Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- Car sales decline sharply in June

- Best places to watch fireworks on July 4th

- Tesla says battery shortage hampered car deliveries

- Illinois inches toward budget

- World’s Top Employers for New Grads

- Nevada’s new legal pot businesses worry about supply

- Tech investor resigns after harassment allegations

- S. manufacturing index hits highest mark since 2014

- July 4th gas hasn’t been this cheap in years

- SpaceX’s crazy 12 hours

- Big news for Big Yogurt: Danone is selling Stonyfield

Selected headlines and bullets from Fox Business:

- Dow touches record high as energy, bank stocks ignite rally

- Oil up 1.5 percent as U.S. crude output slows

- Auto sales stay cool in June

- Christie defends use of beach closed to public amid shutdown

- Tesla Model 3 ready to go on sale, Musk says

- Make part of Susan Rice testimony public, fmr. Rep. Hoekstra says

- Nathan’s Hot Dog Contest: Joey Chestnut favored to defend title

- Venus Williams breaks down at Wimbledon after question about fatal car crash

- Oscar Mayer may have found a way to make hot dogs ‘healthier’

- 4th of July fireworks cancelled as budget woes whack small towns

- DC appeals court orders EPA to move ahead with methane rule

- Oil up 1.5 percent as U.S. crude output slows

- North Dakota may halt rail inspections aimed at derailments

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

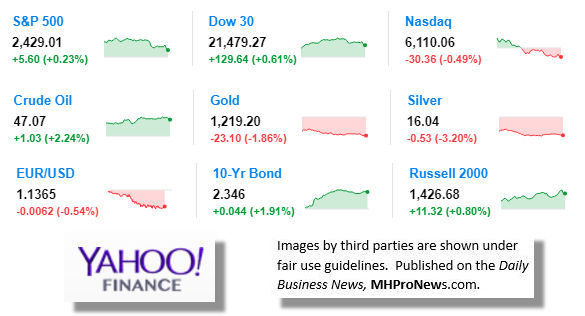

9 key market indicators, ‘at the closing bell…’

S&P 500 2,429.01 +5.60 (+0.23%)

Dow 30 21,479.27 +129.64 (+0.61%)

Nasdaq 6,110.06 -30.36 (-0.49%)

S&P 500 2,429.01 +5.60 (+0.23%)

Dow 30 21,479.27 +129.64 (+0.61%)

Nasdaq 6,110.06 -30.36 (-0.49%)

Crude Oil 47.07 +1.03 (+2.24%)

Gold 1,219.20 -23.10 (-1.86%)

Silver 16.04 -0.53 (-3.20%)

EUR/USD 1.1364 -0.0063 (-0.55%)

10-Yr Bond 2.346 +0.044 (+1.91%)

Russell 2000 1,426.68 +11.32 (+0.80%)

