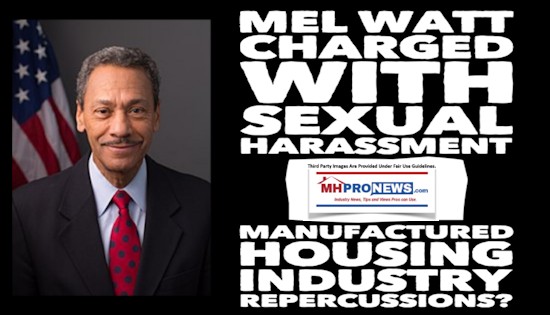

“The mortgage industry and Washington were rocked Friday by news that Federal Housing Finance Agency Director [FHFA] Mel Watt has been accused by an agency employee of sexual harassment,” wrote Rob Blackwell for AmericanBanker.

As many manufactured home industry veterans know, the FHFA was established as the receiver for the Government Sponsored Enterprises (GSEs) of Fannie Mae and Freddie Mac, after the mortgage/housing financial crisis. It was part of the Housing and Economic Recovery Act (HERA 2008), signed into law by President George W. Bush.

The Duty to Serve (DTS) manufactured housing and underserved markets also flows from HERA. Since the FHFA is the regulator of the GSEs, who’s at the top at FHFA matters to the industry’s consumers and professionals. Numerous non-profits – as well as various associations and industry businesses – have expressed their desire for a robust entry by the GSEs into manufactured home lending.

Much of the focus has been in the arena of chattel (personal property, home only) lending.

Watt was already slated to leave the FHFA in January 2019. There have already been several names floated for his replacement. Some, per informed sources, say that while the names are all “familiar faces,” some are “potentially problematic” for the interests of manufactured housing.

If allegations spelled out in Politico prove true, that time line for Watt’s departure could be accelerated.

Politico Pounces

Politico obtained transcripts of reported conversations between Watt and an employee, whose name was withheld. In those alleged conversations, Watt appears to be suggesting a relationship with the employee.

“Well, you probably want to know what I wanted to talk to you about,” Watt said, according to Politico. “I mentioned to you there is an attraction here that I think needs to be explored. In my experience there are four types of attraction: emotional, spiritual, sexual or of friendship. So, the exercise here is to find out which one exists here.”

Watt supposedly noticed a tattoo on the employee’s ankle and asks her, “If I kissed that one would it lead to more?”

“The employee’s lawyer, Diane Seltzer Torre, confirmed to American Banker that an Equal Employment Opportunity complaint had been filed against Watt. The FHFA confirmed an investigation is underway,” but Watt’s response is that it was “intended to embarrass or to lead to an unfounded or political conclusion.”

“However, I am confident that the investigation currently in progress will confirm that I have not done anything contrary to law,” Watt said. “I will have no further comment while the investigation is in progress.”

Watt’s statement did not specifically confirm or deny claims that he made those suggestive comments to an employee. Rather, he stressed that any actions he took were not illegal. One question that needs to be asked, who will pay if there is a settlement? Will it be taxpayers, or Watt himself?

Legalities and the truth aside, if Watt made such comments, this may be enough to force him out before his term is up.

As the head of an independent agency, Watt can only be removed “for cause” by President Donald J. Trump. These allegations could possibly qualify, if the Trump Administration wanted to accelerate his departure for whatever reason.

“The president could either allow one of Watt’s deputies to temporarily run the agency if he stepped aside, or appoint an interim head under the Federal Vacancies Reform Act, which allows a Senate-confirmed official to temporarily serve as director,” according to Blackwell.

Mick Mulvaney is a similar case, who has been serving for months as the temporary head of the Consumer Financial Protection Bureau (CFPB).

Whether Watt chooses to leave or is forced out, it is obvious that his days at the agency were winding down.

“The transition timeline is likely to be expedited,” said Isaac Boltansky, director of policy research for Compass Point Research & Trading.

FHFA, DTS and Manufactured Housing Lending

MHProNews will monitor these developments, as they impact the various efforts to compel the GSEs to do more in the way of supporting manufactured housing chattel and other lending options.

While the Arlington, VA based Manufactured Housing Institute (MHI) has signaled a level of satisfaction with DTS to date, the Washington, D.C. based Manufactured Housing Association for Regulatory Reform (MHARR) has made it clear they believe the process has been largely stymied to date from doing what Congress mandated a decade ago.

MHARR, per sources, has launched several initiatives to compel more lending.

Meanwhile, MHI has given lip service to similar efforts, but there has been signs of foot dragging and posturing, perhaps because of the interests of their dominant Berkshire Hathaway members, Clayton Homes, 21st Mortgage and Vanderbilt Mortgage and Finance.

It should be noted that after numerous offers to publicly respond to or debate the evidence-based reports linked below, neither MHI nor a Berkshire Hathaway owned unit has accepted those offers to respond to these published concerns. Why not? Is it because the documents and quotes provided are often from 21st, Tim Williams, Kevin Clayton, or Warren Buffett himself? Doesn’t that make it hard for them to refute? “We Provide, You Decide.” © ## (News, analysis, and commentary.)

(Third-party images and content are provided under fair use guidelines.) See Related Reports, linked further below.

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To provide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Resources

Related Reports: