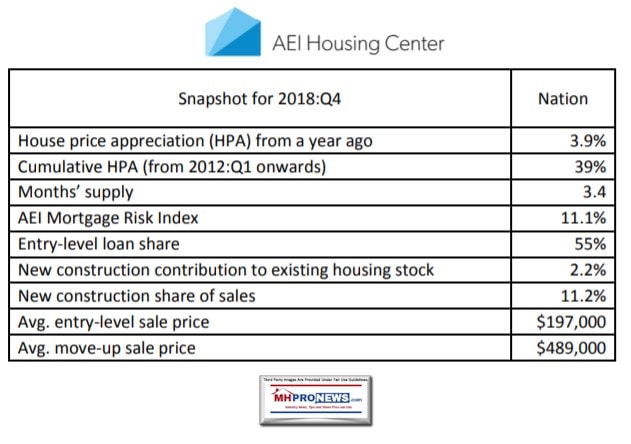

“Housing markets are inherently local, making them notoriously difficult to analyze due to the lack of reliable data at the local level. A new dataset from the AEI Housing Center, the first in a series of quarterly reports, aims to fill this void by analyzing housing market data for the 60 largest US metropolitan areas, as well as for the nation as a whole. The current dataset looks at housing data from 2018:Q4.”

So said the American Enterprise Institute (AEI) in newly unveiled research by Edward Pinto, Codirector, AEI Housing Center and Tobias Peter, Senior Research Analyst, AEI Housing Center.

“The recent declines in mortgage rates will increase demand during the spring buying season which has just begun,” noted Edward Pinto, codirector of the American Enterprise Institute’s (AEI’s) Housing Center. “Since inventories remain fairly tight across the nation, this combination points towards higher house price growth in the months ahead,” Pinto added.

“Reports of the end of current housing boom are exaggerated,” said Tobias Peter, senior research analyst at AEI’s Housing Center. “The data we are releasing demonstrates that inventories remain tight nationally, especially for entry-level homes. This trend, along with continued credit easing for first-time buyers and a significant decline in mortgage rates, all point to a continuation of the boom for entry-level buyers,” Peter also said.

“Stating the obvious, all housing sales are local,” said L. A. ‘Tony’ Kovach, in commenting on this useful new research. “This should be a useful research of housing trends for manufactured, modular, and other forms of factory-building to use as a quick reference for markets near their locations. Bookmark this page and use this as needed, until we publish the next update.”

Place your mouse-pointer over a city or national data to get that snapshot. Let the interactive graphic load, which may take a few seconds.

AEI said that the information was gathered in the following ways. The bullets are all quotes from AEI.

- The data consists of around 41 million arms-length purchase transactions from 2012 to the most recent period. We eliminate transactions that do not involve at least one individual, that are between corporations or builders, or transactions for which the buyer is a government entity or a lender. The final dataset consists of around 34 million transactions.

- The study tracks housing activity both for the entire market and for entry-level and move-up buyer segments. We only focus on institutionally financed sales (meaning we exclude cash sales or sales with seller financing.) We define entry-level as all sales below the Federal Housing Administration (FHA) 80th percentile price in a metro and quarter. The rational for a dynamic price cut-off at the metro level is that the share of entry-level buyers varies across the country. According to FHA’s Production Report, around 80% of FHA’s purchase loans go to first-time buyers, who mostly compete with other first-time buyers from other agencies for entry-level housing. The 80th percentile price cut-off, therefore, captures this market segment reasonably well. This is confirmed by the data. Across the nation, the entry-level segment consists largely of first-time buyers, while the move-up segment consists mostly of repeat buyers.

- The data to compute the FHA price cut-offs come from the HUD FHA Single Family Portfolio Snap Shot, which is a census of all FHA endorsements.

- The study’s house price indices (HPI) are computed from the underlying data. The index construction differs from the most widely known house price indices, which are either repeat sales (i.e. Case Shiller or FHFA) or hedonic (Zillow) indices. AEI creates a “quasi” sales pair consisting of one actual sale and a second reference “sale” as measured by the home’s estimated sales price using an Automated Valuation Model (AVM). The AVM approximates a property’s sale price at a given point in time. The AVMs come from First American (DataTree.com) and are unbiased with a high level of accuracy.

