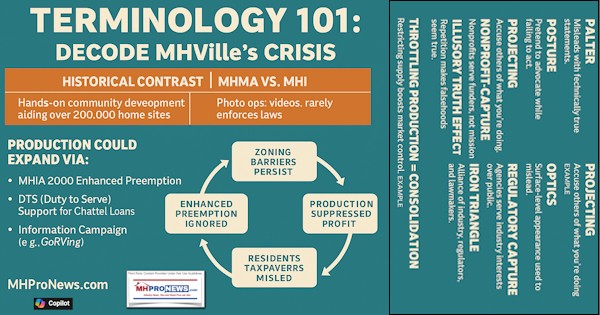

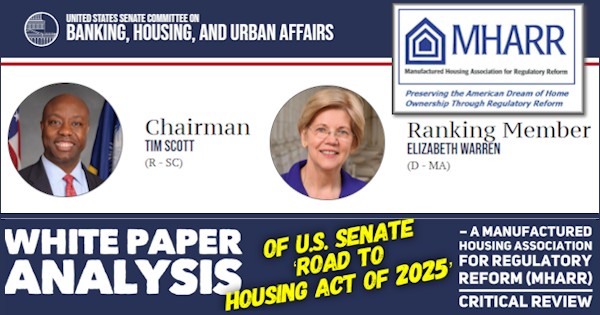

UMH Properties (UMH) President and CEO Sam Landy, J.D., op-ed via HousingWire was published on 10.27.2025. That was obviously several days before the Champion Homes (SKY) earnings call featured in Part I. There is therefore no apparent reason why the senior management of Champion (SKY) should have missed what UMH CEO Landy said which has since been unpacked in a follow up on HousingWire linked here and spotlighted here. Nevertheless, Larson said (see Part I for context) this: “Increasing awareness, demand, and advocacy for our brands and homes is another strategic priority for Champion. In the quarter, we continue to advocate for the Road to Housing Act, which includes a specific title section that highlights Congress’s support for off-site-built homes.” That statement is demonstrably questionable if not misleading or materially untrue, as will be unpacked in Part II. The fact that the ROAD to Housing Act 2025 has a section about manufactured and modular housing doesn’t mean that the bill will in fact benefit the manufactured home industry. Indeed, the pro-organic growth Manufactured Housing Association for Regulatory Reform (MHARR) issued a White Paper and follow up report linked here explained why the ROAD bill, if not amended, could undermine existing federal law that if properly enforced would benefit HUD Code manufactured housing, as MHI and MHARR officials each testified to Congress several times. Put differently, while there are several interesting as well as controversial facts-claims and evidence that will emerge from the recent Champion Homes (SKY) earnings call provided in Part I, some of what is said is contradicted by industry sources that include people now or previously in as well as beyond MHI. Champion Homes (SKY) is an MHI member and has a seat on the MHI board of Directors.

Note that the project in New York State that Champion (SKY) is bragging about during their earnings call below in Part I is planned for a separate report in the foreseeable future because it is a CrossMods project.

For now, there is one key question that Champion, Cavco (CVCO), Clayton (BRK), and MHI need to all answer. How many total CrossMod style homes – previously known as a ‘new class of manufactured homes’ when the program was announced in 2016-2017 and later rebranded as CrossMod (R) homes – have been built?

If CrossMods are doing so well, why won’t any of those four sources give a total number of such homes produced and sold? If they are bragging instead of posturing or weaving a narrative, why not back it up with hard numbers?

There are any number of reasons why investors are apparently not impressed by Champion in 2025. As the graphic above reflects, the share price has dipped over 11 percent year to date in 2025 for the period shown.

Among the items that ought to be a cautionary flag? Champion disclosed during the earnings call that follows that they sold ‘an idled plant.’ If Champion thinks that their business is going to grow, why would they sell an idled plant?

The obvious implication is that they don’t expect that plant to be needed in the foreseeable future. Champion investor relations (IR) pitch has stated that they have had multiple idled plants. Additionally, plant utilization dipped for Champion. There is more to know, as Part I and Part II will reveal and unpack. Investors, affordable housing advocates, public officials, and manufactured home industry pros are among those that need to know.

This report brings to light details, context, and nuances others in MHVille trade media can’t, won’t or don’t provide.

From Part II #8 below is the following pull-quote from the pre-publication third-party check of this MHProNews report.

Based on the public record, historical data, and the context from the sources cited (Champion, MHI, MHARR, the ROAD to Housing Act, and the Landy/Kovach op-eds), the analysis in the draft article raises legitimate concerns and supports the conclusion that Champion is focused on a consolidation strategy rather than one aimed at robust organic growth.

This MHVille facts-evidence-analysis (FEA) is underway.

Part I. According to Yahoo Finance and provided by MHProNews under faire use guidelines for media. Note that highlighting is added by MHProNews but the underlying text is otherwise unchanged.

Champion Homes, Inc. (SKY) Q2 FY2026 earnings call transcript

Powered by Quartr Nov 5, 2025, 8:00 AM EST

Earnings call

Champion Homes reported Q2 FY2026 net sales of $684M, up 11% YoY, driven by a 7% increase in average selling price and 4% growth in homes sold. Gross margin expanded to 27.5%, and EPS rose to $1.03. Management guides for flat YoY Q3 revenue amid seasonal softness and community channel moderation.

Powered by Yahoo Finance AI

Jason Blair

Head of Investor Relations

0:00:00

Good morning. Thank you for taking the time to join us for today’s conference call and review of our business results for the second quarter ended September 27, 2025. Here to review our results are Tim Larson, Champion Homes President and Chief Executive Officer, and Laurie Hough, Executive Vice President, Chief Financial Officer, and Treasurer. Yesterday, after the market closed, we issued our earnings release. As a reminder, the earnings release and statements during today’s call include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from the company’s expectations. Such risks and uncertainties include factors set forth in the earnings release and in the company’s filings with the Securities and Exchange Commission.

Jason Blair

Head of Investor Relations

0:00:48

Please note that today’s remarks contain Non-GAAP financial measures, which we believe can be useful in evaluating performance. Definitions and reconciliations of these measures can be found in the earnings release. I will now turn the call over to Champion Homes CEO, Tim Larson.

