We’ll start in the real estate investment trust (REIT) sector, with UMH Properties. This company, which started out after WWII in the mobile home industry, later become the premier builder of manufactured housing. Today, UMH owns and manages a portfolio of 124 manufactured housing communities, spread across 8 states in the Northeast and Midwest, and totaling well over 23,000 units.

As a REIT, UMH has benefitted from the nature of manufactured houses as affordable options in the housing market. UMH both sells the manufactured homes to residents, while leasing the plots on which the properties stand, and leases homes to residents. The company’s same-property income, a key metric, showed 8.6% year-over-year increase in the third quarter.

Also in the third quarter, UMH reported a 16% yoy increase in top line revenue, showing $43.1 million compared to $37.3 million in the year-ago quarter. Funds from Operations, another key metric in the REIT sector, came in at 11 cents per share, down from 14 cents in 3Q19. The decrease came as the company redeemed $2.9 million in Series B Preferred Stock.

REIT’s are required to return income to shareholders, and UMH accomplishes this with a reliable dividend and a high yield of 4.7%. The payment, at 18 cents per common share, is paid quarterly and has been held stable for over a decade.

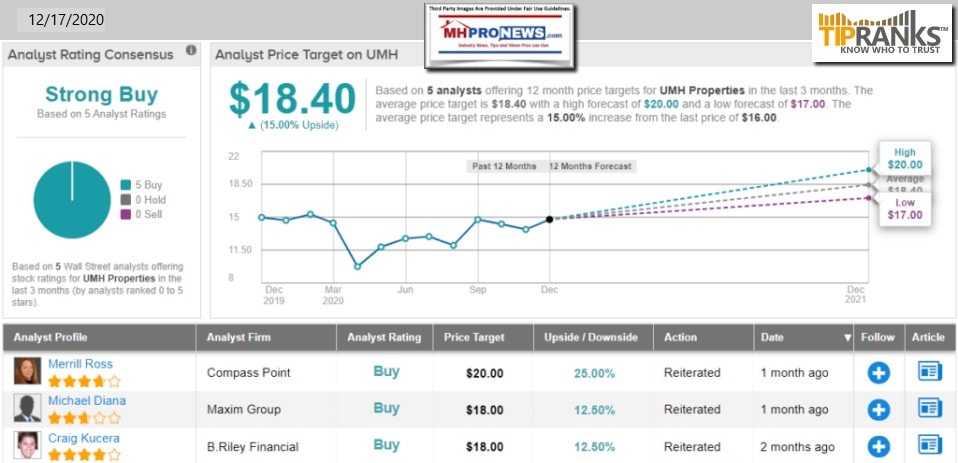

Compass Point analyst Merrill Ross believes the company is in a sound position to create value for both households and shareholders.

“We believe that UMH has proven that it can bring attractive, affordable housing to either renters or homeowners more efficiently than has been possible with vertical rental housing. As UMH improves its cost of funds, it can compete more effectively with other MH community owners in the public and private realms, and because it has a successful formula to turn around undermanaged communities, we think that UMH can consolidate privately-owned properties over the next few years to build on its potential for value creation,” Ross opined.

To this end, Ross rates UMH a Buy, and her $20 price target implies a 25% one-year upside.

Overall, the unanimous Strong Buy on UMH is based on 5 recent reviews. The stock is selling for $15.92, and the $18.40 average price target suggests it has room for 15% growth from that level.”

The Seeking Alpha portion of our review of UMH Properties analysts by third parties are in our featured focus segment. It will be followed by additional information from MHProNews.

For new readers, the featured focus follows thought provoking quotable quotes, today’s left-right headline recap, and two of the three market snapshots at the closing bell today. The manufactured housing market summary of publicly traded equities at the close today follow the featured focus and the linked recent/related reports.

