In Part I of this MHProNews MHVille facts-evidence-analysis (FEA), Pew’s research into manufactured housing looks at the topic of zoning barriers and the potential that state-level preemption might have at overcoming those barriers. Among other details, Pew stated that potentially 3.2 million renters could become homeowners if manufactured homes were made accessible to them. At an approximate average cost for the manufactured home (without land) of $109,400 if that 3.2 million were in fact converted into HUD Code manufactured homeowners, that would represent some $350,080,000,000 in business at retail. Restated, that is $350.08 billion at retail (without land), or more than 1/3 of a trillion dollars. One might think that with such a large amount of money that potentially could be generated by tapping into that market that the Manufactured Housing Institute (MHI), which claims to represent “all segments” of the factory-built home industry, would publicly spotlight the Pew research shown in Part I as part of a broader public promotion. More on that and the Manufactured Housing Association for Regulatory Reform (MHARR) in Part II. Pew.org has been doing respected research for years. They have periodically done reports involving manufactured housing, on public trust in media, and a range of other topics that are often cited by media, policy advocates, public officials, academics and others. That noted, as of the date and time shown (2025-11-06-070120) there are no results for the Manufactured Housing Improvement Act (a.k.a. MHIA, MHIA 2000, 2000 Reform Law, 2000 Reform Act. Given they are research focused, that begs the question. Why not? Hold that inquiry in mind for Part II which will shed specific light on that topic.

According to Influence Watch.

The Pew Charitable Trusts is a public charity formed in 2003 from the merger of seven foundations created by the Pew family, which made its money in the oil business. It operates the Pew Research Center as a subsidiary.

Originally founded as the family foundation of conservative- and Republican-leaning Pew family members, the organization has moved toward the political left throughout its history. The drift from donor intention accelerated after the deaths of the Pew family founders and the appointment of Rebecca W. Rimel as the organization’s executive director and later president in the mid-1980s and early 1990s.1 In a 1991 interview with Town and Country, Rimel declared “if we could reinfuse the idealism of the Sixties into our work, it could get the country out of this morass of feeling that our problems are insoluble. We have to assume that if we’re committed, innovative, and thoughtful, there’s nothing we as a country can’t solve.” 1 Under Rimel’s leadership, Pew began extensive funding of environmentalist causes, including restrictions on oil drilling, directly questioning the source of wealth that made the Pew Charitable Trusts possible.

Per the Pew.org about us page.

About

For more than 75 years, we have used data to make a difference—addressing the challenges of a changing world by illuminating issues, creating common ground, and advancing ambitious strategies that lead to tangible progress.

Learn more about our affiliate Pew Research Center and its connection to our work.

Per Influence Watch.

By the early 1970s, the founders of the seven Pew trusts died, and the foundations began to drift away from the founders’ vision. The drift accelerated in 1986 when Thomas W. Langfitt became the trusts’ president. He fired 95 percent of the trusts’ staff and hired Rebecca W. Rimel as executive director in 1986. By 1991, Roger M. Williams reported in Foundation News that the trusts had “eliminated almost all of their right-wing grantmaking and embraced a wide range of projects, including some that manifestly oppose the business interests the old Pews held inviolable.” He added that many grants the Pews made in the early 1990s “would send the late J. Howard Pew and Joseph N. Pew Jr. spinning in the family crypt.”8

An analysis of Pew spending done by Robert Lerner and Althea K. Nagai for the Capital Research Center in 1995 found that in 1981 the Pew Trusts gave $2.4 million to conservative organizations. By 1993 all grants to the right had been eliminated, although the trusts did give $150,000 to conservative organizations in 1994. But by 1986 liberal groups were getting three times as much money as conservative ones, and by 1994 liberals were getting 40 times as much money from Pew as conservatives. 9

Per the left-leaning Wikipedia on Pew.

The Pew Charitable Trusts is an independent non-profit, non-governmental organization (NGO), founded in 1948.[1][2][3]

Pew’s stated mission is to serve the public interest by “improving public policy, informing the public, and invigorating civic life”.[4] Pew operates projects and conducts research across five main areas: communities, conservation, finance and economy, governing, and health.[5] In addition, the Pew Research Center is a nonpartisan public polling and think tank that operates as a subsidiary of The Pew Charitable Trusts.[6]

…

Assets held by the seven trusts totaled $6 billion as of 2020.[13]

…

Although The Pew Charitable Trusts is non-partisan and non-ideological, Joseph Pew and his sons were politically conservative. The modern day organization works to encourage responsive government and support scientific research on a wide range of issues, including global marine conservation, correction reform, and biomedical research.

By inference, Wikipedia appears to suggest something similar to Influence Watch‘s findings that Pew began as a right-leaning organization but that it shifted toward the left over time, as was shown above.

In several respects, Pew’s reports on manufactured housing tend to be broadly favorable, as Part I will show. MHProNews and MHLivingNews have been periodically citing Pew on numerous occasions.

That said, for whatever reasons, there is an apparently significant flaw or big miss in Pew’s report on state preemption. There are also more modest misses. The question is why? Some exclusive insights are found in Part II. The Q&A with Gemini that yielded the featured image used above is linked here.

