Readers say this is also a quick review tool that saves researchers time in getting a view of the manufactured housing industry, through the lens of publicly traded stocks. MH “Industry News, Tips and Views, Pros Can Use.” ©

Selected bullets from CNN Money:

- Have oil prices stopped plunging?

- McConnell to delay the vote on health care bill

- There’s still no jury for the Martin Shkreli trial

- EU: We’re not biased against US companies

- Carl’s Jr. fined $1.45M for underpaying L.A. workers

- Illinois could soon become America’s first ‘junk’ state

- Senate Republican health bill: Pay more, get less

- The self-driving car startup you’ve never heard of

- Facebook hits 2 billion monthly users

- Eu People really love eating at Olive Garden

- Europe, Ukraine targeted in massive hack attack Trending

Selected headlines and bullets from Fox Business:

- Trump’s HUD initiatives will move forward regardless of health care bill, says Carson

- Massive cyber attack spreads across the globe

- Wall St. falters as Senate delays health vote

- Oil prices up 2 pct on weaker dollar, short-covering

- Yellen: I ‘don’t believe’ we’ll see another financial crisis in our lifetime

- Senate postpones health care vote until after July 4 recess

- UPS said to join growing list of companies freezing pensions

- Millennials still love chain restaurants, Olive Garden’s chief says

- Illinois sinks deeper into financial crisis as Medicaid talks fail

- Joe Namath on John McEnroe, Serena Williams diss: I won’t argue with him

- EU Trump’s agenda will bring higher US growth if implemented, IMF indicates

- Trump’s agenda will bring higher US growth if implemented, IMF indicates

ICYMI – for those not familiar with the “Full Measure,” ‘left-right’ media chart, please click here.

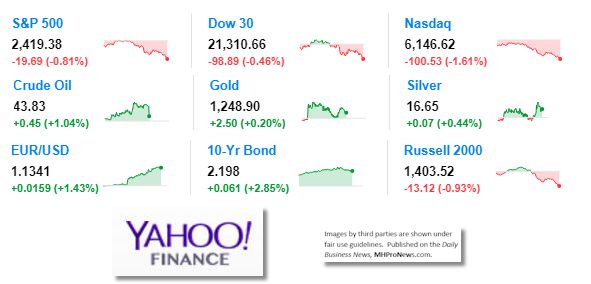

9 key market indicators, ‘at the closing bell…’

S&P 500 2,419.38 -19.69 (-0.81%)

Dow 30 21,310.66 -98.89 (-0.46%)

Nasdaq 6,146.62-100.53 (-1.61%)

Crude Oil 43.83+0.45 (+1.04%)

Gold 1,248.90 +2.50 (+0.20%)

Silver 16.65 +0.07 (+0.44%)

EUR/USD 1.1336 +0.0155 (+1.39%)

10-Yr Bond 2.198 +0.061 (+2.85%)

Russell 2000 1,403.52 -13.12 (-0.93%)

