Here are today’s market summaries.

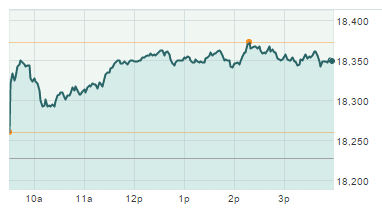

The Dow Jones Industrial Average advanced +0.66 percent, +120.74 points, to end the day at a new high of 18,347.67.

The NASDAQ moved up more than the other two indices, +0.69 percent, +34.18 points to finish at 5,022.82.

The S&P 500 advanced +0.70% percent, +14.98 points, to close at 2,152.14, setting a new record.

Yahoo! Finance Manufactured Housing Composite Value: 1526.5 Today’s Change: +0.79%

Affiliated Managers Group, Inc. (NYSE:AMG) 143.74 +3.77 (2.69%)

Berkshire Hathaway Inc. (NYSE:BRKA) – parent company to Clayton Homes, 21st Mortgage, Vanderbilt Mortgage and other factory built housing industry suppliers: 217,050.00 +1,226.00 (0.57%)

Carlyle Group (NASDAQ:CG) 16.42 +0.08 (+0.49%)

Cavco Industries, Inc. (NASDAQ:CVCO) 99.91 +0.86 (0.87%)

Deer Valley Corporation (OTCMKTS:DVLY)0.4501 0.00 (0.00%)

Drew Industries, Inc. (NYSE:DW) Dow Jones 92.12 +1.54 (1.70%)

Equity LifeStyle Properties, Inc. (NYSE:ELS) 79.91 -0.51 (-0.63%)

Killam Properties Inc. (TSE:KMP) 13.16 +0.09 (0.69%)

Louisiana-Pacific Corporation (NYSE:LPX) 18.85 +0.50 (2.72%)

Nobility Homes Inc. (OTCMKTS:NOBH) 15.70 +0.10 (0.64%)

Northstar Realty Finance Corp (NYSE:NRF) 12.31 +0.26 (2.16%)

Patrick Industries, Inc. (NASDAQ:PATK) 66.51 +0.61 (0.93%)

Skyline Corporation (NYSE:SKY) 9.28 0.03 (0.32%)

Sun Communities Inc. (NYSE:SUI) 75.95 -1.38 (-1.78%)

Third Avenue Value Instl (OTCMKTS:TAVFX) 50.12 +1.19 (1.58 %)

UMH Properties, Inc. (NYSE:UMH) 12.49 -0.08 (-0.64%)

Universal Forest Properties, Inc. (NYSE:UFPI) 100.67 0.53 (0.53%) ##

(Credit: Marketwatch-July 12 Dow Jones Industrial Average)