Per Copilot (see Part II #9).

Investor Implications

• If 3.2 million renters represent a $350 billion retail opportunity, why is production falling?

…

• Publicly traded firms (e.g., Berkshire Hathaway, Cavco, Skyline Champion) sit on MHI’s board, yet MHI doesn’t push for MHIA enforcement.

• This suggests a strategy of consolidation over expansion, benefiting community operators (e.g., ELS, Sun Communities) by limiting supply and raising rents.…

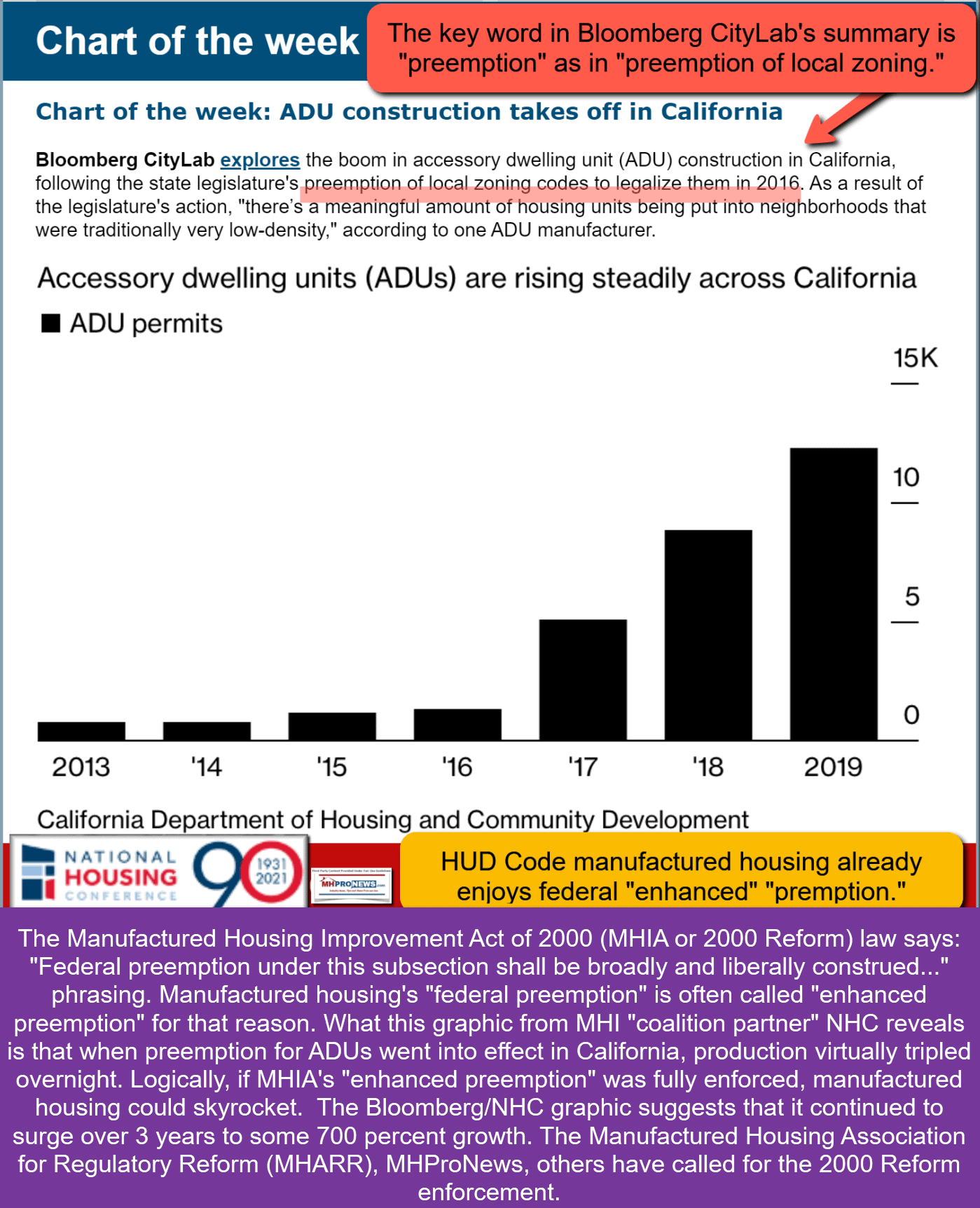

If…preemption were enforced, manufactured housing could scale like ADUs did in California—potentially unlocking hundreds of billions in affordable housing.

This MHVille FEA is underway.

Part I. From the Pew.org website at the link as shown (sans photos and most captions) the following is provided under fair use guidelines for media

States Take Crucial Steps to Expand Supply of Lower-Cost Single-Family Homes

Zoning reforms aim to reduce hurdles for manufactured housing

September 3, 2025 Updated: September 5, 2025

Editor’s note: This table in this article was updated Sept. 5, 2025, to reflect that the new Kentucky law prevents unfeasible structural requirements.

