During manufactured home industry veteran Ken Corbin’s presentation in Deadwood, SD, the former Clayton Homes professional pointed to what he called “the 10,000 Drop.”

What was that “10,000 drop?”

Corbin said it was the vanishing of some 10,000 manufactured home retail (a.k.a. “dealer”) locations since the industry’s last high was achieved in 1998.

Corbin made his statement in the context of the traditional 4 stages of growth for industries and companies. His was a marketing and sales presentation, not specifically intended as a historic look or a general analysis at what caused the industry’s slide since 1998 — much less the following historic industry drop in 2008.

Corbin pointed to the struggles of retailers like K-Mart, Target, and Wal-Mart, which at one point in time, all three were flying high. Today, K-Mart’s closing stores, and Target has their struggles too. Mega-retailer Wal-Mart is trying to play catch up with online giant, Amazon.

Corbin suggested that those 4 Stages have impacted manufactured housing.

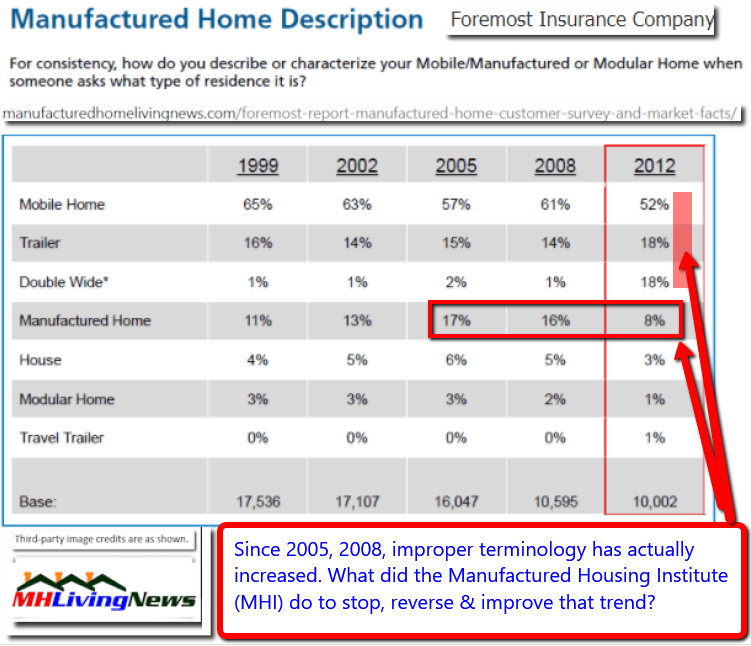

While a case could certainly be made for some of what Corbin said, he also referenced a study by Foremost Insurance which pointed to something else. Perhaps inadvertently, he pointed to data previously published by MHLivingNews, and used with permission by Foremost Insurance.

Before publishing the Foremost Insurance report, at MHLivingNews’ request, Foremost modified its original content to fit a more proper use of today’s industry terminology. See that, linked here.

Just the Facts…

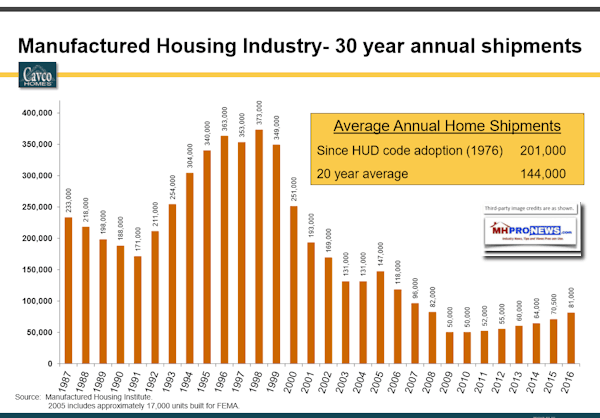

The 2008 plunge took place during a time that HUD Code producer/retailers such as vertically integrated Palm Harbor Homes and American Home Star corporations were doing significant levels of training, TV, and internet marketing. The statistics below demonstrate that appealing looking sales centers, good looking video, internet and other homes ads, Grayson Schwepfinger or other sales training did not reverse the coming collapse.

