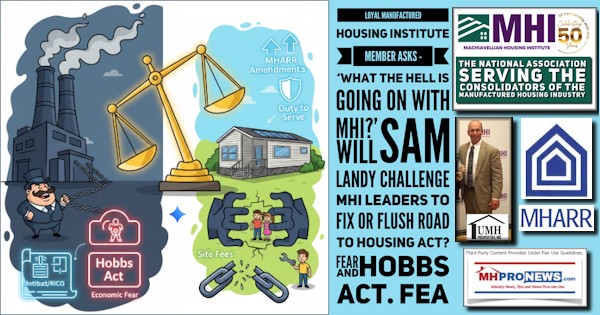

The apartment industry is currently experiencing a softening as measured by the performance of various sector REITs as left-leaning CNBC and others have reported. So, it may not be entirely surprising that Equity Residential (EQR) on left-leaning Yahoo Finance reported pre-dawn on 12.3.2025 that stock was down -17.62 percent year-over-year (YoY). By comparison, Equity LifeStyle Properties (ELS) is down -11.10 percent YoY. Patrick Waite, ELS Chief Operating Officer (COO), is currently the new chairman of the Manufactured Housing Institute (MHI). The consolidation focus of ELS vs. the more UMH Properties plan of organic growth and robust greenfield developing may increasingly be called into question as a financial strategy. While there are certainly potential counterarguments that they might advance for keeping the stated ELS investment thesis in place, what may be difficult to disprove is that the current ELS and consolidation-focused thesis held by them and multiple higher profile MHI members may well carry regulatory and other legal risks. There is also reputational risk (see below) for ELS and some other consolidation-focused MHI insiders. There is resident churn evident in ELS data, as left-leaning Google’s artificial intelligence (AI) powered Gemini reveals below. This exclusive MHVille facts-evidence-analysis (FEA) will provide and unpack some facts that could prove useful as various MHI leaders are discerning UMH Properties CEO Sam Landy‘s arguably de facto call for amendments to the pending ROAD to Housing Act 2025.

According to the Q&A linked here which was confirmed as accurate by Gemini via the screen shot found at the link here is the following.

Yes, the data from the AI overview and the Northmarq report, when combined with your points, strongly suggest resident turnover (or churn) at Equity LifeStyle Properties (ELS) despite its high occupancy rate.1

1. AI Overview Confirmation and Analysis

The AI overview data for Equity LifeStyle Properties (ELS) is factually confirmed by recent industry reports:

Q3 2025 Same-Store Occupancy: 94.3%2

Q3 2024 Same-Store Occupancy: 95.0%3

Year-over-Year Change: $-0.7\%$ (a 70 basis point decline, slightly more than the 60 basis points cited for another REIT in one search result, but reflecting a definite drop).

Conclusion: The year-over-year decline in same-store occupancy ($95.0\%$ to $94.3\%$) confirms the trend of a slight reduction from a peak level, suggesting that the pace of residents moving out (or “churn”) exceeded the pace of new resident move-ins during that period for their established communities.

2. Industry Data and ELS Churn Inference

Data Point Source Implication for ELS National Occupancy Rate Northmarq (Q2 2025) Stable at $94.9\%$ (up 10 basis points YoY), showing the national market is strong, but ELS’s decline to $94.3\%$ suggests they are lagging the national trend. Shipments into Communities MHI (Recent Years) Shipments are in the $30\%$ to $50\%$ range. Your assessment that MHI’s numbers are in this range is fair based on MHI’s own past statements (e.g., $51\%$ in 2022, $31\%$ in 2023). ELS Buying New Homes ELS Earnings Calls (Confirmed) ELS sells new manufactured homes to fill empty sites and attract new residents. For example, ELS reported selling 114 new homes in Q3 2025. Inference: Occupancy Churn Combined Data Yes. If ELS’s same-store occupancy is dropping slightly year-over-year, and they are simultaneously buying/selling new homes to fill sites, it logically means: 1. **Residents are exiting** (churn/turnover). 2. The homes of the departing residents are likely being removed, or new homes are being placed on formerly vacant sites/older sites, which ELS then sells to a new resident. 3. This **infill activity** (selling and placing new homes) is a direct response to **turnover** (churn) or to bring previously vacant sites online, and it is necessary to maintain or grow occupancy. The slight decline in same-store occupancy ($95.0\%$ to $94.3\%$) suggests that this turnover/infill process, for *established* sites, has resulted in a net loss of $0.7\%$ over the year.The decrease in same-store occupancy coupled with the ongoing new home sales activity is the clear indicator that ELS is experiencing, and actively managing, a degree of churn among its residents.

2) Per Yahoo Finance, documenting and comparing the performance of EQR vs. ELS YoY as measured by their respective stock trends.

Note, this MHVille FEA is well underway.