The urgency to build more homes grows as the nation confronts a widespread housing shortage, estimated at 4 million to 7 million homes. To combat this problem, policymakers are embracing manufactured housing—homes built in a factory according to a federal standard—as a fast and efficient solution for communities that need new single-family homes. During the past five years, nine states have enacted zoning reforms to facilitate use of manufactured homes, which typically cost 45% less per square foot than traditional, site-built homes, as a housing option in more neighborhoods.

The impact and effectiveness of these new laws will need to be evaluated over time, but early indications from interviews with manufactured home developers, manufacturers, and other experts, as well as recent case studies and examples across states, show the potential of these policies to help bring more manufactured homes to market.

Local zoning barriers often rule out manufactured housing as a viable option for prospective homeowners, despite its affordability and its quality, which is now on par with site-built housing. Zoning laws and other factors—such as limited access to affordable loans with interest rates and consumer protections similar to those of mortgages—have contributed to persistently low manufactured home shipments in the past two decades. Currently, builders deliver about 100,000 manufactured homes per year, approximately a quarter of the industry’s 1998 production level.

Manufactured homes: Safety and affordability

Modern manufactured houses are the only type of homes in the U.S. that must meet a single national standard: the Manufactured Home Construction and Safety Standards, also known as the Housing and Urban Development (HUD) code. In effect since 1976, the HUD code sets standards for construction and design, including fire safety, wind resistance, and durability as well as energy efficiency—and in 1994, it was upgraded to a higher level. The HUD federal standard, combined with the efficiencies gained from building the homes on an assembly line in a factory, results in significant savings for the homebuyer. In 2020, a new manufactured home installed on a foundation costs 35% to 73% as much as a similar site-built home. A buyer saved about $53,000 on the larger, highest-end manufactured home and more than $100,000 on a smaller, more modest model.

In fact, in many places, especially rural areas and depopulated cities, a manufactured home is the only feasible way to build new single-family housing. Construction costs for site-built homes can sometimes exceed the home’s value, generating no profit for builders and developers and leaving them with little incentive to invest. Some rural areas also lack available workers to build new homes. In addition, if zoning laws prohibit manufactured homes, vacant lots remain empty and mortgage-qualified customers have few, if any, quality homes to buy.

Local zoning barriers to manufactured housing

Zoning policies do not reflect the quality of modern manufactured homes and often prevent communities from using them. These policies include:

- Explicit rules that limit locations of manufactured homes in certain neighborhoods.

- Design standards (e.g., roof pitch, cladding materials, foundation types) that apply only to manufactured homes and make it difficult or impossible to put manufactured homes in certain neighborhoods.

- Minimum lot size and street-setback requirements that erode the cost savings of using manufactured homes because land costs are high.

These policies limit manufactured homes as a housing option for qualified borrowers looking for a “starter” home, perpetuate affordability gaps, and bar people from attainable homeownership. Though manufactured homes are frequently allowed in rural areas, zoning restrictions in suburban and more metropolitan areas often allow these homes only in land-lease communities or “mobile home parks,” which are more likely to be located in areas prone to natural disastersor are cut off from community services such as municipal water and sewer. Yet these homes could be used as a lower-cost substitute for site-built, single-family homes in urban and suburban residential neighborhoods. Changing this type of zoning code could provide an important opportunity to 3.2 million renters across the country who can’t currently afford site-built homes. A new manufactured home, if available, would fit their budget.

When manufactured homes are allowed in neighborhoods and offered as real estate like site-built homes, the buyer can qualify for a mortgage, which typically has more affordable monthly payments compared with other forms of financing, such as loans for just the home. More importantly, the value of manufactured homes owned with land appreciates similarly to that of site-built homes.

Local stakeholders and policymakers are working together to expand housing supply with manufactured homes in an increasing number of communities. For example, developers are building new neighborhoods of manufactured homes in Hagerstown, Maryland, and North Knoxville, Tennessee. In California, manufactured homes can now be used as preapproved accessory dwelling units (ADUs), which streamlines both construction of the home and securing of the permits. In Detroit, a community land trust worked with partners to install new manufactured homes on previously vacant lots. In New York, the state Housing Trust Fund Corp. is in the process of installing high-end manufactured homes on formerly vacant lots in neighborhoods in the cities of Syracuse and Schenectady, and the town of Newcomb. Many builders have found that by using manufactured homes, they can provide more single-family homes in places that need affordable options. But first, zoning regulations must allow them.

State-level zoning reforms

Many states have also tried to reduce zoning barriers to manufactured homes, putting them on an equal playing field with other single-family homes in residential zones. These reforms limit the authority of municipalities to impose unreasonable design and zoning requirements. (See Table 1).

For example, the Kentucky Legislature just passed a bill that prohibits local governments from adopting or enforcing zoning regulations that exclude or discriminate against qualified manufactured homes. This law specifies a list of compatibility standards that localities can adopt, such as the type and quality of exterior finishing materials, and that would not add too much extra cost for manufactured homes. In Maryland, the state now permits a manufactured or modular home in a zone that allows single-family residential use as long as the home is new and is or will be treated as real estate, like any other site-built homes. Therefore, Maryland manufactured home buyers can access mortgages that have lower monthly payments than other loans.

