It’s Flashback Friday. Reviewing two reports by MarketWatch are timely, and ought to make followers of the popular personal finance guru Dave Ramsey, or HBO’s Last Week Tonight with John Oliver sit up and think again.

These are equally timely because of the arguably injustice that is taking place in Bryan, TX of cities and towns across the country, where manufactured homes are increasingly being zoned out. The vote in Bryan is subject to a special petition that, if those petitions are certified as accurate, could void Tuesday’s council vote, so this ought to be a timely topic for our industry’s professionals.

Especially independents, and those who are keen on industry growth should sit up and take notice. Because as the latest Masthead reminds readers, for want of a nail, the war was lost.

https://manufacturedhomepronews.com/masthead/for-want-of-a-nail-manufactured-housing/

Teeing Up the MarketWatch Reports 2018-2019

To set the table, these articles are provided under fair use guidelines. These are not a fact checks per se, but we will clarify the terminology with some graphics and illustrations between them, while providing commentary and analysis.

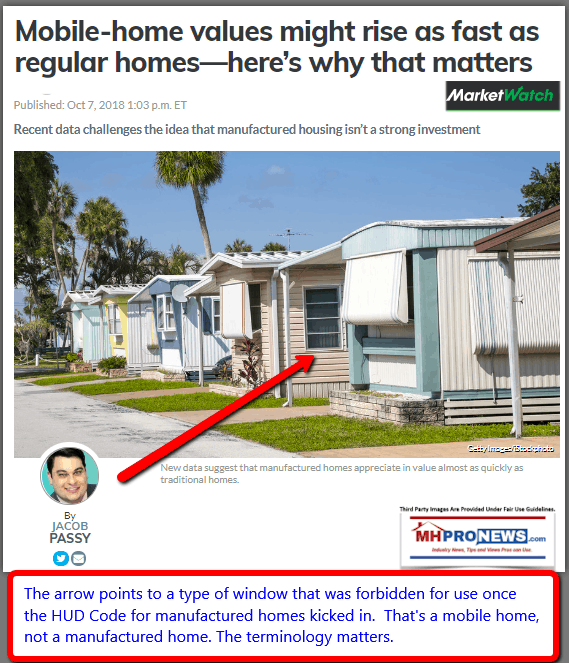

Let’s note that the featured photo below from the first MarketWatch report included at least one home that wasn’t a manufactured home. It is a mobile home, as the windows on that unit are a dead giveaway for a feature that is forbidden by the federally preemptive HUD Code for manufactured homes.

It is worth mentioning that what some MarketWatch staffer selected for use to illustrate was hardly the best photo to use showcase the appeal of modern manufactured homes. Those are either older manufactured homes, and/or mobile homes.

The Daily Business News on MHProNews will then note that anecdotally that mobile homes can and have appreciated too. The factors for appreciation are roughly the same for conventional housing as for mobile homes or manufactured housing. For example,

- availability of financing is a key factor,

- as too are location,

- condition,

- area market conditions,

- along with other aspects of the laws of supply and demand.

With that brief introduction and noting that MHProNews is not editing either report for typos, facts, undisclosed conflicts of interest, or terminology errors, let the reader dive into MarketWatch’s two timely flashback articles on the wisdom of manufactured homes, and appreciation. Here’s the link to the first article.

Recent data challenges the idea that manufactured housing isn’t a strong investment

Many have long held the assumption that mobile homes don’t increase in value — or, at the very least, they rise in value at a much slower rate than traditional homes.

But recent data suggests the opposite is true — and that could have major implications in the push for increased affordable housing nationwide.

A new report from the Urban Institute, a Washington, D.C.–based think tank, examined data released in August by the Federal Housing Finance Agency. The home price index for manufactured homes (also known as mobile homes) featured an average annual growth rate of 3.4%, versus 3.8% for traditional, site-built homes.

In recent years, home prices have actually risen at a faster clip for manufactured, or mobile, homes than they have for traditional properties.

But that trend is not always easy to see, because manufactured housing is more popular in parts of the country where the overall recovery from the housing crisis has been less robust. For instance, California represents nearly 18% of the nation’s overall housing market, but it comprises just 4% of the manufactured housing market based on the number of units shipped.

Because manufactured homes generally aren’t highly concentrated in housing markets that have notably recovered from the crisis, it creates the impression that these homes’ values don’t appreciate at the same rate as traditional homes. In reality, this is more a reflection of where the homes are located than the types of homes.

Comparatively, Alabama, Florida, Louisiana, North Carolina and Texas represent 41% of the manufactured-housing market, but have experienced price appreciation below the national level.