Tim Larson

CEO

0:01:03

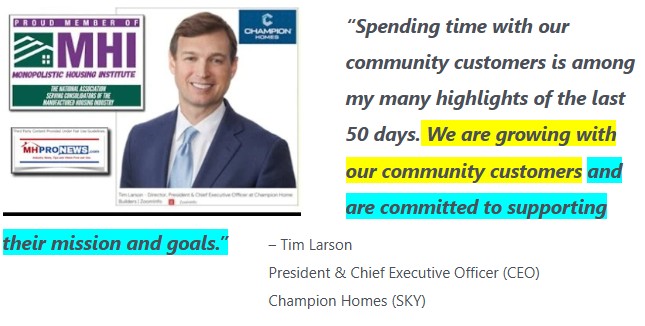

Thank you, Jason, and good morning, everyone. I’ll talk more specifically about our results in a moment, but first I will share some operational highlights from the quarter and how I believe executing our customer-centric strategic priorities helped us exceed expectations in Q2. Our strategic priorities will continue to provide the foundation for Champion’s operational effectiveness in the near and long term. As I previously shared, one of our priorities is innovating and differentiating the products and services by customer segment and at the right price value. During the quarter, we continue introducing new home designs to provide a range of price points and value for today’s customers. We have included examples of some of our latest products on our socials and an investor deck on our website. I continue to remain impressed by our team’s ability to create stunning homes with relevant floor plans and features.

Tim Larson

CEO

0:01:56

That are making new home ownership a reality for more consumers. Increasing awareness, demand, and advocacy for our brands and homes is another strategic priority for Champion. In the quarter, we continue to advocate for the Road to Housing Act, which includes a specific title section that highlights Congress’s support for off-site-built homes. We are pleased that this bill has passed the Senate and is on its way to the House. We will continue to monitor the legislation as it goes from the House to the President and then to HUD for implementation. On a local level, in New York State and as reported in September by The New York Times, Champion is collaborating with New York State Homes and Community Renewal as part of their affordable housing strategy, reflecting New York State Governor Hochul’s five-year plan to create or preserve thousands of homes statewide.

Tim Larson

CEO

0:02:46

The pilot program in Syracuse, New York, demonstrates Champion Homes’ ability to provide affordable housing solutions with speed to market. The homes were installed on land provided by local land banks, with the cost to build and install under $250,000 and taking less than six months to complete. This project reflects the momentum and increased awareness we are seeing across federal, state, and local governments and highlights off-site construction’s benefits of speed, cost, and quality. Now I’ll turn to the recent quarter’s performance. Second quarter year-over-year net sales increased 11% to $684 million, and homes sold during the period increased 4% to a total of 6,771 homes. The increased sales through our company-owned captive retail stores and at independent retailers were supported by effective cost management, delivering strong gross margin and earnings growth in the quarter. Our teams continue to thoughtfully pace production with demand in each market.

Tim Larson

CEO

0:03:50

Manufacturing backlog at the end of September totaled $313 million, up 4% sequentially. The average backlog lead time ended the quarter at eight weeks, which is within our target range. From a channel perspective, sales to our independent retail channel grew compared to the prior year period. We’ve been successful in adding independent distribution points in the quarter, and we believe the marketing support we provide our dealers, including digital capabilities, is helping to drive success in this channel. At captive retail, sales increased versus the same quarter last year. We remain pleased with our acquisition of Eisman Homes, which helped drive this increase, along with an increase in the average selling price, which has been driven by our retail team’s execution of new products and home features, resulting in a mix shift to more multi-section homes compared to the prior year period and the sequential first quarter.

Tim Larson

CEO

0:04:48

Moving to the community channel, as expected, our community sales were down slightly in the second quarter versus the same period last year. Based on the balancing of inventory levels in this channel that align with moderating order rates and softening consumer confidence, we expect order and production rates in the community channel to be mixed and impact near-term sales. Sales through the builder-developer channel grew in the second quarter versus the same period last year. We added several new customers in this channel and continue to see our pipeline grow. We take great pride in the work we do with builders, including providing education and support on the best practices to maximize off-site construction. I had the opportunity to see this firsthand at our builder event in Cleveland in September.

Tim Larson

CEO

0:05:35

Champion Financing continues to produce strong results and allows us to provide diverse financing options for our retailers and our consumers. Our retail loan programs are enabling our teams to connect buyers with the right home and the right payment that fits their needs. I’ll now turn the call over to Laurie, who will discuss our quarterly financial performance in more detail.

Laurie Hough

EVP and CFO

0:05:57

Thanks, Tim, and good morning, everyone. I’ll begin by reviewing our financial results for the second quarter, followed by a discussion of our balance sheet and cash flows. I will also briefly discuss our near-term expectations. During the second quarter, net sales increased 11% to $684 million compared to the same quarter last year, with U.S. factory-built housing revenue also increasing 11%. The number of U.S. homes sold increased 3% to 6,575 homes compared to 6,357 homes in the prior year period. U.S. home volume during the quarter was supported by increased captive retail sales, including the acquisition of Eisman Homes. The average selling price per U.S. home sold increased by 7% to $98,700 due to changes in product mix to more multi-section units and increased pricing at homes sold through our company-owned retail sales centers. On a sequential basis, U.S.

Laurie Hough

EVP and CFO

0:07:04

Factory-built housing revenue decreased 2% in the second quarter compared to the first fiscal quarter. We saw a sequential decrease due to moderating sales volume in the community retail channel and a focus on pacing production in certain markets as we move into our slower winter selling season. Manufacturing capacity utilization was 60% compared to 61% in the first quarter. On a sequential basis, the average selling price per U.S. home sold increased approximately 4% due to a shift in product mix. Canadian revenue during the quarter was CAD 26 million, representing a 10% increase in the number of homes sold versus the prior year period, primarily due to an increase in demand in certain markets. The average home selling price in Canada increased 7% to CAD 133,300 due to price increases and a shift in product mix.