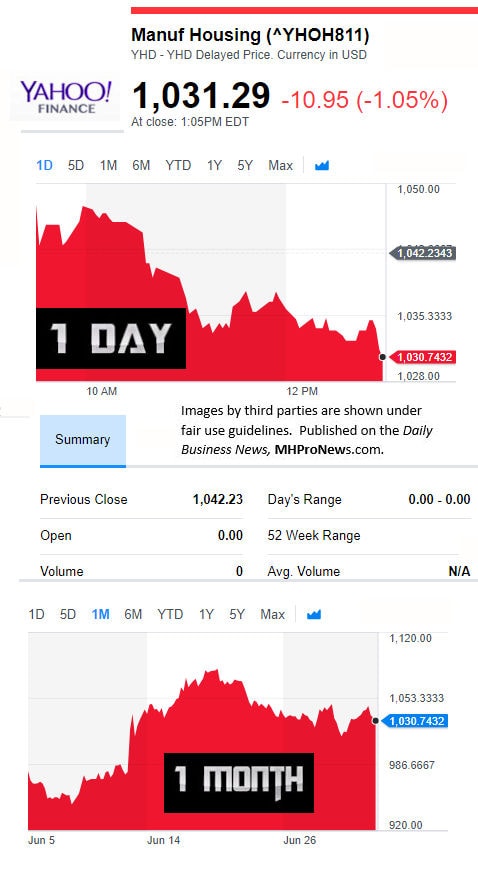

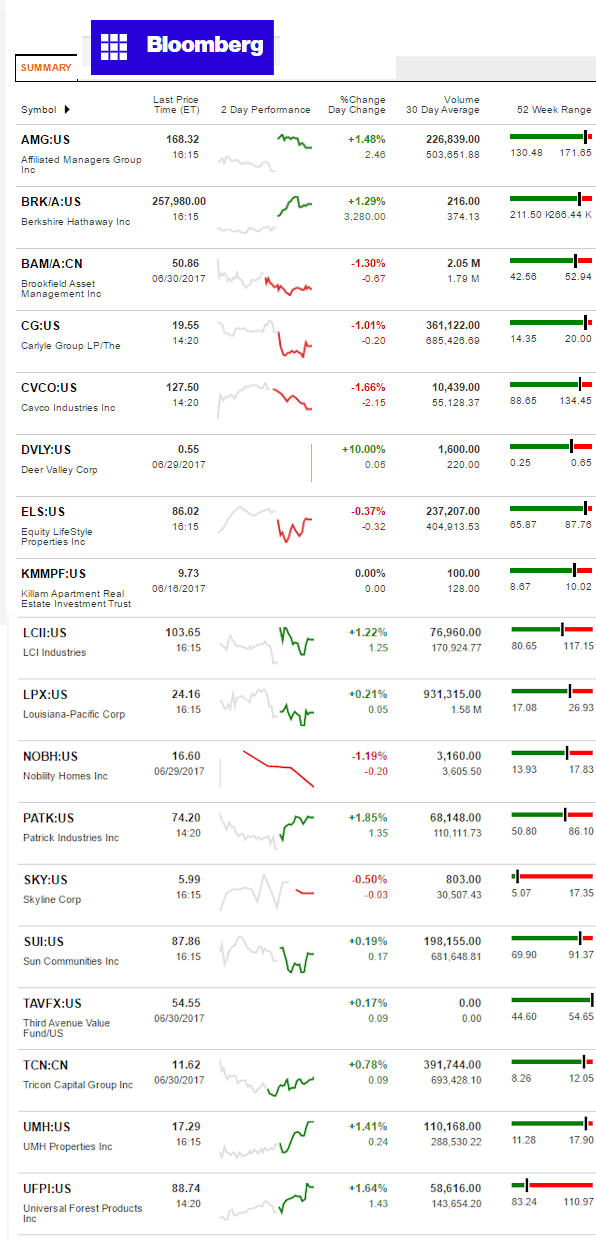

Manufactured Housing Composite Value

Today’s Big Movers

Skyline and LCI lead the gainers. Cavco and LPX lead the decliners. See below for all the ‘scores and highlights.’

