Are you a business owner, executive or manager? Do you have assets that make you a millionaire?

Or do you aspire to be in the 1 percent?

Then this alert is for you.

The potentially costly politics of class envy are on full display in the headline of an article on MarketWatch, which will be reviewed herein. Notice for the minority of those who’ve been misled into believing that MHProNews hates billionaires, au contraire. We applaud success, and always have, so long as the wealth is achieved legally, ethically and sustainably.

The system as it has functioned for much of the recent decades is frankly not sustainable. Teddy Roosevelt busted the trusts – i.e. monopolies – in his era. Are we ready to see “trust busting” again?

What’s the Best Way to Lift Americans out of Poverty?

Properly understood, free enterprise – as opposed to monopolistic capitalism – is the single best way to lift people from poverty.

More to the manufactured housing point, those who have legitimate access to an affordable home arguably have the best opportunity for wealth creation. That case was launched a couple of months ago on Value Penguin, at the link here. An even more robust look is found at the link below.

https://www.manufacturedhomelivingnews.com/fear-a-solution-to-the-affordable-housing-crisis-and-the-manufactured-home-dilemma/

Where Left and Right Can Meet

But there are those, most usually on the economic and political left, that make all capitalism and wealth sound evil. That doesn’t mean that left and right can’t find common ground.

The surprising reality is that left-to-right, a common sense path exists for creating wealth through a proper understanding of basic economics, and a proper application of lending, land and access to manufactured homes.

It must be recalled that many of the wealthiest are at least publicly the most ‘liberal’ or left-leaning “progressives,” who often support Democratic candidates. If they are sincere believers in what they proclaim or not is another question. Millions of Democratic and some independent voters have been led to believe that some of the world’s richest living here in the U.S. favor higher taxes. Hmmm, those billionaires posture for the left as if they want to tax themselves the more? Really?

Does anyone recall just a few weeks ago the pressure that Amazon’s Jeff Bezos put on the City of Seattle to rescind a head tax on employees?

We are not at all defending plan in Seattle, which was supposed to fund a program aimed at alleviating homelessness. The point is that Billionaire Bezos’ company blocked it. Other examples could be given for Warren Buffett or other billionaires in the faces shown above, which reflects that they may say one thing, but in fact routinely do another.

That’s not to slam to all billionaires. It is only to say that for some their behavior doesn’t always match up with what they claim.

Who are the Top 1 Percent? Are You in MHVille Among the Top 1 Percent?

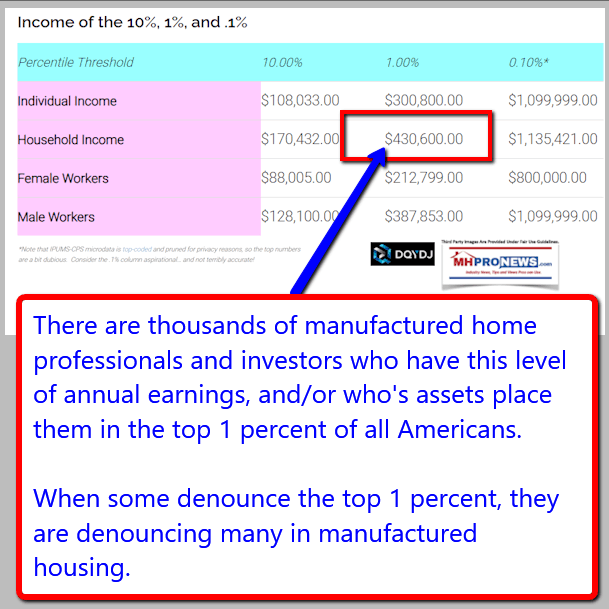

In 2015, using 2010 data, Quora said that the “number of US households was 117 million so there were 1,170,000” households that are in the top 1 percent. $430,600.00 is what that translates to in dollars, per the summary below.

So, there are thousands in manufactured housing that qualify for a fact-based definition of the top 1 percent.

When you watch protestors denouncing the top 1 percent, that’s a figure that over a million American households has achieved, and arguably what thousands more could achieve in the manufactured housing profession.