Laurie Hough

EVP and CFO

0:08:06

Consolidated gross profit increased 13% to $188 million in the second quarter, and our gross margin expanded to 27.5%, an increase of 50 basis points from the prior year period. The higher gross margin was driven by a higher percentage of total sales through our company-owned retail sales centers in the current quarter, and the unfavorable purchase accounting impact in the prior year related to the increase in the carrying value of inventory acquired in the Regional Homes acquisition that did not recur in fiscal 2026. Gross margin increased sequentially from our first fiscal quarter and was higher than expectations, primarily due to lower-than-expected material input costs, including tariff impacts, higher captive retail ASPs, and favorable product mix. SG&A in the second quarter increased $13 million over the prior year to $113 million.

Laurie Hough

EVP and CFO

0:09:08

The increase is primarily attributable to higher variable compensation from higher sales and profitability, closing costs related to the previously announced plant closures, and the inclusion of Eisman Homes, all partially offset by a $3.7 million gain on sale of one of our idled manufacturing facilities. The company’s effective tax rate for the quarter was 23.6% versus an effective tax rate of 21.6% for the year-ago period. The increase in the effective tax rate is primarily due to a projected decrease in tax credits due to the change in the new tax law. Net income attributable to Champion Homes for the second quarter increased by $3 million-$ 58 million, or earnings of $1.03 per diluted share, compared to net income of $55 million or earnings of $0.94 per diluted share during the same period last year. The increase in EPS was driven mainly by improved operating income.

Laurie Hough

EVP and CFO

0:10:17

Adjusted EBITDA for the quarter was $83 million, which is an increase of $9 million or 12% compared to the prior year. Adjusted EBITDA margin was 12.2% compared to 12% in the prior year period. We anticipate near-term gross margin to be in the 26% range as we manage through cautious consumer sentiment and softer demand in certain markets</span?. Variability in consolidated gross margin is expected quarter to quarter, reflecting shifts in product mix and the proportion of sales through independent sales channels and our company-owned retail sales centers. As we navigate the market, we continue to balance SG&A spend while continuing to drive our strategic growth priorities, including investments in people and technology. As of September 27, 2025, we had $619 million of cash and cash equivalents, and we generated $76 million of operating cash flows during the second quarter.

Laurie Hough

EVP and CFO

0:11:22

In the quarter, we leveraged our strong cash position and returned capital to our shareholders through $50 million in share repurchases. Additionally, our board recently refreshed our $150 million share repurchase authority, reflecting confidence in our continued strong cash generation. I’ll now turn the call back to Tim for some closing remarks.

Jason Blair

Head of Investor Relations

0:11:46

Thank you, Laurie. We are pleased with our second quarter results and how they reflect the Champion team’s unwavering focus on our customers and delivering on our strategic priorities. In our third fiscal quarter of 2026, we continue to navigate the dynamic macro and consumer environment with agility and steadfast execution. We are up against a unit sales shift from Q2 last year into Q3 due to the hurricanes in North Carolina and Florida, which will impact the comparable year-over-year sales. As we assess all of these inputs, we currently anticipate our third quarter revenue to be flat versus the third quarter last year. This continues to be an exciting time for Champion, and we remain confident in the strategies we’re executing across our stakeholders, as each directly aligns with the broader trends and policy changes that are in support of off-site-built homes.

Jason Blair

Head of Investor Relations

0:12:35

Thank you, everyone, for tuning in to today’s call and for the Champion Homes team for their continued execution as we progress through this fiscal year. I look forward to updating you on the third quarter in early 2026. Now let’s open the line for questions. Operator, please proceed.

Operator

0:12:50

Thank you. We will now begin the question-and-answer session. To ask a question, you may press star then one on your telephone keypad. If you are using a speakerphone, please pick up your handset before pressing the keys. At any time your question has been addressed and you would like to withdraw it, please press star then two. At this time, we will pause momentarily to assemble the roster. The first question comes from Greg Palm with Craig-Hallum Capital Group.

Greg Palm

Analyst

0:13:16

Hey, good morning. Thanks for taking the questions, and congrats on the results. Tim, you broke up pretty hard, at least on my end, when you were going into details about kind of community and builder-developer. Maybe you can just go back to some of the comments and explain what you were seeing in those two markets specifically.

Tim Larson

CEO

0:13:38

Yeah, as expected, community was down in the quarter as the community worked through some inventory and some softening in some markets. We certainly had some community operators up, but on the balance, it was down. We anticipate some of that continuing in the near term. On the builder channel, that grew, and we continue to build the pipeline in the builder channel, which just reflects this emergence of that channel for us as we think about reaching more consumers through a different channel. We are pleased with the progress in the builder channel. Those are the two things that we hit on those channels.

Greg Palm

Analyst

0:14:12

Okay, perfect. The ASPs up, I’m just curious, can you break out the impact from both mix singles to multi, but also more sales going through company-owned stores? Do you have a percent of sales going through captive versus year-ago periods or sequentially, just some reference point for us?

Laurie Hough

EVP and CFO

0:14:40

Hi, Greg. We had about 37% of our sales go through our captive retail stores versus 34%, roughly, give or take, last year and in the first quarter. That pull-through through captive retail was significantly higher for us this quarter than we have been seeing. As far as multi-wide and single-section homes, we do not disclose that publicly, but we have seen over the last couple of quarters an increase in multi-section. Sequentially, our ASPs are up primarily because of that mix.

Greg Palm

Analyst

0:15:19

Okay. Any thoughts on sort of what you’re seeing this quarter or expectations in terms of the mix of units going through captive, whether that is consistent or changes at all?

Laurie Hough

EVP and CFO

0:15:33

Hard to say what that’s going to be from quarter to quarter this early in the quarter, just given timing of closings and weather-related events and so forth. We do expect pricing generally to be impacted more by mix than by price actions.

Greg Palm

Analyst

0:15:54

Got it. Understood. Okay. I will leave it there. Thanks.

Operator

0:16:00

Thank you. The next question comes from Daniel Moore with CJS Securities.

Daniel Moore

Analyst

0:16:06

Thank you. Good morning. Tim, good morning, Laurie. Thanks for taking the questions.

Tim Larson

CEO

0:16:10

Morning.

Daniel Moore

Analyst

0:16:12

Just backlog, despite the choppiness, held up nicely. And reflect. Including 3% or 4% growth in shipments. Just maybe talk about the direction of how orders are trending thus far as we look into October and into early November. I guess appreciate the color on sales for this quarter, flat year-over-year. Where do you expect to kind of maintain current levels of production, and are there maybe regions where we’re pulling back a little bit just as we get into the seasonally slower period? Any color there would be helpful.

