So began the Manufactured Housing Association for Regulatory Reform (MHARR) media release to the Daily Business News on MHProNews.

“MHARR participated in the forum (as it has with a similar manufactured housing working group convened by Freddie Mac), which featured discussion panels on various manufactured housing-related topics including: “Evolution of the Manufactured Housing Customer” and “Innovations in Manufactured Housing Finance,” as well as a small-group break-out session to address more specific topics related to manufactured home consumer financing,” MHARR stated.

“Attendance at the conference appeared to be split about evenly between industry members and Fannie Mae personnel, including those responsible for the implementation of the “Duty to Serve” (DTS) mandate of the Housing and Economic Recovery Act of 2007 (HERA),” per MHARR President and CEO, Mark Weiss.

“The conference, despite its clear tie-in and applicability to the pending implementation of DTS, was remarkable – particularly in comparison to previous sessions conducted by Freddie Mac – in the broad and seemingly unfocused generality of its subject matter, and the absence of a clear and clearly-enunciated direction forward to the full implementation of DTS in a manner that would have any type of significant impact on the manufactured housing market within a reasonable time-frame,” their statement reported.

“Also remarkable,” stated their release is the fact that almost “a decade now after the enactment of DTS, was the consistent theme of Fannie Mae presenters, to the effect that Fannie Mae had little or no information reflecting the performance of manufactured home chattel loans in the current market or, indeed, over the more-than-two decades since Fannie Mae made its ill-advised purchases of manufactured home loans originated by Greentree Financial, Inc. (“Greentree”) shortly before Greentree filed for federal bankruptcy protection.”

It’s a claim that Daily Business News has previously reported at this link here.

Then MHI Chairman – Tim Williams, President and CEO of the 21st Mortgage Corporation – admitted to a group of a few dozen industry members at a meeting that 21st had turned over no data to FHFA/GSEs. MHProNews was present at that meeting, and heard Williams’ admission.

MHARR’s Analysis

“A major impression coming out of the conference, therefore, is that Fannie Mae,” said MHARR “despite:

(1) having had ten years since the enactment of DTS to seek and gather information relevant to the manufactured housing finance market as a whole and the manufactured housing chattel finance market in particular; and

(2) having had nearly a year since the Federal Housing Finance Agency (FHFA) stated in its final DTS implementation rule that DTS activities could include manufactured home chattel loans, has not (to date) aggressively sought and, more importantly, has not obtained, significant data regarding the current-day performance of the approximately 80% of the manufactured housing consumer finance market represented by chattel loans.”

“This was reflected in steady and consistent references by Fannie Mae officials over the course of the meeting to their current lack of analytical data specifically applicable to chattel loans, which Fannie Mae has not purchased since the Greentree fiasco (and Freddie Mac has not previously purchased),” MHARR said to MHProNews.

“Although not expressly stated in any public session, Fannie Mae’s acknowledgement of its lack of significant relevant data regarding manufactured housing chattel loans and its consistent appeals for such information from meeting participants – combined with the absence from the meeting of personnel from the industry’s two largest lenders, 21st Mortgage Corporation (21st) and Vanderbilt Mortgage Corporation (Vanderbilt) (which are significant chattel lenders, albeit at higher interest rates) — would tend to indicate that specific loan performance data from those market-dominant lenders has still not been provided or offered to Fannie Mae in support of DTS,” stated MHARR.

Corroboration

Unless 21st and Vanderbilt Mortgage have since changed their position, that analysis would be in keeping with what MHProNews has also learned, as previously referenced at this link here.

This is one of several issues that the Daily Business News has pressed Berkshire Hathaway companies, and MHI, to which Rick Robinson replied publicly at the Deadwood, SD setting, “Tony, I won’t be taking any questions from the press.”

Frank Rolfe has told live audiences that MHI is equally reluctant to engage with the mainstream media, as they are with MHProNews.

Why does MHI and their dominating Berkshire Hathaway lender-members fail to address issues raised by MHARR, MHProNews, or others? Why are their inconstancies in their positions?

Marty Lavin graphic

Mark Weiss says “Essential”

On paper, it seems that ‘everyone’ agrees that the Duty to Serve, and long-term manufactured home loans in land-lease is a great idea.

So why is there in practice fractures, and actions that don’t match up with the stated positions?

MHARR dove into those and related issues. Per their release:

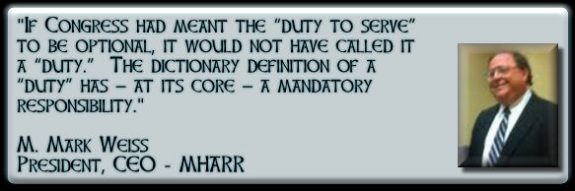

“While this factor is relevant in the context of the economic viability and health of the industry and all of its members, it must be reiterated – as MHARR did in its written DTS comments and during the meeting:

(1) that market-significant DTS securitization and secondary market support for manufactured home chattel loans is essential to the availability of truly affordable housing for all Americans, and to the growth and expansion of the industry;

(2) that Fannie Mae, in particular, for decades has engaged in misdirection regarding its failure to properly serve the manufactured housing market in accordance with its Charter (and now DTS), through similar staged conferences as well as its unused and non-viable “MH Select” program, without ever taking concrete action to re-enter the market – a scenario that seems to be re-playing itself now; and

(3) that despite excuses and misdirection, DTS is a mandatory duty that Congress has statutorily imposed on Fannie Mae and Freddie Mac, that cannot be dismissed or avoided by claims of “lack of data” that is lacking precisely because of the failure to adequately serve the manufactured housing market that Congress sought to remedy through DTS.”

According to Fannie Mae officials, final FHFA approval or non-approval of its DTS implementation plan is expected sometime during December 2017.

MHARR already is on record calling for the modification of the Fannie Mae May 2017 DTS implementation plan to expand the number of chattel loans purchases from an anticipated 350-425 loans per year to a market-significant number within the plan period that would actually achieve the purposes of the DTS mandate.

Moreover, after forty years of toying with the industry and consumers regarding participation in the manufactured housing market, both groups must demand that Fannie Mae and Freddie Mac go beyond small-volume “experimental” undertakings and provide market-significant securitization and secondary market support – beginning within their three-year DTS implementation plans — for manufactured home chattel loans.

MHARR, which technically represents manufactured home producers, and got involved in lending only because they’ve said that MHI has allegedly failed the industry on such issues, said they “will continue to closely monitor, address and participate-in this and other activity by Fannie Mae and Freddie Mac concerning the implementation of the Duty to Serve.” ## (News, Analysis.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)