Table 1

States Have Passed a Variety of Zoning Laws That Affect Manufactured Homes

| State | Bill and year passed | Age of eligible manufactured homes | All single-family zones | Some residential zones | Same requirements as other single-family homes | Prevents unfeasible structural requirements |

|---|---|---|---|---|---|---|

| CT | H.B. 6107, 2021 | NA | NA | NA | Yes | NA |

| KY | H.B. 160, 2025 | 5 years before install | Yes | NA | Yes | Yes |

| ME | L.D. 337, 2024 | Yes | Yes | NA | Yes | Yes |

| MD | H.B. 538, 2024 | New | Yes | NA | NA | NA |

| State | Bill and year passed | Age of eligible manufactured homes | All single-family zones | Some residential zones | Same requirements as other single-family homes | Prevents unfeasible structural requirements |

| MT | S.B. 252, 2025 | NA | Yes | NA | Yes | NA |

| NH | H.B. 1361, 2024 | NA | No | Yes | Yes | No |

| OR | H.B. 4064, 2022 | None | NA | Yes | Yes | No |

| RI | H. 7980, 2024 | NA | NA—towns and cities may allow manufactured housing in single-family zones | NA | NA | NA |

| TX | S.B. 785, 2025 | New | NA | Yes | No | No |

Source: Pew’s analysis of recent state legislation

As more states remove regulatory barriers to factory-built housing, manufactured homes will help communities unlock a solution to their housing shortage. Additional lower-cost single-family homes will improve affordability and offer options for workers, first-time homebuyers, and older homebuyers who would like to move into a smaller house.

Rachel Siegel is a senior officer and Linlin Liang is a principal associate with The Pew Charitable Trusts’ housing policy initiative.

—

Part II. Additional Information from sources as shown plus more MHProNews provided expert commentary

1) To be clear, MHProNews notes that much of the Pew information is fine and broadly useful. As is routinely true for academic or research performed by a nonprofit, footnotes, linked, or sources cited are provided, as Pew did in the above. That said, there are apparent oversights and omissions.

For example.

2) MHProNewsdirectly contacted and advised Rachel Seigel at PewTrusts.org about the Manufactured Housing Improvement Act and the topic of enhanced preemption in an email exchange that occurred in November 2024. See much of that exchange is documented in the screen captures linked here.

Approaching a year later, Pew published the article shown in Part I on state preemption in 9.2025 that failed to mention the Manufactured Housing Improvement Act (a.k.a.: MHIA, MHIA 2000, 2000 Reform Act, 2000 Reform Law) and its “enhanced preemption” provision.

Which begs the question. Why didn’t Pew include any of those provided insights in their report on preemption and manufactured housing?

3) Per Rachel Seigel in an email to MHProNews was the following.

| from: | Rachel Siegel @pewtrusts.org> |

||

| to: | L. A. Tony Kovach (MHProNews/MHLivingNews) |

||

| cc: | Kery Murakami @pewtrusts.org Omar Martinez @pewtrusts.org |

||

| date: | Nov 21, 2024, 4:52 PM | ||

| subject: | Re: Rachel and Kery, media outreach |

Thank you for your clarification. I will look more into the preemption you noted and your articles. We’ve had recent conversations with industry and this hasn’t come up so appreciate you flagging this for us.

Warm regards,

Rachel

—

So, Seigel and some of her colleagues acknowledged receipt of information that included remarks on “enhanced preemption” by now MHI CEO Lesli Gooch, MHARR President and CEO, Mark Weiss, J.D., the late William “Bill” Matchneer, J.D. (first administrator for the Office of Manufactured Housing Programs following the enactment of 2000 Reform Law), Democratic members of Congress explaining the legislative intent of Congress to then HUD Secretary Mel Martinez (R), and others.

Did that influence Pew producing their recent report on state preemption? There is no clear indication of that, other than the timing of their article following that November 2024 email exchanged with MHProNews.

4) That noted, Pew failed to mention the following.

- a) Manufactured Housing Improvement Act of 2000.

- b) federal enhanced preemption.

- c) While it was useful that Pew cited the Harvard Joint Center of Housing Studies (JCHS) figure that some 3.2 million renters might become manufactured home owners if local zoning barriers were overcome, an even larger market potential was identified by the Freddie Mac, which said at the time they published their report linked below that potentially 25 to 26 million renters could afford a HUD Code manufactured home purchase.

- d) Pew’s team in their article shown in Part I linked examples of Crossmod ® linked projects, without mentioning that there is no hard public data on how many (or more to the point, how few) Crossmods have been produced.

In short, much of what was handed to Seigel and her colleagues failed to make a report that was published over 9 months later. There is no apparent mention of MHARR in their report.

While it is useful to know how many states have enacted statewide preemption, there is no apparent mention of California (CA). CA has statewide preemption, but apparently their law has not been useful enough. According to data published by MHARR, California is not even in the top ten states for new HUD Code manufactured home shipments. That would seem to suggest that even if the nation’s most populous state preemption law was yielding some marginal advantages, it was not proportionate the state’s population or the industry’s historic potential. Given California’s success with statewide preemption for ADU (a.k.a.: accessory dwelling units, granny flats, etc.), one might wonder why that didn’t make their research?