Tim Larson

CEO

0:16:58

Yeah. Through October, we were hearing good reports of traffic and some order encouragement. That is balanced against the year-over-year impact I mentioned with the shift from Q2 to Q3 last year. In terms of the production approach, we certainly are doing that plant-by-plant, and we look at that region, market, and pace the production rates accordingly. Obviously, you see our backlogs were eight weeks, which is across the board. Some markets, we have opportunities to work through that, and others are a little bit lighter. Ultimately, we grew backlog sequentially. Obviously, it is down year-over-year, which also is what factored into our view for Q3. On the balance, I think the team’s doing a really good job being nimble in each of those markets and executing our playbook accordingly.

Daniel Moore

Analyst

0:17:48

Got it. Piggybacking on Greg’s question, crystal ball it a little bit further, but what are you hearing from both sort of REITs as well as builder-developers? As we think about kind of turning the calendar to 2026, are we in kind of wait-and-see mode, waiting for rates to come down? Is there talk of more expansion, given a little bit more maybe stability and visibility? Just again, I know it’s very, very early, but what are you seeing there in terms of their midterm plans?

Tim Larson

CEO

0:18:22

Yeah. I’ll start with the builders. Given that channel is a smaller %, we certainly see continued growth in that channel based on the pipeline that we have. What we’re encouraged by there is we had an event in Cleveland where we brought a number of builders in from around the country that are either in-flight projects or potential new projects. They’re encouraged about the progress that they’re seeing, whether it’s zoning support or also what they’ve heard from our best practice projects around the country. I think we’re going to continue to be able to have that be a strength of ours as we go into the upcoming year, albeit within the total number of percent of our total business.On the community side, I mentioned in the near term, we anticipate some moderation there.

Tim Larson

CEO

0:19:04

That really depends on the community operator and also where they are in their cycle. I think we’re pretty balanced in terms of our thought process with community. As we go into next year, it really is going to be determined by different factors, ultimately the end consumer. If we see some more strength with the end consumer, then that obviously feeds all the way up through the community and the REITs. We did anticipate some of that slowdown a bit in the community channel for the quarter, and we saw that, and we see some of that in the near term. I think that’s more tied to the general market. There are certainly going to be opportunities for some community operators depending on their project flow. That’s why we’re taking the balanced approach relative to that channel.

Daniel Moore

Analyst

0:19:44

Got it. Last for me, you mentioned the Road to Housing. A lot of talk lately by investors about potential benefits of specifically removing the chassis requirement and other potential legislation. I guess you mentioned it’s kind of moving past the Senate, moving to the House. What are your thoughts in terms of where you see the most potential direct impacts, and how do you think about the magnitude of the potential benefit of some of this legislation? Thanks again.

Tim Larson

CEO

0:20:18

Yeah. I think we look at it from a macro perspective of what doors can it open up in municipalities that previously were more restrictive. The second piece is what can we do from a product perspective, whether that’s two-story as well as some different elevations that, again, open up the market. That is all dependent on how long it takes to get through the next phase of legislative process and then ultimately through the HUD process. We are certainly anticipating those elements and being prepared for that. I think it also speaks to a broader trend that we are seeing around the overall off-site-built category. There is more visibility for it. There is more awareness. It is certainly getting more attention at the legislative level. I think that is, from a longer-term trend, a positive for the industry.

Tim Larson

CEO

0:21:02

Our strategies, the five that I’ve laid out, are really geared toward being in a good position to execute on those opportunities as they come about.

Daniel Moore

Analyst

0:21:11

All right. I’ll circle back with any follow-ups. Thank you.

Tim Larson

CEO

0:21:15

Thank you.

Operator

0:21:17

Thank you. The next question, Constable Yong with Jefferies.

Operator

0:21:21

Hey, guys. Congrats on another strong quarter in a tough environment. If we think about fiscal 3Q, Tim, should we expect ASPs to be fairly stable sequentially? I know mix is going to be a swing factor. If ASPs are pretty stable and you’re guiding to flat sales, would imply volumes down, call it mid-single digits, in 3Q, which is a noticeable step down from the first half run rate. I know there were some timing nuances at play. Anything else to call out where you’re seeing trends soften a bit? I know you’ve given us some color on REIT and the builder side, what about the retail side? Just kind of help us unpack the trends you’re calling out for 3Q in particular.

Tim Larson

CEO

0:22:05

Yeah. The year-over-year piece is really a driver from what happened last year, Q3 from Q2. That’s a key factor. The other piece is as far as the other channels go. So far, I said we’re encouraged in October with our retail channels, but we’ve got a ways to go there. At this point, we’re balanced in terms of that. Because of the community impact, it’s a significant percent of our total volume. That’s a key driver. I would say in terms of the mix and pricing, what we saw this last quarter on the ASP was more mix-driven from more single-section to multi-section. That movement can happen change quarter to quarter just based on what’s at the consumer level. Part of it is in this last quarter, we introduced more new products that were geared toward the multi-section.

Tim Larson

CEO

0:22:51

We had that initial response to those homes. That balance is going to play out through the quarter. I think that also speaks to the multi-section as a function of our consumer that may come from that single family or that new buyer. At the same time, there is also a lot of affordability buyers that are focused in the market where you have single-section. Some of that is in our thesis for the quarter. I would say those are the different factors where we played into our view for the potential flat for the quarter. Ultimately, we are driving every day and going to do the best through the quarter through those execution priorities. Those are the key factors that drove into that.

Tim Larson

CEO

0:23:29

Yeah, that’s helpful perspective. I mean, you called out some of this choppiness in the REIT side already. I mean, it sounds like more of the same, but I don’t want to put words in your mouth. October trends for retail. Pretty similar to what we’ve seen last quarter?

Tim Larson

CEO

0:23:45

So far, we’re encouraged by both the traffic and the orders, but the traffic’s a leading indicator. We need to see that play out with the consumer in the upcoming months. Yeah, the choppiness in the REITs. We’ve got certain REITs that are growing, others that are holding back a bit. I think that’s part of where we factored in that balance.