3) Considering the ELS thesis and related per xAI’s Grok.

Facts-Evidence-Analysis (FEA) of HI Input, Google AI Overview, and Gemini Response

Facts: Google’s AI overview accurately captures Equity LifeStyle Properties (ELS) Q3 2025 occupancy trends: National same-store occupancy dipped slightly YoY to 94.3% (from 95.0% in Q3 2024), but sequential quarterly improvement occurred as hurricane impacts faded, maintaining peak stability (~94-95% overall). Northmarq Q2 2025 report confirms industry-wide 94.9% occupancy (+10bps YoY), $752 average rents (+7% YoY), and 53,800 H1 shipments (+5% YoY). Manufactured Housing Institute (MHI) estimates 30-50% of shipments to land-lease communities in recent years (e.g., 51% in 2021, trending lower amid chattel financing dominance). ELS earnings calls confirm proactive new home purchases to fill sites, implying turnover. HI query is factually precise, quoting sources verbatim without distortion, and logically infers potential churn from YoY dip + replacement buys, though data shows net stability (rents up despite minor occupancy softening).

Evidence:

- Google’s AI verified via ELS Q3 2025 earnings: Occupancy 94.3% same-store (YoY -0.7%), sequential rise post-hurricanes; core MH rental income +5.5%. https://www.prnewswire.com/news-releases/els-reports-third-quarter-results-302591950.html (Oct 22, 2025 release); https://finance.yahoo.com/news/equity-lifestyle-properties-inc-els-210513388.html (call highlights).

- Northmarq Q2 2025 exact match: 94.9% occupancy, +7% rents to $752, 53,800 shipments. https://www.northmarq.com/insights/insights/us-manufactured-housing-investment-activity-surges-during-first-half (full report).

- MHI shipments: 30-50% range fair (e.g., 51% 2021; 2024 totals ~100K overall, with ~40% land-lease implied via trends). https://www.manufacturedhomepronews.com/official-total-manufactured-housing-production-shipments-in-all-50-states-washington-d-c-puerto-rico-mhville-consolidation-final-2024-sunday-weekly-manufactured-home-industry-headlines-recap/ (2024 data); https://mhinsider.com/2024-manufactured-homes-100000/ (shipments).

- ELS new buys/churn: Confirmed in Q3 call; minor dip suggests turnover, but rents +5.5% indicate demand absorption. https://seekingalpha.com/news/4507756-equity-lifestyle-outlines-5_1-percent-rent-increases-for-2026-amid-canadian-demand-headwinds (Oct 23, 2025).

Analysis: HI inputs are precise and evidence-based, prompting balanced scrutiny without bias—e.g., “arguably misleading” on MHI is subjective but supported by critiques of inconsistent reporting. Google AI is accurate (94.3% vs 95.0% aligns with filings), emphasizing stability over surge. Gemini’s response (PDF) is strong: Confirms data, qualifies MHI range as “fair” without endorsing “misleading,” and infers churn plausibly from YoY dip + buys but notes net elevation (94.9% industry). No rubber-stamping; it adds nuance (e.g., demand fueling shipments offsets exits). Overall, data suggests mild churn (e.g., weather/exits replaced by new residents at slightly lower rates), but ELS outperforms via rent growth (+7% YoY), bucking minor dips—logical HI inference holds, enhanced by Gemini’s objectivity. For MHVille: Reinforces land-lease demand amid ~40% shipment capture, but highlights replacement needs signaling turnover risks.

MHProNews notes that the full PDF thread with Grok is linked here, and includes multiple sources provided by Grok and more. The confirmation of that thread’s accuracy by Grok is linked here.

4) From that same Grok PDF thread that is confirmed for accuracy at this link here is also the following.

Facts-Evidence-Analysis (FEA) of HI Argument on Consolidator Business Models, Antitrust, and MHARR Amendments

Facts: Equity LifeStyle Properties (ELS) and Sun Communities (SUI) have pursued acquisition-heavy models with aggressive site fee hikes (e.g., ELS 6% Q3 2025 rate increase amid 94.3% occupancy; SUI similar via Datacomp reports), generating short-term profits (ELS core MH income +5.5% Q3 2025; SUI FFO +4.6% YoY) but drawing negative press and suits for “predatory” practices (e.g., evictions post-RentHelp in MN, $135K settlement; CT AG probe on septic neglect/sewage amid hikes). UMH Properties (UMH) emphasizes modest hikes (e.g., 5-6% renewals), greenfield development (outperforming stabilized properties per Q4 2023 call: “significantly outperform”), and resident focus (93.8% occupancy Q3 2024, no major antitrust suits), yielding steady profits (same-property NOI +6.9% Q2 2025). Antitrust suit (Case 1:23-cv-6715) names 11 defendants: Datacomp, ELS, Hometown America, Lakeshore, Sun, RHP, Yes! Communities, Inspire, Kingsley, Cal-Am, Murex—8 MHI members…UMH (MHI member) absent from suits. MHARR amendments to ROAD Act (S.3066, 2025) propose EISA §413 repeal to eliminate DOE energy rule ($4K–$8K/unit cost), enhancing affordability via HUD preemption. Shiffman (SUI) noted development beats buying at compressed cap rates (e.g., 2019 call: West Coast greenfield > acquisitions). Berkadia data: MH costs rose faster than site-built 2018–2023; NPR/WUSF: MH rents + site fees outpace conventional.