The report only looked at mobile homes that were financed with loans guaranteed by Fannie Mae and Freddie Mac. However, most homeowners who finance the purchase of a manufactured home don’t get a traditional mortgage because they only own the structure and not the land beneath it.

Instead, they typically get a chattel loan — a personal loan that is more similar to an auto loan than it is a mortgage. Chattel loans are more expensive than mortgages and typically come with higher interest rates.

It is not clear whether the report’s findings apply to homes purchased with chattel loans as well. Nevertheless, it’s a strong indication that mobile homes may be a worthwhile investment. “Although there are limits to what the data can tell us, the index suggests a need to reevaluate the presumption that manufactured homes do not appreciate at the same rate as site-built homes,” the Urban Institute researchers wrote.

There are many downsides to manufactured homes. If a mobile-home owner doesn’t own the land they will obviously have to rent it — and those costs can rise over time. What’s more, these homes aren’t actually mobile in most cases, despite the common moniker. As a result, if land rents get too expensive or if the land’s owner decides to sell, homeowners might be forced to move and sell their home, regardless of what price they can get for their home.

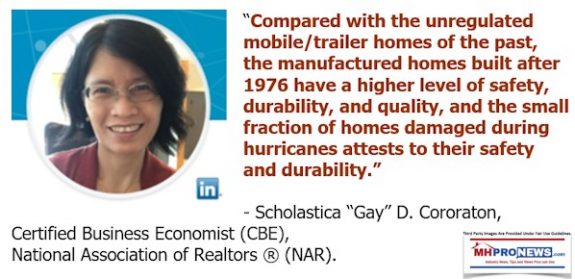

The homes also are more prone to damage in natural disasters like hurricanes and tornadoes. Because many owners buy their mobile homes in cash, insurers often only offer “actual cash value” coverage for the properties rather than covering the replacement value. This lowers the amount the insurer pays out, which left many people in Florida facing serious losses after Hurricane Irma tore through the state last year and destroyed or damaged many manufactured homes.

##

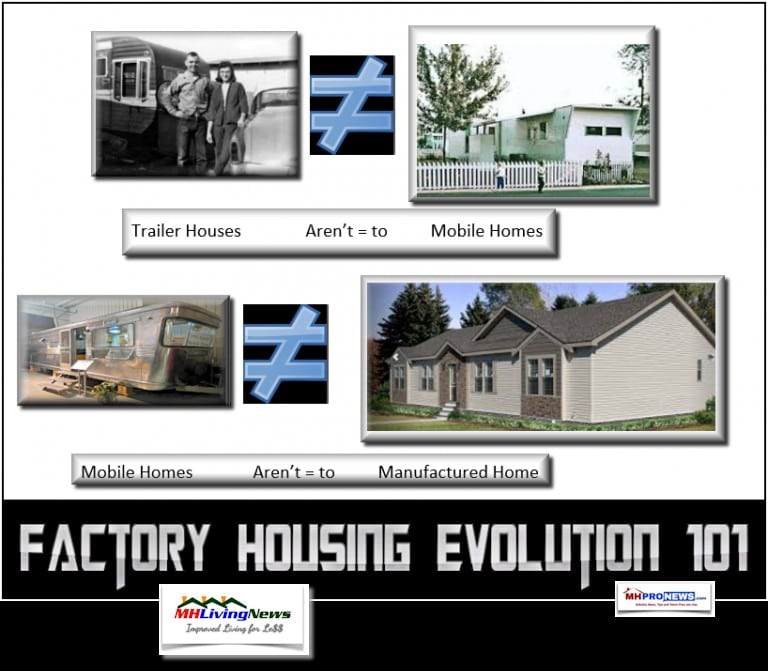

As a brief added commentary to both MarketWatch articles, are the terminology illustrations, plus other quotes and factoids provided above and below by MHProNews. The terminology is not interchangeable.

the terminology determines the

construction standards a home was

built to,” Steve Duke, LMHA.

The link to the next report from MarketWatch is here.

As the housing crunch continues, would-be buyers may want to consider these unorthodox options

Here’s a bold forecast for the housing market in 2019: conditions will continue to be strained as affordable inventory gets snatched up quickly, leaving the least desirable and most pricey properties to stagnate.