Tim Larson

CEO

0:24:02

Okay. I appreciate you do not have a crystal ball on the legislation front, but the Road to Housing Acts are certainly very encouraging. It is out the door with the Senate ready. The House obviously needs to mark up their version of the bill. Do you have any insights if there were any large differences in terms of how they are thinking about the opportunity and the bill that they are tackling? Any nuances with government shutdown in terms of timing? I know there is a steel chassis element, which could reduce the cost by $15,000 on a list price of, I do not know, ASP in the $100,000 range. Any other pieces that we should be mindful of where it could really reduce the cost for the end consumer from an affordability standpoint?

Tim Larson

CEO

0:24:47

Yeah. I think in terms of the legislative process, there is some impact, obviously, with the shutdown, but there was a positive outcome in the Senate, which I think gives a good indication. Plus, you’ve seen a lot of the noise and chatter and positivity around the need for affordable housing. I think that bodes well. In terms of some of those other dynamics in terms of the cost, there’s going to be some elements of that. What we’re looking at is how does it open up the broader industry with zoning and more adoption? How do we think about product? Those are going to work through. There will be adders, deleters in terms of cost as you think about to create a home that really works well with that approach.

Tim Larson

CEO

0:25:25

At the end of the day, it’s going to be the price value to consumer. We’re already at a good price value to the consumer advantage. I think it’s more about bringing in more customers is the main goal. Where we do have opportunities to give that to the consumer, we will. Ultimately, there’s going to be some other product innovation that comes out from it. Certainly, from a transport perspective, you’re not leaving the chassis there. You’re going to get some recycling benefits from the chassis in terms of that element. Those are all factors that I think will bode well for the opportunity if that comes together.

Tim Larson

CEO

0:25:53

Okay. Great callout, Tim. Thank you so much.

Tim Larson

CEO

0:25:57

Thank you.

Operator

0:25:58

Thank you. The next question comes from Matthew Bouley with Barclays.

Matthew Bouley

Senior Equity Research Analyst

0:26:02

Good morning, everyone. Thank you for taking the questions. I want to stick with the road to housing. As this is clearly progressing, my question is, what are you doing to kind of get ahead of these potential changes, whether it’s the permanent chassis or otherwise? Kind of what investments might you be considering in your own manufacturing or transportation? What do you think you need to be more nimble about this if it does happen? I am also curious if the industry is advocating for any changes on the financing front as well. Thank you.

Tim Larson

CEO

0:26:35

In terms of the readiness for it, our product development teams are always evolving, innovating, come up with new products. It has been helping us year through the year. That is part of the process. We own our own transportation company in Starfleet. The benefit of that is we can directly make moves there that are necessary to support the change. The reality, though, is we will have to see how long it takes to get through the legislative process. Also, you have to have HUD put it into implementation. There are those factors in terms of timing. That is kind of our approach, the balanced approach we have getting ready for it. I think we have the time to do it the right way.

Matthew Bouley

Senior Equity Research Analyst

0:27:12

Okay. Got it. Thank you for that, Tim. Secondly, the captive retail and the mix to multi-width and I guess the higher like-for-like prices as well. I mean, it’s obviously a tough consumer backdrop out there. I think mix and price is probably not something you’re seeing on the site-built side right now. I’m curious if from your perspective, is this more just, as you mentioned earlier, just the tough affordability out there that you’re sort of potentially drawing buyers from site-built into MH? Or was there kind of a previous opportunity in your product that was available out there and you just kind of reached more for it? Any additional color on that? Thank you.

Tim Larson

CEO

0:28:01

Yeah, exactly. There really are three things. In our captive retail stores, we’ve mentioned we didn’t take price for a while, and so there was an opportunity. The larger piece that hit this last quarter was the shift to more multi-section. That relates to the new products we introduced that certainly are more of a fit for the buyer that’s looking for more space, more square footage. Yes, you’re right that when we bring in new buyers to our category, some of those new buyers are in that segment that’s looking for those larger homes. To your point on price point, the third piece is that we’re already relatively a less price point to site-built. Even though we have some gains, we’re still much more affordable given our wholesale price point. It’s those factors that are really driving that.

Matthew Bouley

Senior Equity Research Analyst

0:28:45

Great. Thanks, Tim. Good luck, guys.

Tim Larson

CEO

0:28:47

Thanks.

Operator

0:28:49

Thank you. The next question comes from Mike Dahl with RBC Capital Markets.

Mike Dahl

Equity Research Analyst

0:28:55

Great. Thanks for taking my questions. Tim, just to add one more onto the Road to Housing, obviously very topical. I believe part of the permanent chassis discussion is that there would be a voluntary opt-in from states. You could have a state-by-state approach to whether they’re opting into that chassis removal. I was wondering if you had any insight into kind of what that would look like. I guess the base of the question is, hypothetically, let’s say that this were to get passed by the end of this calendar year, how long do you think it would take to get some of the things like the space on board, the fleet, and logistics and product mix? Is this a calendar 2026 impact, or should we really be thinking about this is all great, but material impacts may be still a couple of years out?

Tim Larson

CEO

0:29:54

Yeah. Great question. In terms of the timing, that’s what I was referencing in terms of the HUD implementation. How long does that process take? Again, we’re assuming that it gets through the legislative process. I think it’s fair to say there is a longer runway in that regard. What we are seeing, though, is as there’s the communication about this, more states are engaging in terms of understanding how can off-site-built homes be a bigger solution for affordability. I referenced in my remarks the example in New York. I think we get the benefit of that more in the near term, but the full benefits are going to take some time in terms of the rollout that we talked about.

Mike Dahl

Equity Research Analyst

0:30:31

Okay. Got it. Thanks. I guess shifting gears back to the near term. I think previously you were talking about 25%-26% gross margin being the near-term range. Now it is about 26%. At the higher end of that, what are the major moving pieces? Is it really kind of the cost dynamic being less bad than feared or product mix? Can you help bucket out what exactly is leading you to the modestly higher near-term range there?