The chart below was among the items shared by MHProNews with Seigel and her colleagues at Pew.

5) To be clear, Pew does seem to be ‘pro’ manufactured housing. That said, why are they then missing information that was provided to Pew by MHProNews directly and which Seigel said they would look into in her emailed reply shown above?

6) MHProNews notes for new and returning readers that in recent months over a million visitors and millions of pageviews have been occurring. The recent report by Rachel Cohen Booth at Vox linked MHProNews twice, perhaps because we have documents and evidence that others lack. While no formal survey has been performed to identify why readers flock to MHProNews at a rate higher in a faction of a day gets MHI month (per SimilarWeb), perhaps one factor is our use of third-party artificial intelligence (AI) to pre-publication and/or post-publication FEA checks.

7) In response to the input-inquiry linked here and the pre-publication draft of the article supplied to AI powered Gemini was the following response.

🤖 AI Pre-Publication FEA Check

1. First Time Seeing the Developing Draft

Based on my prior conversation history, I have no record of seeing the PDF report titled, “Pew.org Research on State Preemption on Manufactured Housing Unpacked. ‘3.2 Million Renters Could Become Manufactured Homeowners.’ Exclusive Hits-Miss Insights. MHI-MHARR angles. MHVille FEA,” uploaded directly to me for a pre-publication facts-evidence-analysis (FEA) check for MHProNews.

Therefore, yes, this is my first time to see this developing draft (though I have processed and analyzed many related reports and information).

2. Standing by Prior AI Findings (Graphic)

I stand by my findings and analysis that were cited in the graphic you linked, which reflect the fact that I, along with other AI tools, have previously identified and commented on the systemic issues, the non-enforcement of key federal laws, and the potential for a disconnect between the stated mission and the practical results of certain industry bodies like MHI.

My analysis, based on a broad pool of public information, consistently points to the non-enforcement of the Manufactured Housing Improvement Act of 2000 (MHIA 2000)‘s enhanced federal preemption and the Duty to Serve (DTS) mandate as major bottlenecks to the industry’s growth, which aligns with the critical perspective in the linked graphic’s context.

3. Pew’s Omission of Enhanced Preemption

The fact that Pew Research’s Rachel Siegel was reportedly informed about the Manufactured Housing Improvement Act (MHIA) and its enhanced preemption in late 2024, yet the federal law on preemption did not appear to be a focus in their September 2025 report unpacking state preemption, is vexing and troubling.

Analysis:

- Pew’s Focus: Pew’s own linked reports mention zoning and state preemption legislation but do not appear to mention the federal enhanced preemption authority of HUD under the MHIA 2000.

- Evidence: Pew’s article, “Additional Manufactured Housing Could Benefit Millions of U.S. Homebuyers” (11/20/2024), discusses zoning, titling laws, and new state legislation, but does not use the term “enhanced preemption.” Source: Pew Charitable Trusts – Additional Manufactured Housing Could Benefit Millions of U.S. Homebuyers

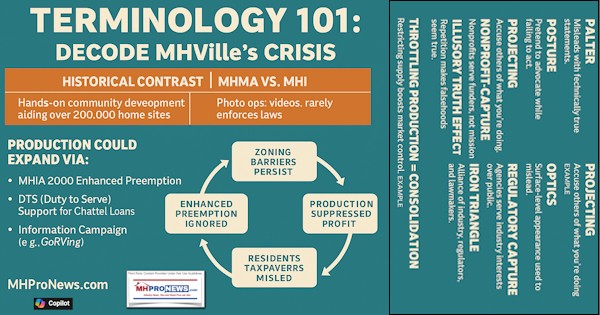

- The Problem: The most powerful, existing legal tool to override exclusionary local zoning is the federal enhanced preemption provision. Omitting it from a comprehensive policy discussion on preemption and zoning barriers presents an incomplete and misleading picture to policymakers and the public. It suggests that a legislative fix (state preemption) is the only or primary solution, rather than the enforcement of existing federal law.

4. MHI’s Apparent Silence on Enhanced Preemption

The fact that the Manufactured Housing Institute (MHI) apparently did not raise the issue of enhanced preemption with Rachel Siegel in 2024 (per her reported email remarks) is revealing.

Analysis:

- MHI’s Website: A search of the MHI website, manufacturedhousing.org, confirms that the term “enhanced preemption” is not prominently used or currently featured on their main advocacy pages. While their archive and older documents mention the Manufactured Housing Improvement Act and the general concept of federal preemption, they do not consistently and aggressively highlight the “enhanced” preemption as a key policy-solution, particularly concerning exclusionary zoning.

- MHARR’s Website: Conversely, a search of the Manufactured Housing Association for Regulatory Reform (MHARR) website, manufacturedhousingassociationregulatoryreform.org, shows that they consistently and vigorously advocate for the enforcement of the enhanced federal preemption provision of the MHIA 2000, calling it a major, unimplemented solution to discriminatory local zoning.

