Commercial real estate company NorthStar Realty Finance Corp (NYSE: NRF) recently received an average rating of “Hold” from a handful of analysts that are covering the firm, reports Baseball News Source’s James Conley.

Among the six analysts, two rated NorthStar’s stock a “buy” and the four issued a “hold” recommendation. The current average one-year price objective among the brokerages that have updated their coverage of the stock in the past 12 months is $15.25.

- FBR & Co. (“market perform”),

- TheStreet (“sell”) and

- Zacks Investment Research (“strong sell”)

are among the equities research analysts that have weighed in on NorthStar’s shares during the last few months.

Despite the consensus “hold” rating, a number of hedge funds and investors have shown confidence in NRF’s stock.

- FMR, LLC raised its position in NRF by 26.6% in the second quarter and now owns 9,827,611 NorthStar stock which is worth $112,329,000.

- Brown Advisory, Inc. boosted its position in NorthStar stock by 57.8% in the second quarter, and now they own 2,904,107 shares, which translates into a $33,194,000 value.

- Private management Group, Inc., and BlackRock Fund Advisors boosted their positions by 0.7% and 14.4%, respectively.

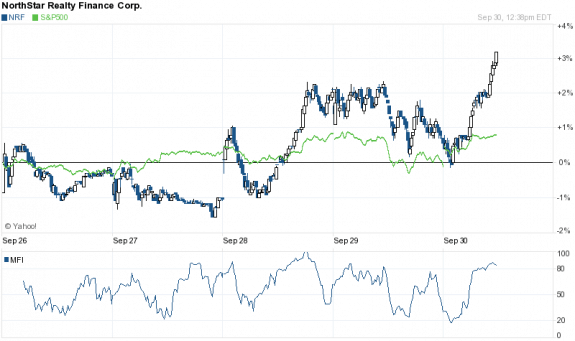

NorthStar currently has a 50-day moving average price of $13.12 and a 200-day moving average price of $12.87; its stock it a low of $8.38 over a 52-week period and a high of $25.62 over the same time period.

The company last reported its earnings results on Thursday, August 4 and reported $0.56 earnings per share for the quarter, according to The Cerbat Gem.

Further reporting showed NorthStar had a positive return on equity of 14.82% and a negative net margin of 20.52% Looking ahead, equities analysts predict the company will post $1.72 for the current fiscal year.

NorthStar is expected to release its next earning report sometime between November 7 and November 11, per the News Oracle.

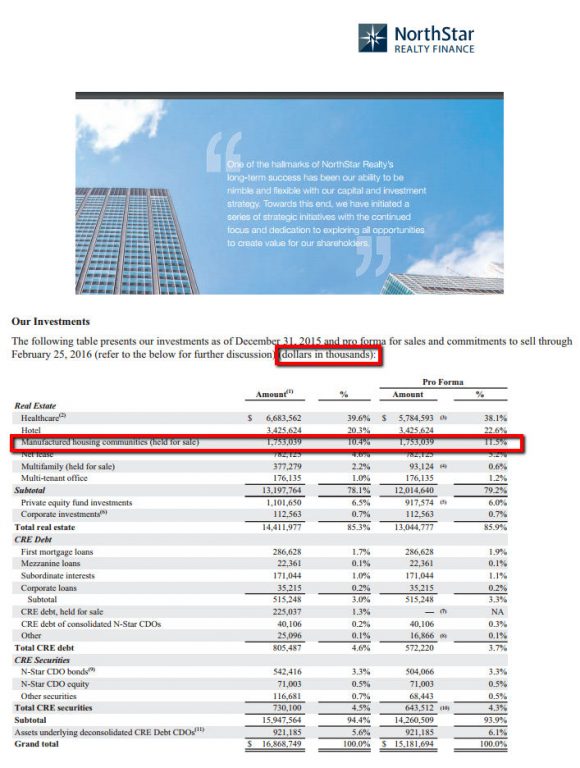

NorthStar Realty Finance is one of the manufactured home related stocks tracked by the Daily Business News, for last night’s close – click here. The firm invests in multiple asset classes across commercial real estate, with a portfolio that comprises manufactured home communities along with healthcare, hotels and multi-family properties. For a previous report by Matthew Silver on NSRF and manufactured housing, please click here. ##

(Image credit is as shown on the linked page.)

Submitted by Joe Dyton to the Daily Business News, MHProNews.