Washington, D.C. The economy and job growth are strong, says Adam DeSanctis, with the National Association of Realtors ® (NAR) communications team.

So why did contract signings for new homes take a “startling” dip in January?

There’s

- bad news for many Americans,

- potentially hopeful news for opportunities for the manufactured home industry’s investors and professionals,

- and then head scratching issues in HUD Code manufactured housing that the NAR report directly and indirectly raises.

“After seeing a modest three-month rise in activity, pending home sales cooled considerably in January to their lowest level in over three years, according to the National Association of Realtors®. All major regions experienced monthly and annual declines in contract signings last month,” said the NAR in a media statement.

The Pending Home Sales Index ® is a forward-looking indicator based on contract signings.

It fell 4.7 percent to 104.6 in January from a downwardly revised 109.8 in December 2017.

After last month’s retreat, the index is now 3.8 percent below a year ago and at its lowest level since October 2014 (104.1).

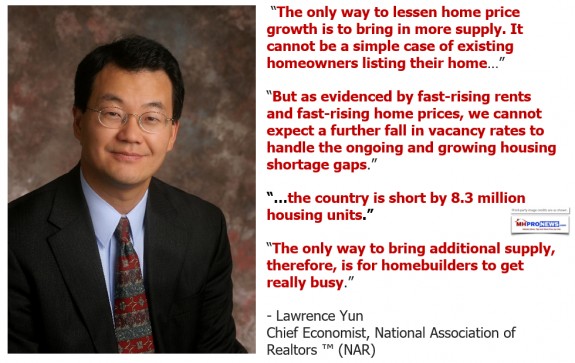

Lawrence Yun, NAR chief economist, says pending sales took a noticeable step back to start 2018.

“The economy is in great shape, most local job markets are very strong and incomes are slowly rising, but there’s little doubt last month’s retreat in contract signings occurred because of woefully low supply levels and the sudden increase in mortgage rates,” Yun said.

“The lower end of the market continues to feel the brunt of these supply and affordability impediments. With the cost of buying a home getting more expensive and not enough inventory, some prospective buyers are either waiting until listings increase come spring or now having to delay their search entirely to save up for a larger down payment,” stated Yun.

This is one of several areas that manufactured housing could be providing a much needed boost for the overall housing market.

But arguably,

- controversies surrounding the Manufactured Housing Institute (MHI) and some of their major players,

- plus over a decade of improper actions at the Department of Housing and Urban Development (HUD),

- and other interrelated issues has yielded a negative storm that harms the interests of millions of Americans,

- while also acting as a limiting factor for many in the manufactured home industry.

Added Yun, “Even though contract signings were down, Realtors® indicated that buyer traffic in most areas was up January compared to a year ago1. The exception was likely in the Northeast, where the frigid cold snap the first two weeks of the month may have contributed some to the region’s large decline.”

The number of available listings at the end of January was at an all-time low for the month and a startling 9.5 percent below a year ago, says NAR.

In addition to new home construction making progress closer to its historical annual average of 1.5 million starts,

“As new multi-family supply catches up with demand and slows rents, some large investors may begin putting their holdings of affordable single-family homes up for sale, which would be great news, particularly for first-time buyers,” said Yun.

In 2018, Yun forecasts for existing-home sales to be around 5.50 million – roughly unchanged from 2017 (5.51 million). The national median existing-home price this year is expected to increase around 2.7 percent. In 2017, existing sales increased 1.1 percent and prices rose 5.8 percent.

Note that the NAR video has related information, but the quotes above are not in the video.

If these underlying issues aren’t addressed, doesn’t the Obama era data – linked below – indicate the economic harm caused, and perhaps reflect a potentially avoidably economic stall?

YIMBY vs. NIMBY, Obama Admin Concept Could Unlock $1.95 Trillion Annually, HUD & MH Impact

Manufactured Housing and the NAR Data, What Does it Mean?

The issues raised by the NAR’s experts point to concerns that MHProNews has raised for years, and with increased intensity in roughly the past 18 months.

When manufactured housing has the advantage of the enhanced preemption called for by the HUD Code, why are MHI and some key larger players delaying a meaningful public and media engagement effort that would allow the current products of manufactured home producers to be better understood, and thus more widely embraced?

Is it incompetence, or some other agenda?

While everyone makes mistakes, no one is accusing MHI’s top staff or leaders to be fools.

So rule incompetence out.

The Masthead

The Manufactured Housing Institute has finally provided a series of written responses to concerns raised by a number of industry members. MHI did so to via an email to their members, as they ask them to renew their annual membership dues. Let’s make this hyper-simple.

Therefore, when HUD Code manufactured home sales are already being made – albeit at relatively modest levels – to the kinds of buyers that would seek a site-built home, why has MHI foot dragged and failed to take robust steps, which their budget makes possible?

Last year at Tunica, manufactured home lender Credit Human’s long-time industry veteran, Barry Noffsinger laid out the case for how some professionals are already selling homes to those who might otherwise buy a conventional house.

Related at this link.

Meanwhile, the Manufactured Housing Association for Regulatory Reform (MHARR) and others in the industry – including MHI members – share insights with MHProNews that MHI routinely ducks out on responding to; why? If there is nothing for MHI’s leadership to hide from, why do they duck pro-industry, pro-growth, pro-consumer trade media questions?

## (News, analysis, and commentary.)

## (News, analysis, and commentary.)

Sign Up Today! Click here to sign up in 5 seconds for the manufactured home industry’s leading – and still growing – emailed headline news updates. You’ll see in the first issue or two why big, medium and ‘mom-and-pop’ professionals are reading these headline news items by the thousands. These are typically delivered twice weekly to your in box.

(Third party images, and cites are provided under fair use guidelines.)

Follow us on Twitter:

ManufacturedHomes

@mhmsmcom

Soheyla is a managing member of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.