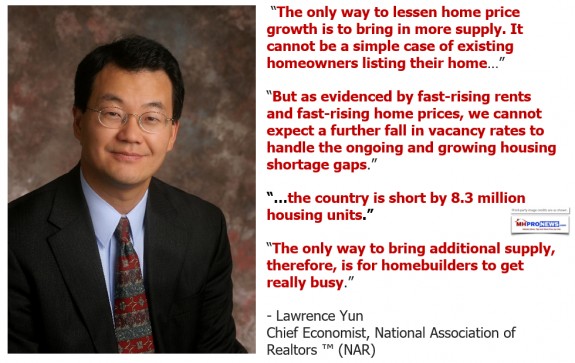

Given how steep the housing shortfall has been for so many years – Freddie Mac economists estimated we’re nearly 5 million units short – that’s kind of a no-brainer. The bigger question is what we do about it.

In the spirit of “new year, new approach,” MarketWatch has collected several suggested solutions to the housing crunch. These are unconventional ideas, but ones that industry participants have been exploring for years. They may provide fodder for house hunters willing to think outside the box – especially if the idea of another wasted Sunday afternoon of open houses doesn’t appeal.

Factory-built homes

Jenny Cochrane and her husband had spent years taking care of her mother, who was struggling with breast cancer and who owned a manufactured home in Yulee, Florida.

The couple ran into some financial trouble in the downturn – “the economy went splat and so did we,” Cochrane said in an interview. But she still had enough saved in her 401(k) to consider buying a traditional house. Eventually, though, the couple decided to assume her mother’s mortgage and take over her house, mostly because they liked the space that the much-cheaper factory-built home afforded them.

“It’s a double-wide manufactured home on a solid foundation, it’s not going anywhere,” Cochrane said. The couple rode out the last hurricane with barely a scratch to show for it. They have a front porch, back porch, 3 bedrooms, and laundry room on about an acre of land.

Manufactured homes are 35-47% cheaper than traditional “site-built” properties, according to an analysis from the Urban Institute. Factory-built homes accounted for 16-25% of all new single-family houses between 1977 and 1995, but just 10% in 2017, even as the quality of construction has become much better over the past few years, the Urban researchers noted.

Restrictive zoning is partially to blame for the low take-up of manufactured homes. About one-third of them are currently in single-purpose communities, and municipalities often ban the development of such areas.

But a more significant challenge is that lenders have often struggled to make mortgages on manufactured homes. That’s in part because it can be challenging to find comparable properties against which to appraise them, and in part because most owners don’t own the land on which the houses sit. (Another wrinkle, as the Urban Institute notes, is that most mortgages for manufactured homes tend to be much smaller, and small-dollar loans are always less desirable for lenders, who have fixed overhead costs.)

Freddie Mac, the giant government-sponsored enterprise that buys mortgages from banks and other lenders, has introduced a new program to allow conventional-style financing for factory-built homes, in part by allowing appraisers to use site-built properties as comparables. But Freddie’s financing, and that offered by many lenders, including Cochrane’s mortgage, is only available for homes where the house is tied to the property.

Still, that small step may be enough to start to encourage more supply and lending into the housing market, the Urban analysts wrote.

Communal living

Imagine a scheme that allowed a third-party bureaucracy to own property and homeowners to lease those ownership rights from it. (If that sounds somewhat Bolshevik, don’t forget that most Manhattan properties are cooperatives, and utilize roughly the same structure, with little of the socialism.)

Community land trusts use a similar structure to help foster affordable housing and economic development. They’ve been around for a few decades, and have a stellar track record for building community and enabling sustainable homeownership.

“The basic concept is that you want to take housing and land off the speculative market,” said Michael Swack, who helped develop the concept, and now directs the Center for Impact Finance at the University of New Hampshire. The “speculative” real estate market Swack describes is familiar: communities can be affordable for many families, until they’re “discovered” by more affluent people outside the neighborhood, who move in and, over time, make it less affordable for everyone and off-limits for some.

But community land trusts, which despite their name are usually not true trusts, but nonprofit entities, own and retain ownership of land, and offer long-term leases to homeowners. One of the oldest in the country is the Burlington, Vermont-based Champlain Housing Trust. The trust currently has 611 owned homes, and over the 35 years it’s been around, 1,100 families have become owners with its help.