Now, with that backdrop, let’s look at what Quentin Fottrell wrote for MarketWatch, that MSN (Bing, i.e. Microsoft) wants you to spend time reading.

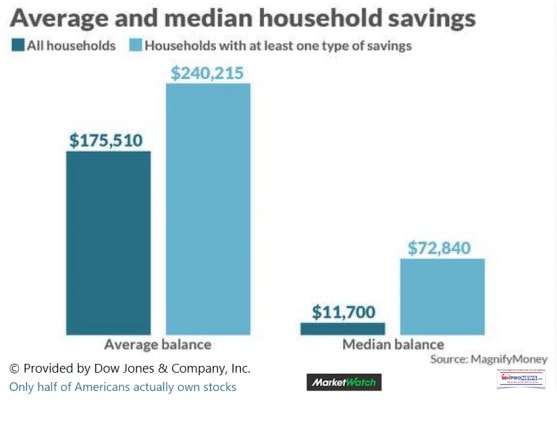

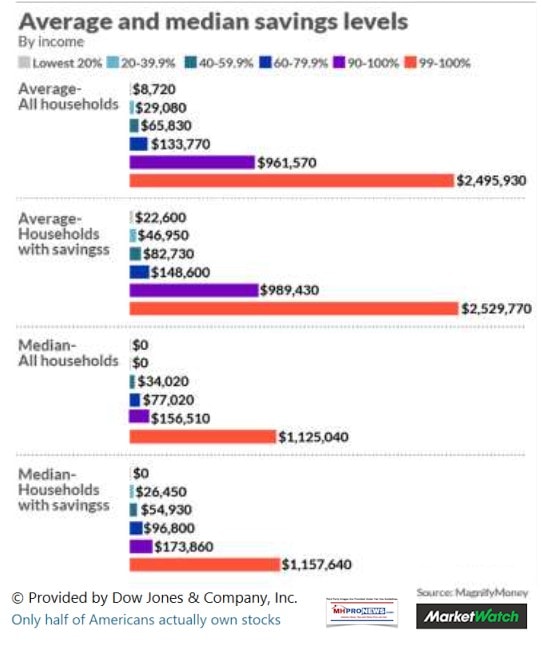

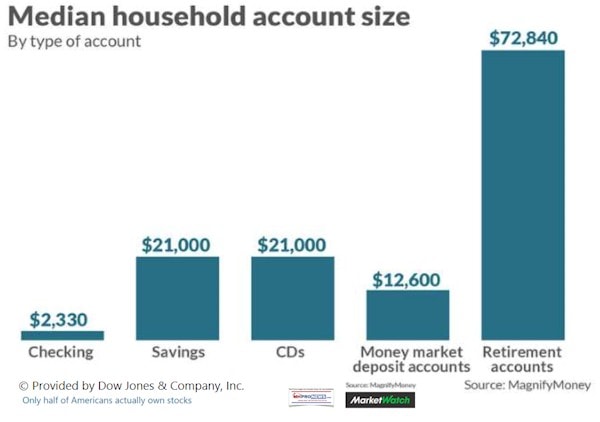

“The median American household currently holds just $11,700 in savings, according to a new analysis of Federal Reserve and Federal Deposit Insurance Corp. data by personal-finance site Magnify Money. Median balances (the midpoint value) are lower than the average savings rates. The top 1% of households in the U.S. by income have a median savings of $1.1 million across a variety of saving accounts. The bottom 20% by income have no savings accounts and the second lowest 20% income earners have just $26,450 saved,” wrote Fottrell

“Stagnant wages, student debt, soaring house prices and rising credit-card debt have not helped people save,” per that same MarketWatch column. “Lots of families are living paycheck to paycheck and struggling to save even a little,” said Caroline Ratcliffe, a senior fellow at the Urban Institute, a nonprofit policy group based in Washington, D.C. “Limited savings isn’t only an issue for low-income families. Quite a few middle- and high-income families have no savings cushion to fall back on. One in 5 middle-income families and 1 in 10 high-income families have no retirement savings.”

Now first, the data here is somewhat contradicted by other data, include the chart we posted above.

You may recall HUD Secretary Ben Carson’s often-repeated statement in 2017 that the average homeowner household had a net worth of some $200,000, while the average renter household only had $5,000 in net worth.