That plunge was caused in part related to a drop-in consumer financing.

But it was also fueled, say several industry sources, by a significant throttling of wholesale, floorplan lending. That choking off of floorplan lending, sources tell MHProNews, combined with the drop in retail finance, caused thousands of retailers to vanish. In the wake of that contraction, naturally, several manufactured home producers also closed, went bankrupt, or at some point sold out to other industry players.

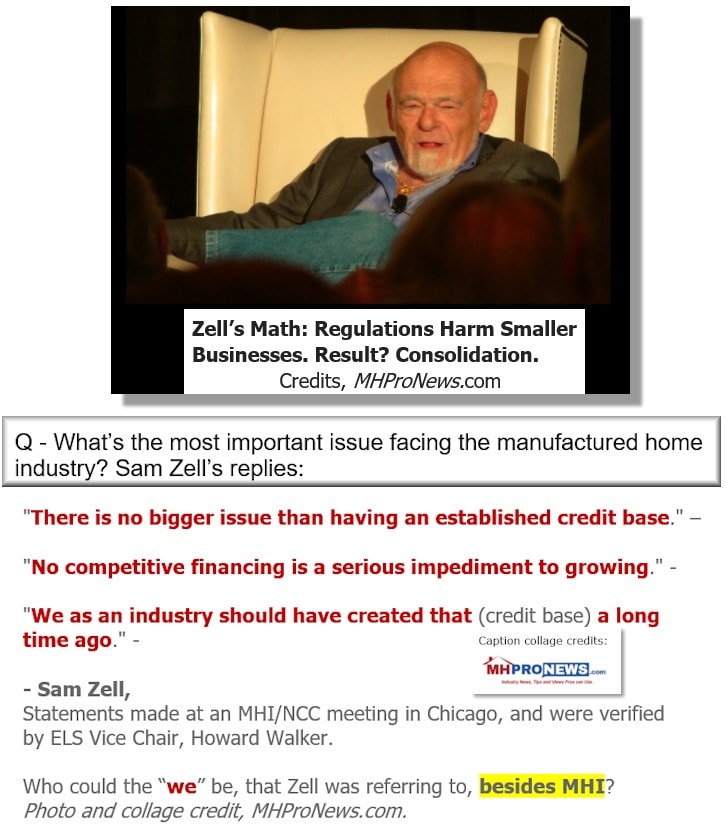

What was MHI’s and Berkshire Hathaway’s Response to the Crisis?

Then MHI Chairman, Tim Williams admitted at in a meeting with dozens in the room that the Arlington, VA based association lurched from reacting too late to the SAFE Act (“that horse has left the barn“), to reacting too late to Dodd-Frank. That caused prior MHI Chairman Nathan Smith to say on a video interview – linked here or from the image below – that he hoped to make the association less reactive, and more pro-active.

Very few industry analysts point to the fact that it was the Housing and Economic Recovery Act (HERA 2008) that gave the industry the potential promise of the Duty To Serve (DTS) Manufactured Housing by the Government Sponsored Enterprises, also gave the industry the SAFE Act.

DTS has still not taken place almost a decade later. By contrast, the SAFE Act did take hold and was rolled into the looming train wreck of the passage of Dodd-Frank in 2010, and the creation of the Consumer Financial Protection Bureau (CFPB), which has since driven out industry lenders, such as U.S. Bank.

Back to Ken…

None of that was part of Corbin’s presentation, which after all, was focused on marketing and training, not a history or a deep analysis of all the factors at play in the industry’s collapse and the slow recovery since.

But as independent manufactured housing industry HUD Code producers examine what happened that caused the dire lack of retailers today – that “10,000 drop” Corbin cited – is part of a broader pattern that helps explain why the industry is struggling with under 100,000 new home shipments for over a decade – at the very time as the well-documented affordable housing crisis in America has grown. ## (News, events, analysis, commentary.)

(Image credits are as shown above, and when provided by third parties, are shared under fair use guidelines.)