Every evening our headlined provide snapshots from two major media outlets on each side of the left-right news spectrum that reflect topics that influence or move investor sentiment. In moments on this business evening report, you can get insights-at-a-glance.

This report also sets the broader context for manufactured housing markets, in keeping with our mantra, “News through the lens of manufactured homes and factory-built housing” ©.

We begin with left-of-center CNN followed by right-of-center Fox Business. We share closing tickers and other related data courtesy of Yahoo Finance, and more. 5 to 10 minutes reading this MHProNews market report every business night could save you 30 minutes to an hour of similar reading or fact-gathering elsewhere.

Headlines from left-of-center CNN Business.

· Still on the decline – Even after emerging from bankruptcy, Sears and Kmart continue to shrink

· Walgreens, CVS and Wegmans are the latest to ask customers not to openly carry guns in stores

· The facts about China, GM and its four plants slated for closure

· 47,000 grocery workers in California are closer to striking. Here’s why

· Amazon apologizes for shipping Margaret Atwood’s new novel early

· Ford recalls more than 500,000 vehicles

· 3 things to watch in the August jobs report

· Match stock falls on Facebook Dating news. It may be an overreaction

· WeWork may cut its IPO valuation by billions

· Banking has a problem: It’s still easier to talk about sex than money

· Apple exec: ‘We’re watching cryptocurrency’

· Nintendo rewinds time back to 1990 with old SNES games release

· Opinion: America is too focused on the unemployment rate. Here’s what we need to be looking at

· Facebook’s dating service is launching in the US

· THE TRADE WAR’S WINNERS AND LOSERS

· US networking equipment maker Ciena continues to thrive during Huawei ban

· Elon Musk visited China and won a tax break for Tesla

· Soybeans, coffee and oil among the products hit by a new round of Chinese tariffs on US goods

· US tariffs on China could cost American households $1,000 per year, JPMorgan says

· China has a $1 trillion trade war weapon. Will it ever use it?

· Starbucks plans to improve US employees’ mental health benefits

· Starbucks will open its first store in Provo, Utah, near coffee-free BYU campus

· Jollibee buys Coffee Bean & Tea Leaf

· China’s Luckin Coffee is taking on Starbucks

· Starbucks, in partnership with Nestlé, is launching a line of creamers to reach customers at home

Headlines from right-of-center Fox Business.

· TRUMP ADMINISTRATION RELEASES PLAN TO END FANNIE, FREDDIE CONSERVATORSHIP

· Stocks extend gains on strong job creation, trade progress

· Private sector hiring rebounds in August with 195,000 added

· Trade war causing companies to flee China

· HURRICANE DORIAN: THE LATEST

· The NFL’s best stadiums, according to fan rankings

· Cowboys owner Jerry Jones: Natural gas investment helped pay for Ezekiel Elliott

· Hulk Hogan slammed by Florida judge in divorce battle

· Taco Bell’s menu is about to get a whole lot cheesier

· This Democratic 2020 hopeful is in the lead on climate change: poll

· Worth it? Costs of top US colleges compared to grads’ expected salaries

· CVS, Walgreens are latest retailers to ask shoppers to leave guns at home

· GM CEO Mary Barra calls Trump meeting ‘productive and valuable’

· Papa John’s founder makes big donation after racial slur backlash

· What to expect from the August jobs report

· Hurricane Dorian: Waffle House Index flashing red in South Carolina

· Indianapolis Colts owner snubs offer to buy team at record-setting price

· Stocks rally ahead of August jobs report

· Point View Wealth Management’s David Dietze and FOX Business’ Jackie DeAngelis on the major jump in the stock market.

· Apple expected to roll out new phone

· Wedbush Managing Director Daniel Ives talked about how the phone model should drop on Sept. 10.

· Markets cheer China trade optimism, but is that correct?