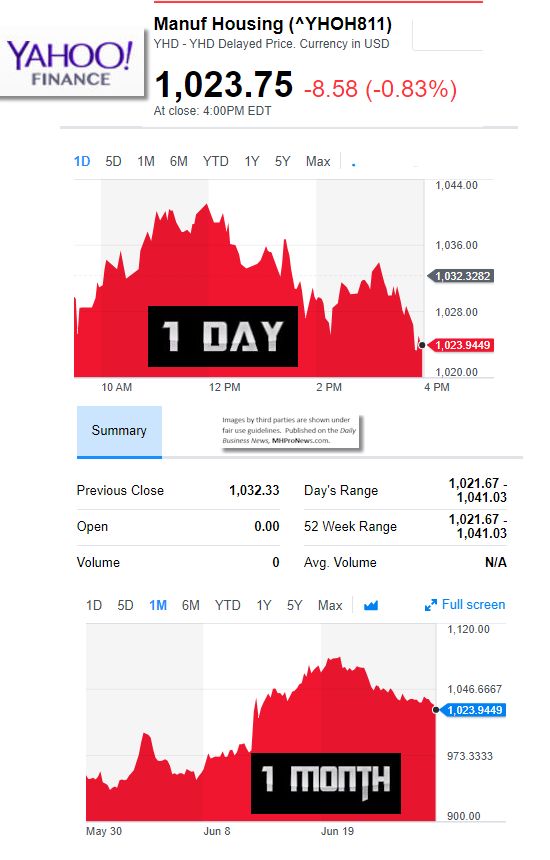

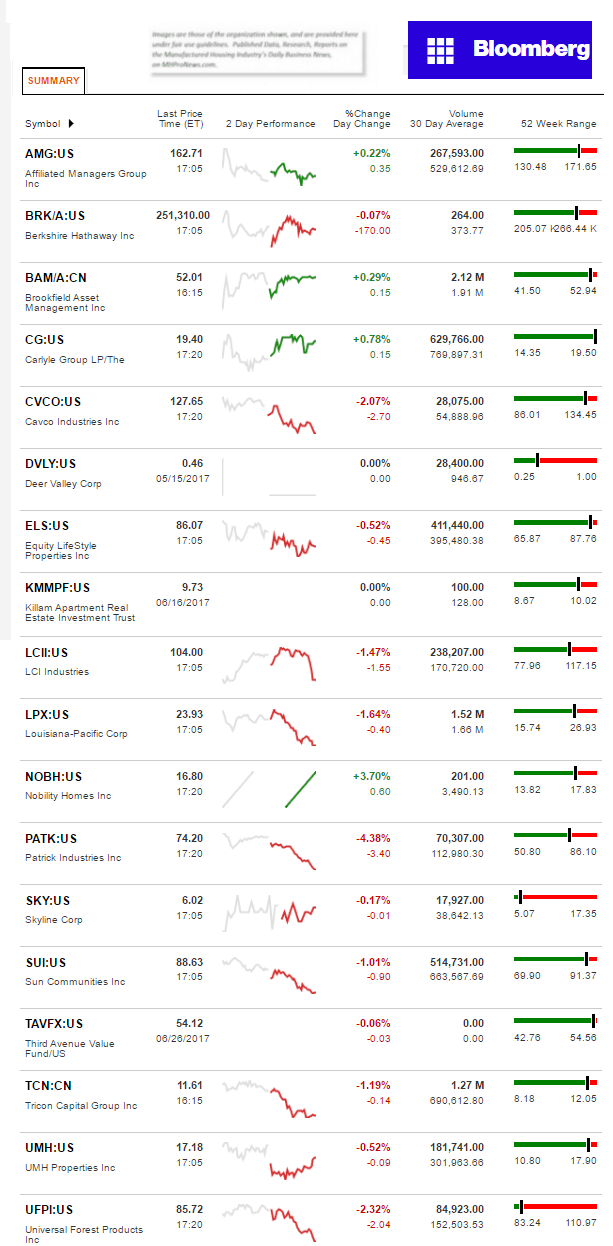

Manufactured Housing Composite Value 6.27.2017

Manufactured Housing Connected Stocks

Today’s Big Movers

Nobility Homes and Carlyle lead the gainers. Patrick and UFPI lead the decliners.

See below for all the ‘scores and highlights.’

