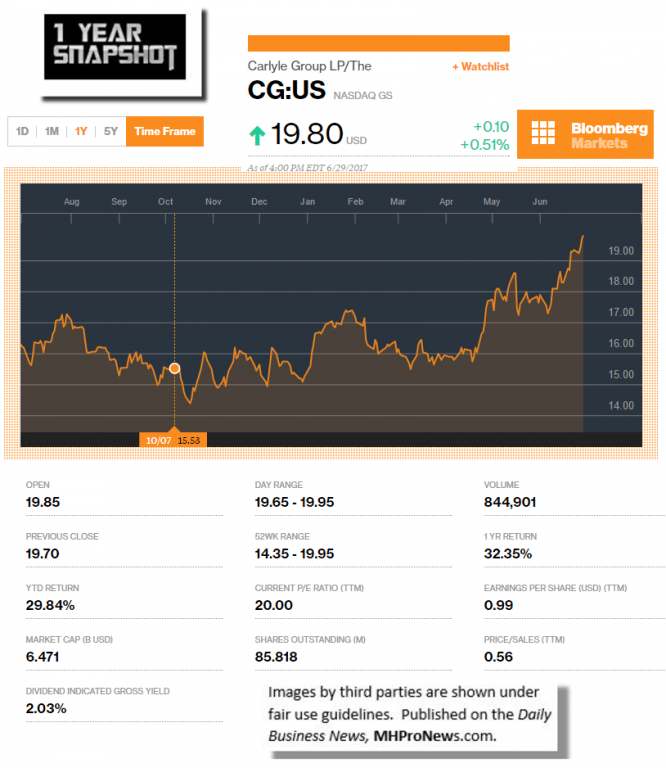

Today’s MH Market Spotlight Report – Carlyle Group (CG)

The Daily Business News has been tracking CG’s growing presence in the manufactured home community space.

The firm has focused on high quality – and high priced – properties that a firm such as theirs is better suited towards obtaining.

“Analysts observe that this purchase by Carlyle Group continues a trend of growing interest in manufactured homes and land lease communities by investors.” – WSJ.

South Florida’s The Real Deal noted the private equity firm’s strong move on Royal Manor Mobile Home Estates Inc.

But communities are nowhere near close to the CGs biggest investments. The firm is pointing to their ESG – Environmental, Social, Governance – strategy in recent announcements on their website (see graphics and photos, further below).

The LATimes reported in May 2017 that the firm had some 162 billion in assets under their management.

Per their website today, “Our real estate funds have $13 billion in assets under management (as of March 31, 2017).”

CG Insider Trades and Moves

Per the Highlight Press, with other mainstream stock tracking sources reporting similarly –

“Traders are a little more bearish on shares of the company if you look at the increase in short interest. The stock experienced a rise in short interest between June 15, 2017 and May 31, 2017 of 11.50%. Short shares increased from 1,057,172 to 1,178,756 over that timeframe. Days to cover increased 0.4 to 1.6 and the short interest percentage is 0.01% as of May 31.

There has been some selling insider activity on The Carlyle Group L.P. (NASDAQ:CG) recently. Pamela L. Bentley, CAO disclosed the sale of 9,928 shares of CG stock. The shares were purchased at an average price of $17.40. Bentley now owns $2,813,615 of the stock per the Form 4 SEC filing. Curtis L. Buser, CFO disclosed the sale of 8,294 shares. The shares were sold on August 2nd for an average price of $16.13. The CFO now owns $3,126,397 of the stock according to the SEC filing.

General Counsel Jeffrey W. Ferguson sold 10,498 shares at an average price of $16.13 on Tue the 2nd. The General Counsel now owns $1,198,685 of the stock as reported to the SEC.

The Carlyle Group L.P., launched on July 18, 2011, is a diversified multi-product global alternative asset management firm. The Company advises on various investment funds and other investment vehicles that invests across a range of industries, geographies, asset classes and investment strategies, and seeks to deliver returns for its fund investors.

The Company operates in four segments:

- Corporate Private Equity (CPE),

- Real Assets,

- Global Market Strategies (GMS) and

- Investment Solutions.

Across its Corporate Private Equity and Real Assets segments, as of December 31, 2016, it had investments in more than 270 active portfolio companies.

Moves By the Majors

These firms have also modified their investment in CG. Morgan Stanley trimmed its stake by shedding 44,511 shares a decrease of 1.4% from 12/31/2016 to 03/31/2017. Morgan Stanley claims 3,051,576 shares with a value of $48,673,000. The value of the position overall is up by 3.1%. As of the end of the quarter Tower Research Capital LLC (trc) had disposed of a total of 106 shares trimming its stake by 80.9%. The value of the investment in The Carlyle Group L.P. decreased from $2,000 to $0 a change of 100.0% for the reporting period.

Goldman Sachs Group Inc cut its investment by selling 271,680 shares a decrease of 15.0% in the quarter. Goldman Sachs Group Inc controls 1,533,726 shares worth $24,463,000. The total value of its holdings decreased 11.1%. Hightower Advisors, LLC augmented its holdings by buying 11,201 shares an increase of 83.3% as of 03/31/2017. Hightower Advisors, LLC now holds 24,651 shares valued at $394,000. The value of the position overall is up by 91.3%.

On June 8 the stock rating was upgraded to “Buy” from “Neutral” by Bank of America. On May 11 the company was upgraded from “Neutral” to “Outperform” in a statement from Credit Suisse.

October 14 investment analysts at Keefe Bruyette & Woods kept the company rating at “Equal-Weight” and lowered the price expectation to $17.00 from $34.00. On July 28 Citigroup made no change to the company rating of “Neutral” and raised the price target from $17.25 to $18.00.

On April 28 the stock rating was downgraded from “Outperform” to “Market Perform” by analysts at Keefe Bruyette & Woods. March 11 investment analysts at Deutsche Bank held the stock rating at “Hold” and moved up the price target from $14.00 to $16.00.

The company is so far trading up by 0.38% since yesterday’s close of $19.7. The company also recently declared a dividend for shareholders paid on Monday May 22nd, 2017. The dividend was $0.348 per share for the quarter which is $1.39 annualized. This dividend represents a yield of $7.22. The ex-dividend date was Thursday the 11th of May 2017.

It is trading at $19.77 which is marginally higher than the 50 day moving average of $17.95 and a bit higher than the 200 day moving average of $16.66. The 50 day moving average was up $1.78 or +9.897% and the 200 day average went up by +18.369%.

The company’s P/E ratio is 91.744 and the market value is 1.69B. As of the latest earnings report the EPS was $0.22 and is expected to be $2.52 for the current year with 85,818,000 shares currently outstanding. Next quarter’s EPS is expected be $0.47 with next year’s EPS projected to be $2.42.”

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)