Quotes That Shed Light – American Social, Industry, National Issues…

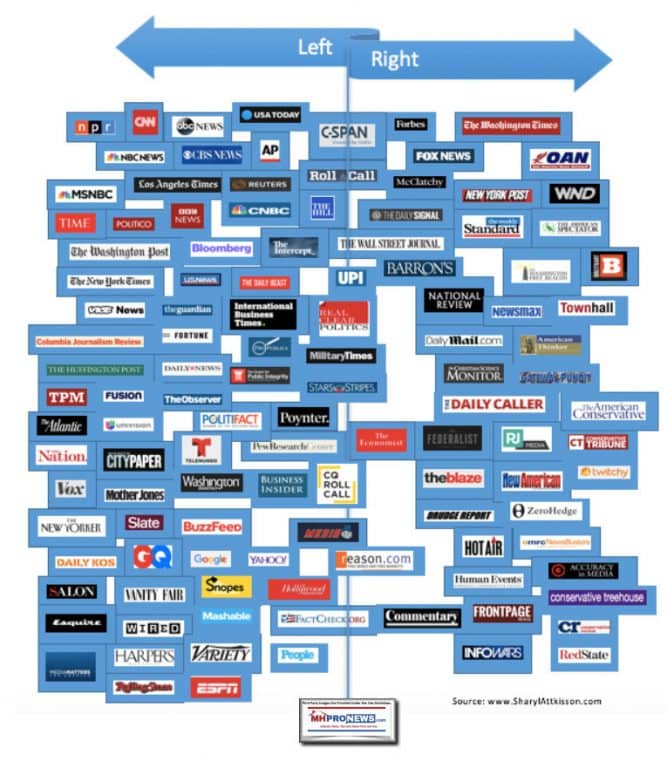

Headlines from left-of-center CNN Business

- Inflation fears

- Joe Biden’s financial team — Jerome Powell and Janet Yellen — could create a giant stock bubble

- Mortgage rates fall to yet another record low

- These 5 charts show the pandemic’s devastating effect on working women

- When lawmakers buy and sell stocks, they’re playing with fire

- More bad jobs news: 885,000 people filed for unemployment last week

- Robinhood agrees to pay a $65 million fine for deceiving clients

- The antitrust lawsuits against Google just keep coming

- Internet freaked out by this ‘creepy’ lifelike face mask

- Gridlock at UK ports could cancel Christmas for retailers

- Tyson fires managers following allegations of Covid-19 betting pool

- OPINION To keep the heat on this winter, Congress needs to help families pay their utility bills

- Papa John’s brings stuffed crust to the pizza wars

- Fox News personalities attack Bill Gates for pandemic comments on CNN

- An apartment maintenance man changes the lock of an apartment after constables posted an eviction order on October 7, 2020 in Phoenix, Arizona. Thousands of court-ordered evictions continue nationwide despite a Centers for Disease Control (CDC) moratorium for renters impacted by the coronavirus pandemic. Although state and county officials say they have tried to educate the public on the protections, many renters remain unaware and fail to complete the necessary forms to remain in their homes. In many cases landlords have worked out more flexible payment plans with vulnerable tenants, although these temporary solutions have become fraught as the pandemic drags on. With millions of Americans still unemployed due to the pandemic, federal rental assistance proposals remain gridlocked in Congress. The expiry of the CDC moratorium at year's end looms large, as renters and landlord face a potential tsunami of evictions and foreclosures nationwide.

- Landlords are running out of money. ‘We don’t get unemployment’

- For the first time, there’s a woman on every S&P 500 board. But they’re still in the minority

- 2020 Dodge Challenger is on display at the 112th Annual Chicago Auto Show at McCormick Place in Chicago, Illinois on February 6, 2020.

- Automatic braking is now on most new cars. But not GM or Fiat Chrysler vehicles

- MARKETS

- TRANSPORTATION

- A customer prepares to charge his Tesla electric vehicle (EV) after parking in a bay for electric vehicles at a supermarket in north London on November 18, 2020. – Britain will ban petrol and diesel vehicle sales from 2030 as part of a 10-point plan for a “green industrial revolution” to be unveiled Wednesday by Prime Minister Boris Johnson. The British premier has earmarked £12 billion (13.4 billion euros, $15.9 billion) for the wide-ranging plans, which he hopes will secure up to 250,000 jobs and help meet a target for the UK to become carbon neutral by 2050.

- 2020: When electric vehicle excitement kicked into high gear

- Here’s the robotaxi Amazon wants you to ride around in

- See Walmart’s self-driving delivery trucks in action

- Self-driving robotaxis are taking off in China

- Bill Gates, Amazon and British Airways are backing a hydrogen plane startup

- STREAMING

- The Child and Ahsoka Tano (Rosario Dawson) in Lucasfilm’s THE MANDALORIAN, season two.

- Streaming is about to get a lot more expensive

- HBO Max and Roku finally reach a deal

- Disney+ is about to get a lot bigger

- AT&T chief defends Warner Bros. streaming strategy

- OPINION TV viewers are craving comfort food. 2021 will deliver

Headlines from right-of-center Newsmax

- CISA Warns Foreign Hack a ‘Grave’ Matter, and Much Larger Than Reported

- “This threat poses a grave risk to the Federal Government and state, local, tribal, and territorial governments as well as critical infrastructure entities and other private sector organizations.”