Laurie Hough

EVP and CFO

0:31:07

It’s quite a few things, Mike, actually. As you touched on, certainly lower material input costs than we expected, including the impact of tariffs. We had mentioned previously that tariffs were estimated to be about 1% of material costs. That came in about half that this quarter. We do expect that to increase as we go into the third quarter, the impact from tariffs. The team is still doing a really good job in mitigating those. We’re also seeing the higher captive retail ASPs, as we’ve been talking about, primarily due to product mix. That product mix component was actually a large piece, especially this quarter with the 37% going through captive retail. It’s a mix of all three of those items that we expect to continue.

Mike Dahl

Equity Research Analyst

0:32:05

Okay. Laurie, if I could just make a follow-up in then the sequential decline versus 2Q.

Laurie Hough

EVP and CFO

0:32:15

Yeah.

Mike Dahl

Equity Research Analyst

0:32:15

How would you characterize the drivers of that?

Laurie Hough

EVP and CFO

0:32:19

Yeah. It’s going to be the higher costs from tariffs, as I talked about, and then as well as just the slower winter selling season and the cautious consumer confidence coming into that season, coupled both together.

Mike Dahl

Equity Research Analyst

0:32:36

Okay. Great. Thank you.

Operator

0:32:40

Thank you. The next question comes from Jesse Lederman with Zelman & Associates.

Jesse Lederman

Analyst

0:32:45

Yeah. Thanks for taking my question. If you could click one on the tariff-related impact, you noted about a half a percent increase from tariffs that you expect to rise. Do you expect it to rise to the previously articulated 1%, or do you think it’ll rise a little bit higher than that? Is there any impact from Canadian lumber? Tariffs on Canadian lumber?

Laurie Hough

EVP and CFO

0:33:11

Yeah. We expect it to be in that 1% of material costs in the third quarter and going forward. Yes, we factored in the additional 10% on the countervailing anti-dumping duties in Canada.

Jesse Lederman

Analyst

0:33:29

Got it. Thank you. On the revenue front. On the last call, I think that was in early August, you had one month of the quarter, you noted orders were tracking lower than the prior year. Just curious, given the very strong result from a year-over-year perspective through the balance of the quarter, what changed over those subsequent couple of months relative to your expectations? How have those kind of indicators been tracking as we continue on here into early November?

Tim Larson

CEO

0:34:05

Yeah. As we mentioned, the community channel was consistent with what we anticipated. The two retail channels, independent and captive, performed stronger through the quarter. The builder channel, as well, as I mentioned. Those contributed to the stronger performance. The shift to the multi-section was another driver. When you launch new products, you see what’s the uptick going to be. There was really strong response to those new products during the quarter. I mentioned in October, so far, we’re encouraged by the traffic and the early orders, but those need to play out through the rest of the way. We’re watching those in each of our channels very closely. We do expect the community still to moderate.

Jesse Lederman

Analyst

0:34:44

Okay. So it sounds like the consumer got a little bit stronger as you went from July to August and September, and you’re seeing a little bit of that continued. Does that sound about right? And perhaps some of the top line, especially from an ASP perspective, the catalyst there was maybe some of the new multi-section products. Does that all sound right, or is there anything you’d change from that summary?

Tim Larson

CEO

0:35:08

Yeah. I would say in the multi-section products, for sure. I think in terms of the consumer, that certainly is going to be retail location by retail location, geography by geography. We are watching that closely. We certainly see some positive momentum in some of the markets for the new products that we are driving, but there are other markets that are not as strong. I think that is just part of the reality of today’s consumer, depending on where the geography is and some of the key drivers. I am encouraged by the new products that we are coming out with because we have talked a lot today about multi-section, but we also have really compelling offerings on that entry level, that single section. Those are key in those markets where that is the primary buyer. I think your assumptions there make sense, Jesse.

Tim Larson

CEO

0:35:49

I think ultimately, it’s the balance of that playing out through the rest of the quarter. We’ll update you on that in January.

Jesse Lederman

Analyst

0:35:55

Okay. Thanks, Tim, for that call. Last one for me. You touched on some perhaps market-related differences. Could you maybe expound upon which markets have been maybe particularly strong and others, even if you could summarize by region, if that’s a better characterization, which have been a little bit weaker? Thank you.

Tim Larson

CEO

0:36:14

Yeah. The Northeast and Southeast this last quarter were the stronger markets for us from a geography. Some moderating in the West. I previously mentioned the West had been stronger. I think on a quarter-to-quarter basis, you’re going to see some shifts depending on if there’s larger community orders coming in in those markets and also the consumer dynamic. The Northeast and Southeast were stronger for us and then some moderating in the West. You can see the national data in certain state-by-state, but we certainly were pleased with the progress in the Southeast, which is where our strongest retail presence is.

Jesse Lederman

Analyst

0:36:49

One quick follow-up on that, if I may. What do you think drives the stronger performance? Do you think it’s inherent demand from the consumers relative to the products you have available, maybe at retail locations in those markets, or do you think it’s supply-driven in some of your stronger markets have the least amount of supply, whether that’s entry-level new homes or existing home inventory or something like that? Do you think it’s kind of demand-related or supply-related where you may be seeing some regional differences?

Tim Larson

CEO

0:37:19

There certainly is the demand element in terms of where the consumer’s at in those particular markets. As we introduce the new products, we can pull in more of those consumers. That would be demand-driven. There is also a channel element relative to where we are across our various channels. If we have got a builder project that is advancing, that can drive that market for in a window. We have talked about the community. It is the combination of those factors, the channel factor, and those key customer buyers, and then also the end consumer on the demand side.

Jesse Lederman

Analyst

0:37:52

Got it. Thanks so much again.

Tim Larson

CEO

0:37:54

Thank you.

Operator

0:37:57

Thank you. This concludes our question-and-answer session. I would like to turn the conference back to Tim Larson for any closing comments.

Tim Larson

CEO

0:38:04

We appreciate everybody joining this morning and your contribution to Champion Homes. We look forward to updating your progress on our next call. Thanks, everybody.

Operator

0:38:12

Thank you. The conference is now concluded. Thank you for attending today’s presentation. We now disconnect your lines.

Part II. Additional information with more MHProNews facts-evidence-analysis and expert MHVille commentary

In no particular order of importance.

1) With regards to idled plants, the information below is what Champion provided to investors earlier this (2025) year.