Owners deed the land on which the homes sit to Champlain, which reduces the market price of those homes by about 20%. When an owner is ready to sell, she gets 100% of the equity that comes from having paid down her mortgage, and 100% of the appraised value of any capital improvement, but only 25% of the market appreciation, also determined by an appraisal. The home reverts back to the trust, and the cycle can begin again.

| A sample community land trust lifecycle | ||

| Year 1 | Appraised value of home | $240,000 |

| Purchase price | $200,000 | |

| Year 8 | Appraised value of home | $280,000 |

| Equity built | $20,000 | |

| Market appreciation assigned to owner | $10,000 | |

| New purchase price | $230,000 | |

| Source: Champlain Housing Trust | ||

“We’ve added a rung” to the homeownership ladder, Brenda Torpy, the trust’s CEO and one of its founders, told MarketWatch. “People now see that they can use our program as a stepping stone. We can provide a homeownership equivalent to what they can pay in rent and they start building equity immediately.”

Champlain owners sell their homes about every seven years or so, roughly the same tenure as national averages, and they move on for all the reasons Americans always move – in search of a bigger home to accommodate children, to warmer places for retirement, or to wherever a new job beckons.

In contrast, the Dudley Street Neighborhood Initiative, in Boston’s Roxbury neighborhood, has about 36 owned housing units dating back to its inception in 1989, and “less than a handful” of those owners have left, according to its director of operations, Tony Hernandez.

“People confess that they originally thought of it as a stepping stone, but now they think of it as home,” Hernandez said. “The intent was to get owners who would stay and keep the family knit into it, rather than a land trust model where they come in, build wealth and move on. We created a village.”

Grounded Solutions Network, a national affordable housing advocacy group, estimates that there are about 165 community land trusts around the country, with about 12,000 owned homes between them. Many land trusts also have affordable rental properties, which Grounded Solutions estimates includes about 25,000 rental units.

A Grounded Solutions analysis as of June 2018 founded that the average household income at the time of home purchase was 64% of area median income, and on average owners were buying homes at about 34% below fair market value.

For the people who buy from land trusts, homeownership has been a success. Through the worst of the foreclosure crisis, they became delinquent only about one-fourth as often as other homeowners.

Grounded Solutions and others argue that it also works for communities: “These programs retained the affordability of the homes to serve the same income level resale after resale. That means that these programs successfully created a stock of affordable homes that remain forever, even if the neighborhood gentrifies or the real estate market turns up or down.”

Fixer-uppers

Picture a house-hunter in an average American city, pre-qualified for a mortgage that would allow him to buy a median-priced home of about $250,000. Now picture that buyer hustling to bid on every house that comes along in that price range, only to be outbid by someone with more money, an all-cash offer, or something else.

But now imagine there’s a house that’s lingered on the market. It’s priced at about $180,000, but that’s because it requires a lot of work – a lot.

This scenario happens often enough that the mortgage finance industry has tools specifically for it. Meet the “renovation mortgage,” an innovation that allows the home buyer to take out one loan for the purchase price of the home plus the cost to rehab it.

“I like to say, don’t look at a house as it is, look at a house as what it could be,” said Jonathan Lawless, who runs Fannie Mae’s product development team for affordable housing. “That could be a much better way to get people in the door.”

What’s the catch? Anyone who’s ever undertaken a big renovation knows the drill, pardon the pun. While it may be a lot more convenient to apply for and manage one debt rather than two, renovation loans can still be a beast, rolling the nightmare of home repair into the knotty bureaucracy of mortgage underwriting. Brooke Anderson-Tompkins, president of upstate New York-based 1st Priority Mortgage, calls them both “cumbersome” and “a phenomenal product that more agents need to be aware of.”

For one thing, most renovation loans require that contractors be paid on a draw basis, which several sources told MarketWatch usually makes many potential hires uninterested in such projects. But Jamie Zeitz, who manages the Southeastern U.S. operations of Homebridge Financial Services, points out that contractors and homeowners should both be aware “there’s no safer way” to enter into a construction deal since the work being done is part of a financing package that requires all parties be satisfied, and that work be paid for.

There are also more parties involved than in a regular renovation process. Most loan programs require that a consultant oversee the project, for example. Homebridge offers a “Concierge Service Manager” to serve as a single point of contact for the homeowner, rather than forcing that person to deal with the consultant, the contractor, the appraiser, the people paying the contractor, and so on.

While they’re unwieldy, the mortgage finance industry increasingly sees such loan programs as an important key to solving the housing crunch, Lawless said. Fannie is looking at ways to streamline the draw process, for example, and also recently clarified that its program, called HomeStyle, can be used for accessory dwelling units, which are smaller, standalone buildings on an existing property. ADUs can be used to create rental income, or to house relatives.

Homebridge is the biggest originator of the renovation loan program offered by the Federal Housing Administration, which carries the unwieldy title “203(k) loans.” As with its more traditional mortgage programs, FHA 203(k) loans can be made with as little as 3.5% down, but they will cost a bit more than conventional mortgages.