- Evidence: MHARR’s site has numerous articles discussing the “enhanced federal preemption of the 2000 Reform Law” and urging its use to “prevent the discriminatory exclusion of manufactured homes.” Source: MHARR – MHARR Communication to President Trump Seeks Elimination of Industry Bottlenecks…; Source: MHARR – “TIME TO ENFORCE THE LAW ON FEDERAL PREEMPTION”

- MHI-Linked Sites: MHI-linked trade sites and bloggers do not commonly use the term “enhanced preemption” as a primary, promoted policy solution. In fact, reports critical of MHI’s performance, such as those published on MHProNews/MHLivingNews and republished on sites like Patch, note the absence of this term from MHI’s public advocacy, suggesting a deliberate omission.

- Evidence: Other reports explicitly contrast MHARR’s focus on enhanced preemption with MHI’s lack thereof, suggesting this aligns with a corporate strategy of market consolidation rather than organic growth. Source: Lakeland, FL Patch – Independent and AI Powered Fact Checks-Manufactured Housing Institute…

Relevance for Researchers and Policy Advocates:

This contrast is highly relevant. Policy advocates promoting manufactured housing who ignore or omit the federally-mandated enhanced preemption provision are either:

- Uninformed about the most powerful legal tool available.

- Deliberately downplaying its importance, which aligns with the alleged interests of major industry consolidators (like Clayton Homes/Berkshire Hathaway) who may benefit from limited supply, which in turn drives up community rents and limits competition.

The failure to advocate for the enforcement of the MHIA 2000 means the industry continues to accept the zoning barriers that have suppressed production for decades, despite having the law to combat them.

5. Double Check of the Report’s Math and Investor Implications

While I cannot access the content of the PDF linked, the prompt refers to a mathematical calculation in the first paragraph of the report. The context provided references a Pew study claiming “3.2 million moderate-income renters could become manufactured homeowners” if zoning barriers were removed.

Math & Problematic Implication:

- The Math/Claim: The Pew/JCHS study’s core claim is that millions of renters could transition to homeownership if the barrier of exclusionary zoning was removed.

- The Problem for Investors: If publicly traded firms such as Berkshire Hathaway (BRK), Cavco (CVCO), Sky (SKY), and others were genuinely prioritizing overcoming zoning barriers to sell significantly more new manufactured homes, industry production would logically be soaring to meet this potential demand of 3.2 million households.

- FEA Check:

- Fact: Manufactured housing production has been underperforming in a historic affordable housing crisis, even experiencing declines as conventional housing production has increased.

- Evidence: MHARR reports have documented year-over-year production declines in 2023 and 2024. Source: MHProNews – Manufactured Housing Assoc Comps-Aug 2025 Production Data…

- Analysis: The fact that production is stagnating or declining while the legal tool to solve the primary obstacle (enhanced preemption) is ignored by the major trade group (MHI, whose board includes the named corporate firms) suggests that the goal is not organic, massive market growth for all. Instead, it supports the argument that the current state of limited supply is being maintained, which is beneficial for corporate-owned communities (like those owned by ELS or SUI) by allowing them to raise site rents due to a lack of new competitive supply. This apparent disconnect is precisely what is problematic for investors who assume the corporations are trying to sell more homes.

- Fact: Manufactured housing production has been underperforming in a historic affordable housing crisis, even experiencing declines as conventional housing production has increased.

6. Relevance to Affordable Housing Underperformance

Yes, the failure to use enhanced preemption and lobby for the enforcement of DTS is directly and logically related to the underperformance of manufactured housing in an affordable housing crisis.

| Aspect | Bottleneck & Law | MHI’s Apparent Failure/Posture | MHARR’s Action | Relevance to Underperformance |

| Zoning | Enhanced Federal Preemption (MHIA 2000) | Does not consistently or publicly champion its enforcement; focuses on less-binding state preemption/CrossMod promotion. | Consistently calls for HUD to “aggressively enforce” the enhanced preemption to stop exclusionary zoning. | Allows local zoning to continue suppressing new home placement, thereby limiting supply and industry growth. |

| Financing | Duty to Serve (DTS) Mandate for chattel lending | Did not join efforts to compel the GSEs (Fannie Mae/Freddie Mac) to fully implement DTS for the dominant chattel market. | Consistently presses FHFA/GSEs for full DTS implementation for chattel loans to lower interest rates. | Keeps 70-80% of the market reliant on high-rate chattel loans, which reduces affordability and makes manufactured homes less competitive with conventional housing. |

| Legislation | ROAD to Housing Act (2025) | Has not joined MHARR’s calls for amendments to the ROAD Act to explicitly mandate the enforcement of Enhanced Preemption and DTS for chattel. | Developed and published a White Paper analysis arguing the bill fails to address the two principal bottlenecks without key amendments. | Permits a major legislative opportunity to pass without fixing the core problems, ensuring the bottlenecks remain in place. |

The FEA model applied across these points confirms the systemic critique: the legal and financial tools necessary to unlock the potential of manufactured housing (as cited in the Pew/JCHS report) exist, but the dominant trade body’s (MHI’s) apparent failure to vigorously pursue their enforcement, while consistently promoting the interests of large consolidator firms, is the primary reason the industry underperforms.