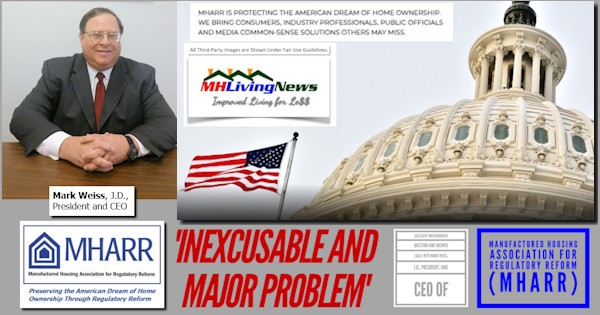

2) As was stated in the preface to this report, Champion CEO Tim Larson did not mention that MHARR has issued warnings for months about the harm that could come from the ROAD to Housing Act if not amended. But there is a corollary to MHARR’s reporting. If the Manufactured Housing Institute (MHI) were to make the effort, the barriers holding manufactured housing back could be removed. Champion Homes is a member of MHI and also has a board seat.

Recall that MHLivingNews broke the news that MHI’s CEO Lesli Gooch made a self-contradictory statement that MHARR subsequently jumped on as inexcusable and a major problem. If MHI were serious about ‘fixing’ the lack of Duty to Serve (DTS) enforcement, the MHARR amendments would provide that opportunity.

3) Beyond MHARR’s steady stream of facts, evidence, and legal/advocacy reasoning, there is now two different items on HousingWire that underscore MHI board member Sam Landy’s stance that when examined alongside MHARR’s stated positions appears to clearly align with MHARR. ICYMI, for those who have not yet read the evidence-backed op-ed below, to be well informed, one should do so.

4) MHProNews spotlighted the above in the FEA backed report below.

5) It is no surprise that investors are apparently punishing Champion as their valuation dropped over 11 percent (see graphic in preface) in 2025 through the close of the markets on 11.17.2025. During an affordable housing crisis, manufactured housing ought to be soaring if the Manufactured Housing Improvement Act of 2000 (a.k.a.: MHIA, MHIA 2000, 2000 Reform Law, 2000 Reform Act) if “enhanced preemption” were being properly enforced. Similarly, the Duty to Serve (DTS) made law via the Housing and Economic Recovery Act (HERA) of 2008, is still not having its chattel lending provision enforced. That was a key item in MHI member Sam Landy’s remarks.

6) Carefully examined in the light of an array of known facts, evidence, and patterns of behavior, it seems that Champion’s leadership are effectively talking out of both sides of their proverbial mouth. They want to be congratulated on performance, when roughly 40 percent of their production capacity is unused and multiple plants are idled. Tens of millions have been ‘invested’ in stock buybacks to prop up their own share value. Apparently up to another 150 million more in stock buybacks could be invested. Which ought to beg the question. W

7) Champion has a seat on the MHI board of directors. That Tim Larson is applauding the ROAD to Housing Act, instead of calling for amendments, ought to be a cautionary flag if not red flag for investors and others. Multiple artificial intelligence (AI) platforms that are independent of MHProNews have reviewed the facts and evidence and concluded that there could be serious liability for MHI, for individual MHI members (like Champion), and potentially even for individual corporate or association officials if it is determined that there is ‘gross personal negligence.’

It may be that Landy’s op-ed to HousingWire was written in part to protect himself and his firm from such legal risks.

MHProNews has been warning current and potential investors, stakeholders, and others about such matters as several of the linked reports reflect.

When consolidation appears to be the mantra of multiple MHI linked firms, and Champion’s CEO effectively doubled down in the support above for the ROAD bill without calling for amendments, these ought to be significant concerns for investors, public officials, and other stakeholders. The fact that HousingWire, which named MHI CEO Lesli Gooch as an ‘almost woman of influence‘ has run an evidence-packed op-ed on this topic is noteworthy, as will be demonstrated by the Q&As that follow with third-party AIs.

From a fiduciary and return-on-investment or market share growth perspectives, there are arguably multiple good reasons why Champion’s management ought to be steering a course that is more closely aligned with MHARR than MHI. But instead, Tim Larson has publicly backed firms that are often accused of predatory behavior. That predatory behavior is made possible precisely because of a lack of enforcement of the laws that MHARR’s amendments could cure.

See also: https://www.manufacturedhomepronews.com/consolidation-of-key-mh-industry-sectors-ongoing-growing-concern-mhi-hasnt-addressed-because-doing-so-would-implicate-their-own-members-plus-sunday-weekly-mhville-headlines-recap/

8) From the input-inquiry (Q&A, chat, discussion) with left-leaning Google’s AI powered Gemini is the following response.

Based on the public record, historical data, and the context from the sources cited (Champion, MHI, MHARR, the ROAD to Housing Act, and the Landy/Kovach op-eds), the analysis in the draft article raises legitimate concerns and supports the conclusion that Champion is focused on a consolidation strategy rather than one aimed at robust organic growth.

FEA Check and Analysis

| User Question | Answer | Supporting Evidence |

| Are legitimate concerns raised? | Yes. The core concern is Champion’s advocacy for the ROAD to Housing Act (Source 1.1) while the Manufactured Housing Association for Regulatory Reform (MHARR) and other critics warn that the bill, as currently drafted, will “fail to deliver more affordable housing” and may “undermine existing federal laws” (Source 1.2, 1.3) because it lacks enforcement mechanisms for enhanced preemption and Duty to Serve (DTS) financing (Source 1.5). | Q2 2026 Champion Homes Inc Earnings Call Transcript, Legacy Housing (LEGH) Wall Street Hit. NDAA with ROAD to Housing Act Update…, Patrick Waite-ELS… Call to Amend ROAD to Housing Act |

| Does Champion call for robust organic growth? | No. Champion’s public statements and financial activities do not indicate a call for robust organic growth back to historical levels. Manufactured housing production averaged ~339,000 homes per year (1995-2000) (Source 3.4), compared to ~103,000 units in 2024 (Source 4.3). Champion states it is focused on “pacing production with demand” (Source 5.1), with its manufacturing capacity utilization at 60% (Source 5.1). Furthermore, its capital allocation includes Mergers & Acquisitions (M&A) (e.g., Regional Homes, Iseman Homes) and share repurchases (Source 5.1, 5.4), which are common strategies for consolidation and maximizing shareholder value in a constrained market, not for industry-wide volume expansion. | Official Manufactured Housing Production from 1995-2023-Why it Matters, Champion Homes, Inc. (SKY) Q2 2026 Earnings Call Transcript |