##

The MHProNews report linked below on Sun Communities provides some useful data as a tie-in to the above from MarketWatch. How so?

Sun, as a publicly trade company, has provided their research points comparing manufactured home rentals with apartment rentals. The savings and advantages to manufactured homes in that category is significant.

Then, there is a comparison of buying a manufactured home with purchasing an existing home. Neither Sun or MarketWatch makes a list of all of the possible pluses, but those they share – such as price point data – are useful.

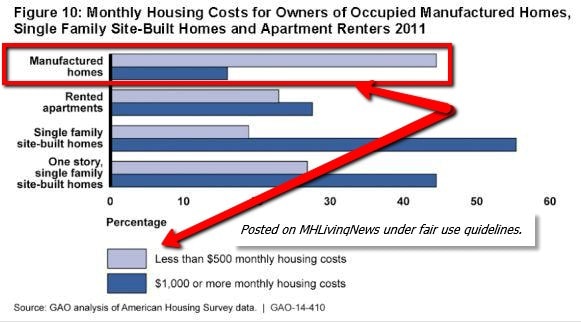

The Government Accountability Office’s 2014 report on manufactured homes was largely favorable, and included an explanation for a concern that MarketWatch and the Urban Institute raised but did not resolve. Namely, that even with a higher loan cost, the price saving makes the monthly payment for a manufactured home significantly less than conventional housing.

The possible takeaways or bottom lines are many. Most certainly, the above is useful in scenarios like Byran, TX, debunking Dave Ramsey, or clarifying some issues with John Oliver’s viral “Mobile Homes” video.

They also make the sad case for what one of the sources with long ties to MHI provided information to MHProNews about state executives chatter which bemoaned the Oliver video dubbed “association malpractice.” See more on that in an upcoming report that will rip another band-aid off what is taking place in the MHI affiliated network.

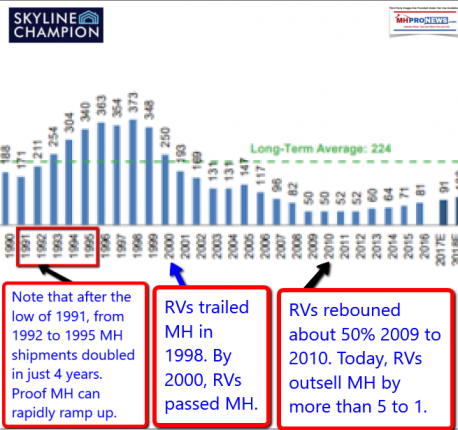

All of these are reasons why manufactured home sales should be soaring, not snoring. As MHI member Skyline-Champion notes in their illustration, shown below, manufactured homes are far below their long term average, much less their recent or all-all time highs.

That’s this this morning’s edition of “News through the lens of manufactured homes, and factory-built housing.” © where “We Provide, You Decide.” © ## (News, analysis, and commentary.)

NOTICE: You can get our ‘read-hot’ industry-leading emailed headline news updates, at this link here. You can join the scores who follow us on Twitter at this link. Connect on LinkedIn here.

NOTICE 2: Readers have periodically reported that they are getting a better experience when reading MHProNews on the Microsoft Edge, or Apple Safari browser than with Google’s Chrome browser. Chrome reportedly manipulates the content of a page more than the other two browsers do.

(Related Reports are further below. Third-party images and content are provided under fair use guidelines.)

1) To sign up in seconds for our MH Industry leading emailed news updates, click here.

2) To pro-vide a News Tips and/or Commentary, click the link to the left. Please note if comments are on-or-off the record, thank you.

3) Marketing, Web, Video, Consulting, Recruiting and Training Re-sources

Related Reports:

You can click on the image/text boxes to learn more about that topic.

HBO’s John Oliver on Last Week Tonight Mobile Homes Video, Manufactured Home Communities Fact Check – manufacturedhomelivingnews.com

” Mobile homes were perfected by humans, but invented by snails,” John Oliver on HBO’s Last Week Tonight, per Time. ” The homes of some the poorest people in America are being snapped up by some of the richest people in America.” Really?

Why is Seattle Dying? Affordable Housing, Misplaced Compassion, and Manufactured Homes – manufacturedhomelivingnews.com

In just over three weeks, this video below entitled ” Seattle is Dying ” by KOMO, a local ABC TV affiliate there, has broken 2.1 million views. It is an hour-long and compelling documentary that ends with hope based upon some promising solutions. But it first lays out one troubling fact and example after another.