- The advantage of this approach is that it combines the best of the repeat and hedonic models. Unlike a true repeat sales index, which is limited to repeat sales and may therefore not be representative of the actual sales taking place during the measurement period, AEI’s index includes virtually the entire universe of sales during the period. And, unlike a true hedonic index, which incorporates every property (even unsold ones), it reduces the amount of errors since at least one sale of the pair actually sold during the measurement period. This also allows for index construction by market segment and at fine geographic levels.

- The AEI HPIs are based on a high proportion of institutionally financed home sales (after eliminating some extreme outliers) back to January 2012. The data are weighted at the county level to assure that they are representative of the full count of actual sales.

- For the Atlanta metro, for which it is currently impossible to distinguish institutionally financed sales from cash sales for the most recent 2 quarters, we use the house price trends for all sales for these two quarters.

- Data on housing inventory come from Zillow. We receive quarterly data on median daily listings and existing homes sales at the county level and broken out by market segment. The data are from 2013 to the most recent period. We aggregate these data up to the metro level and break them out into entry- and move-up buyers.

- The AEI Mortgage Risk Index measures how the loans originated in a given month would perform if subjected to the same stress as in the financial crisis that began in 2007. This is similar to stress tests routinely performed to ascertain an automobile’s crashworthiness or a building’s ability to withstand severe hurricane force winds.

- Mortgages are risk rated using a matrix of benchmark default rates for home purchase loans acquired by Freddie Mac in 2007. This approach has been adopted by FHFA in joint research with the AEI Housing Center’s staff. A detailed methodology of the risk index can be found here.

- The data to identify new constructions come from different data sources. The inputs are public records data (deed & assessor files) and Listings data from Zillow. We primarily rely on a home’s “year built” variable in the assessor file. If the “year built” is missing, we check the home’s seller name from the deed file. If the seller matches a name in a list of over 400 builders or it includes a key word that helps identify smaller builders, then the sale is most likely a new construction that has not yet been assessed.

- In the case that “year built” or seller name are missing, we check listings data for a “year built” or “land use code,” which helps us determine the new construction status of the home. We only count the first sale of a home as a new construction.

- We have verified the accuracy of our methodology through random sampling and checking of newly constructed and existing homes using Zillow data, Google Street View and satellite images. We find around 2% false positives and around 1% false negatives, which leads us to conclude that our methodology is very accurate.

- We estimate the residential housing stock from the assessor file. We eliminate multifamily and non-residential sales to arrive at an estimate for the total housing stock. Since the data are overwritten once new assessments at the county level become available, the data show the stock when it was last assessed. No historical estimates are available.

- Our analysis is done at the metro level. We use the National Bureau of Economic Research’s (NBER) county to CBSA (core based statistical area) crosswalk files for 2017 to aggregate counties into metros. We create Housing Market Indicator reports for the nation’s largest 60 metros. We rank metros based on their institutionally financed purchase home sales in 2017 using Home Mortgage Disclosure Act (HMDA) data for 2017.

NBER research was cited in the reports linked above, and below.

Manufactured housing is underperforming as an industry, which means it is underperforming at the local level too. But it need not be so. By making the proper adjustments at the local level, sales with high customer satisfaction can and should occur. Don’t let others limit your thinking about the potential in your market. To learn more, click here to scroll the development options, or do so below in the related links that follows the bylines and notices.

That’s this afternoon’s look at “News through the lens of manufactured homes, and factory-built housing” © where “We Provide, You Decide.” ©

Your link to industry praise for our coverage, is found here.

For the examples of our kudos linked above…plus well over 1,000 positive, public comments, we say – “Thank You for your vote of confidence.”

“We Provide, You Decide.” © ## (News, analysis and commentary.)

(Image credits and information are as shown above, and when provided by third parties, are shared under fair use guidelines.)

Submitted by Soheyla Kovach to the Daily Business News for MHProNews.com.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

Not Renaming Manufactured Homes, Redefining Manufactured Homes – Tiny House Lessons Learned

“Out-Performing the Market” Robert Robotti, Value Investing, and Manufactured Housing

Warren Buffett’s Profitable Lessons for Manufactured Housing

Declining Manufactured Home Shipments More Serious Than Retailers, Communities Being Told