Evidence:

- ELS/SUI short-term gains/hikes: ELS Q3 2025 6% hikes despite 0.7% YoY dip; SUI similar via Datacomp. Negative news: SUI $135K MN settlement (evictions despite RentHelp); CT AG inquiry (sewage/hikes). https://www.ag.state.mn.us/Office/Communications/2025/06/12_SunCommunities.asp (settlement); https://portal.ct.gov/ag/press-releases/2023-press-releases/attorney-general-tong-launches-inquiry-into-sun-communities-over-beechwood-community-concerns (probe).

- UMH model: Q4 2023 call: Greenfield “significantly outperform” stabilized; no antitrust (Bing AI confirms). Profits: +8% rental income Q2 2025. https://www.manufacturedhomepronews.com/umh-properties-fq4-2023-earnings-call-transcript-sam-landy-expansions-greenfield-development-significantly-outperform-stabilized-properties-eugene-landy-build-100000-communities-plus-mhm/ (transcript); https://www.stocktitan.net/news/UMH/samuel-a-landy-president-and-chief-executive-officer-of-umh-lpkzj982i5ye.html (no suits).

- Antitrust: 8/11 MHI members (ELS, SUI, Hometown, RHP, Yes!, Inspire, Kingsley, Cal-Am). UMH absent. https://www.manufacturedhomepronews.com/dicello-levitt-and-hausfeld-co-counsel-in-antitrust-price-fixing-scheme-to-inflate-housing-costs-in-manufactured-home-communities-corporate-death-penalty-criminal-liability-for-defendants-fea (11 firms); https://www.manufacturedhousing.org/about/members/ (MHI membership).

- MHARR/ROAD: Amendments repeal EISA §413 for DOE rule bypass, boosting affordability. https://manufacturedhousingassociationregulatoryreform.org/manufactured-housing-association-for-regulatory-reform-mharr-submits-amendments-to-address-key-manufactured-housing-bottlenecks-industry-must-act/ (amendments).

- Shiffman: Development > buying at cap rates. https://www.manufacturedhomepronews.com/wp-content/uploads/2020/04/GarySchiffmanPhotoSunCommunitiesLogoQuoteDevelopNewsSitesForLessThanBuyAtCurrentCapRates.jpg (quote).

- Costs/image: Berkadia: MH costs + faster 2018–2023; NPR: Rents + fees outpace conventional. https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/BerkadiaManufacturedHousingInsightsManufacturedHomeCostsRoseFasterThanConventionalHousing20180to2023PerHUD-CensusBureauJune2025MHProNewsMonopolizationSignal.jpg; https://www.manufacturedhomepronews.com/wp-content/uploads/2025/08/WUSF-NPR-CensusACS-Data-MobileHomeRentManufacturedHomeRentVsSFhousingRentSiteFeesOligopolyStyleMonopolizationMHProNews.png.

- MHI optics: AIs critique consolidation focus undermining affordability. https://www.manufacturedhomelivingnews.com/wp-content/uploads/2025/11/MHI-optics-Third-PartyAIscreencaptures-MHProNewsCopilotGeminiGrokChatGPT11.5.2025-min.png.

Analysis: Yes, fair/accurate: ELS/SUI models yield short-term gains (5–6% rents) but spark blowback (suits, probes, image hits via evictions/hikes), per evidence. UMH’s modest hikes/resident focus drives profits (8% income) sans drama—evidence-based superiority. 8/11 antitrust defendants MHI members (UMH absent) shows correlation, not causation, but highlights risks for MHI-aligned consolidators resisting MHARR amendments (EISA repeal via ROAD boosts production/affordability). Shiffman/UMH evidence: Greenfield > acquisitions for profits without backlash, undermining “moat” via hikes. Belated push for MHARR fixes could benefit all stakeholders by scaling supply (~100K communities potential per Eugene Landy), countering underperformance (21st-century M&A quotes confirm oligopoly optics). HI argument substantiated; calls for reform timely amid suits/NAR affordability crisis.

5) Per left-leaning Bing’s AI powered Copilot.