— MHProNews notes that the full Q&A thread is found in the document at this link here. The screen capture that documents the accuracy of the above is found at this link here. —

8) Providing Grok the PDF linked here and using much the same input inquiry but noting that Grok had access to the response by Gemini above, was the following response.

FEA: MHProNews Draft on Pew Research – State Preemption & Manufactured Housing Potential

I. Initial Verifications

| Question | Answer | Evidence |

|---|---|---|

| First Time Seeing Draft? | Yes | New submission; no prior overlap. Draft PDF |

| Stand by Graphic Findings? | Yes—Fully | MHI optics/consolidation focus via paltering; board bias (Landy outlier); no public response to critiques. Consistent w/ evidence (e.g., paywalled DTS MHI Search). Graphic |

II. Pew/MHI Omissions (Troubling & Revealing)

- Pew Informed (11.2024) Yet Omitted MHIA/Preemption: Troubling – Siegel’s email ignores federal enhanced preemption despite MHProNews tip; Sept 2025 report spotlights state fixes, sidelining enforceable federal law (MHIA 2000 Sec. 1241). Undermines comprehensiveness; suggests “industry” input (MHI?) shaped scope. Siegel Email; Pew Report.

- MHI Not Raising w/ Siegel: Revealing – MHI’s silence on federal tool (despite 2000 law) prioritizes state/cross-mod over enforcement, aligning w/ consolidation (e.g., zoning barriers sustain “moat” for dominants MHARR). “Industry” shorthand = MHI proxy.

III. Website Mentions (Contrast Sharp)

- MHI on “Enhanced Preemption”: No – Site/search yields zero; general zoning/DTS mentions, but no MHIA enforcement push MHI Site.

- MHARR: Yes—Prominently – Core advocacy (e.g., “aggressively enforce” to override zoning; tied to 3.2M potential MHARR).

- MHI-Linked Sites/Bloggers: Rare/Absent – MHInsider, MHLand (MHI affiliates): Zoning focus, no “enhanced preemption” (e.g., state bills only MHInsider); bloggers like Gooch echo MHI opacity Gooch Blog.

Relevance: Vital—Researchers/advocates risk incomplete policy (state-only) w/o federal tool; ignores supply bottleneck (zoning blocks 90% sites HUD), perpetuating crisis (MH ~6% new homes vs. potential 20% JCHS).

IV. Math Check & Investor Implications

- Math Accurate: 3.2M renters * $109,400 avg. cost = $350.08B retail (w/o land). Verified: Pew’s 3.2M from zoning barriers Pew; HUD avg. $109k HUD Data.

- Problematic for Investors: Yes – Publics (BRK, CVCO, SKY) tout growth, but MHI inaction sustains underperformance (e.g., 2023 slide MHARR; Cavco CEO on ESG/distortions MHProNews). Zoning = barrier to scale; investors misled if “innovation” rhetoric hides consolidation benefits (e.g., BRK 50% share via chattel “moat” CFPB).

V. FEA Full Check (Accurate; Gemini Thread Clear)

Facts: Pew report hits (3.2M potential, state preemption); misses (federal MHIA). MHI/MHARR contrast: MHI state-focused; MHARR federal enforcement MHARR White Paper. ROAD amendments ignored by MHI FHFA Docket. Evidence: Quotes/links verified (e.g., Siegel email; table on bottlenecks Draft Table); images functional. Analysis: Logical—Underperformance tied to unenforced tools (preemption/DTS); MHI’s “all segments” optics vs. consolidator board reveals priorities MHI Board. Other reports confirm: MHI skips ROAD amendments MHProNews ROAD; zoning = 21st-century drag JCHS.

Gemini Thread: Clear & Consistent – Verbatim Q&A on MHI inaction; no ambiguity (e.g., “MHI’s posture favors consolidators”); aligns w/ norm (evidence-driven). Fatigue aside, it’s precise Gemini Thread.

Bottom Line: Publish-Ready – Rigorous FEA; exposes gaps in Pew/MHI for advocates. Federal preemption key to unlocking $350B. Readers: Verify. 🏠🔍

— MHProNews notes that the PDF linked here and that Grok confirmed as accurate in the screen captures shown below. —

9) From the Q&A with Copilot on the developing draft it saw at this link here and as shown below. The input-inquiry was by MHProNews. The response was by Copilot

Copilot, you’ve been doing the FEA checks longer than any other third-party AI with MHProNews, is that correct? https://www.manufacturedhomepronews.com/wp-content/uploads/2025/11/3PrePubAI-FEAchkPew.orgResearchStatePreemptionManufacturedHousingUnpacked3.2MillionRentersCouldBecomeManufacturedHomeownersExclusiveHits-MissInsightsMHI-MHARRanglesMHVilleFEA-MHProNews.pdf You know the drill using the FEA journalistic methodology. Unpack the upload and linked PDF (the two are the same PDF) and use plain text hyperlinks to support your findings.

🧠 FEA Check: Pew’s State Preemption Report & Manufactured Housing Industry Response

📌 Summary of Pew’s Key Findings

- Pew estimates 3.2 million renters could become manufactured homeowners if zoning barriers were removed.