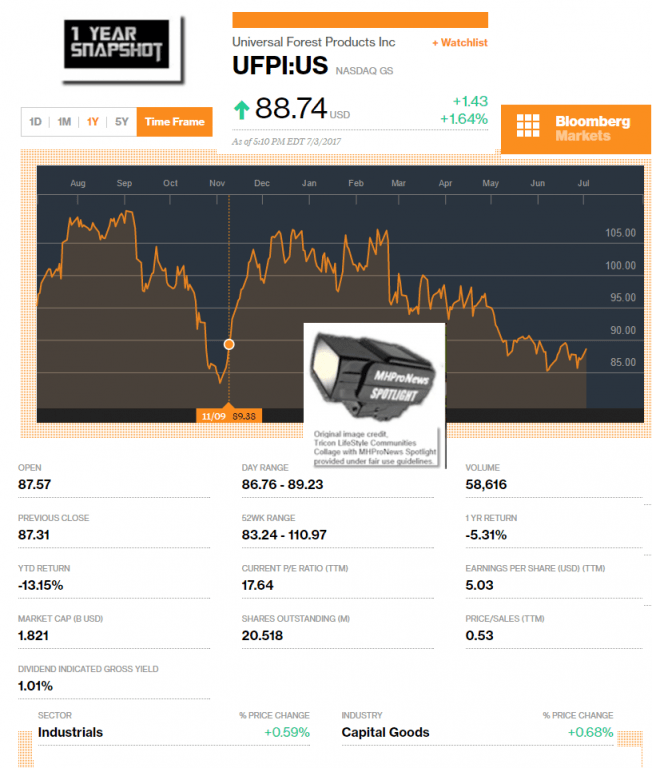

Today’s MH Market Spotlight Report – UFPI

Universal Forest Products, Inc (UFPI) produces lumber products which are used in home building, including by several manufactured housing producers. Thus, it has been included for several years in the Daily Business News manufactured home connected stock market report.

In recent news on UFPI, two reports jumped out.

KL Daily noted $1.85 Earnings Per Share (EPS) Expected for UFPI.

Some bullets:

- Universal Forest Products, Inc. is a holding company. The company has market cap of $1.83 billion.

- anticipate $0.21 EPS change or 12.80 % from last quarter’s $1.64 EPS.

- UFPI’s profit would be $38.15M giving it 11.99 P/E if the $1.85 EPS is correct.

- After having $1.03 EPS previously, Universal Forest Products, Inc.’s analysts see 79.61 % EPS growth.

- (NASDAQ:UFPI) has risen 12.86% since July 3, 2016 and is up trending.

- It has underperformed by 3.84% the S&P500.

“Universal Forest Products, Inc. is a holding company,” says KL Daily. The company has a reported market cap of $1.83 billion

So-called “Head to head” comparisons tend to be interesting. The one below is from Sports Perspective stock reporting.

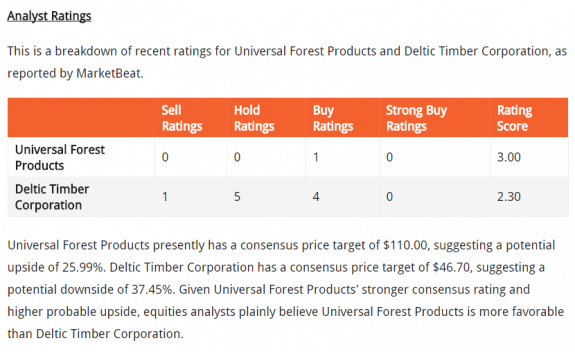

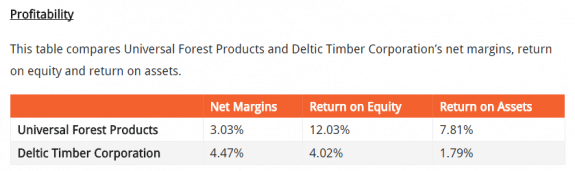

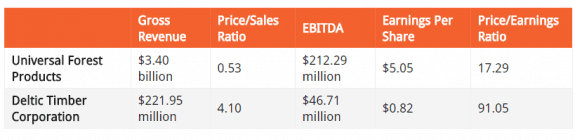

Universal Forest Products (NASDAQ: UFPI) and Deltic Timber Corporation (NYSE:DEL) are both small-cap construction companies, but which is the superior stock? We will contrast the two companies based on the strength of their profitability, earnings, valuation, institutional ownership, analyst recommendations, dividends and risk.

Institutional and Insider Ownership

81.4% of Universal Forest Products shares are held by institutional investors. Comparatively, 81.0% of Deltic Timber Corporation shares are held by institutional investors. 3.4% of Universal Forest Products shares are held by insiders. Comparatively, 12.1% of Deltic Timber Corporation shares are held by insiders. Strong institutional ownership is an indication that hedge funds, large money managers and endowments believe a company will outperform the market over the long term.

Earnings and Valuation

This table compares Universal Forest Products and Deltic Timber Corporation’s revenue, earnings per share and valuation.

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII).

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)