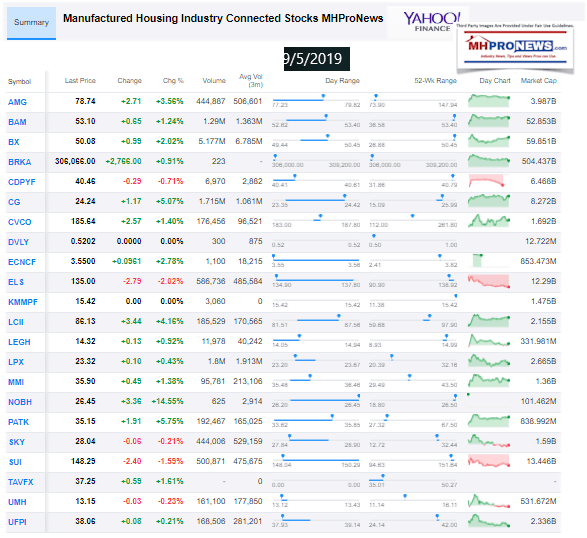

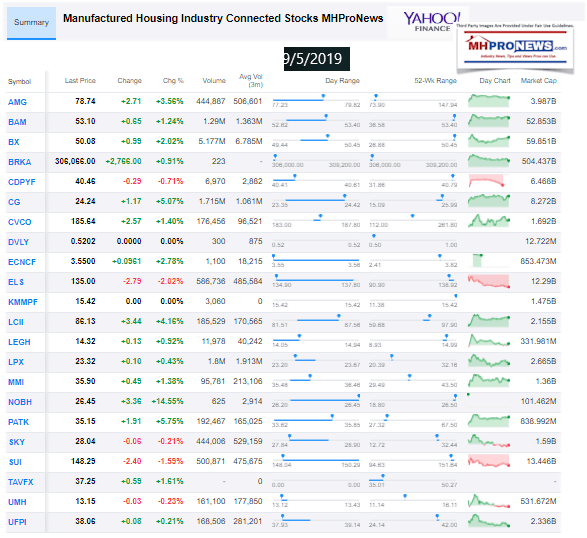

10 Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Tonight’s Business/Market/Political Impact Spotlight –

Jim Cramer: US economic strength empowers Trump to continue to play hardball on China trade

· “Trump is set in his ways because he doesn’t see any weakening” in growth compared to the drag that China’s economy has been experiencing, argues CNBC’s Jim Cramer.

· “The Chinese still need it more than we do,” said Cramer, pointing to the strong U.S. labor market and the strong American consumer.

· Cramer was reacting to China announcing Thursday that top U.S. and Chinese trade negotiators agreed to meet early next month for another round of talks.

President Donald Trump can continue to take a hard line on China trade because the U.S. economy keeps chugging along, CNBC’s Jim Cramer said today.

“Trump is set in his ways because he doesn’t see any weakening” in the U.S. growth compared with the drag that China’s economy has been experiencing, Cramer stated in the video above.

“The Chinese still need it [the trade deal] more than we do,” Cramer said, pointing to the strong U.S. labor market, with Thursday data on weekly jobless claims showing only a small uptick and the ADP private payrolls report for August coming in much better than expected.

Investors are consider those numbers for hints on what the government’s monthly employment report might show when it’s released tomorrow.

“What I’m surprised at is how strong the [U.S.] consumer is,” Cramer said, while dismissing the notion that the U.S-China trade war and the billions of dollars of import tariffs on both sides caused American manufacturing to slow. “Manufacturing has been in recession in this country for ages,” he said,

Left of center CNBC said that the latest round of tariffs went into effect Sunday, with the U.S. imposing 15% duties on about a third of the additional $300 billion worth of Chinese goods earmarked for levies.

More tariffs on both sides are set to go into effect Dec. 15, if President Trump and China don’t come to some agreement.

What CNBC didn’t say in this report is this.

Given the ongoing controversies about Democratic front runner former VP Joe Biden, and the president’s recent caution to China that after he wins in 2020, the deal on China ‘will get tougher,’ that too may be a factor in China coming back to the table. Chinese leaders have shown remarkable interest in U.S. politics. Several of their tariffs have targeted areas in swing or battleground states. If China thinks that the 45the president is going to get re-elected, the odds that a deal happens sooner than later could rise.

Related Reports:

U.S. Labor, China-American Trade, Warren Buffett, and Housing – High Cost of Short-Range Thinking?

After U.S. China Saber Rattling, is a Truce the Best Hope? Plus, Manufactured Home Investing Updates

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services.

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Updated for Summer 2019…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses.

Your link to an example of industry praise for our coverage, is found here and here. For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for Your Vote of Confidence.”

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach, co-managing member of LifeStyle Factory Homes, LLC and co-founder for MHProNews.com, and MHLivingNews.com.