Big news for Tricon Capital Group Inc. (TCN), as they have announced their acquisition of Silver Bay Realty Trust Corp (NYSE:SBY), an owner and operator of single-family rental homes in the United States for $1.4B.

According to HousingWire, the all cash transaction valued Silver Bay at $21.50 per share, and the deal will create the country’s 4th largest publicly owned single-family rental operator with over 16,800 units nationwide.

“The proposed acquisition of Silver Bay is an incredibly exciting and transformational event for Tricon. This acquisition will more than double the size of Tricon American Homes, establishing it as the fourth largest publicly-owned SFR company in the U.S. Silver Bay’s high-quality and well managed portfolio of SFR homes is a natural complement to our TAH assets, in particular given the geographic overlap in the Sun Belt,” said Tricon President and CEO Gary Berman.

“We believe that the transaction will result in significant operating and overhead synergies creating immediate value for our shareholders. In conjunction with the Acquisition, we also intend to exit our smaller non-core businesses and take a meaningful step toward simplifying our overall corporate business model by focusing on scale, industry leadership, enhanced disclosure and operational integration across our investment verticals.”

The newly combined company will operate in a total of 18 markets, including six markets with one thousand homes or more.

“We have continually evaluated the most prudent way to drive sustainable, long-term capital appreciation and we believe this transaction is the best opportunity to return maximum value to our stockholders,” said Silver Bay CEO Thomas Brock.

“Over the past year, we have been making excellent strides in driving efficiency across our operating platform. We closed out the year with the best quarter in our company’s history, which I credit to the dedication and focus of our Silver Bay team.

Our well-crafted portfolio of single family properties and the recent strong performance across our platform will serve as a great complement to Tricon Capital Group Inc.’s business as the single family rental industry continues to evolve and consolidate.”

The deal is expected to close by end of Q2 2017.

Insider Action

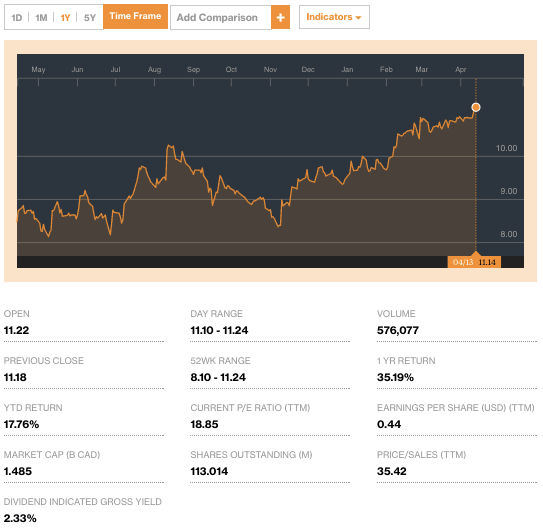

Tricon Capital Group Director Ira Gluskin purchased 50,000 shares of the company’s stock last month, at an average price of C$10.72 ($8.05 USD) per share for a total transaction of C$536,000.00 ($402,482 USD).

The company has received an overall “buy” rating consensus from analysts, including CIBC, BMO Capital Markets, TD Securities, and Royal Bank of Canada.

Tricon Capital Group is a principal investor and asset manager focused on the residential real estate industry in North America with approximately $3.1 billion USD of assets under management. Tricon owns, or manages on behalf of third party investors, a portfolio of investments in land and homebuilding assets, single-family rental homes, manufactured housing communities and multi-family development projects.

For the most recent closing numbers on Tricon Capital Group – and all MH industry-connected tracked stocks – please click here. ##

(Image credits are as shown above.)

Submitted by RC Williams to the Daily Business News for MHProNews.