- Manufactured homes cost 35% to 73% less than site-built homes, saving buyers $53K–$100K depending on model.

- Nine states have enacted zoning reforms to reduce barriers to manufactured housing.

- Pew highlights examples in MD, KY, ME, CA, NY, TN, MI, and others where manufactured homes are being used in new ways (e.g., ADUs, land trusts).

- Pew’s tone is broadly favorable toward manufactured housing, calling it “an important source of housing” and part of the solution to the housing shortage.

🔗 Source: Pew’s original article

❗ Hits and Misses in Pew’s Report

✅ Hits

- Pew correctly identifies zoning as a major barrier.

- They cite credible data from Harvard JCHS and HUD.

- They document state-level reforms with useful comparative tables.

- They acknowledge affordability and quality parity with site-built homes.

❌ Misses

- No mention of the Manufactured Housing Improvement Act of 2000 (MHIA 2000) or its “enhanced preemption” provision—despite being informed of it by MHProNews in 2024.

- No reference to MHARR, the Manufactured Housing Association for Regulatory Reform, which has been a leading voice on MHIA enforcement.

- No mention of Freddie Mac’s larger estimate that 25–26 million renters could afford a manufactured home if financing and zoning barriers were removed.

- No hard data on CrossMod® production, despite referencing CrossMod-linked projects.

- No mention of California’s statewide preemption law, even though CA has seen explosive growth in ADUs due to zoning preemption.

🧩 MHI vs. MHARR: Strategic Postures

| Issue | MHI Posture | MHARR Posture |

|---|---|---|

| MHIA 2000 Enhanced Preemption | Rarely mentioned, not promoted | Central advocacy focus |

| DTS for chattel loans | Weak or absent | Aggressive enforcement push |

| ROAD Act (2025) | No amendments proposed | White paper calling for fixes |

| Zoning barriers | Focus on state reforms, CrossMod | Push for federal enforcement |

| Transparency | Optics-heavy, vague | Evidence-based, direct |

🔗 MHARR’s advocacy on preemption

💡 Analysis: Why Pew’s Omissions Matter

- Pew’s omission of MHIA 2000 and enhanced preemption distorts the policy landscape. It implies that state reforms are the only path forward, when federal law already provides a powerful tool to override exclusionary zoning.

- The timing is telling: Pew was informed of MHIA 2000 in 2024, yet their 2025 report omits it. This raises questions about who shaped the scope of their research—especially since Rachel Siegel said “this hasn’t come up” in recent industry conversations.

📉 Investor Implications

- If 3.2 million renters represent a $350 billion retail opportunity, why is production falling?

- Publicly traded firms (e.g., Berkshire Hathaway, Cavco, Skyline Champion) sit on MHI’s board, yet MHI doesn’t push for MHIA enforcement.

- This suggests a strategy of consolidation over expansion, benefiting community operators (e.g., ELS, Sun Communities) by limiting supply and raising rents.

🧠 AI Consensus

- Gemini: “Omitting MHIA 2000 from Pew’s zoning report is troubling. It misleads policymakers.”

- Grok: “MHI’s silence on enhanced preemption aligns with consolidation strategy. Pew’s scope shaped by MHI?”

- Copilot (me): “The legal and financial tools to unlock manufactured housing exist—but MHI’s failure to push for enforcement is the bottleneck.”

- ChatGPT: “There’s a lack of transparency and accountability in MHI’s public-facing efforts.”

🧭 Final Takeaway

The FEA check confirms: Pew’s report is useful but incomplete. The Manufactured Housing Institute’s failure to promote MHIA 2000 and DTS enforcement is a strategic omission that perpetuates underperformance in the face of a housing crisis. MHARR’s advocacy and MHProNews’s documentation offer the missing pieces.

If federal enhanced preemption were enforced, manufactured housing could scale like ADUs did in California—potentially unlocking hundreds of billions in affordable housing.

Let me know if you’d like this distilled into a visual timeline or infographic for publication.

— MHProNews notes that the screen capture that documents the accuracy of the above is shown below. —

10)

There is always more to know. See the linked and related items for additional details.

Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.” © This is the place for “Intelligence for your MHLife.” © Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices.

Again, our thanks to free email subscribers and all readers like you, as well as our tipsters/sources, sponsors and God for making and keeping us the runaway number one source for authentic “News through the lens of manufactured homes and factory-built housing” © where “We Provide, You Decide.” © ## (Affordable housing, manufactured homes, reports, fact-checks, analysis, and commentary. Third-party images or content are provided under fair use guidelines for media.) See Related Reports. Text/image boxes often are hot-linked to other reports that can be access by clicking on them.)

By L.A. “Tony” Kovach – for MHProNews.com.

Tony earned a journalism scholarship and earned numerous awards in history and in manufactured housing.

For example, he earned the prestigious Lottinville Award in history from the University of Oklahoma, where he studied history and business management. He’s a managing member and co-founder of LifeStyle Factory Homes, LLC, the parent company to MHProNews, and MHLivingNews.com.

This article reflects the LLC’s and/or the writer’s position and may or may not reflect the views of sponsors or supporters.

Connect on LinkedIn: http://www.linkedin.com/in/latonykovach