- Election 2020

- Trump: ‘Thousands of Noncitizens Voted in Nevada’

- Tommy Tuberville Floated as Ally for Rep. Brooks’ Electoral College Challenge

- Rick Scott to Newsmax TV: We’ll See What Happens With Electors Jan. 6 |

- Emerson Poll: Loeffler Has 3-Point Lead Over Warnock

- Poll: Perdue Holds Slight Lead in Georgia Senate Runoff

- Report: Zuckerberg Money Used in Violation of Federal Election Law

- The Trump Presidency

- Trump’s Legacy Surpasses That of Any Modern President

- Watchdog Members Urge Probe on Mnuchin’s Shift of Pandemic Funds

- Pence Set to Oversee Joint Session – and Then Leave US

- Interior Secretary Tests Positive for COVID-19

- Trump Admin. Withholding $200M in Medicaid Funds From California

- Kaine: COVID Relief Bill ‘Good Deal for a Short Period of Time’

- US Confirms Recent Hacking Campaign Hit Government Networks

- Newsfront

- Trump: ‘Nothing to Do With’ Potential Prosecution of Hunter Biden

- President Donald Trump said on Thursday that he had nothing to do with any potential prosecution of President-elect Joe Biden’s son, Hunter, who has disclosed that his taxes are being investigated by a federal prosecutor in Delaware…

- Related Stories

- Amid Probe and Dad’s Rise to Power, Hunter Biden Leans Into … Art?

- Email: Hunter Sought $10M From China Firm in ’17

- John Rose to Newsmax TV: Special Counsel Needed to Investigate Hunter Biden

- Joe Biden ‘Confident’ Son Hunter Did Nothing Wrong

- Buck: Special Counsel Must Be Named to Investigate Hunter Biden

- President Trump Urged to Pardon Assange, Snowden

- President Trump Urged to Pardon Assange, Snowden

- Supporters of Julian Assange and Edward Snowden are asking President

- France’s Macron Tests Positive for COVID-19

- Google Hit With 3rd Antitrust Suit as States Sue Over Search Monopoly

- Alphabet Inc’s Google on Thursday faced its third major lawsuit

- Iran President: ‘No Doubt’ Biden Will Reenter Nuclear Deal, Lift Sanctions

- Jobless Claims Jump to 885,000 Amid Virus Spike

- Finance

- BlackRock Touts Dividend Stocks for 2021

- The stocks that appeal to investors looking for a steady stream of income are back in favor and may continue to beat bonds in a world of historically low rates, according to BlackRock Inc.

- Coca-Cola to Cut 2,200 Jobs Worldwide Amid Pandemic

- Gold Bulls Heartened by Fed’s Resolve as Dollar Buckles

- Cryptocurrency Exchange Coinbase Files to Go Public

- Wall Street Braces for Trading Surge as Tesla Enters S&P 500

Market Indicator Closing Summaries – Yahoo Finance Closing Tickers on MHProNews…

Featured Focus –

Where Business, Politics and Investing Can Meet

Continuing by sharing the flip side of the analysis above, is this from Seeking Alpha yesterday. It will be followed by additional information and commentary from MHProNews.

Dec. 16, 2020 11:13 AM ET by Daniel Jones, via Seeking Alpha

Summary

In recent years, UMH Properties has proven itself to be a quality operator in its space.

The firm is fundamentally healthy, but things are not quite that simple.

Shares of the firm look pricey and it’s likely there are better prospects elsewhere on the market…

…REITs can make for attractive investment opportunities. Their legal structure often allows for significant cash payments to be made directly to their unitholders on a tax-advantaged basis. At times, even factoring in these payments, units of these entities tend to trade at fairly low multiples, but it’s important to know that the REIT market is not a monolith. Some firms in this space do trade at hefty multiples, and even with the distributions they pay out, can be considered unappealing relative to the broader market. Such is the case today with UMH Properties (UMH). At this moment, the company, while fundamentally sound, is disappointingly overpriced and investors looking for strong returns would likely be wise to consider elsewhere for opportunities.

A look at UMH

UMH is a rather simple REIT. By and large, the company consists of leased out homesites to the owners of manufactured homes. These are properties built inside factories and because of their lower cost of construction (and lower quality), they are often the choice of lower income individuals. This is not a universal truth, but it’s definitely the trend you would see. In addition to this, the company does generate some income from selling these types of homes, plus it has some cash flow coming in from its portfolio of securities.

Nationwide, UMH operates 124 communities. This is up from the 122 seen at the end of the business’ 2019 fiscal year. Of these, 51, or about 41%, are located in Pennsylvania. A further 36, or 30%, are in Ohio. The state with the third-largest presence is Indiana, with 14. In all, these top three states account for 81.5% of the company’s communities. In all, as of the third quarter of its 2020 fiscal year, the business operated 23,428 sites. This is up 1.8% compared to the 23,009 sites seen a year earlier.