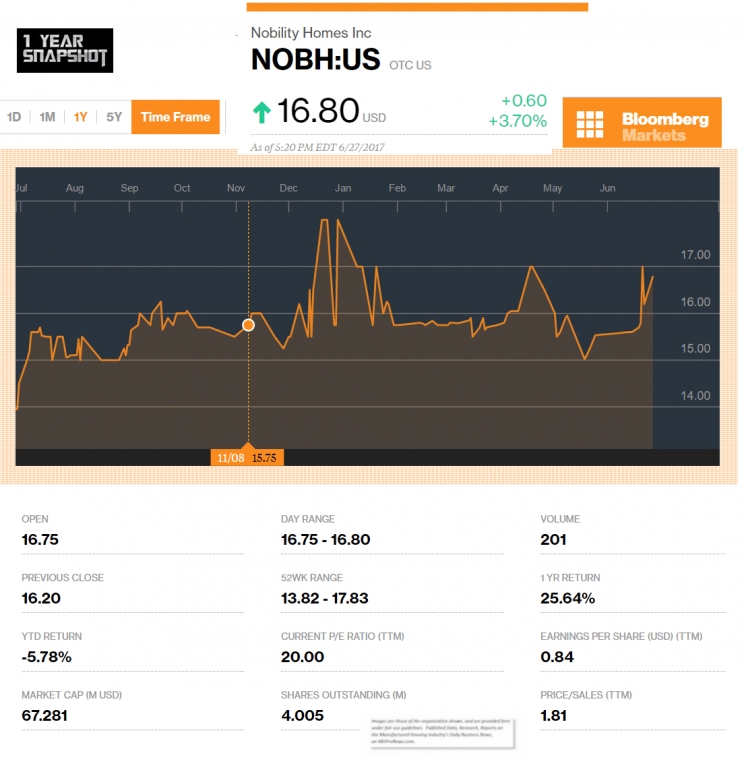

Today’s MH Market Spotlight Report – Nobility Homes (NOBH)

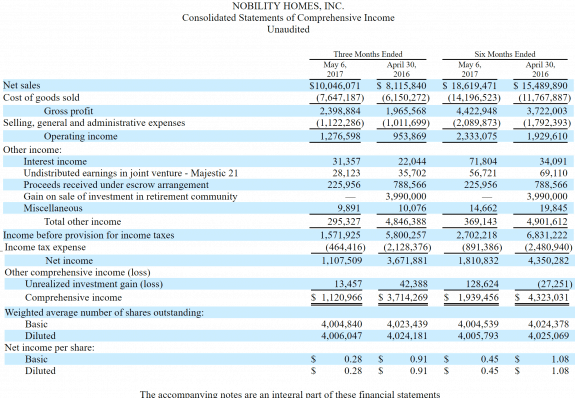

Some highlights, per Nobility’s investor information:

Market Descriptions and Report Highlights

“The Company has specialized for over 50 years in the design and production of quality, affordable manufactured homes at its plant located in central Florida. With multiple retail sales centers, an insurance agency subsidiary, and an investment in a retirement manufactured home community, we are the only vertically integrated manufactured home company headquartered in Florida…

…Sales to two publicly traded REITs and other companies which own multiple retirement communities in our market area accounted for approximately 11% and 22% of our sales for the first six months ended May 6, 2017 and April 30, 2016, respectively. Accounts receivable due from these customers were approximately $863,664 at May 6, 2017.

The demand for affordable manufactured housing in Florida and the U.S. continues to improve. According to the Florida Manufactured Housing Association, shipments in Florida for the period from February through April 2017 were up approximately 6% from the same period last year. Our sales and earnings continue to be affected by the lack of available retail and wholesale financing. Constrained consumer credit and the lack of lenders in the industry, partly as a result of an increase in government regulations, have limited many manufactured housing buyers from purchasing affordable manufactured homes.”