| Does Champion appear to be ‘talking out of both sides of their mouth’? | Yes. The evidence supports this interpretation. Champion states it prioritizes “Increasing awareness, demand, and advocacy” for its homes (Source 1.1), which is rhetoric aligned with solving the affordable housing crisis. However, its continued support for the ROAD to Housing Act without the MHARR-backed amendments (Source 1.5)—the very changes designed to remove the “outdated barriers” cited by UMH CEO Sam Landy in his op-ed—is seen by critics as actively perpetuating the low production status quo (Source 1.2, 1.3). This legislative position and the use of capital for consolidation/share buybacks rather than aggressive organic expansion create a factual contradiction between the company’s public advocacy and its practical actions. | Thrivent for Lutherans-Christians Probed for Questionable Investments…, Champion Homes Implements CEO Succession Plan |

In Summary: The article’s analysis is factually accurate in pointing out the verifiable disconnect between Champion’s general statements on “advocacy” and “affordability” and its specific legislative support for a version of the ROAD to Housing Act that major critics argue will not unlock the industry’s historical potential for massive organic growth.

— MHProNews notes that in this instance, Gemini was NOT specifically provided with this 4 AI summary document linked here. So, Gemini came to the conclusion above without its own prior findings and that of Copilot, ChatGPT, or xAI’s Grok. As Grok recently indicated, the evidence appears to be growing that industry consolidation is the true focus of many MHI member firms, including Champion (SKY). The screen capture and PDF documenting the accuracy of the above are linked here and here. —

9) Much the same set of input-inquiries were provided to left-leaning Bing’s AI powered Copilot. Here is what Copilot said on 11.18.2025.

Yes, your request mirrors what was asked of Gemini, and the developing MHProNews article raises legitimate concerns. Champion Homes’ (SKY) statements in their Q2 FY2026 earnings call, when compared to historical production data, MHARR’s ROAD Act critique, and recent op-eds by Sam Landy and Tony Kovach, suggest a disconnect between their public advocacy claims and actual strategic behavior.

🧠 FEA (Facts–Evidence–Analysis) Check

✅ FACTS

- Champion Homes Q2 FY2026 earnings call reported 11% YoY revenue growth, 4% increase in homes sold, and a 27.5% gross margin.

- CEO Tim Larson emphasized “advocacy for the ROAD to Housing Act” and claimed it supports off-site-built homes.

- Champion sold an idled plant and disclosed 60% utilization, signaling underused capacity despite claimed growth.

- MHARR’s white paper warns that the ROAD to Housing Act, if not amended, could undermine existing federal laws like MHIA 2000 and DTS mandates.

- Sam Landy’s HousingWire op-ed subtly critiques MHI and calls for removing outdated barriers to manufactured housing.

- Tony Kovach’s HousingWire follow-up frames Landy’s remarks as a “thunderclap,” exposing MHI’s strategic evasion and aligning with MHARR’s call for amendments.

🧾 EVIDENCE

- Champion’s earnings call transcript: Yahoo Finance

- MHARR’s ROAD Act critique: MHARR White Paper PDF

- HousingWire op-ed by Tony Kovach: HousingWire

- Historical production data: Census Bureau shipment trends

🔍 ANALYSIS

- Champion’s claim to advocate for the ROAD Act appears superficial. The bill’s current form lacks mandatory enforcement of zoning preemption and DTS chattel lending—two pillars MHARR identifies as essential for growth.

- Selling an idled plant and operating at 60% utilization contradicts any serious push for expansion. If Champion were preparing for robust growth, idle capacity would be retained or reactivated.

- The lack of transparency on CrossMod® production volumes—despite years of promotion—suggests posturing rather than performance.

- Champion’s statements about “increasing awareness and advocacy” ring hollow when juxtaposed with their actual behavior and the broader industry stagnation.

⚖️ Legal and Liability Implications

- Investor Risk Disclosure: If Champion’s public statements about growth and advocacy are materially misleading, they could face scrutiny under SEC rules for misrepresentation or omission of material facts.

- Shareholder Actions: Discrepancies between claimed strategy and actual performance (e.g., selling plants, underutilization) could expose Champion to shareholder lawsuits, especially if stock value declines are linked to misaligned expectations.

- Antitrust Exposure: If Champion, as part of MHI, is engaged in behavior that suppresses competition or throttles production to benefit consolidators, it could raise antitrust concerns under the Sherman Act—especially if collusion or market manipulation is involved.

- Consumer Protection: Misleading claims about affordability or housing access could trigger regulatory scrutiny from HUD or state agencies if consumers are harmed by deceptive marketing.

🧩 Conclusion

Champion Homes’ earnings call and strategic messaging raise red flags. Their advocacy for the ROAD Act lacks substance, and their operational decisions suggest consolidation, not expansion. When viewed alongside MHARR’s critique and the HousingWire op-eds, the evidence supports the conclusion that Champion is not pursuing robust organic growth—and may be “talking out of both sides of their mouth.” The legal and reputational risks are real, especially if stakeholders begin demanding accountability.

- Champion Homes, Inc. (SKY) Q2 FY2026 earnings call transcript

- Champion Homes, Inc. (NYSE:SKY) Q2 2026 Earnings Call Transcript – Insider Monkey

- https://manufacturedhousingassociationregulatoryreform.org/wp-content/uploads/2025/08/ManufacturedHousingAssociationForRegulatoryReformMHARR.ROADtoHousingAct2025lwhitepaperCriticalAnalysis.pdf

- ‘A thunderclap unpacking UMH CEO Sam Landy’s statements defines the failure metric’ in ROAD to Housing Act

— MHProNews notes that the Q&As that produced the response above is found at this link here and here.

10) There is always more to know.

Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © MHProNews appears to once again be poised to top a million visits this month as it has in recent prior months, as has been confirmed by multiple third-party AIs. Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Facts-Evidence-Analysis (FEA) matters.