Over the past several years, UMH has seen some reasonable growth. Back in 2015, revenue from the firm totaled $81.52 million. It has risen every year since then, eventually closing 2019 out at $146.59 million. This implies an increase of 79.8%, or 15.8% per year. Even from 2018 through 2019 sales grew a respectable 13.1%. You might think that the COVID-19 pandemic would have put a stop to UMH’s growth prospects, but you would be incorrect. In the first three quarters of the company’s 2020 fiscal year, revenue came in at $120.78 million. This is 11% higher than the $108.85 million seen in the same time last year. In the third quarter alone, sales were up 15.5% year-over-year.

UMH has benefited from sales growth across the board. Consider, for instance, the number of homes it sold recently. So far in 2020, the company has sold 252 homes. This compares to 230 the same period of 2019. In the latest quarter alone, sales of 108 homes far eclipsed the 71 seen in the third quarter of 2019. This all shows some nice upward trajectory for the business, which on its own is bullish.

On the bottom line, the situation for the firm has been mixed some, but across most metrics UMH has improved over the past few years. Net loss has been generated every year except for in 2019 when the firm generated a profit of $2.57 million. Even this year, its net loss is so far $45.35 million compared to $6 million seen in the first three quarters of 2019. However, REITs don’t run so much on profit as they do on cash flow. My personal favorite cash flow metric to look at is operating cash flow. This came out in 2019 to $38.52 million. This compares to $29.55 million in 2015, with both 2017 and 2018 posting results in excess of $40 million. Thus far in 2020, the company has seen operating cash flow soar to $50.34 million. This is nearly double the $25.86 million seen in the same time of 2019.

Most REIT investors, though, prefer to look at FFO (funds from operations) and/or AFFO (adjusted funds from operations). FFO has shown a gradual improvement, rising from $14.27 million in 2015 to $26.97 million in 2018. 2019 saw a modest decline of $24.57 million, but it’s important to keep in mind that not every year can be excellent. AFFO, meanwhile, has followed a similar path, rising from $14.19 million in 2015 to $27.47 million in 2018 before hitting $25.21 million last year. In 2020, FFO of $17.74 million is only marginally higher than last year’s figure, while AFFO has risen from $18.15 million last year to $20.61 million now.

Shares look pricey

Looking at UMH’s path so far, investors might consider taking a stake in the business. After all, consistent growth and positive cash flows are excellent to see. They might also cite the improved same-property occupancy rate, which rose from 83.7% last year to 86.9% today. This may seem low to some investors, but considering that many of its sites are rented on an annual or even month-to-month basis, the firm is not really protected by long-term contracts like other REITs are. Having said that, I fear investors might be too bullish on UMH.

All in all, my fear boils down to price. With a market capitalization of $631.9 million as of this writing, UMH is trading at 25.8 times last year’s FFO and 25.1 times its AFFO. The flurry of excitement over the firm has pushed the yield down to 4.64%, which isn’t bad on its own but isn’t exactly an exciting return either. On a price/operating cash flow basis, the firm is a little more appealing with a multiple of 16.4, but even that’s not excellent. The only way in which the firm looks truly attractive is if this year’s operating cash flow continues to be about double last year’s and continues that way in the years to come. There, the multiple on a price/operating cash flow basis would drop to about 8.4, but that is speculative.

Takeaway

Right now, conceptually, UMH is an interesting business, but that’s where the appeal ends for me: at the conceptual level. On the whole, the firm seems to have done quite well in recent years, but it really does leave investors paying a high price for it when there are more attractive REITs in the market…”

The Seeking Alpha author provided this “Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.”

###

The ‘technical’ look at ‘company fundamentals’ by various analysts – such as the two reports above – are interesting. But as the above examples reflect, two reports, published within hours of each other on the same day, and one says ‘buy to strong buy,’ while the other says overpriced.