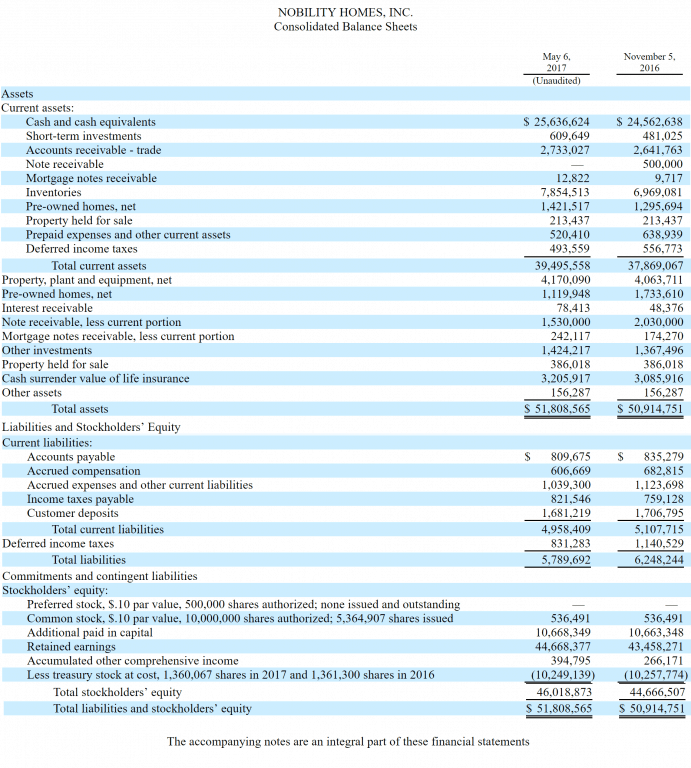

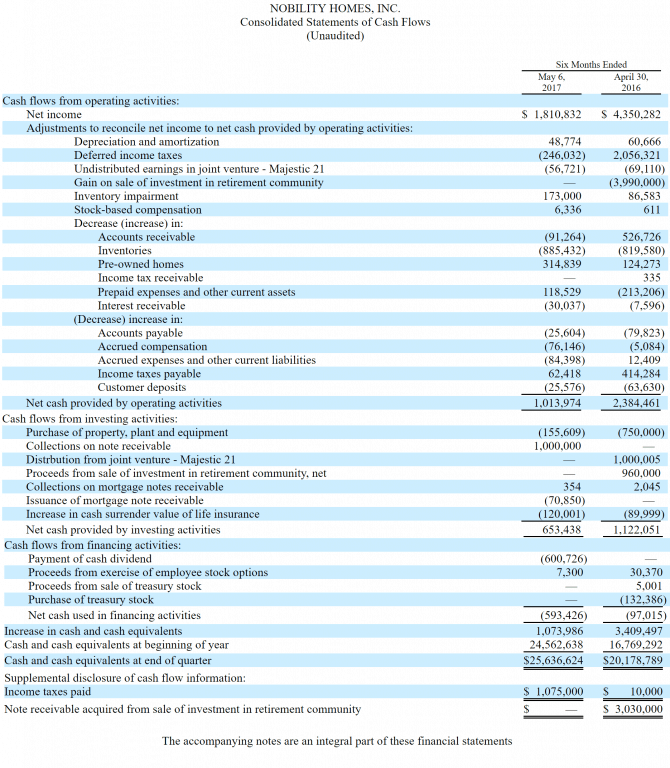

Liquidity and Capital Resources

“Cash and cash equivalents were $25,636,624 at May 6, 2017 compared to $24,562,638 at November 5, 2016. Short-term investments were $609,649 at May 6, 2017 compared to $481,025 at November 5, 2016.

Working capital was $34,537,149 at May 6, 2017 as compared to $32,761,352 at November 5, 2016.

The Company has no material commitments for capital expenditures.

On March 10, 2017 the Board of Directors declared a one-time cash dividend of $.15 per common share to stockholders of record as of March 27, 2017. The cash dividend was paid from our cash reserves on April 17, 2017 in the amount of $600,726 .

We view our liquidity as our total cash and short term investments.

We currently have no line of credit facility and we do not believe that such a facility is currently necessary for our operations. We have no debt. We also have approximately $3 million of cash surrender value of life insurance which we could access as an additional source of liquidity though we have not currently viewed this to be necessary.

As of May 6, 2017, the Company continued to report a strong balance sheet which included total assets of approximately $52 million and stockholders’ equity of approximately $46 million.”

See Recent Exclusive 1 Year Snapshot of All Tracked Stocks

NOTE: the chart below covers a number of stocks NOT reflected in the Yahoo MHCV, shown above.

NOTE: Drew changed its name and trading symbol at the end of 2016 to Lippert (LCII)

Berkshire Hathaway is the parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers. LCI Industries, Patrick, UFPI and LP all supply manufactured housing, while AMG, CG and TAVFX have investments in manufactured housing related businesses.

Providing you only with the very best industry coverage, every business day.

“We Provide, You Decide.” © ##

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)