But set the anomalies in the respective data aside.

The question should be — what policies would honestly bring more wealth to more people?

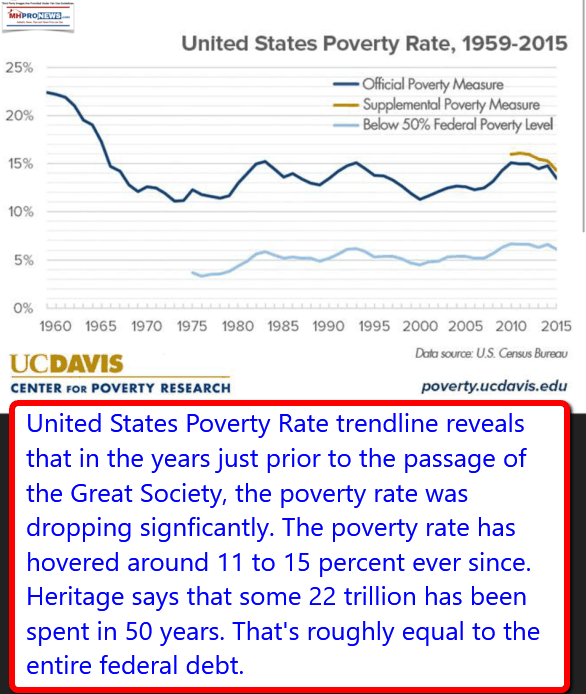

What recent Daily Business News reports revealed is that 50 years of the “War On Poverty” launched by Democratic President Lyndon Baines Johnson (LBJ) has cost the nation some $22 trillion dollars, per Heritage. That’s roughly equal to all of the national debt.

Yet, poverty rates – while vacillating – have barely moved from when those programs and others since have been launched. Why does the nation pour billions every year into programs that are proven not to work?

The evidence reveals this. The way to wealth creation for the majority is a combination of regulatory and tax and policy changes that allow more Americans to sustainably buy their own home.

The value of that home should be protected against estate (i.e. death) taxes. That would boost wealth for the working women and men of America.

Let the workers and middle class buy an affordable home, which existing laws related to manufactured homes – if applied – would make reasonably easy.

That can be done in a demonstrably sustainable fashion.

What left, right and independents ought to be able to agree upon is this. Giving more citizens a path to home ownership, which existing laws could easily be done with manufactured homes, is a sure path for raising the standard of living for tens of millions in the USA.

That’s the ticket that Warren Buffett ought to be promoting, instead of his moat. So why isn’t he doing so?

Regardless of what Mr. Buffett does or doesn’t do, tens of thousands of industry professionals – regardless of political affiliation or the lack thereof – should support:

- the robust application of enhanced preemption,

- a reform of the 10/10 rule on FHA Title 1 lending,

- and should push the GSEs into a true support for manufactured housing, instead of the fig leaf programs they have put in place.

The closing note is this. The answer in November isn’t to vote for those who support redistribution of the wealth. That’s a proven and failed approach that ballooned the debt.

A combination of trust-busting of:

- Berkshire-Hathaway,

- Apple,

- Microsoft,

- Alphabet (Google/YouTube, etc.)

- Amazon, and

plus a robust application of enhanced preemption and existing lending laws could raise millions of Americans from poverty to prosperity. That’s how existing laws and free enterprise could be used in an ethical and sustainable manner.

Professionals, owners, and investors, it pays to help your fellow Americans understand the truth about socialism and America’s historic style of free enterprise. To be clear, crony capitalism and free enterprise are not the same thing.

Trust-busting and a level economic playing field are as American as apple pie, and the dream of home ownership. That’s “News through the lens of manufactured homes, and factory-built housing” © where “We Provide, You Decide.” ©. ## (News, analysis, and commentary.)

(Third party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Related Reports:

Rising Prices and Rates Cool Housing Sales, MH Industry Pro Sounds Off, New Data & Video

How to Avoid Losing Billions, Huge Loses Reported by WSJ, Other Media

http://mhmarketingsalesmanagement.com/blogs/tonykovach/?p=14889