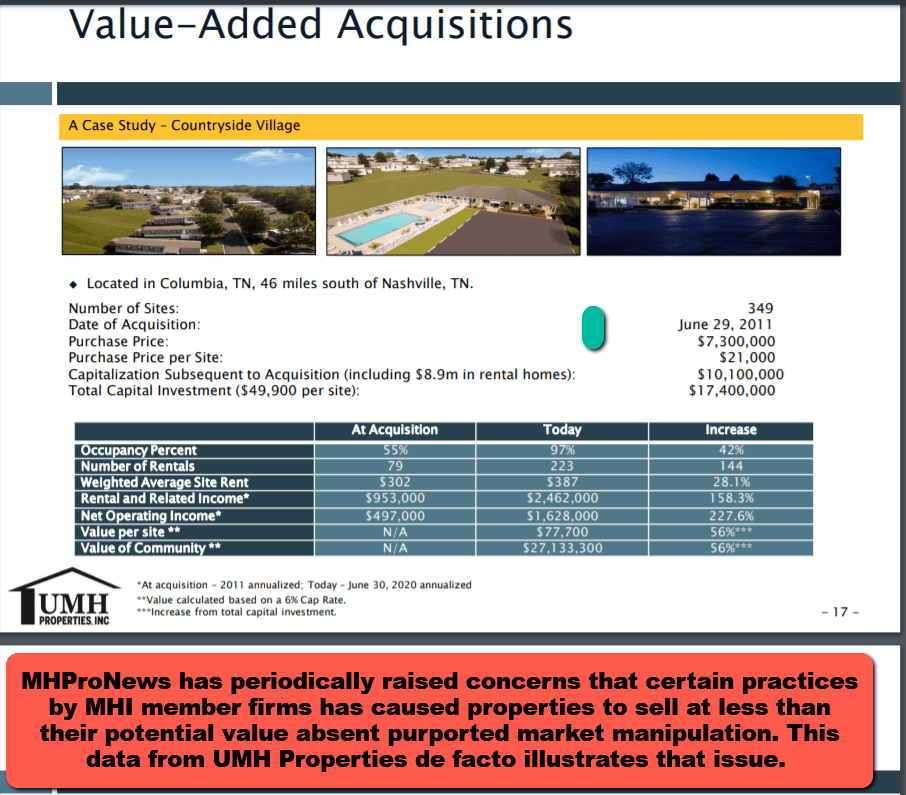

MHProNews will weigh in on the nuances on UMH in a planned upcoming report. For now, the one data point that Daniel Jones raised above, he arguably missed its true significance. Namely, UMH – which has a sales division – is so locked into their rental program, that their sales per property are sadly low. Per the above, and using the lower community count, 252 sales through the reporting period divided by 122 communities, yields a paltry 2.07 sales per property for the year?!?

That noted, it is not a dissimilar result from others in the manufactured home community REIT sector.

See the related reports, below, for more on communities and manufactured housing in general.

As a relevant aside, too few in the financial writing sector seem to be considering the impact of all of the FED pumping and federal borrowing with respect to that impact on the actual value of the dollar. While prices are ‘going up,’ in an absolute purist sense, once the inflated money is considered, there are investments that are actually losing in value. It is one more reason why longterm thinkers should be pondering the motivations for keeping President Donald Trump and Vice President Mike Pence for four more years. That is still doable. The Biden-Harris alternative is going to be good for a few, but arguably problematic for the many. See more, linked below.

That segue noted, watch for our planned deeper dive into UMH Properties here on MHProNews in the days ahead.

Related, Recent, and Read Hot Reports

Manufactured Housing Industry Investments Connected Closing Equities Tickers

Some of these firms invest in manufactured housing, or are otherwise connected, but may do other forms of investing or business activities too.

- NOTE: The chart below includes the Canadian stock, ECN, which purchased Triad Financial Services, a manufactured home industry lender

- NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

- NOTE: Deer Valley was largely taken private, say company insiders in a message to MHProNews on 12.15.2020, but there are still some outstanding shares of the stock from the days when it was a publicly traded firm. Thus, there is still periodic activity on DVLY.

Fall 2020…

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers.

· LCI Industries, Patrick, UFPI, and LP each are suppliers to the manufactured housing industry, among others.

· AMG, CG, and TAVFX have investments in manufactured housing related businesses. For insights from third-parties and clients about our publisher, click here.

Enjoy these ‘blast from the past’ comments.

MHProNews. MHProNews – previously a.k.a. MHMSM.com – has celebrated our 11th year of publishing, and is starting our 12the year of serving the industry as the runaway most-read trade media.

Sample Kudos over the years…

Learn more about our evolutionary journey as the industry’s leading trade media, at the report linked below.

· For expert manufactured housing business development or other professional services, click here.

· To sign up in seconds for our industry leading emailed headline news updates, click here.

Disclosure. MHProNews holds no positions in the stocks in this report.

That’s a wrap on this installment of “News Through the Lens of Manufactured Homes and Factory-Built Housing” © where “We Provide, You Decide.” © (Affordable housing, manufactured homes, stock, investing, data, metrics, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) (See Related Reports, further below. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHLivingNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing. For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com. This article reflects the LLC’s and/or the writer’s position, and may or may not reflect the views of sponsors or supporters.