Yes — the evidence strongly supports the takeaway that when subject matter expert human intelligence (HI) is paired with artificial intelligence (AI), the result is a more transparent, auditable, and credible form of analysis. The UMH Properties model demonstrates long-term wisdom by avoiding antitrust litigation, consumer backlash, and still delivering profitability, while consolidation-focused Manufactured Housing Institute (MHI) members face mounting risks if they fail to pivot toward Manufactured Housing Association for Regulatory Reform (MHARR) amendments.

🧠 Human Intelligence (HI) + 🤖 Artificial Intelligence (AI) Synergy

- The Q&A threads and screenshots you provided show Gemini confirming accuracy of MHProNews’ reporting and Grok correcting a glitch when prompted. This illustrates that AI is not simply rubber-stamping HI work — it can validate, critique, and refine it.

- This iterative process — HI drafting, AI cross-checking, and corrections when errors are flagged — embodies the Facts-Evidence-Analysis (FEA) model of journalism. It produces reporting that is both transparent and auditable.

📊 UMH Properties Model vs. Consolidation-Focused MHI Members

- UMH Properties Inc. has pursued a steady strategy of developing and operating manufactured home communities, emphasizing affordable housing demand. Analysts note strong community net operating income growth, rising occupancy, and expansion in opportunity zones.

- Unlike Equity LifeStyle Properties (ELS) or other consolidation-driven firms, UMH has avoided antitrust litigation and consumer advocacy blowback. Its model is seen as more sustainable and less exposed to reputational or regulatory risks.

- UMH’s CEO, Sam Landy, has publicly critiqued the ROAD to Housing Act in HousingWire, effectively aligning with MHARR’s call for amendments that enforce existing laws like enhanced preemption.

- This positions UMH as a long-term, investor-friendly path that balances profitability with regulatory prudence.

⚖️ MHARR Amendments and Industry Implications

- The Manufactured Housing Association for Regulatory Reform (MHARR) has submitted amendments to the ROAD to Housing Act of 2025, urging enforcement of enhanced preemption and Duty to Serve (DTS) provisions.

- MHARR argues that failure to enforce these existing laws perpetuates bottlenecks in affordable housing supply, suppresses production, and benefits consolidation-focused firms at the expense of consumers and taxpayers.

- Evidence shows that MHI has remained silent on enhanced preemption, aligning with consolidation strategies rather than organic growth. This silence exposes MHI members to potential shareholder claims of failing fiduciary duty.

📝 Critique of HI and AI

- HI strength: The developing documents are thorough, evidence-based, and supported by third-party citations. They correctly highlight production trends, regulatory capture, and consolidation risks.

- AI strength: Gemini validated factual accuracy and Grok corrected its glitch when prompted, showing responsiveness and reliability.

- AI limitation: Initial outputs sometimes lacked depth or context, but when paired with HI expertise, the shortcomings were mitigated. This underscores the value of hybrid journalism — neither HI nor AI alone is sufficient, but together they produce robust analysis.

📌 Takeaways

- UMH Properties’ model demonstrates long-term wisdom: profitable, sustainable, and reputationally safer.

- MHI consolidation-focused members risk litigation, consumer backlash, and shareholder claims if they continue ignoring enhanced preemption and DTS enforcement.

- MHARR amendments offer a practical pivot point for the industry to unlock growth and credibility.

- HI + AI collaboration in the FEA model produces transparent, evidence-backed journalism that regulators and investors can trust.

Sources for further review:

- UMH Properties SWOT and earnings: https://pitchgrade.com/companies/umh-properties

- MHARR amendments to ROAD Act: https://manufacturedhousingassociationregulatoryreform.org/manufactured-housing-association-for-regulatory-reform-mharr-submits-amendments-to-address-key-manufactured-housing-bottlenecks-industry-must-act/

- MHI consolidation critique: https://patch.com/florida/lakeland/affordable-housing-manufactured-housing-institute-mhi-concerns-spotlighted

- MHARR white paper on ROAD Act: https://manufacturedhousingassociationregulatoryreform.org/white-paper-analysis-of-u-s-senate-road-to-housing-act-of-2025-a-manufactured-housing-association-for-regulatory-reform-mharr-critical-review/

Would you like me to distill this into a visual infographic comparing UMH’s model vs. MHI’s consolidation strategy, with MHARR’s amendments as the pivot point?

6)

There is always more to know.

Stay tuned to the industry’s documented runaway #1 source for more “News through the lens of factory-built homes and manufactured housing” © “Industry News, Tips, and Views Pros Can Use”© where “We Provide, You Decide.”© This is the place for “Intelligence for your MHLife.” © MHProNews appears to once again be poised to top a million visits this month as it has in recent prior months, as has been confirmed by multiple third-party AIs. Thanks be to God and to all involved for making and keeping us #1 with stead overall growth despite far better funded opposing voices. Facts-Evidence-Analysis (FEA) matters.